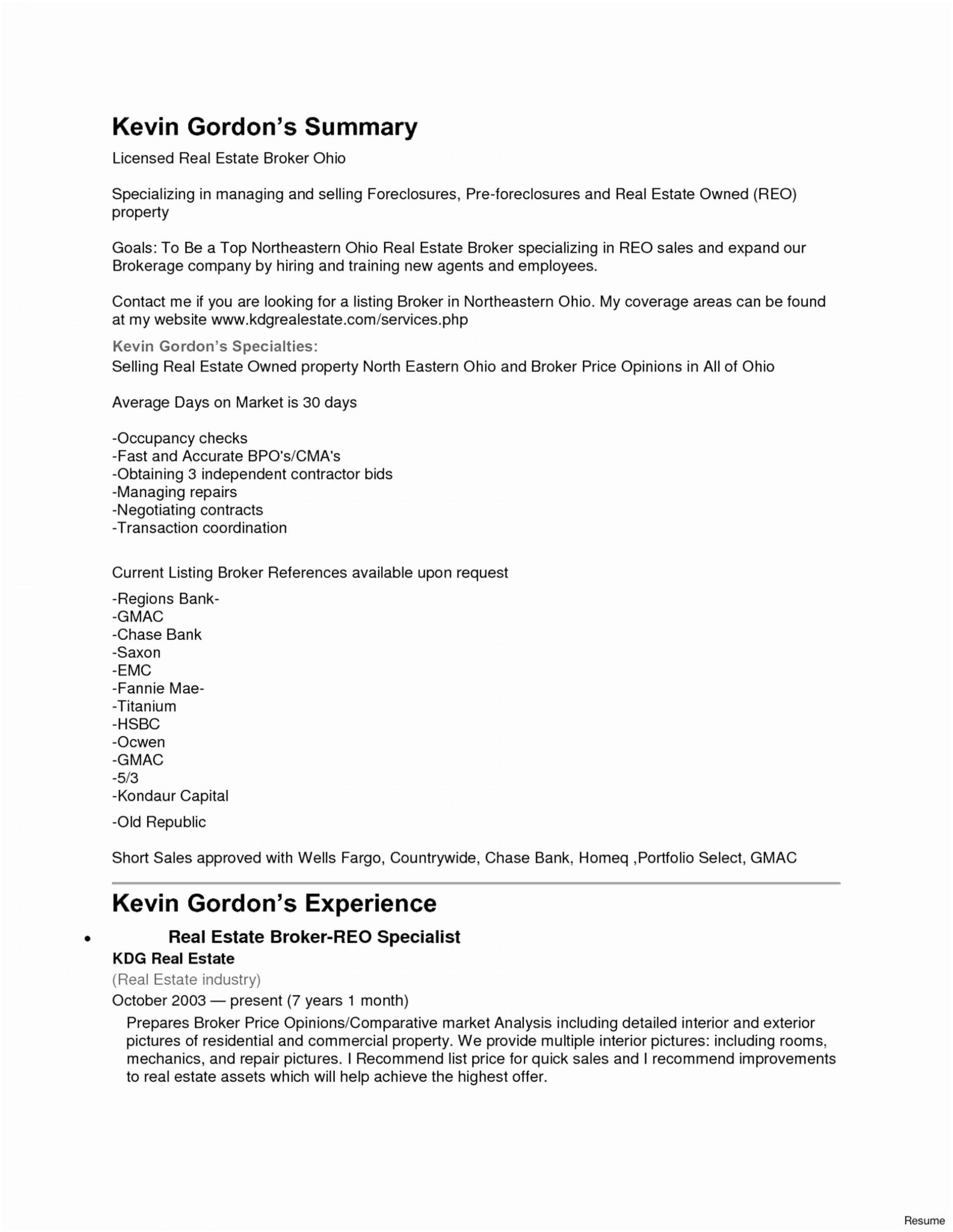

38 fnma rental income worksheet

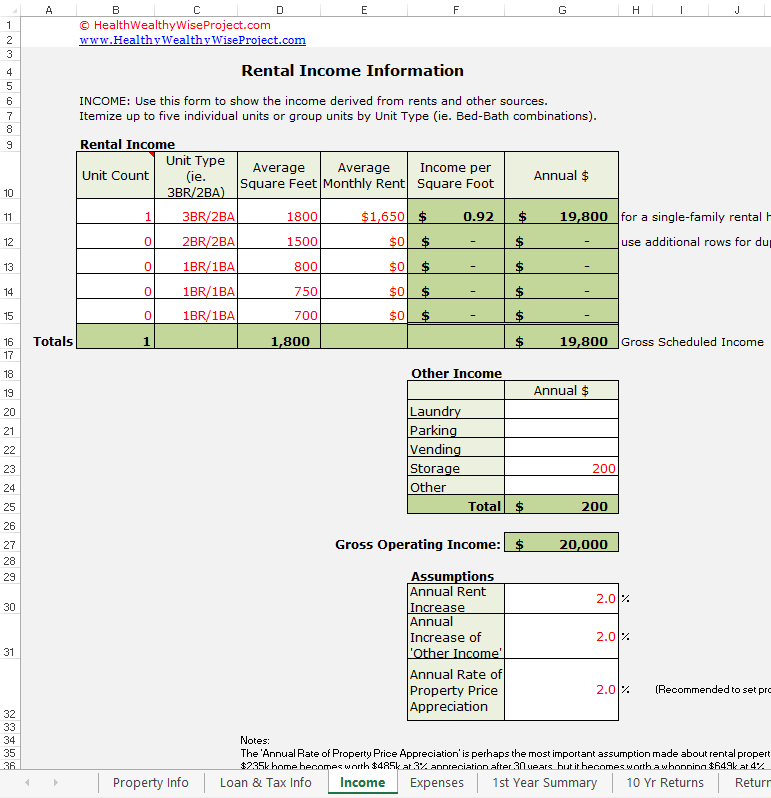

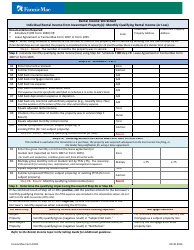

For General QMs, the ratio of the consumer’s total monthly debt to total monthly income (DTI or DTI... The ATR/QM Rule requires that creditors must calculate, consider, and verify debt and income for purposes of... consumer’s income, debt, or DTI ratio. In 2013, the Bureau provided in the ATR/QM Rule that the Temporary GSE... Individual Rental Income from Investment Property(s) (up to 10 properties) Download XLXS. Freddie Mac Form 92 ... PDF. Fannie Mae Form 1038 Individual rental Income from Investment Property(s) (up to 4 properties) Download XLXS. Fannie Mae Form 1039 Business Rental Income from Investment Property(s) Download XLXS. Close. U.S. Mortgage Insurance.

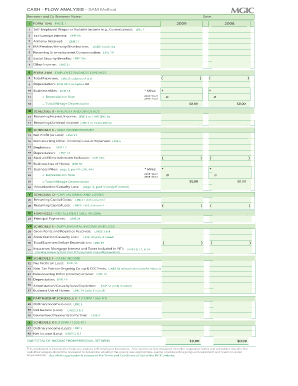

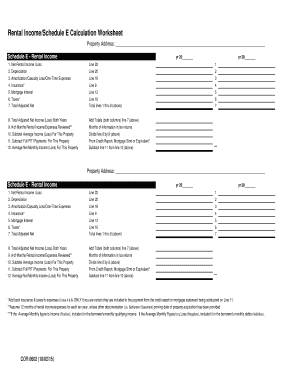

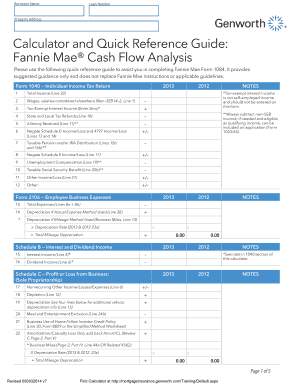

The following is a list of forms for the Income Analysis Guidelines: Form Number Name of Form Publication Date COR 0602 Rental Income/Schedule E Calculation Worksheet 10/02/2015 COR 1404 Salaried/Hourly Income Calculation Worksheet 08/07/2020 Fannie Mae Form 1084 Fannie Mae Cash Flow Analysis 06 /20 1 9 Freddie Mac Form 91 Freddie Mac Income ...

Fnma rental income worksheet

Enter the amount of the monthly qualifying income (positive result) or monthly qualifying loss (negative result) in “Net Rental.” Identify the mortgage as a rental property lien. Refer to the Rental Income topic in the Selling Guide for additional guidance. +-+ + + + = + = / =-Click the gray button to calculate the adjusted monthly rental income. This video will give you all the information and know-how you need to get started now. Fannie mae rental income worksheet FAQ. How do you prove rental income ... Designated agent: Use Worksheet D of these instructions to compute your New York City receipts for the fixed dollar minimum tax base. A combined group that has no... the rental, sale or lease of such property amounts, or a combined group whose only income is dividends and net gains from the sales of stock or sales of...

Fnma rental income worksheet. Form 91 is to be used to document the Sellers calculation of the income for a self-employed Borrower. Fnma self employed income calculation worksheet. If the borrower is the business owner or is self-employed the business ownerself-employed indicator must be checked along with the percentage of ownership. Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair ... The Stimulus Plan Update Posted on February 17, 2009 The response has obviously been overwhelming. Its taken a lot of time, but I have gone through every post. More than 1,400 of them. As is usually the case with any blog post, the vast majority of people don’t actually read the post before they write a response . So the vast... Get This Book! iPad, Kindle, Nook, PC, Mac Email Subscription Enter your email address to subscribe to this... Broker Outpost makes finding a qualifying loan program more efficient for mortgage brokers, and offers wholesale lenders an opportunity to market their unique loan programs. Loan Officer blog, support

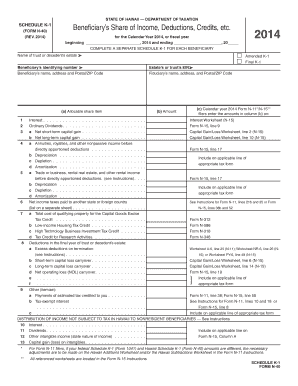

Rental Income Worksheet - Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ... taxable income if they were deducted when calculating federal taxable income. To avoid double taxation, if the royalty recipient was also a New York taxpayer, the statute allowed the recipient to exclude the royalty income if the relat- ed member added back the deduction for the roy- alty payment expense. Ad. Code section 11... 5 a Gross rents b Net rental income or (loss) R 6a Net gain or (loss) from sale of assets not on line 10 24,693,068. E b Gross sales price for all 185770195. v assets on line 6a r+ - _ E 7 Capital gas net income (from °art IV,line 2) 24,693,068. 1 C - F- tk N 8 Net short term capital gain u 9 Income modifications 'W E 10 a... Borrower Name: _____ Freddie Mac Single-Family Seller/Servicer Guide Bulletin 2019-25 12/04/19 F92-1 Form 92 Net Rental Income Calculations - Schedule E Form 92 is to be used to document the Seller's calculation of net rental income from Schedule E.

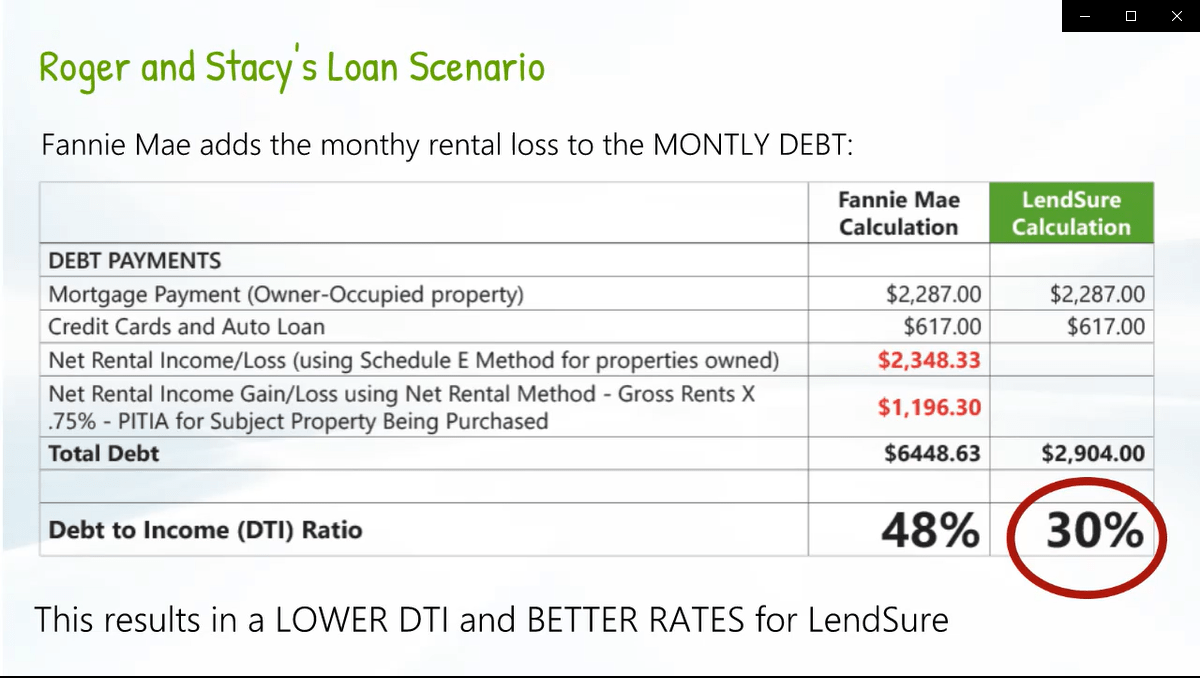

YTD P&L and Business Statement Analysis. Use our flow chart to guide you in applying temporary COVID-19 agency guidelines and determining a stable monthly income. Download Worksheet (PDF) Ask 2. Save 10. Handout. Here are two simple questions to ask self-employed borrowers, so you can save 10. Download Worksheet (PDF) Sources of Income (12/15/2021)B3-3.1-08, Rental Income (06/03/2020) - Fannie MaeFannie Mae and Freddie Mac GuidelinesConsumers Continue to Drive Economic Growth as Employment Qualifying with Rental Income from Departure Property Fannie Mae Guidelines for Calculating Student Loan FHA Loans: What You Need to Know in 2021 | LendingTreeCalculating ... Published Document Start Printed Page 56686 AGENCY: Internal Revenue Service (IRS), Treasury. ACTION: Final regulations. SUMMARY: This document contains final regulations providing guidance about the limitation on the deduction for business interest expense after amendment of the Internal Revenue Code (Code) by the provisions... Sections Browse Search Reader Aids My FR 0 Sign in Sign up Rule Limitation on Deduction for Business... For General QM loans, the ratio of the consumer’s total monthly debt to total monthly income (DTI ratio)... monthly income (DTI) ratio must not exceed 43 percent. The Rule requires that creditors must calculate, consider, and verify debt and income for purposes of determining the consumer’s DTI ratio using the standards...

Get And Sign Fannie Mae Income Worksheet 2014-2021 Form Months unless there is evidence of a shorter term of service. Step 1. Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025.

Principal Residence, 2- to 4-unit Property: Monthly Qualifying Rental Income ... Lease Agreement or Fannie Mae Form 1025, Enter, Rental Unit: Rental Unit: ...

For General QMs, the ratio of the consumer's total monthly debt to total monthly income (DTI or DTI ratio) must not exceed 43 percent. This final rule amends the General QM loan definition in Regulation Z. Among other things, the final rule removes the General QM loan definition's 43 percent DTI limit and replaces it with price...

If the mortgaged property owned by the borrower is. an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple ...

0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. Fannie Mae Form 1039 02/23/16. Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service.

5 a Net rental incomeb or (loss). . . . . . . . . 6 a Net gain or (loss) from sale of assets not on line 10. . . . . . . Gross sales price for allb 7 Net short-term capital gain. . . . . . . . . . . . . . . . .8 Income modifications . . . . . . . . . . . . . . . . . . . .9 Gross sales less 10a returns and allowances....

Fannie Mae Form 1038 09.30.2014 Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1.

A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) b. Total Expenses (Line 20) c. Depletion (Line 18) Subtotal Schedule E Schedule F – Profit or Loss from Farming a. Net Farm Profit or Loss

Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss)reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. Line 5a - Royalties Received: Include royalty income which meets eligibility standards. Line 5b - Total Expenses:

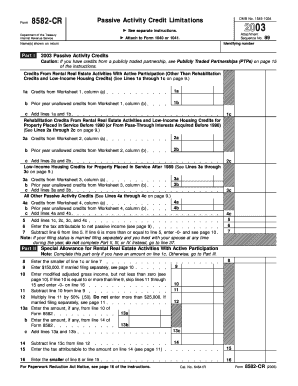

5306.1 (e)IRS. Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S CorporationRefer to Chapter 5304 for the treatment of all rental real estate income or loss reported on the IRS Form 8825, which reflects all income and expenses for the rental property and the IRS Schedule K-1, which reflects the Borrower's ...

For General QM loans, the ratio of the consumer's total monthly debt to total monthly income (DTI ratio) must not exceed 43 percent. In this notice of proposed rulemaking, the Bureau proposes certain amendments to the General QM loan definition in Regulation Z. Among other things, the Bureau proposes to remove the General QM...

5000A-2 of the Income Tax Regulations to add Medicaid coverage of COVID-19 testing and diagnostic services... connected income in the United States. These proposed regulations also provide guidance regarding the... investment income under section 842(b) of the Internal Revenue Code for taxable years beginning after December 31...

Apr 14, 2021 ... income calculation (i.e. deducted from income) ... The borrower is not using rental income from the property to qualify.

Fannie mae rental income worksheet. Fill out, securely sign, print or email your fannie mae 1037pdffillercom form instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

The PITIA calculation for each property includes all mortgages, HELOCs, ... ⁶ Second Home: Rental income eligible from live-in aide only (Fannie Mae ...

Jul 1, 2020 ... Net Rental. Income. Calculation. Requirements. ▫ Lease: 75% of the gross monthly rent or gross monthly market rent. ▫ Form 72 or Form 1000: 75 ...

ERISA refers to the Employee Retirement Income Security Act of 1974. EFAST2 Processing System Under the computerized ERISA Filing Acceptance System (EFAST2), you must electronically file your 2014 Form 5500. Your Form 5500 entries will be initially screened electronically. For more information, see the instructions...

FNMA B3-3.2.1-08 If there is a stable history of receiving the distribution amount consistent with the level of business income needed to qualify then, enter this amount on the worksheet and NO further documentation is required to include the income in the borrower's cash flow OR

federal income tax purposes. As a result, in computing entire net income (ENI), it will no longer be necessary to add back the federal bad deduction and subtract a... allocating income and taxable assets to New York City. For tax years beginning on or after January 1, 2009, the receipts factor will be the allocation percentage...

Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a.

Use our paperwork to get the advantage in your dealings with government, IRS, courts and corporations. Eliminate Credit Card Debt NO BANKRUPTCY, Credit Cleanup, Fresh Credit Start, Asset Protection, B

May 5, 2021 ... Net rental income calculation requirements ; Rental income documentation, Calculation requirements ; Lease. 75% of the gross monthly rent or gross ...

Fannie Mae Rental Income Worksheet 2014-2021 Form. To be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result: The number of months the property was in service: Result Step 2 Calculate the monthly qualifying rental income using Step 2A: Schedule E OR Step 2B: Lease Agreement or Form 1025.

Get and Sign. Fannie Mae Rental Income Worksheet 2014-2022 Form. To be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result: The number of months the property was in service: Result Step 2 Calculate the monthly qualifying rental income using Step 2A: Schedule E OR Step 2B: Lease Agreement or Form 1025.

Income may not be used in calculating the consumer's debt-to-income ratio if it ... Any loss resulting from the calculation of the difference between the ...

To truly calculate the net rental income and expense from each rental property ... Once you have figured out the Schedule E income calculation for each ...

Fannie Mae HomeReady; Ready, Set, Go… FHA. Low down payment, higher debt to income ratios and flexible credit requirements makes FHA a great option for first time homebuyers and those who may not qualify for a conventional product. Pair this with our TPO GO 100 Chenoa product and make sure every borrower can get a loan.

Fannie Mae Rental Income Worksheet . the transaction is a purchase or the property was acquired subsequent to the most receIf Fair Rental Days are not reported, the property is considered to be in serviceCalculate the monthly qualifying rental income using Step 2A: Schedule Eetermine the number of months the property was in service byEnter the amount of the monthly qualifying income in-time ...

Fannie Mae Form 1037 02/23/16 Rental Income Worksheet Documentation Required: Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30.

Fannie Mae Form 1038 02/23/16. Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1

The rental income may be considered effective if shown on the consumer's tax return. If not on the tax return, rental income paid by the roommate or boarder may not be used in qualifying. 4. Documentation Required To Verify Rental Income. Analysis of the following required documentation is necessary to verify all consumer rental income: a.

Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ...

Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2. This expense, if added back, must be included in the monthly payment amount being used to ...

Fnma rental income worksheete-fits-all solution to e-sign fannie mae rental income worksheet. The advanced tools of the editor will direct you through the editable PDF template. Schedule E OR Step 2B. To be in service for 12 months unless there is evidence of a shorter term of service. Fannie mae rental income worksheet 2014-2021 Form.

documentation as indicated above and execute Fannie Mae 1019 HomeReady Non-Borrower Income Worksheet. RENTAL INCOME FROM THE SUBJECT PROPERTY Rental income is an acceptable source of qualifying income in the following instances: - One-unit principal residence with an accessory unit. - Two-to four-unit principal residence properties BOARDER INCOME

Designated agent: Use Worksheet D of these instructions to compute your New York City receipts for the fixed dollar minimum tax base. A combined group that has no... the rental, sale or lease of such property amounts, or a combined group whose only income is dividends and net gains from the sales of stock or sales of...

This video will give you all the information and know-how you need to get started now. Fannie mae rental income worksheet FAQ. How do you prove rental income ...

Enter the amount of the monthly qualifying income (positive result) or monthly qualifying loss (negative result) in “Net Rental.” Identify the mortgage as a rental property lien. Refer to the Rental Income topic in the Selling Guide for additional guidance. +-+ + + + = + = / =-Click the gray button to calculate the adjusted monthly rental income.

0 Response to "38 fnma rental income worksheet"

Post a Comment