40 1031 exchange calculation worksheet

Net Gains (Losses) from the Sale, Exchange, or Disposition of ... Definitions of like-kind properties can be found in IRC Section 1031. Involuntary Conversions Pennsylvania PIT law follows the provisions of IRC Section 1033 for property subject to involuntary conversion (destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) after September 11, 2016. U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ...

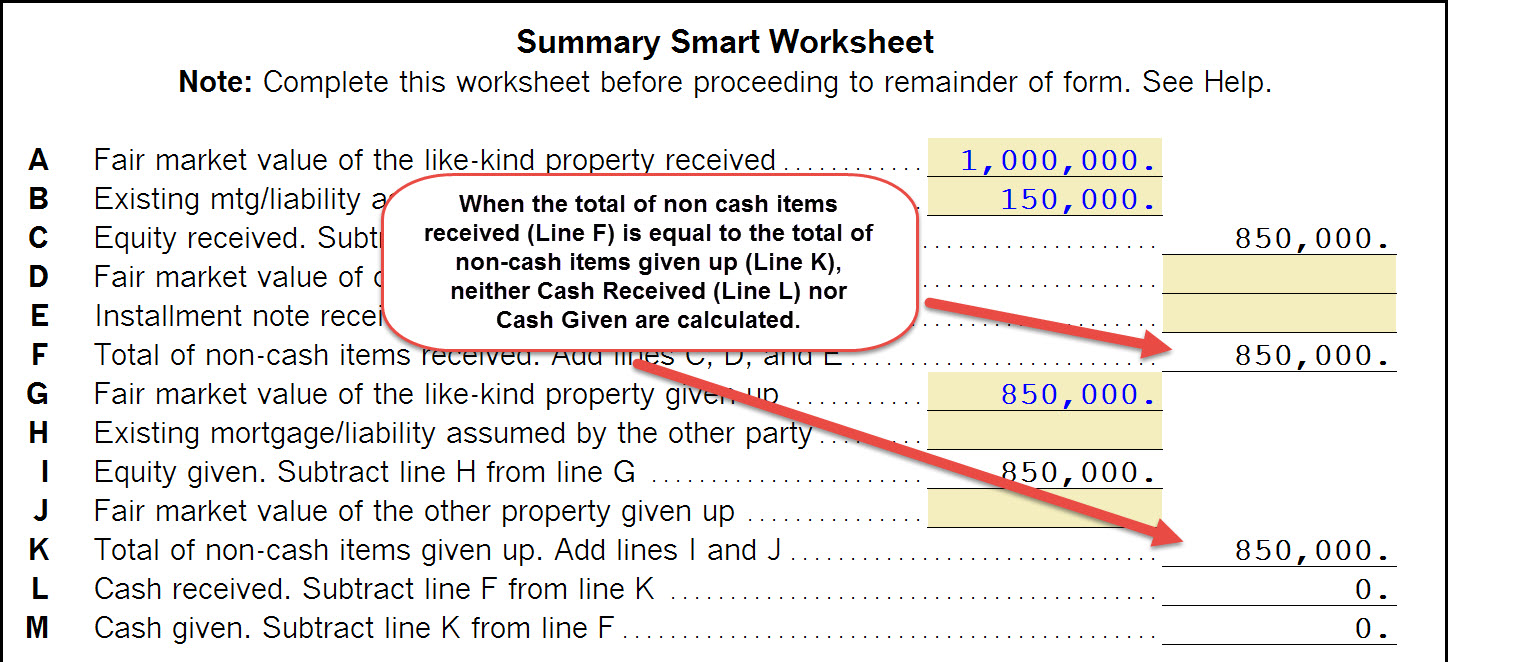

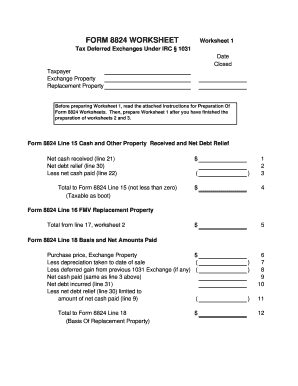

1031 exchange calculation worksheet

Publication 537 (2021), Installment Sales | Internal Revenue ... 2018 Section 453A Calculation: Deferred Tax Liability: 1,827,006 x Applicable Percentage: 64.2857% x Underpayment Rate: 5.00% 2018 Section 453A additional tax: $58,725 2019 Section 453A Calculation: Note is paid off in full, so no deferred tax liability Deferred Tax Liability: 0 x Applicable Percentage: 64.2857% x Underpayment Rate: N/A 2020 Corporation Tax Booklet 100 | FTB.ca.gov - California On a separate worksheet using the Form 100 format, the corporation must complete the equivalent of Form 100, Side 2, line 18 through line 30, based on taxable income including the LIFO recapture amount. Form 100, Side 2, line 30, must then be compared to line 30 of the worksheet. The difference is the additional tax due to LIFO recapture. PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

1031 exchange calculation worksheet. Pass Through Entities - Pennsylvania Department of Revenue Note: For tax year 2005 and forward, an investment club that derives all of its receipts for the taxable year from either federally taxable portfolio interest income or dividends or from the sale and exchange of securities, is considered a partnership for Pennsylvania purposes and is required to file a PA-20S/PA-65 Information Return. PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... 2020 Corporation Tax Booklet 100 | FTB.ca.gov - California On a separate worksheet using the Form 100 format, the corporation must complete the equivalent of Form 100, Side 2, line 18 through line 30, based on taxable income including the LIFO recapture amount. Form 100, Side 2, line 30, must then be compared to line 30 of the worksheet. The difference is the additional tax due to LIFO recapture. Publication 537 (2021), Installment Sales | Internal Revenue ... 2018 Section 453A Calculation: Deferred Tax Liability: 1,827,006 x Applicable Percentage: 64.2857% x Underpayment Rate: 5.00% 2018 Section 453A additional tax: $58,725 2019 Section 453A Calculation: Note is paid off in full, so no deferred tax liability Deferred Tax Liability: 0 x Applicable Percentage: 64.2857% x Underpayment Rate: N/A

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "40 1031 exchange calculation worksheet"

Post a Comment