38 qualified education expenses worksheet

PDF Education Expenses - IRS tax forms scholarship. (But for exceptions, see Payment for services in Publication 970, Tax Benefits for Education.) Use Worksheet 1-1 below to figure the amount of a scholarship or fellowship you can exclude from gross income. Education Expenses The following are qualified education expenses for the purposes of tax-free scholarships and fellowships: What Counts As Qualified Education Expenses? | Credit Karma Qualified education expenses For higher education, the following expenses may qualify: • Tuition and fees required for enrollment at an eligible educational institution • Books, supplies and equipment required for enrollment • Expenses for special-needs services in connection with enrollment or attendance

2020 Education Expense Worksheet (H&Rblock) - Fill 2020 Education Expense Worksheet (H&Rblock) On average this form takes 20 minutes to complete The 2020 Education Expense Worksheet (H&Rblock) form is 1 page long and contains: 0 signatures 0 check-boxes 80 other fields Country of origin: US File type: PDF Use our library of forms to quickly fill and sign your H&Rblock forms online.

Qualified education expenses worksheet

Sheet1 - Tax Season Resources 1, Education Expenses Worksheet for 2018 Tax Year ... 18, Total Qualified Expenses, $0, Sum of tuition/fees and books/supplies. Publication 535 (2021), Business Expenses - IRS tax forms Although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion and whether the section 274(e)(2) exception for expenses treated as compensation applies, the deduction that is disallowed relates to the expense of providing a qualified transportation fringe, not its value. For more information, see Regulations sections … S-Corp Educational Assistance - WCG CPAs Jerry deducted $8,712 in qualified education expenses on his 2010 amended tax return (first mistake… give an IRS human a reason to say, "yeah right."). His second mistake was not demonstrating how his Doctoral studies improved his current work skills. The Court said it was not enough to simply make the assertion as a global argument; the ...

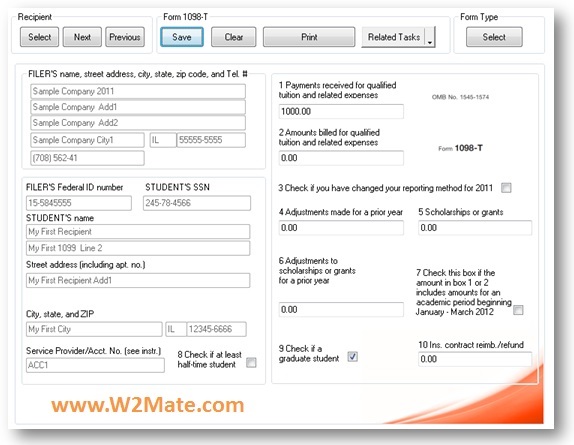

Qualified education expenses worksheet. Education Expense Credit - Credits - Illinois Education Expense Credit You may figure a credit for qualified education expenses, in excess of $250, you paid during the tax year if you were the parent or legal guardian of a full-time student who was under the age of 21 at the close of the school year, you and your student were Illinois residents when you paid the expenses, and Publication 936 (2021), Home Mortgage Interest Deduction The home acquisition debt is limited to the amount of the expenses incurred within the period beginning 24 months before the work is completed and ending on the date of the mortgage. (See Example 2, later.) Example 1. You bought your main home on June 3 for $175,000. You paid for the home with cash you got from the sale of your old home. On July 15, you took out a … Reporting 529 Plan Withdrawals on Your Federal Tax Return February 5, 2020. When 529 plan funds are used to pay for qualified education expenses there is usually nothing to report on your federal income tax return. Form 1099-Q and Form 1098-T will list the amount of the 529 plan distribution and how much was used to pay for college tuition and fees, but it is up to the 529 plan account owner to ... Qualified Ed Expenses | Internal Revenue Service - IRS tax forms Qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Who Must Pay Qualified education expenses must be paid by: You or your spouse if you file a joint return, A student you claim as a dependent on your return, or A third party including relatives or friends. Funds Used

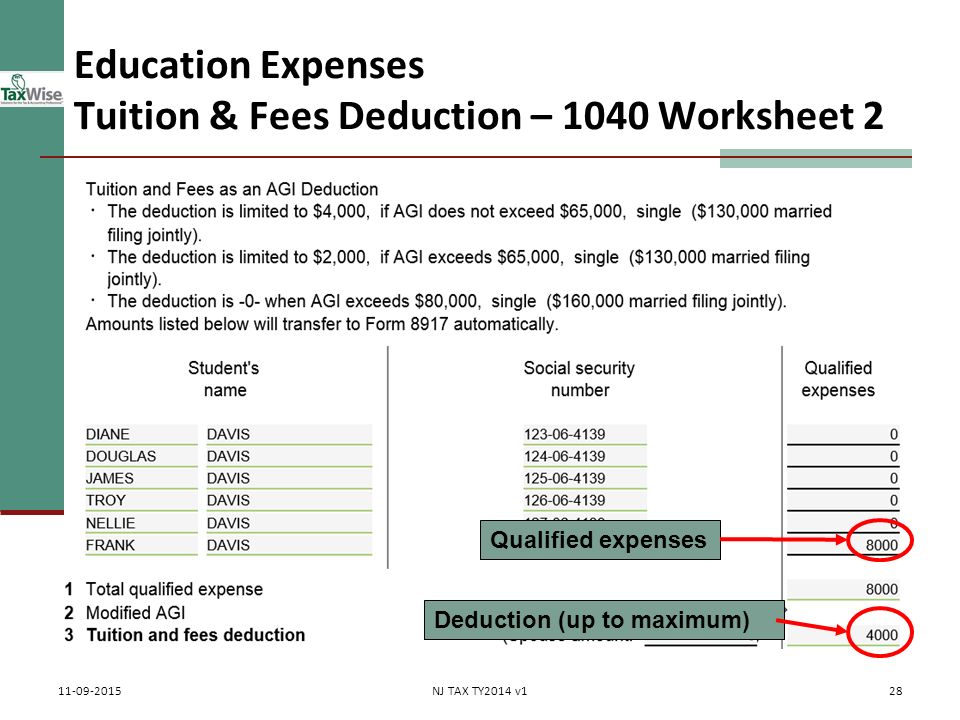

Publication 526 (2021), Charitable Contributions - IRS tax forms See Form 8839, Qualified Adoption Expenses, and its instructions, for more information. Appraisal Fees. You can't deduct as a charitable contribution any fees you pay to find the fair market value of donated property. Contributions to Donor-Advised Funds. You can't deduct a contribution to a donor-advised fund if: The qualified organization that sponsors the fund is a … Qualified Education Expenses: What Can You Deduct in 2022? - Policygenius Qualified education expenses primarily include tuition, but also costs that are required for you to enroll in a course or program You will probably receive a copy of Form 1098-T from each school where you have eligible expenses The tuition and fees deduction, available to all taxpayers, allows you to deduct up to $4,000 › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... Qualified business income deduction. The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. If you don't meet the requirements to file Form 8995, use Form 8995-A, Qualified Business Income Deduction. For more information, see each form's ... Publication 587 (2021), Business Use of Your Home The Simplified Method Worksheet and the Daycare Facility Worksheet in this section are to be used by taxpayers filing Schedule F (Form 1040) or by partners with certain unreimbursed ordinary and necessary expenses if using the simplified method to figure the deduction. If you are filing Schedule C (Form 1040) to report a business use of your home in your trade or …

Guide to IRS Form 1099-Q: Payments from Qualified Education ... - TurboTax For example, suppose your qualified education expenses are $10,000, you receive a $2,000 Pell grant and boxes 1 and 2 of your 1099-Q report a gross distribution of $8,000 and earnings of $1,000. Your adjusted expenses are $8,000—which means you don't have to report any education program distributions on your tax return. › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... • Student loan repayment from programs, such as the Department of Defense Educational Loan Repayment Program, to the extent that qualified higher education expenses exceed $5,250 annually • Certain payments made by an employer after March 27, 2020, and before January 1, 2026, of principal or interest on certain qualified education loans Education Credits - Tax Season Resources Remaining expenses that qualify for scholarships/grants but not LLC/AOC Line 9 $0. Line 3 - Line 4. Put 0 if negative. Amount of scholarships/grants to transfer to student as income Line 10 $0. See "Your 2018 tax return included education expenses" for amount to put on return. Line 7 - Line 8 - Line 9. Put 0 if negative. › instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms You held the stock for 63 days (from July 16, 2021, through September 16, 2021). The $500 of qualified dividends shown in box 1b of Form 1099-DIV are all qualified dividends because you held the stock for 61 days of the 121-day period (from July 16, 2021, through September 14, 2021).

Education, Student Loan, ESA, 529 Plan Worksheet * Room and board are typically not deductible as an education expense, but they count towards qualified education expenses when using an Education Savings ...

Adjusted Qualified Education Expenses Worksheet - Tomas Blog You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from. The irs does have a worksheet for calculating the education credit included in pub 970 and other sources, but it is used to calculate what can be excluded from income and lacks the logic. Source: zzahz.blogspot.com

Topic No. 456 Student Loan Interest Deduction - IRS tax forms 05/10/2022 · A qualified student loan is a loan you took out solely to pay qualified higher education expenses that were: For you, your spouse, or a person who was your dependent when you took out the loan; For education provided during an academic period for an eligible student; and; Paid or incurred within a reasonable period of time before or after you took out …

Where can I find the calculations for the adjusted qualified ... Mar 26, 2022 ... You can find the actual computation method in the Adjusted Qualified Education Expenses Worksheet on page 8 of the 2021 Instructions for ...

2021 Form 8815 - IRS tax forms Qualified higher education expenses include tuition and fees required for the enrollment or attendance of the person(s) listed on line 1, column (a), at the institution(s) listed in column (b). They also include contributions to a Coverdell ESA or a QTP for the person(s) listed on line 1. Qualified expenses do not include expenses for: • Room and board; or • Courses involving …

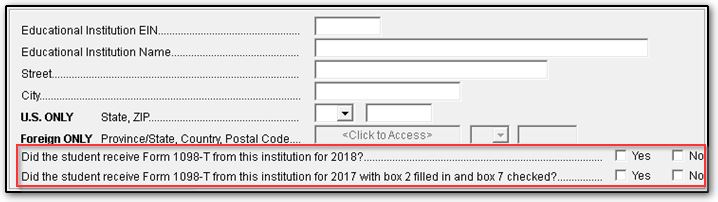

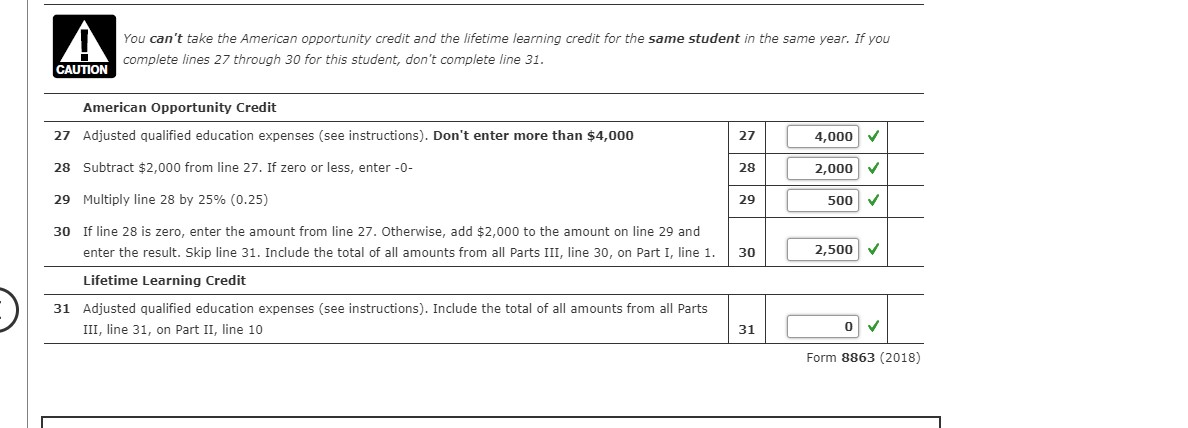

8863/8917 - Education Credits and Deductions - Drake Software In Drake 15 and prior, Details for two schools can be entered on the first 8863 screen for each student Press Page Down to enter additional information for 3 or more schools on subsequent screens.; Complete the Adjusted Qualified Education Expenses Worksheet in the Instructions for Form 8863 to determine what amount to enter on line 27 for the American Opportunity Credit or line 31 for the ...

Qualified Teacher and Educator Tax Deductions 2022 Returns - e-File Start and e-File your Education Tax Return Now. For Tax Year 2021, teachers or educators can generally deduct unreimbursed, out-of-pocket, school, trade, or educator business expenses up to $250 on their federal tax returns using the Educator Expense Deduction. You do not have to itemize your deductions to claim this.

1040 (2021) | Internal Revenue Service - IRS tax forms Qualified higher education expenses. Student Loan Interest Deduction Worksheet—Schedule 1, Line 21; Line 22; Line 23. Archer MSA Deduction; Lines 24a through 24z. Line 24a. Jury duty pay. Line 24b ; Line 24c; Line 24d; Line 24e; Line 24f; Line 24g; Line 24h; Line 24i; Line 24j; Line 24k; Line 24z; Instructions for Schedule 2 Additional Taxes. General Instructions; Specific …

Qualified Education Expense Tax Credit - Georgia Department of Revenue 2020 Qualified Education Expense Tax Credit - cap status 7-1-20.pdf (221.7 KB) 2020 Qualified Education Expense Tax Credit - cap status 6-5-20.pdf (220.81 KB) 2020 Qualified Education Expense Tax Credit - cap status 4-30-20.pdf (221.75 KB) 2020 Qualified Education Expense Tax Credit - cap status 4-6-20.pdf (221.58 KB)

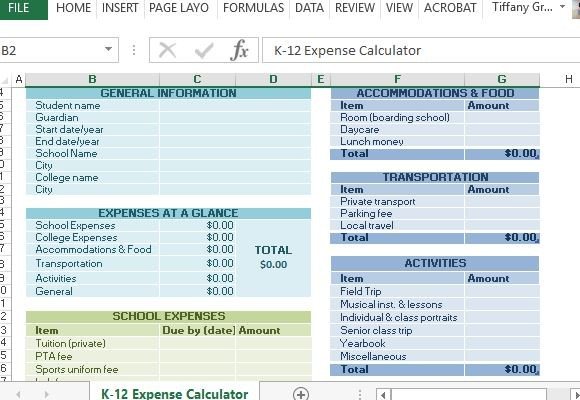

Get the up-to-date k 12 education expense credit worksheet 2022 now Edit your receipt for qualified k 12 education expenses online. Type text, add images, blackout confidential details, add comments, highlights and more. 02. Sign it in a few clicks ... Adhere to the instructions below to complete k 12 education expense credit worksheet online easily and quickly: ...

› publications › p590bPublication 590-B (2021), Distributions from Individual ... Qualified higher education expenses are tuition, fees, books, supplies, and equipment required for the enrollment or attendance of a student at an eligible educational institution. They also include expenses for special needs services incurred by or for special needs students in connection with their enrollment or attendance.

Year: EDUCATION EXPENSE WORKSHEET Name of Student EDUCATION EXPENSE WORKSHEET. Name of Student: Taxpayer. Spouse. Dependent. Status during acedemic period: Full Time. Part-Time. N/A. Qualifying Education:.

Publication 970 (2021), Tax Benefits for Education | Internal Revenue ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, ...

Why are the Adjusted Qualified Higher Education Expenses on my ... - Intuit First, scholarships & grants are applied to qualified education expenses. The only qualified expenses for scholarships and grants are tuition, books, and lab fees. that's it. If there is any excess, then it's taxable income. It automatically gets transferred to and included in the total on line 7 of the 1040.

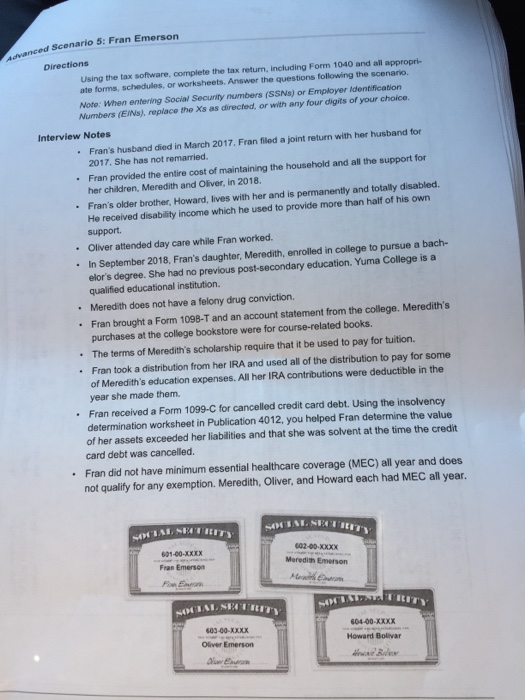

Qualified Education Expenses Exception (Code 08) (for IRAs) - TaxAct You can take a distribution from your IRA before you reach age 59 1/2 and not have to pay the 10% additional tax if, for the year of the distribution, you pay qualified education expenses for: yourself; your spouse; your or your spouse's child, foster child, adopted child; or your or your spouse's grandchild. Qualified education expenses.

PDF A Opportunity Tax Credit Worksheet The IRS does have a worksheet for calculating the education credit included in Pub 970 and other sources, but it is used to calculate what can be excluded from income and lacks the logic included in the regulations for elective taxable ... Based on his adjusted qualified education expenses of $4,000, Bill would be able to claim an American ...

Education Expenses - VITA Resources for Volunteers that it can't be used for qualified education expenses; and ... Use Worksheet 1–1 below to figure the amount of a scholarship or fellowship you can exclude ...

Adjusted Qualified Education Expenses Worksheet Adjusted Qualified Education Expenses Worksheet. Use the adjusted qualified education expenses worksheet, later, to figure each student's adjusted qualified education expenses. 2020 education expense worksheet (h&rblock) on average this form takes 20 minutes to complete.

Qualified Education Worksheet - Intuit The amount on line 18 would be the education expenses used for purposes of qualifying for an education credit or tuition and fees deduction. You can't use the same expenses to exclude income on your education plan that you used to receive an education expense credit or deduction. **Say "Thanks" by clicking the thumb icon in a post

Publication 970 (2021), Tax Benefits for Education | Internal … If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2022 instead of reducing your expenses for 2021..

Determining Qualified Education Expenses - IRS the worksheet above. The $3,000 Pell Grant will be entered on line 2a. The line 3 amount is $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500. If the resulting qualified expenses are less than $4,000, the student may choose to treat some of the grant as income to make more of the expenses eligible for the ...

Publication 590-B (2021), Distributions from Individual Retirement ... Use Worksheet 1-2 in chapter 1 of Pub. 590-A, or the IRA Deduction Worksheet in the Form 1040 or 1040-SR, or 1040-NR instructions to figure your deductible contributions to traditional IRAs to report on Schedule 1 (Form 1040), line 20. After you complete Worksheet 1-2 in chapter 1 of Pub. 590-A or the IRA Deduction Worksheet in the form instructions, enter your …

PDF IL-1040-RCPT, Receipt for Qualified K-12 Education Expenses - Illinois Add the amounts in the "Total Amount of Qualified Expenses Paid by Parent or Guardian" column for each student. Use this total to complete the K-12 Education Expense Credit Worksheet on Schedule ICR. Total $ (This required information may be (K-12 only) provided by the recipient)

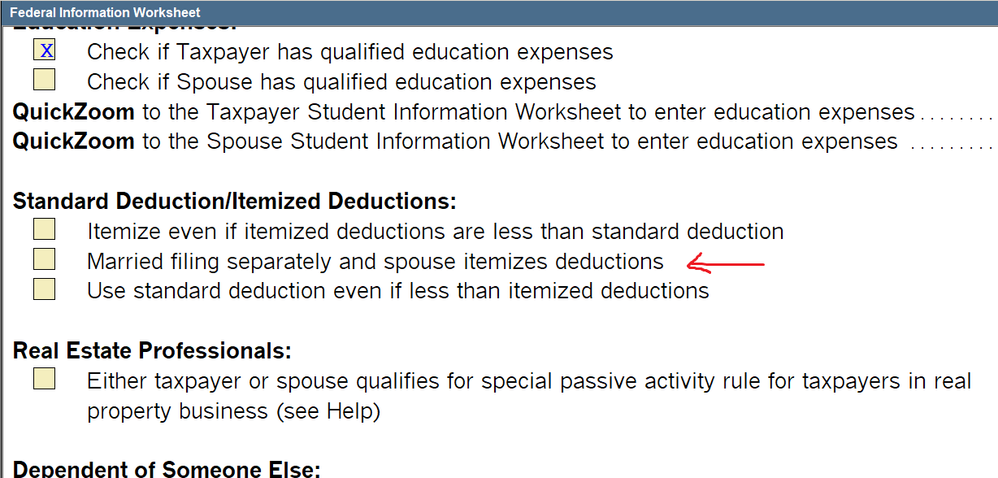

Entering education expenses in ProSeries - Intuit Step 1: Activating the Student Info Worksheet Open the tax return to the Federal Information Worksheet. If a dependent is the student:: Scroll down to Part III Dependent/Earned Income Credit/Child and Dependent Care Credit Information. Enter the basic identification information. Check the box for Educ Tuition and Fees box.

› instructions › i8863Instructions for Form 8863 (2021) | Internal Revenue Service Enter the student's adjusted qualified education expenses for line 27. See Qualified Education Expenses, earlier. Use the Adjusted Qualified Education Expenses Worksheet, later, to figure each student's adjusted qualified education expenses. Don't enter more than $4,000. Enter the total of all amounts from all Parts III, line 30, on Part I, line 1.

️Education Expense Worksheet Free Download| Qstion.co 35 Qualified Education Expenses Worksheet Worksheet Education expenses worksheet for 2016 tax year to be used in determining potential education credits on 2016 tax return american opportunity credit lifetime learning credit attach a copy of the student's account summary for each semester. The facts are the same as in 970‐1, except that ...

› publications › p936Publication 936 (2021), Home Mortgage Interest Deduction Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Adjusted Qualified Education Expenses - TurboTax Support - Intuit Feb 28, 2021 ... Are the Adjusted Qualified Education Expenses calculated by adding the total tuition and required books/course material, minus grants/ ...

Qualified 529 expenses | Withdrawals from savings plan | Fidelity American Opportunity Tax Credit allows families of undergraduates to deduct the first $2,000 spent on qualified education expenses and 25% of the next $2,000. To qualify for the full credit in 2019, single parents must have a modified adjusted gross income of $80,000 or less, or $160,000 or less if married and filing jointly.

› publications › p526Publication 526 (2021), Charitable Contributions | Internal ... Qualified cash contributions for 2021 plus qualified contributions for relief efforts in a qualified disaster area, declared prior to February 26, 2021, subject to the limit based on 100% of AGI. Deduct the contributions that don't exceed 100% of your AGI minus all your other deductible contributions.

How do I calculate the amount of qualified education expenses? This total would become the qualified expenses plus any eligible books and supplies. For example, Box 5 is $1000 and Box 1 is $3000, then the qualified expense amount would be $2000 plus any books or supplies. If the amount in Box 5 is greater than the amount in Box 1, then you are not eligible to take an education credit.

Incorporation (business) - Wikipedia In 1816, the New Hampshire state legislature passed a bill intended to turn privately owned Dartmouth College into a publicly owned university with a Board of Trustees appointed by the governor. The board filed a suit challenging the constitutionality of the legislation. The suit alleged that the college enjoyed the right to contract and the government changing that contract was …

Get the free k 12 education expense credit worksheet 2004 form Fill k 12 education expense credit worksheet tax instantly, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile. ... Illinois Department of Revenue Receipt for Qualified Education Expenses Calendar year To be completed by school personnel and distributed to parents or guardians Recipients Attach this receipt to your Form IL ...

S-Corp Educational Assistance - WCG CPAs Jerry deducted $8,712 in qualified education expenses on his 2010 amended tax return (first mistake… give an IRS human a reason to say, "yeah right."). His second mistake was not demonstrating how his Doctoral studies improved his current work skills. The Court said it was not enough to simply make the assertion as a global argument; the ...

Publication 535 (2021), Business Expenses - IRS tax forms Although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion and whether the section 274(e)(2) exception for expenses treated as compensation applies, the deduction that is disallowed relates to the expense of providing a qualified transportation fringe, not its value. For more information, see Regulations sections …

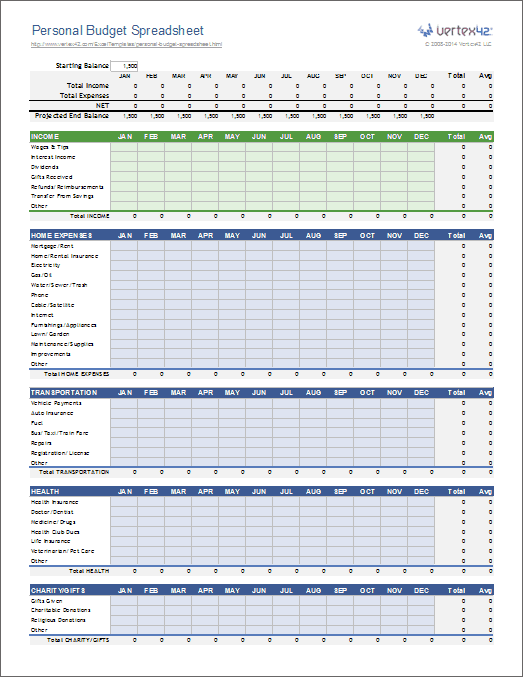

Sheet1 - Tax Season Resources 1, Education Expenses Worksheet for 2018 Tax Year ... 18, Total Qualified Expenses, $0, Sum of tuition/fees and books/supplies.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "38 qualified education expenses worksheet"

Post a Comment