39 fannie mae rental income worksheet

Selling & Servicing Guide Forms | Fannie Mae Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) Form 1038A . ... Lender Record Information allows you to prepare your annual certification and submit it electronically to Fannie Mae. View Form. Form 629. formspal.com › other › fannie-mae-income-worksheetFannie Mae Income Worksheet – Fill Out and Use This PDF Question Answer; Form Name: Fannie Mae Income Worksheet: Form Length: 1 pages: Fillable? No: Fillable fields: 0: Avg. time to fill out: 15 sec: Other names: fannie mae self employed worksheet, fannie mae income worksheet, mae income worksheet, fannie mae form 1038 fillable

Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B. Author: Rowland, Darian Last modified by: Serret, Christopher J Created Date: 10/20/2015 1:58:34 PM

Fannie mae rental income worksheet

Fannie Mae Rental Income Worksheet - signNow Create a custom fannie mae rental income worksheet 2014 that meets your industry's specifications. Show details How it works Upload the mgic rental income worksheet Edit & sign fannie mae income calculation worksheet from anywhere Save your changes and share fannie mae self employed worksheet Rate the mgic income worksheet 4.8 Satisfied 101 votes selling-guide.fanniemae.com › Selling-GuideB3-6-06, Qualifying Impact of Other Real Estate Owned (06/30 ... Oct 05, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower; en.wikipedia.org › wiki › Mortgage_lawMortgage law - Wikipedia In most jurisdictions, a lender may foreclose on the mortgaged property if certain conditions—principally, non-payment of the mortgage loan – apply. A foreclosure will be either judicial or extrajudicial (non-judicial), depending upon whether the jurisdiction within which the property to be foreclosed interprets mortgages according to title theory or lien theory, and further depending upon ...

Fannie mae rental income worksheet. Fannie Mae Income Worksheet – Fill Out and Use This PDF Question Answer; Form Name: Fannie Mae Income Worksheet: Form Length: 1 pages: Fillable? No: Fillable fields: 0: Avg. time to fill out: 15 sec: Other names: fannie mae self employed worksheet, fannie mae income worksheet, mae income … Fannie Mae Fannie Mae Form 1037 02/23/16 Rental Income Worksheet Documentation Required: Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. selling-guide.fanniemae.com › Selling-GuideB3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Oct 05, 2022 · Rental Income Worksheet – Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ... Fannie Mae Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 existing PITIA (for non-subject property). B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). B2 Multiply x.75 Equals adjusted monthly rental income. B3 Subtract DU Data Entry

Second mortgage - Wikipedia Second mortgage types Lump sum. Second mortgages come in two main forms, home equity loans and home equity lines of credit. A home equity loan, commonly referred to as a lump sum, is granted for the full amount at the time of loan origination. Interest rates on such loans are fixed for the entire loan term, both of which are determined when the second mortgage is initially granted. PDF Enact MI Enact MI Mortgage law - Wikipedia A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt, usually a mortgage loan. Hypothec is the corresponding term in civil law jurisdictions, albeit with a wider sense, as it also covers non-possessory lien.. A mortgage in itself is not a debt, it is the lender's security for a debt. fannie-mae-income-worksheet.pdffiller.comFannie Mae Income Calculation Worksheet - Fill Online ... Rental Income Worksheet Individual Rental Income from Investment Property s Monthly Qualifying Rental Income or Loss Investment Investment Property Documentation Required Property Address Address Schedule E IRS Form 1040 OR Enter Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 1.

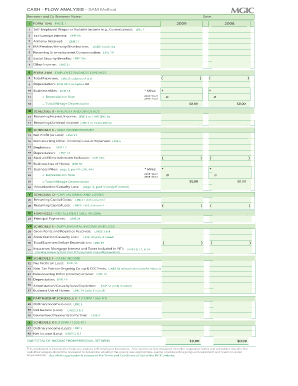

Fannie mae income calculation worksheet excel excel arceuus. fannie mae income calculator.excel fannie mae income calculation pdf documents. fhlbboston equity builder program and affordable housing. form 91 freddie mac home. fnma income calculation worksheet excel cbb uiokdg loan.fannie mae updates underwriting rules for self employed income. cash flow analysis borrower name norcom. "/> singlefamily.fanniemae.com › selling-servicingSelling & Servicing Guide Forms | Fannie Mae Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) Form 1038A . ... Lender Record Information allows you to prepare your annual certification and submit it electronically to Fannie Mae. View Form. Form 629. PDF Rental Income Worksheet Principal Residence, 2- to 4-unit Property ... Fannie Mae Form 1037 09.30.2014 Refer to the Rental Income topic in the Selling Guide for additional guidance. Rental Income Worksheet Principal Residence, 2- to 4-unit Property: Monthly Qualifying Rental Income Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1025 Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Fannie mae income calculation worksheet 2021 An ideal option for low- to moderate- income families with minimal savings to apply toward the purchase of their. SARS Income Tax Calculator for 2023 Work out salary tax (PAYE), UIF, taxable income and what tax rates you will pay. Download Income Tax Calculator FY 2021 -22 (AY 2022-23) April 19, 2022.How.

B3-6-06, Qualifying Impact of Other Real Estate Owned (06 ... - Fannie Mae Oct 05, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Oct 05, 2022 · Rental Income Worksheet – Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ...

Fannie Mae Rental Income Worksheet - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to design your Fannie make income worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Fannie Mae Rental Income Worksheet: Fill & Download for Free - CocoDoc Fannie Mae Rental Income Worksheet: Fill & Download for Free GET FORM Download the form How to Edit Your Fannie Mae Rental Income Worksheet Online On the Fly Hit the Get Form button on this page. You will go to our PDF editor. Make some changes to your document, like adding checkmark, erasing, and other tools in the top toolbar.

Fannie Mae Income Calculation Worksheet - Fill Online, Printable ... Video instructions and help with filling out and completing fannie mae income calculation worksheet. ... 32, Schedule B (Form 1040) – Interest and Ordinary Dividends ... 55, Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) Rate free fnma income calculation worksheet form. 4.9. Satisfied. 291. Votes

Fannie Mae Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 B1 B2

Income Analysis Worksheet | Essent Guaranty Download Worksheet (PDF) Download Calculator (Excel) Income Analysis Job Aids. ... Guideline Comparison - Rental Income Generated From an ADU. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental income from an accessory dwelling unit on a 1-unit primary residence.

Mortgage-backed security - Wikipedia A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy.Bonds securitizing mortgages are usually …

Where can I find rental income calculation worksheets? - Fannie Mae Rental Income Calculation Worksheets Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*,

PDF Form 1038: Rental Income Worksheet - Enact MI Result: Monthly qualifying rental income (or loss): Result Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

PDF For full functionality, download PDF first before entering data. Please ... Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: ... Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or ...

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

en.wikipedia.org › wiki › Mortgage_lawMortgage law - Wikipedia In most jurisdictions, a lender may foreclose on the mortgaged property if certain conditions—principally, non-payment of the mortgage loan – apply. A foreclosure will be either judicial or extrajudicial (non-judicial), depending upon whether the jurisdiction within which the property to be foreclosed interprets mortgages according to title theory or lien theory, and further depending upon ...

selling-guide.fanniemae.com › Selling-GuideB3-6-06, Qualifying Impact of Other Real Estate Owned (06/30 ... Oct 05, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

Fannie Mae Rental Income Worksheet - signNow Create a custom fannie mae rental income worksheet 2014 that meets your industry's specifications. Show details How it works Upload the mgic rental income worksheet Edit & sign fannie mae income calculation worksheet from anywhere Save your changes and share fannie mae self employed worksheet Rate the mgic income worksheet 4.8 Satisfied 101 votes

0 Response to "39 fannie mae rental income worksheet"

Post a Comment