42 qualified dividends and capital gain tax worksheet

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet Short-term capital gains tax is a tax on profits from the sale of an asset held for one year or less. The short-term capital gains tax rate equals your ordinary income tax Rather than reinvest dividends in the investment that paid them, rebalance by putting that money into your underperforming investments. ACCA FM (F9) Past Papers: E2c. WACC... | aCOWtancy Textbook The dividend for 20X7 will be paid in the near future. Dividends paid in recent years have been as Required: (a) Calculate the after-tax weighted average cost of capital of Tufa Co on a market value DD Co has a dividend payout ratio of 40% and has maintained this payout ratio for several years.

The Dividend Tax Rate for 2021 and 2022 - SmartAsset Qualified dividends are subject to the lower capital gains tax rates. Naturally, there are some exceptions though. If you are unsure what tax implications The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. For 2021, these rates remain unchanged from 2020.

Qualified dividends and capital gain tax worksheet

qualified-dividends-tax-worksheet.pdffiller.com qualified dividends and capital gain tax worksheet fillable 2020. The challenge of maximizing the foreign tax credit on qualified... If the taxpayer has completed the "Qualified Dividends and Capital Gain Tax Worksheet" included in the instructions for Form 1040, U.S. Individual Income To adjust foreign-source qualified dividends or capital gain distributions, multiply the taxpayer's foreign-source qualified dividends or capital... Qualified Dividends And Capital Gain Worksheet - sdasingles.org All capital gains plus qualified dividends between $58,301 and $77,200 … The amount is used in the worksheet for calculating the Qualified Business Income Deductions taken on line 9 of the … Qualified Dividends and Capital Gain Tax Worksheet Before you begin: Before you begin...

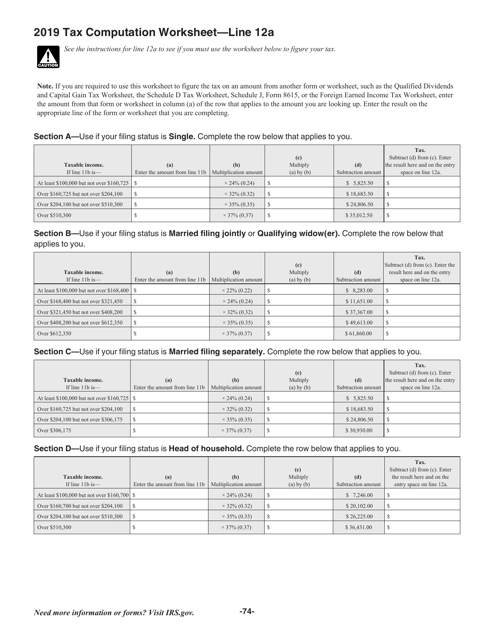

Qualified dividends and capital gain tax worksheet. Publication 505 (2022), Tax Withholding and Estimated Tax 2022 Annualized Estimated Tax Worksheet—Line 10 Qualified Dividends and Capital Gain Tax Worksheet · Worksheet 2-9.2022 Annualized Estimated Tax ... Qualified Dividends and Capital Gains Worksheet... - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified Dividends and Capital Gains Worksheet.pdf ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Tax reform Q&A Thread 1 - Pass-through and 20% deduction | Forum 10 any qualified REIT dividends, qualified cooperative. 11 dividends, or qualified publicly traded partnership. 12 income. IRC Section 199A(b)(1)(B) includes 20% of Qualified REIT Dividends - a defined term, which excludes section 857(b)(3) capital gain dividends and section 1(h)(11) qualified...

How to Figure the Qualified Dividends on a Tax Return - Zacks Figuring the tax on qualified dividends can throw even the most seasoned tax accountants for a loop. There are definitions to memorize, tax codes to adhere to and Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. Netherlands - Corporate - Income determination | Capital gains However, capital gains realised on disposal of shares qualifying for the participation exemption are tax exempt (see Dividend income below). For portfolio investment participations not qualifying for the participation exemption, double taxation will be avoided by applying the tax credit method, unless... PDF Tax Forms Guide Prior-Year Qualifying Person Worksheet, Screen 2.324 Figure 2-26. (printed when tax due, not visible on screen) Schedule A - Itemized Deductions Schedule B - Interest and Dividend Income Schedule C/C-EZ - Profit (5 copies: one for each business) Schedule D - Capital Gains and Losses. 2021 And 2022 Capital Gains Tax Rates - Forbes Advisor Long-term capital gains are taxed at lower rates than ordinary income, while short-term capital gains are taxed as ordinary income. We've got all the 2021 and 2022 capital gains tax rates in one place.

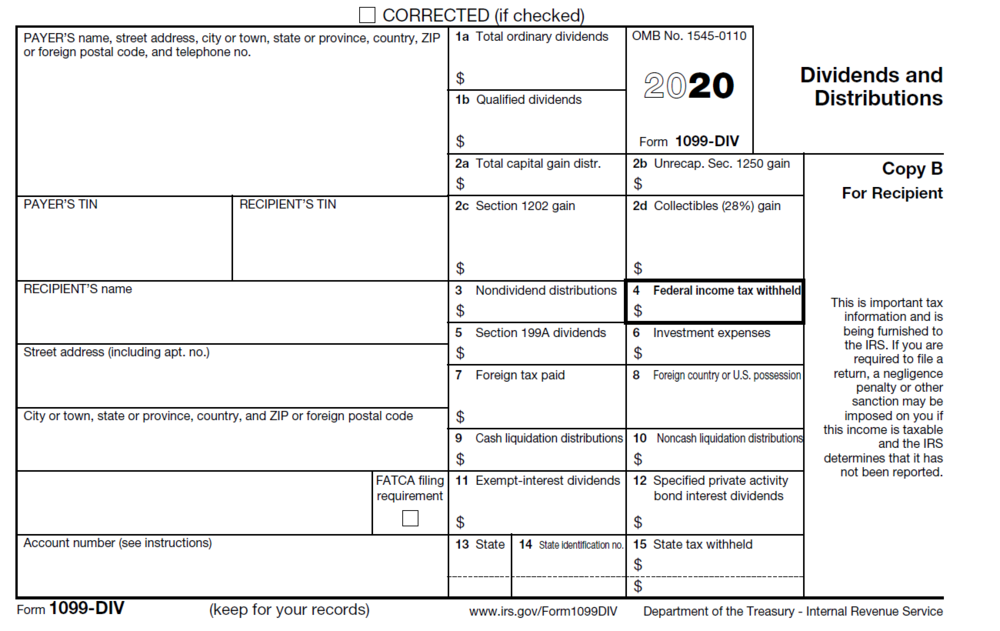

Screen B&D - Interest, Dividends, Capital Gains / Losses, REMICs... Enter total tax-exempt dividends, including dividend income attributable to private activity bonds issued after 8/7/86. Do not enter any tax-exempt Gain or loss is included in Schedule D, the NOL Worksheet as business capital gain or loss, in the income used to limit section 179 expense, and... Qualified Dividend Definition A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Qualified dividends must meet special requirements put in place by the IRS. The maximum tax rate for qualified dividends is 20... Qualified dividend - Wikipedia Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%. Qualified Dividends and Capital Gain Tax Worksheet (2020) Tools or Tax ros ea Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15.

Qualified Dividends - Fidelity Since 2003, certain dividends known as qualified dividends have been subject to the same tax rates as long-term capital gains, which are lower than Qualified dividends are generally dividends from shares in domestic corporations and certain qualified foreign corporations which you have held for at...

PDF Capital Gains and Losses Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16. If the demutualization transaction qualifies as a tax-free reorganization, no gain or loss is recognized on the ex-change of your equity interest in the mu-tual company for stock.

capital gains tax calculation worksheet - Search Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. The Capital gain or capital loss worksheet (PDF 143KB) calculates a capital gain or capital loss for each separate capital gains tax (CGT) event.

Qualified Dividends and Capital Gain Tax Worksheet Form 2015 ... capital gains worksheet 2021reate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them.

Difference Between Ordinary and Qualified Dividends | Compare the... Qualified dividends can be taxed at a lower capital gains tax rate, which is currently 0%-15%. Ordinary dividends and qualified dividends are similar to each other in that they both represent a form of income that a shareholder receives for holding shares in a company.

How Capital Gains and Qualified Dividends Are Taxed There are 4 advantages to taxpayers of capital gains taxes over the taxation of income earned from work To receive the preferential tax treatment for long-term capital gains, the taxpayer must use the Qualified Dividends and Capital Gains Tax Worksheet in the Form 1040 instructions.

Qualified Dividends and Capital Gains Worksheet.pdf - 2016... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.

Guide to Taxes on Dividends - Intelligent Income by Simply Safe... Qualified dividends are taxed at the long-term capital gains tax rate, as long as you hold each stock long enough. Currently that means a holding period of The lower tax rate associated with qualified dividends can go a long ways. For example, for lower to middle class investors, meaning those with...

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1.

Why is the system using tax worksheet item 4, Qualified Dividends... Capital gains can trigger all the income to be taxed at the Capital gains tax rate which starts at Zero. Look at the worksheet and follow the calculation. Long-term capital gains are generally taxed at lower rates than ordinary income.

PDF Wealth sets you free Tax Reckoner Dividend and Capital Dividend and Capital gain taxation in the hands of investors in. 8. The short term/long term capital gain tax will be deducted at the time of redemption of units in The FPI Regulations replaced the SEBI (Foreign Institutional Investor) Regulations, 1995 and the Qualified Foreign Investors framework, and...

How to Maximize the Foreign Tax Credit | Protax If the taxpayer has completed the "Qualified Dividends and Capital Gain Tax Worksheet" included in the instructions for Form 1040, U.S By treating the qualified dividend income as investment income, it is no longer subject to the qualified dividend adjustment for foreign tax credit purposes.

1040 (2021) | Internal Revenue Service - IRS tax forms

Capital gains, qualified dividends and return of capital FAQs The tax rate for qualified dividends is determined by an individual's taxable income and filing status. For tax planning purposes, you can see year-to-date dividends and capital gains on your quarterly statements under Activity Detail for each of your funds.

How Your Tax Is Calculated: Qualified Dividends and Capital ... Sep 24, 2021 · For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income. Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

2017 Qualified Dividends And Capital Gain Tax Worksheet Worksheets works extremely well as one tool that provides extra knowledge and to see the improvement belonging to the skills in a time required to finish, quantity of skills to always be included and importantly the idea which is a particular 2017 Qualified Dividends And Capital Gain Tax...

Self Assessment: Capital gains summary (SA108) - GOV.UK Use supplementary pages SA108 to record capital gains and losses on your SA100 Tax Return. The Capital gains summary form and notes have been added for tax year 2020 to 2021.

Qualified Dividends And Capital Gain Worksheet - sdasingles.org All capital gains plus qualified dividends between $58,301 and $77,200 … The amount is used in the worksheet for calculating the Qualified Business Income Deductions taken on line 9 of the … Qualified Dividends and Capital Gain Tax Worksheet Before you begin: Before you begin...

The challenge of maximizing the foreign tax credit on qualified... If the taxpayer has completed the "Qualified Dividends and Capital Gain Tax Worksheet" included in the instructions for Form 1040, U.S. Individual Income To adjust foreign-source qualified dividends or capital gain distributions, multiply the taxpayer's foreign-source qualified dividends or capital...

qualified-dividends-tax-worksheet.pdffiller.com qualified dividends and capital gain tax worksheet fillable 2020.

/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "42 qualified dividends and capital gain tax worksheet"

Post a Comment