41 clergy tax deductions worksheet

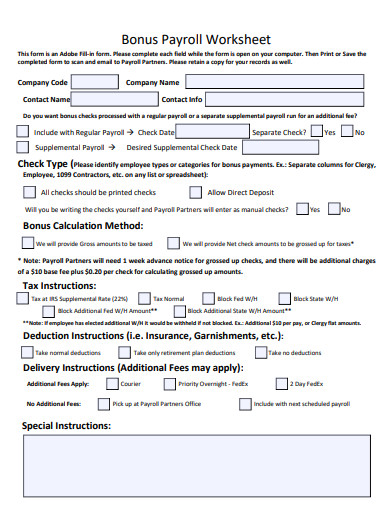

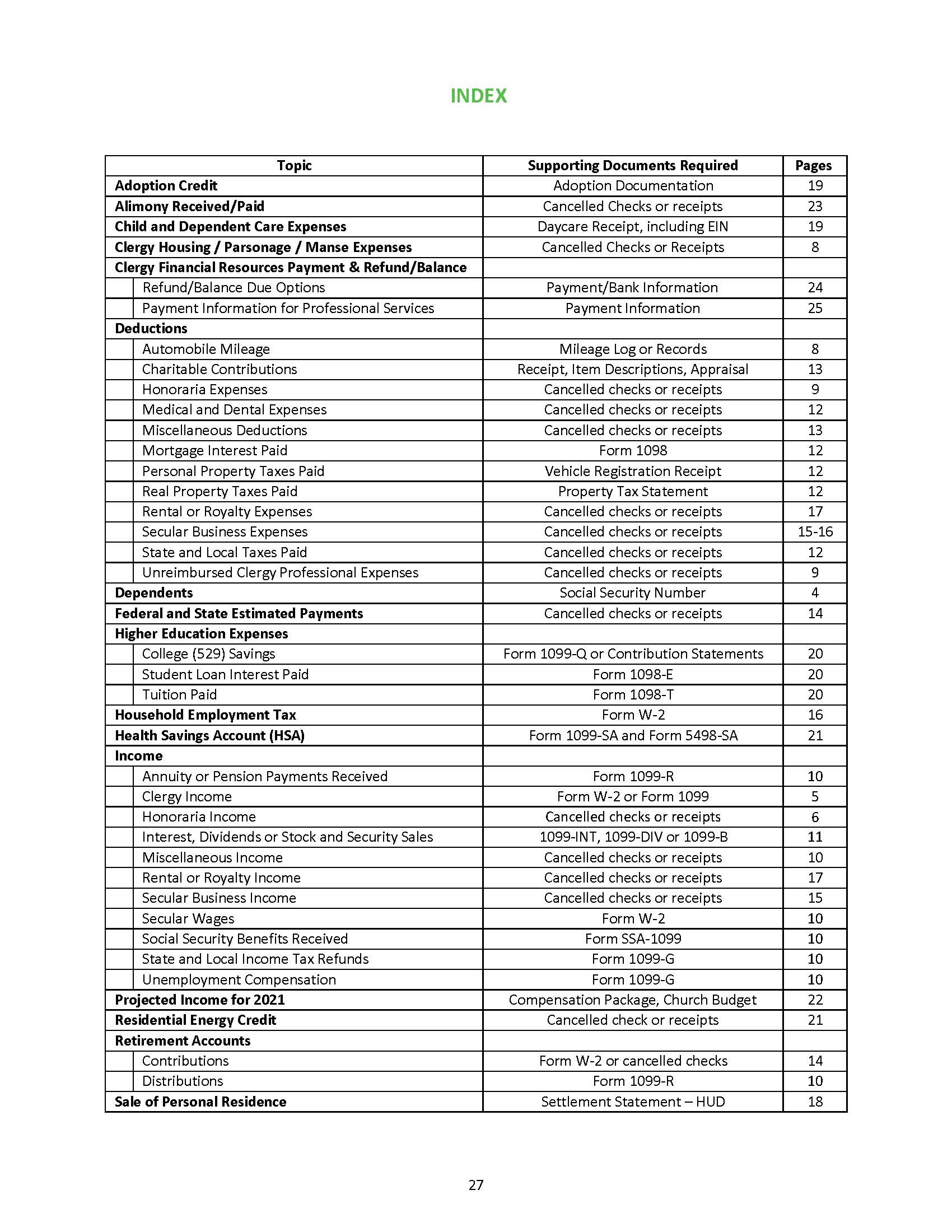

Clergy Worksheet - All About Numbers If you use your personal vehicle for ministry related business and DO NOT receive a tax-free reimbursement from the church, please complete the following ... Deductions for Ministers and Other Clergy | Nolo Before this change, these expenses were deductible as a miscellaneous itemized deduction on Form 1040 Schedule A. Employee ministers should seek to have their work-related expenses reimbursed by their church. Such reimbursements are tax-free so long as the expenses are properly documented. Common deductions for self-employed ministers include:

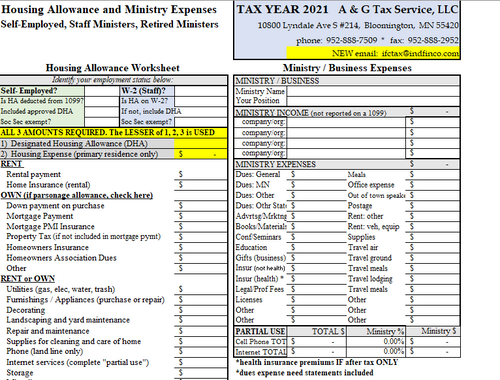

1040-US: IRS Publication 517 Clergy Worksheets - Thomson Reuters IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income)

Clergy tax deductions worksheet

Clergy Tax Worksheet Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). ... To be assured of a deduction, clearly mark your monthly phone bill to show the business calls. Since there are special rules ... ️Clergy Income Tax Worksheet Free Download| Qstion.co Clergy Tax Deductions Worksheet Worksheet List "in the case of a minister of the gospel, gross income does not include— (1) the rental value of a home furnished to him as part of his compensation; These worksheets are used to calculate: Save Image *Click "Save Image" to View FULL IMAGE Free Download Schedule SE - Clergy Self-Employment Tax Adjustment Worksheet Start your TaxAct Desktop program, then click Forms in the top left corner. Click to expand the Federal folder, then click to expand the Worksheets folder. Scroll down and double-click Schedule SE - Adjustments - Self-Employment Adjustment Worksheet. In the print dialog box that appears, you can send the output to a printer or a PDF document.

Clergy tax deductions worksheet. Tax Considerations for Ministers - The Tax Adviser usually, a taxpayer may not deduct otherwise deductible expenses if the expenses are attributable to tax-free income. 18 a minister must reduce deductions for business expenses by the percentage of compensation attributable to the tax-free housing allowance. 19 however, a minister may deduct the full amounts of home mortgage interest … 1040-US: IRS Publication 517 Clergy Worksheets IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income) Clergy Expense Worksheet - atmTheBottomLine! Below are forms and worksheets to help you keep track of your expenses: Clergy Expense Worksheet (.xls) Clergy Expense Works... T1223 Clergy Residence Deduction - Canada.ca T1223 Clergy Residence Deduction For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in: PDF t1223-20e.pdf PDF fillable/saveable t1223-fill-20e.pdf Last update: 2021-01-18 Previous-year versions are also available. Report a problem or mistake on this page Date modified:

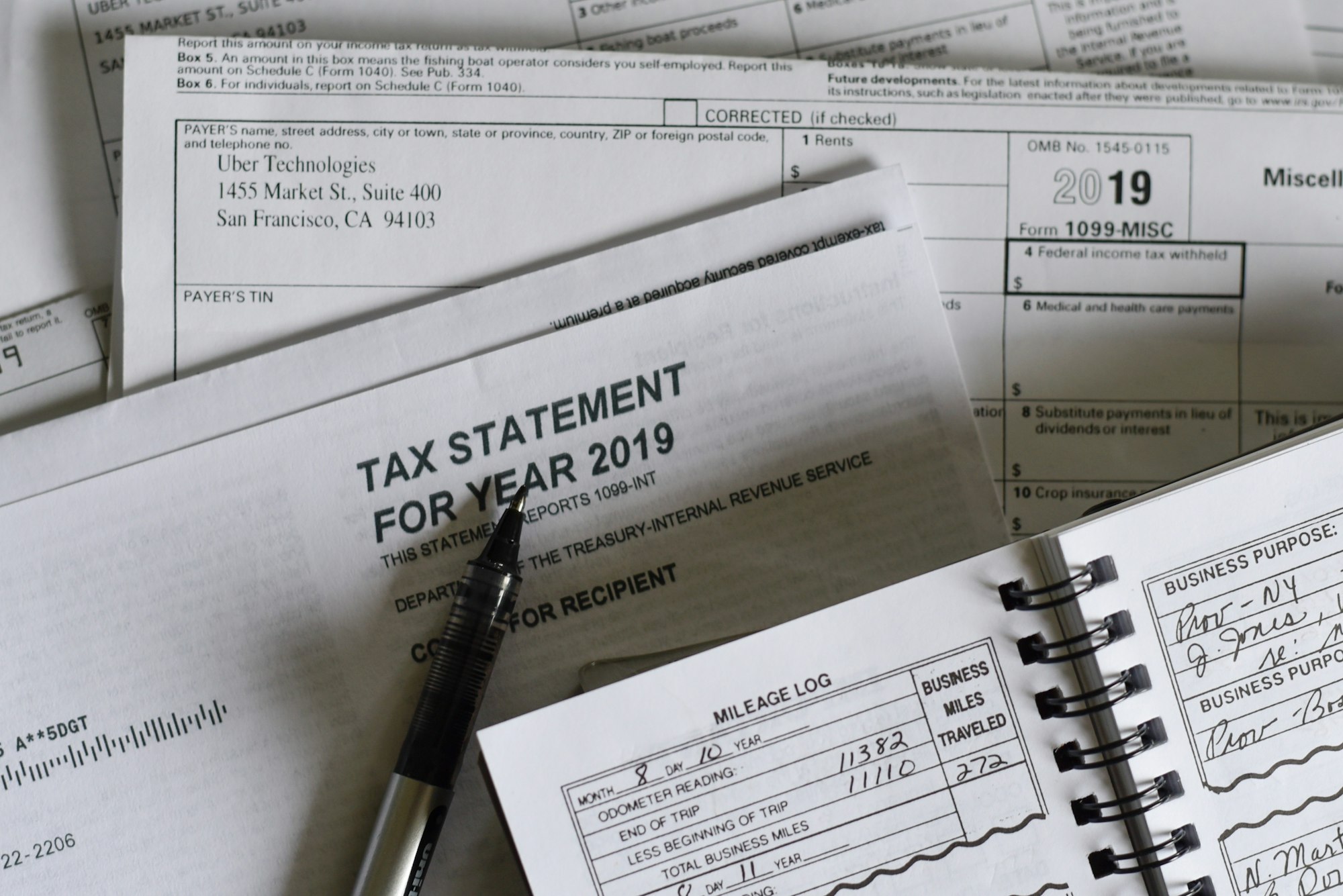

A Guide to Self-Employment Tax & Deductions for Clergy and Ministers A Guide to Self-Employment Tax & Deductions for Clergy and Ministers If you are a member of the clergy, you should receive a Form W-2, Wage and Tax Statement, from your employer reporting your salary and any housing allowance. Generally, there are no income or Social Security and Medicare taxes withheld on this income. PDF Clergy Housing Allowance Worksheet NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources Rev. 11/2010 Worksheet For Clergy Worksheet For Clergy. Your Name ... Clergy clothing (include cleaning & laundry) ... Tax Packets\IRS REQUIREMENT FOR VEHICLE EXPENSE DEDUCTION. Clergy Tax Deductions - Clergy Financial Resources For more information or if you need additional assistance, please use the contact information below. Clergy Financial Resources 11214 86th Avenue N. Maple Grove, MN 55369 Tel: (763) 425-8778 Fax: (888) 876-5101 Email: clientservices@clergyfinancial.com

CLERGY HOUSING ALLOWANCE WORKSHEET CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____. NOTE: This worksheet is provided for educational purposes only.1 page Tax and Payroll Worksheets - Clergy Financial Resources View our collection of clergy tax and church payroll resources, including worksheets for charitable donations, expense reporting, mileage logs and more. Top 10 Tax Deductions - Clergy Financial Resources The credit is a percentage of your eligible work-related child or dependent care expenses, ranging from 20% to 35%, depending on your income. There is a dollar limit on the amount of expenses for which you can claim the credit. The limit is $3,000 of the expenses paid in a year for one person, or $6,000 for two or more. Pastoral Care, Inc. - Minister Expense Form Minister Expense Form. The 2018 Tax Laws may affect most of our pastors. The Standard Deduction for 2018 will double to $24,000 (married filing jointly), which will affect most pastors on them deducting certain items (mileage, dues, ministry expenses, etc) from their Schedule A. Beginning on January 1, 2018, Unreimbursed Business Expenses are ...

Tax Information | Wespath Benefits & Investments Housing Allowance Estimate Worksheet; Learn more about the Clergy Housing Allowance as it pertains to active clergy living in an owned or rented home, ... The new law eliminated the deduction and exclusion for moving expenses from 2018-2025. If the expense of moving is paid for by your church, conference or employer, the value of those services ...

Topic No. 417 Earnings for Clergy | Internal Revenue Service You must file it by the due date of your income tax return (including extensions) for the second tax year in which you have net earnings from self-employment of at least $400. This rule applies if any part of your net earnings from each of the two years came from the performance of ministerial services. The two years don't have to be consecutive.

Clergy residence - Canada.ca Clergy residence deduction. If your employee is a member of the clergy, they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits return. An employee who is a member of the clergy, a regular minister, or a member of a religious order can claim the clergy residence deduction if the ...

7 Top Minister Tax Deductions - freechurchaccounting.com Last of all but certainly not least...one of the greatest minister tax deductions: 7. Housing Allowance: A housing allowance is the greatest tax benefit available to ministers. It is also one of the least understood. It is simply a portion of a minister's compensation that is so designated in advance by the minister's employing church.

PDF IRS tax forms IRS tax forms

PDF CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year:

PDF Supporting Your Calling is Our Calling | MMBB Supporting Your Calling is Our Calling | MMBB

PDF CLERGY INCOME & EXPENSE WORKSHEET YEAR - Cameron Tax Services CLERGY BUSINESS EXPENSES (continued) EQUIPMENT PURCHASED Musical instruments, office equipment, office furniture, professional library, etc. Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Business Use Other Information 1099s: Amounts of $600.00 or more paid to individuals (not

2022 Church & Clergy Tax Guide - Church Law & Tax Buy in bulk and save. $59.95. Quantity: Description. Additional Information. Find comprehensive help understanding United States tax laws as they relate to pastors and churches with Richard Hammar 's 2022 Church & Clergy Tax Guide. Tax law in general is highly complex and ever changing. Add to that the many unique rules that apply to church and ...

Schedule SE - Clergy Self-Employment Tax Adjustment Worksheet Start your TaxAct Desktop program, then click Forms in the top left corner. Click to expand the Federal folder, then click to expand the Worksheets folder. Scroll down and double-click Schedule SE - Adjustments - Self-Employment Adjustment Worksheet. In the print dialog box that appears, you can send the output to a printer or a PDF document.

️Clergy Income Tax Worksheet Free Download| Qstion.co Clergy Tax Deductions Worksheet Worksheet List "in the case of a minister of the gospel, gross income does not include— (1) the rental value of a home furnished to him as part of his compensation; These worksheets are used to calculate: Save Image *Click "Save Image" to View FULL IMAGE Free Download

Clergy Tax Worksheet Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). ... To be assured of a deduction, clearly mark your monthly phone bill to show the business calls. Since there are special rules ...

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "41 clergy tax deductions worksheet"

Post a Comment