43 1040ez worksheet for line 5

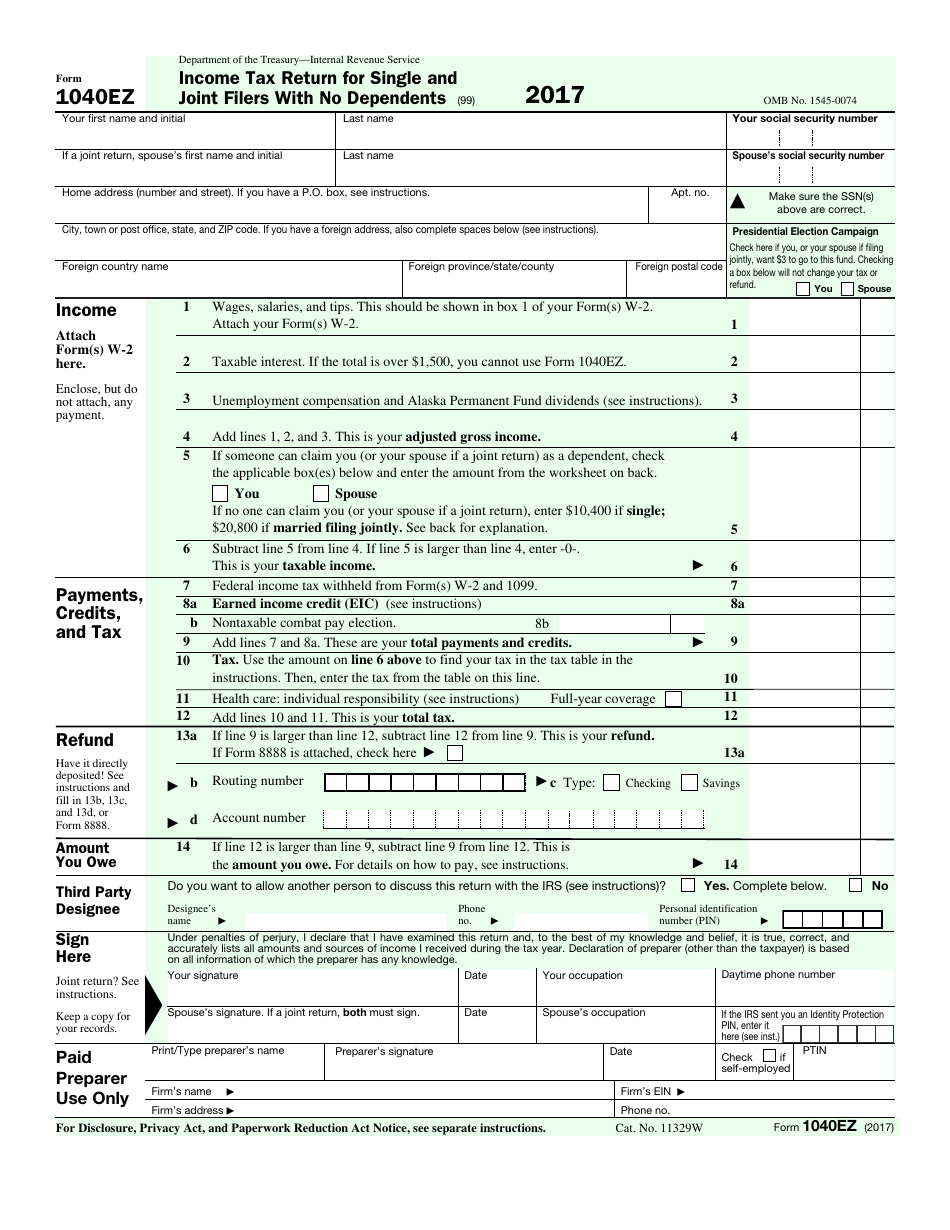

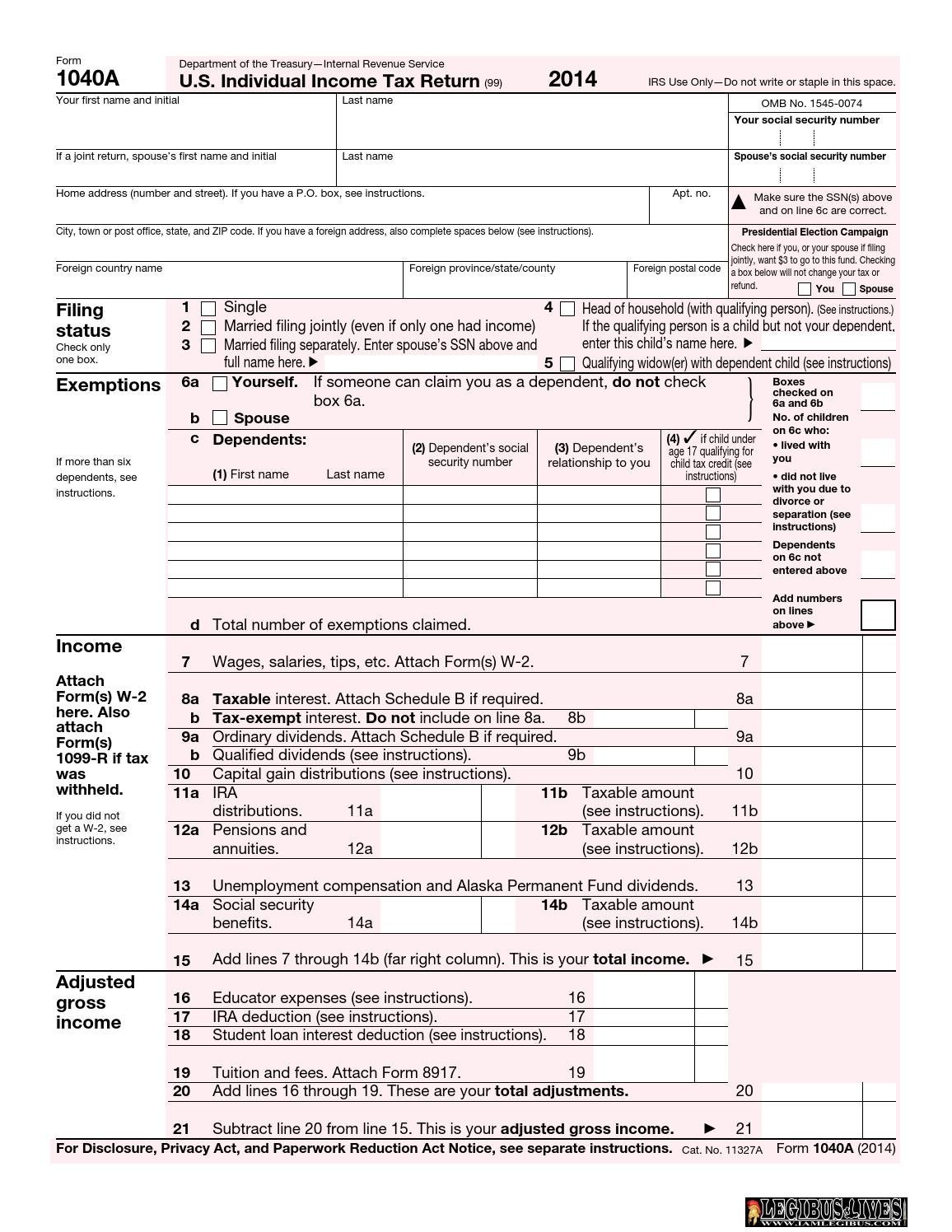

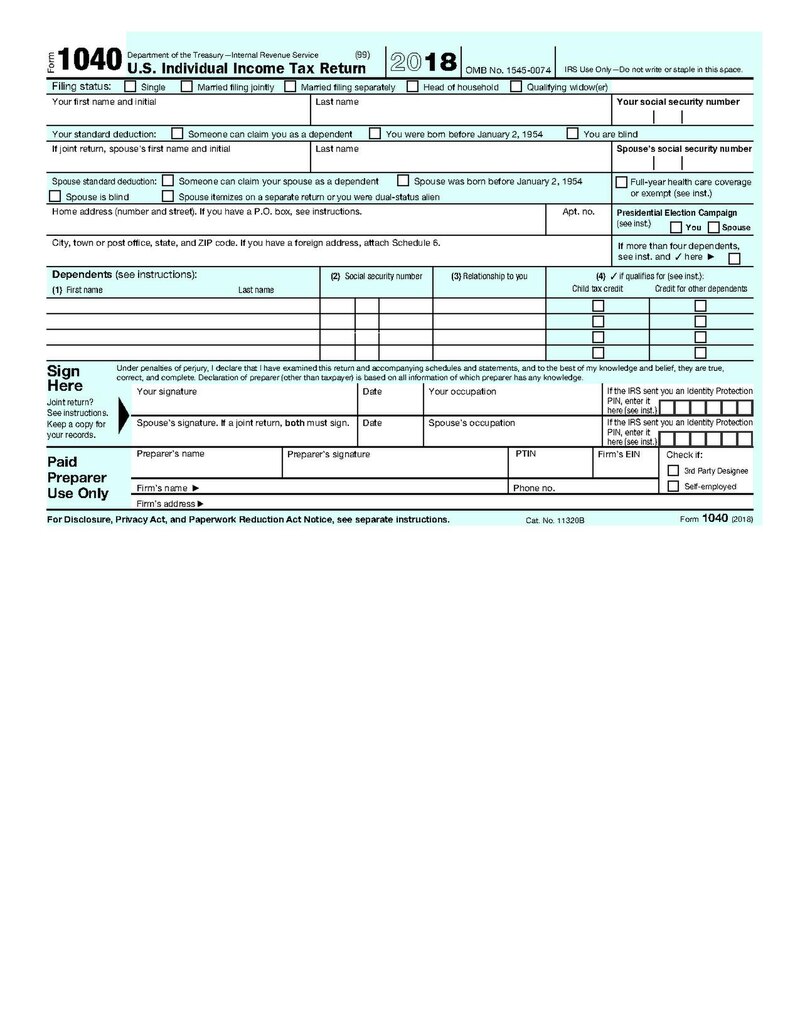

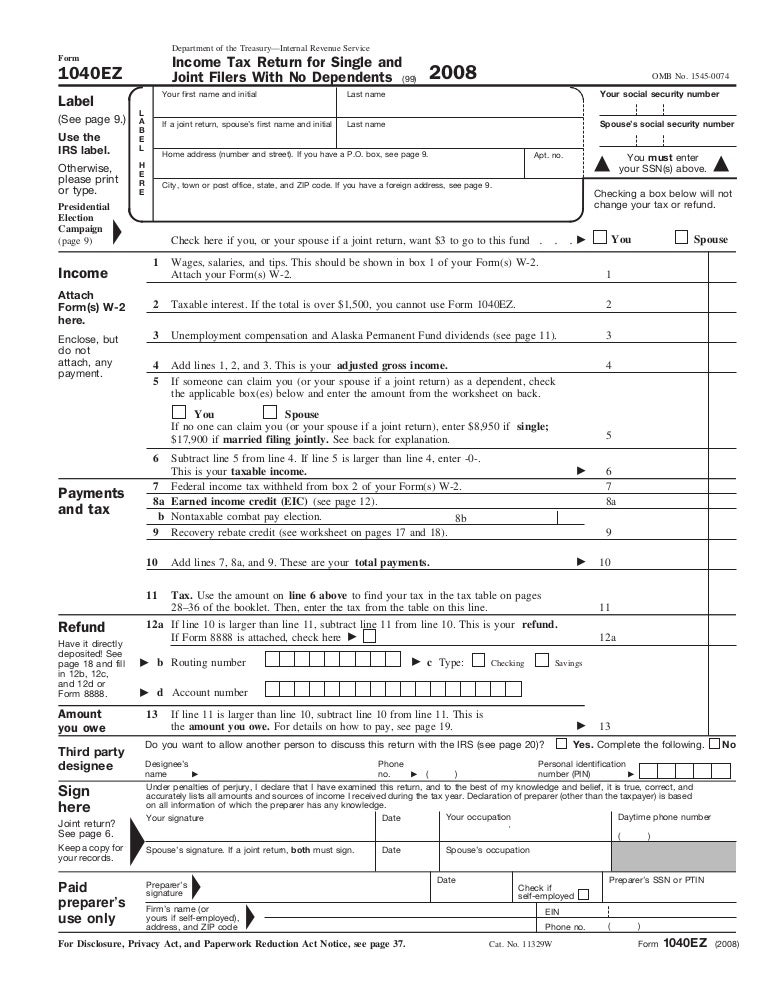

PDF 2014 2015 WASFA Student Information Worksheet Instructions the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,700 equals one exemption). If a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. Adjusted Gross Income - 2013 (Ref. 3c):* Enter 2013 adjusted gross income from: IRS Form 1040 line ... About Form 1040-EZ, Income Tax Return for Single and Joint ... Sep 23, 2020 · Form 1040-EZ is a short-version tax form for annual income tax returns filed by single filers with no dependents. Income tax return filed by certain citizens or residents of the United States.

IRS 1040 2007 - Fill out Tax Template Online | US Legal Forms IRS Form 1040 Use Line: 6d. IRS Form 1040EZ, and didn't check either box on line 5, enter 01 if you are single, or 02 if you are married. IRS Form 1040EZ, and checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($4,050 equals one exemption).

1040ez worksheet for line 5

Note We calculate line 16 if you completed the MINI ... Note: We calculate line 16 if you completed the MINI-WORKSHEET FOR LINE 5. See the FAQ to the left to learn what is considered support. * If YES, this person is your Qualifying Relative and we'll make this person your dependent. * If NO, this person is not your Qualifying Relative or your dependent. Not for Filing PDF NAME SID - Green River College For IRS Form 1040EZ, if box on line 5 is unchecked, enter 1 for unmarried and 2 for married; if box on line 5 is checked, use 1040EZ worksheet line F. This information will be used only to determine or verify eligibility for the TRIO Student Success Services program at South Seattle College. 1040ez Line 10 - 2013 form irs 1040 fill online printable ... 1040ez Line 10. Here are a number of highest rated 1040ez Line 10 pictures upon internet. We identified it from reliable source. Its submitted by running in the best field. We say you will this kind of 1040ez Line 10 graphic could possibly be the most trending topic afterward we allowance it in google benefit or facebook.

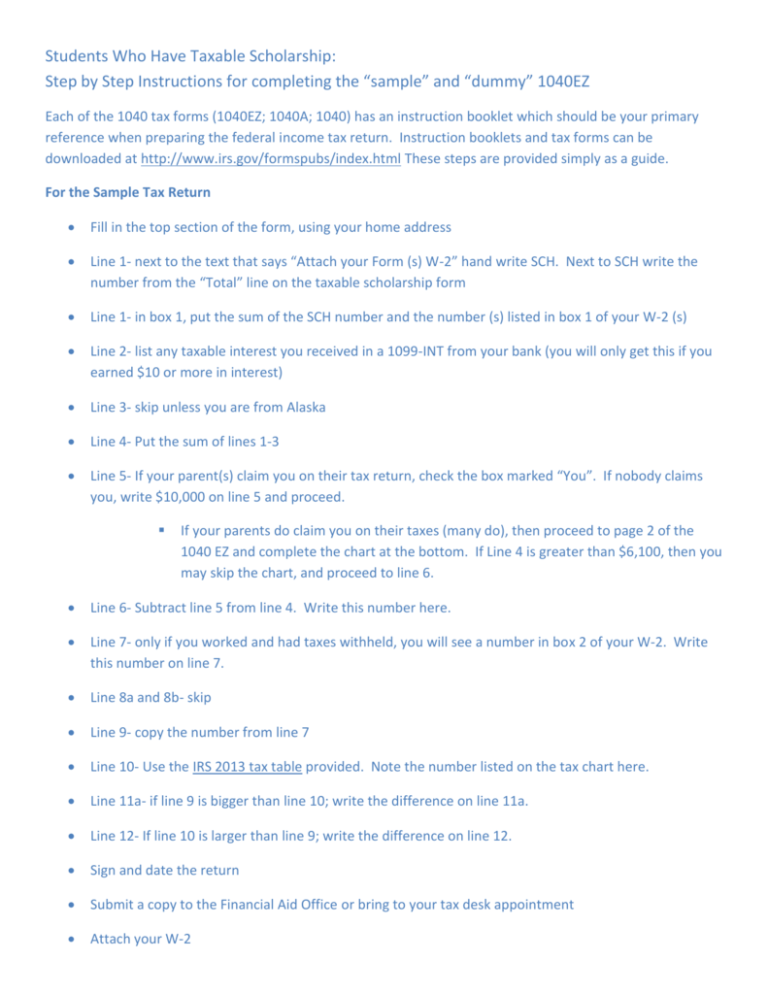

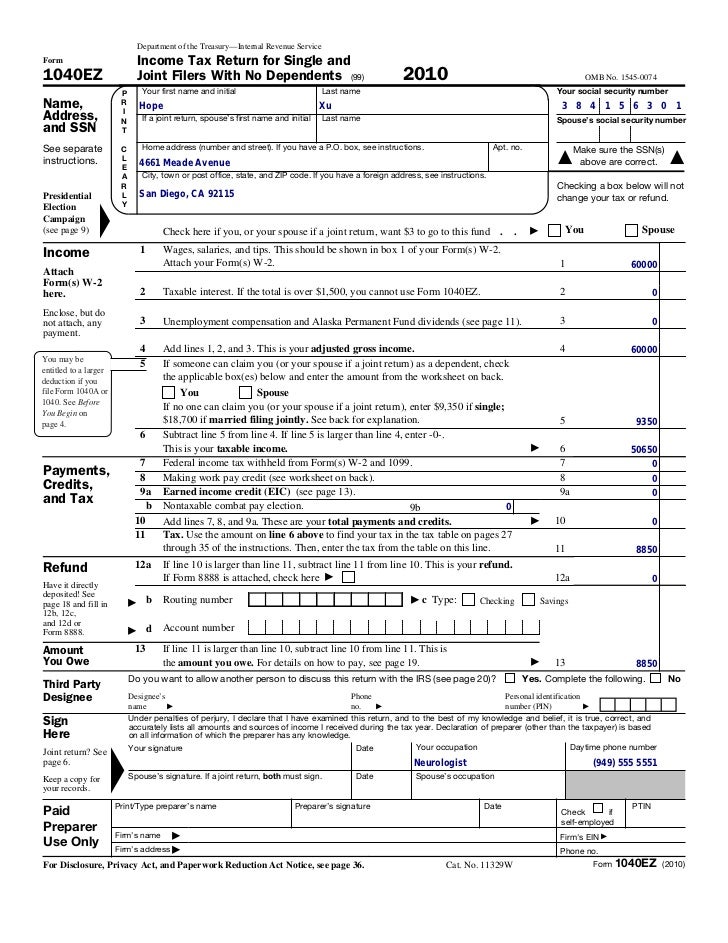

1040ez worksheet for line 5. PDF Sample - Do not submit on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,500 equals one exemption). If a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. Notes for questions 42 and 43 (page 4) 1040ez-form.pdf - Department of the Treasury—Internal ... See back for explanation. 5 6 Subtract line 5 from line 4. If line 5 is larger than line 4, enter -0-. If line 5 is larger than line 4, enter -0-. This is your taxable income. 6 Payments, Credits, and Tax 7 Federal income tax withheld from Form(s) W-2 and 1099. 7 8a Earned income credit (EIC) (see instructions) 8a b Nontaxable combat pay election. PDF UCLA Financial Statement Instructions 2016-17 the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($4,000 equals one exemption).If you claimed less than ten exemptions, please fill in the first digit as a zero. 12. Work income earned by student in 2015 - PDF 2016 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,350 if . single; $20,700 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

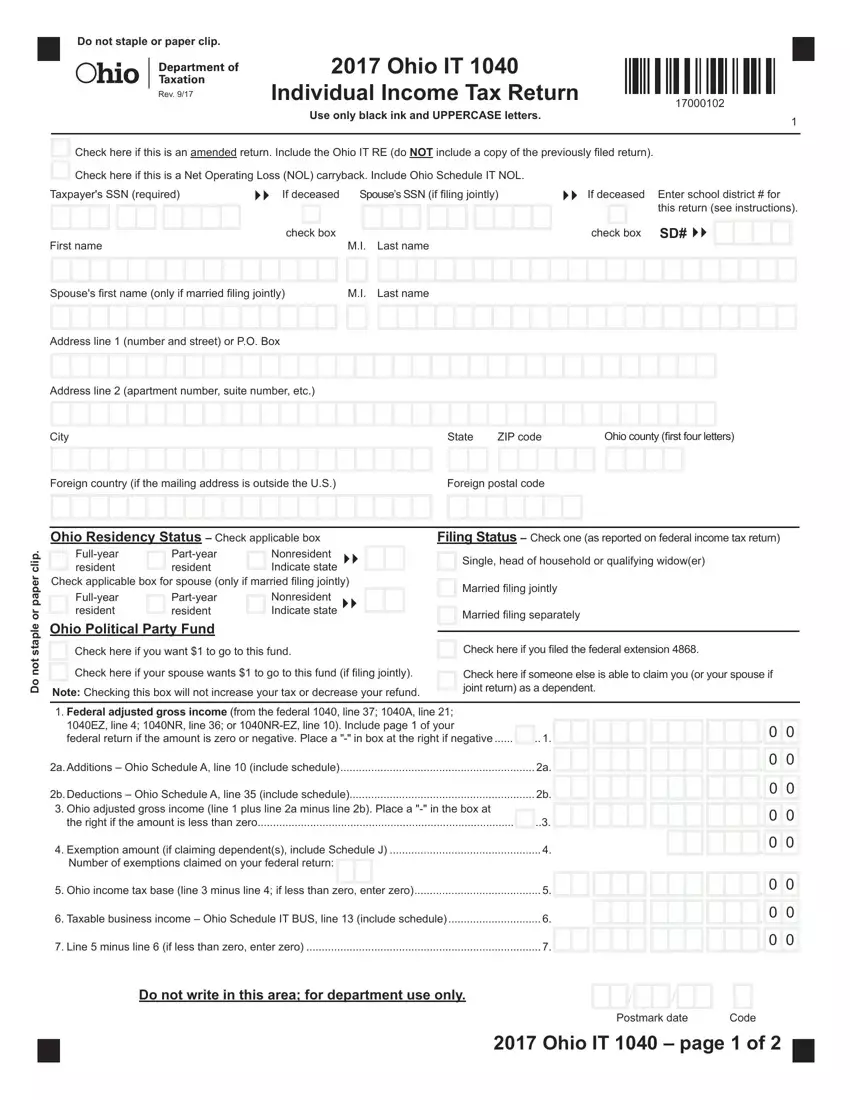

What is an exemption on 1040? - Leagueslider.com IRS Form 1040A - Use Line: 6d. IRS Form 1040EZ, and didn't check either box on line 5, enter 01 if they are not married, or 02 if they are married. IRS Form 1040EZ, and checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($4,050 equals one exemption). Awesome 1040ez Line 5 Worksheet - The Blackness Project 1040ez Line 5 Worksheet Example. Some of the worksheets for this concept are 2017 form 1040ez 2014 form 1040ez 2017 form 1040ez Step 5 standard deduction dependent exemptions 1040ez 2014 income tax return for single and joint filers Standard deduction and tax. 1040EZ 2016 from 1040Ez Worksheet Line F sourceirsgov. Whats A 1040ez Tax Form. What is parents exemptions fafsa? - JacAnswers IRS Form 1040A - Use Line: 6d. IRS Form 1040EZ, and didn't check either box on line 5, enter 01 if they are not married, or 02 if they are married. IRS Form 1040EZ, and checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($4,050 equals one exemption). PDF 2006 - tax.state.oh.us Amount you owe (if line 16 is less than line 15, subtract line 16 from line 15).Check hereand enclose form IT 40P (see page 41) on the front of return if you are enclosing a payment (payable to Ohio Treasurer of State).i17.18.

PDF DRAFT AS OF - IRS tax forms 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,150 if single; $20,300 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from ... PDF 2021 Ohio IT 1040 hio Department of Taxation Use only ... Sequence No. 2. 2021. Ohio IT 1040. Individual Income Tax Return. SSN. IT 1040 - page 2 of 2. If line 20 is MORE THAN line 13, skip to line 24. OTHERWISE, continue to line 21. PDF Do not use staples. 2012 - Ohio Department of Taxation IRS form 1040A or 1040EZ. Complete this worksheet to determine if you are entitled to a deduction on line 2 of Ohio form IT 1040EZ. a. Did you fi le a . 2012 IRS form 1040A or 1040EZ? Yes. STOP. and enter -0- on line 2 of Ohio form IT 1040EZ. No. Complete line b below. b. Enter here and on line 2 of Ohio form IT 1040EZ the amount from line 10 ... Amazing Line 5 1040ez Worksheet - Goal keeping intelligence 1040ez Worksheet For Line 5. When you start to complete your 201617 application you will be asked if you want the information from the 2015 fafsa to pre fill the new application. 4 Foot Letter Stencils. 1040ez Worksheet For Line F. 1040ez Worksheet Line 5. For Dependents Who Checked One Or Both Boxes On Line 5. Tax Form 1040ez Line F.

1ez Worksheet Line 1 - worksheets.thegreenerleithsocial.org Form 1-EZ Income Tax Return for Single and Joint Filers With No Intended For 1040ez Worksheet Line 5. It is ready after unadjusted trial balance is extracted from the ledgers' balances. Major function of the worksheet is to include changes to the closed accounts in a structured method following a certain format.

Screen FAFSA - Federal Student Aid Application Information ... Enter the exemptions from Form 1040 line 6d or 1040A line 6d. For 1040EZ, if no boxes are checked on line 5, enter 1 if the taxpayer is single, 2 if the taxpayer is married. If either box on line 5 is checked, use 1040EZ worksheet line F to determine the number of exemptions.

Form 1040EZ-Income Tax Return for Single and Joint Filer ... Worksheet Use this worksheet to figure the amount to enter on line 5 if someone can claim you (or your spouse if married filing jointly) as a dependent, even if that person chooses not to do so. To find out if someone can for claim you as a dependent, see Pub. 501. dependents A .

16 Best Images of Federal 941 Worksheet - 2013 1040EZ ... Encouraging your creative skills by stacking the typography of different weight for a stylish effect. Apply color to your image as a block of color in your design for consistency. Use letter spacing to fill the dead space, align text, or abbreviate words that take up too much space. 2013 1040EZ Worksheet Line 5 via 2013 Federal Income Tax Forms via

PDF CT-1040EZ, Connecticut Resident EZ Income Tax Return 24. Enter the Lesser of Line 22 amount or $350 (If $100 or less, enter this amount on Line 26. If greater than $100, go to Line 25). 25. Limitation - Enter 0 or the result from the Property Tax Credit Limitation Worksheet. (See note below) 26. Subtract Line 25 from Line 24. Enter Here and on Form CT-1040EZ, Line 5.

Diy 1040ez Worksheet Line 5 - The Blackness Project 1040ez worksheet line 5. 1040ez tax form line 11.Fafsa 1040ez Worksheet Line F. 1040ez_worksheet_for_line_5 35 1040ez Worksheet For Line 5 moments of introspection at the Lords table to the terrible agony of the cross and culminating with the joyous resurrection this cantata is a moderately easy yet completely satisfying and inspirational implement for worship.

9 Best Images of EZ Math Worksheets - 2013 1040EZ ... Continue with more related ideas such 2013 1040ez worksheet line 5, form 1040ez worksheet line f and cursive writing worksheets 4th grade. We have a dream about these EZ Math Worksheets pictures collection can be a hint for you, give you more examples and of course make you have what you search.

PDF 2002 Form 1040EZ - Money Instructor Subtract line 5 from line 4. If line 5 is larger than line 4, enter -0-. This is your taxable income. 6 6 Payments and tax Earned income credit (EIC). 7 7 Tax. Use the amount on line 6 above to find your tax in the tax table on pages 25-29 of the booklet. Then, enter the tax from the table on this line. 10 10 Refund 11a 11a If line 10 is ...

PDF 2017 Form 1040EZ 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,400 if single; $20,800 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from ...

What is line 11a on Form 1040? - Pursuantmedia.com IRS Form 1040A - Use Line: 6d. IRS Form 1040EZ, and didn't check either box on line 5, enter 01 if they are not married, or 02 if they are married. IRS Form 1040EZ, and checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($4,050 equals one exemption).

IRS Form 1040EZ - See 2020 Eligibility & Instructions ... Jan 07, 2022 · On Line 4, add lines 1, 2 and 3 to get your Adjusted Gross Income (AGI). On Line 5, indicate whether someone can claim you (or your spouse if you’re filing a joint return) as a dependent. If so, check the applicable box(es) and enter the amount from the worksheet on the back of Form 1040EZ.

PDF 2017 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,400 if . single; $20,800 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

1040ez Line 10 - 2013 form irs 1040 fill online printable ... 1040ez Line 10. Here are a number of highest rated 1040ez Line 10 pictures upon internet. We identified it from reliable source. Its submitted by running in the best field. We say you will this kind of 1040ez Line 10 graphic could possibly be the most trending topic afterward we allowance it in google benefit or facebook.

PDF NAME SID - Green River College For IRS Form 1040EZ, if box on line 5 is unchecked, enter 1 for unmarried and 2 for married; if box on line 5 is checked, use 1040EZ worksheet line F. This information will be used only to determine or verify eligibility for the TRIO Student Success Services program at South Seattle College.

Note We calculate line 16 if you completed the MINI ... Note: We calculate line 16 if you completed the MINI-WORKSHEET FOR LINE 5. See the FAQ to the left to learn what is considered support. * If YES, this person is your Qualifying Relative and we'll make this person your dependent. * If NO, this person is not your Qualifying Relative or your dependent. Not for Filing

0 Response to "43 1040ez worksheet for line 5"

Post a Comment