40 credit card comparison worksheet

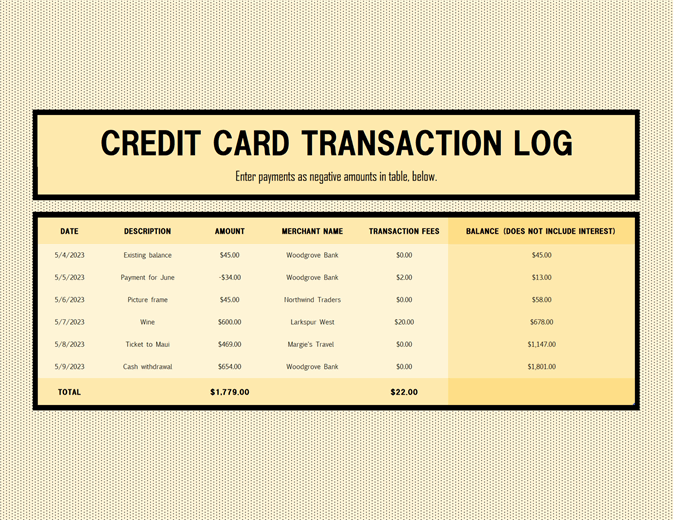

Understand Your Credit Card Statement | MyCreditUnion.gov A credit card statement is a summary of how you've used your credit card for a billing period. If you’ve ever looked at credit card statements, you know how difficult they can be to read. Credit card statements are filled with terms, numbers and percentages that play a role in the calculation of your total credit card balance. 16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) Differences between a bank account and a credit union; FDIC insurance, and what it means; Etc. All of these and more, can be taught with these free banking basics worksheets. Psst: pair these banking worksheets pdfs with over 50 banking activities for kids. 1. Econlowdown's Banking Basics Worksheet. Suggested Age: Middle School

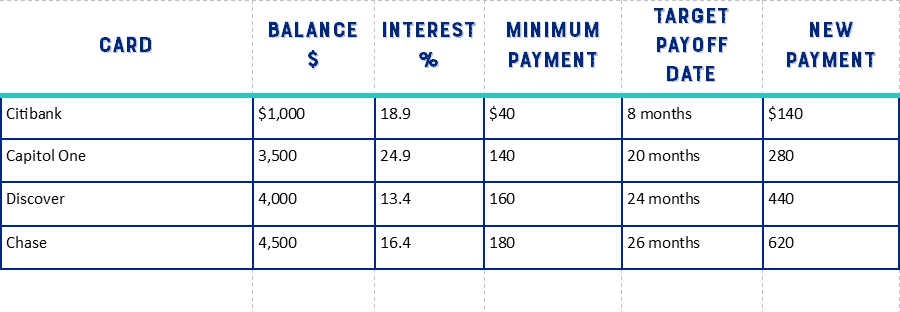

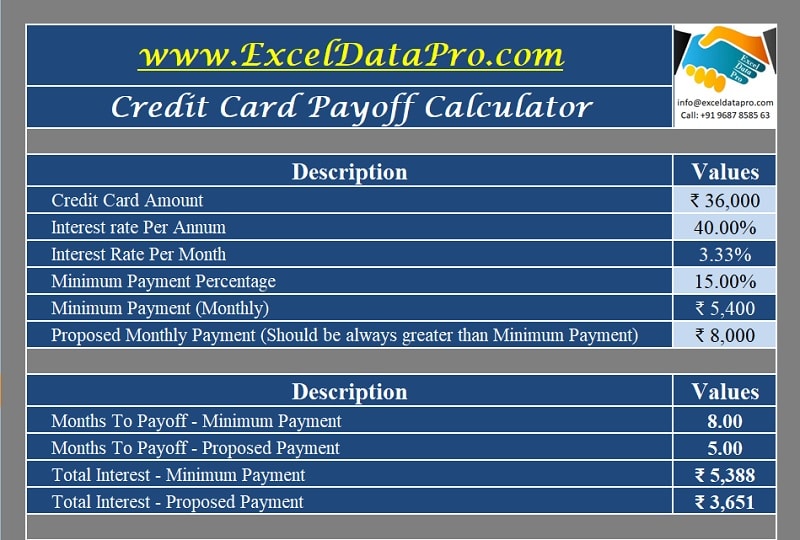

finance assignment.docx - CREDIT CARD COMPARISON WORKSHEET ... CREDIT CARD COMPARISON WORKSHEET QUESTION Card 1: Capital One Venture One rewards credit card Card 2:Bank Americard cash rewards Card 3:Discover it 1. Annual fee $0 $0 $0 2. Interest rate on purchases 11.9%-19.9% 12.99%-22.99% 10.99% - 22.99% 3.

Credit card comparison worksheet

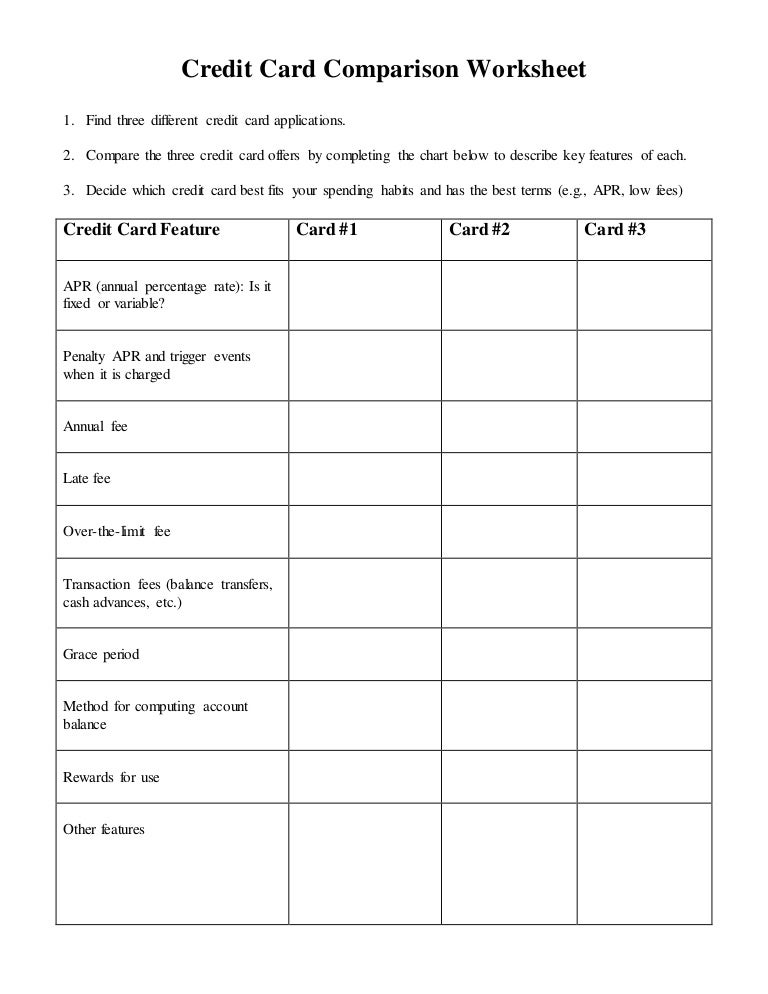

XLSX Clemson University, South Carolina Credit Card 1 Credit Card 2 Credit Card 3 Fees Annual Late Payment Cash Advance Maximum Credit Limit Grace Period Type of Card Secured Regular Premium Issuer Purchases Cash Advances Late Payment Penalty APR for: Fixed or Variable APR Rewards Cash Back Points Frequent Flyer Miles Rebates Other Balance Consolidation Inactivity Teacher Printables - FITC - Finance in the Classroom Coin Recognition Worksheets Set up an FREE account with Education.com and access hundreds of amazing printables. ... Credit Card Tricks (pdf) A spin-free guide to reading the fine print on credit car offers and agreements. 10-12 Grades. Credit Card Comparison (pdf) Practice choosing the right credit card for you! Credit Masquerade Activity (pdf ... PDF Compare credit cards - Sc Compare credit cards Use this worksheet to compare the fine print on credit cards you're considering as well as keeping track of the terms you agree to. Feature Card 1 Card 2 Card 3 Issuer: Credit limit: Interest rate for: Purchases Cash advances Balance transfers Penalty for late payment Fees: Annual

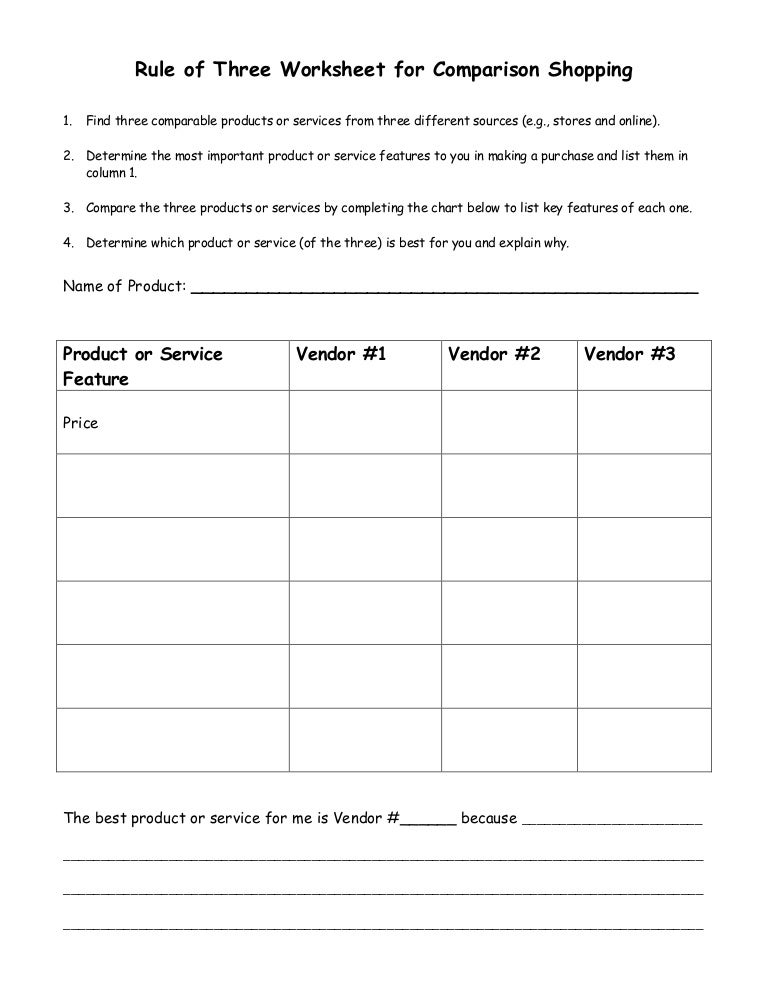

Credit card comparison worksheet. PDF Introducing the Credit Card - Credit Cards | Compare The ... 1 Introducing the Credit Card 2 5 8 11 13 15 18 19 - What a credit card is - How a credit card works - Fees associated with credit cards - How to apply for a credit card - How to avoid credit card debt - How rewards programs work - How to choose the right credit card for you With the help of detailed explanations, simple exercises, and visual aids, you will soon be fully PDF Comparison Shopping for a Credit Card - Weebly Page | 25 2.6.3.A5 Comparison Shopping for a Credit Card Total Points Earned Name Kora Nagle 35 Total Points Date 5315 Directions : Compare at least three sample credit card offers. Real Credit Card Numbers To Buy Stuff - Payment Jun 11, 2020 · Getting someone to cosign for you is another way of obtaining a valid credit card. Real Credit Card Numbers To Buy Stuff – Parting Shot! There are quite a few credit card issuing firms out there to consider. You have Chase, Discover, American Express and Visa to mention a few. Make sure you are 18 years + before you apply for a credit card. Compare Credit Cards - Credit Card Comparison Calculator Compare Credit Cards For The Best Deal. Searching for credit cards can be an exhausting process - especially when it comes time to compare them. To make it easier, The Financial Mentor partners with Cardratings, a site that makes it easy to browse and compare hundreds of the best credit card offers available today.

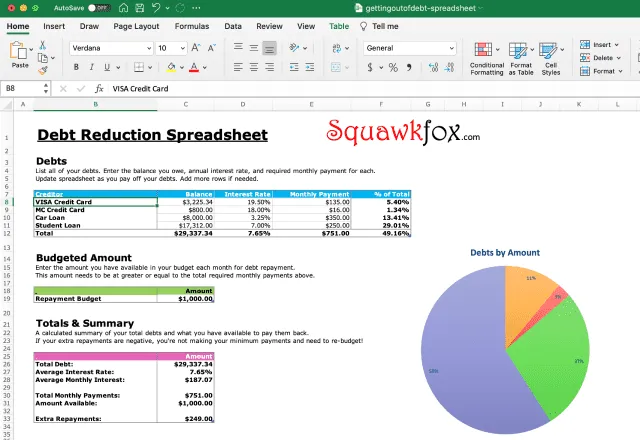

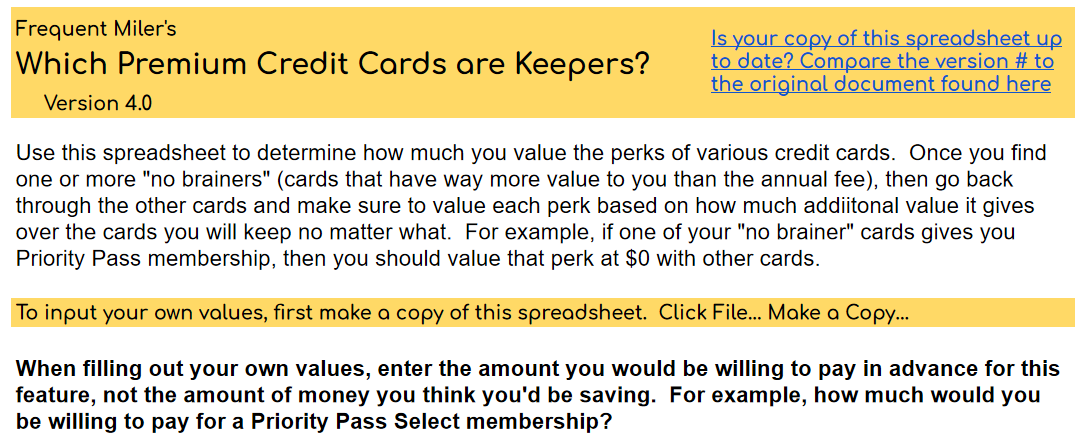

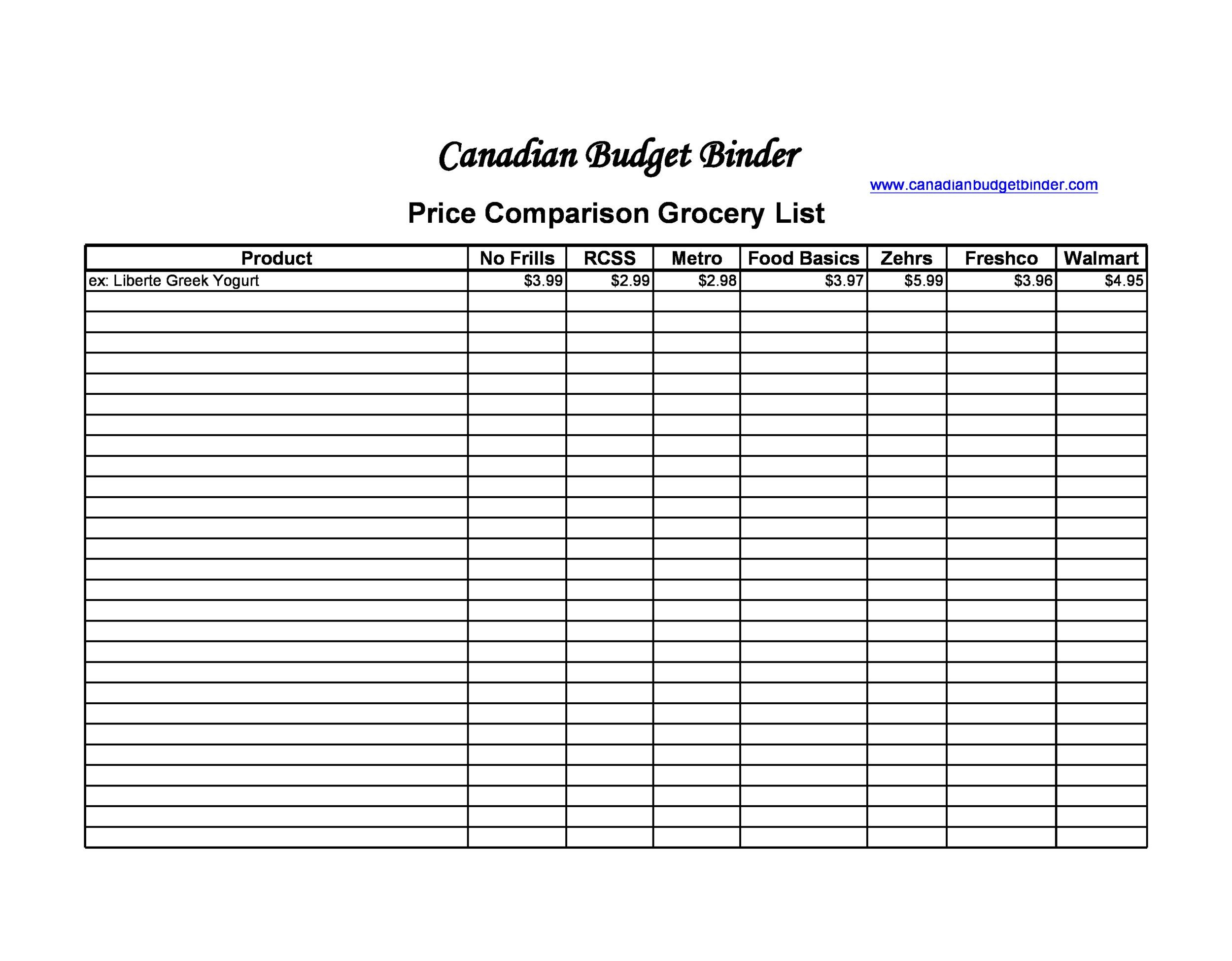

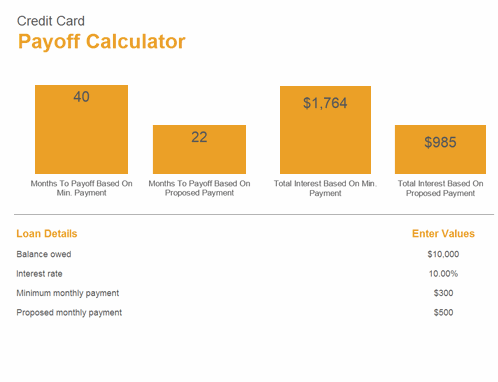

Compare 25+ Cash Back Credit Cards in This Free Spreadsheet Compare 25+ Cash Back Credit Cards in This Free Spreadsheet Compare cash back offers, annual fees, bonuses and more from over 25 cash back credit cards in this free Google spreadsheet. By Jak Frist On March 28, 2019 Why A Credit Card Comparison Worksheet Is So Important ... A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees. PDF Credit Card Comparison Shopping Worksheet Publisher Credit Card Comparison Shopping Worksheet Things to consider when choosing a credit card: • If you're going to pay the bill in full every month, then the interest rate doesn't really matter to you. Look for a card with no annual fee and a longer grace period so you don't get hit with a finance charge. Student Printables - FITC - Finance in the Classroom Monthly Budget Worksheet (pdf) Simple worksheet for budgeting! 10-12 Grades. Cheap Date Ideas (pdf) Fun dating ideas that are sure to leave your pockets full of cash! ... Credit Card Comparison (pdf) Practice choosing the right credit card for you! Learn About Your Offer (pdf) Understand Your Credit Card Offer .

PDF Comparison Shopping for a Credit Card - Weebly the comparison table is completed, choose which credit card would be the best choice. Write a one page essay explaining why the credit card is the best choice and why. In addition, explain the decision making process used and the possible consequences of the choice (attach Comparison Shopping for a Credit Card worksheet to essay). Compare Credit Cards: Compare & Apply Online Instantly Compare credit cards from all the major credit card companies and quickly find the best credit card for your needs. To use WalletHub's free credit card comparison tool, start by applying the filters on this page to narrow down your search based on card feature, required credit standing, issuer and more (some cards are from WalletHub partners). Adoption Tax Credit - Form 8839 | H&R Block Expires 4/10/2018. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. PDF Choosing a Credit Card - Save and Invest Worksheet: Choosing a Credit Card Select the primary reason(s) for obtaining a credit card. 1. ewar R/ edsbates r Yes No 2. Cre dt Bil ui d Yes No 3. Emergenseahccysr up Yes No 4. You got an offer in the mail Yes No 5. herOt Describe: _____ Select the following places you looked to obtain a credit card: Bank Credit Union Mail Offers Other ...

Comparing Credit Card Offers Worksheet Keep credit card offers please try to borrow money worksheets, and worksheet for credit? Students will correlate a pen or pencil and copies of the activity.

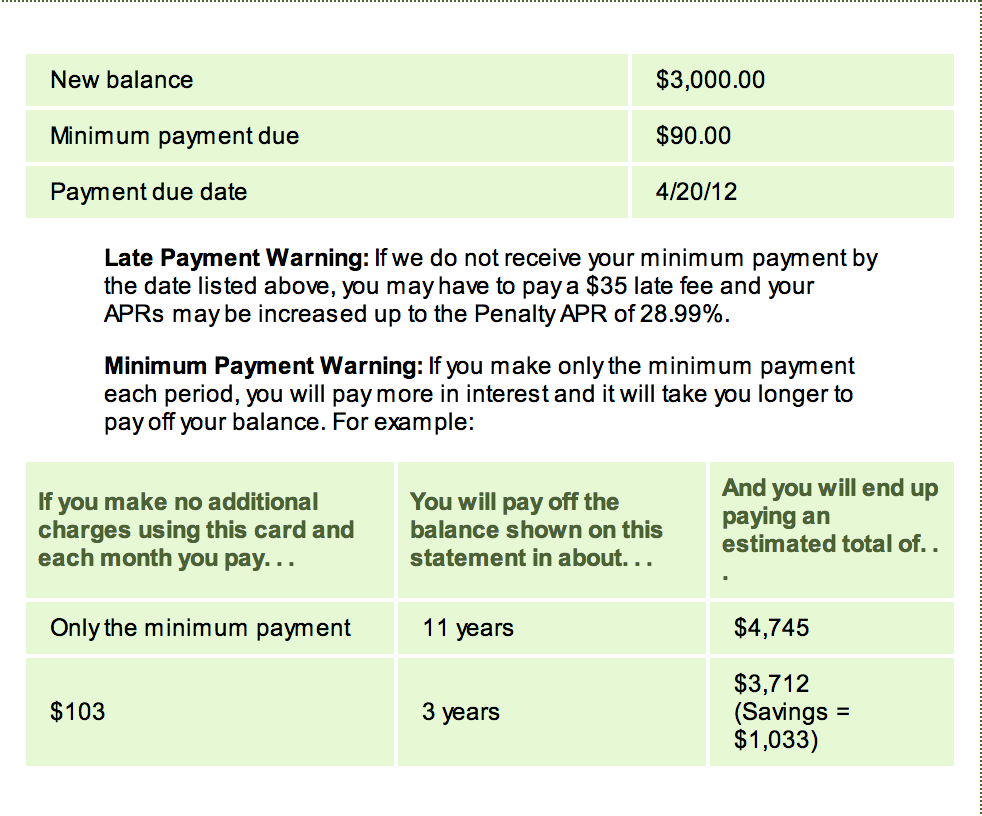

Lesson Five Credit Cards - Practical Money Skills credit cards student activity 5-3b Marie just used her new credit card to buy a bike for $400. Her budget allows her to pay no more than $25 each month on her credit card. Marie has decided not to use the credit card again until the bike is paid off. The credit card she used has an Annual Percentage Rate of 21%.

PDF CREDIT CARD COMPARISON - Finance in the Classroom credit card comparison Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit Card information: . Store Cards and Pay Day Lenders search individually on internet.

4 Credit Card Comparison Charts (Rewards, Fees, Rates ... A credit card comparison chart can be an extremely valuable took when exploring the numerous cards that are available to consumers these days — hopefully saving both time and money. Once upon a time, credit cards were simple devices, used to conveniently make purchases at your favorite store or restaurant that you paid off when your bill came ...

Side by Side Credit Card Comparison - NerdWallet To compare credit cards well, the key is to identify the features that are most important to you and to know what a good offer looks like. There's no such thing as a "best credit card for ...

Waterbury CT Teachers Federal Credit Union | Serving 28 CT Towns Contact Us DANBURY 203.791.1117 110 Federal Rd., Danbury, CT 06811 MIDDLEBURY 203.758.9500 773 Straits Turnpike, Middlebury, CT 06762 TOLL FREE 1.800.992.2226

Credit Card Comparison Flashcards | Quizlet Credit Card Comparison. STUDY. Flashcards. Learn. Write. Spell. Test. PLAY. Match. Gravity. Created by. csmithocvts. Terms associated with comparing credit cards. Terms in this set (14) Interest Rate. The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. At an interest rate of 10%, a borrower would pay $110 for ...

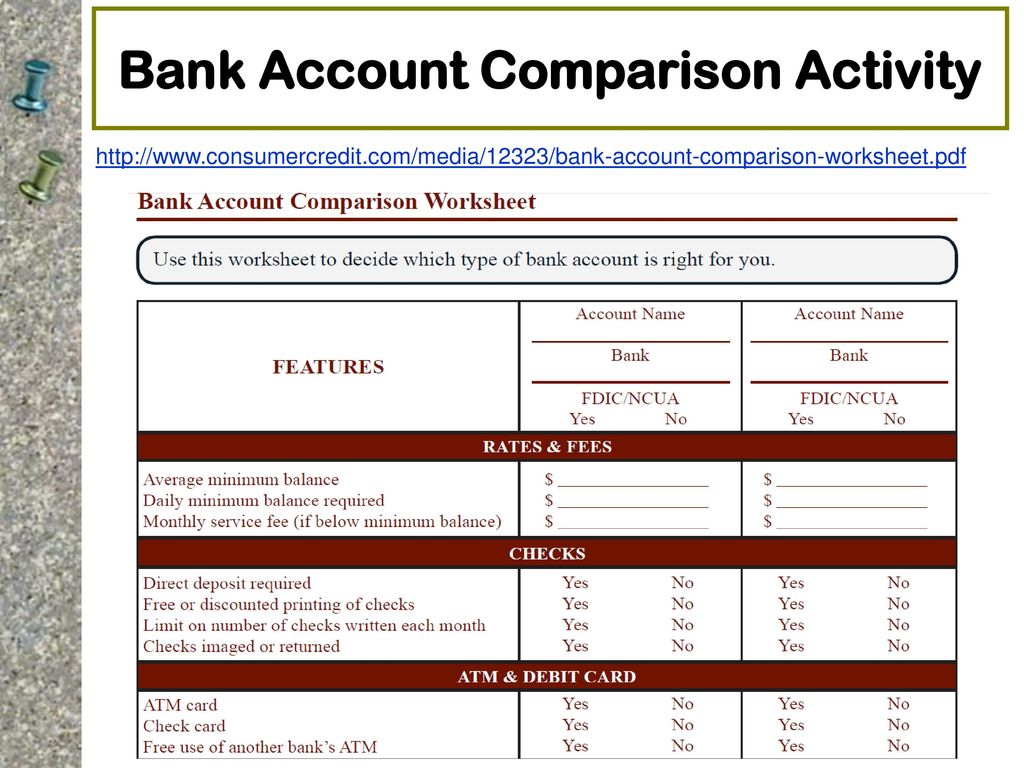

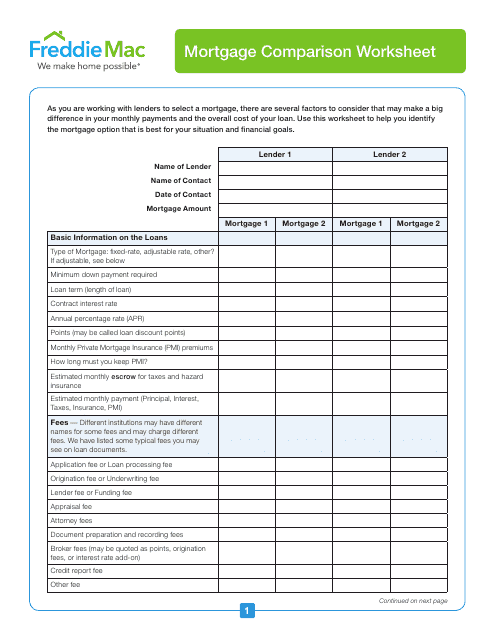

Personal Financial Workbook - Consumer Credit 11. Financial Goals Worksheet 13. Bank Account Comparison Worksheet 14. Investment Options Worksheet 15. Creditworthiness Worksheet 16. Debt-to-Income Ratio Worksheet 17. Credit Card Options Worksheet 18. Annual Credit Report Request Form 19. Resources American Consumer Credit Counseling (ACCC) is a nonprofit 501(c)(3) organization. Founded in ...

Credit Card Comparison Worksheets & Teaching Resources Results 1 - 24 of 23000+ — Browse credit card comparison resources on Teachers Pay ... This worksheet has students research and compare various credit cards.

PDF Compare credit cards - Sc Compare credit cards Use this worksheet to compare the fine print on credit cards you're considering as well as keeping track of the terms you agree to. Feature Card 1 Card 2 Card 3 Issuer: Credit limit: Interest rate for: Purchases Cash advances Balance transfers Penalty for late payment Fees: Annual

Teacher Printables - FITC - Finance in the Classroom Coin Recognition Worksheets Set up an FREE account with Education.com and access hundreds of amazing printables. ... Credit Card Tricks (pdf) A spin-free guide to reading the fine print on credit car offers and agreements. 10-12 Grades. Credit Card Comparison (pdf) Practice choosing the right credit card for you! Credit Masquerade Activity (pdf ...

XLSX Clemson University, South Carolina Credit Card 1 Credit Card 2 Credit Card 3 Fees Annual Late Payment Cash Advance Maximum Credit Limit Grace Period Type of Card Secured Regular Premium Issuer Purchases Cash Advances Late Payment Penalty APR for: Fixed or Variable APR Rewards Cash Back Points Frequent Flyer Miles Rebates Other Balance Consolidation Inactivity

/English/thumb.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Its-Your-Money-Budget-Spreadsheet-56a2f0b55f9b58b7d0cfd06f.png)

0 Response to "40 credit card comparison worksheet"

Post a Comment