40 sale of rental property worksheet

Microsoft says a Sony deal with Activision stops Call of Duty … 21/10/2022 · A footnote in Microsoft's submission to the UK's Competition and Markets Authority (CMA) has let slip the reason behind Call of Duty's absence from the Xbox Game Pass library: Sony and Net Gains (Losses) from the Sale, Exchange, or Disposition of Property Net gains and losses on the sales of tangible and intangible personal property, including the sale of rights, royalties, patents and copyrights, used in a trade or business or that are part of a rental property or royalty business, are required to be reported as gains or losses on PA Schedule D if property of a similar nature is not purchased or obtained to replace the disposed property. In ...

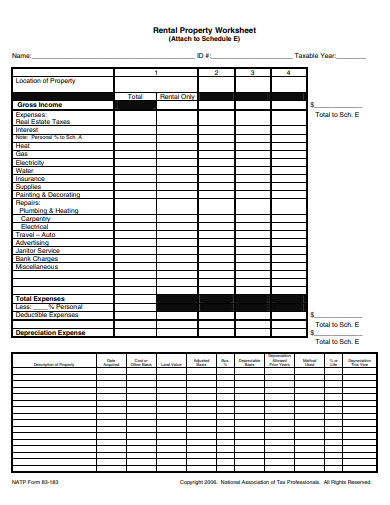

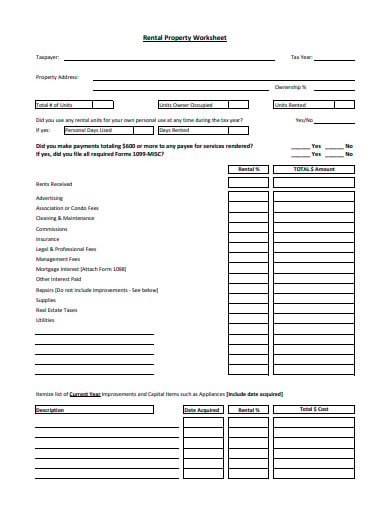

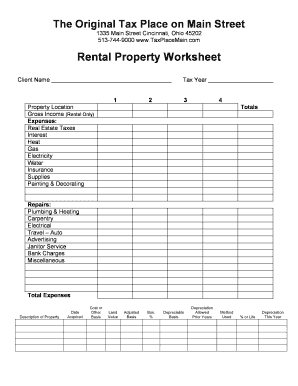

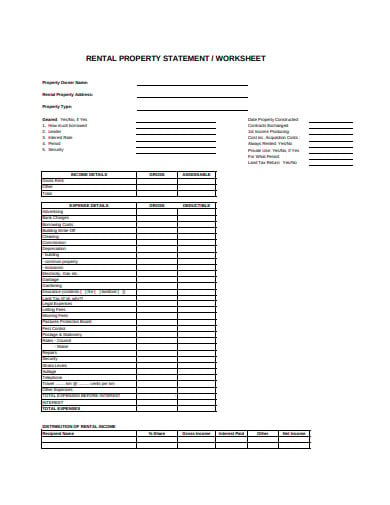

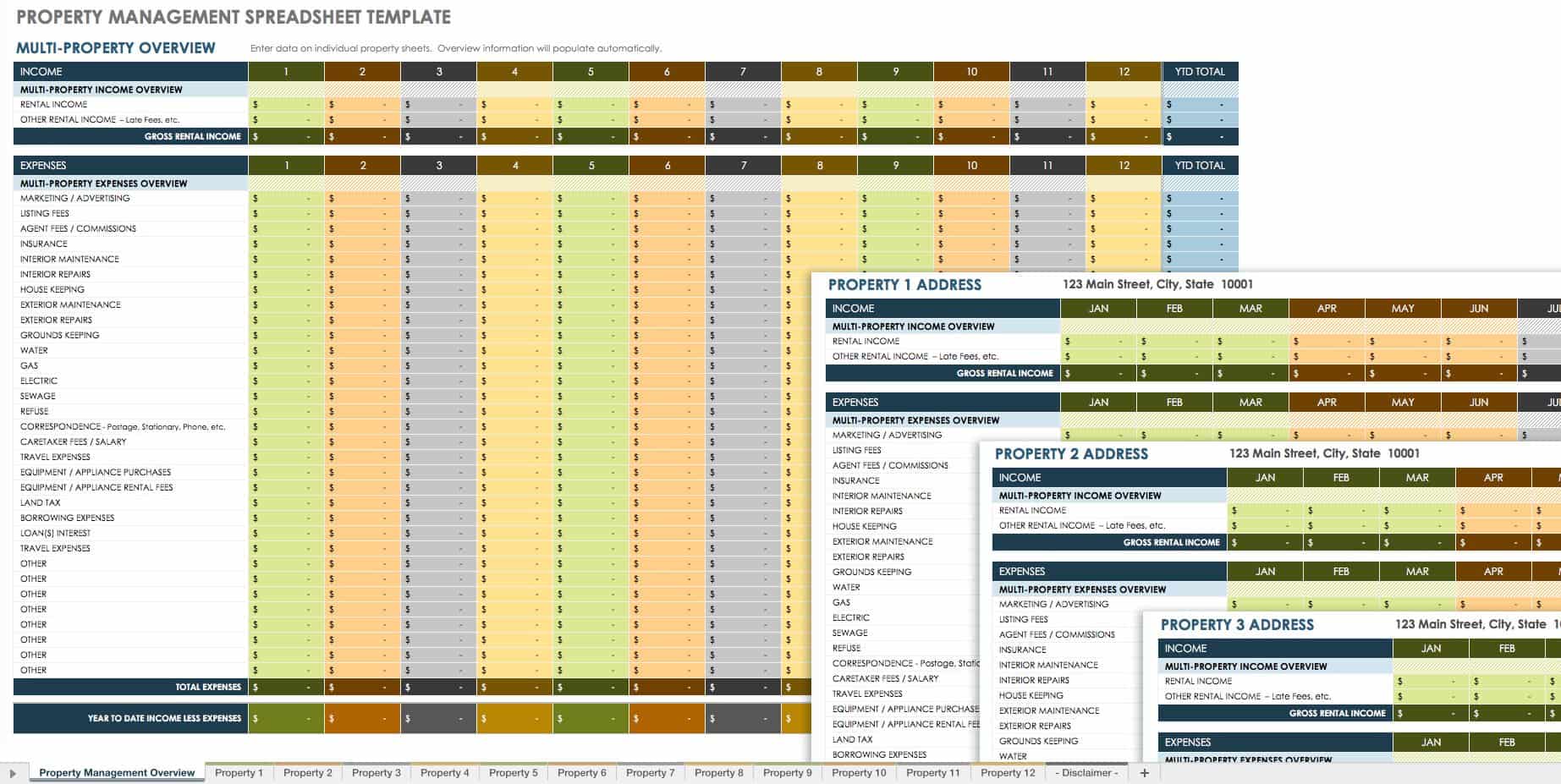

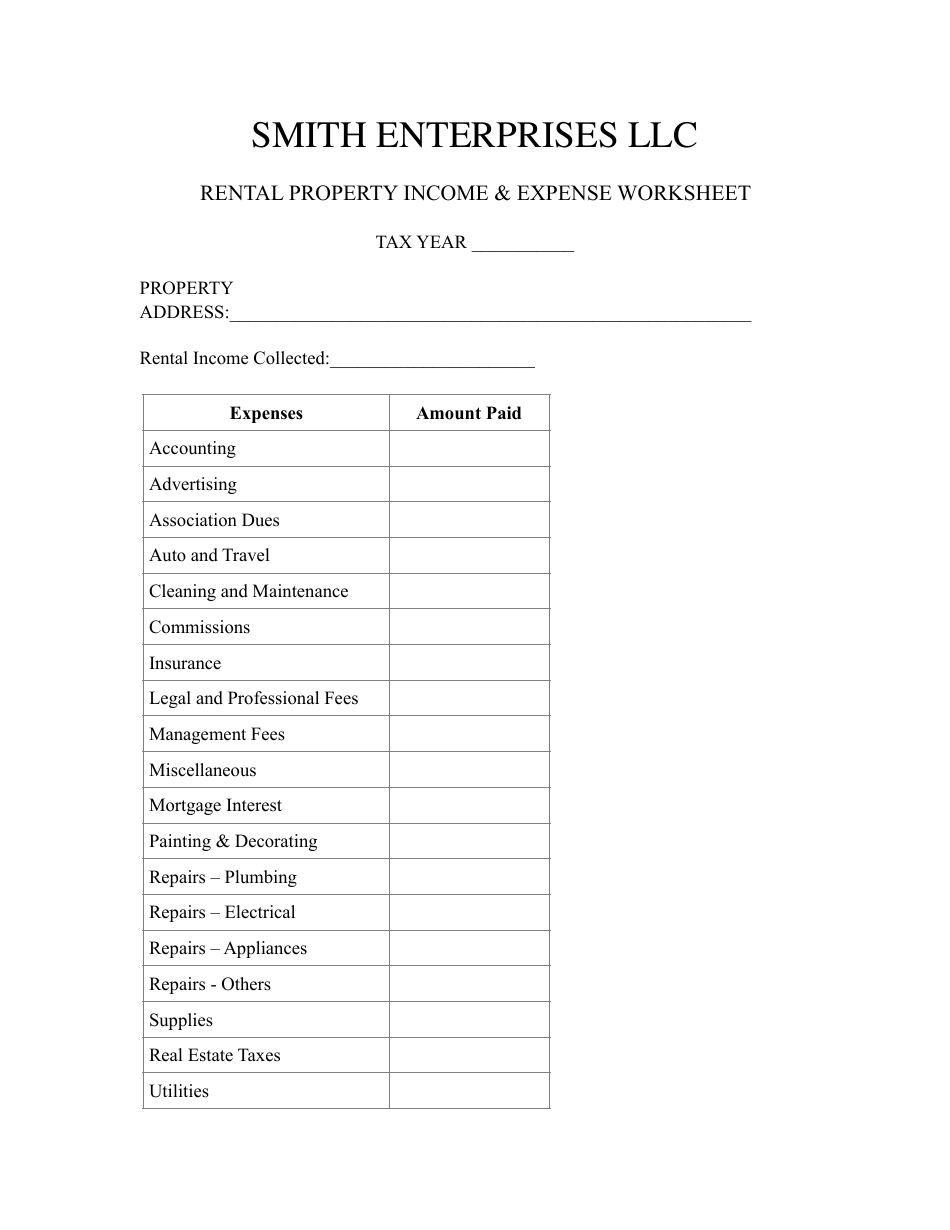

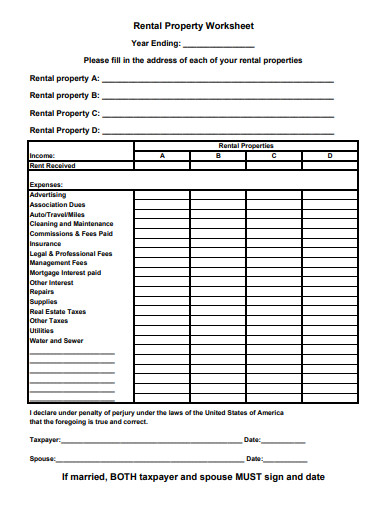

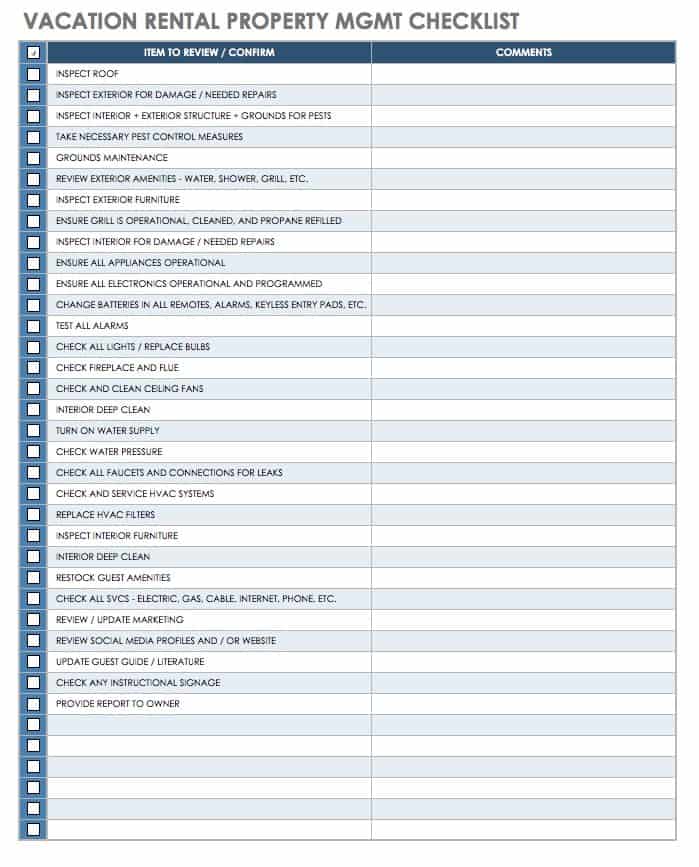

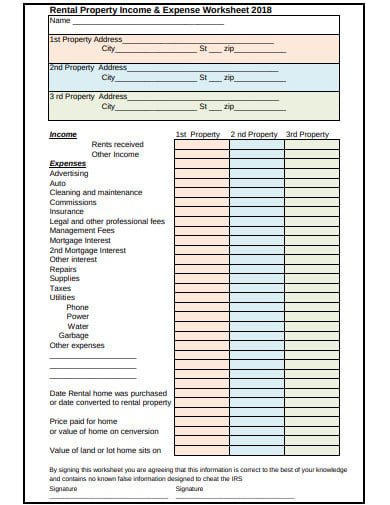

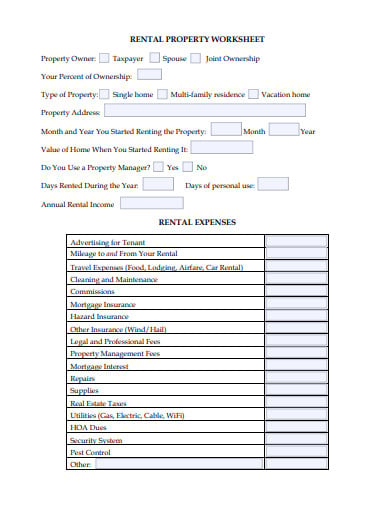

Rental Income and Expense Worksheet - Rentals Resource Center 01/01/2021 · This worksheet, designed for property owners with one to five properties, has a section for each category of income and spending associated with managing a rental property. Appropriate sections are broken down by month and by property. Each section automatically calculates the totals to provide your gross income, net income and total expenses for the year.

Sale of rental property worksheet

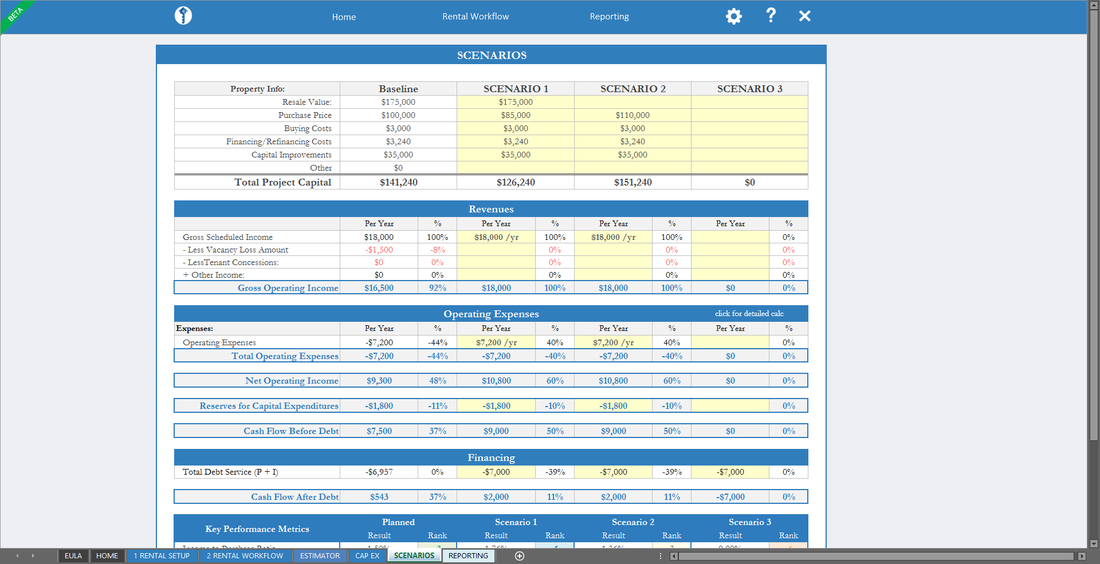

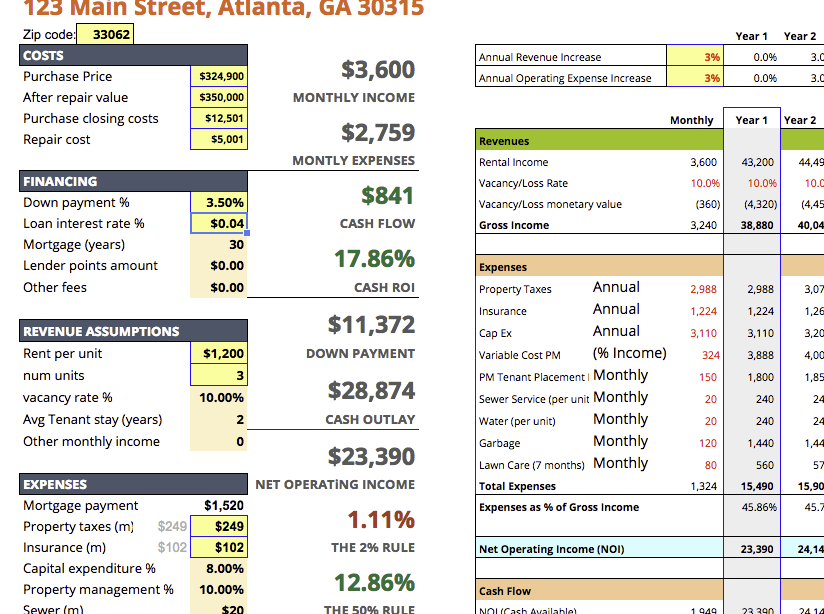

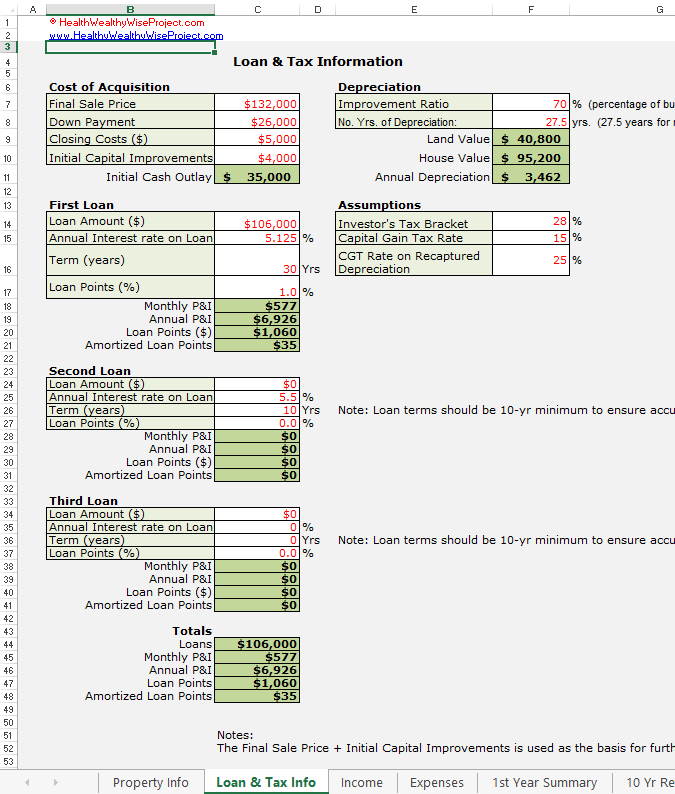

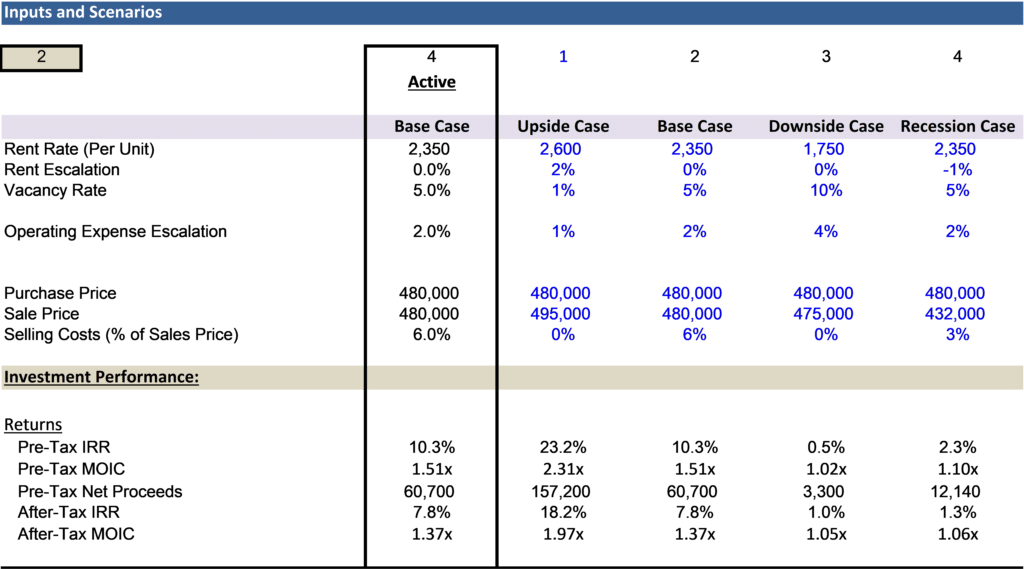

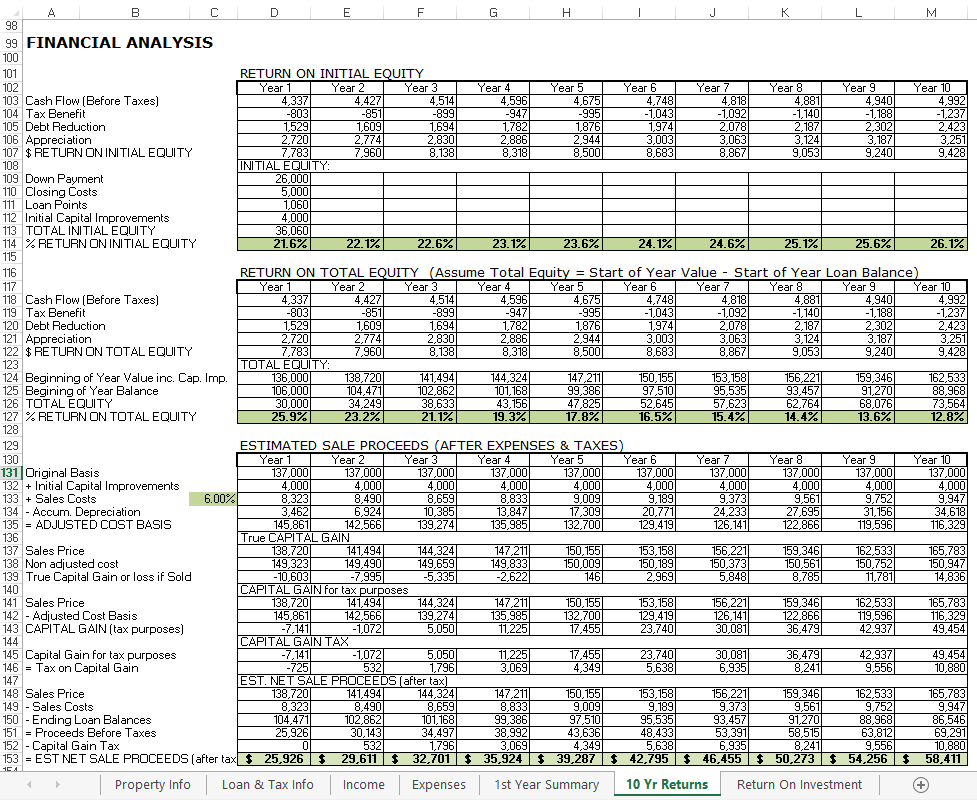

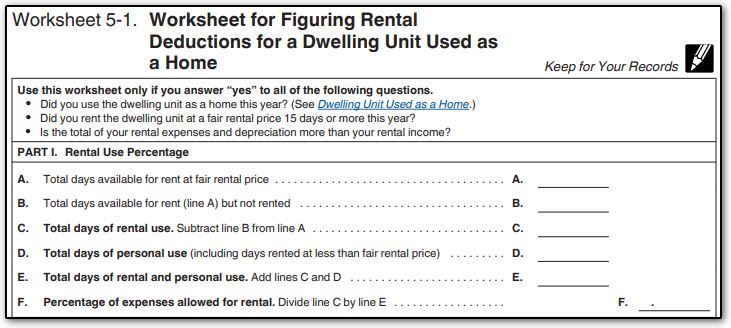

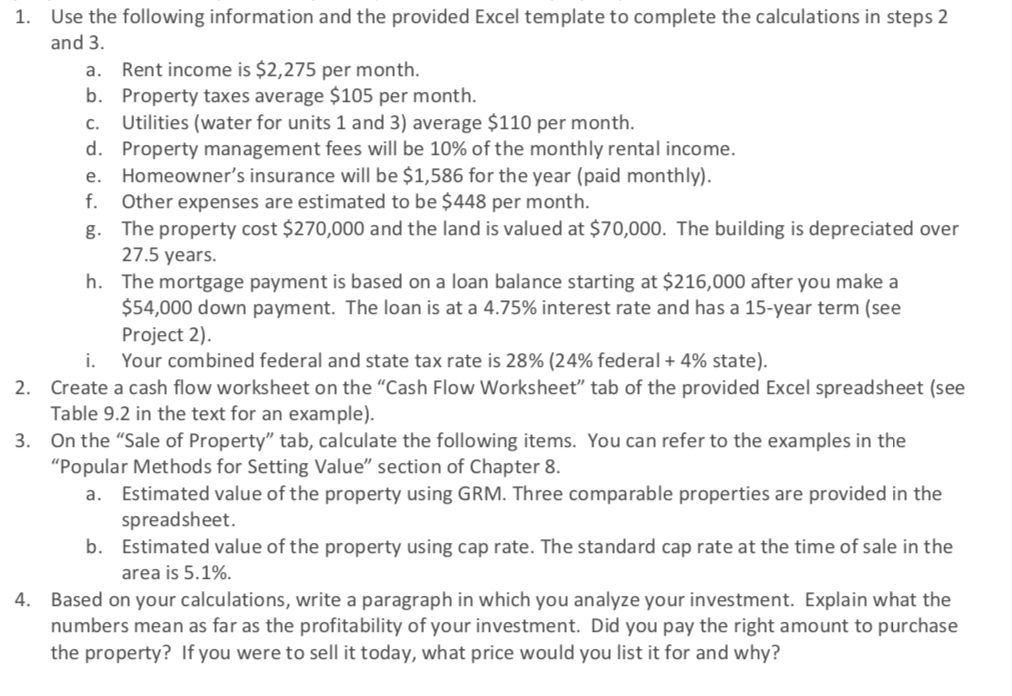

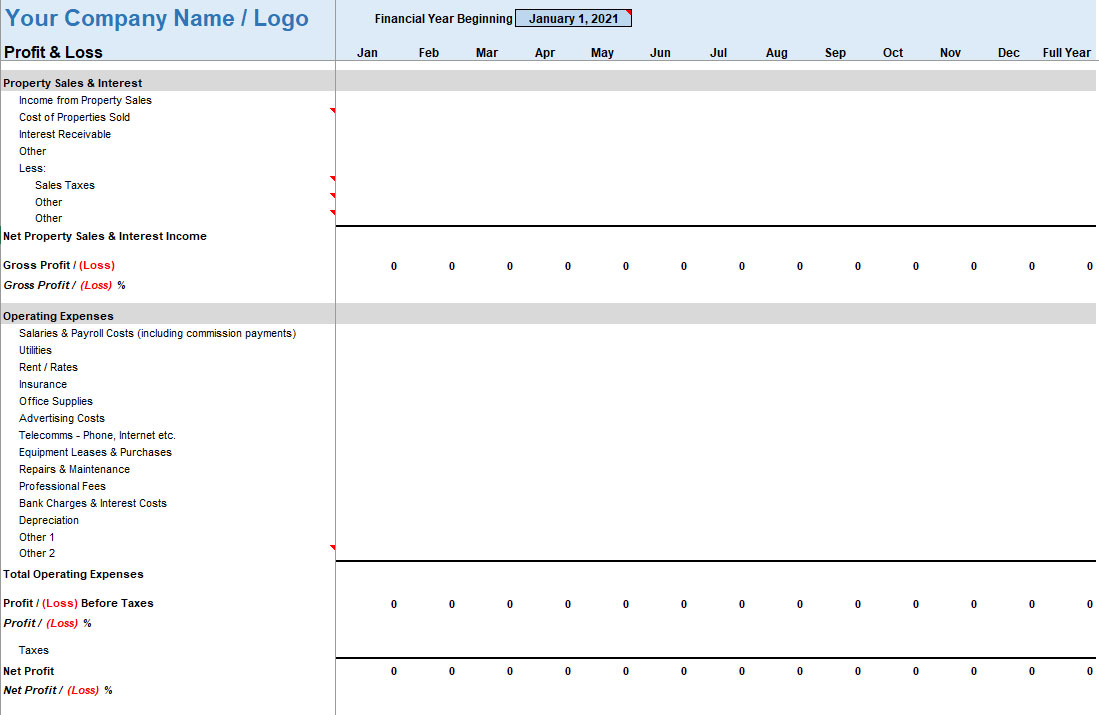

Publication 550 (2021), Investment Income and Expenses Line 7; also use Form 8949, Schedule D, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet: Gain or loss from exchanges of like-kind investment property : Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in … Cash Flow Analysis Worksheet for Rental Property - Vertex42.com 18/08/2021 · It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return. This worksheet is not going to teach you how to be a good real estate investor. It is just a simple tool to help you put into practice some techniques for property valuation and cash flow analysis. … Publication 587 (2021), Business Use of Your Home If you used your home for business and you are filing Schedule C (Form 1040), you will use either Form 8829 or the Simplified Method Worksheet in your Instructions for Schedule C. The rules in this publication apply to individuals. If you need information on deductions for renting out your property, see Pub. 527, Residential Rental Property.

Sale of rental property worksheet. JPMorgan Chase says it has fully eliminated screen scraping 06/10/2022 · JPMorgan Chase has reached a milestone five years in the making — the bank says it is now routing all inquiries from third-party apps and services to access customer data through its secure application programming interface instead of allowing these services to collect data through screen scraping. Publication 523 (2021), Selling Your Home | Internal Revenue … For more information about using any part of your home for business or as a rental property, see Pub. 587, Business Use of Your Home, and Pub. 527, Residential Rental Property. Gain from the sale or exchange of your main home isn’t excludable from income if it is allocable to periods of non-qualified use. Non-qualified use means any period after 2008 where neither you nor your … PlayStation userbase "significantly larger" than Xbox even if … 12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Publication 527 (2020), Residential Rental Property Sale of main home used as rental property. For information on how to figure and report any gain or loss from the sale or other disposition of your main home that you also used as rental property, see Pub. 523. Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange …

Publication 587 (2021), Business Use of Your Home If you used your home for business and you are filing Schedule C (Form 1040), you will use either Form 8829 or the Simplified Method Worksheet in your Instructions for Schedule C. The rules in this publication apply to individuals. If you need information on deductions for renting out your property, see Pub. 527, Residential Rental Property. Cash Flow Analysis Worksheet for Rental Property - Vertex42.com 18/08/2021 · It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return. This worksheet is not going to teach you how to be a good real estate investor. It is just a simple tool to help you put into practice some techniques for property valuation and cash flow analysis. … Publication 550 (2021), Investment Income and Expenses Line 7; also use Form 8949, Schedule D, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet: Gain or loss from exchanges of like-kind investment property : Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in …

0 Response to "40 sale of rental property worksheet"

Post a Comment