43 mortgage insurance premiums deduction worksheet

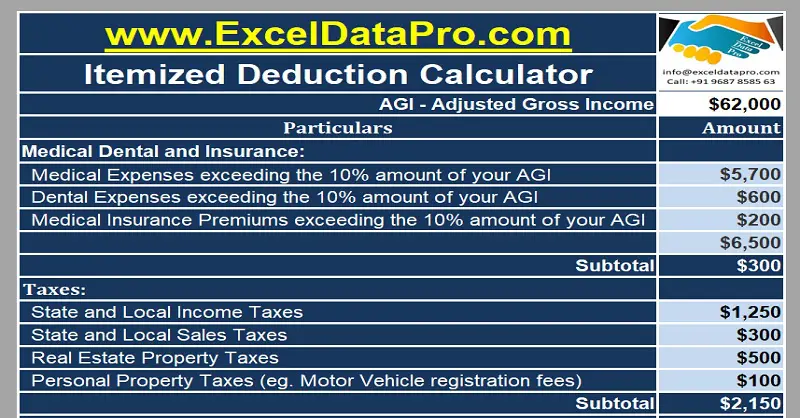

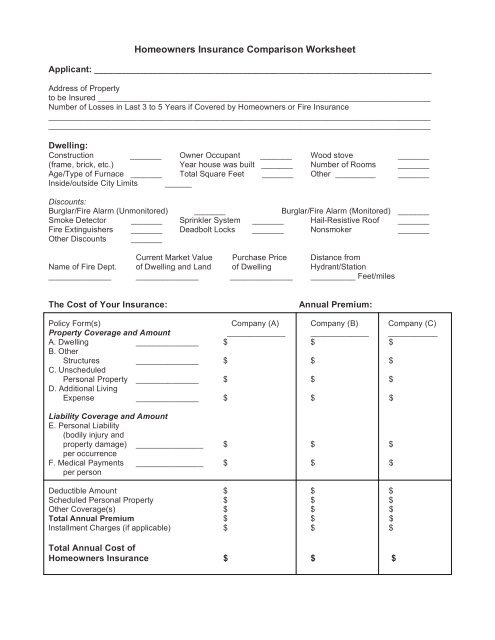

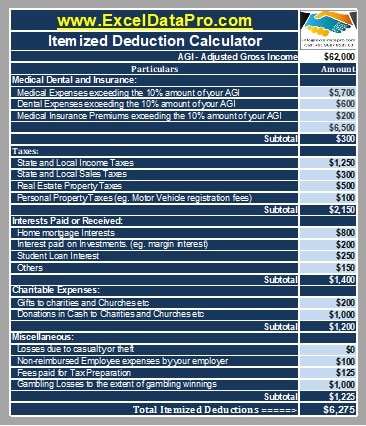

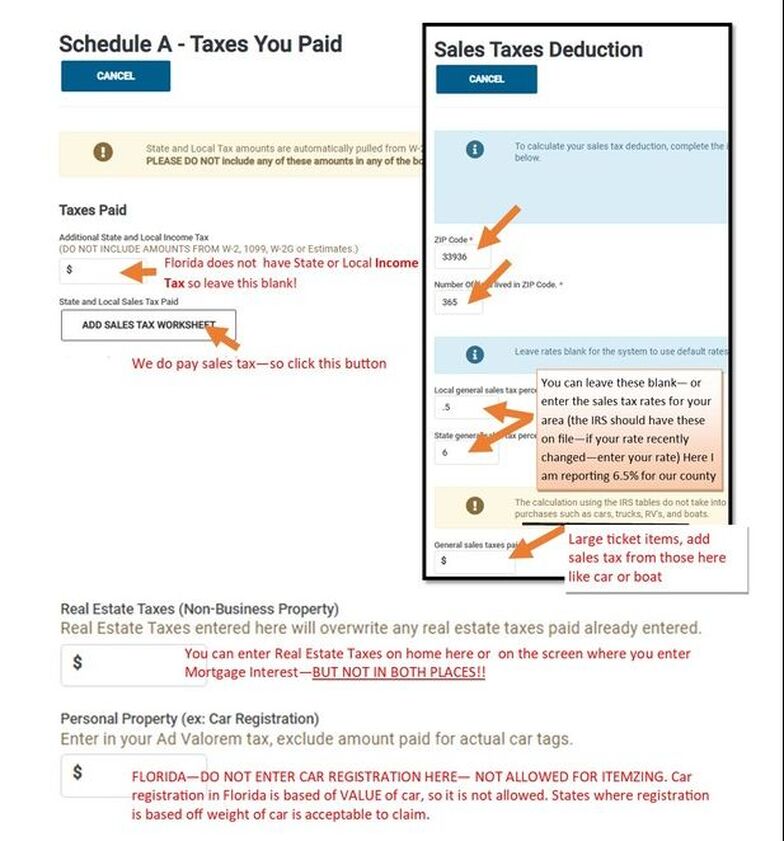

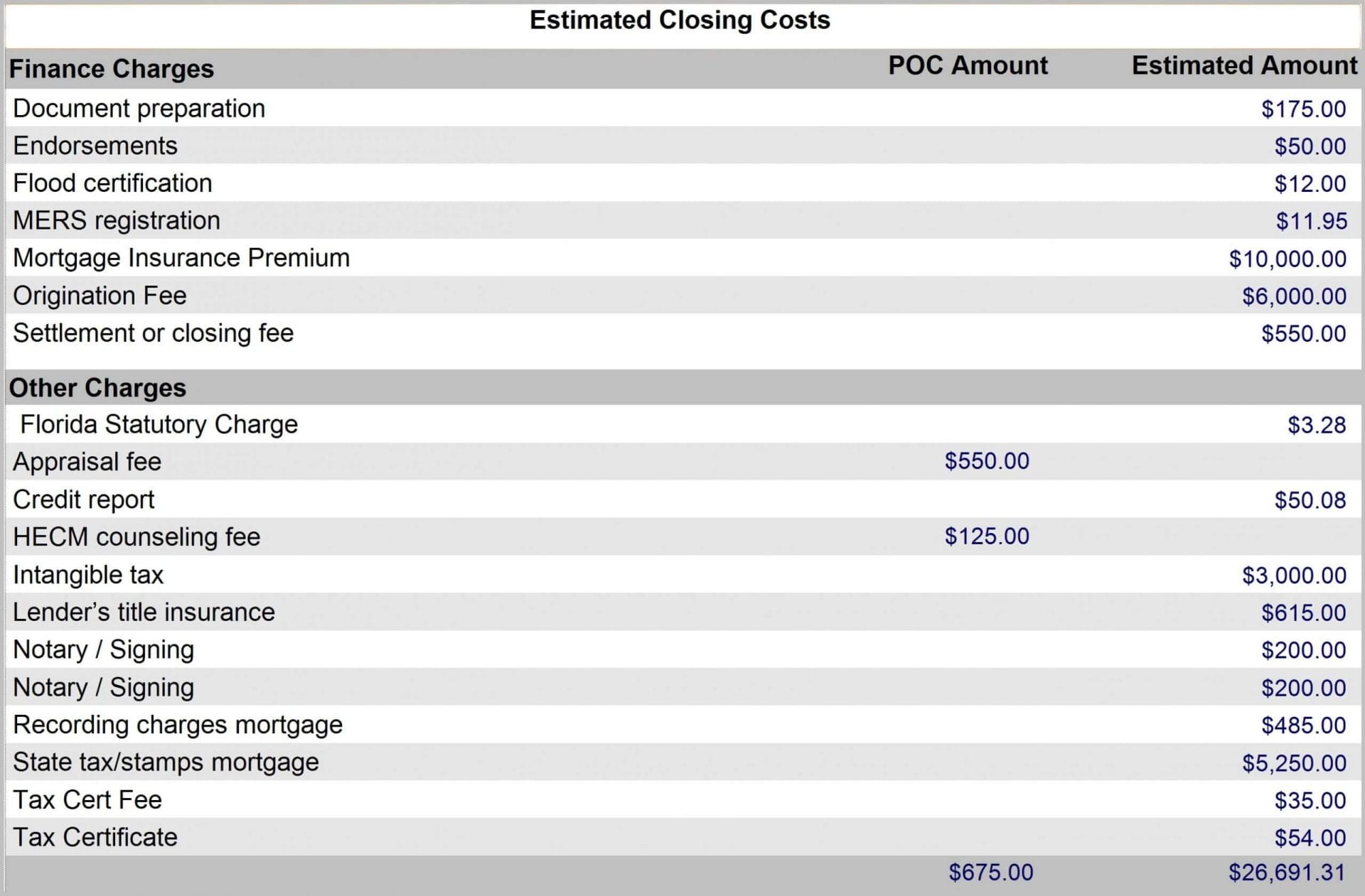

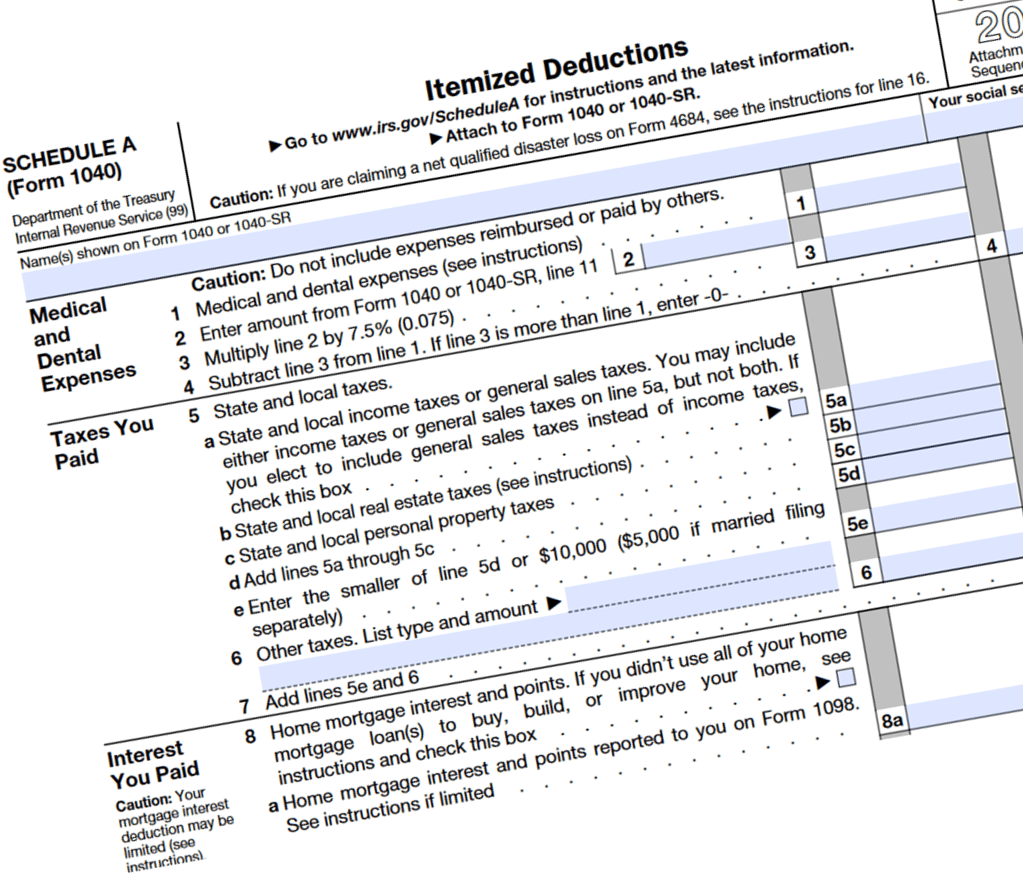

Publication 527 (2020), Residential Rental Property You can deduct the expenses related to the part of the property used for rental purposes, such as home mortgage interest, mortgage insurance premiums, and real estate taxes, as rental expenses on Schedule E (Form 1040). You can also deduct as rental expenses a portion of other expenses that are normally nondeductible personal expenses, such as expenses for electricity … Deductions (Form 1040) Itemized - IRS tax forms Mortgage insurance premiums. The deduction for mortgage insurance premi-ums has been extended through 2017. You can claim the deduction on Line 13 for amounts that were paid or accrued in 2017. Prepaid 2018 real estate and personal property taxes. If your 2018 state and local real estate or personal property tax- es were assessed and paid in 2017, you may be able …

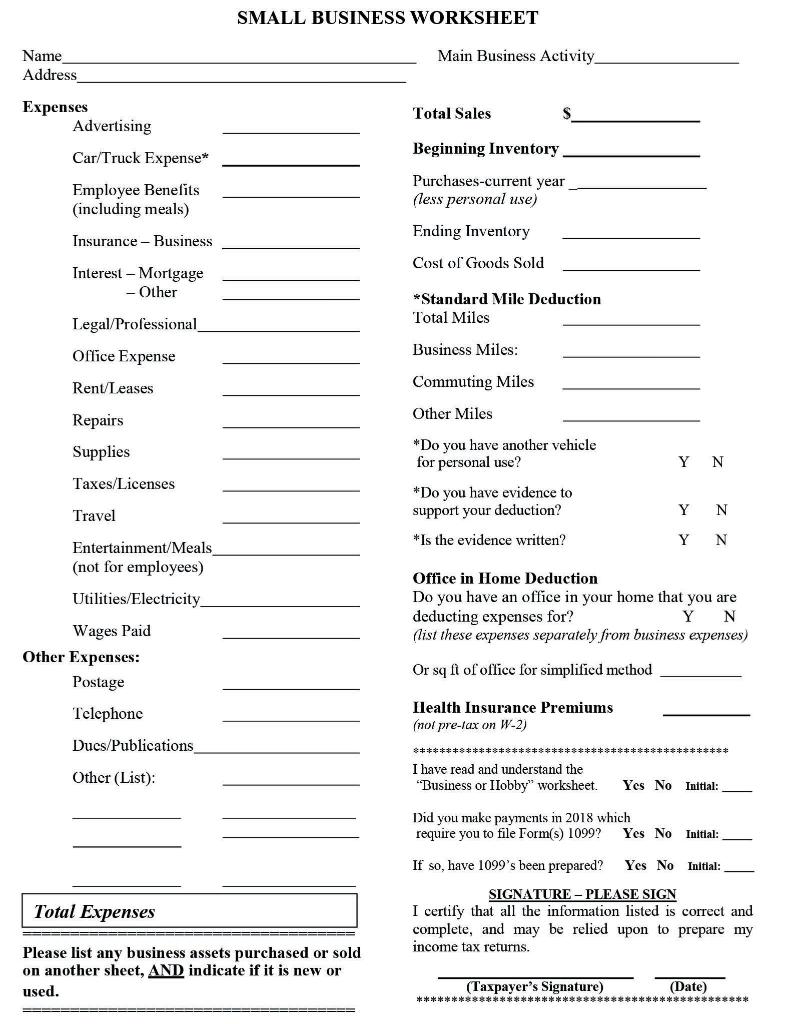

Are health insurance premiums tax deductible? 19.08.2022 · Self-employed health insurance deduction. Most self-employed people can deduct health insurance premiums as an adjustment to their gross income. Serrano says self-employed people with a net profit for the year can deduct medical and health expenses without itemizing expenses. He added that there's no need to itemize your deductions because it ...

Mortgage insurance premiums deduction worksheet

Are Health Insurance Premiums Tax-Deductible? - Investopedia 07.11.2022 · If your medical premiums are deducted through a payroll deduction plan, it's more than likely that you're covering your share of your insurance premium with pre-tax dollars. So, if you deducted ... 2021 Instructions for Schedule A - IRS tax forms •Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You can't deduct insurance … Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can include in …

Mortgage insurance premiums deduction worksheet. Publication 530 (2021), Tax Information for Homeowners See Line 8d in the Instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you can't deduct your mortgage insurance premiums. Form 1098. The amount of mortgage … Publication 936 (2021), Home Mortgage Interest Deduction Enter your qualified mortgage insurance premiums on line 1 of the Mortgage Insurance Premiums Deduction Worksheet in the Instructions for Schedule A (Form 1040) to figure the amount to enter on Schedule A (Form 1040), line 8d. Line 16. You can't deduct the amount of interest on line 16 as home mortgage interest. If you didn't use any of the proceeds of any … Publication 535 (2021), Business Expenses | Internal Revenue … File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year in the course of your trade or business at least $600 in rents, prizes and awards, other income payments, medical and health care payments, and crop insurance proceeds. See the Instructions for Forms 1099-MISC and 1099-NEC for more information and additional reporting … Second mortgage - Wikipedia Second mortgage types Lump sum. Second mortgages come in two main forms, home equity loans and home equity lines of credit. A home equity loan, commonly referred to as a lump sum, is granted for the full amount at the time of loan origination. Interest rates on such loans are fixed for the entire loan term, both of which are determined when the second mortgage is initially granted.

Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can include in … 2021 Instructions for Schedule A - IRS tax forms •Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You can't deduct insurance … Are Health Insurance Premiums Tax-Deductible? - Investopedia 07.11.2022 · If your medical premiums are deducted through a payroll deduction plan, it's more than likely that you're covering your share of your insurance premium with pre-tax dollars. So, if you deducted ...

.png)

0 Response to "43 mortgage insurance premiums deduction worksheet"

Post a Comment