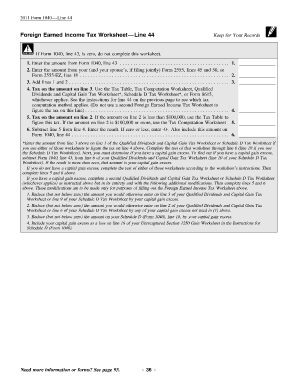

42 foreign earned income tax worksheet

U.S. News: Breaking News Photos, & Videos on the United States - NBC News WebFind the latest U.S. news stories, photos, and videos on NBCNews.com. Read breaking headlines covering politics, economics, pop culture, and more. Publication 575 (2021), Pension and Annuity Income WebBox 9—Federal Income Tax Withheld. This is the total federal income tax withheld from your NSSEB, tier 2 benefit, VDB, and supplemental annuity benefit. Include this on your income tax return as tax withheld. If you are a nonresident alien and your tax withholding rate and/or country of legal residence changed during 2021, you will receive ...

American Family News Web02/08/2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do.

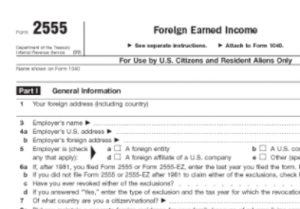

Foreign earned income tax worksheet

Foreign Housing Exclusion or Deduction - IRS tax forms Jul 27, 2022 · Your foreign housing deduction cannot be more than your foreign earned income less the total of (1) your foreign earned income exclusion, plus (2) your housing exclusion, if any. You would not have both a foreign housing deduction and a foreign housing exclusion unless during the tax year you were both self-employed and an employee. Qualified Business Income Deduction | Internal Revenue Service The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (QBI), plus 20 percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. Income earned through a C corporation or by providing services as an employee is not eligible for the ... 3.11.3 Individual Income Tax Returns | Internal Revenue Service (58) IRM 3.11.3.14.2.32(5) Added Medicaid Waiver payments and IHHS to list of earned income and wages while incarcerated to the list of non-earned income. Deleted PYEI from list of earned income. (59) IRM 3.11.3.14.2.33 Deleted info for non taxable combat pay, no longer used on line 27b. Subsequent subsections renumbered.

Foreign earned income tax worksheet. Publication 4681 (2021), Canceled Debts, Foreclosures ... - IRS tax … Web31/12/2020 · Robin completes a separate Insolvency Worksheet and determines she was insolvent to the extent of $4,000 ($9,000 total liabilities minus $5,000 FMV of her total assets). She can exclude her entire canceled debt of $2,500. When completing his separate tax return, James checks the box on line 1b of Form 982 and enters $5,000 on line 2. He … Instructions for Form 5471 (01/2022) | Internal Revenue Service WebFor the foreign corporation’s annual accounting period with respect to which reporting is being made on this Form 5471, if the foreign corporation is required to file a U.S. income tax return (for example, Form 1120‐F), check the “Yes” box if the foreign corporation has previously disallowed interest expense under section 163(j) carried forward to the current … Publication 525 (2021), Taxable and Nontaxable Income WebIf you're a U.S. citizen or resident alien, you must report income from sources outside the United States (foreign income) on your tax return unless it’s exempt by U.S. law. This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2, Wage and Tax Statement, or Form 1099 from the foreign payer. This applies … Tax Support: Answers to Tax Questions | TurboTax® US Support WebAdjusted Gross Income Self-employment Personal income Investments and retirement benefits Small business Cryptocurrency. View all help. Discover TurboTax. Watch videos to learn about everything TurboTax — from tax forms and credits to installation and printing. Help Videos. Short videos for a long list of topics. Get help understanding taxes, using …

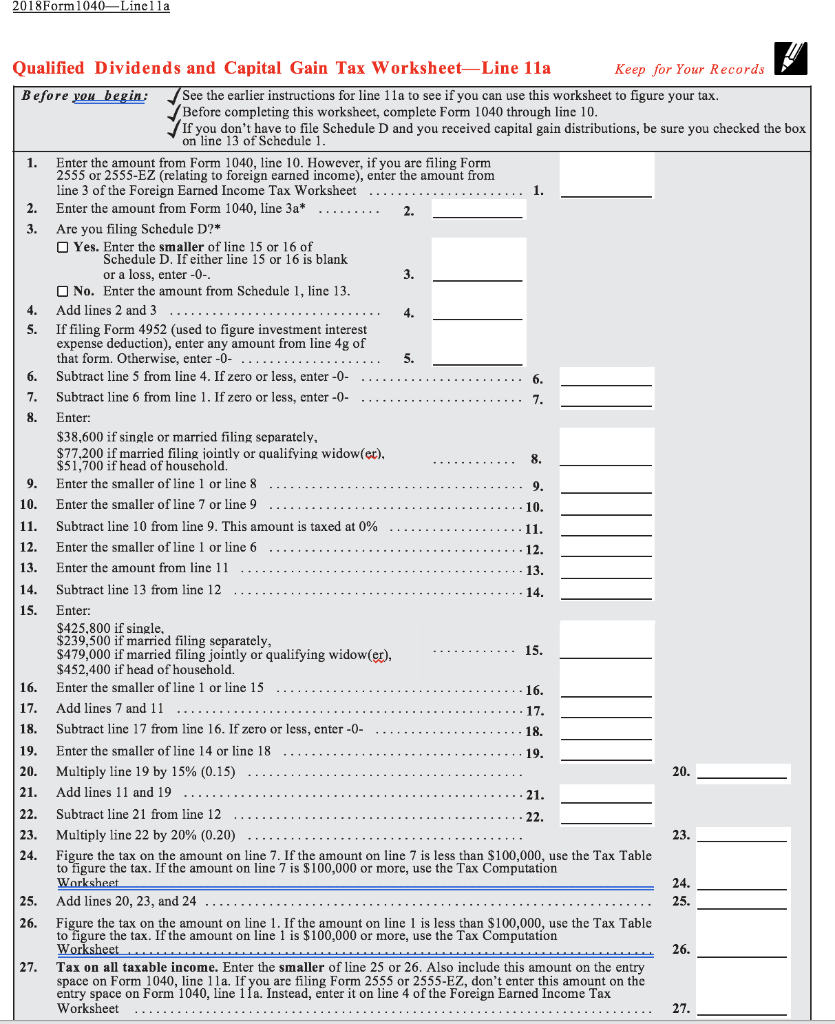

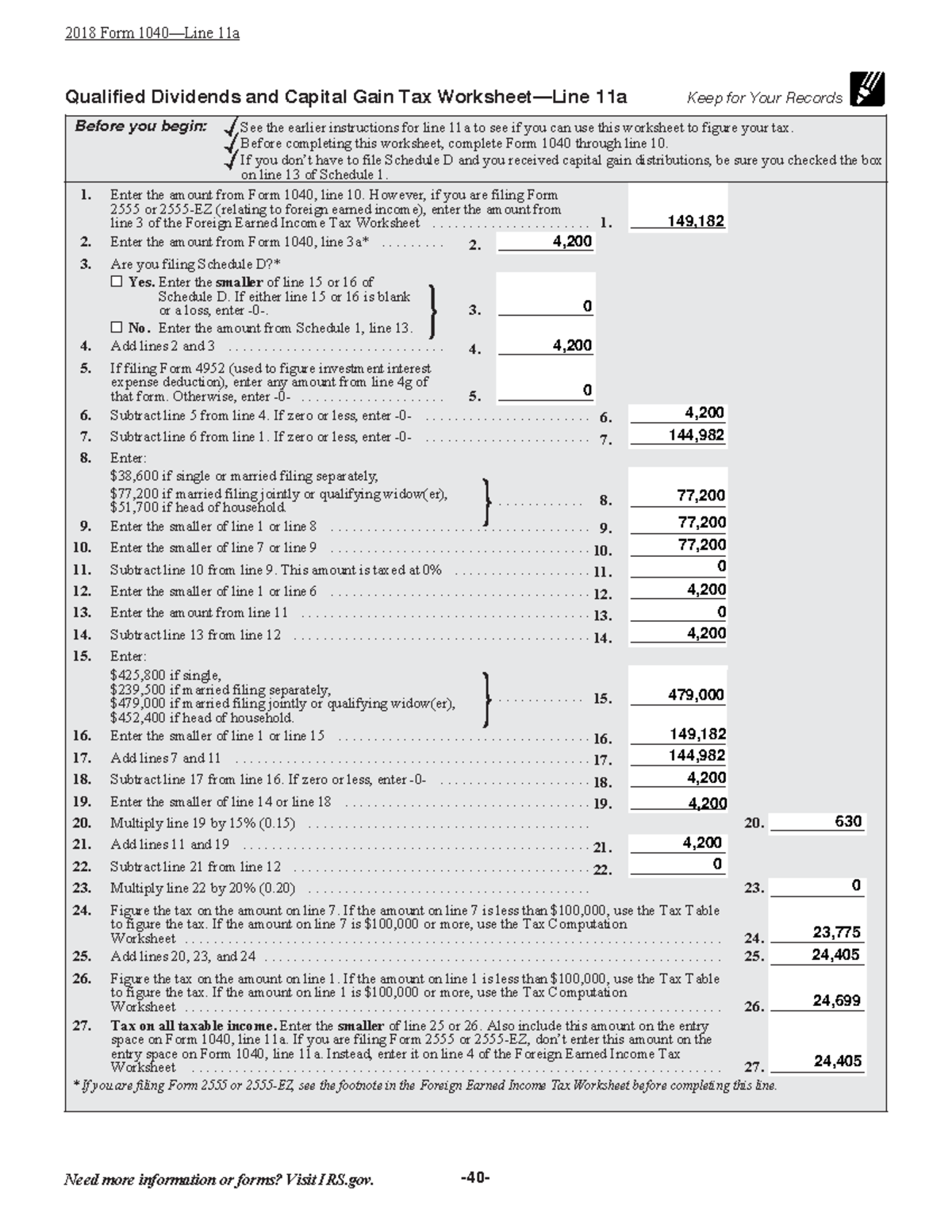

Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... B.C. basic personal income tax credits - Gov WebIf you're eligible to claim a minimum tax credit under the federal Income Tax Act, you may also claim a B.C. minimum tax credit. The B.C. minimum tax credit is calculated as a percentage of your federal minimum tax credit and is currently 33.7%. Special rules may apply if you are not a B.C. resident or if you have income earned outside the ... Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). 1040 (2021) | Internal Revenue Service - IRS tax forms WebForeign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments. Line 25 Federal Income Tax Withheld. Line 25a—Form(s) W-2; Line 25b—Form(s) 1099 ; Line 25c—Other Forms; Line 26. 2021 …

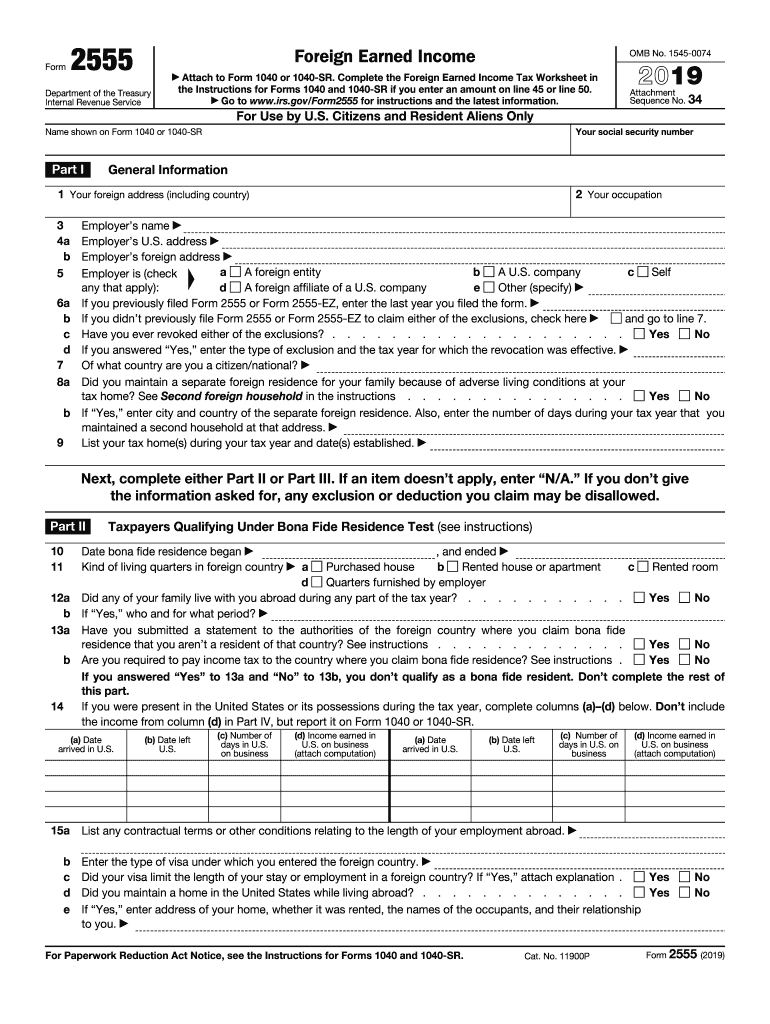

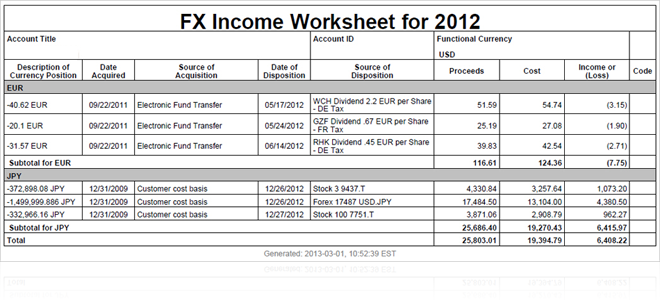

Foreign Earned Income Exclusion | Internal Revenue Service Nov 14, 2022 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions. Claiming the Foreign Tax Credit with Form 1116 - TurboTax Dec 01, 2022 · Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when: Publication 550 (2021), Investment Income and Expenses - IRS tax … WebForeign source income. If you are a U.S. citizen with investment income from sources outside the United States (foreign income), you must report that income on your tax return unless it is exempt by U.S. law. This is true whether you reside inside or outside the United States and whether or not you receive a Form 1099 from the foreign payer. 3.11.3 Individual Income Tax Returns | Internal Revenue Service (58) IRM 3.11.3.14.2.32(5) Added Medicaid Waiver payments and IHHS to list of earned income and wages while incarcerated to the list of non-earned income. Deleted PYEI from list of earned income. (59) IRM 3.11.3.14.2.33 Deleted info for non taxable combat pay, no longer used on line 27b. Subsequent subsections renumbered.

Qualified Business Income Deduction | Internal Revenue Service The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (QBI), plus 20 percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. Income earned through a C corporation or by providing services as an employee is not eligible for the ...

Foreign Housing Exclusion or Deduction - IRS tax forms Jul 27, 2022 · Your foreign housing deduction cannot be more than your foreign earned income less the total of (1) your foreign earned income exclusion, plus (2) your housing exclusion, if any. You would not have both a foreign housing deduction and a foreign housing exclusion unless during the tax year you were both self-employed and an employee.

0 Response to "42 foreign earned income tax worksheet"

Post a Comment