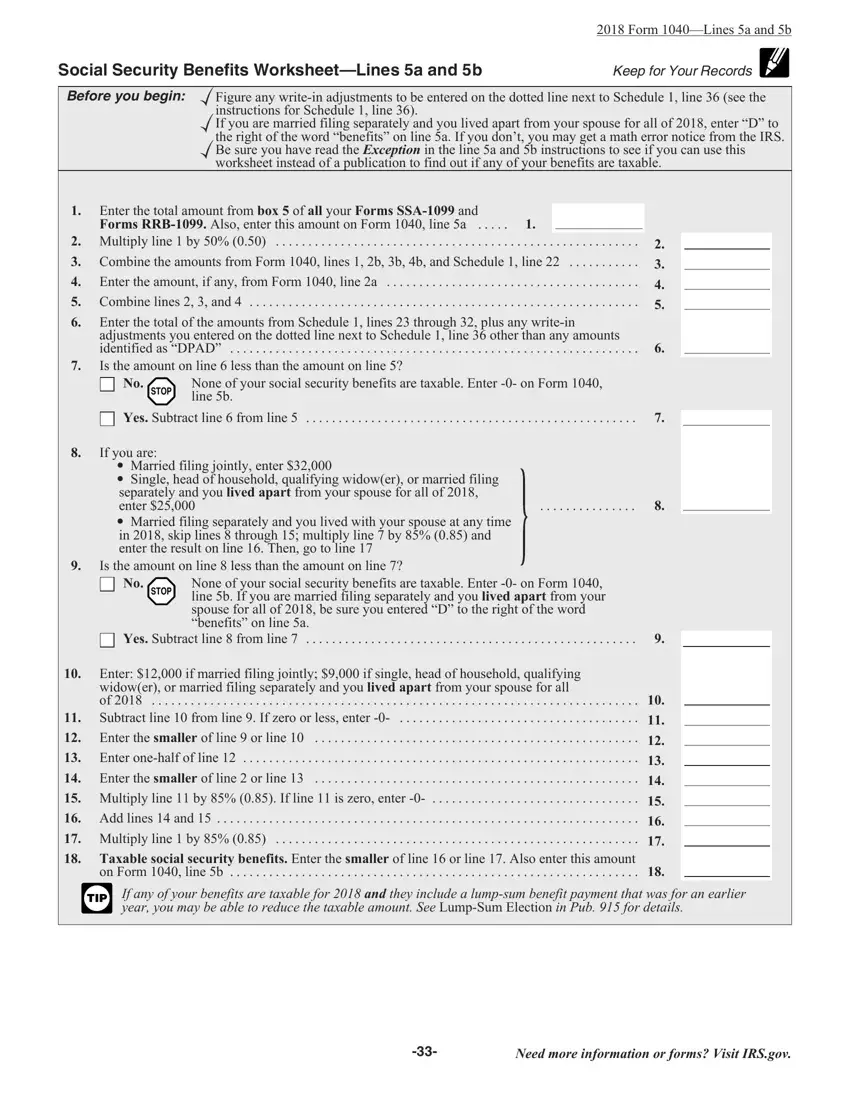

39 social security benefits worksheet lines 20a and 20b

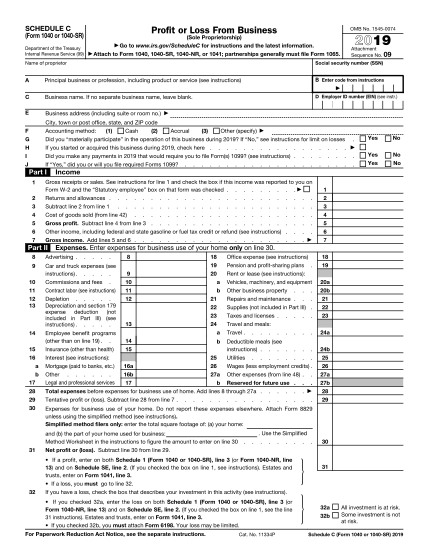

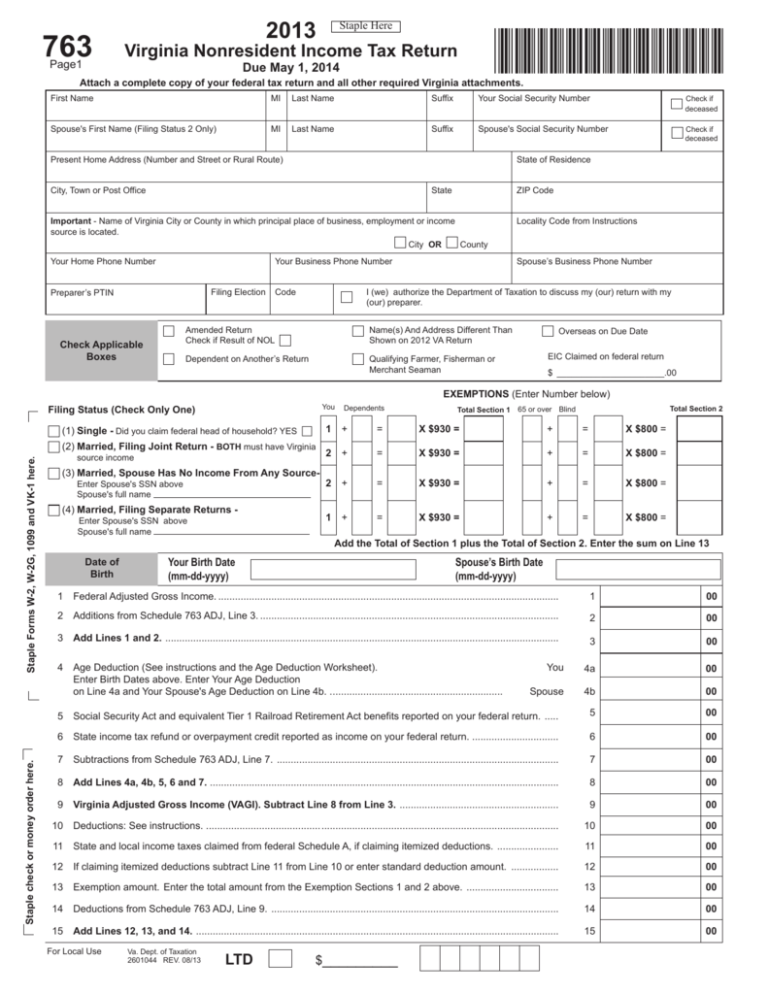

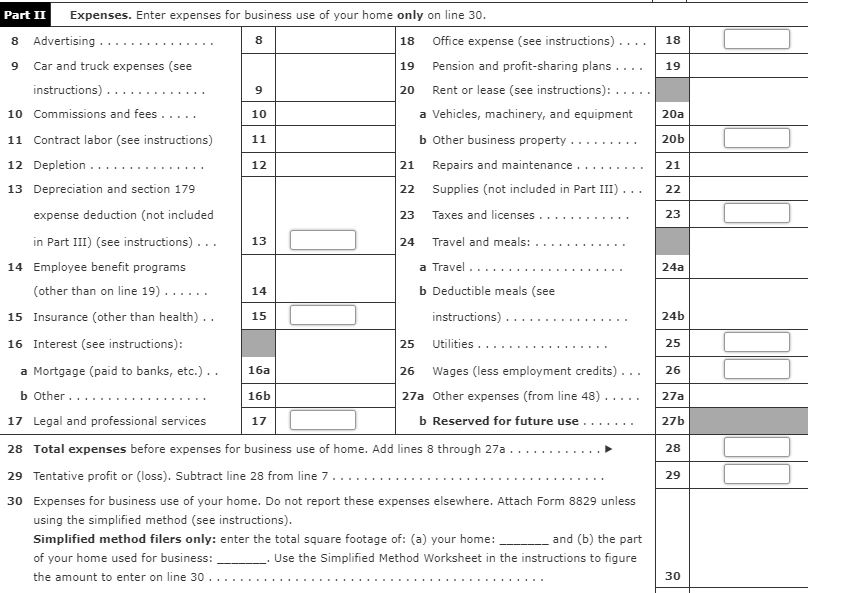

learnykids.com › worksheets › social-securitySocial Security Benefits Lines 20a And 20b Worksheets ... Some of the worksheets for this concept are 30 of 107, 2013 social security benefits work lines 20a and 20b, Social security benefits work lines 20a and 20b, Social security benefits work forms 1040 1040a, Benefits retirement reminders railroad equivalent 1, Social security benefits work lines 14a and 14b keep, Social security benefits work work 1 figuring, Source 1217. Schedule A Schedule A Section 1: Income or Loss Enclosure ... Name(s) shown on Form IT-40PNR Your Social Security Number Section 1: Income or (Loss) Enter in Column A the same income or loss you reported on your 2021 federal income tax return, Form 1040, Form 1040-SR, and Form 1040 Schedule 1 (except for line 19B and/or a net operating loss carryforward on line 20B; see instructions).

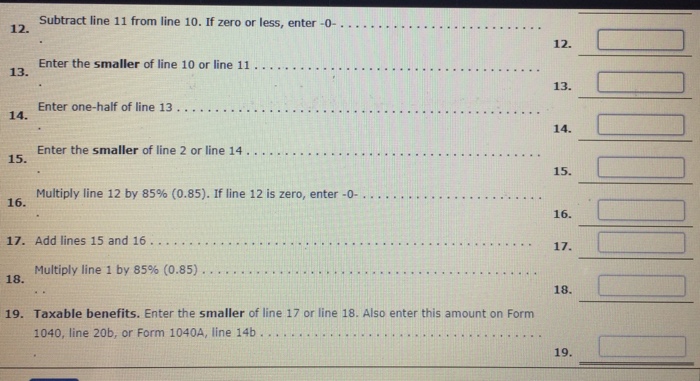

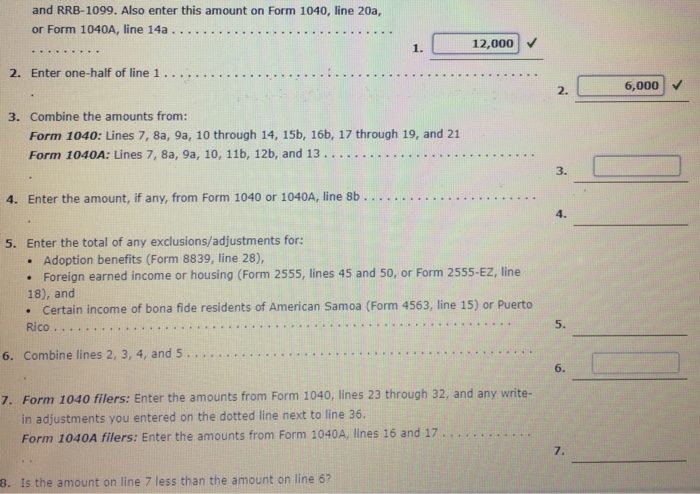

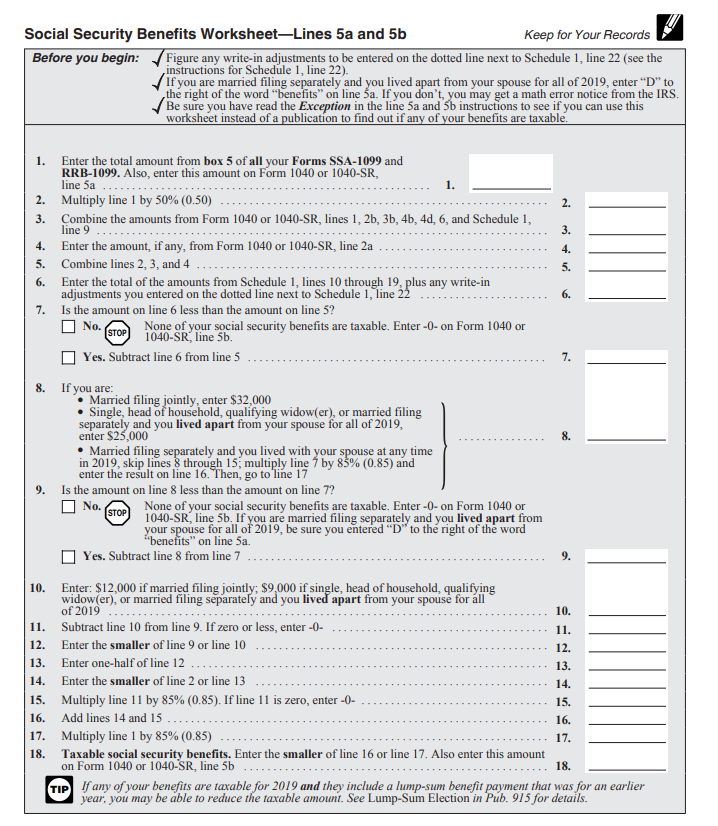

forum.thetaxbook.com › filedata › fetchWorksheet 1 - Taxable Social Security Benefits Worksheet 1 - Taxable Social Security Benefits Calculation for Form 1040, Lines 20a and 20b If you are married filing separately and you lived apart from your spouse for all of 2010, enter 'D' to the right of the word 'benefits' on Form 1040, line 20a. Do not use this worksheet if you repaid benefits in 2010 and your total repayments (box 4 of Forms

Social security benefits worksheet lines 20a and 20b

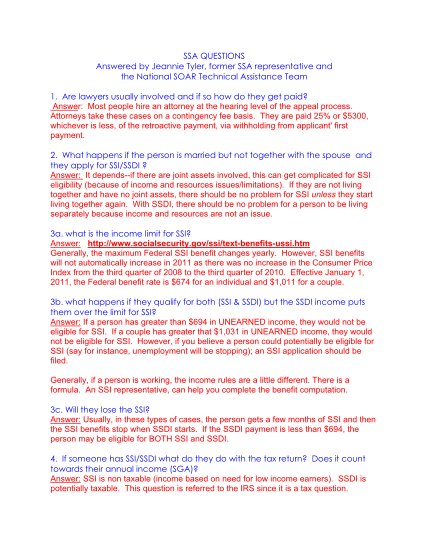

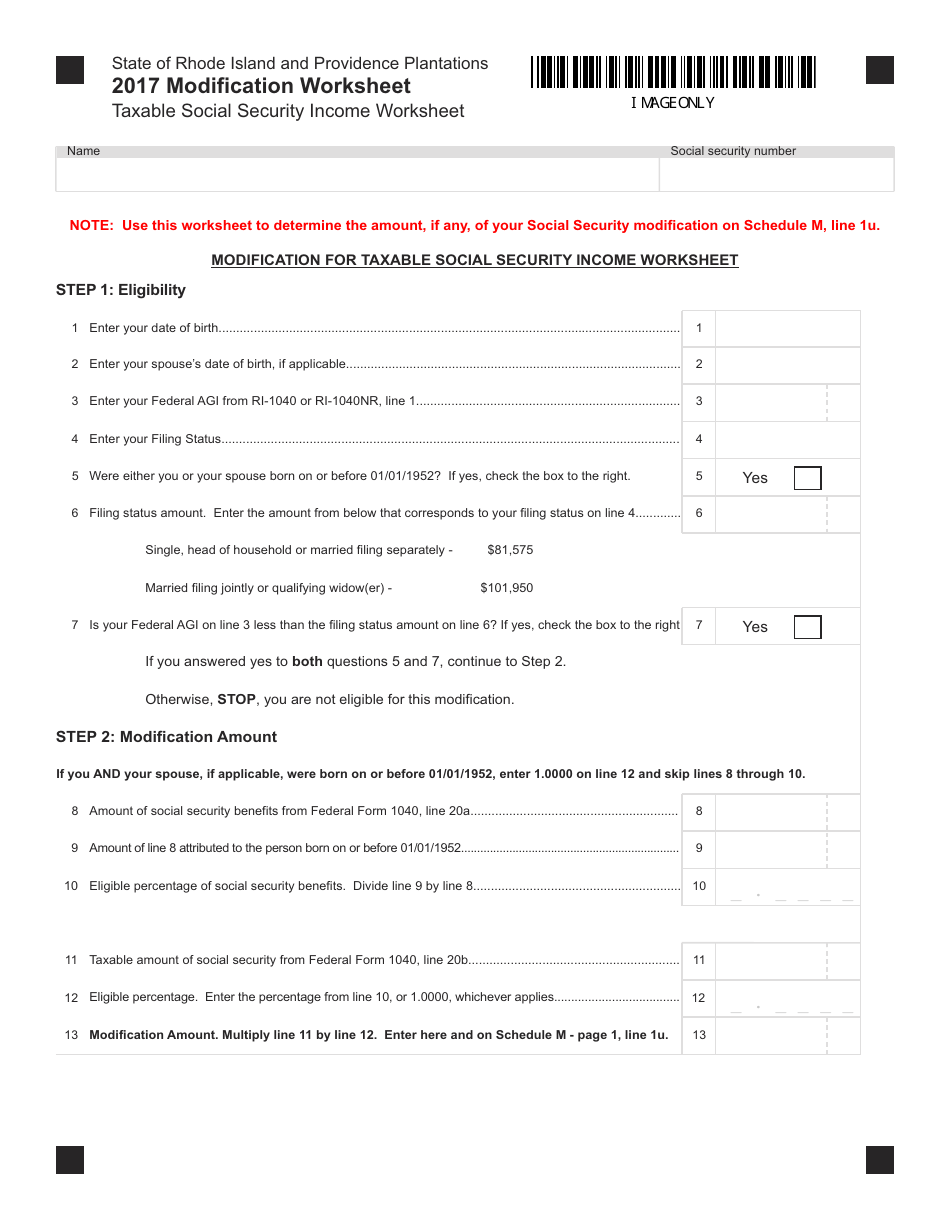

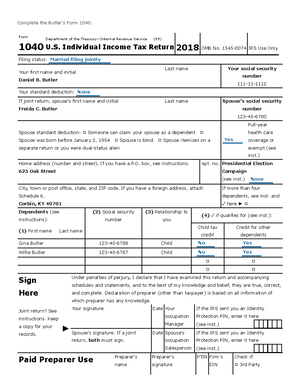

Arch Mortgage | Home 2017 & Prior Years — Line 20b of the 1040, Page 2. NOTE: Form 2106 EZ was retired in 2018. ... The AMITRAC will determine the Total Value of the Social Security Benefits by grossing up the non-taxable portion and adding it to the amount received. Remember, in order for the AMITRAC to be accurate, you must enter an amount on both Lines 8 and 9 ... 2021 Instruction 1040 - IRS tax forms an extension to le or excess social security tax withheld. Owe alternative minimum tax (AMT) or need to make an excess advance premium tax credit epayment.r Can claim a nonrefundable credit (other than the nonrefundable child tax cedit or the cr … › business-finance › fill-outHow Do You Fill Out Lines 20a and 20b on Form 1040? Apr 02, 2020 · Report the total amount of Social Security income received on line 20a of the IRS’ Form 1040, and on line 20b, report the taxable portion of Social Security income, as U.S. Tax Center explains. The total amount of Social Security benefits and income a taxpayer receives determines how taxpayers report Social Security benefits. In determining if any of the Social Security benefits taxpayers receive are taxable, they should compare the base amount of their filing status with the sum of one ...

Social security benefits worksheet lines 20a and 20b. formspal.com › pdf-forms › otherLines 20A 20B ≡ Fill Out Printable PDF Forms Online How to Edit Lines 20A 20B. It is possible to fill in the social security benefits worksheet 2020 document with this PDF editor. The next actions can help you immediately create your document. Step 1: This web page has an orange button stating "Get Form Now". Press it. › file › 10322804SSBEN - 2013 Form 1040Lines 20a and 20b Social Security ... View full document. 2013 Form 1040—Lines 20a and 20b Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36). New Jersey Individual Tax Instructions (Form NJ-1040 ... Sample W-2 (This form is for illustration only and is not reproducible.) 2 2 2 2 2 Void a Employee’s social security number For Official Use Only OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld c Employer’s name, address, and ZIP code 3 Social security wages 4 Social ... › business-finance › fill-outHow Do You Fill Out Lines 20a and 20b on Form 1040? Apr 02, 2020 · Report the total amount of Social Security income received on line 20a of the IRS’ Form 1040, and on line 20b, report the taxable portion of Social Security income, as U.S. Tax Center explains. The total amount of Social Security benefits and income a taxpayer receives determines how taxpayers report Social Security benefits. In determining if any of the Social Security benefits taxpayers receive are taxable, they should compare the base amount of their filing status with the sum of one ...

2021 Instruction 1040 - IRS tax forms an extension to le or excess social security tax withheld. Owe alternative minimum tax (AMT) or need to make an excess advance premium tax credit epayment.r Can claim a nonrefundable credit (other than the nonrefundable child tax cedit or the cr … Arch Mortgage | Home 2017 & Prior Years — Line 20b of the 1040, Page 2. NOTE: Form 2106 EZ was retired in 2018. ... The AMITRAC will determine the Total Value of the Social Security Benefits by grossing up the non-taxable portion and adding it to the amount received. Remember, in order for the AMITRAC to be accurate, you must enter an amount on both Lines 8 and 9 ...

0 Response to "39 social security benefits worksheet lines 20a and 20b"

Post a Comment