39 1040 qualified dividends and capital gains worksheet

When To Use Qualified Dividends And Capital Gain Tax ... Except for qualified retirement accounts (401(k), 403(b), IRA), mutual fund capital gains and dividend distributions are taxable for the year in which they are received. If you accept cash distributions from a qualified account of dividends or capital gains, this is regarded as a distribution from the account and may be subject to taxation. Irs Qualified Dividends And Capital Gains Worksheet Irs Qualified Dividends And Capital Gains Worksheet. If your baby business is a sole proprietorship, partnership, bound accountability aggregation or S-corporation, you and any co-owners pay the business's taxes through the assets you address to the Internal Revenue Service on your 1040. If your business awash any basic assets, assisting or not, you will accept to address it to the IRS ...

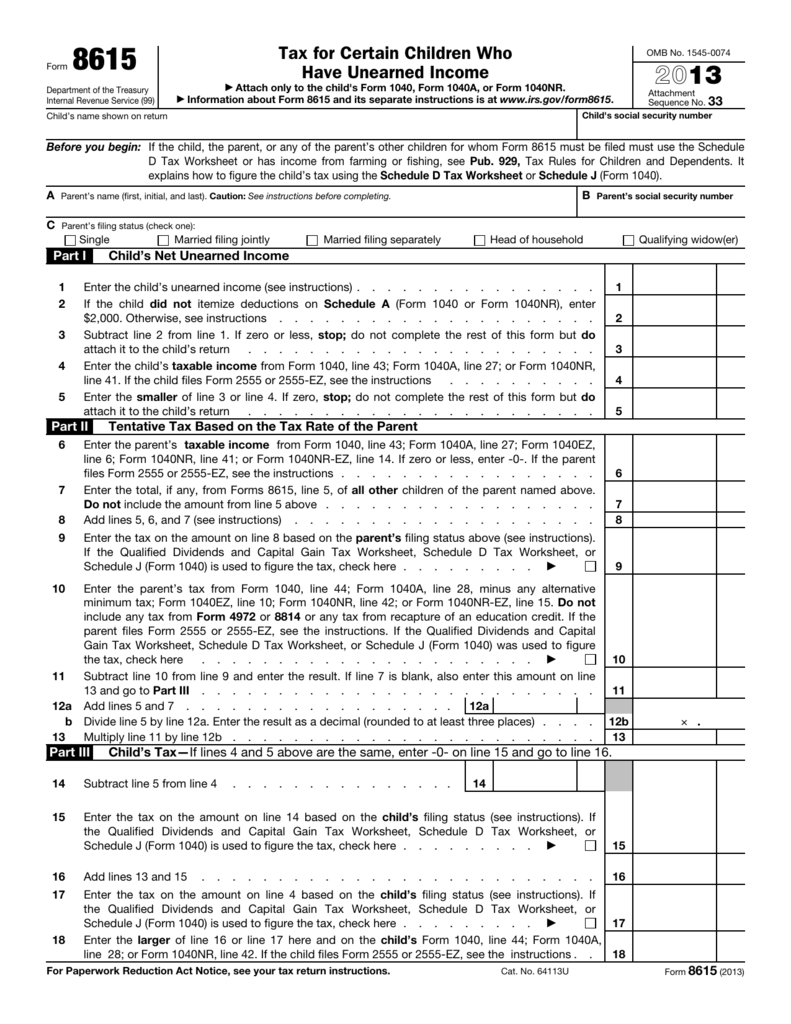

Correction to Line 9 in the 2021 Instructions for Form ... Under the section "Using the Qualified Dividends and Capital Gain Tax Worksheet for line 9 tax," steps 5, 7, and 8 should read as shown below. 5. If the Foreign Earned Income Tax Worksheet was used to figure the parent's tax, go to step 6 below. Otherwise, skip steps 6, 7, and 8 of these instructions below, and go to step 9.

1040 qualified dividends and capital gains worksheet

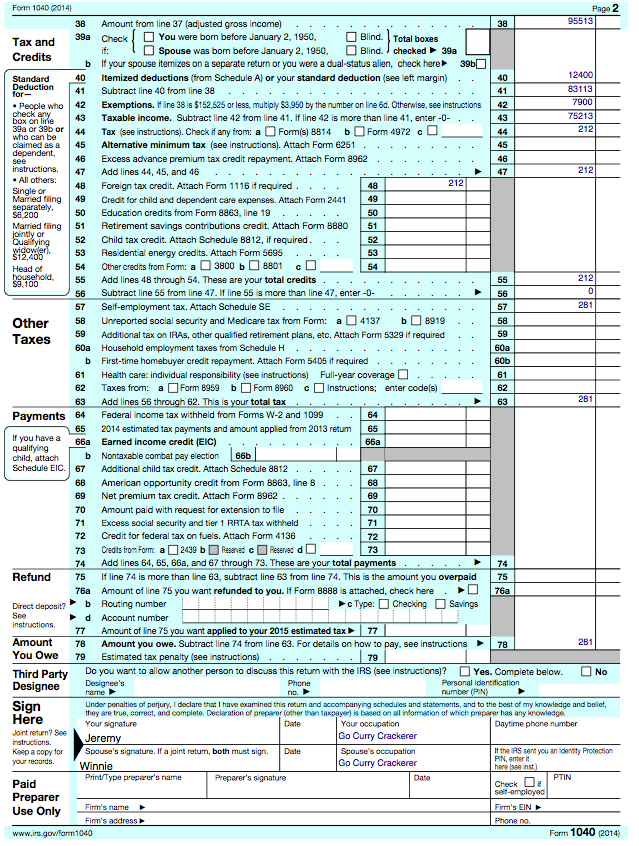

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. ... Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of ... Where Do Qualified Dividends Go On 1040? - TheMoneyFarm Use the Qualifying Dividends and Capital Gains Tax Worksheet provided in the instructions for Form 1040 to calculate the tax on qualified dividends at the selected tax rate. Where do qualified dividends go on the Schedule B? On a Schedule B, dividends that are not qualified are taxed. Your taxable income includes the dividends. Solved Instructions Form 1040 Schedule 1 Schedule 5 ... Transcribed image text: Instructions Form 1040 Schedule 1 Schedule 5 Schedule B Qualified Dividends and Capital Gain Tax Worksheet Form 1040 X 7,000 6 173,182 4,453.50 + 22% 38,700 7 173,182 → 14,089.50 + 24% 2018 Tax Rate Schedules 38,700 82,500 82,500 157,500 157,500 200,000 200,000 500,000 500,000 82,500 157,500 32,089.50 + 32% 9 8 24,000 45,689.50 + 35% 200,000 9 150,689.50 + 37% 500,000 ...

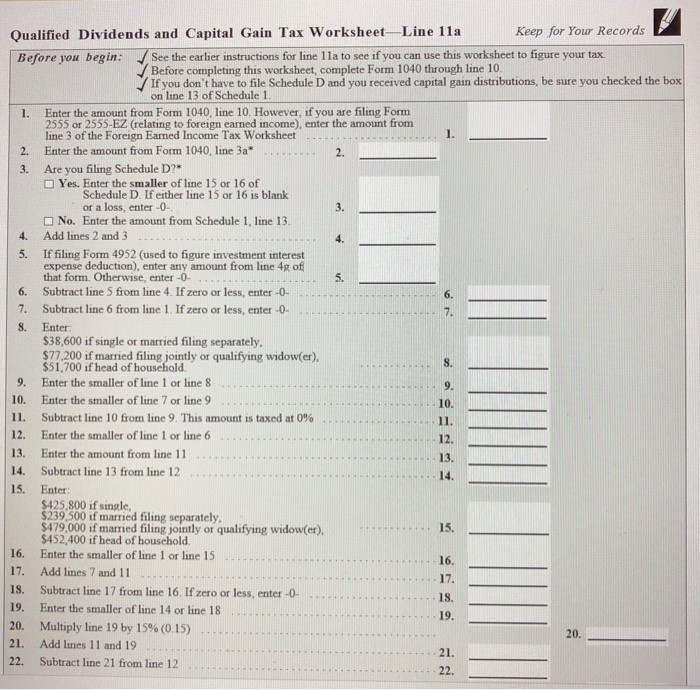

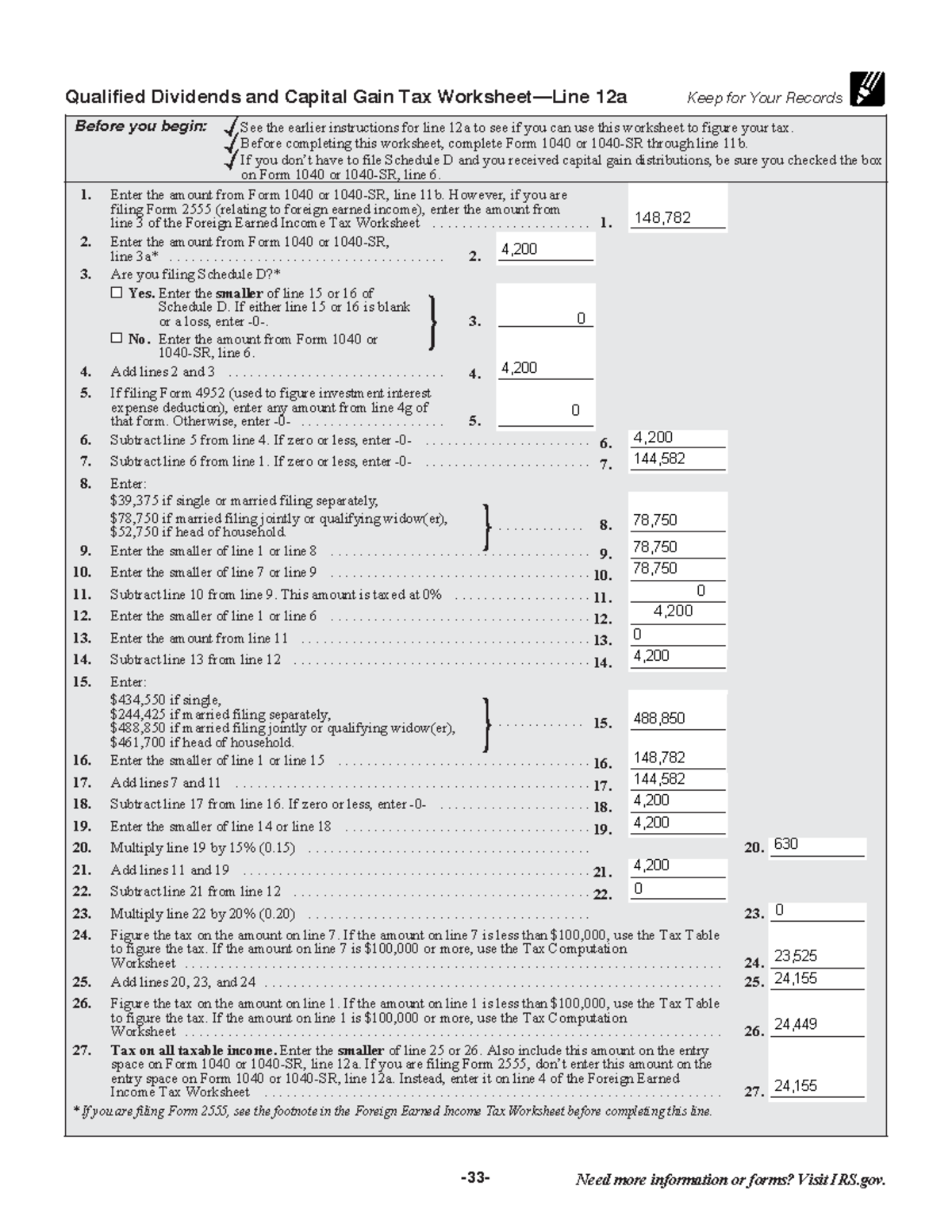

1040 qualified dividends and capital gains worksheet. How To Report Qualified Dividends On Tax Return ... Line 9b of Form 1040 or 1040A is where you report your qualifying dividends. To calculate your total tax amount, use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a. To calculate your tax, use the Schedule D spreadsheet. Are qualified dividends tax deductible? PDF and Losses Capital Gains - IRS tax forms •To report a gain or loss from a partnership, S corporation, estate, or trust; •To report capital gain distributions not reported directly on Form 1040 or 1040-SR, line 7 (or effectively connected capital gain distributions not reported direct-ly on Form 1040-NR, line 7); and •To report a capital loss carryover from 2020 to 2021. Qualified Dividends and Capital Gains Worksheet.pdf ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Why doesn't the tax on my return (line 16) match ... - Support When you have qualified dividends or capital gains, you do not use the tax table. Instead, you will need to use the Capital Gains Worksheet to figure your tax. 1040 Instructions Line 16 , Qualified Dividends and Capital Gains Worksheet. The program has already made this calculation for you.

1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200. cotaxaide.org › tools › Estimated Tax WorksheetEstimated Tax Worksheet - cotaxaide.org Ordinary dividends: Qualified dividends: Section 199A dividends: IRAs distributions (Amount of QCD included: ) Pensions and annuities: Amount of social security expected: Business income: Capital gains/loss Short term gain/loss: Long term gain/loss: Alimony (if taxable) Unemployment: Other income (rentals, royalties, etc) Gross income expected 2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ... › pub › irs-pdf2021 Form 6251 - IRS tax forms Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter -0-.

42 1040 qualified dividends and capital gains worksheet ... IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. How To Report Ordinary And Qualified Dividends On 1040 ... Calculate your qualified dividend amount using Form 1099-DIV. Ordinary dividends should be filed in Box 1a, qualifying dividends should be filed in Box 1b, and total capital gain distributions should be filed in Box 2a. Line 9b of Form 1040 or 1040A is where you report your qualifying dividends. To calculate your total tax amount, use the ... PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. 2021 Qualified Dividends And Capital Gain Tax Worksheet ... IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gain s rates without having to fill out the Schedule D.

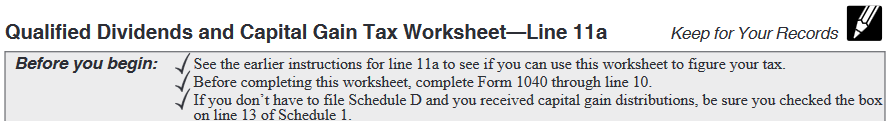

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

How Your Tax Is Calculated: Qualified Dividends and ... Instead, 1040 Line 16 "Tax" asks you to "see instructions." In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

Creative Qualified Dividends And Capital Gains Tax ... Qualified dividends and capital gains tax worksheet. IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The difference between the two means that the tax rate can be substantial.

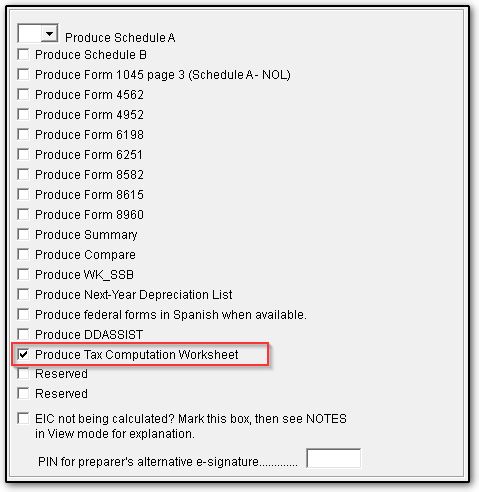

Calculation of tax on Form 1040, line 16 - Thomson Reuters You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified ... Don't enter an amount less than zero on line 3a (qualified dividends) of Form 1040, 1040-SR, or 1040-NR. Page Last Reviewed or Updated: 09-Apr-2021 Share

Qualified Dividends and Capital Gain Tax Worksheet - Drake ... See the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. • Before completing this worksheet, complete Form 1040 or ...2 pages

Qualified Dividends and Capital Gain Tax Worksheet Form ... 2021 qualified dividends and capital gain tax worksheetreate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

2021 Qualified Dividends And Capital Gains Worksheet and ... Qualified Dividend And Capital Gains Worksheet 2021 and ... best . Qualified Dividends Tax Worksheet 2021 and Similar ... best . In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% ...

Where Is The Qualified Dividends And Capital Gain Tax ... The Qualified Dividends and Capital Gains worksheet uses taxable income as the starting point for calculating taxes. Where are the qualified dividends reported on Form 1099-DIV? All regular dividends you received will be reported in Box 1a of Form 1099-DIV. Qualified dividends can be found in Box 1b.

Qualified Dividends and Capital Gains Worksheet - ACC330 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Diy Qualified Dividends And Capital Gain Worksheet - The ... IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.

apps.irs.gov › app › picklistForms and Instructions (PDF) Instructions for Schedule C (Form 1040 or Form 1040-SR), Profit or Loss From Business (Sole Proprietorship) 2021 12/22/2021 Form 1040 (Schedule D) Capital Gains and Losses 2021 12/10/2021 Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses

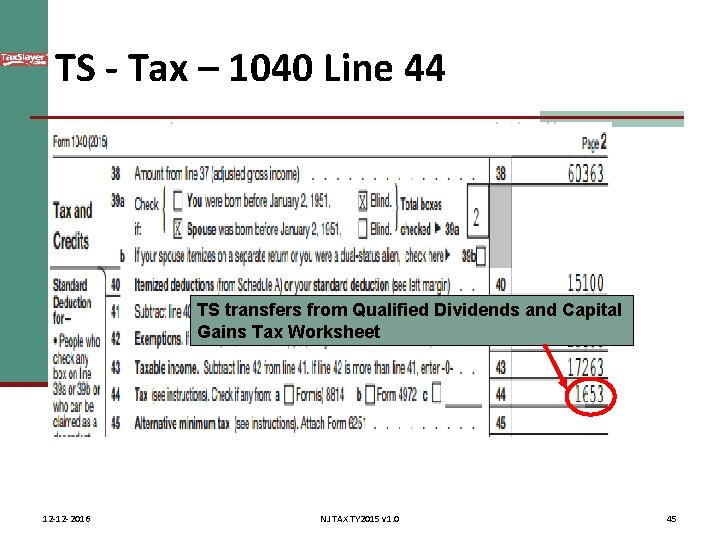

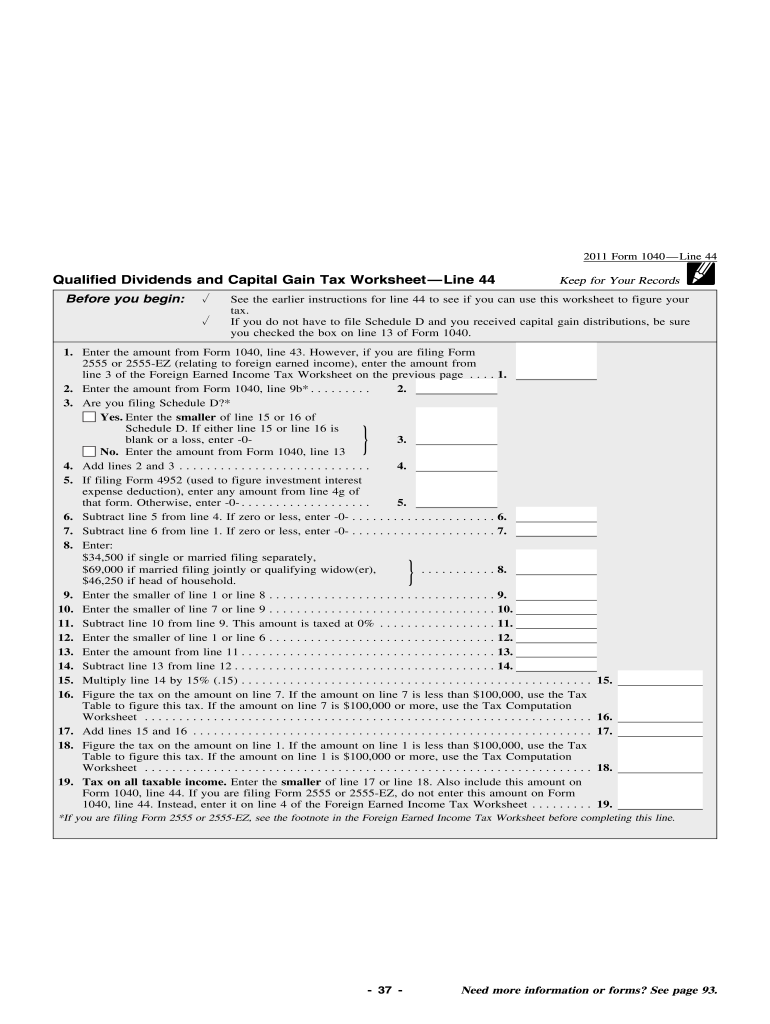

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ...

› instructions › i8801Instructions for Form 8801 (2021) | Internal Revenue Service Jan 13, 2022 · If for 2020 you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; or you reported qualified dividends on Form 1040 or 1040-SR, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040), enter the amount from line 3 of this worksheet on Form 8801, line 27. Complete the rest of Part III of Form 8801.

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records Form 1040—Line 44 Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

42 qualified dividends and capital gain tax worksheet ... Qualified Dividends and Capital Gain Tax Worksheet for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106. 6%) were subject to the maximum long-term capital gains and qualified dividends rate (20%).

1040 US Individual Income Tax Return - Drake Support Go to for instructions and the latest information. ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the ...8 pages

Solved Instructions Form 1040 Schedule 1 Schedule 5 ... Transcribed image text: Instructions Form 1040 Schedule 1 Schedule 5 Schedule B Qualified Dividends and Capital Gain Tax Worksheet Form 1040 X 7,000 6 173,182 4,453.50 + 22% 38,700 7 173,182 → 14,089.50 + 24% 2018 Tax Rate Schedules 38,700 82,500 82,500 157,500 157,500 200,000 200,000 500,000 500,000 82,500 157,500 32,089.50 + 32% 9 8 24,000 45,689.50 + 35% 200,000 9 150,689.50 + 37% 500,000 ...

Where Do Qualified Dividends Go On 1040? - TheMoneyFarm Use the Qualifying Dividends and Capital Gains Tax Worksheet provided in the instructions for Form 1040 to calculate the tax on qualified dividends at the selected tax rate. Where do qualified dividends go on the Schedule B? On a Schedule B, dividends that are not qualified are taxed. Your taxable income includes the dividends.

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. ... Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of ...

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "39 1040 qualified dividends and capital gains worksheet"

Post a Comment