41 irs form 886 a worksheet

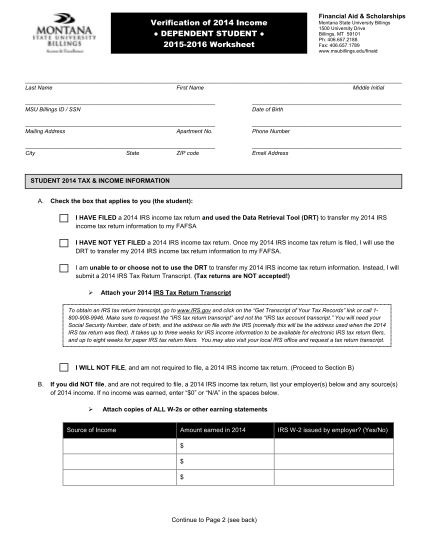

Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP: Supporting Documents for Dependency Exemptions 1019 07/31/2020 Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children ... PDF Financial Aid Office Fax: (814)886-6463 7373 Admiral Peary ... eligible to use the IRS Data Retrieval Tool you and your parent(s) are required to submit a 2020 IRS Tax Return Transcript or a signed copy (must be a wet signature) of the 1040 with schedule 1,2 and 3 (if applicable). To request a transcript, visit or call 1-800-908-9946. Untaxed Income and Benefits and Income Exclusions in 2019.

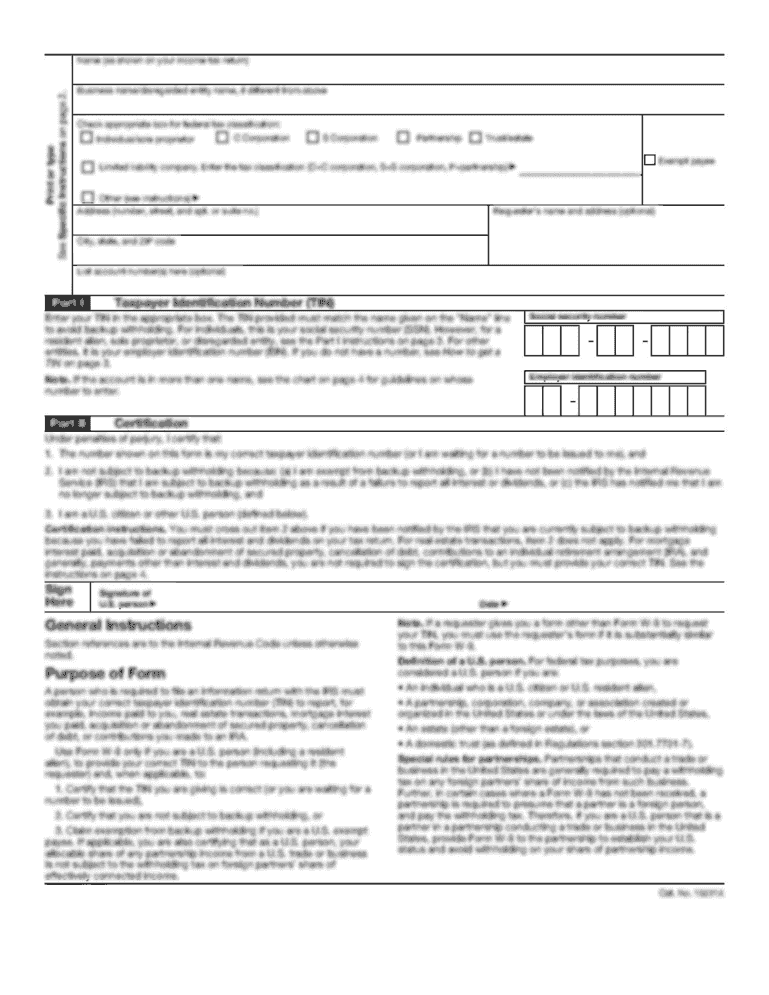

PDF Form 886-L (Rev. December 2014) Form 886-L (Rev. 12-2014) Catalog Number 73202A Department of the Treasury - Internal Revenue Service Form 886-L (Rev. December 2014) Supporting Documents Please provide a photocopy of the document or documents requested below. Return the photocopies with this form in the envelope provided.

Irs form 886 a worksheet

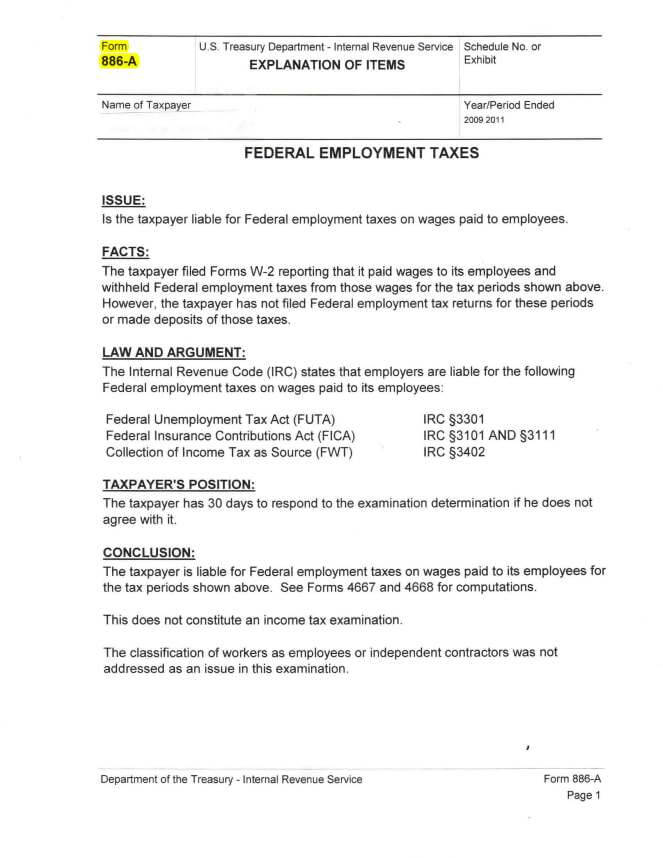

Irs 886 H Dep - Fill Out and Sign Printable PDF Template ... 886 dependencia formsigning a irs 886 h dep in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field. To sign a irs h dep form right from your iPhone or iPad, just follow these brief guidelines: Is there a downloadable/fillable version of Schedule C-7 ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported. Form 886-A - Internal Revenue Service Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended __ Your plan submitted a request to the Internal Revenue Service for a determination letter on the qualified status of the plan.

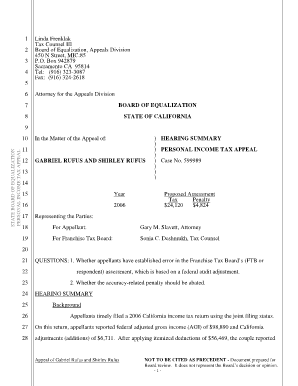

Irs form 886 a worksheet. Form 886 A Worksheet - Fill Online, Printable, Fillable ... Get the free form 886 a worksheet. Get Form. Show details. Hide details. Department of the Treasury Internal Revenue Service. Section 403 (b) Compliance Check for Higher Education. Questions 1-7 ask about the opportunity you ... IRS Form 886A | Tax Lawyer Shows What to do in Response Most often, Form 886A is used to request informationfrom you during an audit or explain proposed adjustmentsin an audit. This form is extremely importantbecause the IRS will want their questions answered by you! Audit Procedure You will need to provide more than just a few cancelled checks to the government. Form 886 A Worksheet - Fill Online, Printable, Fillable ... irs form 886 a worksheet for qualified loan limit CALIFORNIA Montana appellants 2006 LATC IRC supra pp Zachary Related Forms - form 886 a worksheet for qualified loan limit 60 Issue 7 - oldbridgebethohr 1 Vol. 60 Issue 7 EMail: July 2016 congregationbet hohr gmail.com 5776 Sivan/Tammuz Synagogue Office: 7322571523 What is the Link between 17th ... irs form 886-a worksheet - Fill Online, Printable ... Get the irs form 886-a worksheet and fill it out with the feature-rich PDF editor. Work easily and keep your data risk-free with irs form 886-a worksheet online. Irs form 886-a worksheet. Get . Irs 886-a worksheet Form 2017-2022. Get Form. Home; TOP Forms to Compete and Sign;

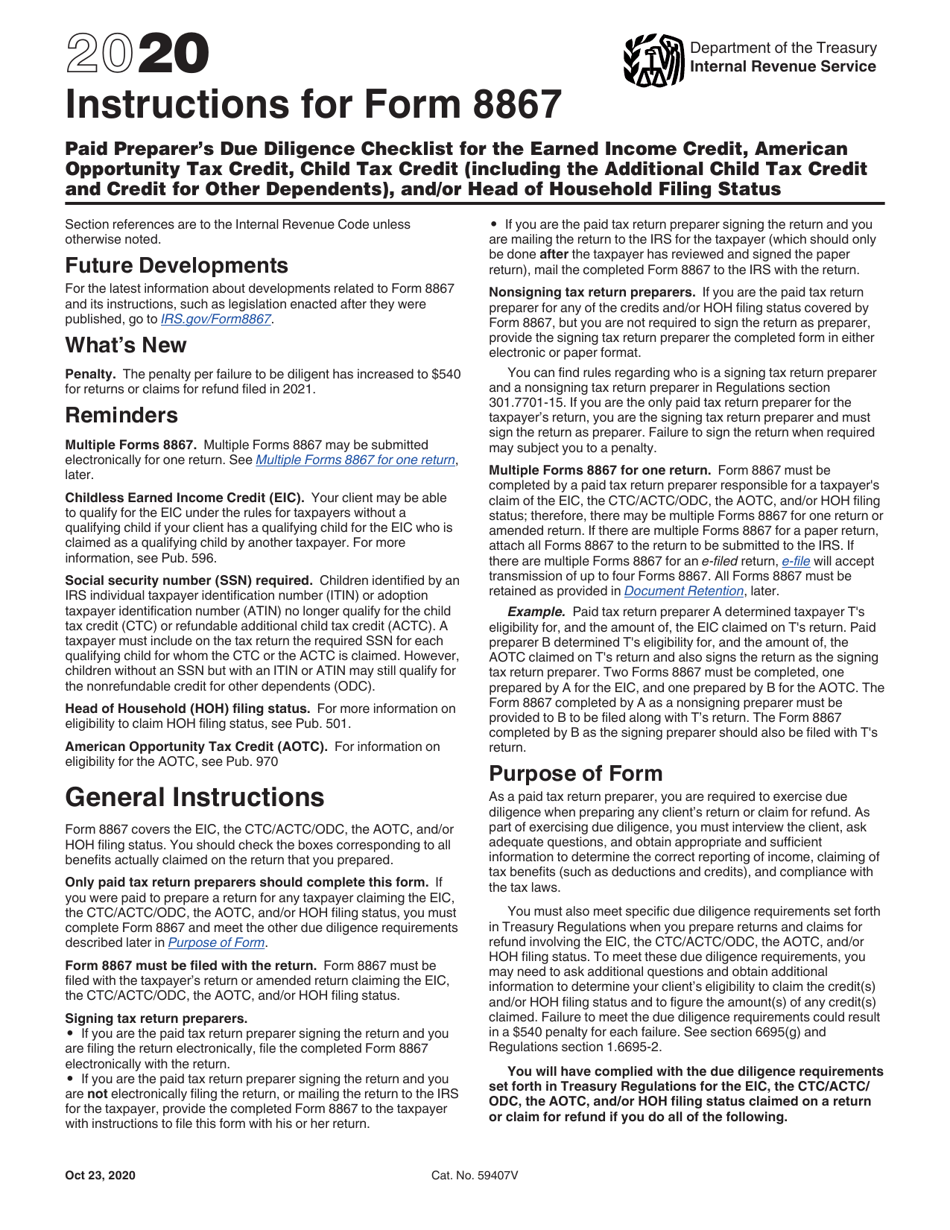

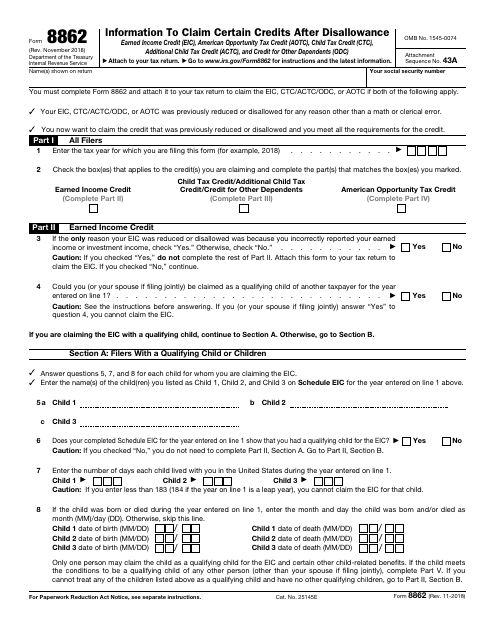

Form 886 A - Fill Out and Sign Printable PDF Template ... irs form 886-a worksheet for qualified loan limit. form 886-h-dep. form 4549. irs form 13825. explanation of items irs. irs form 886i. form 866 a worksheet. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Head of Household Filing Status - Support To claim a spouse's exemption, from the Main Menu of the Tax Return (Form 1040) select: Personal Information; Other Categories (Form 8914 - Housing Exemptions) HOH or MFS and Claiming Spouse Exemption; Additional Information: IRS Form 886-H-HOH - Supporting Documents to Prove Head of Household Filing Status PDF Employer'S Quarterly Unemployment Tax Worksheet Change in ownershipC omplete Form UI-21, Report of Change in Ownership or Discontinuance of Business in Whole or Part, which will be mailed to you upon receipt of this form. Form UI-21 may also be obtained by Fax from Fax-on-Demand at (502) 564-4459 or Tax Status and Accounting at (502) 564-2272. o Request for cancellation (date business closed) Forms 886 Can Assist You | Earned Income Tax Credit Dec 08, 2021 · Most of the forms are available in both English and Spanish. For example, you could use the Form 886-H-EIC PDF and/or the 886-H-EIC (Spanish Version) PDF, Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children for Tax Year 2021. Review the document with your client, showing the client the ...

Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted. Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 886-H-EIC (SP) Property Tax Forms - Texas Comptroller of Public Accounts 50-801, Agreement for Electronic Delivery of Tax Bills (PDF) 50-803, 2021 Texas Property Tax Code and Laws Order Form (PDF) 50-813, Revocation of Appointment of Agent for Property Tax Matters (PDF) 50-820, Notification of Eligibility or Ineligibility to be Appointed or Serve as Chief Appraiser (PDF) Rec'd a Form 886-A worksheet pre Qualified Loan limit and ... Recd a Form 886-A worksheet re Qualified Loan limit and Ded. I'm trying to do my daughters taxes. She made $25000, I'm trying to do my daughters taxes. She made $25000, purchased a mftg home, has the form indicating interest paid and points on the loan, paid … read more Stephen G. Sr Financial & Tax Consultant Bachelor's Degree

MW - My 2004 Federal and State Tax Returns; ... 2013 form 8863 instructions; Irs Form 886 A Worksheet - Ivuyteq; Amazon.com : Full-Body Silicone Smart Baby Doll, 6 Kinds ... Wykrój Simplicity 8863 ... Form 8863 filled out - Form 8863 Department of the ... 8863 Folding-shape Mask (30 pieces) ...

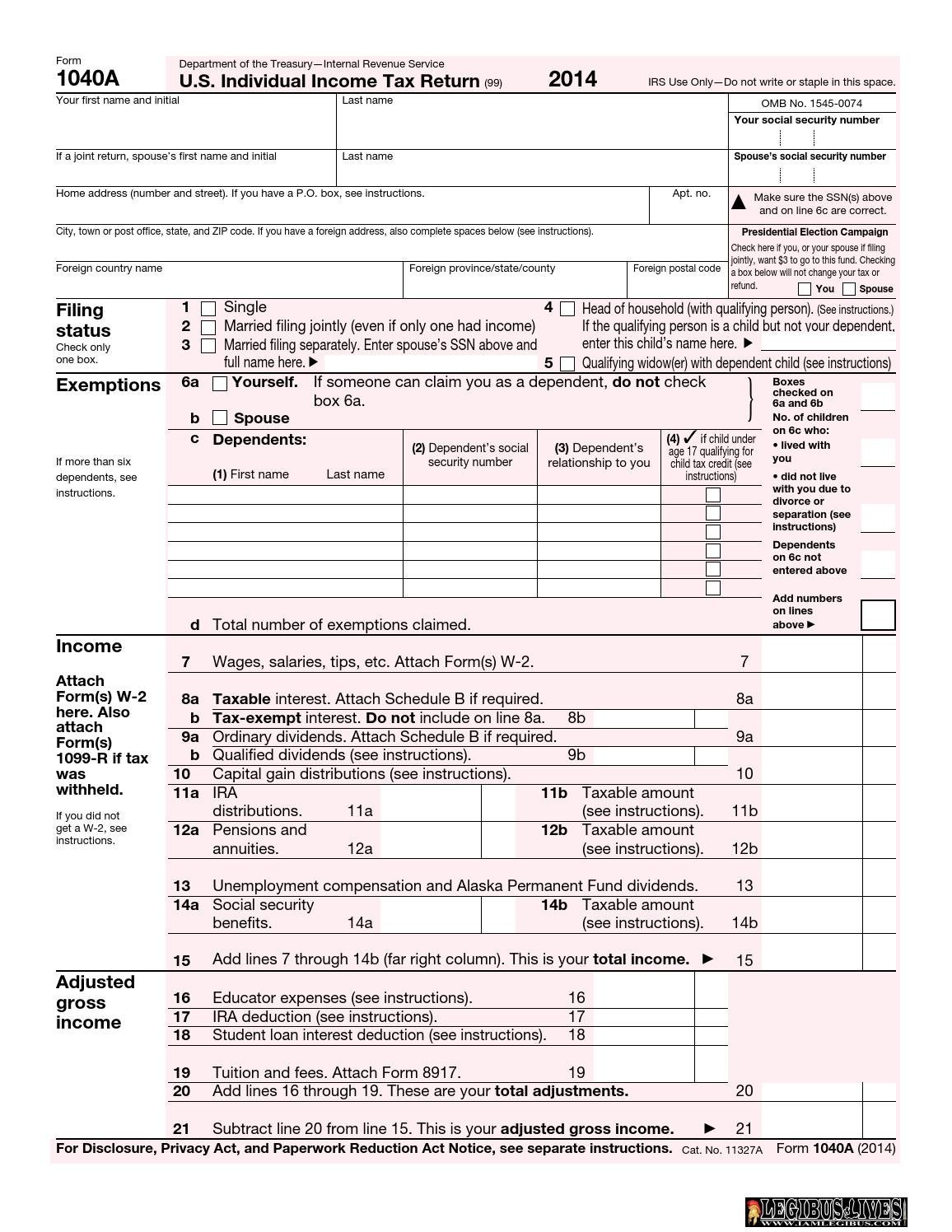

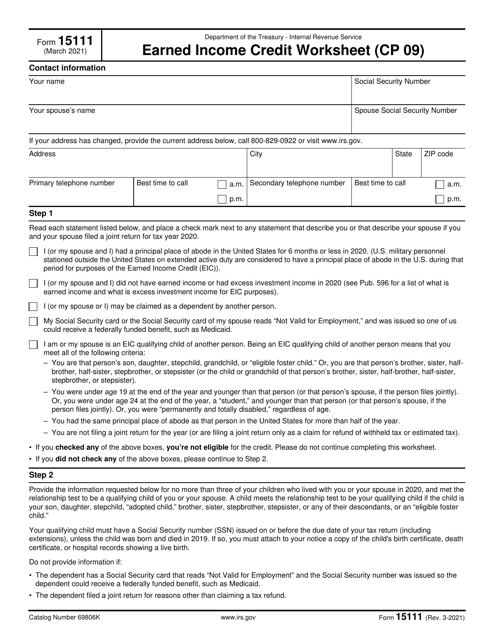

Fillable Form 1040: 2021 U.S. Individual Income Tax Return ... Form 15111: Earned Income Credit Worksheet (CP 09) (IRS) Form 886-H-HOH: Supporting Documents to Prove Head of (IRS) F1096 21 2021 Form 1096 (IRS) FORM 1040, PAGE 1 of 2: 20 05 (IRS) FORM 1040, PAGE 1 of 2: 07 20 (IRS) Form 5329: Additional Taxes on Qualified Plans (Including (IRS)

PDF Form 886-I Explanation of Items - ncpe Fellowship Form 886-I (October 2011) Catalog Number 58489B Explanation of Items Department of the Treasury - Internal Revenue Service Schedule Number . Name of taxpayer Tax Identification Number . Taxable Year Ended We need documentation to verify that you are eligible to claim the Employee Business Expenses listed on your Form

PDF Form 886-H-DEP Supporting Documents for Dependency Exemptions Form 886-H-DEP (Rev. 10-2016) Catalog Number 35111U publish.no.irs.gov . Department of the Treasury - Internal Revenue Service. Form . 886-H-DEP (October 2016) Department of the Treasury-Internal Revenue Service . Supporting Documents for Dependency Exemptions. Taxpayer Name Taxpayer Identification Number Tax Year. If You Are: And: Then ...

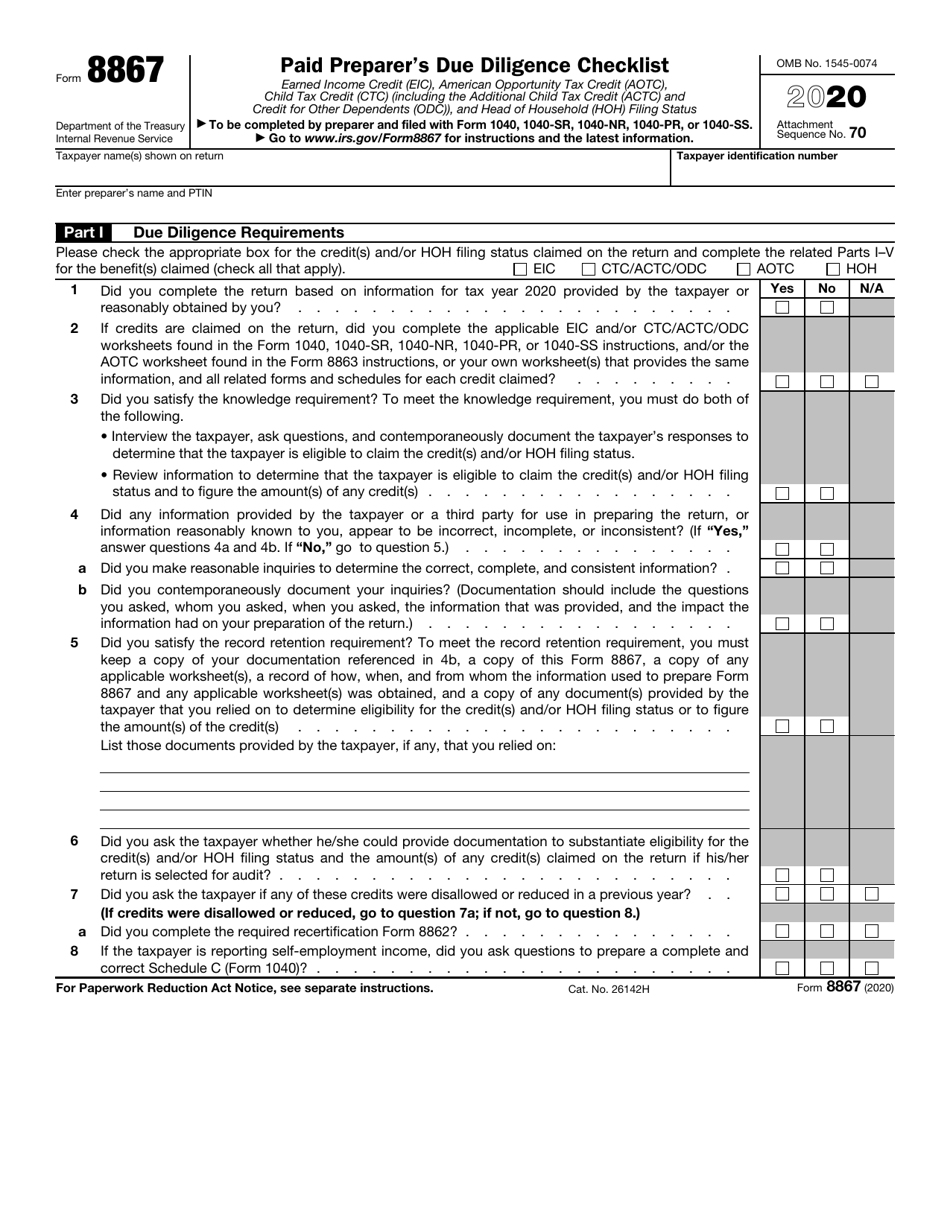

Tax Worksheets | Tax Prep Financial Services Corporation **** For clients wishing to claim the Earned Income Tax Credit, you are required to sign an eligibility checklist upon completion of your tax return. Please review IRS Form 886-H-EIC to see if you qualify to claim this credit. **** Thanks for being a client and accessing our worksheets for one of the 4 types of clients described below.

Form 886 A Worksheet Fillable - Fill and Sign Printable ... Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details.

Form 886 A Worksheet - Fill and Sign Printable Template ... Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one. Make sure that each field has been filled in properly.

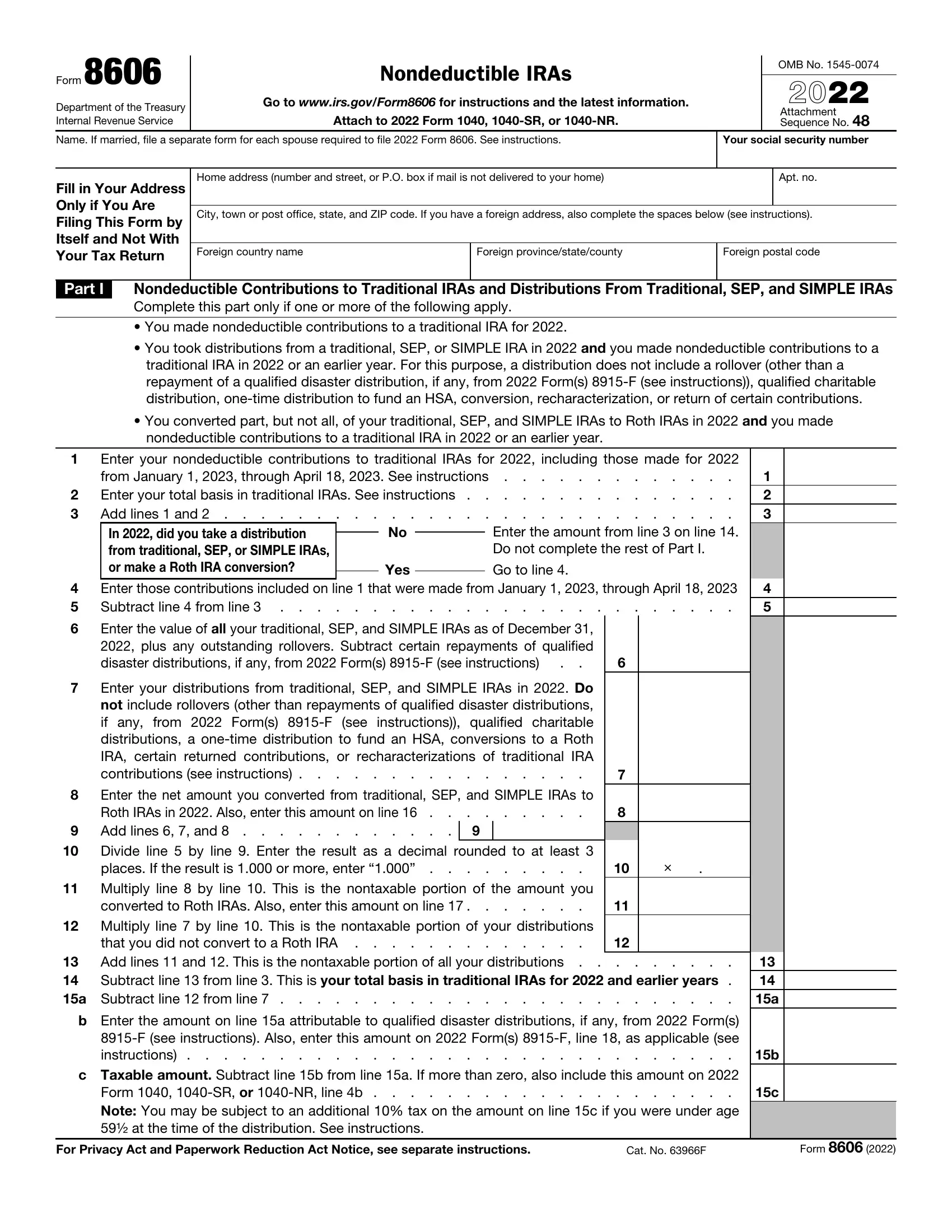

Fill - Free fillable IRS PDF forms IRS e-file Signature Authorization for an Exempt Organization Form 8879-E0. Installment Sale Income Form 6252. Request for Public Inspection or Copy of Exempt or Political Organization IRS Form 4506-A. Payment Card and Third Party Network Transactions Form 1099-K. Compensation Information Schdul J Form 990.

PDF Deduction Interest Mortgage - IRS tax forms Table 1, which is a worksheet you can use to figure the limit on your deduction. Comments and suggestions. We welcome your comments about this publication and sug-gestions for future editions. You can send us comments through IRS.gov/FormComments. Or, you can write to the Internal Revenue Service, Tax Forms and

Form 886 - Fill Online, Printable, Fillable, Blank | pdfFiller Fill Form 886, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now!

PDF 886-H-HOH (October 2020) Supporting ... - IRS tax forms Form . 886-H-HOH (October 2020) Department of the Treasury - Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. ...

PDF Head of Household Worksheet Rent Mortgage payment Insurance Repairs/Maintenance Utilities Food Other household expenses (Signature) (Date) You must complete the Dependent/Child Tax/Education Credit Worksheet and provide a copy of the Divorce/Separation/Child support agreement. You affirm you have reviewed Form 886-H-HOH Supporting Documents to Prove Head-of-Household status

Form 886-A - Internal Revenue Service Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended __ Your plan submitted a request to the Internal Revenue Service for a determination letter on the qualified status of the plan.

Is there a downloadable/fillable version of Schedule C-7 ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported.

Irs 886 H Dep - Fill Out and Sign Printable PDF Template ... 886 dependencia formsigning a irs 886 h dep in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field. To sign a irs h dep form right from your iPhone or iPad, just follow these brief guidelines:

0 Response to "41 irs form 886 a worksheet"

Post a Comment