42 itemized deduction worksheet 2015

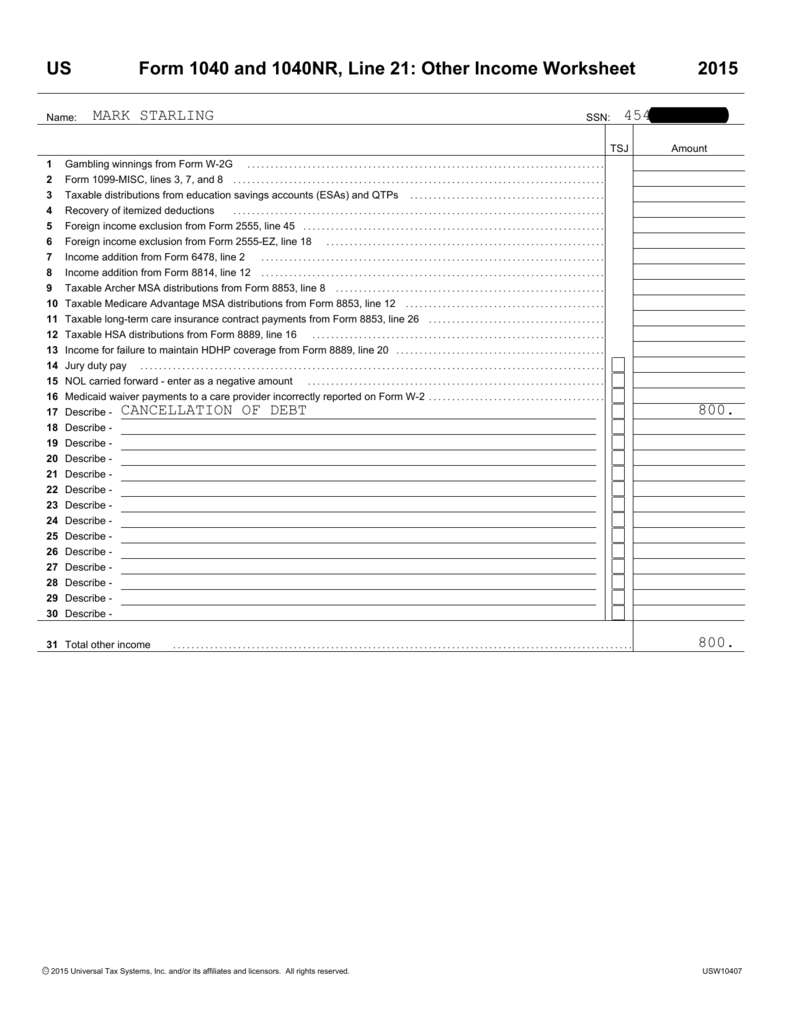

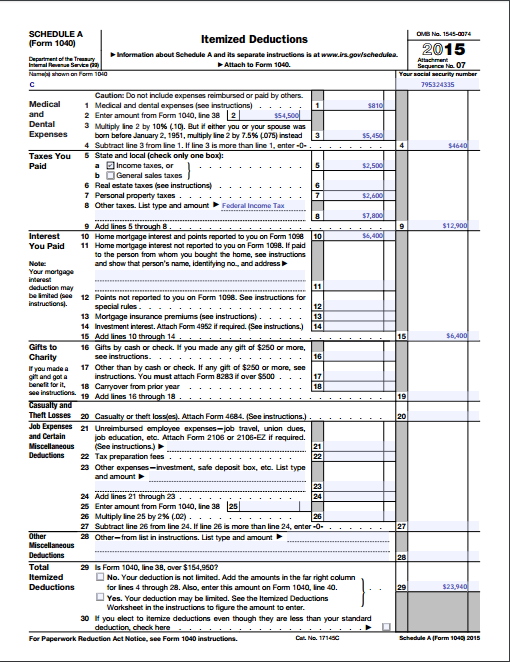

PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance PDF Attach to Form 1040. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ...

Prior Year Products - IRS tax forms 2021. Form 1040 (Schedule A) Itemized Deductions. 2021. Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions. 2020. Form 1040 (Schedule A) Itemized Deductions.

Itemized deduction worksheet 2015

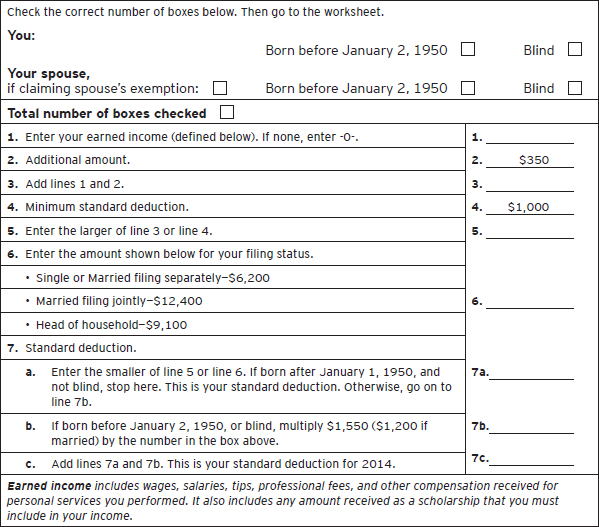

PDF Itemized Deduction Worksheet TAX YEAR - Maceyko Tax Itemized Deduction Worksheet Medical Expenses. Must exceed 7.5% of income to be a benefit. Include cost for dependents-do not include any expenses that were reimbursed by insurance Dentists $ Hospitals $ Doctors $ Insurance $ Equipment $ Prescriptions $ Eyeglasses $ Other $ Medical Miles _____ PDF Itemized Deductions Limitation Worksheet - 1040.com $154,950 for married filing separately for 2015. Subtract line 6 from line 5 Multiply line 7 by 3% (.03) Enter the smaller of line 4 or line 8 Enter the amount for your carryback year as follows: For 2008 and 2009, divide line 9 by 1.5; For 2006 and 2007, divide line 9 by 3.0; or For all other carryback years, enter -0-. Subtract line 10 from ... About Schedule A (Form 1040), Itemized Deductions - Internal ... Aug 23, 2021 — In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Current ...

Itemized deduction worksheet 2015. PDF 2015 737 Worksheet -- California RDP Adjustments Worksheet ... There are other itemized deductions that are also subject to the 2% limitation rule and some itemized deductions are subject to an overall limitation rule . Get federal Publication 17, Your Federal Income Tax, Part Five, Standard Deduction and Itemized Deductions . ... 2015 737 Worksheet -- California RDP Adjustments Worksheet Recalculated ... PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre- PDF Worksheet IX - Tax Benefit Rule for Recoveries of Itemized ... Complete a separate worksheet for each year. Use the information from Form 2 or 2M, Itemized Deductions, for the year the expense was deducted. If the only refund you received in 2017 was of a federal tax you deducted in 2016, use worksheet II. Example: You claimed a casualty loss as an itemized deduction on your 2015 Montana income tax return. 2015 Form 140PY Schedule A(PYN) Itemized Deductions 2015 Form 140PY Schedule A(PYN) Itemized Deductions For Part-Year Residents who also had Arizona source income during the part of the year while an Arizona nonresident. Before you complete Arizona Form 140PY, Schedule A(PYN), you must complete a federal Form 1040, Schedule A. You may itemize your deductions on your Arizona return even

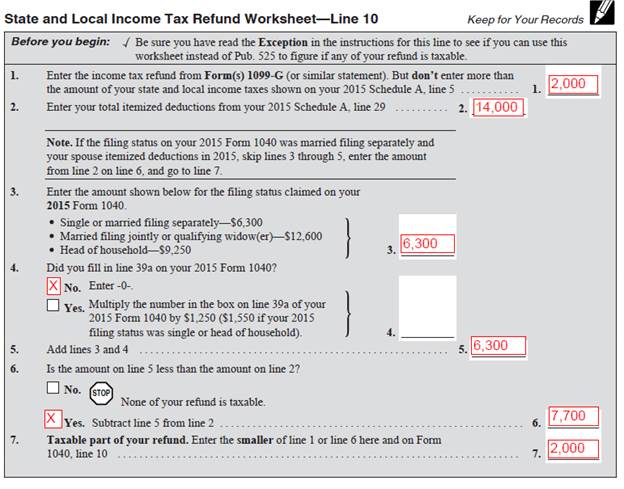

PDF 2015 PIT-1, page 1 Explain this… charitable deduction amount included in your itemized deductions on Form 1040, Schedule A. To calculate the amount of the charitable deduction to add back, click the button next to line 4, on the PIT-ADJ page, and complete the Charitable Deduction Worksheet. PDF Itemized Deductions Checklist - Affordable Tax Itemized Deductions Checklist Medical Expenses Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65. Some common medical expenses: Doctor/Dentist Fees Drug/Alcohol Treatment Cost of Guide Dogs Handicap Access Devices for Disabled Hospital Fees 42 itemized deduction worksheet 2015 - Worksheet Was Here Jan 09, 2022 · The Standard Mileage Rate for operating expenses of a vehicle for medical reasons is 23 cents per mile. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. The amounts will be reported on the Schedule KPI KS or KF you received from the entity. 2015 Schedule A Itemized Deductions Worksheet - Math ... Aug 31, 2021 · Miscellaneous itemized deductions in cluding the deduction for unreimbursed job expenses. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. Itemized deduction worksheet 2015. Itemized deductions also reduce your taxable income.

PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses. PDF Department of Taxation and Finance Instructions for Form ... a greater tax benefit from the college tuition itemized deduction. To compute your college tuition itemized deduction, complete Worksheet 1 below. Note: If the amount on Form IT-201, line 33, is more than $1,000,000, do not complete Part 4. You should claim the college tuition credit since your college tuition itemized deduction is reduced to zero. Schedule A (Form 1040) - Prior Year Products Results 1 - 76 of 76 — Form 1040 (Schedule A), Itemized Deductions, 2015. Inst 1040 (Schedule A), Instructions for Schedule A (Form 1040), Itemized Deductions ... PDF 2015 M1M, Income Additions and Subtractions Itemized Deduction Limitation Complete the worksheet for line 1 on this page if your federal adjusted gross income is more than $184,000 ($92,000 if married filing separate) and you filed federal Schedule A. Line 2 Personal and Dependent Exemption Phase Out Complete the worksheet for line 2 (on the next page) if your federal adjusted gross

42 itemized deductions worksheet 2015 - Worksheet Information Mar 02, 2022 · Itemized deductions worksheet 2015. 2015 Instructions for Schedule A (Form 1040) - Internal ... Jan 11, 2016 — In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you ... IT-203-D - Tax.ny.gov Itemized Deduction Schedule. IT-203-D. Submit this form with Form IT-203.

Solved: Itemized deduction worksheet? You can view your Scheule A: Itemized Deductions by taking the following steps: 1.) In the upper right-hand corner, click Forms. 2.) On the left-hand side, click O pen Form. 3.) Type Schedule A into the search bar. You can also view your Form 1040 while in Forms mode by finding it on the listed menu.

Worksheet for Itemized Deductions - Google Sheets Text r otation . Conditional f ormatting. A l ternating colors. C lear formatting Ctrl+\. Sort sheet by column A, A → Z. Sort sheet by column A, Z → A. So r t range by column A, A → Z. Sor t range by column A, Z → A. S ort range.

PDF Iowa Department of Revenue 2015 IA 104 2015 IA 104 Iowa Itemized Deductions Worksheet 41-104 (09/08/15) Use only if your federal AGI, plus bonus depreciation/section 179 adjustment from the IA 1040, line 14, is more than: $309,900 for married filing jointly or qualifying widow(er); $284,050 for head of

PDF Qualified Health Ins Premiums Worksheet 2015 - Missouri QUALIFIED HEALTH INSURANCE PREMIUMS WORKSHEET FOR MO-A, LINE 12 Complete this worksheet and attach it, along with proof of premiums paid, to Form MO-1040 if you included health insurance premiums paid as an itemized deduction or had health insurance premiums withheld from your social security benefits.

Iowa IA 104-Wkst (Itemized Deduction Worksheet) - 2021 ... 2018 IA 104 Iowa Itemized Deductions Worksheet This worksheet computes the amount of itemized deductions to enter on line 26 of the IA Schedule A for high income taxpayers. Step 1 Complete the IA 1040 Schedule A, lines 1-25. Step 2 Re-compute the federal Itemized Deduction Worksheet: 1.

Download Tax Filing Software Easy, Fast, Affordable - TaxAct TaxAct 2015 State 1040 Edition Finish Your State Return In Minutes! ... Itemized Deductions Worksheet for Nonresidents. Form N-15. Itemized Deductions Worksheet for Part-Year Residents. Form N-15. Capital Gain/Loss Worksheet. Form N-15. Interest Worksheet. Form N-15. Other Adjustments Worksheet.

PDF K-40 2015 Kansas Individual Income Tax You must have been a Kansas resident for ALL of 2015. K-40 2015. 114515 (Rev. 7/15) KANSAS INDIVIDUAL INCOME TAX . DO NOT STAPLE . Your First Name Initial Last Name Spouse's First Name Initial Last Name Mailing Address (Number and Street, including Rural Route) School District No. City, Town, or Post Ofice State Zip Code County Abbreviation

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

PDF 2014 Itemized Deductions Worksheet 2014 ITEMIZED DEDUCTIONS WORKSHEET For 2014 the "Standard Deduction" is $12,400 on a Joint Return, $9,100 for a Head of Household, and $6,200 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

PDF 2015 Form MO-1040A Individual Income Tax Return Single ... Worksheet For Net State Income Taxes, Line 9 of Missouri Itemized Deductions 2015 TAX CHART If Missouri taxable income from Form MO-1040A, Line 10, is less than $9,000, use the chart to figure tax;

Deduction | Iowa Department Of Revenue For tax year 2015, the itemized deduction for state sales and use tax is allowed on the Iowa Schedule A. If a taxpayer claimed an itemized deduction for state sales and use tax paid on the Federal return, the taxpayer must claim the itemized deduction for state sales and use tax paid on the Iowa return.

PDF Itemized Deductions Worksheet - integrityintaxllc.com Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return.

PDF Form IT-203-B:2015:Nonresident and Part-Year Resident ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a:

About Schedule A (Form 1040), Itemized Deductions - Internal ... Aug 23, 2021 — In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Current ...

PDF Itemized Deductions Limitation Worksheet - 1040.com $154,950 for married filing separately for 2015. Subtract line 6 from line 5 Multiply line 7 by 3% (.03) Enter the smaller of line 4 or line 8 Enter the amount for your carryback year as follows: For 2008 and 2009, divide line 9 by 1.5; For 2006 and 2007, divide line 9 by 3.0; or For all other carryback years, enter -0-. Subtract line 10 from ...

PDF Itemized Deduction Worksheet TAX YEAR - Maceyko Tax Itemized Deduction Worksheet Medical Expenses. Must exceed 7.5% of income to be a benefit. Include cost for dependents-do not include any expenses that were reimbursed by insurance Dentists $ Hospitals $ Doctors $ Insurance $ Equipment $ Prescriptions $ Eyeglasses $ Other $ Medical Miles _____

0 Response to "42 itemized deduction worksheet 2015"

Post a Comment