38 qualified dividends and capital gain tax worksheet instructions

Instead, 1040 Line 44 “Tax” asks you to “see instructions.” In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

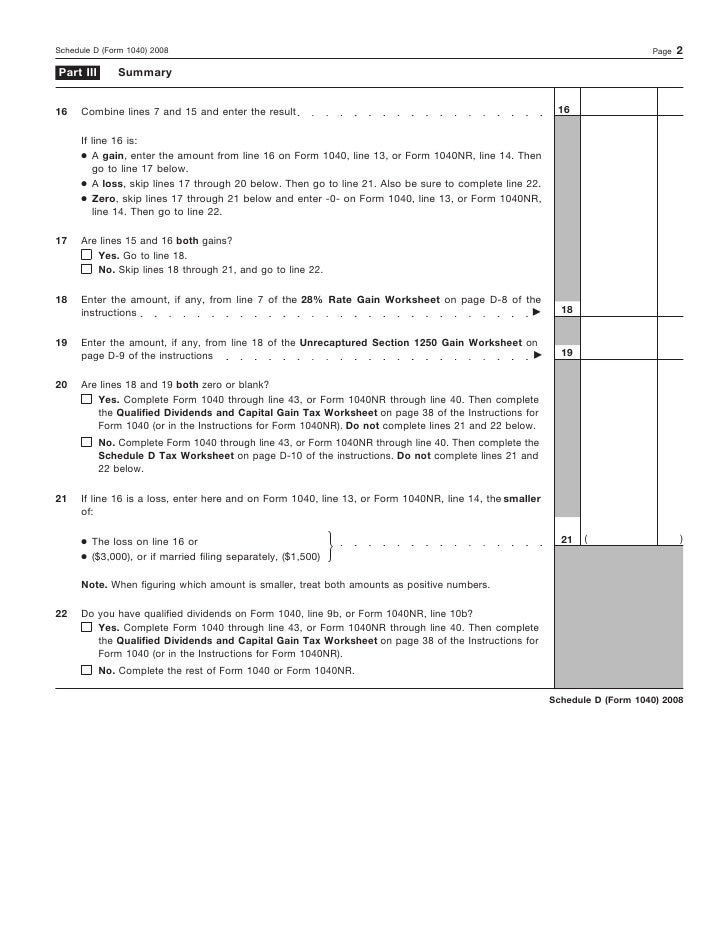

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16 (or in …

long-term capital loss on Form 8949, but any gain is reported as ordinary income on Form 4797. • If qualified dividends that you re- ported on Form 1040, ...18 pages

Qualified dividends and capital gain tax worksheet instructions

2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET -LINE 16 Keep for Your Records Before you begin: J See the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. J Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. J If you do not have to file Schedule D and you received capital gain distributions,

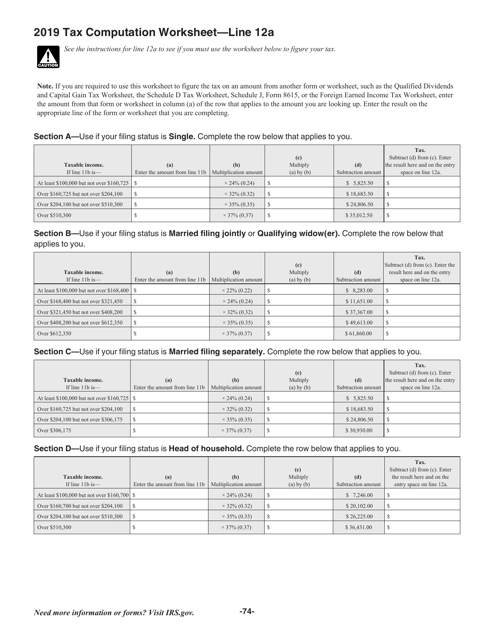

for individuals, the amounts taxed at the 0% rate are on line 11 of the qualified dividends and capital gain tax worksheet in the 2019 form 1040 and 1040-sr instructions, line 9 of the qualified dividends and capital gain tax worksheet in the 2019 form 1040-nr instructions, or line 22 of the schedule d tax worksheet in the 2019 schedule d (form …

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Qualified dividends and capital gain tax worksheet instructions.

To report capital gain distributions not reported directly on Form 1040 or ... in a QOF during the tax year and any ... If qualified dividends that you re-.17 pages

13 Apr 2021 — employment taxes, additional tax on IRAs or other qualified ... opments affecting Form 1040 or 1040-SR or the instructions, go to IRS.gov/.115 pages

Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less ... the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.2 pages

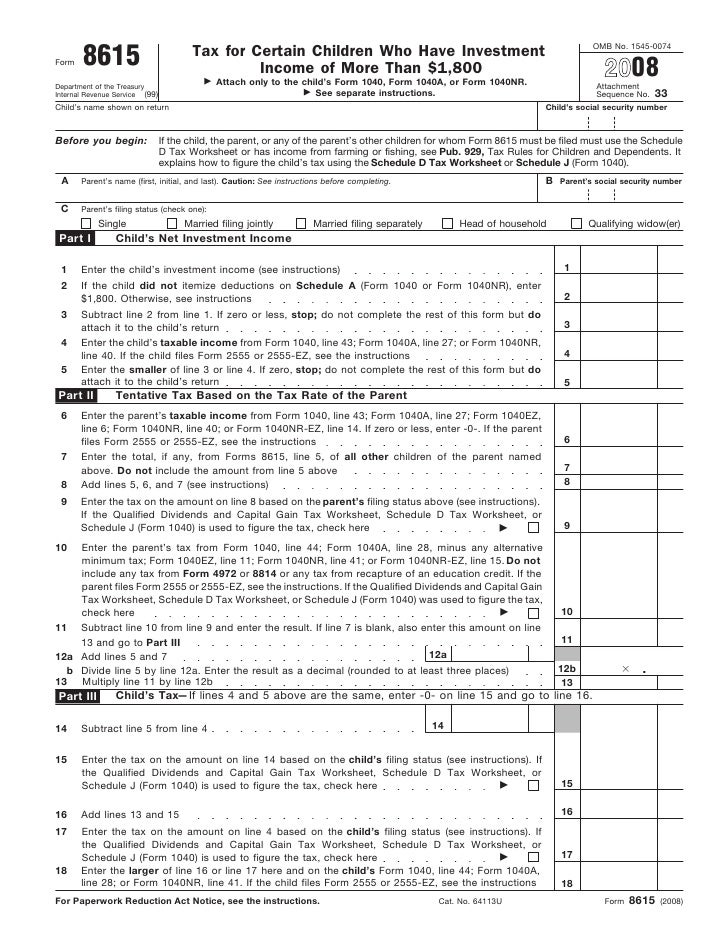

If the child has a net capital gain or qualified dividends, use the appropriate Line 5 Worksheet in these instructions to find the amount included on line 5. These worksheets are needed to adjust the child's net capital gain and qualified dividends by the appropriate allocated amount of the child's deductions.

Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV.

However, the federal income tax on the child's income, including qualified dividends and capital gain distributions, may be higher if this election is made. For.6 pages

Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Although many investors use Schedule D to get the benefit of lower capital gains tax rates, others can still use a worksheet in the tax instructions to skip ...1 page

24-09-2021 · In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. So, for those of you who are curious, here’s what they do. Understanding Taxable Income

Tools or Tax ros ea Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15.

Qualified Dividends and Capital Gain Tax Worksheet - Line 16 (Form 1040) 2020 Before you begin: FOR ALT MIN TAX PURPOSES ONLY 1. 1. 2. 2. 3. Yes. 3. No.

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "38 qualified dividends and capital gain tax worksheet instructions"

Post a Comment