41 1023 ez eligibility worksheet

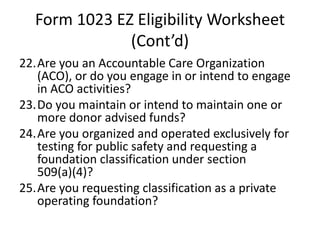

› charities-non-profits › form-1023-ezForm 1023-EZ Revisions | Internal Revenue Service - IRS tax forms Oct 05, 2022 · Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must ... form1023.org › irs-form-1023-ez-qualifiesForm 1023-EZ (1023EZ) Application for 501c3 Pros & Cons Where can I find the form 1023 EZ eligibility worksheet? You can find the Form 1023 EZ eligibility worksheet from here. Conclusion. I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal ...

LiveInternet @ Статистика и дневники, почта и поиск Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

1023 ez eligibility worksheet

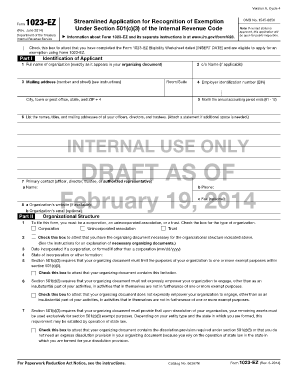

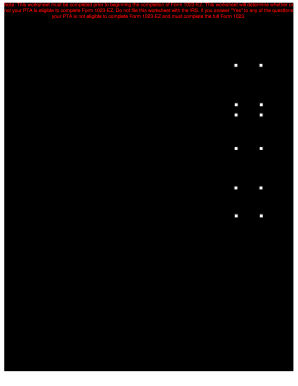

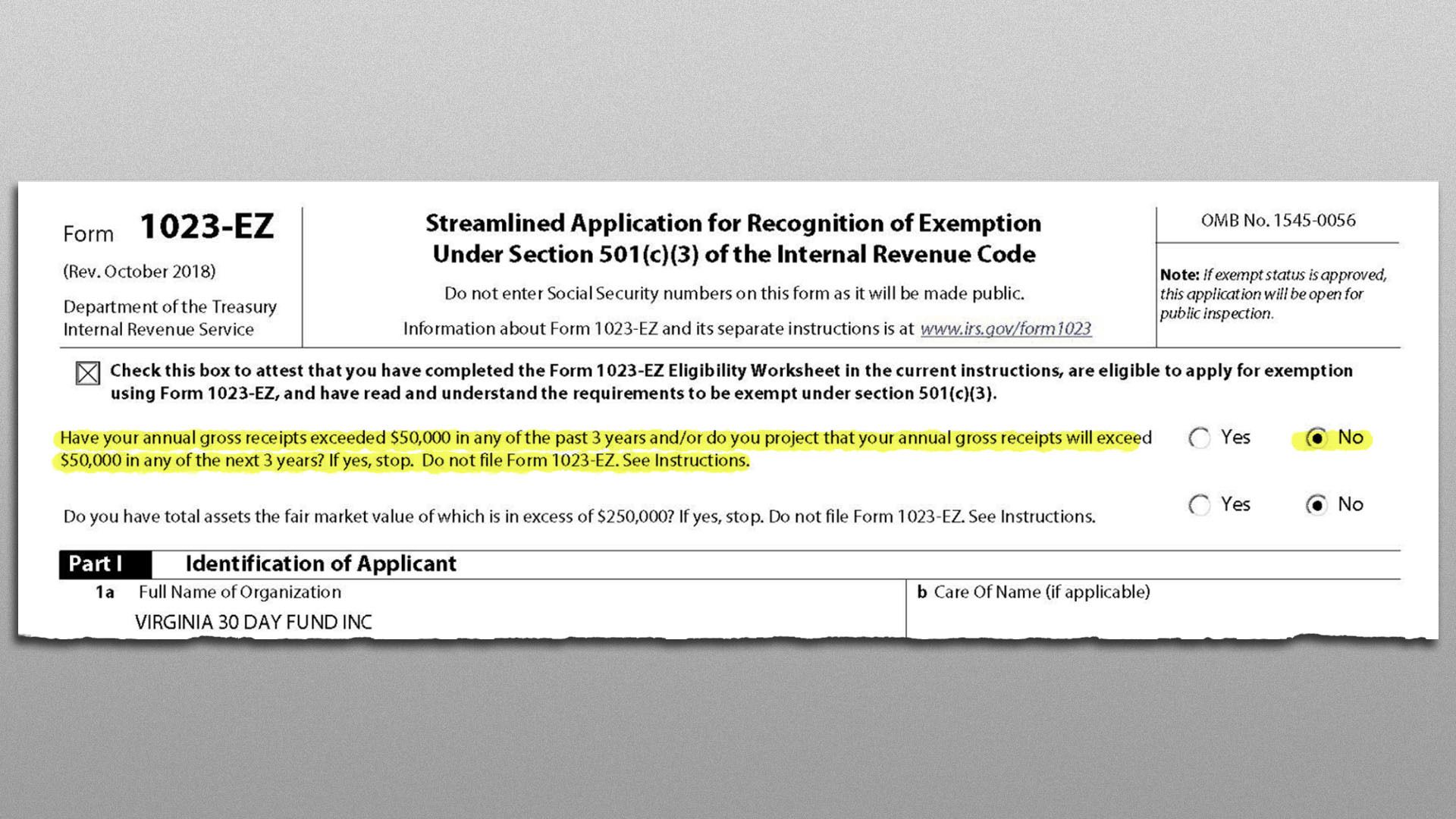

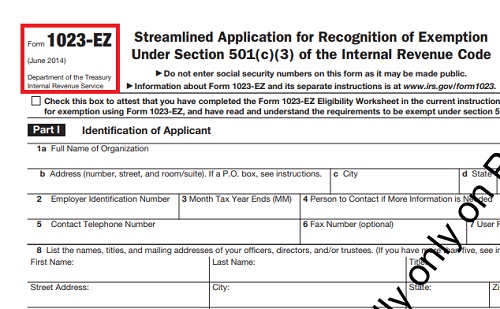

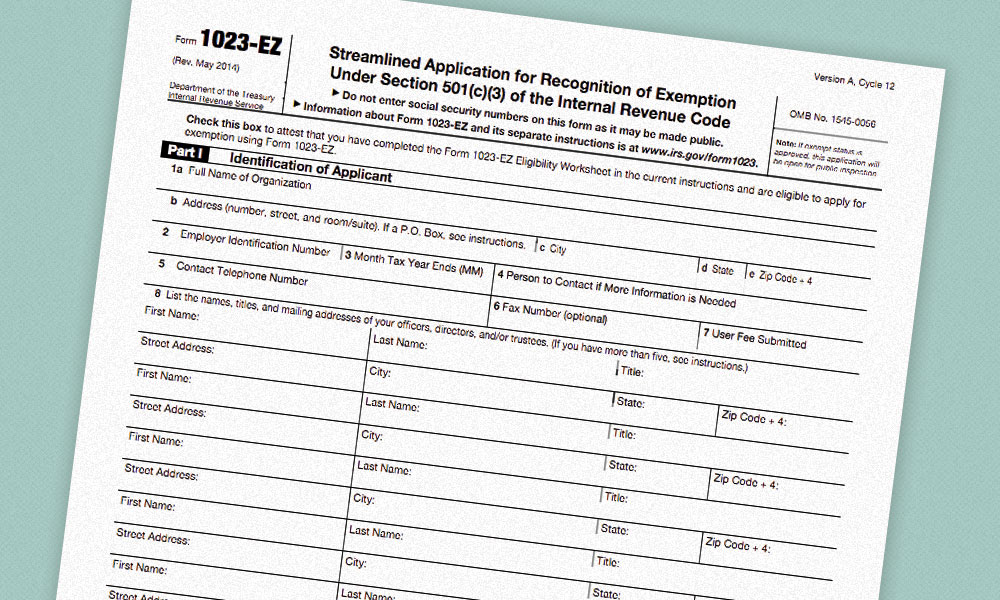

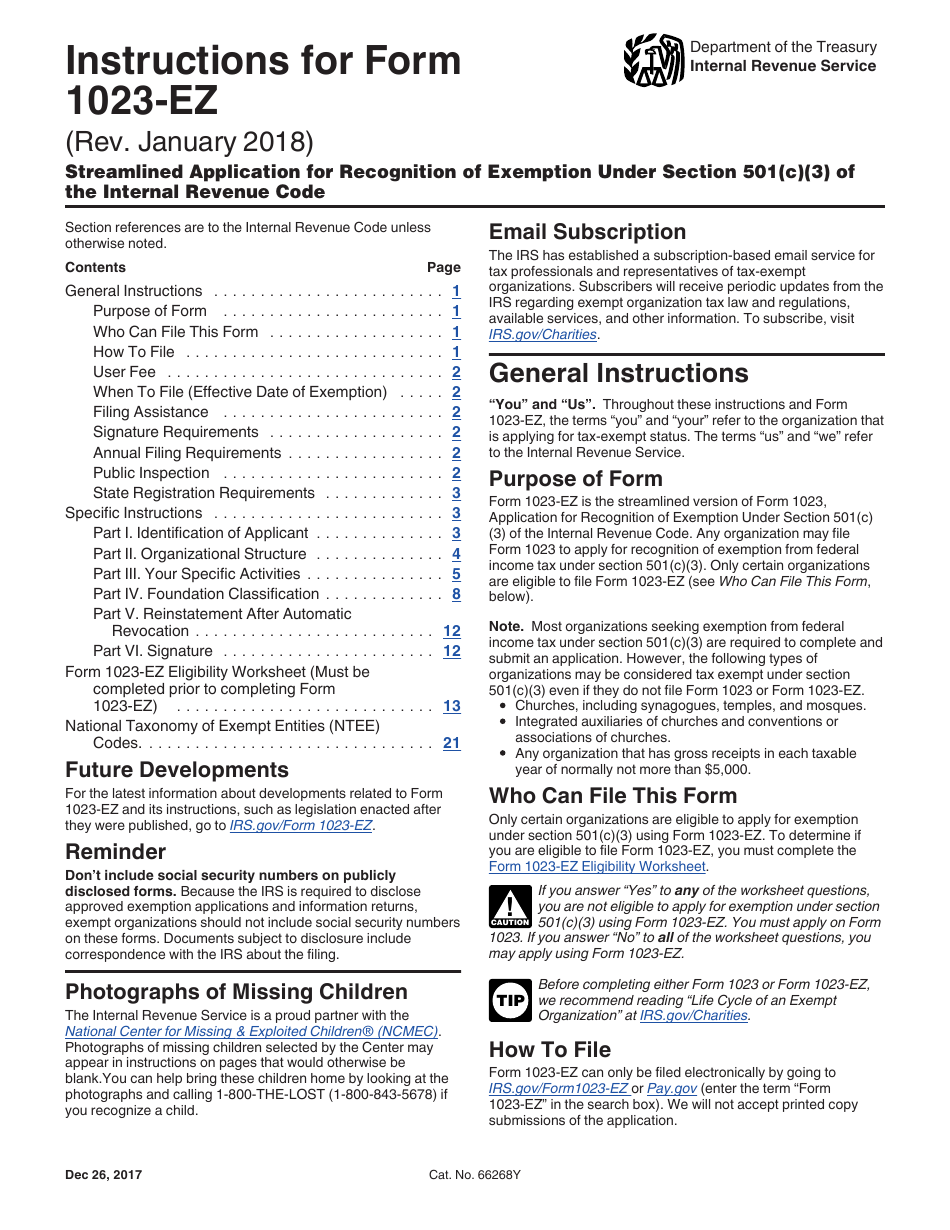

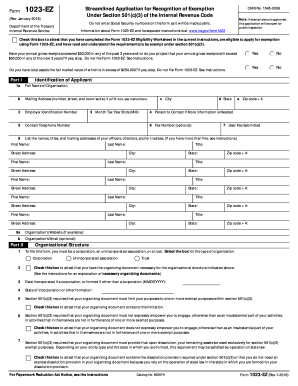

› forms-pubs › about-form-1023-ezAbout Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... › pub › irs-pdfInstructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Before completing either Form 1023 or Form 1023-EZ, we recommend reading …

1023 ez eligibility worksheet. › public › formPay.gov - Streamlined Application for Recognition of ... 2 days ago · Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3). › pub › irs-pdfForm OMB No. 1545-0056 Under Section 501(c)(3) of the ... Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant 1a Full Name of Organization About Form 1023-EZ, Streamlined Application for Recognition of ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... › instructions › i1023ezInstructions for Form 1023-EZ (01/2018) | Internal Revenue ... Dec 20, 2019 · Also see questions 12 through 14 on the Form 1023-EZ Eligibility Worksheet. If you are seeking recognition as a church, school, or hospital, you are not eligible to use Form 1023-EZ and should instead submit Form 1023 if you wish to obtain a determination letter from the IRS.

Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Before completing either Form 1023 or Form 1023-EZ, we recommend reading … › pub › irs-pdfInstructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. › forms-pubs › about-form-1023-ezAbout Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ...

0 Response to "41 1023 ez eligibility worksheet"

Post a Comment