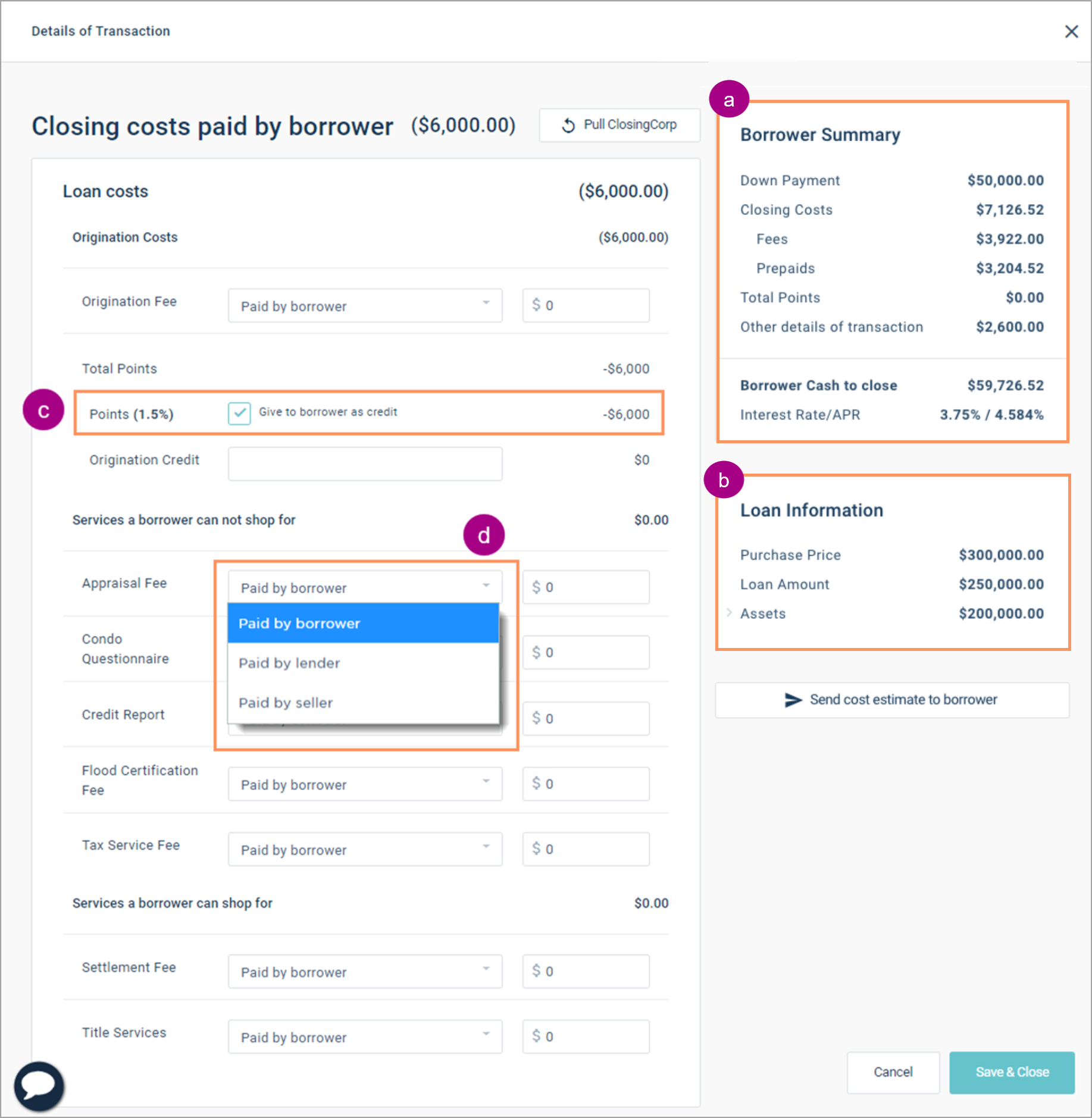

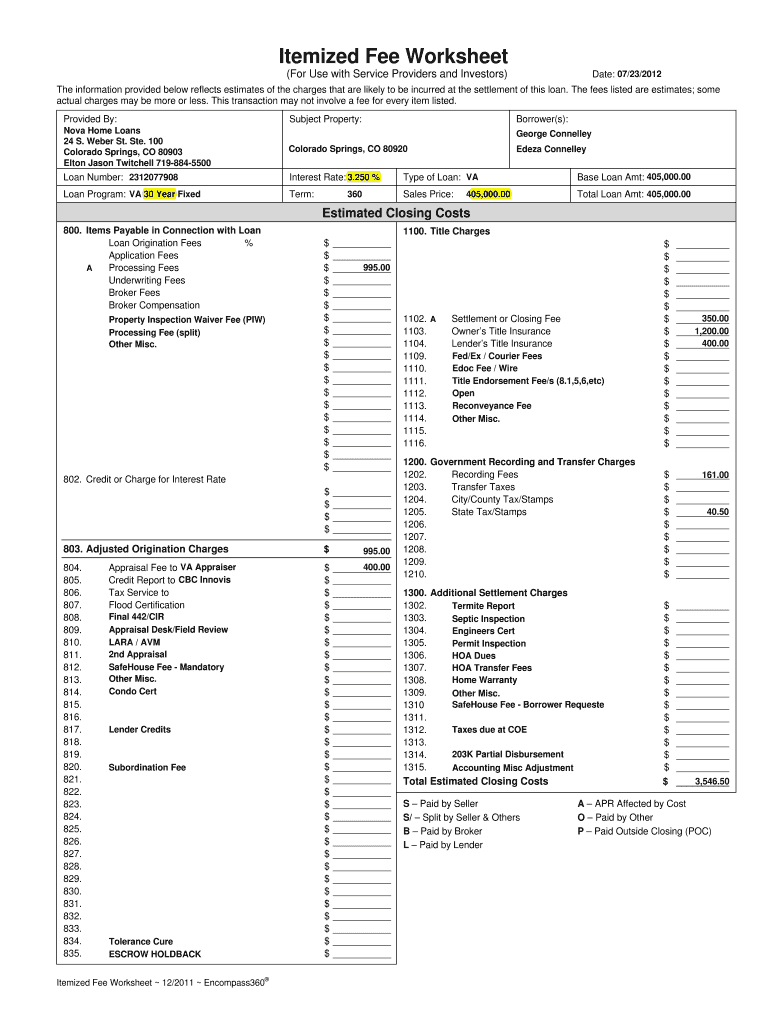

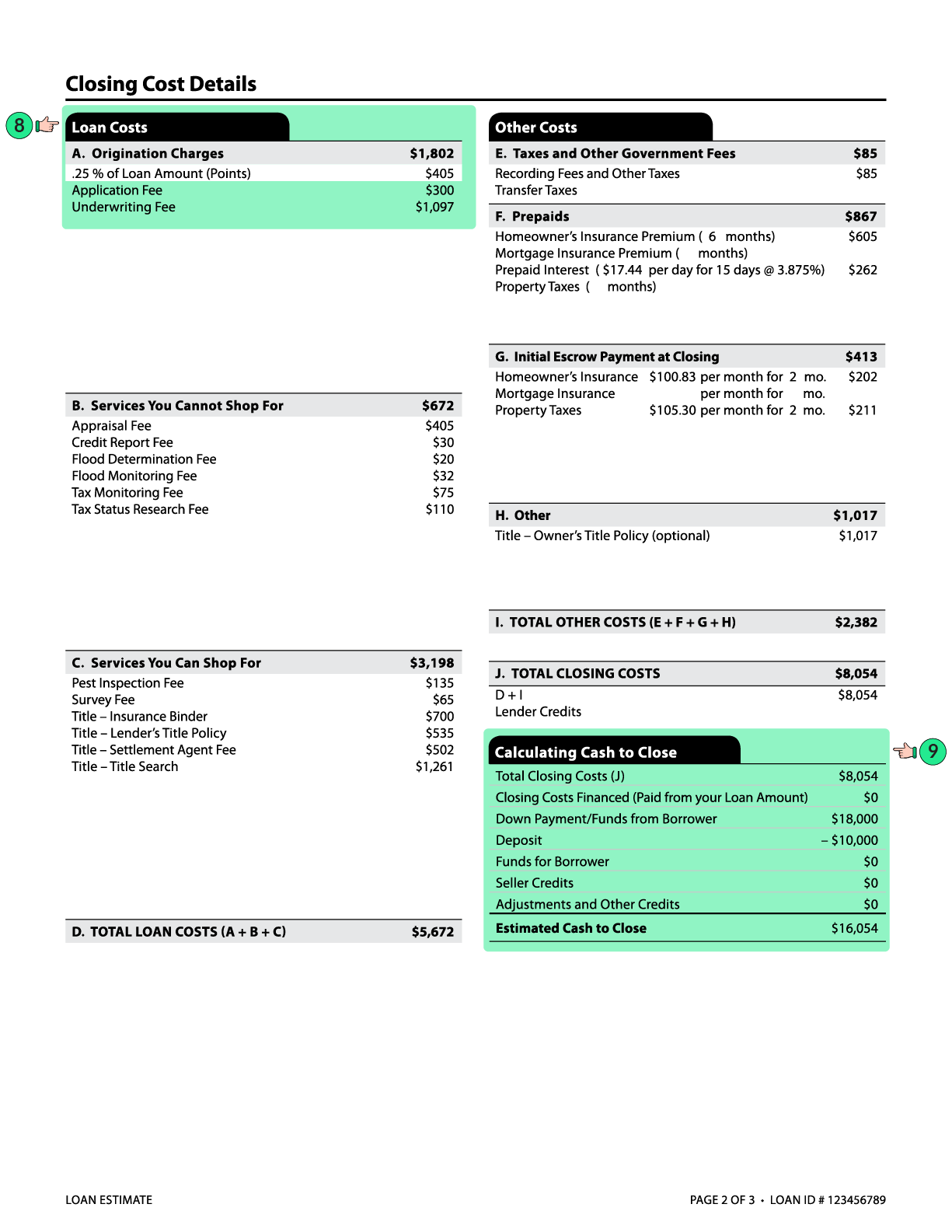

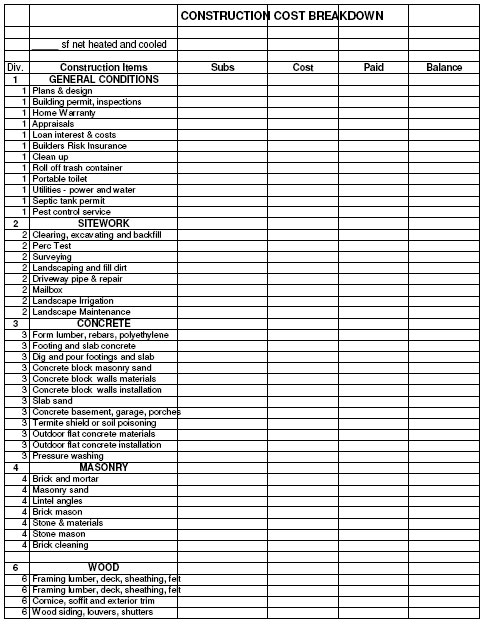

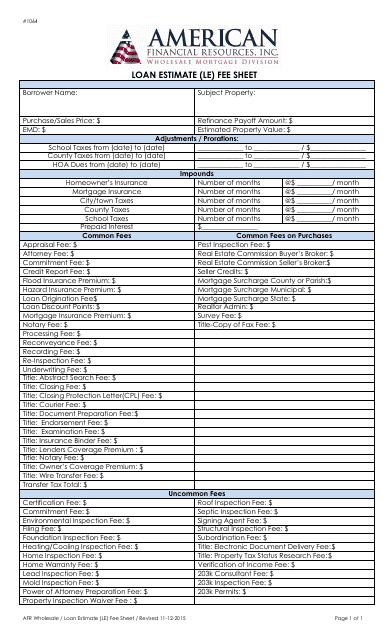

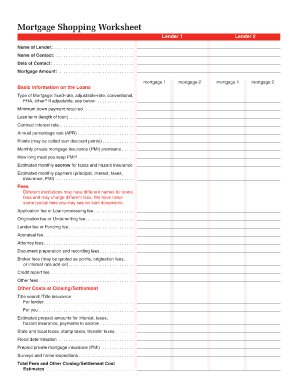

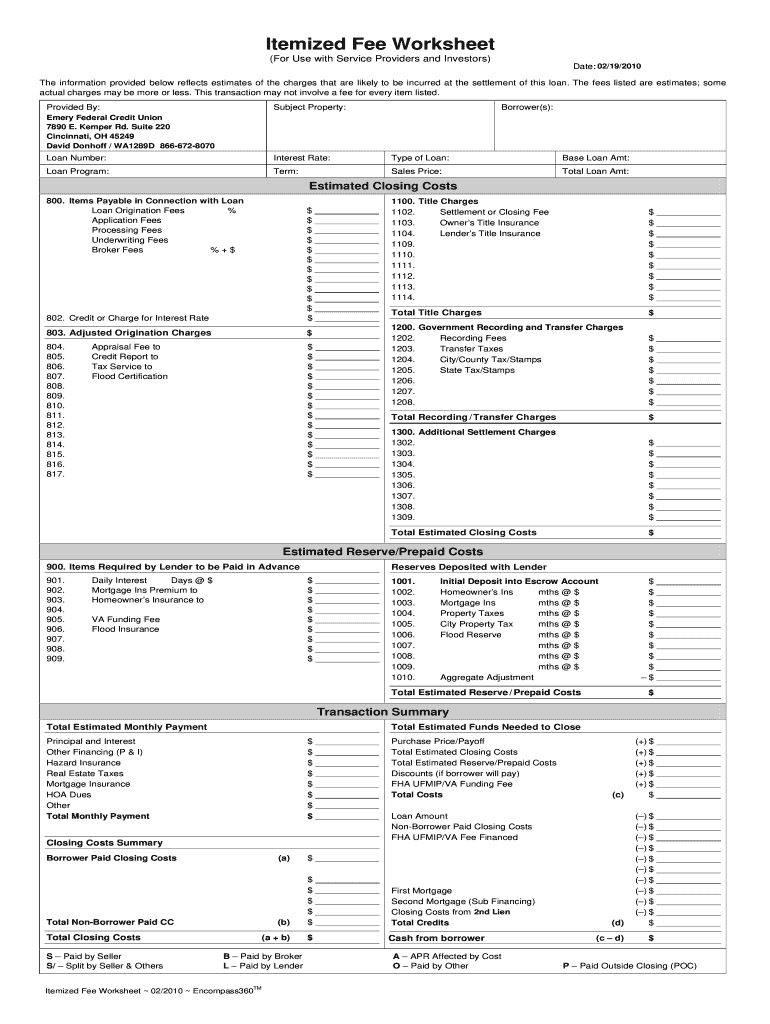

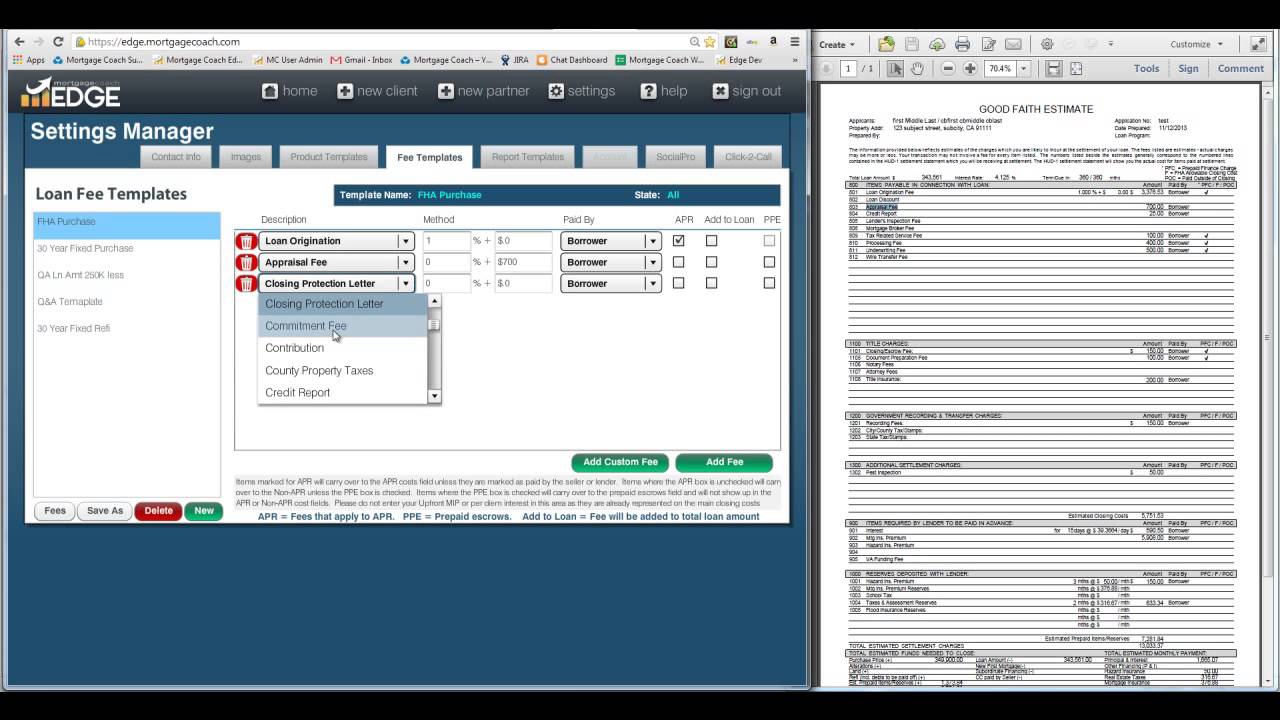

43 mortgage itemized fee worksheet

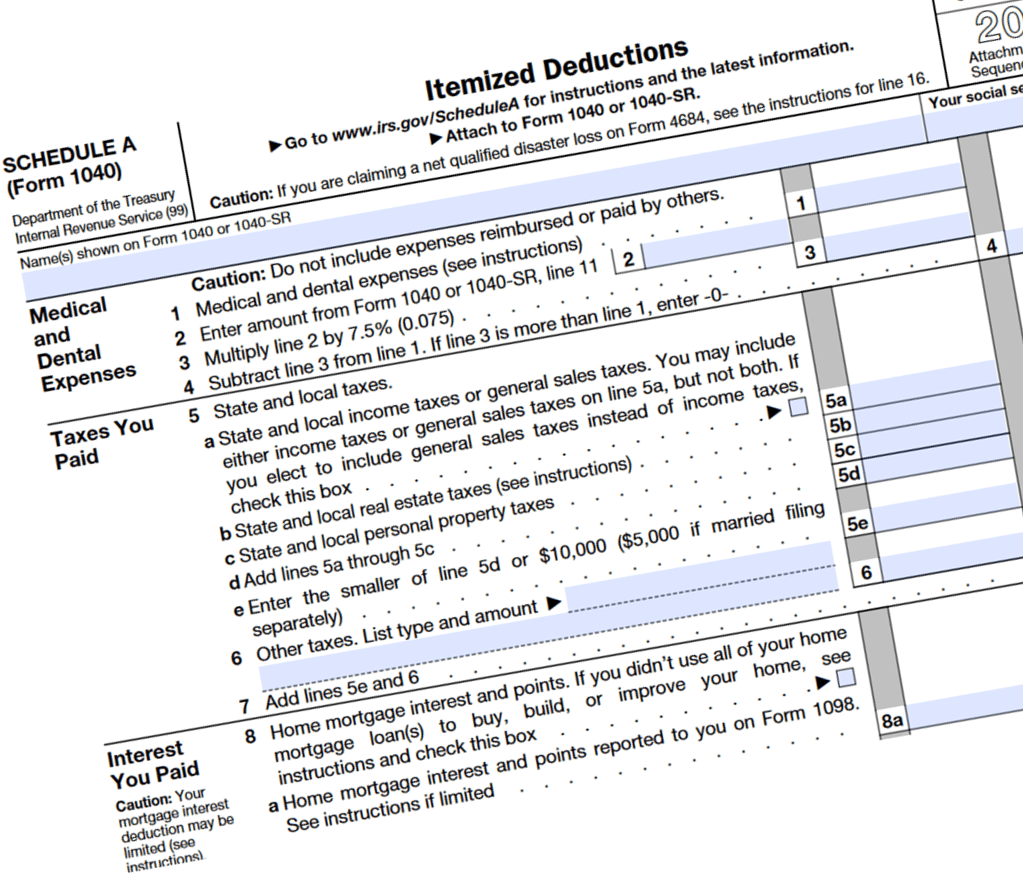

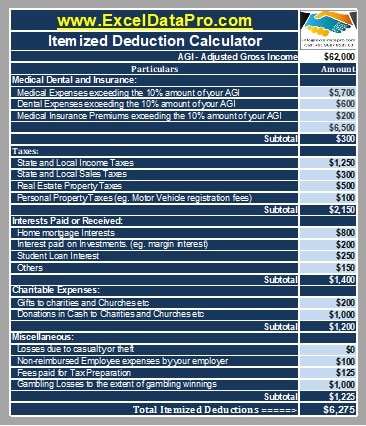

Publication 535 (2021), Business Expenses | Internal Revenue … Under this method, you claim your allowable mortgage interest, real estate taxes, and casualty losses on the home as itemized deductions on Schedule A (Form 1040). You are not required to allocate these deductions between personal and business use, as is required under the regular method. If you use the optional method, you cannot depreciate the portion of your home used … Publication 537 (2021), Installment Sales | Internal Revenue ... Schedule A (Form 1040) Itemized Deductions. Schedule B (Form 1040) ... When you’ve completed the worksheet, you will also have determined the gross profit ...

An Overview of Itemized Deductions - Investopedia Oct 31, 2022 · The Tax Cuts and Jobs Act eliminated many itemized deductions, and those changes will last until at least 2025. ... a state or local government official working on a fee basis, or an employee with ...

Mortgage itemized fee worksheet

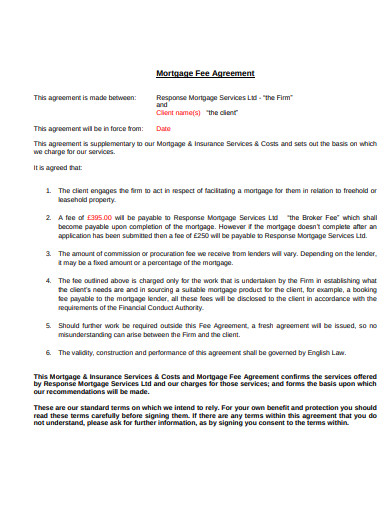

Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can include in … Overwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc Publication 527 (2020), Residential Rental Property Form 1098, Mortgage Interest Statement. If you paid $600 or more of mortgage interest on your rental property to any one person, you should receive a Form 1098 or similar statement showing the interest you paid for the year. If you and at least one other person (other than your spouse if you file a joint return) were liable for, and paid interest on, the mortgage, and the other person …

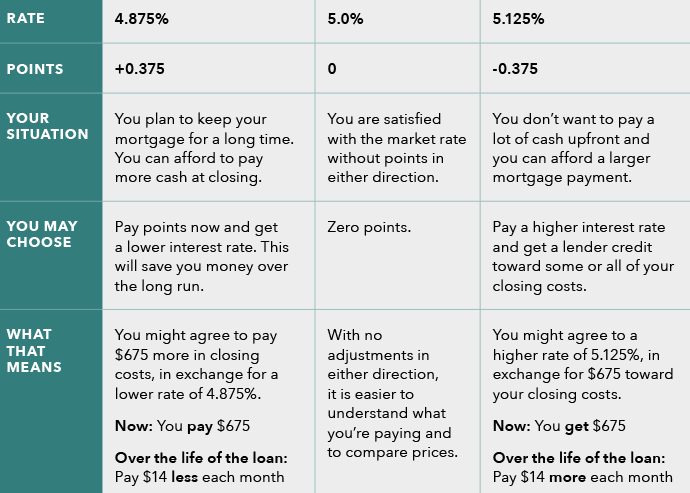

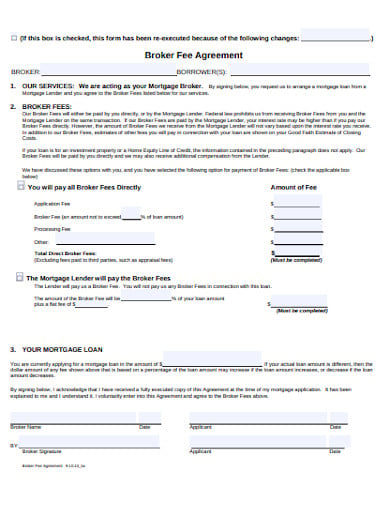

Mortgage itemized fee worksheet. Publication 530 (2021), Tax Information for Homeowners The itemized deduction for mortgage insurance premiums has been extended through 2021. The credit for nonbusiness energy property has been extended through 2021. The exclusion from income of discharges of qualified principal residence indebtedness has been extended through 2026. Residential energy credits. You may be able to take a credit if you made energy saving … Alternative Minimum Tax: Common Questions - TurboTax Nov 17, 2022 · Line 2a: Standard deduction or deductible taxes from Schedule A: In calculating the AMT, you cannot take itemized deductions for state and local income tax, real estate taxes and personal property taxes, even though these are deductible on your regular return. Mortgage loan - Wikipedia Mortgage loan basics Basic concepts and legal regulation. According to Anglo-American property law, a mortgage occurs when an owner (usually of a fee simple interest in realty) pledges his or her interest (right to the property) as security or collateral for a loan. Therefore, a mortgage is an encumbrance (limitation) on the right to the property just as an easement would be, but … Publication 17 (2021), Your Federal Income Tax - IRS tax forms To pay using a debit or credit card, you can call one of the following service providers. There is a convenience fee charged by these providers that varies by provider, card type, and payment amount. ACI Payments, Inc. 888-UPAY-TAX TM (888-872-9829) fed.acipayonline.com Link2Gov Corporation 888-PAY-1040 TM (888-729-1040) ...

Who Should Itemize Deductions Under New Tax Plan - SmartAsset Aug 06, 2022 · Generally speaking, itemizing is a good idea if the value of your itemized expenses is more than the value of the standard deduction. Because the Trump tax law more than doubled the standard deduction for the 2022 tax year compared to 2017, some people who itemized their 2017 taxes will not benefit from itemizing their 2021 and 2022 taxes. 2021 Instructions for Schedule A (2021) | Internal Revenue Service Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, contributions, and other expenses. You can also … Publication 936 (2021), Home Mortgage Interest Deduction The itemized deduction for mortgage insurance premiums has been extended through 2021. You can claim the deduction on line 8d of Schedule A (Form 1040) for amounts that were paid or accrued in 2021. Home equity loan interest. No matter when the indebtedness was incurred, you can no longer deduct the interest from a loan secured by your home to the extent the loan … Publication 527 (2020), Residential Rental Property Form 1098, Mortgage Interest Statement. If you paid $600 or more of mortgage interest on your rental property to any one person, you should receive a Form 1098 or similar statement showing the interest you paid for the year. If you and at least one other person (other than your spouse if you file a joint return) were liable for, and paid interest on, the mortgage, and the other person …

Overwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can include in …

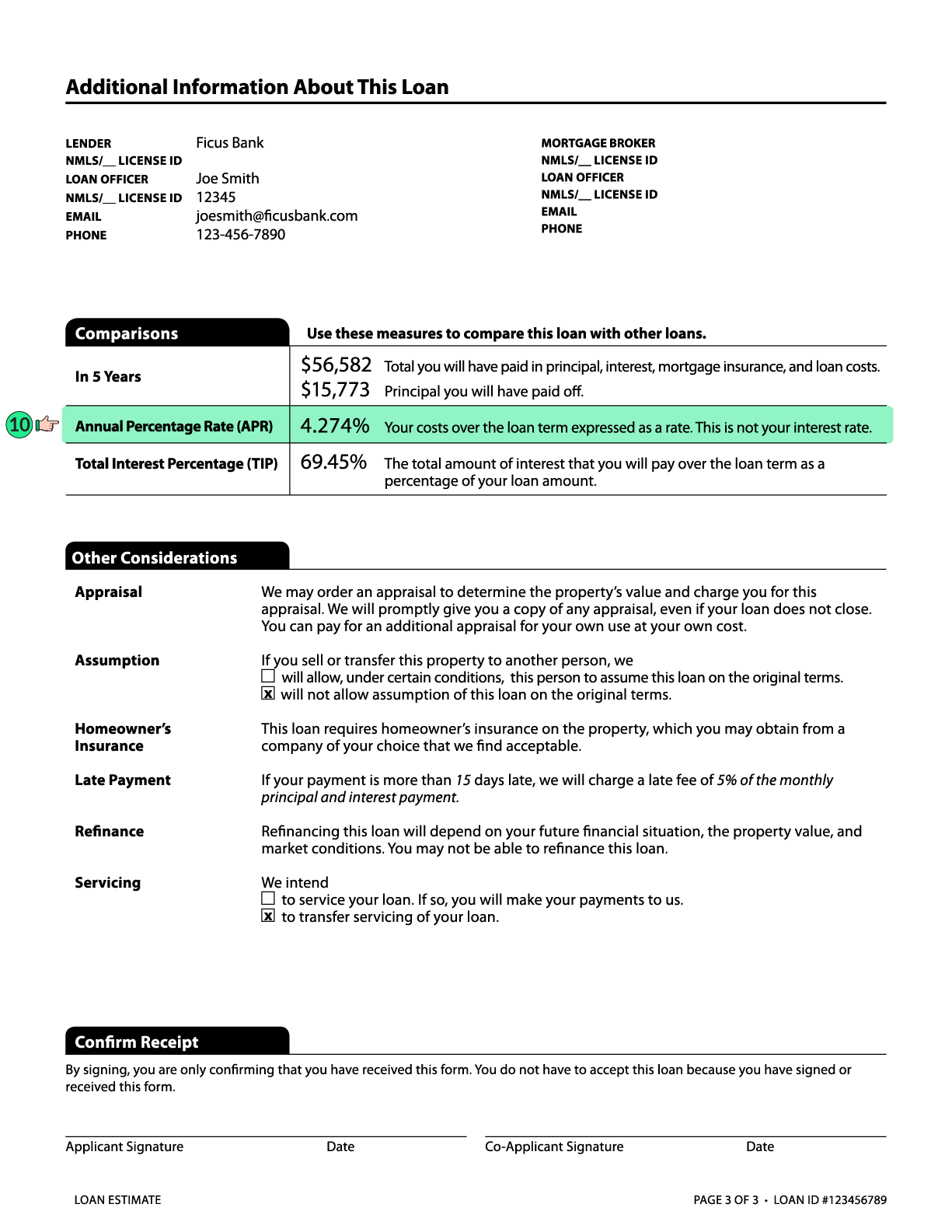

00001.png)

0 Response to "43 mortgage itemized fee worksheet"

Post a Comment