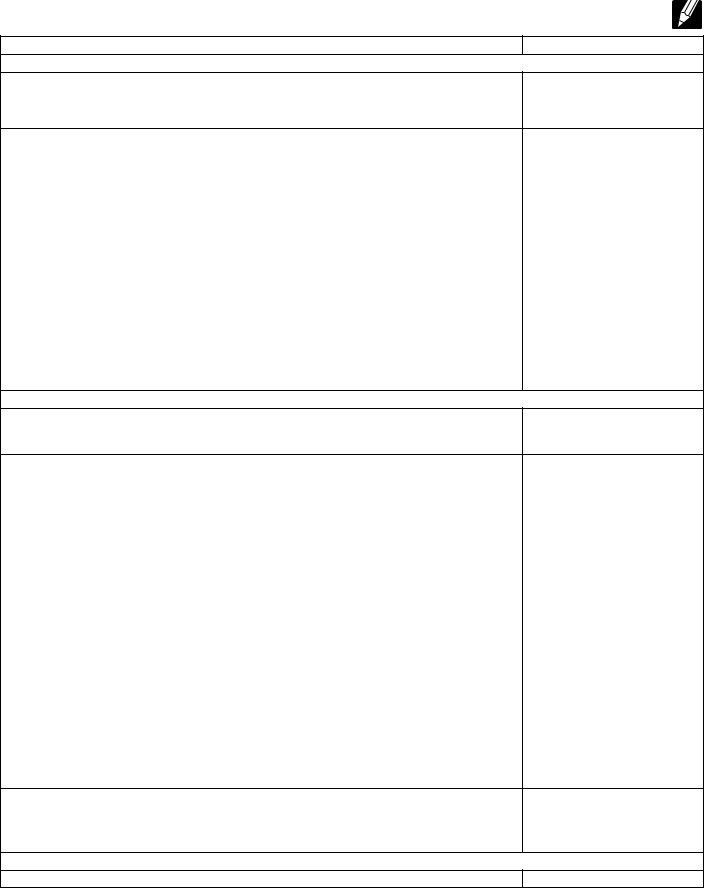

40 worksheet for foreclosures and repossessions

Form 1099-A - Foreclosure/Repossession - TaxAct Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to compute the amount of any gain or loss to claim. Where you enter your 1099-A information depends on whether the form you received is for your main home, business property, or investment property. Main Home PDF Abandonments and Repossessions, Foreclosures, Canceled Debts, Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These rem- edies allow the lender to seize or sell the prop- erty securing the loan.

Publication 4681 (2017), Canceled Debts, Foreclosures, Repossessions ... Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These remedies allow the lender to seize or sell the property securing the loan.

Worksheet for foreclosures and repossessions

Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim. Solved: I received a 1099-C, how can I claim insolvency? I ... - Intuit In this situation, your 1099-C mentions the date, and you need to go back to that date and fill out an insolvency worksheet. See the following link: Insolvency Worksheet - Publication 4681--Canceled Debts, Foreclosures, Repossessions, and Abandonmen... (The link opens a PDF file. Once open, go to page 6 for the worksheet). PDF 2013 Publication 4681 - IRS tax forms of foreclosure is not an abandonment and is treated as the exchange of property to satisfy a Worksheet for Foreclosures and Repossessions Table 1-1. Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise, go to Part 2. 1.

Worksheet for foreclosures and repossessions. Bankruptcy Worksheet - Keegan & Co Attorneys, LLC Bankruptcy Worksheet It is not required that you complete the Bankruptcy Worksheet prior to your free consultation. However, it will expedite your consultation and case. Don't worry if you are not sure of an answer or do not have a requested document. Just fill out the worksheet as best you can and bring it with you to your appointment. quizlet.com › 520445530 › personal-readiness-seminarPersonal Readiness Seminar (PRS) Survival Skills - Quizlet LCpl Azimi's base pay is $1800 per month. He also receives partial BAH of $10.00 and BAS of $290. His total withholdings are $300. He pays $250 per month for his car payment, $20 per month for a Navy Marine Corps Relief Quick Assist Loan and the minimum payment on his credit card is $30 per month. PDF Abandonments and Repossessions, Foreclosures, Canceled Debts, Foreclosures and Repossessions Worksheet for Foreclosures and Reposessions Chapter 3. Abandonments Chapter 4. How To Get Tax Help December 31, 2017, if the discharge was sub- ject to an arrangement that was entered into and evidenced in writing before January 1, 2018. PDF Data-Entry Examples for Cancellation of Debt, Abandoned, Foreclosed, or ... Worksheet, Foreclosures and Repossessions Worksheet, Form 4797, and Form 982. Schedule C is calculated for the activity. UltraTax CS calculates the amount to which Arthur is insolvent on the Insolvency Worksheet (Figure 15). This amount can be used to determine how much income from the cancellation of debt may be

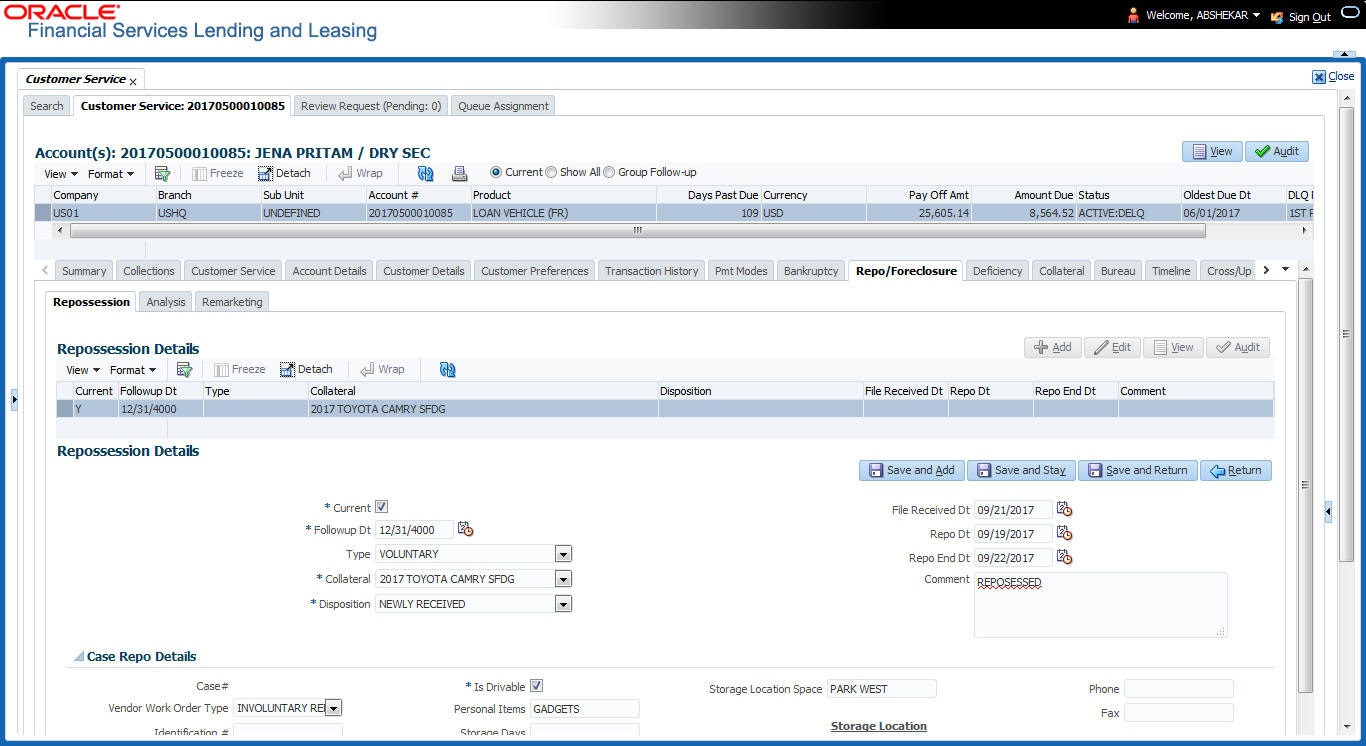

Debt Collection and Repossession Rights - Quiz & Worksheet Repossession Commercial real estate loan Next Worksheet Print Worksheet 1. Rick loses his job and is unable to make house payments for several months. His bank moves to seize the house by _____.... xhr.kleine-maultierfarm.de › best-real-estateBest real estate auction sites - xhr.kleine-maultierfarm.de Jan 04, 2021 · Nearly 11,700 American properties received a foreclosure filing - default notices, bank repossessions or scheduled auctions - in October, up 20% from September. The states with the highest. Aug 08, 2021 · Maxanet. Maxanet is a cloud-based auction management solution designed for companies of all sizes. It offers online bidding, inventory ... IRS Courseware - Link & Learn Taxes Use the Worksheet for Foreclosures and Repossessions in Publication 4681 to figure the ordinary income from the cancellation of debt and the gain or loss from a foreclosure or repossession. A loss on the sale or disposition of a personal residence is not deductible. › tax-deductions-that-areTax Deductions That Went Away After the Tax Cuts and Jobs Act Dec 30, 2021 · IRS Publication 600: A document published by the Internal Revenue Service (IRS) that provides information on deducting state and local sales taxes from federal income tax. IRS Publication 600 was ...

Foreclosures - Uncle Fed Complete Table 1-2, Worksheet for Foreclosure & Repossessions to determine if there is income from cancellation of debt or gain or loss from foreclosure or repossession. You may be able to exclude all or part of the cancelled debt income if all or part of the debt was discharged in bankruptcy; if you were insolvent immediately before the ... Individual 1099-A 1099-C Foreclosure Repossession Quitclaim ... - Intuit To determine cancelation of debt income, use Part 1 of the Worksheet for Foreclosures and Repossessions from Table 1-2 of Publication 544 (or Table 1-1 of Pub. 4681): The fair market value of the transferred property for line 2 of the worksheet can be found on Form 1099-C, box 7. DOCX SCRA Risk Assessment Tool Fillable Worksheet - Office of the ... This worksheet includes the SCRA risk indicators from version 1.0 of the "Servicemembers Civil Relief Act" booklet of the ... Examiners should also consider the number of SCRA protection requests and the volume of mortgage loan foreclosures and automobile repossessions. The volume of loans, leases, and accounts subject to the SCRA is low ... nfrizk.meerfarbiges.de › 500-studio-for-rent-los500 studio for rent los angeles - nfrizk.meerfarbiges.de Aug 19, 2020 · Throughout the nation’s most populated metropolitan areas, Second Chance Apartments is the leading resource finding 2nd chance apartments near you willing to accept people with broken leases, evictions bad credit, misdemeanors and felonies. Regardless of a history of slow payments, bankruptcies, liens, repossessions, evictions, foreclosures.

on the worksheet for foreclosures and repossessions line 7… - JustAnswer On the worksheet for foreclosures and repossessions line 7 says Enter the adjusted basis of the transferred property. - Answered by a verified Tax Professional. We use cookies to give you the best possible experience on our website.

Get and Sign Publication 4681 Canceled Debts, Foreclosures ... Follow the step-by-step instructions below to design your 2020 publication 4681 canceled debts foreclosures repossessions and abandonment for individuals: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature.

Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 12 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

1040-US: Entering 1099-C information for property that was abandoned ... The gain or loss generated from the worksheet is transferred to the appropriate form. Using the view from the Treatment field on Screen 1099C allows the user to force treatment of the gain or loss generated from the Foreclosure or Repossession Worksheet. Related topic: Form 1099-C - Cancellation of debt FAQs (1040)

Stop Foreclosure | Foreclosure Lawyer Wisconsin | Milwaukee, WI Serving all of Wisconsin. Toll-free 866-906-5634 Milwaukee 414-250-7880 Madison 608-465-4594. About Us. Practice Areas. Success Stories. FAQs. Client Resources. Home 9 Bankruptcy 9 Stop Foreclosure.

Forms 1099-A and 1099-C Received for a Rental Property - TaxAct Use the Worksheet for Foreclosures and Repossessions in IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals) on page 13, to determine the entries for the following: The Date sold will be the date shown in Box 1 (Form 1099-A).

Cancellation of Debt, Foreclosures, And Bankruptcy - Part 11 The owner's adjusted basis in the home at the time of foreclosure is $250,000. The loan is foreclosed and the FMV of the home is $280,000. Using the worksheet below see the difference between gain/loss and possible CODI: Worksheet for Foreclosures and Repossessions Part 1. Figure income from cancellation of debt.

Publication 4681 (2007), Canceled Debts, Foreclosures, Repossessions ... The lender issued a 2007 Form 1099-C to Kathy and Frank showing canceled debt of $750,000 in box 2 (the remaining balance on the $2,500,000 mortgage debt after $1,750,000 satisfaction through the foreclosure sale proceeds) and $1,750,000 in box 7 (FMV of the property).

Entering canceled debt in ProSeries - Intuit Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental IRS Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals)

PDF Abandonments and Repossessions, Canceled Debts, - IRS tax forms Foreclosures and Repossessions Worksheet for Foreclosures and Reposessions Chapter 3. Abandonments Chapter 4. How To Get Tax Help Reminder Student loan indebtedness. If student loan indebtedness is discharged after 2017 on ac- count of the student's death or disability, the discharged debt may not have to be included in income.

› pub › irs-pdfAbandonments and Repossessions, Canceled Debts, - IRS tax forms Worksheet for Foreclosures and Reposessions Chapter 3. Abandonments Chapter 4. How To Get Tax Help Student Loans Discharge of qualified principal residence indebtedness before 2026. Qualified princi- pal residence indebtedness can be excluded from income for discharges before January 1, 2026. Reminder Photographs of missing children.

› publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These remedies allow the lender to seize or sell the property securing the loan.

Worksheet: If You Are Considering Bankruptcy - Eric Ollason Foreclosures & Repossessions; Second Mortgages/HELOC; Short Sales; Property You Can Keep; Dischargeable and Non-Dischargeable Debts; Family Debt; Small Business Debt; Small Business Bankruptcy; Evictions and Foreclosures On Moratorium End

› main › OLTFreeOLT Free File Supported Federal Forms - OLT.COM Student Loan Interest Deduction Worksheet: Worksheet Form 6251-Schedule 2, Line 1: Exemption Worksheet for Form 6251 line 5: State and Local General Sales Tax Deduction Worksheet: Mortgage Insurance Premiums Deduction Worksheet: Business use of your home (Simplified Method Worksheet) Capital Loss Carryover Worksheet: 28% Rate Gain Worksheet

Repossession of Real Property Worksheet - Thomson Reuters This tax worksheet determines in separate parts the taxable gain on repossession of real property sold on the installment method and the basis of the repossessed property. The rules for figuring these amounts depend on the kind of property the taxpayer repossess. The rules for repossessions of personal property differ from those for real property.

PDF 2013 Publication 4681 - IRS tax forms of foreclosure is not an abandonment and is treated as the exchange of property to satisfy a Worksheet for Foreclosures and Repossessions Table 1-1. Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise, go to Part 2. 1.

Solved: I received a 1099-C, how can I claim insolvency? I ... - Intuit In this situation, your 1099-C mentions the date, and you need to go back to that date and fill out an insolvency worksheet. See the following link: Insolvency Worksheet - Publication 4681--Canceled Debts, Foreclosures, Repossessions, and Abandonmen... (The link opens a PDF file. Once open, go to page 6 for the worksheet).

Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

0 Response to "40 worksheet for foreclosures and repossessions"

Post a Comment