45 car insurance worksheet for students

How much is car insurance for a 16 year old | CarInsurance.com The average car insurance rate for a 16-year-old is $7,625 a year for full coverage - $635 per month - but you can still find affordable rates by following the steps in our guide. ... Good student discount: Drivers who maintain a 3.0 or "B" average may get a discount of up to 16%. How much car insurance do I need ? Get tips from the experts The average annual rate for liability coverage with limits of 50/100/50 is $637. The average annual rate for full coverage with limits of 100/300/100 and a $500 deductible is $1,682. To see what the average driver pays for liability coverage in each state, and how much more you would pay to boost your coverage, refer to the table below.

Liability Auto Insurance 101 | RamseySolutions.com Liability insurance is the most important type of car insurance. Here's why. Meet Travis. Travis gets in a car accident that's found to be his fault. Now he's liable for the damages he caused—meaning he has to pay for the other driver's car repairs and medical bills. Travis doesn't have thousands of dollars to pay those costs.

Car insurance worksheet for students

Comprehensive deductible: How to make the smart choice. - Carinsurance.com Typically, comprehensive deductibles range from $100 to $2,500, as car insurance deductible choices vary depending on your state laws and insurance company guidelines. Deductibles tend to be between $250 and $1,000. Usually, the deductible is paid per incident, which implies you will pay for every comprehensive auto insurance claim you make. Car Insurance - The Balance What is full coverage car insurance? Full coverage auto insurance indicates a package of coverages—usually at least comprehensive, collision, and liability—but may also include other coverages, depending on your state's requirements, your lender's requirements, and your personal preferences. The more extensive your coverage, the more ... Insurance for Beginners: What You Need to Know Deductible: Your deductible is the amount of money you have to pay out of pocket before your insurance company pitches in. For example, let's say your car insurance has a $1,000 deductible and you get into a car accident that causes $2,000 worth of damage to your car. You'll have to pay $1,000 toward the repair before your insurance will cover the rest.Pro tip: You can generally pay a ...

Car insurance worksheet for students. 7 Free Teen Budget Worksheets & Tools (Start Your Teenager Budgeting) Psst: you'll also definitely want to check out 58 common teenager expenses, to get your teen started with how to fill out the expense part of their budget worksheet. Also, here's 3 sample budgets for 18-year-olds to help, and 11 teenage budgeting tips. 1. Money Prodigy's Teen Budget Worksheet Filing a Car Insurance Claim: Key Things to Know in 2022 - WalletHub 5 Steps to File a Car Insurance Claim 1. Contact Your Insurance Company Contact your agent or insurer to report the accident as soon as possible. Be prepared to provide the following information: Which covered vehicle was involved Who was driving Location and time of the accident A basic description of the accident and the severity of the damage Compare the Best Car Insurance Rates [August 2022] | Compare.com While rates can vary quite a bit from driver to driver, the same can be said for insurance companies. In the table below, you'll see the national average rates for 10 of the top insurance companies in the U.S. Avg. Monthly Premium. State Farm. $158. Allstate. $199. Key Changes Coming To The FAFSA For Fall 2022 "If the answer is yes, students will be provided a worksheet. Students should answer the questions correctly; however, the questions won't impact students' eligibility," they write. According to...

14 Free Financial Literacy Worksheets PDF (Middle & High School) One of the worksheets in this free workbook that you can download individually is about reading a paycheck and understanding what everything means. Students will then answer some questions about what the paycheck says. 2. It's a Job Getting a Job Suggested Age: High school 136 Insurance Quizzes Online, Trivia, Questions & Answers - ProProfs What is: Insurance that pays for the cost of injuries to people involved in an accident and protects the insured against financial loss from lawsuits and other legal expenses incurred as a result of an accident. There are two limits: the maximum that will be paid to any one person and the maximum for each accident. Car insurance for college students | Dairyland Auto® Non-owner coverage. If you're attending college and don't own a car, but think you might occasionally drive someone else's car, you'll need non-owner coverage. This will help protect you in case you're at fault in an accident while driving a car that you don't own. Get a Dairyland quote today. Find your coverage. Financial Literacy for High School Students - InCharge Debt Solutions The average cost for students attending a public university is up 213% ($3,190 in 1988 to $9,970 in 2018), while private school is up 129% ($15,160 to $34,740) over the same time period. That's the primary reason Americans are $1.4 trillion in debt on student loans.

Compare Car Insurance Rates for August 2022 - NerdWallet Drivers around the age of 20 typically get higher car insurance rates because as a group they get into more accidents on average than older drivers. Rates vary from company to company. For example,... Writing the Perfect Elevator Pitch for Insurance Agents A word of caution on "canned" statements. They can come across as too "boxed" or stale. Practice this and it will become second nature, taking note that if you're selling insurance with your polished pitch it may come off as "robotic" if it appears at all unnatural. Make it conversational (with pauses) and it will be one of your ... How to Review Your Car Insurance Coverage - The Balance Comprehensive coverage is more affordable than collision insurance—about $134 per year, on average—making it a good value if your car still has a market value of a few thousand dollars. 4 Medical Coverage Medical payments (also known as "med pay") coverage helps pay the medical expenses of you and your passengers after a covered accident. FDIC: Money Smart for Young People - Grades 9 - 12 The worksheets can be found in the Educator Guide for grades Pre-K-2, and in a standalone Student Guide for grades 3-12. Parents'/Caregivers' Guide with a summary of the key concepts covered in the module, and that offers exercises, activities, and conversation-starters for parents. Superintendents, Principals, Educators and other Administrators:

Auto Insurance Liability Limits | MoneyUnder30 This is all what liability insurance is for. When you cause an accident, your liability insurance covers all of the expenses outside the damage of your own car. Liability insurance covers two types of damages: Bodily injury. As the name suggests, this type covers the medical bills and emergency aid expenses of the others involved in the accident.

Car Insurance 101 for College Students | USAA To lower your premium, you can make changes to your coverage or your vehicle. There are four other ways to lower your auto insurance rate: 1. Raise your deductible. Your deductible is what you'll pay out of pocket before your insurance kicks in. If you're comfortable with a higher deductible, you may lower your premium.

16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) Use this TD lesson plan and worksheet to teach students how to balance a checkbook. They'll then be given a case study of someone's spending, and need to balance that person's checkbook with the provided worksheet. 3. Introduction to Earning Interest Suggested Age: Middle School

NGPF Answers Key 2022 [100% FREE Access] Your budget for a new car includes your loan, gas, and insurance. List any other costs to budget? Ans: Maintenance, Repairs, Tires, Oil Changes, Etc. Q. ... (NGPF) is a nonprofit organization that provides free, high-quality personal finance education to students and educators. It was founded in 2008 by Debra Schneider and Lowell Steiger. Both ...

The Student's Guide to Budgeting in College | BestColleges Check your student bill to make sure everything has been paid for before you spend any refund money. Step 2: Assess and Categorize Your Expenses To assess your financial situation, log in to your bank or credit union's website. Here, you can review your spending and earnings over the past month.

Best car insurance for college students In these cases, you will want to be aware of the companies that have the lowest rates for students. Among national auto insurance providers, USAA, Liberty Mutual, and Geico have the cheapest rates for students. Concord is the cheapest overall, but it is only available in Maine, Massachusetts, New Hampshire, and Vermont.

The Best & Cheapest Car Insurance for College Students Cheapest Car Insurance for 18-Year-Old College Students. The following car insurance companies offer the cheapest car insurance for 18-year old college students: Gainsco - $145/mo. MetroMile - $155/mo. Commonwealth Casualty - $155/mo. Dairyland - $165/mo.

Data Visualization using Tableau Week 2 Session 1 6_1_2022, 4_01_14 PM ... Data Visualization using Tableau Week 2 Session 1 6_1_2022, 4_01_14 PM.png - Tableau Public - Car Insurance_DVT File Data Worksheet Dashboard Story. Data Visualization using Tableau Week 2 Session 1 6_1_2022, 4_01_14 PM.png. School Kendriya Vidyapati Sanghatan; ... Students who viewed this also studied.

Insurance Expense - Overview, Types, Insurance Payable Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. The agreement is that, as the policyholder, the company pays premiums on the policies. The policies are designed to protect the company - and employees - from anything adverse that might happen.

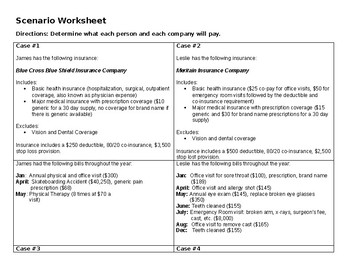

Analyzing auto insurance scenarios | Consumer Financial Protection Bureau What students will do. Read about different types of auto insurance. Work in groups to select three types of coverage to buy. Read a scenario about a person with auto insurance and, based on the insurance coverage selected, determine how much they and the insurance company would be responsible for paying. Reflect on the need for auto insurance.

Is There a Good Student Discount for Car Insurance? - The Balance Here's a look at the average good student discount offered by three large insurance carriers. The dollar amount of the discount would depend on the amount of your premium. While good student discount amounts vary from insurer to insurer, it's often between 5% and 25%. See with your insurer how much you can save. 6 7 8.

Insurance for Beginners: What You Need to Know Deductible: Your deductible is the amount of money you have to pay out of pocket before your insurance company pitches in. For example, let's say your car insurance has a $1,000 deductible and you get into a car accident that causes $2,000 worth of damage to your car. You'll have to pay $1,000 toward the repair before your insurance will cover the rest.Pro tip: You can generally pay a ...

Car Insurance - The Balance What is full coverage car insurance? Full coverage auto insurance indicates a package of coverages—usually at least comprehensive, collision, and liability—but may also include other coverages, depending on your state's requirements, your lender's requirements, and your personal preferences. The more extensive your coverage, the more ...

Comprehensive deductible: How to make the smart choice. - Carinsurance.com Typically, comprehensive deductibles range from $100 to $2,500, as car insurance deductible choices vary depending on your state laws and insurance company guidelines. Deductibles tend to be between $250 and $1,000. Usually, the deductible is paid per incident, which implies you will pay for every comprehensive auto insurance claim you make.

0 Response to "45 car insurance worksheet for students"

Post a Comment