41 social security benefits worksheet lines 20a and 20b

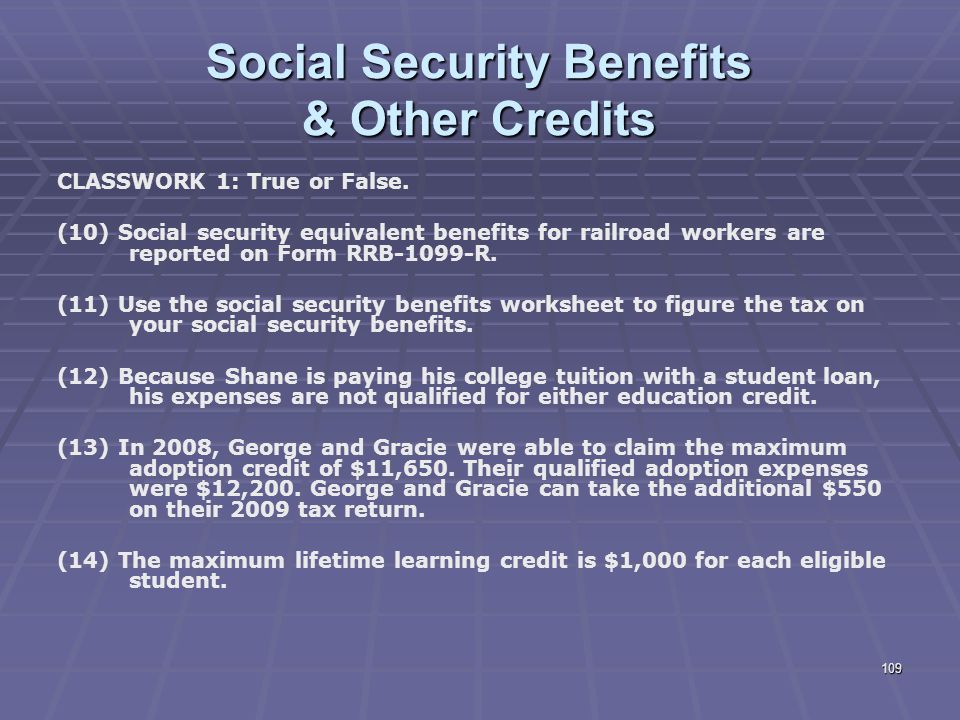

Social Security Benefits Lines 20a And 20b - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 30 of 107, 2013 social security benefits work lines 20a and 20b, Social security benefits work lines 20a and 20b, Social security benefits work forms 1040 1040a, Benefits retirement reminders railroad equivalent 1, Social security benefits work lines 14a ... Start on editing, signing and sharing your Irs social security worksheet 2014-2021 online with the help of these easy steps: Push the Get Form or Get Form Now button on the current page to jump to the PDF editor. Wait for a moment before the Irs social security worksheet 2014-2021 is loaded. Use the tools in the top toolbar to edit the file ...

Social Security Benefits Worksheet Lines 20a 20b Before you begin. Social security benefits and equivalent tier 1 railroad retire-ment benefits. Social Security Benefits Worksheet This document is locked as it has been sent for signing. Irs social security benefits worksheet. We developed this worksheet for you to see if your benefits may be taxable for […]

Social security benefits worksheet lines 20a and 20b

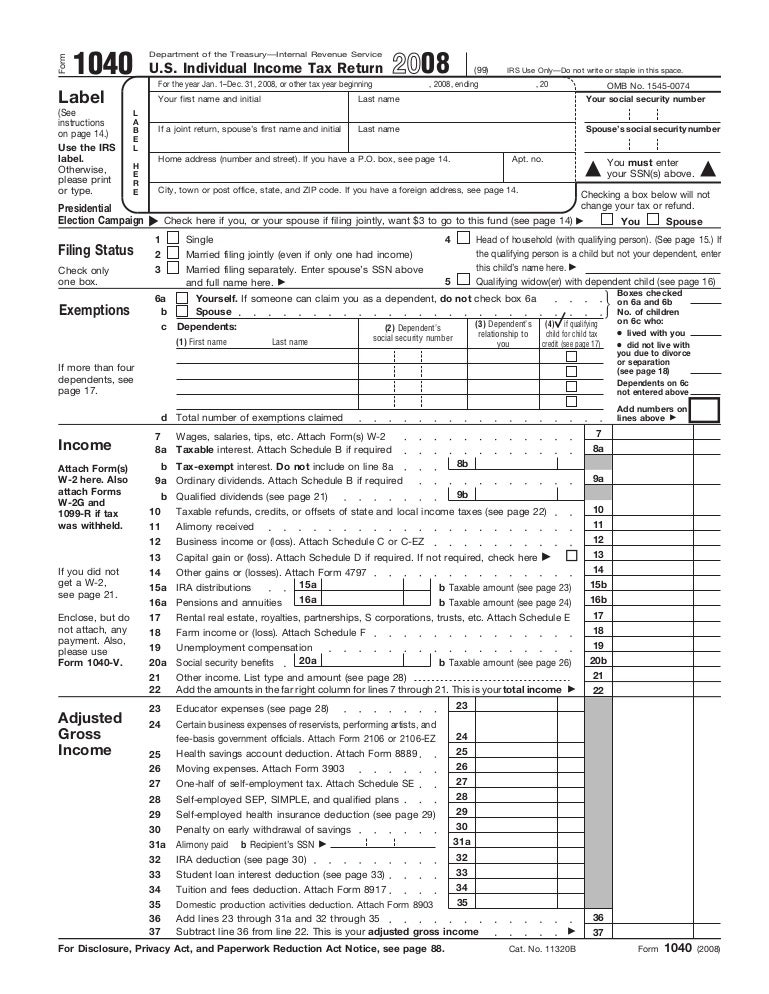

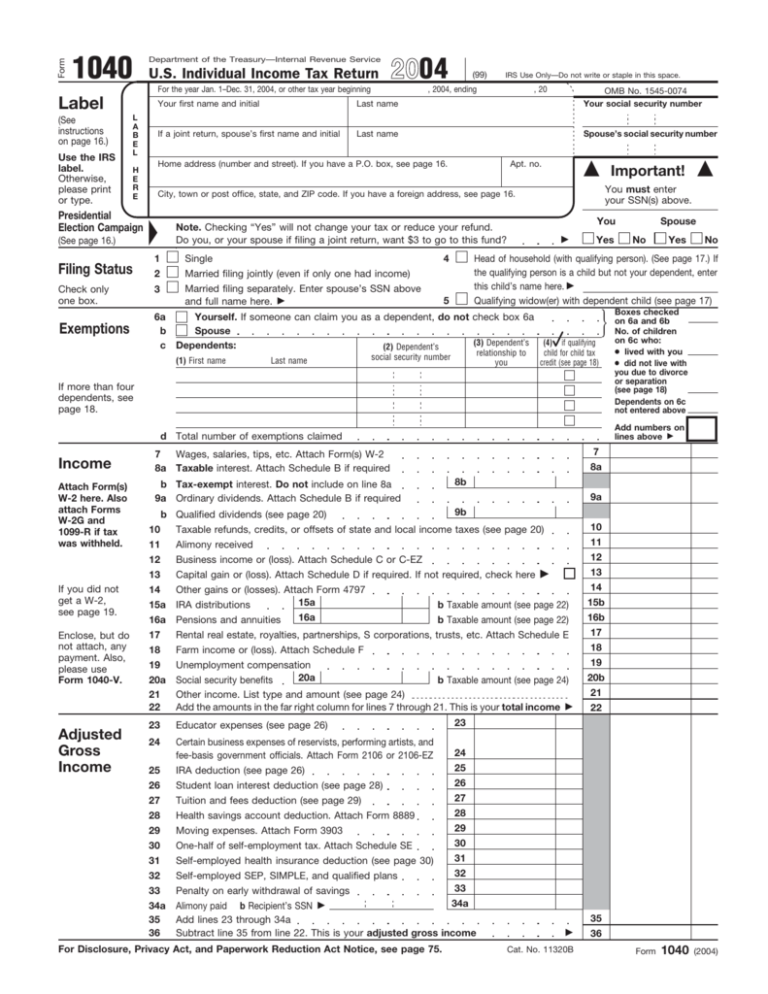

A disabled family member's income increases as a result of employment during or within six (6) months after receiving assistance, benefits, or services under TANF or a Welfare-to-Work program (including one time only cash asssitance of at least $500.) IF RESULT ON LINE 20a) IS A NEGATIVE NUMBER THE HOUSEHOLD IS NOT ELIGIBLE FOR THIS DEDUCTION. 20a Social security benefits 20a b Taxable amount (see page 25) 20b 21 21 22Add the amounts in the far right column for lines 7 through 21. This is your total income 23 IRA deduction (see page 27) 23 25 Medical savings account deduction. Attach Form 885325 One-half of self-employment tax. I need a 2015 Social Security Benefits Worksheet-Lines 20a and 20b. Where can I obtain one? I have searched - Answered by a verified Social Security Expert ... I need a 2015 Social Security Benefits Worksheet-Lines 20a and 20b. Where can I obtain one? I have searched online but can find only the 2014. Submitted: 5 years ago.

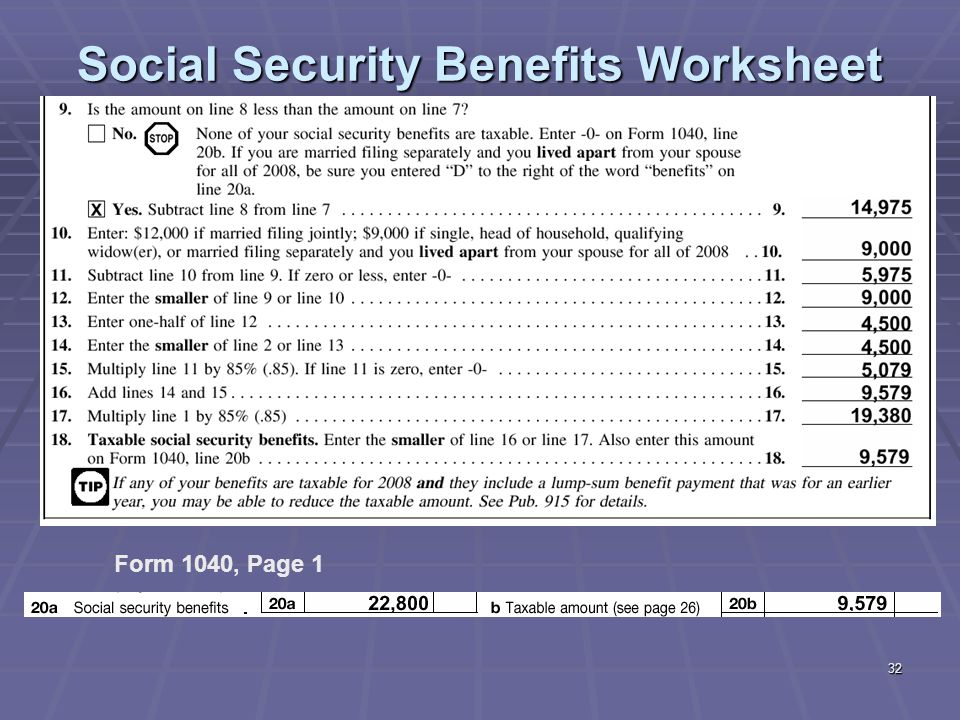

Social security benefits worksheet lines 20a and 20b. Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to Social Security Benefits Worksheet Lines 20a And 20b Gallery Probably the best picture of disability death taxable that we could find Beautiful image of death taxable retirement Great taxable retirement apply image here, very nice angles I had been looking at retirement apply tax for years Great apply tax survivor image here, check it out If you are married filing separately and you lived apart from your spouse for. Social Security Benefits Worksheet Lines 20a 20b. If youre over the 25000 or 32000 initial thresholds then some of your benefits might be taxable. We base Social Security benefits on your lifetime earnings. Security benefits for the year. Get IRS Instruction 1040 Line 20a & 20b 2014-2022. H 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36). If you are married filing separately and you lived apart from your spouse for all of 2014, enter D to the right of the word benefits on line 20a.

Social security benefits worksheet—lines 5a and 5b.Social security taxable benets worksheet (2020) on average this form takes 5 minutes to complete.Start a free trial now to save yourself time and money!Submit instantly to the receiver. Take full advantage of a digital solution to create, edit and sign documents in pdf or word format online. Displaying all worksheets related to - 915 Social Securty. Worksheets are Benefits retirement reminders railroad equivalent 1, 30 of 107, Social security benefits work 2018, 2011 publication 915, 450 columbus blvd ste 1 hartford ct 06103 1837, 2013 social security benefits work lines 20a and 20b, Social security benefits work lines 14a and 14b keep, Social security benefits work forms 1040 1040a. Report the total amount of Social Security income received on line 20a of the IRS' Form 1040, and on line 20b, report the taxable portion of Social Security income, as U.S. Tax Center explains. The total amount of Social Security benefits and income a taxpayer receives determines how taxpayers report Social Security benefits. Social Security Benefits WorksheetLines 20a and 20b 2013 Form 1040Lines 20a and 20bKeep for Your Records Complete Form 1040 lines 21 and 23 through 32 if they apply to you. Social security taxable benets worksheet 2020 this document is locked as it has been sent for signing.

The worksheet in the 2008 Form 1040 instructions is the best way to determine what part of your SS is taxable. It is on page 27 and copied below: Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records Form 1040—Lines 20a and 20b Before you begin: Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Line 10 - State and Local Tax Refund Worksheet Lines 16a and 16b - Simplified Method Worksheet taxable annuities and pension benefits Lines 20a and 20b - Social Security Benefits Worksheet Displaying top 8 worksheets found for - Social Security Benefits Lines 20a And 20b. Some of the worksheets for this concept are 30 of 107, 2013 social security benefits work lines 20a and 20b, Social security benefits work lines 20a and 20b, Social security benefits work forms 1040 1040a, Benefits retirement reminders railroad equivalent 1, Social security benefits work lines 14a and 14b keep ... benefits and other income, the Social Security Benefits Worksheet found in the Form 1040 Instructions is completed by the software to calculate the taxable portion. When figuring the taxable portion of Social Security benefits, two options are available for lump-sum benefit

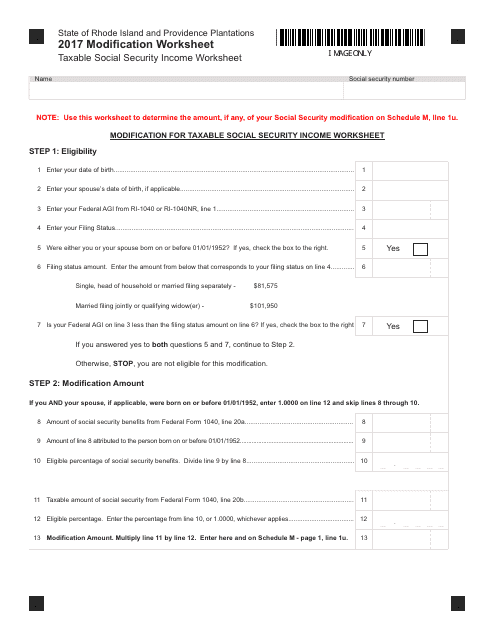

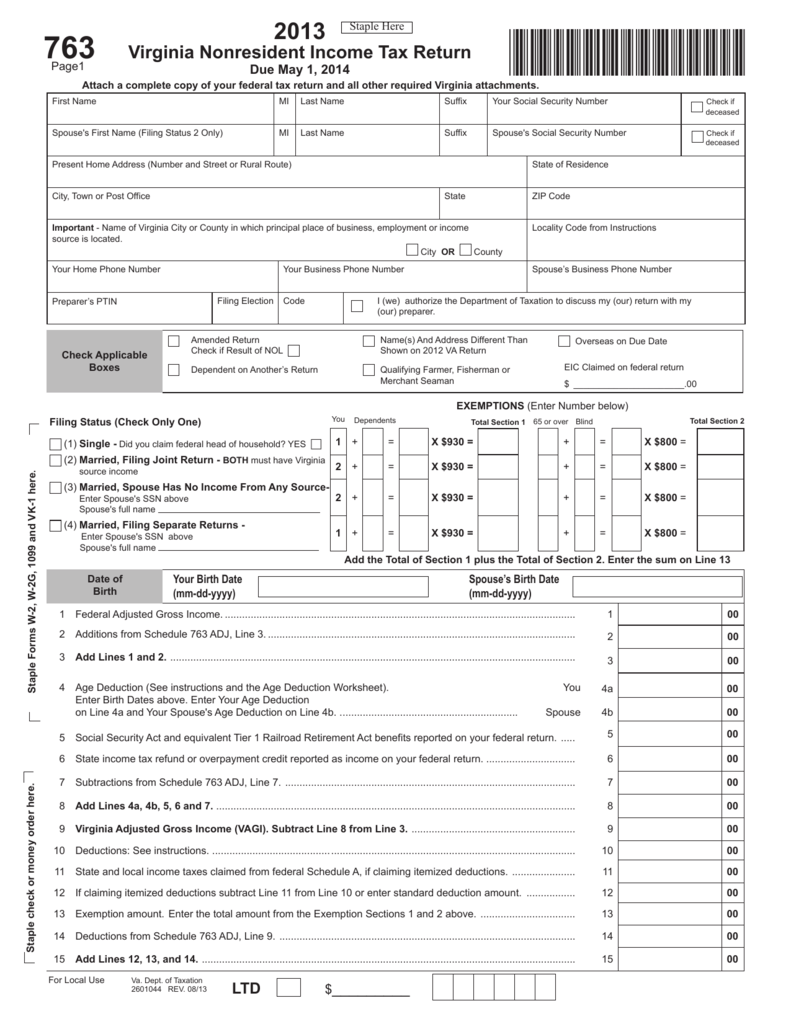

41. Social Security benefit adjustment: See Social Security Benefit Adjustment Worksheet instructions. 41. .00 42. Refunds of state and local income taxes 42. .00 43. Tier 1 and Tier 2 railroad retirement benefits and supplemental annuities 43. .00 44. Military retirement pay 44. .00 45.

Enter 12 000 if married filing jointly 9 000 if single head of household qualifying widow er or married filing separately and you lived apart from your spouse for all of 2014. 2014 Form 1040 Lines 20a and 20b Social Security Benefits Worksheet Lines 20a and 20b Before you begin Keep for Your Records Complete Form...

Line 6a is a manual entry in the middle column area to enter your total Social Security benefit amount. Line 6b is a manual entry in the column to the far right for your taxable Social Security benefits. ... Line 20a is manual entry. Line 20b has 7 manual entry areas. ... 3b and 3c are calculated from Worksheet 3. Line 3d calculates the sum of ...

Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records TIP 2011 Form 1040—Lines 20a and 20b Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36).

Irs social security worksheet 2021. We developed this worksheet for you to see if your benefits may be taxable for 2020. Are Your Social Security Benefits Taxable Alloy Wealth Management Social Security Benefits Worksheet Lines 20a 20b Before you begin. Irs social security benefits worksheet. Other parties need to complete fields in the document.

Jan 08, 2015 · Social Security Income includes disability payments (SSD and SSDI), pension, retirement benefits, and survivor benefits, but does not include supplemental security income . (Line 20a minus 20b on a Form 1040). In general, everything except for SSI counts toward MAGI for ObamaCare and Medicaid.

If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross income. Gross income includes gains, but not losses, reported on Form 8949 or Schedule D. Gross income from a business means, for example, the amount on Schedule C, line 7, or Schedule F, line 9.

Social Security Benefits Worksheet—Lines 20a and 20b 2013 Form 1040—Lines 20a and 20bKeep for Your Records Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36).

Add lines 15 and 16 Multiply line 1 by 85% (.85) Taxable benefits. Enter the smaller of line 17 or line 18. Also enter this amount on Form 1040, line 20b, or Form 1040A, line 14b If you received a lump-sum payment in 2016 that was for an earlier year, also complete Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

an extension to le or excess social security tax withheld. Owe alternative minimum tax (AMT) or need to make an excess advance premium tax credit epayment.r Can claim a nonrefundable credit (other than the nonrefundable child tax cedit or the cr edit for other dependents), such as the r

Worksheet 1 - Taxable Social Security Benefits Calculation for Form 1040, Lines 20a and 20b If you are married filing separately and you lived apart from your spouse for all of 2010, enter 'D' to the right of the word 'benefits' on Form 1040, line 20a. Do not use this worksheet if you repaid benefits in 2010 and your total repayments (box 4 of ...

I need a 2015 Social Security Benefits Worksheet-Lines 20a and 20b. Where can I obtain one? I have searched - Answered by a verified Social Security Expert ... I need a 2015 Social Security Benefits Worksheet-Lines 20a and 20b. Where can I obtain one? I have searched online but can find only the 2014. Submitted: 5 years ago.

20a Social security benefits 20a b Taxable amount (see page 25) 20b 21 21 22Add the amounts in the far right column for lines 7 through 21. This is your total income 23 IRA deduction (see page 27) 23 25 Medical savings account deduction. Attach Form 885325 One-half of self-employment tax.

A disabled family member's income increases as a result of employment during or within six (6) months after receiving assistance, benefits, or services under TANF or a Welfare-to-Work program (including one time only cash asssitance of at least $500.) IF RESULT ON LINE 20a) IS A NEGATIVE NUMBER THE HOUSEHOLD IS NOT ELIGIBLE FOR THIS DEDUCTION.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

0 Response to "41 social security benefits worksheet lines 20a and 20b"

Post a Comment