39 capital gain worksheet 2015

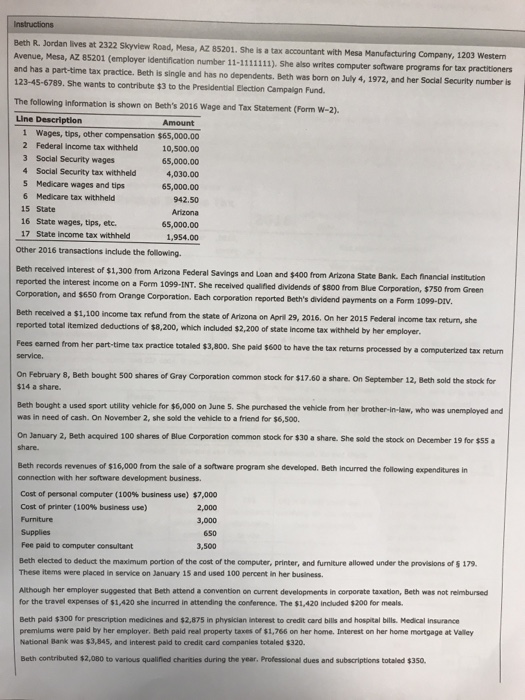

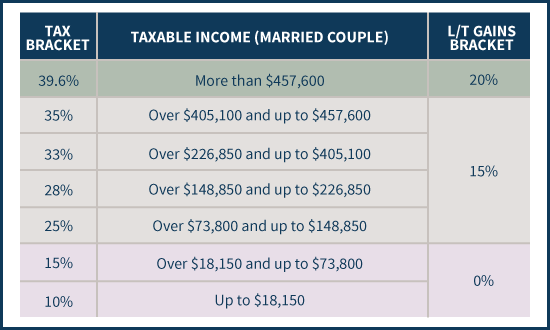

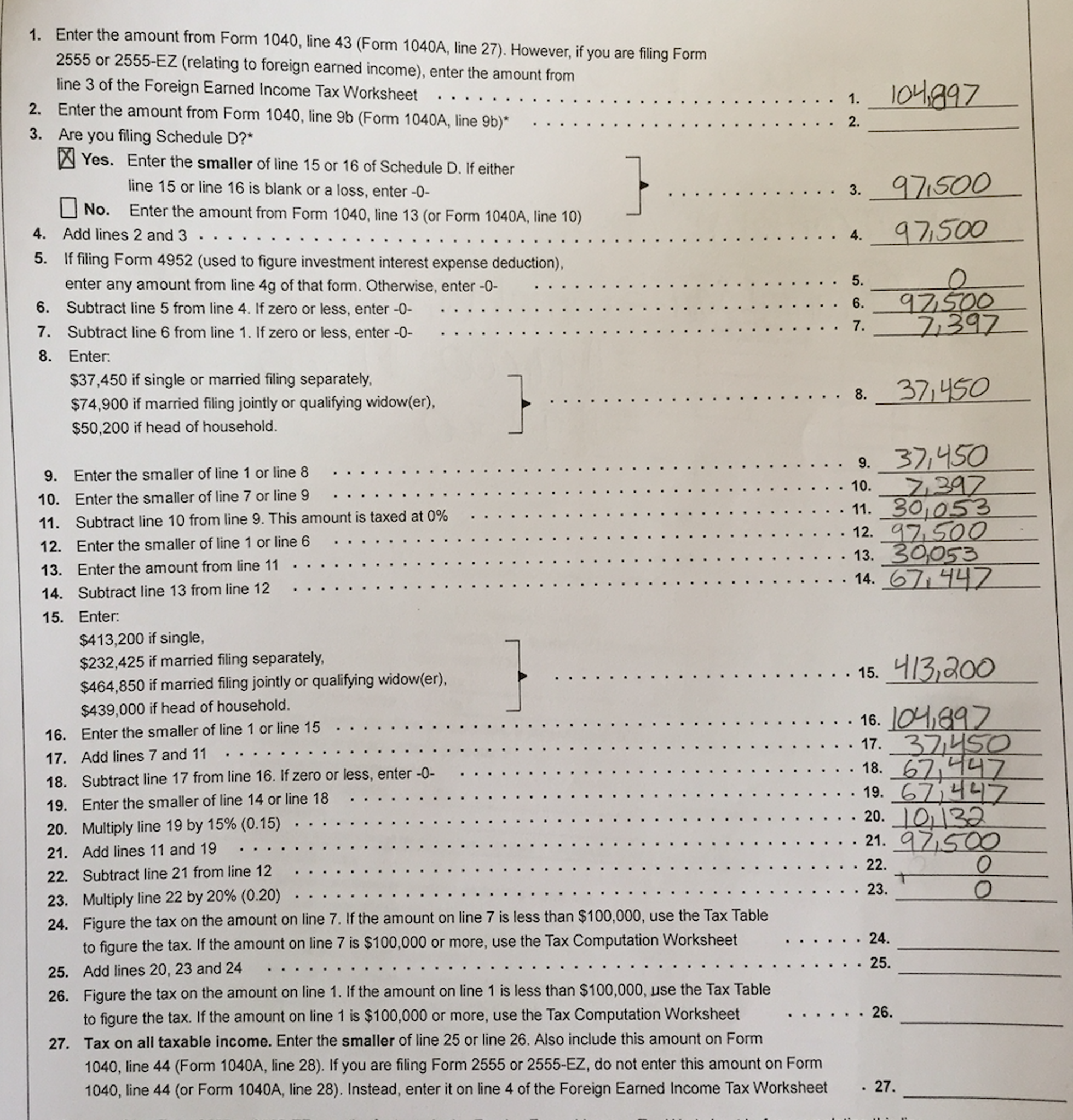

2015 Capital Gains Rates - Bradford Tax Institute The table below indicates capital gains rates for 2015. Short-term capital gains. One year or less. Ordinary income tax rates, up to 39.6%. Long-term capital gains. More than one year. 0% for taxpayers in the 10% and 15% tax brackets. 15% for taxpayers in the 25%, 28%, 33% and 35% tax brackets. Capital Gain Worksheet 2015 - worksheet For 2015 the maximum capital gain rates are 0 15 20 25 and 28. Capital gain worksheet 2015. Qualified dividends and capital gain tax worksheet form 1040 instructions page 44. 2015 qualified dividends and capital gain tax worksheet line 44 see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.

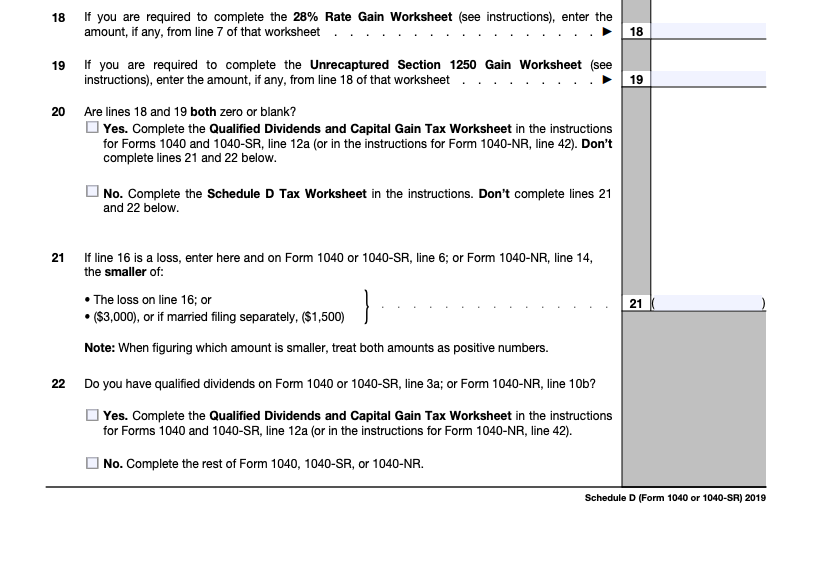

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form

Capital gain worksheet 2015

Capital Gains Tax Calculation Worksheet - The Balance Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ... Capital Gains Worksheet 2015 - Blueterminal Capital Gains Worksheet 2015. by Kimberly R. Foreman March 31, 2021. ... Qualified dividends and capital gain tax worksheet in the instructions for forms and, line. no. complete the rest of form, or. schedule d form title schedule d form author subject capital gains and, below, find out what the capital gains tax rates were for and a couple ... Download Free Capital Gain Worksheet 2015, High quality ... Capital Gains Worksheet Printable Worksheets And Activities For Teachers Parents Tutors Qualified Dividends And Capital Gain Tax Worksheet Worksheets 1st grade ...

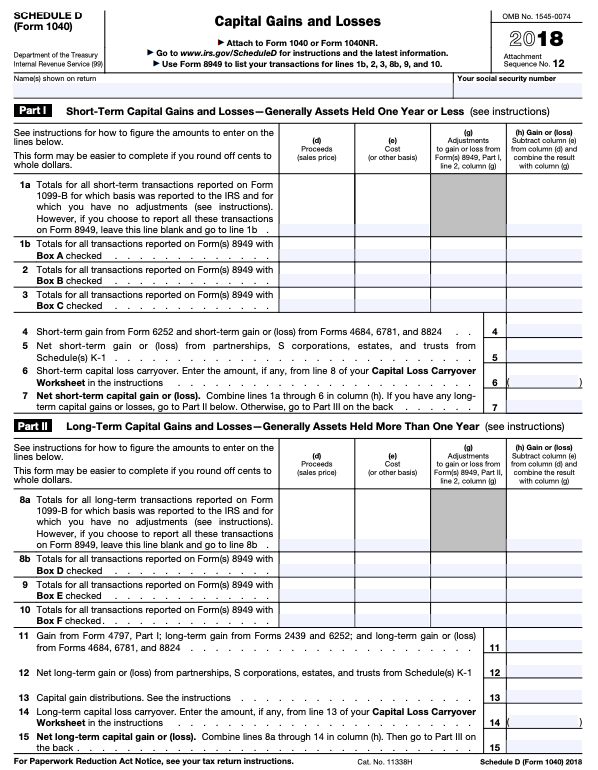

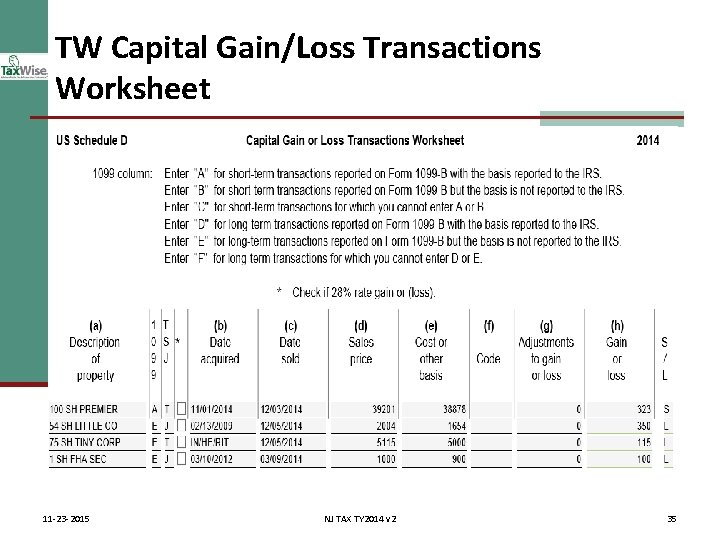

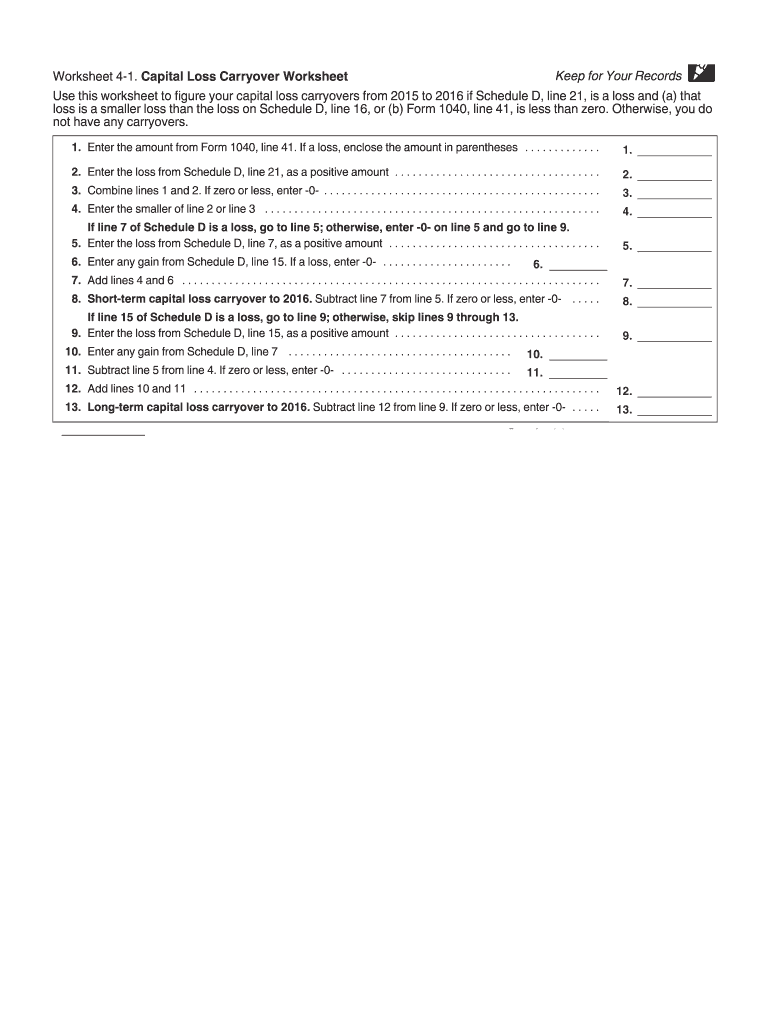

Capital gain worksheet 2015. Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Get and Sign Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Get form. Checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43. capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. PDF and Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information. Qualified Dividends And Capital Gain Tax 2015 Worksheets ... Displaying all worksheets related to - Qualified Dividends And Capital Gain Tax 2015. Worksheets are 40 of 117, Caution draftnot for filing, 2015 tax law highlights, Qualified dividends and capital gain tax work line, Calculations not supported in the 2015 turbotax individual, Basis issues for partnerships and s corporations, Interactive brokers, 2020 national income tax workbook.

Capital Gains Tax Worksheet 2015 References ... Capital Gains Tax Worksheet To Get Professional And. 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. 2015 schedule d tax worksheet form 1040 schedule d instructions page d 15. 41 capital gain worksheet 2015 - Worksheet Online 16.08.2015 · Capital gain distributions. Dividends paid on deposits with mutual savings banks, cooperative banks, credit unions, U.S. building and loan associations, U.S. savings and loan associations, federal savings and loan associations, and similar financial institutions. 28 rate gain worksheet 2018, easily create electronic signatures for signing a 2015 form schedule d in PDF format ... Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. How to Use The Capital Gains Worksheet | Passiv How To Use The Worksheet. You can record five different types of actions in the Capital Gains Worksheet - buy, sell, split, name change, and return of capital. Let me go through each one. Buy and sell actions should be self-explanatory for the most part. Security refers to the stock/ETF/bond that you bought or sold.

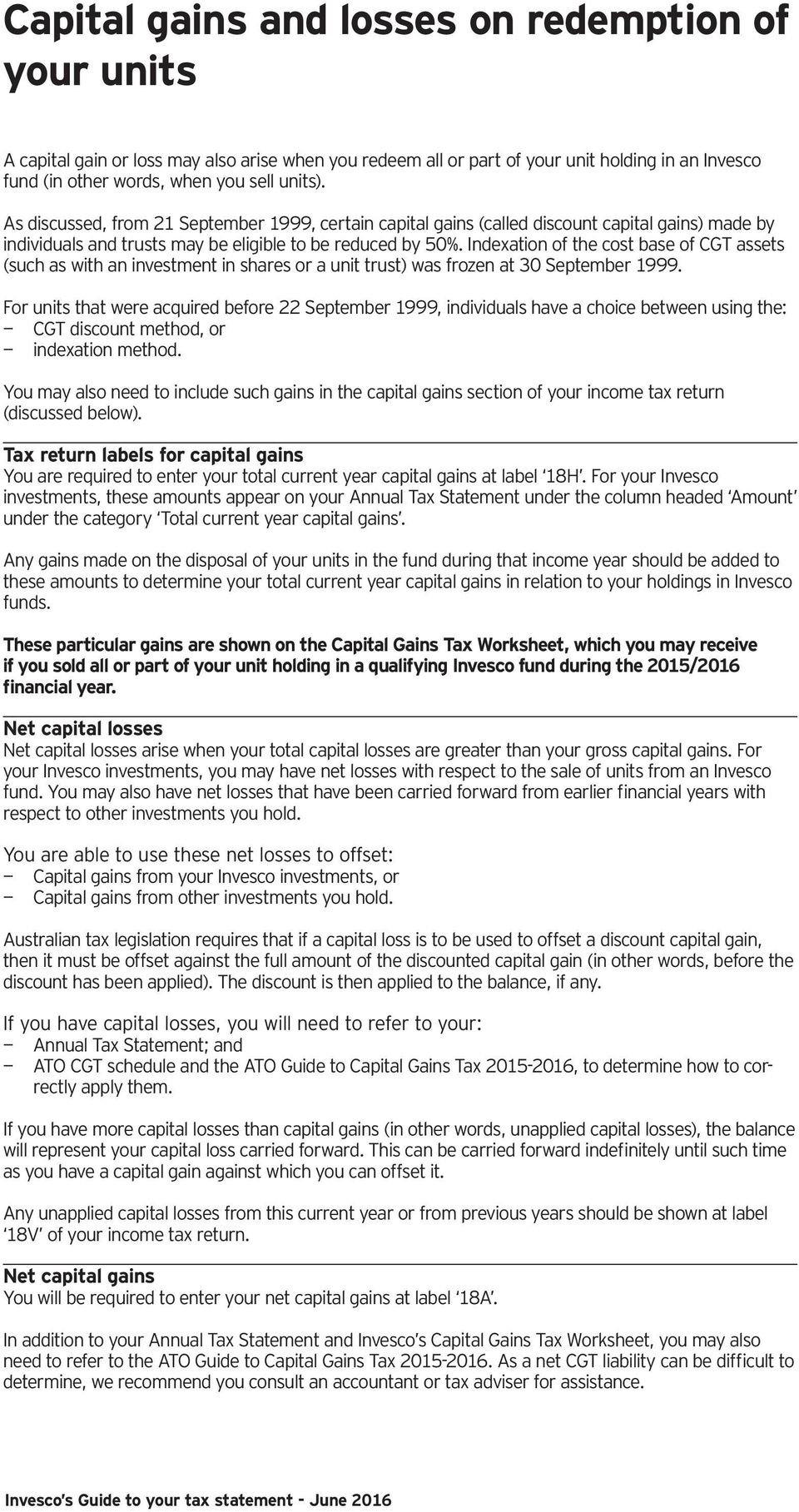

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2021: Title: 2021 Schedule D (Form 1040) Author: SE:W:CAR:MP Subject: Capital Gains and Losses PDF Capital Gain or Capital Loss Worksheet CAPITAL GAIN OR CAPITAL LOSS WORKSHEET This worksheet helps you calculate a capital gain for each CGT asset or any other CGT event1using the indexation method2, the discount method3and the 'other' method. It also helps you calculate a capital loss. CGT asset type or CGT eventShares in companies listed on an Australian securities exchange4 Qualified Dividends And Capital Gain Tax Worksheet 2015 ... Capital Gain Worksheet 2015 Worksheet List 2013 Tax Computation Worksheet Line 44 Https Www Yang2020 Com Wp Content Uploads Yang2015 Pdf Capital Gains Tax In The United States Wikipedia Magnetic Hysteresis Characteristics In Fe Sio Sub 2 Multilayered 30 Qualified Dividends And Capital Gain Tax Worksheet Calculator ... 38 capital gain worksheet 2015 - Worksheet Resource Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form. Use the qualified dividends and capital gain tax worksheet 2020 2015 template to simplify high-volume document management. Checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43.

35+ Ideas For Qualified Capital Gains Worksheet 2015 Qualified Capital Gains Worksheet 2015 - Fun for my own blog, on this occasion I will explain to you in connection with Qualified Capital Gains Worksheet 2015.So, if you want to get great shots related to Qualified Capital Gains Worksheet 2015, just click on the save icon to save the photo to your computer.They are ready to download, if you like and want to have them, click save logo in the ...

Worksheet: Calculate Capital Gains - Realtor Magazine Your capital gain: =. A Special Real Estate Exemption for Capital Gains. Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or ...

Download Free Capital Gain Worksheet 2015, High quality ... Capital Gains Worksheet Printable Worksheets And Activities For Teachers Parents Tutors Qualified Dividends And Capital Gain Tax Worksheet Worksheets 1st grade ...

Capital Gains Worksheet 2015 - Blueterminal Capital Gains Worksheet 2015. by Kimberly R. Foreman March 31, 2021. ... Qualified dividends and capital gain tax worksheet in the instructions for forms and, line. no. complete the rest of form, or. schedule d form title schedule d form author subject capital gains and, below, find out what the capital gains tax rates were for and a couple ...

Capital Gains Tax Calculation Worksheet - The Balance Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ...

0 Response to "39 capital gain worksheet 2015"

Post a Comment