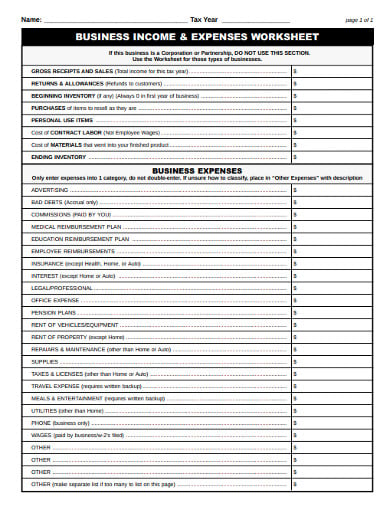

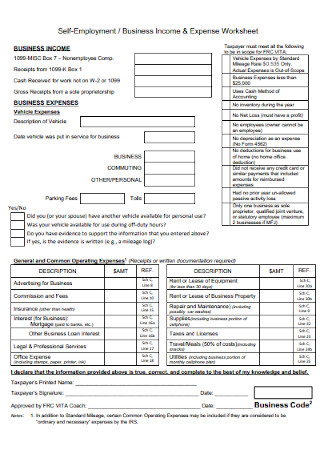

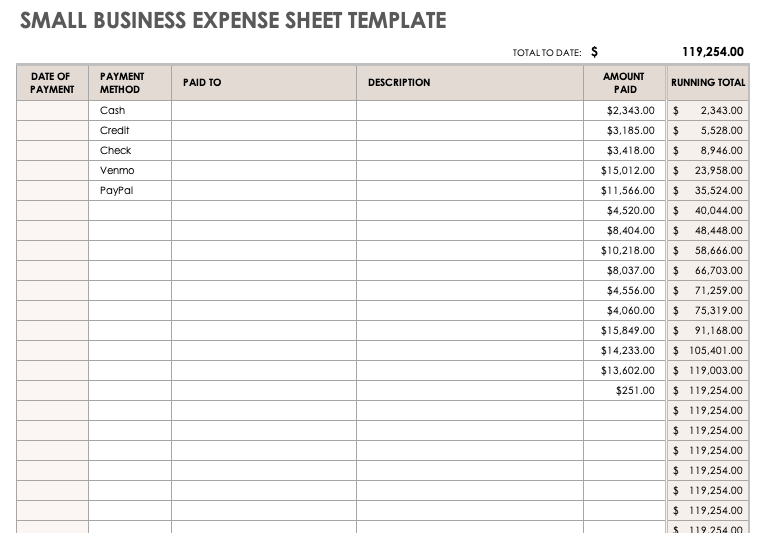

40 self employed business expenses worksheet

Business - Wikipedia In the context of business and management, finance deals with the problems of ensuring that the firm can safely and profitably carry out its operational and financial objectives; i.e. that it: (1) has sufficient cash flow for ongoing and upcoming operational expenses, and (2) can service both maturing short-term debt repayments, and scheduled ... Self-Employed Individuals Tax Center | Internal Revenue Service What are My Self-Employed Tax Obligations? As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly. Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Self-employed health insurance deduction | healthinsurance.org Mar 25, 2022 · Assuming the employer isn’t subsidizing any portion of the cost, it’s possible that the premiums could be deducted based on your wife’s self-employment. But the sticking point, in my mind, would be the requirement that the coverage for the self-employed person has to be established in the name of the self-employed person or their business.

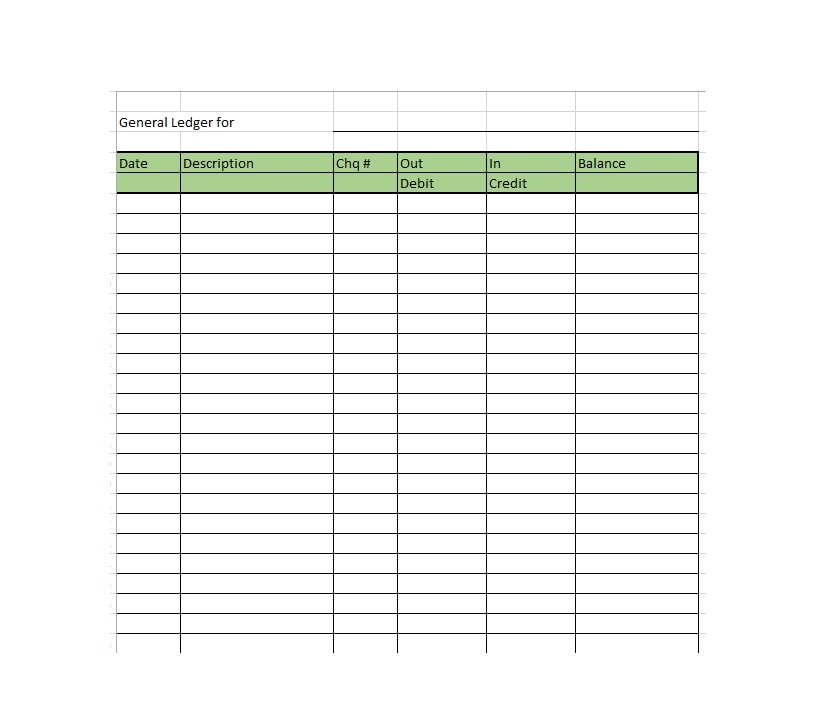

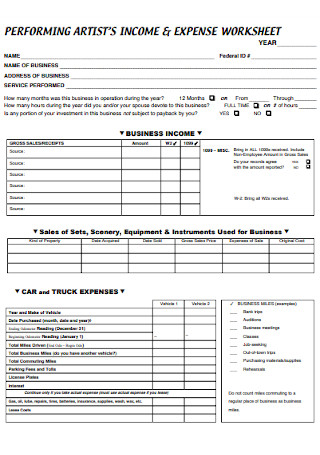

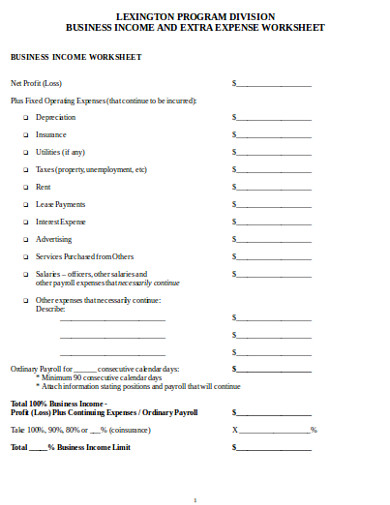

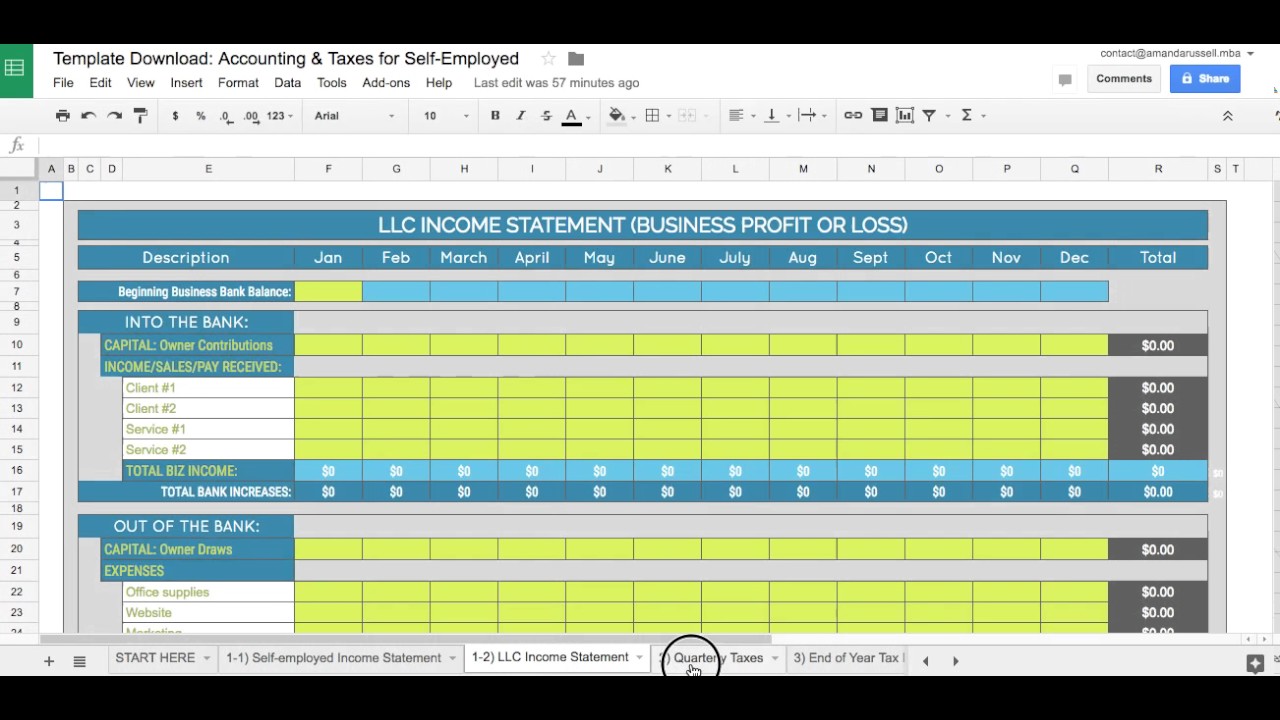

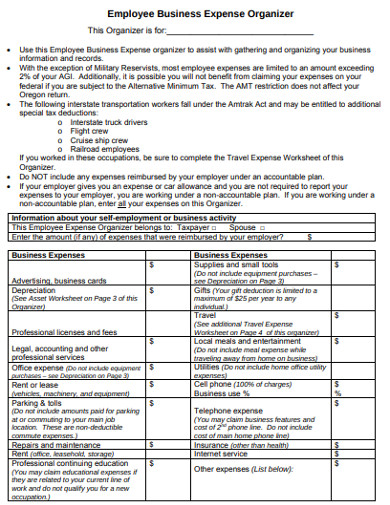

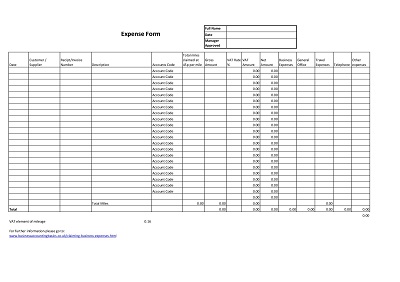

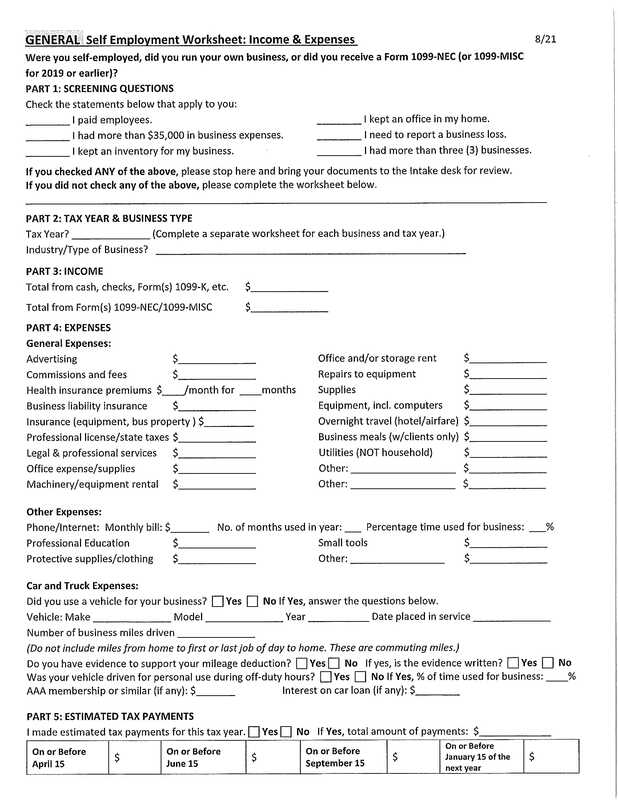

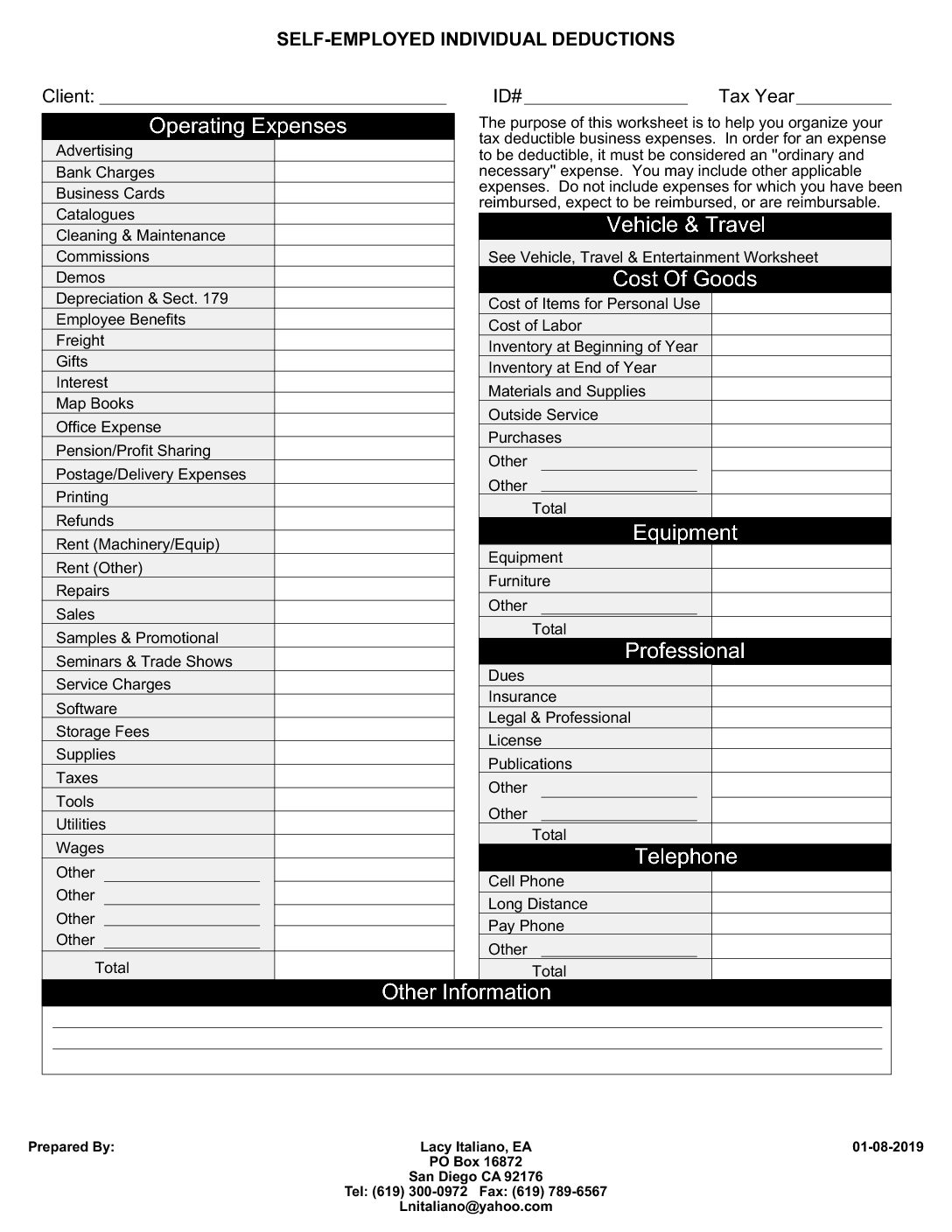

Self employed business expenses worksheet

Self-Employed 401k Plan from Fidelity - Fidelity Investments Complete a Self-Employed 401(k) Account Application for yourself and each participating owner (including the business owner's spouse, if applicable). Fidelity Investments PO Box 770001 Cincinnati, OH 45277-0003; Once you have established your Self-Employed 401(k) Plan and any new account(s), the next step is to contribute to your 401(k). 4. Tips on Rental Real Estate Income, Deductions and ... Oct 27, 2022 · You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance. Small Business, Self-Employed, Other Business | Internal ... Sep 07, 2022 · If you are a statutory employee (box 13 of Form W-2 checked), report your expenses using the same rules as self-employed persons on Schedule C (Form 1040). Additional Information: Publication 587 Business Use of Your Home

Self employed business expenses worksheet. How to File Taxes When You Are Self-Employed Jan 10, 2022 · The cost to hire a tax professional varies. A 2020-2021 survey report from the National Society of Accountants, which surveyed 1,009 NSA members and associate members, found that a typical firm ... Small Business, Self-Employed, Other Business | Internal ... Sep 07, 2022 · If you are a statutory employee (box 13 of Form W-2 checked), report your expenses using the same rules as self-employed persons on Schedule C (Form 1040). Additional Information: Publication 587 Business Use of Your Home Tips on Rental Real Estate Income, Deductions and ... Oct 27, 2022 · You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance. Self-Employed 401k Plan from Fidelity - Fidelity Investments Complete a Self-Employed 401(k) Account Application for yourself and each participating owner (including the business owner's spouse, if applicable). Fidelity Investments PO Box 770001 Cincinnati, OH 45277-0003; Once you have established your Self-Employed 401(k) Plan and any new account(s), the next step is to contribute to your 401(k). 4.

0 Response to "40 self employed business expenses worksheet"

Post a Comment