40 funding 401ks and roth iras worksheet answers

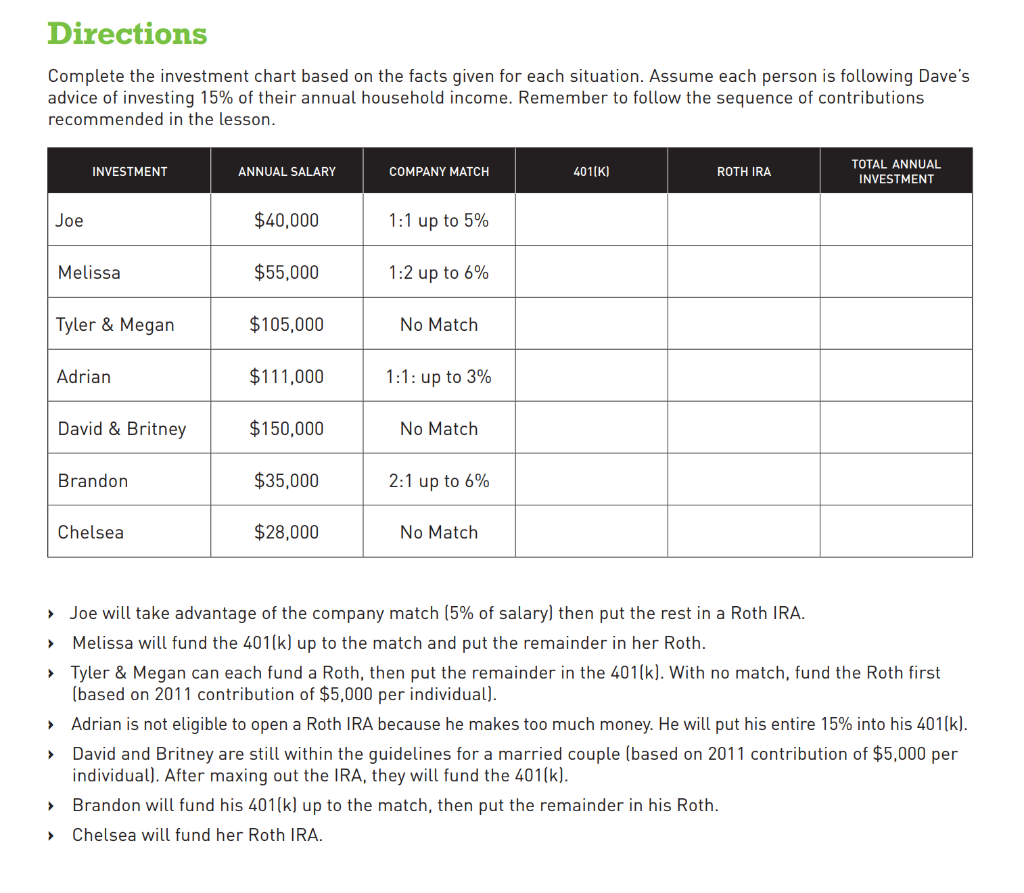

PDF Foundations in Personal Finance - Welcome to Mr ... 4 Foundations in Personal Finance dave ramsey, a personal money management expert, is an extremely popular national radio personality, and author of the New York Times best-sellers The Total Money Makeover, Financial Peace and More Than Enough.Ramsey added television host to his title in 2007 when "The Solved Activity: Funding 401(k)s and Roth IRAs Objective ... Accounting questions and answers; Activity: Funding 401(k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

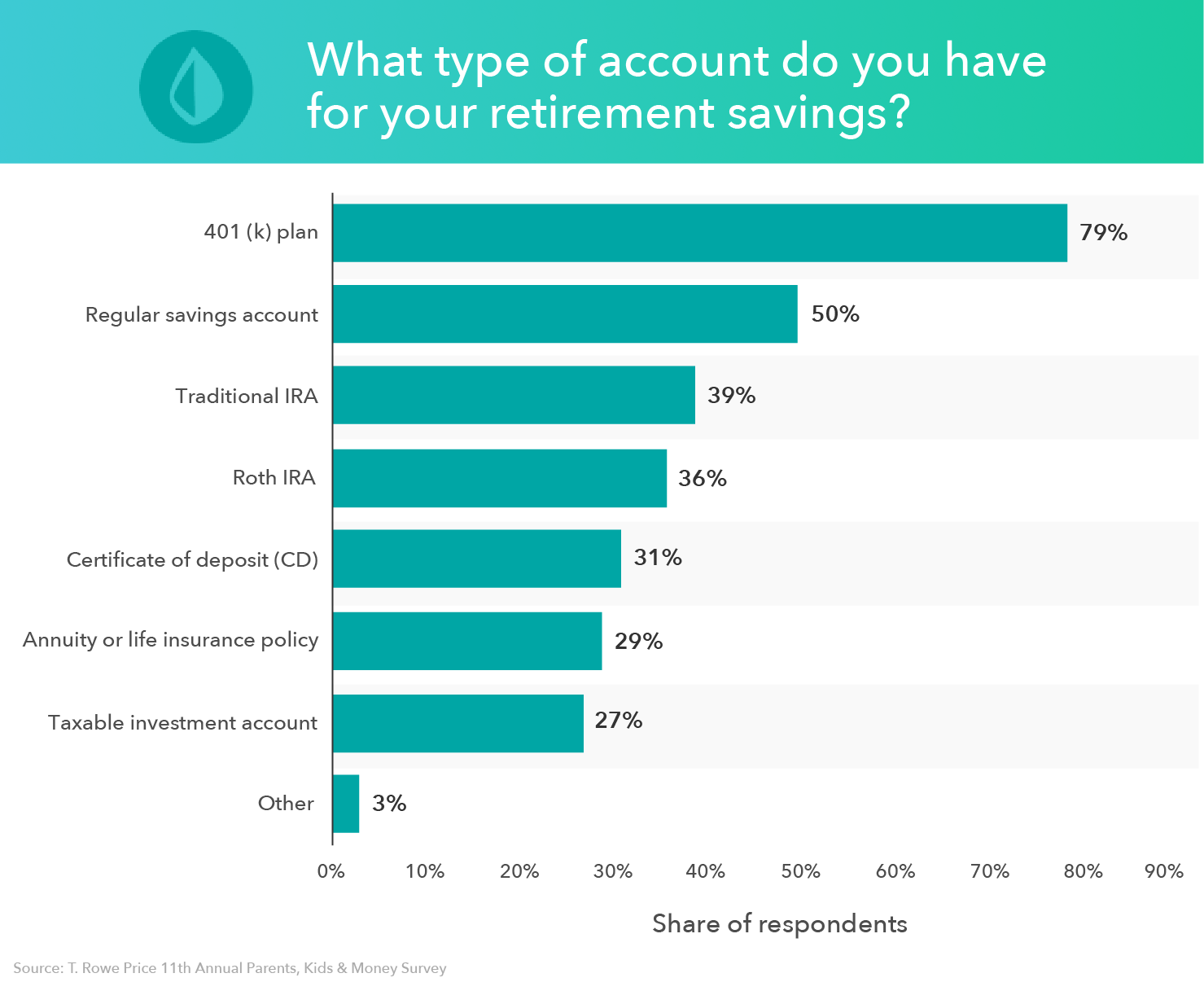

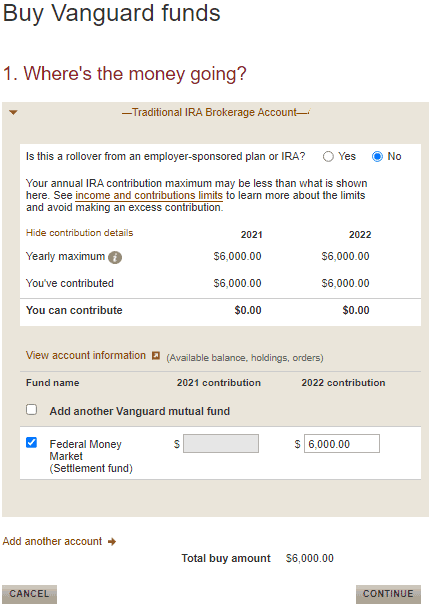

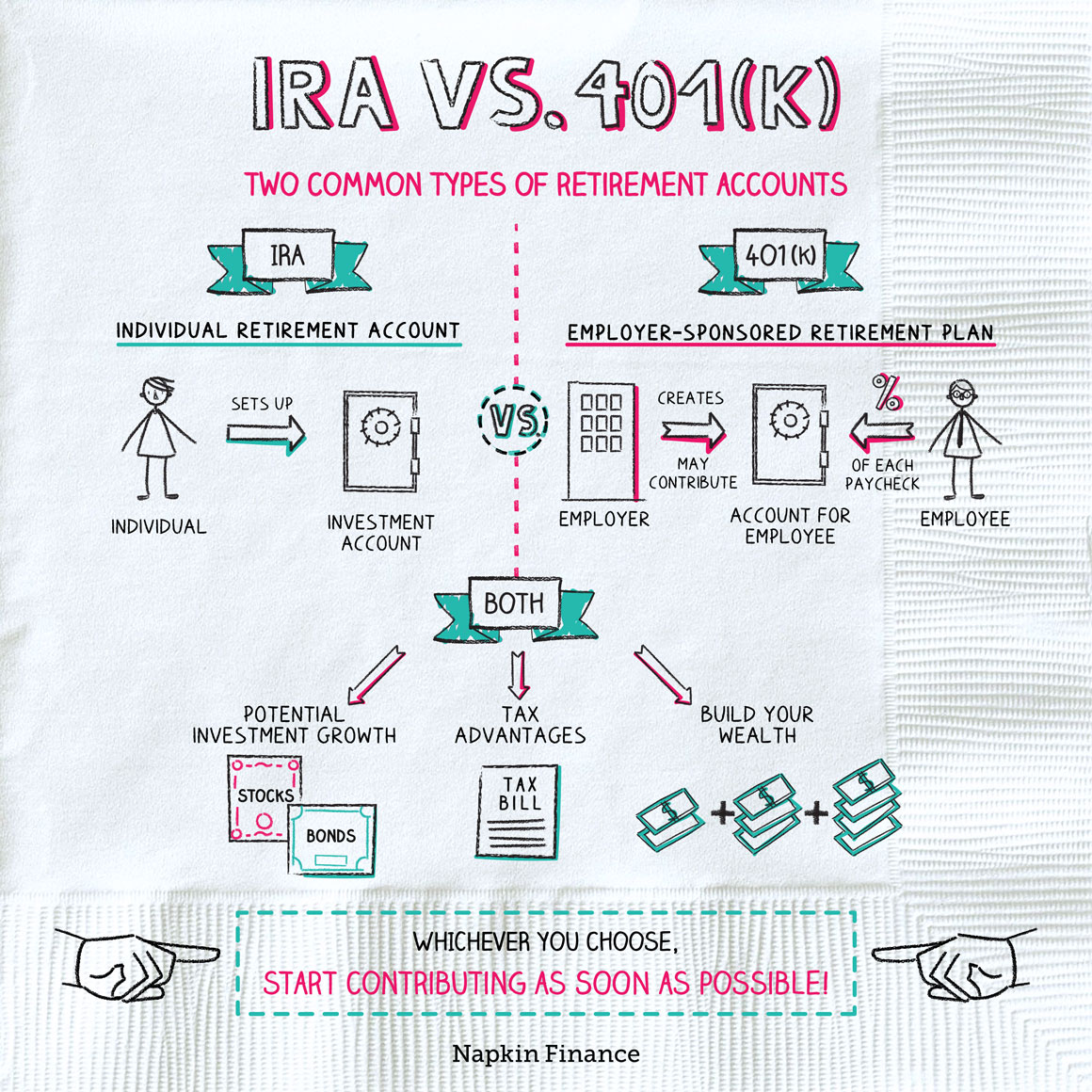

401(k) and IRA Contributions: You Can Do Both IRA Eligibility and Contribution Limits . The contribution limits for both traditional and Roth IRAs are $6,000 per year, plus a $1,000 catch-up contribution for those 50 and older, for both tax ...

Funding 401ks and roth iras worksheet answers

401k-and-roth-ira-worksheet.pdf - WordPress.com Chelsea will fund her Roth IRA. TVI . 15% savings: avingo Always take advantage of the 401K match . Additional savings, beyond the 401k match, should be.2 pages PDF Roth 401(k) Contributions Questions and answers to help ... The new Roth 401(k) feature in your plan allows you to invest after-tax dollars (allowing them to grow on a tax- deferred basis) and take qualifying distributions tax-free. The following questions and answers will help you decide if Roth 401(k) contributions are right for you. 39 funding 401ks and roth iras worksheet answers ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

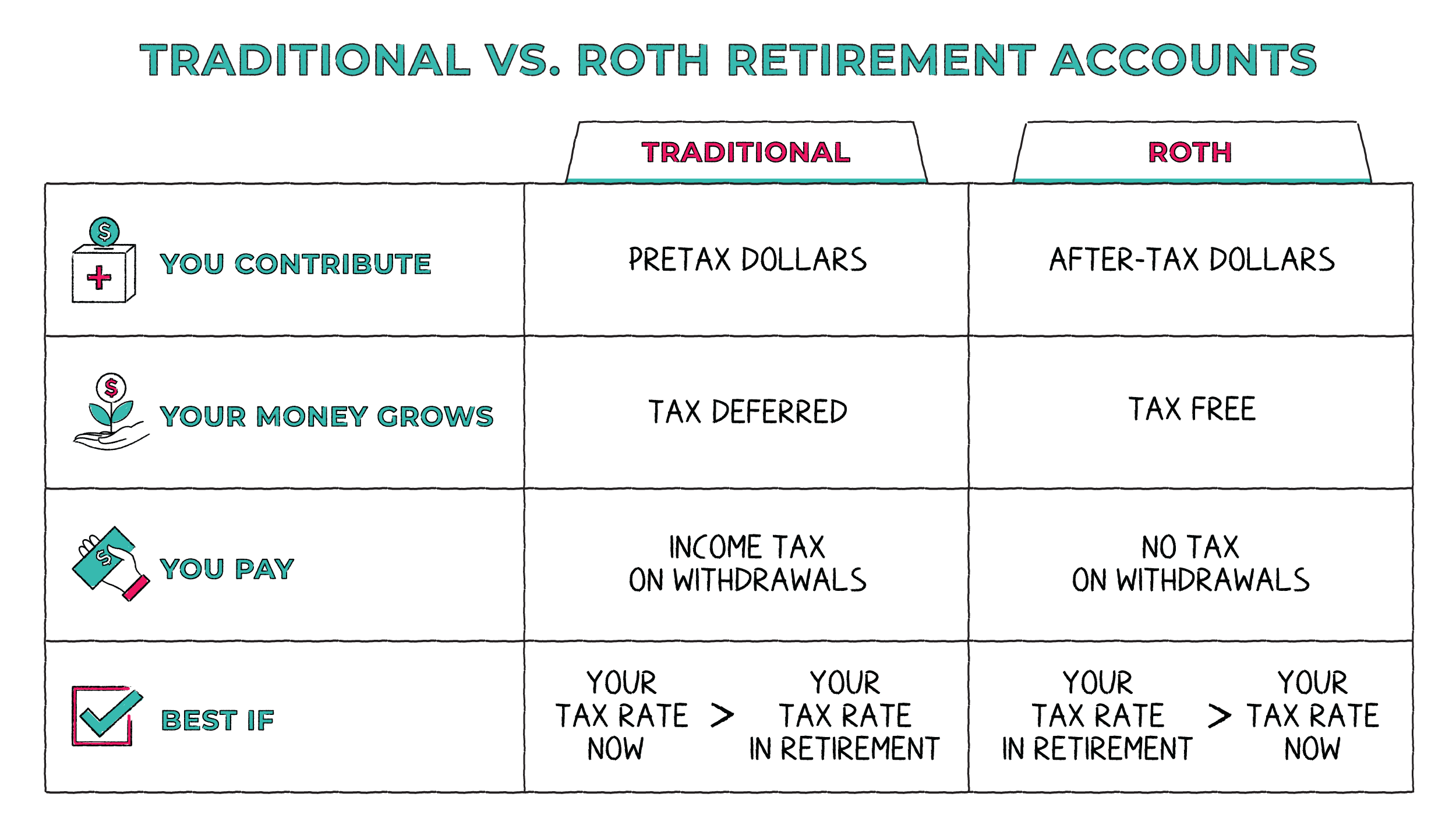

Funding 401ks and roth iras worksheet answers. PDF Roth vs. Traditional 401(k) Worksheet - Morningstar Roth vs. Traditional 401(k) Worksheet ... accounts such as IRAs DETERMINE TRADITIONAL VS. ROTH 401(K) ... p If most of your answers fell under the Roth 401(k) column, you're a good candidate for ... Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume PDF Mr. Powell's Classes - Home 401(k), 403(b), 457 When it comes to IRAs, everyone with an income is eligible The maximum annual contribution for income earners is as of 2008. Remember: IRA is not a type of It is the tax treatment on virtually any type at a bank. of investment. The Roth IRA is an The Roth IRA has more -tax IRA that grows tax Higher at retirement. Funding 401K And Roth Ira Worksheet - Free Gold IRA ... Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET ... View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual Is Your 401(k) Enough for Retirement? | RamseySolutions.com The contribution limit for Roth IRAs in 2021 and 2022 is $6,000 per individual, and it increases to $7,000 if you're 50 or older. 2 It's possible that you might not reach 15% of your income in your Roth IRA. If that happens, go back to your 401 (k) and invest the remainder to take advantage of your 401 (k)'s tax deferral. Joe will take advantage of the company match (5% of salary ... 10 Aug 2015 — He invested 5% in his 401K which is (0.05)*($40,000) = $2000. He put the rest (10%) in a Roth IRA which totals (0.10)*($40,000) = $4000.1 answer · Top answer: Joe invested 15% of his income, so his total annual investment is 15% of $40,000 = (0.15)*($40,000) = $6000 He invested 5% in his 401K which is (0.05)*($40,000 ... Chapter 7 6 Nervous System Worksheet Answers - Chapter ... Read : Funding 401ks And Roth Iras Worksheet Answers Chapter 8. A printable worksheet can help the youngsters discover the alphabet. These worksheets is being utilized in a secondary school class. The alphabet printables can be personalized by a kid's teacher to fulfill their particular needs. After finding out to compose letters, a kid can ...

Funding 401 K S and Roth IRAs Worksheet Answers Funding 401 K S and Roth Iras Worksheet Answers and 218 Best 401k Images On Pinterest. Your contributions could be tax-deductible, lowering your present tax invoice. Non-deductible IRA contributions are. The most important advantage of the 401(k) plan is the sum of money you may add to the plan. Funding 401k And Roth Ira Worksheet Answers - bradfieldschool Conceptually, funding 401 k s and roth iras worksheet answers are an understanding medium for teaching students storage on classes discovered in the classroom. Calculate the maximum match that can be contributed to the 401 (k) step 3: 31 funding 401ks and iras worksheet answers written by jon l ruth wednesday, september 1, 2021 add comment edit. Roth IRAs and 401(k)s: Answers to Readers' Questions - WSJ Roth IRAs and 401(k)s: Answers to Readers' Questions ... These accounts include the Roth variety of individual retirement account and also the Roth type of company-sponsored 401(k) savings plan. ... PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

thefinancebuff.com › medicare-irmaa-income2022 2023 Medicare Part B IRMAA Premium Brackets Feb 10, 2022 · I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000. It would be nice to know that 2022 would be above the 2021 brackets $88,000/$176,000.

Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

401(k) and roth ira Flashcards | Quizlet 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k)

Funding 401 Ks And Roth Iras Worksheet Answers - Worksheet ... Funding 401 Ks And Roth Iras Worksheet Answers Youngsters take pleasure in locating remedies to problems. Single-digit reproduction is the primary focus of this worksheet. There are advanced steps for children to learn after mastering enhancement.

Funding 401 K S and Roth Iras Worksheet Answers Funding 401 K S and Roth Iras Worksheet Answers. A Funding 401 K Sage IRA Worksheet answers some common questions of IRA conversions and IRA custodians. The worksheet answers the following questions: "What is a Conversion?". A conversion is an IRA investment in a non-qualified or non-elective account that is converted to a qualified plan ...

FoundationsU - foundationsu.com 1. Budget Builder; 2. Activity: Free Credit Report; 3. Activity: The Hidden Cost of Credit; 4. Video: Drive Free Cars; 5. Video: 15 vs. 30 Year Mortgages

Funding a 401 K and Roth - financial lit Flashcards | Quizlet FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts -Do you have a matching 401 (K)? >>If so, fund your 401 (k) up to the matching amount >>If not move on to step 3 -Fund the Roth >>Up to $5,500 - one person >>Up to $11,000 - you and non income earning spouse

Funding 401ks And Roth Iras Worksheet Answers - Nidecmege Funding 401ks and iras worksheet and best 25 retirement savings amp. We think it bring interesting things for funding 401 k s and roth iras worksheet answers along with assignment create a roth ira assignment create a. Excel 2007 along with the newest 2010 improve break the previous hurdles about the range of columns and rows available.

Chapter 2 The Muslim World Expands Worksheet Answers ... Read : Funding 401ks And Roth Iras Worksheet Answers Chapter 8. There are lots of ways to utilize kindergarten worksheets. You can use them for lots of purposes. They can aid your child learn mathematics as well as gain self-confidence. These worksheets are wonderful for battling kindergarten math students. Making discovering fun and effective ...

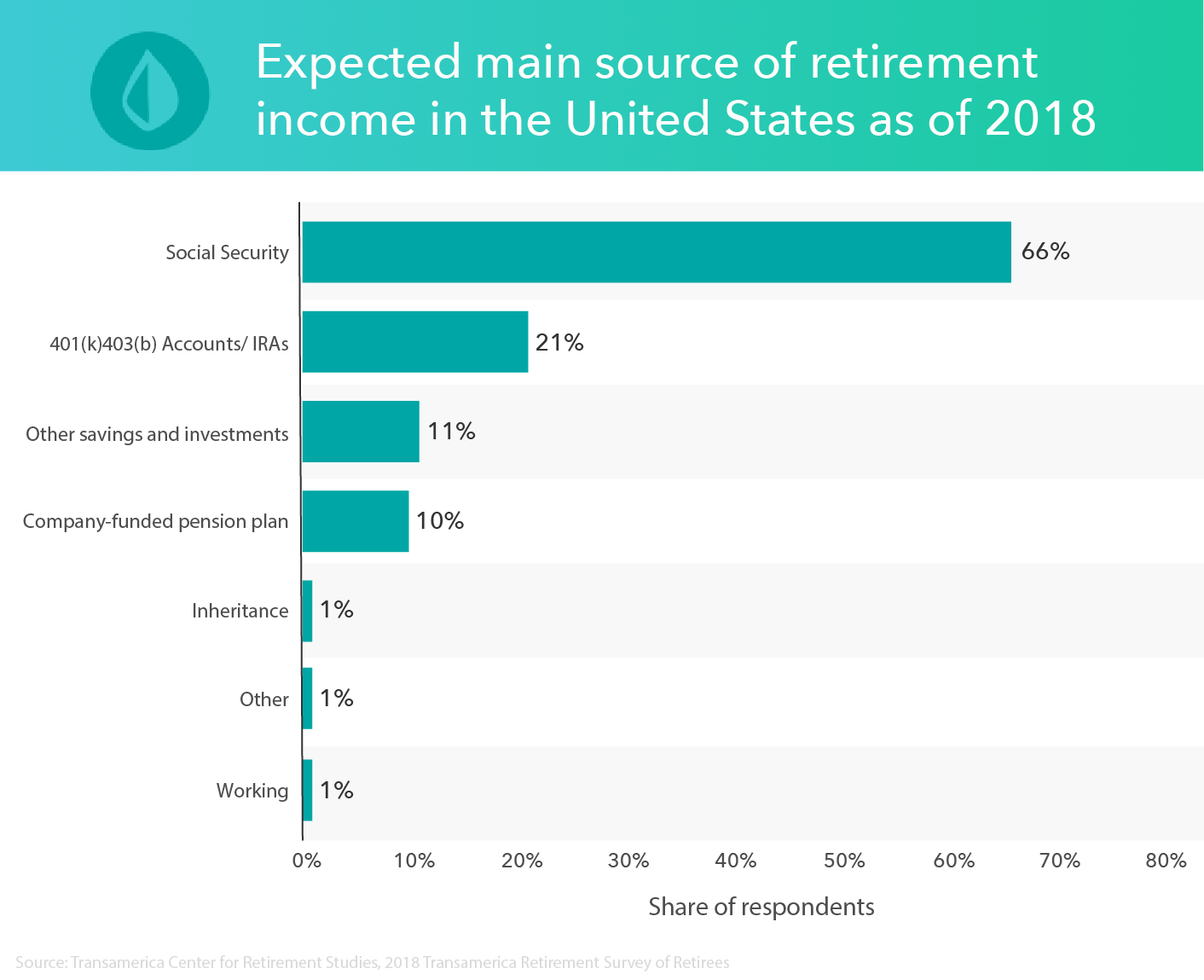

› required-minimumRequired Minimum Distribution (RMD) — ImmediateAnnuities.com The IRS requires you to begin withdrawing around 3.5% from your IRAs upon reaching age of 70-½. Failure to do so can result in steep penalties, as high as 50%. The Treasury Inspector General recently reported that as many as 250,000 tax payers fail each year to withdraw the required amount from their IRAs.

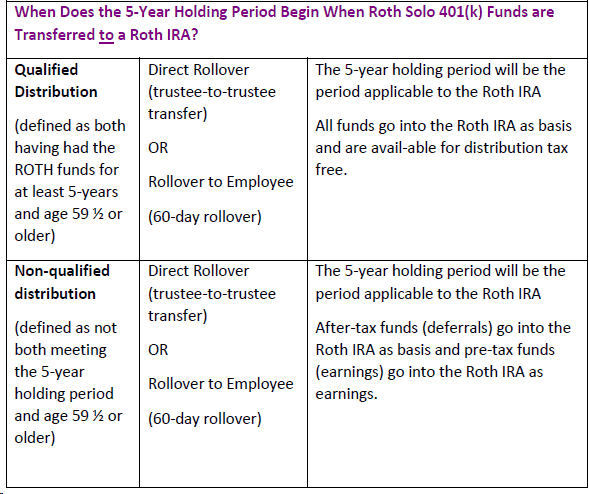

› backdooBackdoor Roth IRA 2022: A Step by Step ... - Physician on FIRE Jan 06, 2022 · Money contributed to Roth accounts does not result in a tax deduction, unlike contributions to tax-deferred accounts. Both Roth and tax-deferred accounts benefit from tax-free growth, unlike a taxable account that is subject to tax drag (which can be minimized). The Roth dollars, unlike tax-deferred dollars, will not be taxed when withdrawn.

39 funding 401ks and roth iras worksheet answers ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

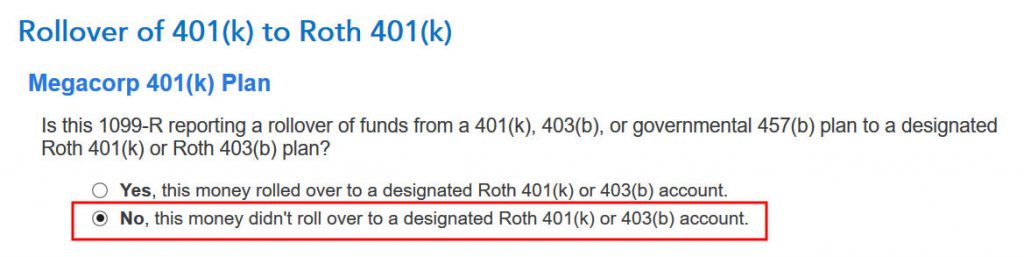

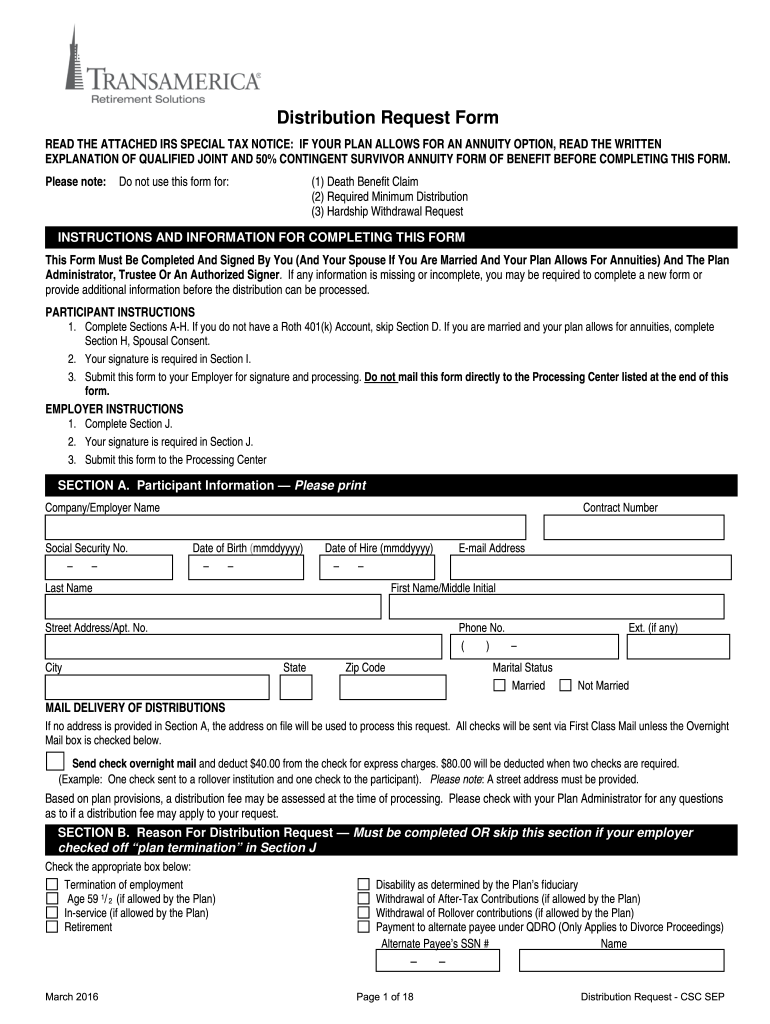

PDF Roth 401(k) Contributions Questions and answers to help ... The new Roth 401(k) feature in your plan allows you to invest after-tax dollars (allowing them to grow on a tax- deferred basis) and take qualifying distributions tax-free. The following questions and answers will help you decide if Roth 401(k) contributions are right for you.

401k-and-roth-ira-worksheet.pdf - WordPress.com Chelsea will fund her Roth IRA. TVI . 15% savings: avingo Always take advantage of the 401K match . Additional savings, beyond the 401k match, should be.2 pages

![Backdoor Roth IRA 2021 [Step-by-Step Guide] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Late-Backdoor-Roth-IRA-Contributions-2020.png)

/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

0 Response to "40 funding 401ks and roth iras worksheet answers"

Post a Comment