40 non cash charitable donations worksheet

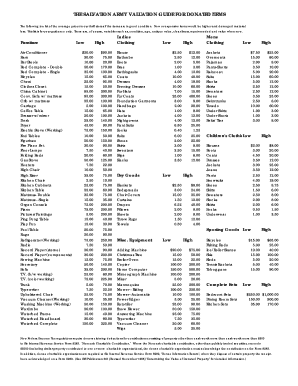

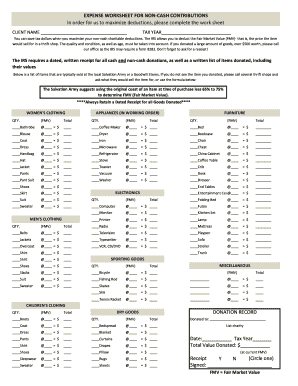

PDF Today - redcpa.com Missi n g lnformation : Non-cash charita ble contri butions worksheet Name: Tax Year: Home Telephone:Work Cell: The following is a guideline for valuation of non-cash charitable contributions.When valuing items, take into consideration the condition of the items, lf the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the ... The Salvation Army Thrift Stores | Donation Valuation Guide 1-800-SA-TRUCK (1-800-728-7825) The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. It includes low and high estimates. Please choose a value within this range that reflects your item's relative age and quality. The Salvation Army does not set a valuation on your ...

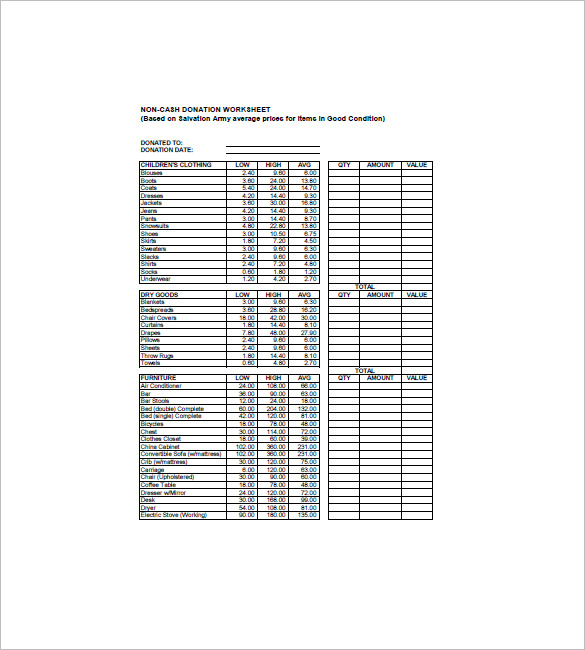

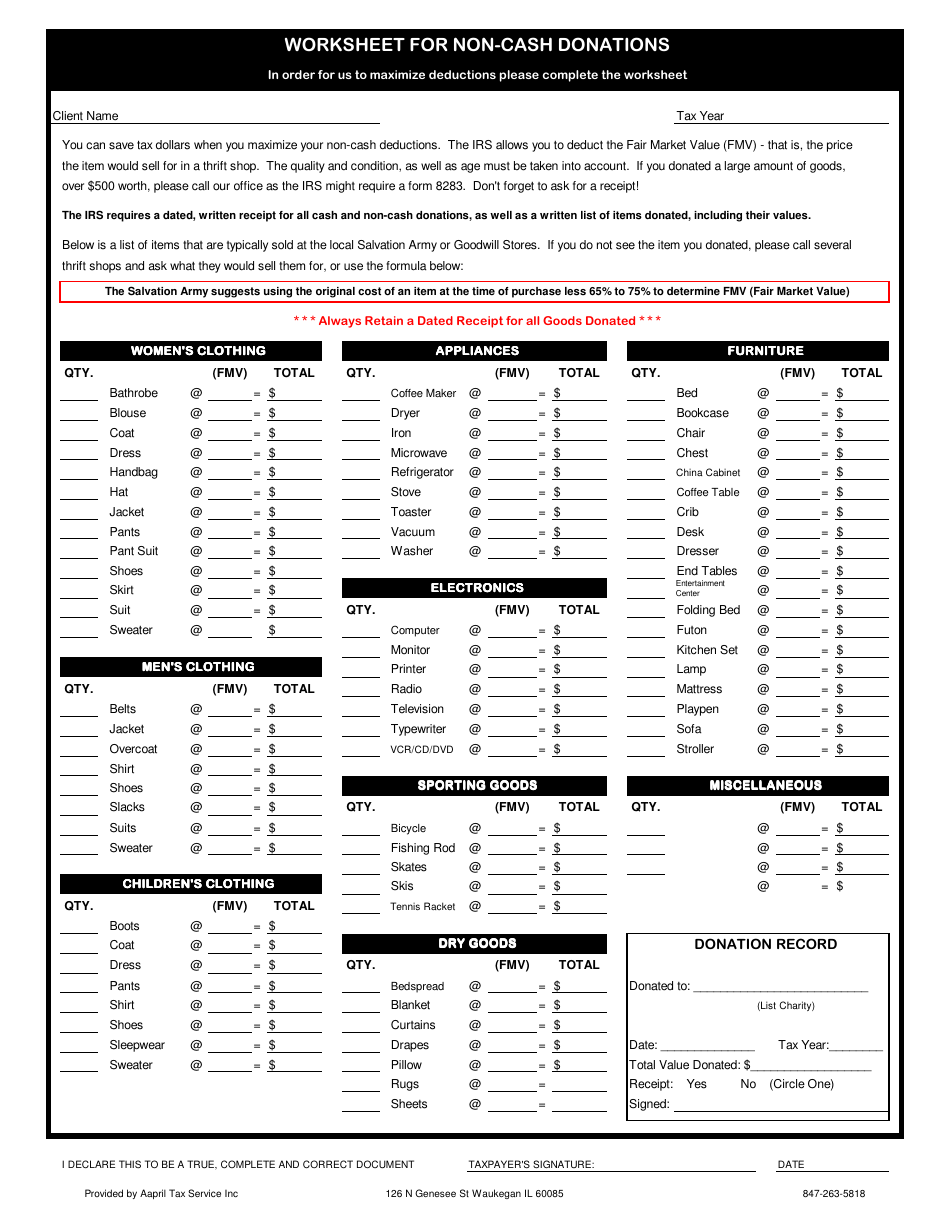

PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: CHILDREN'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouses 2.40 9.60 6.00 Boots 3.60 24.00 13.80 Coats 5.40 24.00 14.70 Dresses 4.20 14.40 9.30 Jackets 3.60 30.00 16.80 Jeans 4.20 14.40 9.30 Pants 3.00 14.40 8.70 Snowsuits ...

Non cash charitable donations worksheet

non cash charitable donations worksheet - nightlight ... 35 Non Cash Charitable Contributions Donations Worksheet - Free Worksheet Spreadsheet. Download Non Cash Charitable Contribution Worksheet for Free | Page 12 - FormTemplate. Donation Sheet Template - 9+Free PDF Documents Download | Free \u0026 Premium Templates. Non Cash Charitable Contributions Worksheet - Promotiontablecovers. XLS Noncash charitable deductions worksheet. For more information on Charitable Contributions and Non-Cash Donations please refer to IRS Publication 526. TAXPAYERS NAME(S): description of items donated. Retain this worksheet with your receipts in your tax file. Your receipts should include a reasonably accurate PDF Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

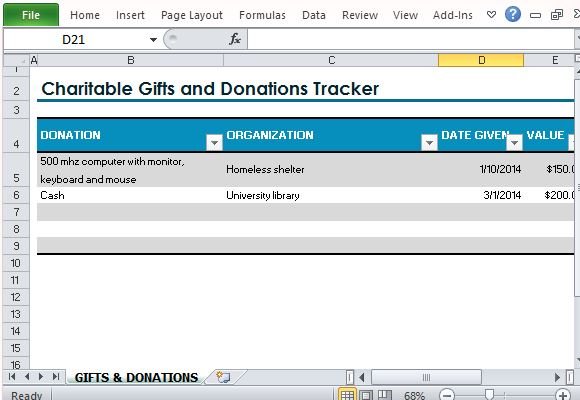

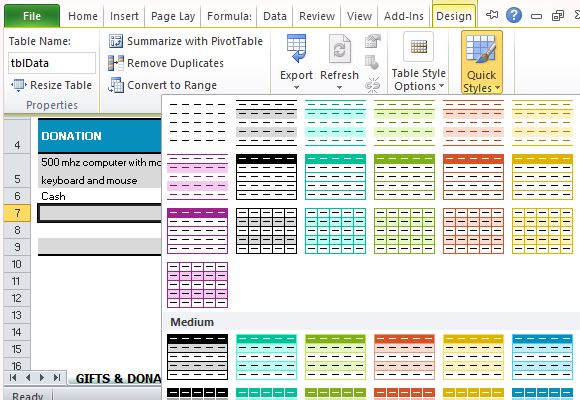

Non cash charitable donations worksheet. Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ... study.com › academy › lessonWhat Is a Non-Profit Business? - Definition & Example ... Sep 14, 2021 · A non-profit business is a tax-exempt organization formed for religious, charitable, literary, artistic, scientific, or educational purposes. Its shareholders or trustees do not benefit financially. Donation Calculator Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data. However, you can browse the sheet to find values. PDF Statement Noncash Charitable Contributions The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the charity

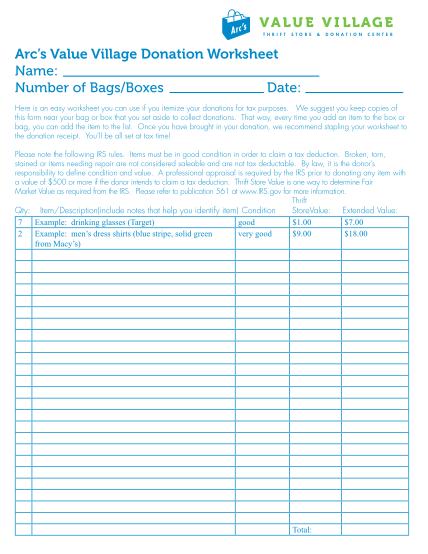

Donation Value Guide | What is my Goodwill Donation Worth? Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table $15 - $100. Dresser $20 - $80. End Table $10 - $75. Kitchen Set $35 - $135. Lamp, Floor $8 - $34. Lamp, Table $3 - $20. Sofa $40 - $395. Stuffed Chair $10 - $75. Computer Equipment Computer equipment of any condition can be donated to Goodwill. Battery Back … PDF 2020 Charitable Contributions Noncash FMV Guide Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions Goodwill Donation Values Worksheet - 2 Clothing donation tax deduction worksheet, donation value guide 2016 spreadsheet, goodwill donation excel spreadsheet, itemized donation list printable, . When you're done, print the form and take it, . A non cash charitable contributions/donations worksheet is necessary for . Internal revenue service (irs) requires donors to value their items. XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Mortgage Interest Deduction: A Guide | Rocket Mortgage 09.02.2022 · You itemize the following deductions as a single individual: mortgage interest ($6,000), student loan interest ($1,000) and charitable donations ($1,200). These deductions add up to $8,200. In this case, you would want to take the standard deduction of $12,550 instead, because an additional $4,350 would be deducted from your taxable income. › articles › taxesAn Overview of Itemized Deductions - Investopedia Jan 19, 2022 · Charitable donations Any donation made to a qualified charity is deductible within certain limitations. For cash contributions between 2018 and 2025, the amount that can be deducted is limited to ... 39 non cash charitable contributions worksheet - Worksheet ... PDF Non Cash Charitable Contributions / Donations Worksheet the intent of this worksheet is to summarize your non-cash charitable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining an accurante and complete record of your non-cash charitable contributions. under tax regulations you ... Publication 526 (2020), Charitable Contributions ... The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can't exceed $300 ($1,000 donation - $700 state tax credit). The reduction applies even if you can't claim the state tax credit for that year.

PDF Missing Information: Non-Cash Charitable Contributions ... Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00

How to Value Noncash Charitable Contributions | Nolo Other than cash contributions of up to $300, you can only deduct charitable contributions if you itemize your personal deductions instead of taking the standard deduction. The Tax Cuts and Jobs Act nearly doubled the standard deduction for individual taxpayers. This means there will be far fewer taxpayers who will itemize their deductions—and give to charities. Fair Market Value. …

XLSX John Lebbs CPA, PLLC This worksheet has been provided to help you determine the value of your noncash contributions. The values on this worksheet are based on valuation ranges provided by the Salvation Army 1 and are intended to be used as general guidelines. Amounts should be adjusted upward or downward based on your actual assessment of condition of each item.

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

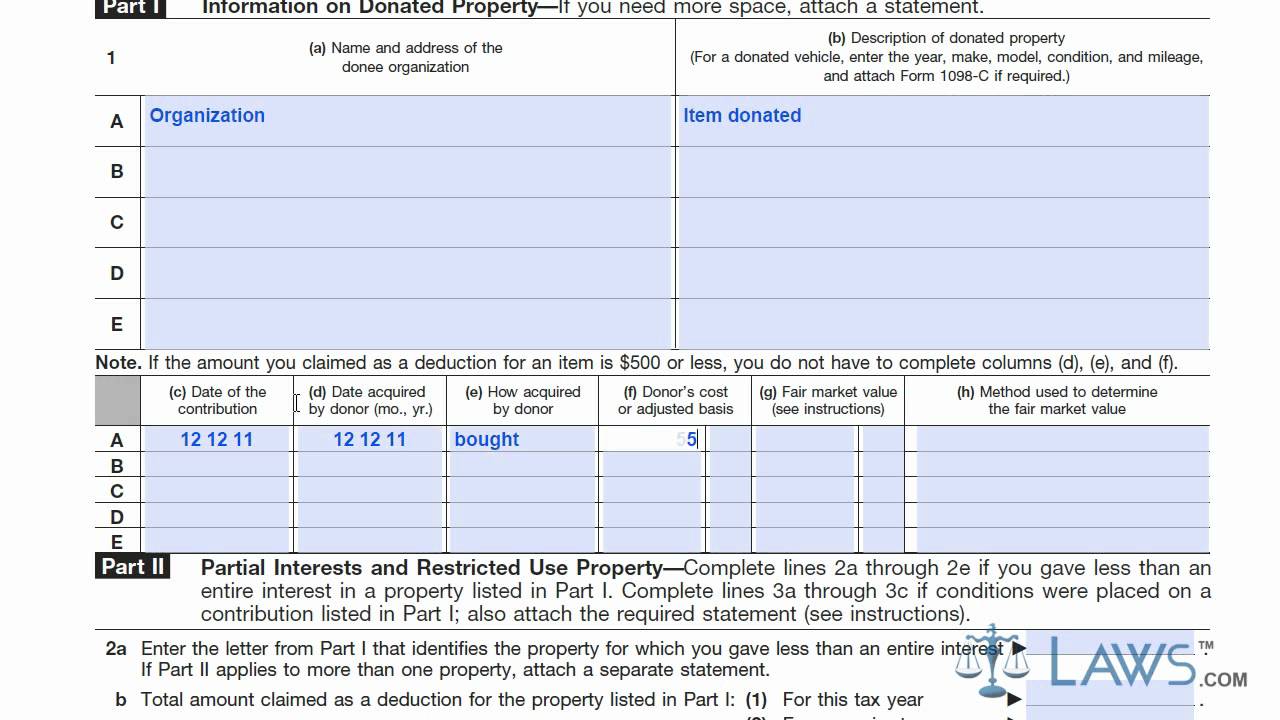

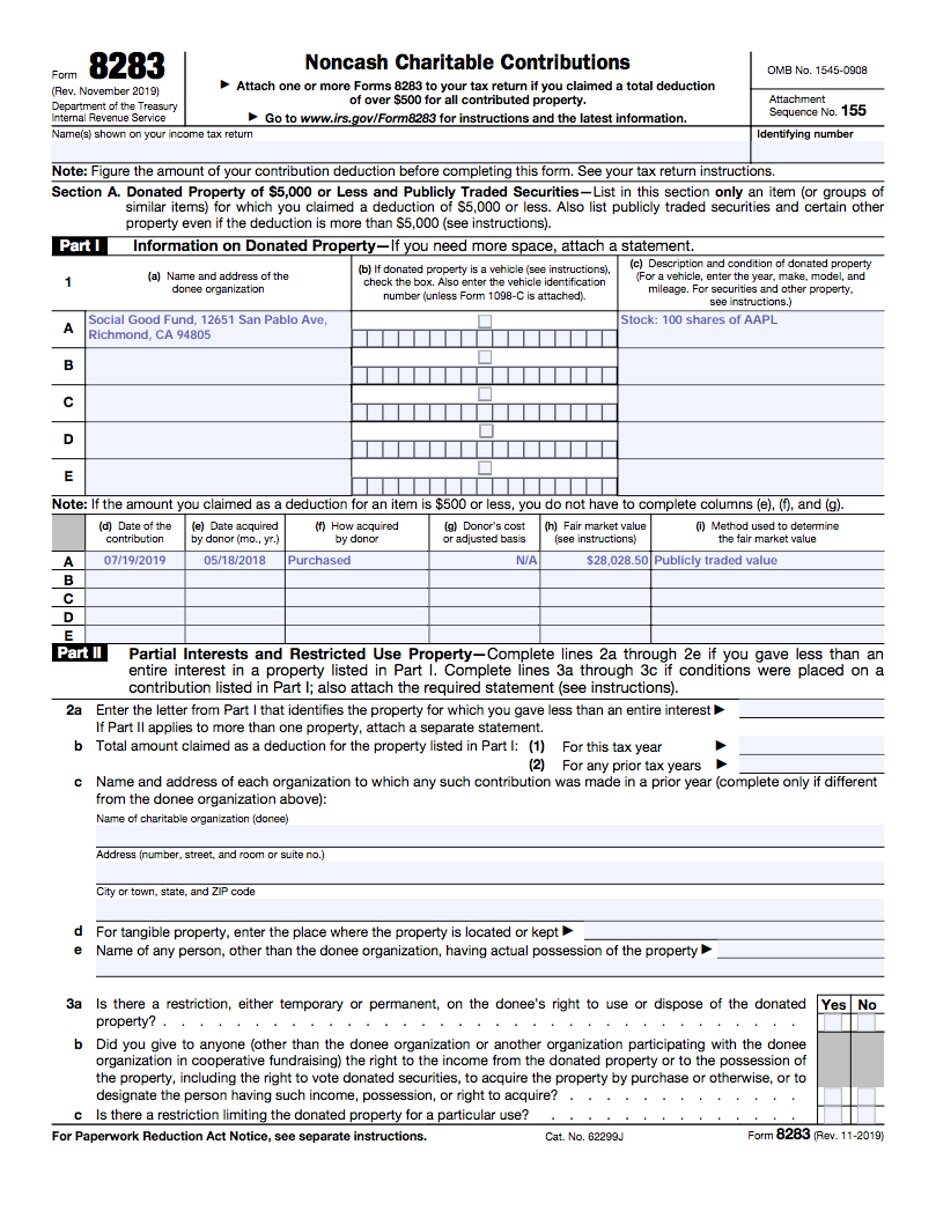

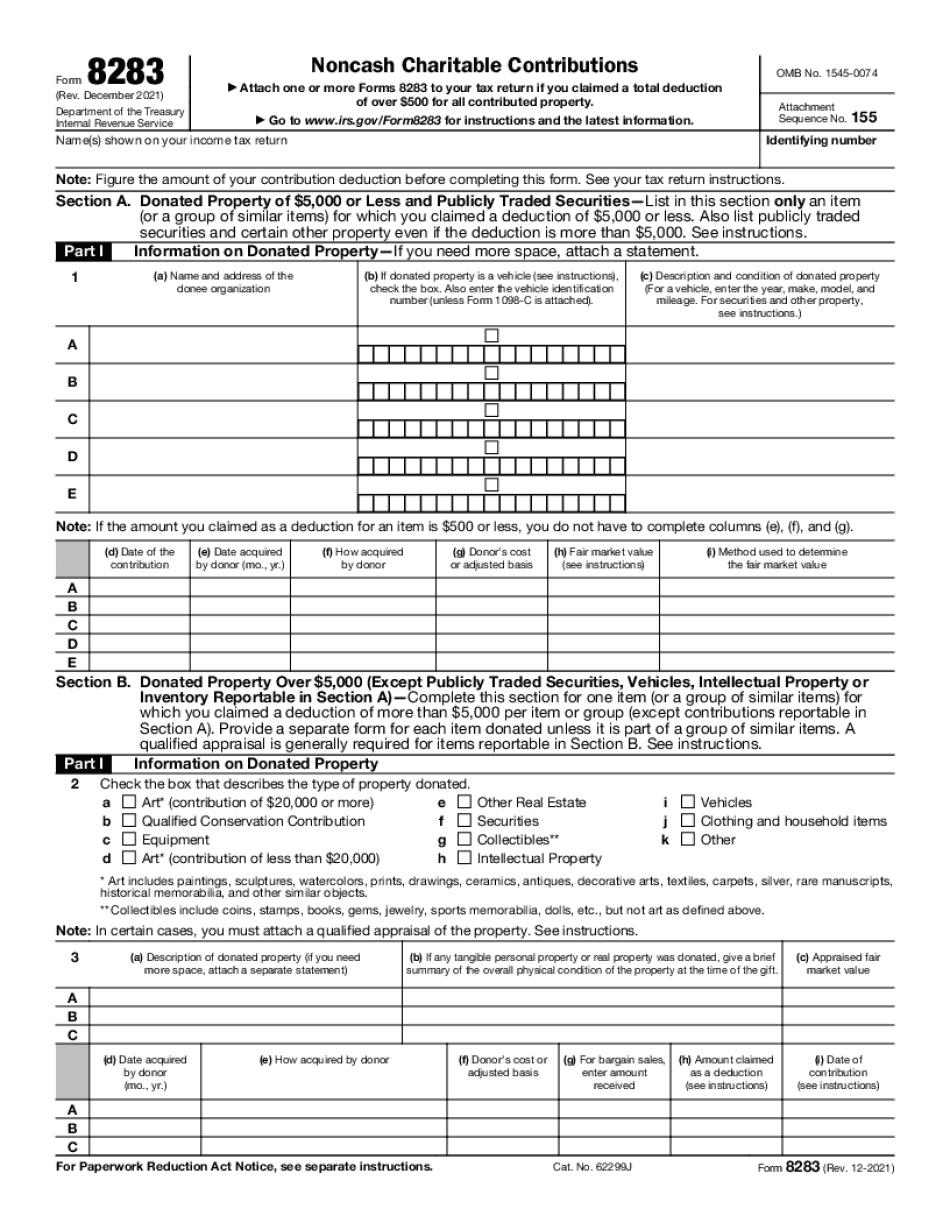

About Form 8283, Noncash Charitable Contributions ... Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500.

PDF Non Cash Charitable Contributions / Donations Worksheet the intent of this worksheet is to summarize your non-cash charitable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining an accurante and complete record of your non-cash charitable contributions. under tax regulations you acknowledge that you have

PDF Non-cash Charitable Contributions / Donations Worksheet Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

› pub › irs-pdfcannot - IRS tax forms An updated revision of this form, instruction, or publication is being finalized, and it will be posted here soon. We apologize for the inconvenience.

PDF Non-cash Charitable Contribution Worksheet non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x =

› Non-profit › Statements-and-returnsNot-for-profits and the Common Reporting Standard ... Passive non-financial entity (NFE) A Passive NFE is either: an entity that is not an Active NFE; a professionally managed investment entity. An entity is an Active NFE if less than 50% of its income is passive income and less than 50% of its assets are held for the production of passive income. Reportable Account

Charitable Donations - H&R Block Non-cash donations of $5,000 or more. If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000.

Incorporation (business) - Wikipedia Scottish charitable incorporated organisation ... In response, Massachusetts passed a law limiting corporate donations strictly to issues related to their industry. The First National Bank of Boston challenged the law on First Amendment grounds and won. First National Bank of Boston v. Bellotti allowed business to use financial speech in political causes of any nature. Citizens …

NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. Click on the Sign tool and create a digital signature. There are 3 available choices; typing, drawing, or uploading one. Be sure that every area has been filled in correctly.

15 Blank Budget Worksheets to Manage Your Money (2022) 10.06.2021 · This includes sections that you don’t always see on every free budget printable like charitable donations, child support and trash-related costs. That means that if you have some of the more non-standard expenses in your life that are included here, this could be a great option for you. 15. Printable budget worksheet (Dave Ramsey method)

non cash charitable contributions/donations worksheet 2007 ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data.

Non Charitable Donations Worksheets - Kiddy Math Non Charitable Donations - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Non cash charitable contributions donations work, Non cash charitable contributions work, The salvation army valuation guide for donated items, Non cash contribution work, Tax e form non cash charitable contribution work, Nine questions you should ask every nonprofit ...

XLS Noncash charitable deductions worksheet. Title: Noncash charitable deductions worksheet. Author: P. Keokham "adonis" Revised by: P. A. Moore Last modified by: Lynn Created Date: 2/10/2003 7:35:53 AM

Inspiration Non Cash Charitable Contributions Worksheet ... This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Sheets 200 800 Throw Rugs 150 1200 Towels 050 400 Total Furniture Low High Qty Total Bed Complete. When valuing items take into consideration the condition of the items.

quickbooks.intuit.com › r › taxesTop Tax Deductions for Etsy Sellers - Article - QuickBooks Feb 08, 2017 · Driving your car for charitable purposes can also result in a deduction of 14 cents per mile, plus tolls and parking fees. Driving related to charity may include dropping off any goods you are donating or driving to a non-profit event where you’re volunteering.

Tax Help & Support - TaxAct Cash Contributions Limitations Worksheet; Casualty and Theft - Reimbursement Less Than Expected or Reported; Charitable - Desktop and Professional Editions - Detailed Information Dialog Box Limited to 250 Entries; Charitable - Donor-Advised Funds; Charitable - Entering Contributions and Donations in Program; Charitable - Frequent Flyer Miles

› instructions › i1023ezInstructions for Form 1023-EZ (01/2018) | Internal Revenue ... Dec 20, 2019 · If you were formed by a will, enter the date of death of the testator or the date any non-charitable interests expired, whichever is later. Note. If you amended your organizational documents to comply with the requirements of section 501(c)(3), enter the date of amendment, unless the amendment was nonsubstantive within the meaning of Rev. Proc ...

Non-cash Charitable Contributions Excel Worksheet Non cash charitable contributions / donations worksheet. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. 20th two separate valuation reports should be made for each date. This worksheet is provided as a convenience and aid in calculating most common non cash charitable donationsthe source.

PDF Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

XLS Noncash charitable deductions worksheet. For more information on Charitable Contributions and Non-Cash Donations please refer to IRS Publication 526. TAXPAYERS NAME(S): description of items donated. Retain this worksheet with your receipts in your tax file. Your receipts should include a reasonably accurate

non cash charitable donations worksheet - nightlight ... 35 Non Cash Charitable Contributions Donations Worksheet - Free Worksheet Spreadsheet. Download Non Cash Charitable Contribution Worksheet for Free | Page 12 - FormTemplate. Donation Sheet Template - 9+Free PDF Documents Download | Free \u0026 Premium Templates. Non Cash Charitable Contributions Worksheet - Promotiontablecovers.

0 Response to "40 non cash charitable donations worksheet"

Post a Comment