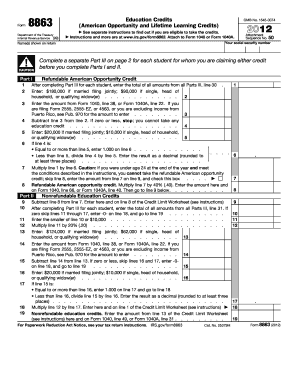

39 2012 child tax credit worksheet

Tax Return Forms | Maine Revenue Services Tax Return Forms NOTE: Tax return forms and supporting documents must be filed electronically (see Electronic Services) or submitted on paper. Do NOT submit disks, USB flash drives, or any other form of electronic media. PDF IT-540B-WEB 2012 LOUISIANA NONRESIdENT IMPORTANT! ANd PART ... 2012 LOuISIANA NONREFuNDABLE CHILD CARE CREDIT - your Federal Adjusted Gross Income must be GREATER THAN $25,000 to claim a credit on this line.See Nonrefundable Child Care Credit Worksheet. 13C A mO uNT OF LO ISIANA NONREF NDABLE CHILD CARE CREDIT CARRIED FORwARD FRO 2008 THROuGH 2011 - See Nonrefundable Child Care Credit Worksheet. 13D

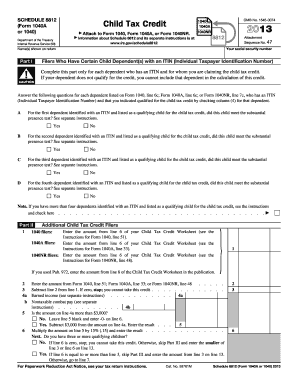

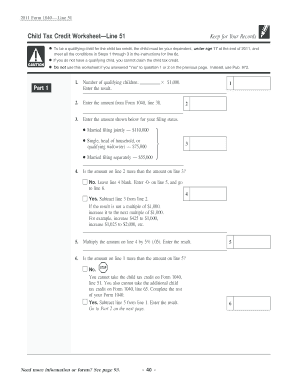

PDF Credit Page 1 of 12 14:31 - 22-Dec-2014 Child Tax the additional child tax credit, follow the steps below. 1. Make sure you figured the amount, if any, of your child tax credit. 2. If you answered "Yes" on line 9 or line 10 of the Child Tax Credit Worksheet in the Form 1040, Form 1040A, or Form 1040NR instructions (or on line 13 of the Child Tax Credit Worksheet in this publication), use

2012 child tax credit worksheet

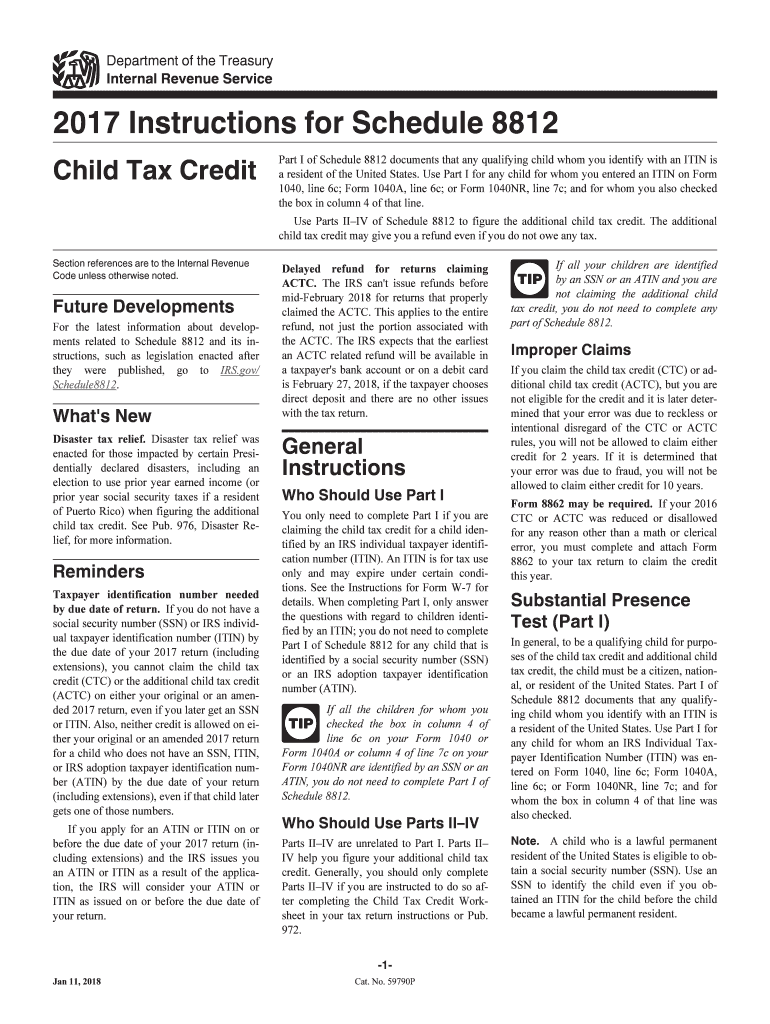

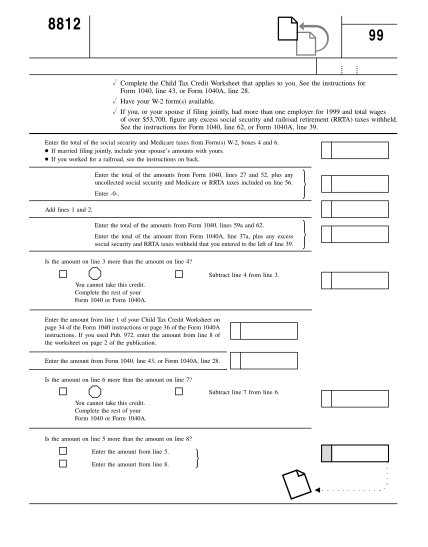

Child Tax Credit Amount 2012: Child Tax Credit Worksheet Child Tax Credit Worksheet We are going to work our way through the child tax credit worksheet. So many questions come in pertaining to the child tax credit. The first thing I will stress is the child must be under the age of 17 by the end of the year. PDF Credit Page 1 of 11 8:27 - 14-Jan-2013 Child Tax household in 2012, that child meets condition (7) above to be a qualifying child for the child tax credit. Exceptions to time lived with you. A child is consid- ered to have lived with you for more than half of 2012 if the child was born or died in 2012 and your home was this child's home for more than half the time he or she was alive. Schedule 8812 and the Additional Child Tax Credit | Credit ... Schedule 8812 is the form used to claim the additional child tax credit. Understanding the additional child tax credit begins with the child tax credit. Starting with the 2018 tax year, the child tax credit is worth up to $2,000 per qualifying child. Like all tax credits, the child tax credit reduces your tax bill on a dollar-for-dollar basis.

2012 child tax credit worksheet. Insolvency Determination Worksheet ... - IRS tax forms Insolvency Determination Worksheet Assets (FMV) Liabilities Homes $ Mortgages $ Cars Home equity loans Recreational vehicles, etc. Vehicle loans Bank accounts Personal signature loans IRAs, 401Ks, etc. Credit card debts Jewelry Past-due mortgage interest, real estate taxes, utilities, and child care costs Furniture Other liabilities Clothes ... 2012 Federal Income Tax Forms : Free Printable Form 1040EZ ... Form 1040, Form 1040A, and Form 1040EZ instructions booklet include the most common worksheets and tables necessary to complete your 2012 IRS income tax return: 2012 Earned Income Credit (EIC) Table 2012 Tax Table Alternative Minimum Tax Worksheet Child Tax Credit Worksheet Publication 972 (2020), Child Tax Credit and Credit for ... Child Tax Credit (CTC) This credit is for individuals who claim a child as a dependent if the child meets additional conditions (described later). It is in addition to the credit for child and dependent care expenses (on Schedule 3 (Form 1040), line 2, and the earned income credit (on Form 1040 or 1040-SR, line 27)). Internal Revenue Bulletin: 2012-26 - IRS tax forms Jun 25, 2012 · The federal short-term rate determined in accordance with section 1274(d) during April 2012 is the rate published in Revenue Ruling 2012-13, 2012-19 I.R.B. 878, to take effect beginning May 1, 2012. The federal short-term rate, rounded to the nearest full percent, based on daily compounding determined during the month of April 2012 is 0 percent.

Individual Income Tax Forms - 2020 | Maine Revenue Services Note that this form is not necessary unless you have tax due; Form 2210ME underpayment of estimated tax (PDF) - Revised April 2021. Annualized Income Installment Worksheet for Form 2210ME (PDF) Schedules & Worksheets. Schedule PTFC/STFC for property tax fairness credit and sales tax fairness credit (PDF)-Revised March 2021 How the 2021 Child Tax Credit works More than 35 million families have received a direct deposit payment from the IRS this week worth up to $300 per child. The July 15 payment is part of the enhanced Child Tax Credit, one piece of the $1.9 trillion Covid-19 stimulus bill President Joe Biden signed into law in March to support people with kids. PDF Child Tax Credit & Credit for Other Dependents Child Tax Credit & Credit for Other Dependents 24-3 Tax Software Hint: The entries for each qualifying child in the Basic Information section will help the software determine if the child is eligible for the child tax credit. Taxpayers claiming the child tax credit must have a valid identification number (SSN or ITIN) by the due date of Child Tax Credit Deduction Calculator 2012, 2013 - YouTube 2012, 2013 Child Tax Credit Deductionhttp://

2012 Income Tax Forms - Nebraska Department of Revenue Form 1041N, Electing Small Business Trust Tax Calculation Worksheet. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return. Form. Form 4797N, 2012 Special Capital Gains Election ... PDF 2012 Louisiana Nonrefundable Child Care Credit Worksheet ... 32 2012 Louisiana Nonrefundable Child Care Credit Worksheet (For use with Form IT-540) 1 Enter Federal Child Care Credit from Federal Form 1040, Line 48 or Federal Form 1040A, Line 29. 1.00 1A Enter the applicable percentage from the chart shown below. Federal Adjusted Gross Income Percentage The Qualifications for the Adoption Tax Credit Feb 07, 2022 · Adoptive parents may qualify for Adoption Tax Credit for their adoption-related out-of-pocket expenses. Adoption tax credit is capped at $14,440 per child for 2021 and $14,890 per child for 2022. Adoption tax credit is phased out based on your modified adjusted gross income (MAGI). The phase out MAGI range is $216,600 to $256,660 for 2021. PDF Credit Page 1 of 12 8:57 - 17-Dec-2013 Child Tax the additional child tax credit, follow the steps below. 1. Make sure you figured the amount, if any, of your child tax credit. 2. If you answered "Yes" on line 9 or line 10 of the Child Tax Credit Worksheet in the Form 1040, Form 1040A, or Form 1040NR instructions (or on line 13 of the Child Tax Credit Worksheet in this publication), use

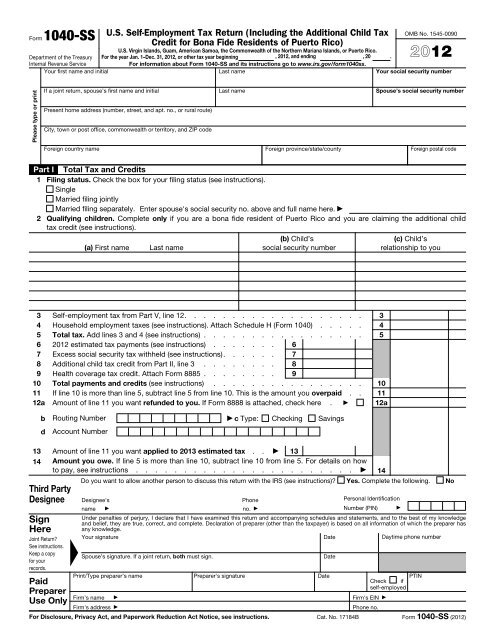

Forms and Publications (PDF) - IRS tax forms Child Tax Credit 2021 02/15/2022 Publ 972 (SP) Child Tax Credit (Spanish Version) 2021 02/15/2022 Form 1040-SS: U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) 2021 01/21/2022 Inst 1040-SS

PDF Quality Child-care Investment Tax Credit Worksheet for Tax ... 2012 QUALITY CHILD-CARE INVESTMENT TAX CREDIT WORKSHEET INSTRUCTIONS Rev. 11/12 A taxpayer that has made an investment during the tax year toward the goal of providing quality child-care services is allowed a credit in an amount equal to the qualifying portion of expenditures paid or expenses incurred by the taxpayer for

PDF Introduction Objectives Topics - IRS tax forms Form 1040 Instructions, Child Tax Credit Worksheet Schedule 8812, Credits for Qualifying Children and Other Dependents Pub 17, Chapter 14, Child Tax Credit . TaxSlayer Demo: Entering Basic Credits, Verify the amount of the credit in TaxSlayer by viewing the return summary Determining Eligibility and

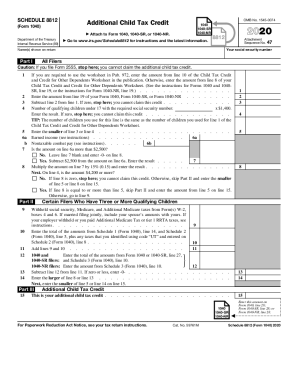

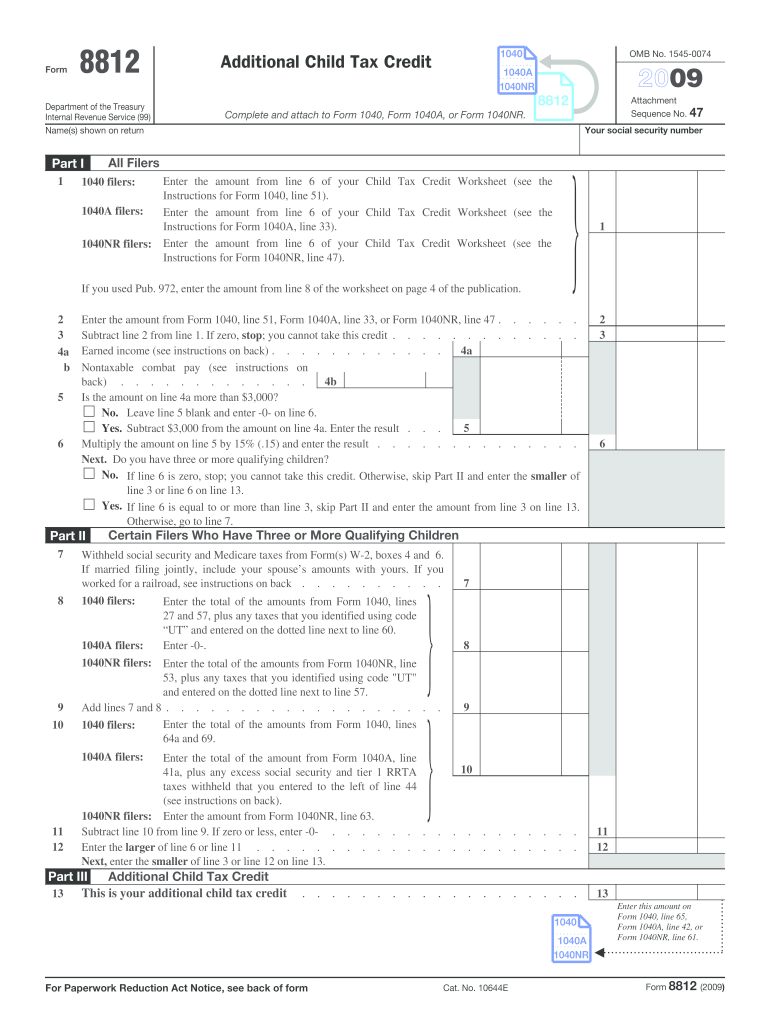

Federal Form 8812 Instructions - eSmart Tax Additional Child Tax Credit (Parts II-IV) If any of your dependents is a qualifying child for purposes of the child tax credit (whether identified by an ITIN or not), you may qualify for the additional child tax credit. Before completing Parts II-IV of Schedule 8812, complete the Child Tax Credit Worksheet that applies to you.

Prior Year Products - IRS tax forms Child Tax Credit 2012 Inst 1040 (Schedule 8812) Instructions for Child Tax Credit 2012 Form 1040 (Schedule 8812) (sp) Credits for Qualifying Children and Other Dependents (Spanish Version) 2021 Inst 1040 (Schedule 8812) (sp) Instructions for Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents (Spanish Version) ...

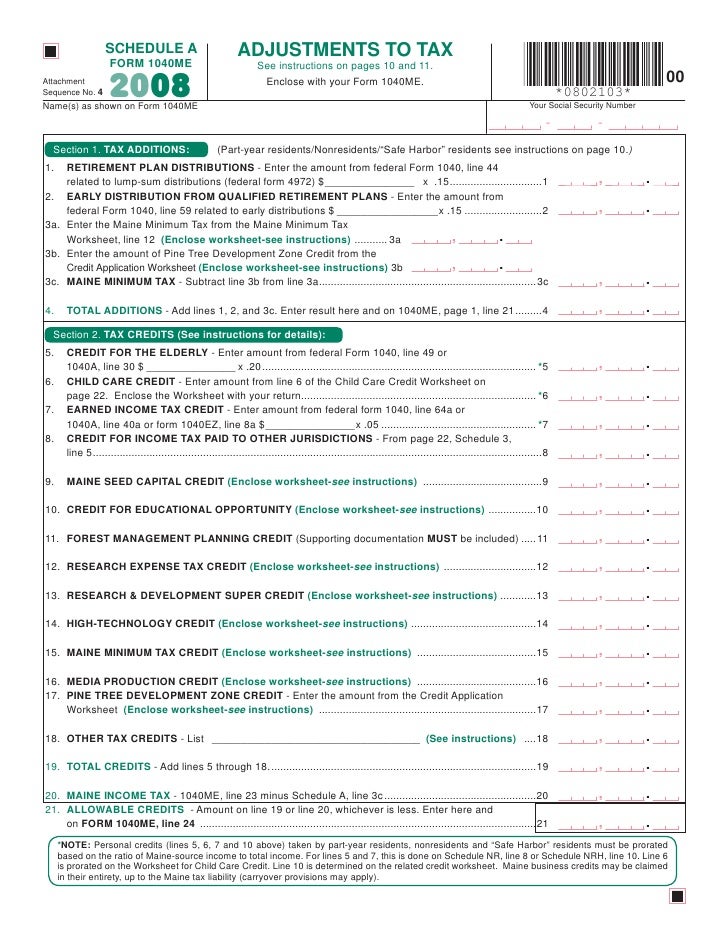

Individual Income Tax Forms - 2019 | Maine Revenue Services Worksheet for "other" income modifications - Additions (PDF) Worksheet for "other" income modifications - Subtractions (PDF) - Revised June 2020; Schedule 2 itemized deductions (PDF) Schedule A adjustments to tax/child care credit worksheet (PDF) Worksheet for "other" tax credits (PDF) Worksheet for credit for taxes paid to other jurisdictions ...

Personal Allowances Worksheet - United States Department ... Tax credits. You can take projected tax credits into account in figuring your allowable number of withholding allowances. Credits for child or dependent care expenses and the child tax credit may be claimed using the Personal Allowances Worksheet below. See Pub. 505 for information on converting your other credits into withholding allowances.

2021 Schedule 8812 Form and Instructions - Income Tax Pro Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents, asks that you first complete the Child Tax Credit and Credit for Other Dependents Worksheet. See the instructions for Form 1040, line 19, or Form 1040NR, line 19. The 2021 Schedule 8812 Instructions are published as a separate booklet which you can find below.

Publication 501 (2021), Dependents ... - IRS tax forms The nonrefundable child tax credit, credit for other dependents, refundable child tax credit, or additional child tax credit . Head of household filing status. The credit for child and dependent care expenses. The exclusion from income for dependent care benefits. The earned income credit.

PDF Child Support Worksheet - circuitclerk.nashville.gov 1a Federal benefit for child + + 1b Self-employment tax paid - - 1c Subtotal $ $ Use Credit Worksheet 1d Credit for In-Home Children - - to calculate line items 1e Credit for Not In Home Children - - 1d and 1e. 2 Adjusted Gross Income (AGI) $ $ 2a Combined Adjusted Gross Income $ 3 Percentage Share of Income (PI) % % Part III.

Adoption Tax Credit FAQs - The North American Council on ... In one year, taxpayers can use as much of the adoption tax credit as the full amount of their federal income tax liability, which is the amount on line 18 of the 2020 Form 1040 less certain other credits (such as the up to $600 of the Child Tax Credit per child and the Child and Dependent Care Expenses).

New York Form IT-213 (Claim for Empire State Child Credit ... The credit amount allowed is 33% of the portion of the federal child tax credit and additional child tax credit (calculated using the NY recomputed FAGI as well as the federal credit amounts and income thresholds that were in effect for tax year 2017, prior to the enactment of Public Law 115-97) attributable to qualifying children, or $100 ...

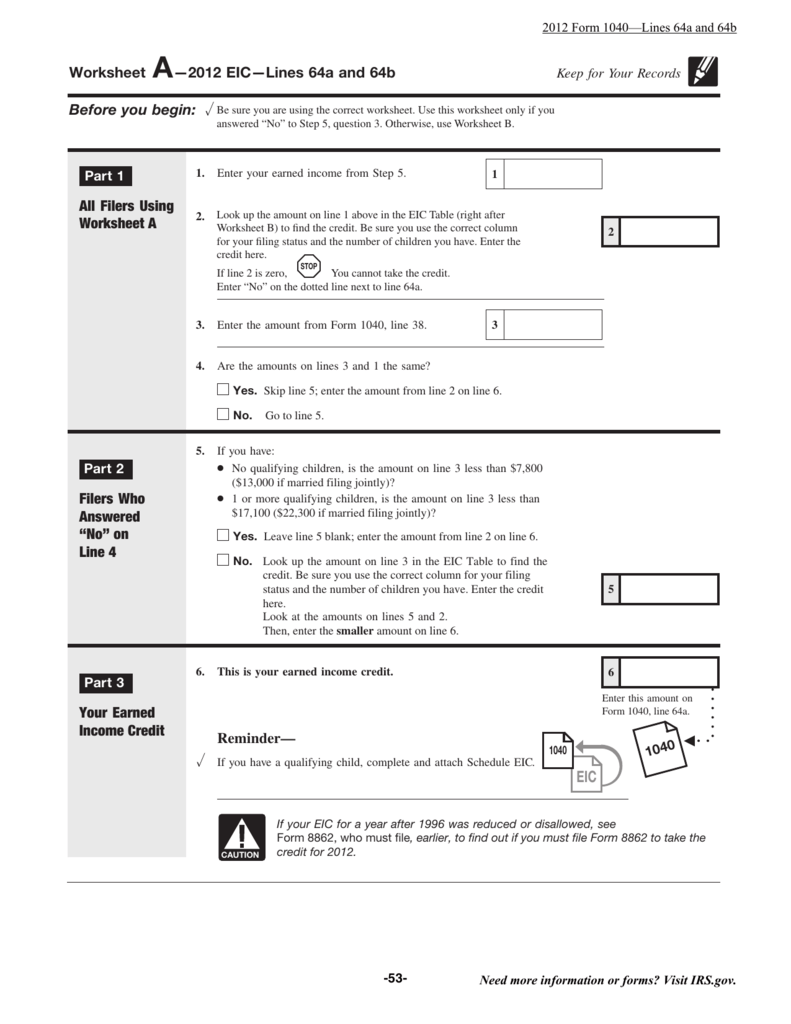

40 2012 child tax credit worksheet - Worksheet Information 2012 child tax credit worksheet tional Child Tax Credit, later. Line 11 Worksheet (page 6) or Form 8812. Form 1040 or 2. Your modified adjusted gross income (AGI) is above Form 1040NR filers, use the worksheet on page 8 to figure the amount shown below for your filing status. your earned income.

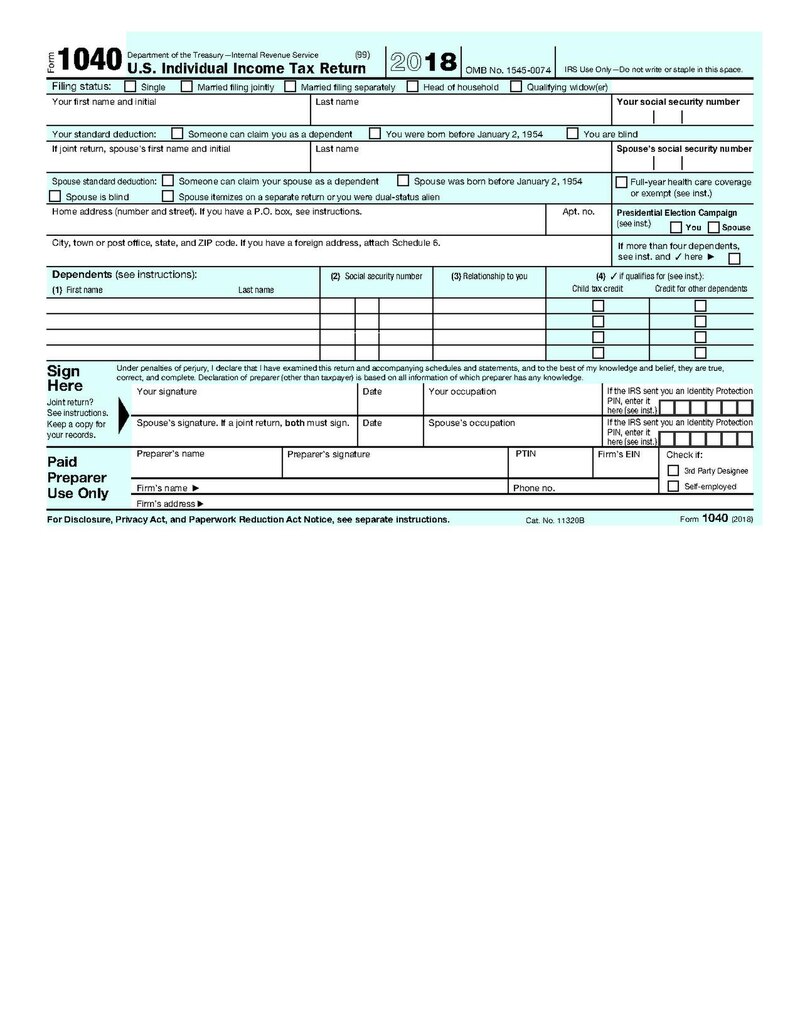

PDF Worksheet—Line 12a Keep for Your Records ... - IRS tax forms 2018 Child Tax Credit and Credit for Other Dependents Worksheet—Line 12a Keep for Your Records 1. To be a qualifying child for the child tax credit, the child must be your dependent, under age 17 at the end of 2018, and meet all the conditions in Steps 1 through 3 under Who Quali es as Your Dependent. Make sure you checked the box in

PDF LOUISIANA FILE ONLINE Fast. Easy. Absolutely Free. 2013 LOUISIANA NONREFUNDABLE ChILD CARE CREDIT - Your Federal Adjusted Gross Income must be GReATeR ThAN $25,000 in order to claim a credit on this lineSee Nonrefundable Child Care . Credit Worksheet. 12C AMOUNT OF LOUISIANA NONREFUNDABLE ChILD CARE CREDIT CARRIED FORWARD FROM 2009 T hROUG 2012 - See Nonrefundable Child Care Credit ...

Child Tax Credit Amount 2012 In 2012, the Child Tax Credit can be worth a maximum of $1,000 for each qualifying child below 17 years old. Depending on your income level, the Child Tax Credit may be used to lower your federal income tax by a specific amount. To qualify for Child Tax Credit, the child must meet the qualifying requirements as outlined by six tests: Age Test

Federal 1040 (Schedule 8812) (Child Tax Credit) - 2021 ... 1040 (Schedule 8812) is a Federal Individual Income Tax form. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar-for-dollar reduction of tax liability. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations.

Individual Income Tax Forms - 2012 | Maine Revenue Services Schedules & Worksheets. Schedule CP voluntary contributions and park pass purchases (PDF) Schedule 1 income modifications / pension income deduction worksheet (PDF) Schedule 2 itemized deduction (PDF) Schedule A adjustments to tax/child care credit worksheet (PDF) Worksheet for credit for taxes paid other jurisdiction (PDF)

PDF Child Tax Credit 2012 or 1040) Attach to Form 1040, Form ... Enter the amount from line 6 of your Child Tax Credit Worksheet (see Instructions for Form 1040NR, line 48). If you used Pub. 972, enter the amount from line 8 of the Child Tax Credit Worksheet in the publication.

Schedule 8812 and the Additional Child Tax Credit | Credit ... Schedule 8812 is the form used to claim the additional child tax credit. Understanding the additional child tax credit begins with the child tax credit. Starting with the 2018 tax year, the child tax credit is worth up to $2,000 per qualifying child. Like all tax credits, the child tax credit reduces your tax bill on a dollar-for-dollar basis.

PDF Credit Page 1 of 11 8:27 - 14-Jan-2013 Child Tax household in 2012, that child meets condition (7) above to be a qualifying child for the child tax credit. Exceptions to time lived with you. A child is consid- ered to have lived with you for more than half of 2012 if the child was born or died in 2012 and your home was this child's home for more than half the time he or she was alive.

Child Tax Credit Amount 2012: Child Tax Credit Worksheet Child Tax Credit Worksheet We are going to work our way through the child tax credit worksheet. So many questions come in pertaining to the child tax credit. The first thing I will stress is the child must be under the age of 17 by the end of the year.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-06.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-05.jpg)

0 Response to "39 2012 child tax credit worksheet"

Post a Comment