40 truck driver tax deductions worksheet

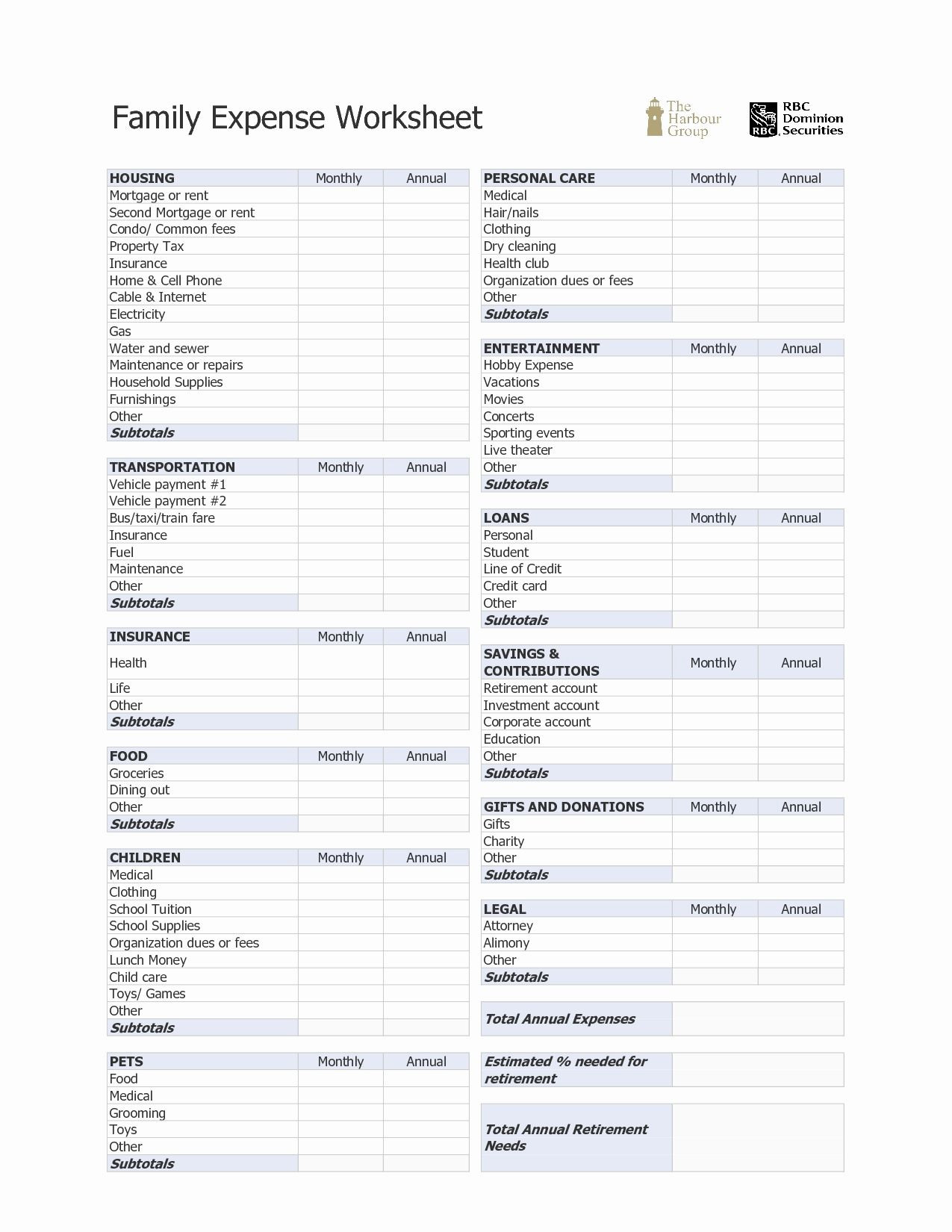

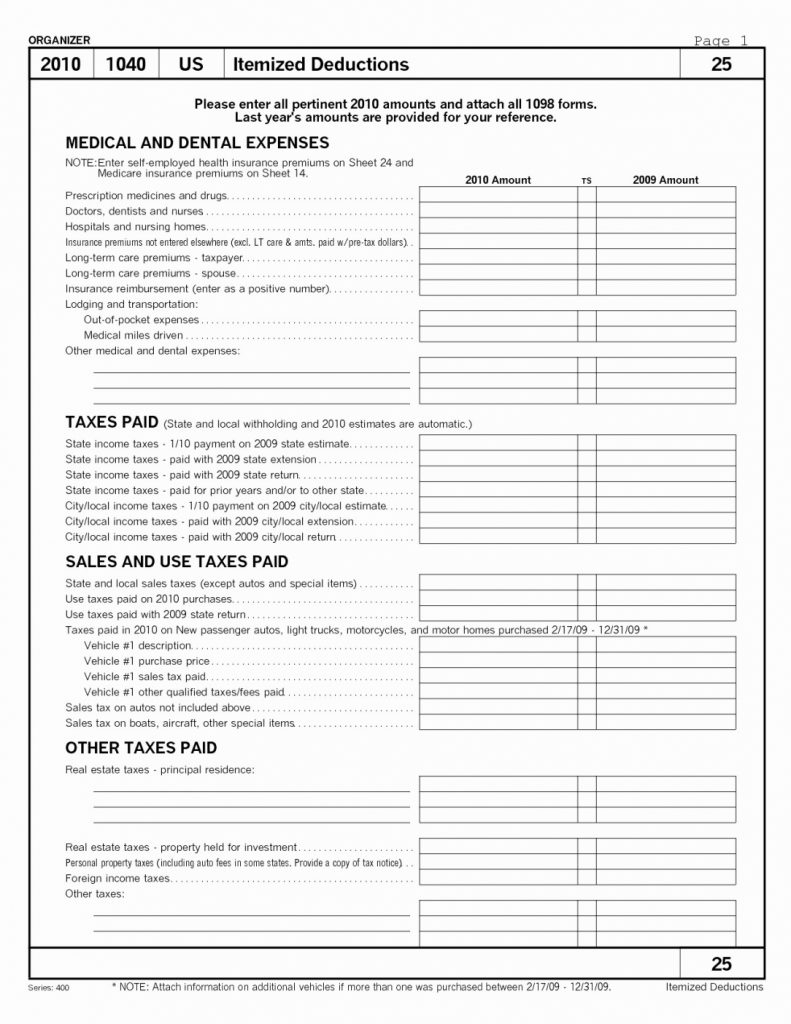

Trucker Tax Deduction Worksheet Truck driver tax deductions worksheet elegant tax deduction from truck driver tax deductions worksheet source play texasholdem us. 153 00 per 1 000 before adjustment on the front of your 1040 tax return. In the event the car was merely a method of transport it has in itself no specific significance and other specifics of the dream should be ... List of Common Tax Deductions for Owner Operator Truck Drivers Some trucking companies might have some differences when it comes to truck driver tax deductions or tax breaks. It all depends on the type of business the trucking company is in and their vehicle operating expenses. That said, there are common deductible business expenses that most owner operator truck drives can claim.

PDF Trucking Business Tax Worksheet - tnttaxserviceaz.com Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: ... Other Equipment Rental $ Truck Maintenance $ Postage & Delivery $ Other - Explain $ ... Do you have evidence to support the deduction? Yes or No Number of Miles Driven for Commuting mi. Home Office Square Footage of Home sq./ft Cost of Utilities Except Water per ...

Truck driver tax deductions worksheet

What You Need to Know About Truck Driver Tax Deductions - TurboTax While the IRS allows most industries to deduct 50% of meals, drivers subject to the Department of Transportation's "hours of service" limits, can claim 80% of their actual meal expenses. The hours of service rule requires drivers who have driven a certain amount of hours to stop and rest for an assigned period of time. TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron ... TRUCKER'S INCOME & EXPENSE WORKSHEET ... License Plates ____ To truck or business location Interest Continue only if you take actual expense (must use actual expense if you lease) Mfg. gross vehicle weight (check one): Gas, oil, lube, repairs, tires, batteries, insurance, supplies, wash, wax, etc. _____ 6000 lbs. or less Truck Driver Deductions Spreadsheet Owner operator truck drivers can significantly reduce domestic tax liability by including these line items on monster truck driver tax deductions worksheet. Can claim a tag, wait a few days you can...

Truck driver tax deductions worksheet. Truck Driver Tax Deductions: 9 Things to Claim - Drive My Way Truck driver tax deductions are a great way to save money on taxes. There are three golden rules of filing taxes. Step 1. Find your Form. Step 2. Save Money with Truck Driver Tax Deductions. Step 3. File before April 15. The money you spend for work on the road might increase the money you get back from taxes. Owner Operator Truck Driver Tax Deductions Worksheet Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Download 2019 per diem tracker. TRUCKER'S INCOME & EXPENSE WORKSHEET - Webflow TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!! YEAR_____ NAME ... Truck Driver Tax Deductions Visit for more CDL Truck Driver Solutions Cleaning Supplies Misc. Supplies Misc. Supplies Air Freshener Alarm Clock Thermos Bottle Armour-All Fly Swatter First Aid Supplies ... Tax Deduction List for Owner Operator Truck Drivers - CDLjobs.com For tax year 2021, participants with family coverage, the floor for the annual deductible is $4,800, up from $4,750 in 2020; however, the deductible cannot be more than $7,150, up $50 from the limit for tax year 2020. For family coverage, the out-of-pocket expense limit is $8,750 for tax year 2021, an increase of $100 from tax year 2020.

Top 18 Tax Deductions for Truck Drivers: Keep More of Your Own Money For 2021, the daily allowance is $95 for lodging + $55 for meals and incidentals. In other words, you can deduct a daily travel expense of $150. You can only deduct travel expenses as a truck driver if you are driving away from your tax home, which is your main place of business. PDF Tax Deduction checklist for truck drivers -•J'.evnrietTO'peralor Truck Expenses-e ,,J . C itizens Band Rad o . Description of Truck . Compass/GPS . Date Placed in Service . Fire Extinguisher . Odometer-Beginning of Year . First Aid Kit . Odometer-End of Year . Flares . Interest Paid . Flashlight . Gas, Lube and Oil . Glasses- Safety and Sun . Repairs and Maintenance . Gloves . Tires ... PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST - Trucker to Trucker you cannot legitimately deduct the income lost as a result of deadhead/unpaid mileageonly the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. you cannot legitimately deduct for downtime (with some minor exceptionsask your tax pro). you cannot deduct charitable contributions … PDF Truck Drivers Worksheet - Accounting Unlimited TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS ... -Depending On How You Keep Track Of Your Meals Deduction- ... Days on Road Quarters on Road Days Not on Road -If You Use Your Personal Car Or Truck For Any Business Related Transactions- (Picking Up Supplies, Making Deposit At The Bank, etc.)

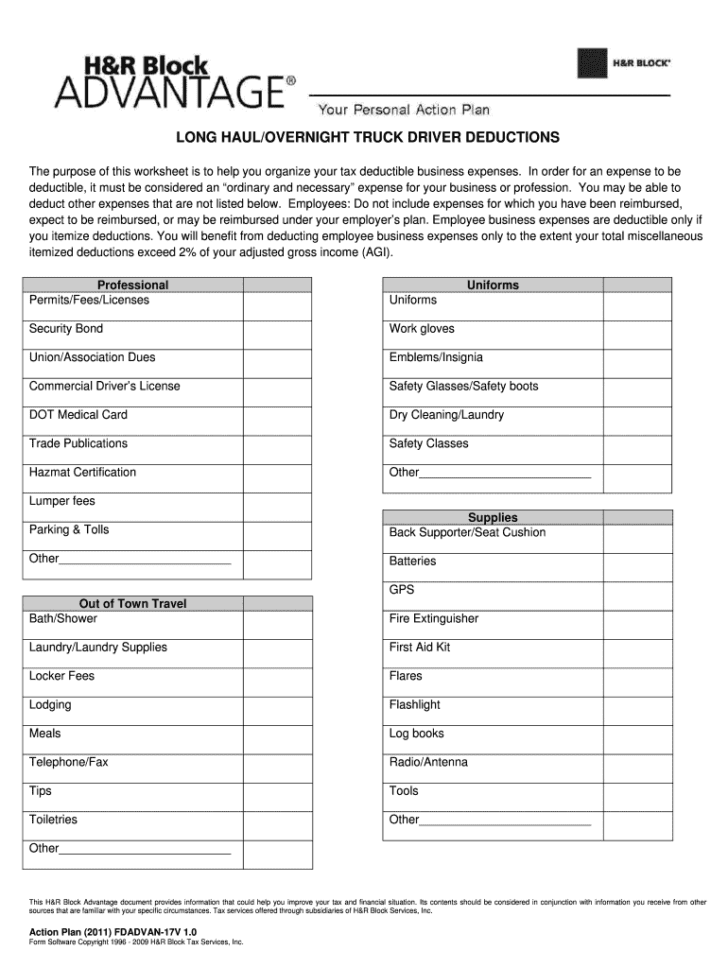

PDF Tax Organizer--Long Haul Truckers and Overnight Drivers - Taxes By Rachel PART 2—Owner/Operator Truck Expenses Description of Truck Date Placed in Service Odometer—Beginning of Year Odometer—End of Year Vehicle Weight Interest Paid Gas, Lube and Oil Repairs and Maintenance Tires Insurance License and Registration Fees Other: PART 3—Dues and Fees tfx.tax › truck-driver-tax-deductionsTruck Driver Tax Deductions: How to File in 2021 | TFX Sep 01, 2021 · We know it’s tricky to keep in mind the whole list, so we’ve created a downloadable truck driver tax deductions worksheet. Get yours and mark every checkbox as you go. Non-deductible truck driver expenses Unfortunately for truck drivers, not all the expenses are deductible. Let’s see what non-deductible expenses are: Everyday clothes Ultimate Tax Deductions for Truckers & Owner Operators Here are the Tax Deductions & Expense List for Long Haul Truckers & Owner Operators: Fuel for Truck, Tractor & Refer Legal & Professional Fees Repair & Maintenance Highway Use Tax (Form 2290) Truck & Trailer Insurance Supplies DMV Fees for Truck & Trailer Uniforms, Safety Shoes & Safety Equipment Contract Labor ( 1099 NEC Required) Trailer Rent Tax Deductions for Truck Drivers - Jackson Hewitt Meal Allowance. Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US. The special standard meal allowance is ...

Long Haul Trucker/OTR Driver Deductible Expenses Worksheet This worksheet is to help you organize your tax deductible business expenses. For an expense to be deductible, it must be considered an "ordinary and necessary" ...2 pages

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction spreadsheet template excel. Tax ...

Truck drivers - Deductions | Australian Taxation Office Deductions You may be able to claim deductions for your work-related expenses. These are expenses you incur to earn your income as a truck driver. For a summary of common claims, see Truck driver deductions (PDF, 343KB) . Or use the list of expenses below to learn more. To claim a deduction for work-related expenses:

truckstop.com › blog › truck-driver-tax-deductions19 Truck Driver Tax Deductions That Will Save You Money Dec 14, 2021 · So if your new laptop cost $1,000 and you use it for work 50% of the time, you can deduct $500. Education If you pay for truck driver school or other training to maintain your CDL license, you can deduct it. Other education may be tax deductible too, as long as it’s directly related to your trucking career.

2020 Truck Driver Tax Deductions Worksheet - Fill Online, Printable ... LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered Fill trucking income and expense excel spreadsheet: Try Risk Free Form Popularity owner operator tax deductions worksheet form

Truck Expenses Worksheet | Spreadsheet template, Printable worksheets ... Truck Expenses Worksheet. The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

PDF Over-the-road Trucker Expenses List - Pstap THE BASIC RULES: (1) Keep all receipts, including those point of sale receipts, (2) pay all bills with a check or debit (or credit) card, and (3) anything you pay cash for without a detailed receipt or bill of sale is treated as a non-deductible personal expense, not a business income deduction.

Get and Sign Truck Driver Tax Deductions Worksheet Form Follow the step-by-step instructions below to eSign your truck driver expenses worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

Truck Driver Deductions Spreadsheet: Fillable, Printable & Blank PDF ... Start on editing, signing and sharing your Truck Driver Deductions Spreadsheet online with the help of these easy steps: Push the Get Form or Get Form Now button on the current page to make access to the PDF editor. Wait for a moment before the Truck Driver Deductions Spreadsheet is loaded

Free Owner-Operator Trucker Tools - ATBS Our per diem calendar will help you keep track of your days on the road for the truck driver per diem tax deduction. Write a slash (/) through partial days and an X through full days on the road. Download 2021 Per Diem Tracker Download 2020 Per Diem Tracker DOWNLOAD Trucker Tax Deduction Worksheet

PDF Truck Driver Income Worksheet - CrossLink Tax Tech Truck Driver Expense Worksheet . VEHICLES FOR HIRE MUST USE ACTUAL EXPENSES. Business Miles Driven Other Than While Hauling Loads: _____ Vehicle Expense: (Standard Mileage Rate) Business Miles Only [From . Mileage Log Worksheet] _____ total business miles x 57.5¢ per mile = _____ Do you own the tractor trailer/truck that you use to haul loads? ...

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287,48( Year RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies

Truck Driver Deductions Spreadsheet Owner operator truck drivers can significantly reduce domestic tax liability by including these line items on monster truck driver tax deductions worksheet. Can claim a tag, wait a few days you can...

Free CDL Pre Trip Checklist | PRE TRIP INSPECTION SHEET Driver Date Vehicle Route | Stuff to Buy ...

TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron ... TRUCKER'S INCOME & EXPENSE WORKSHEET ... License Plates ____ To truck or business location Interest Continue only if you take actual expense (must use actual expense if you lease) Mfg. gross vehicle weight (check one): Gas, oil, lube, repairs, tires, batteries, insurance, supplies, wash, wax, etc. _____ 6000 lbs. or less

What You Need to Know About Truck Driver Tax Deductions - TurboTax While the IRS allows most industries to deduct 50% of meals, drivers subject to the Department of Transportation's "hours of service" limits, can claim 80% of their actual meal expenses. The hours of service rule requires drivers who have driven a certain amount of hours to stop and rest for an assigned period of time.

0 Response to "40 truck driver tax deductions worksheet"

Post a Comment