43 2015 qualified dividends and capital gain tax worksheet

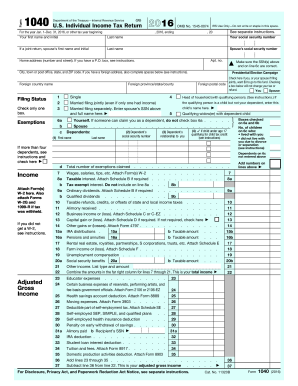

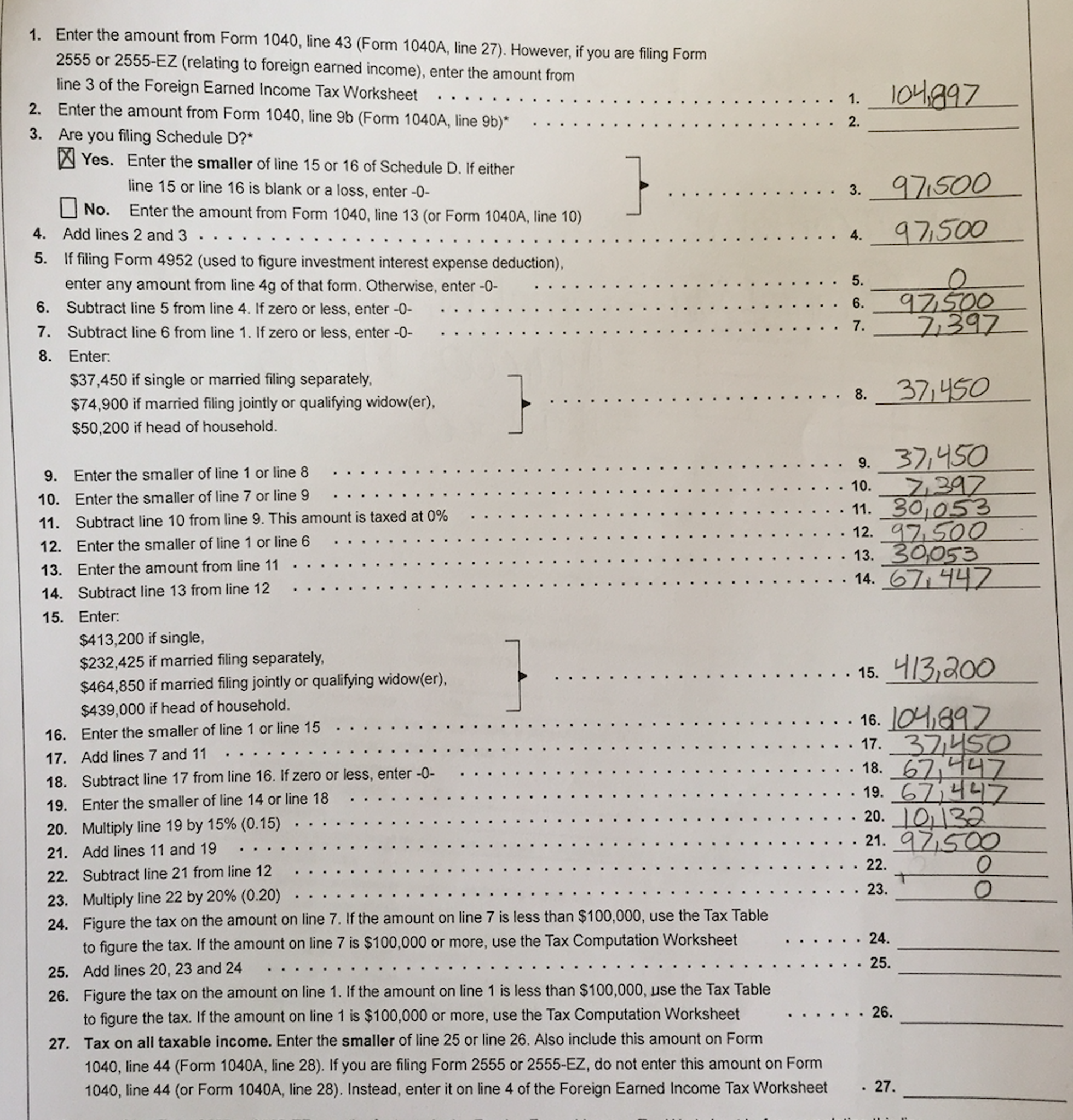

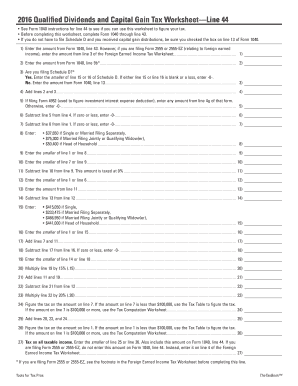

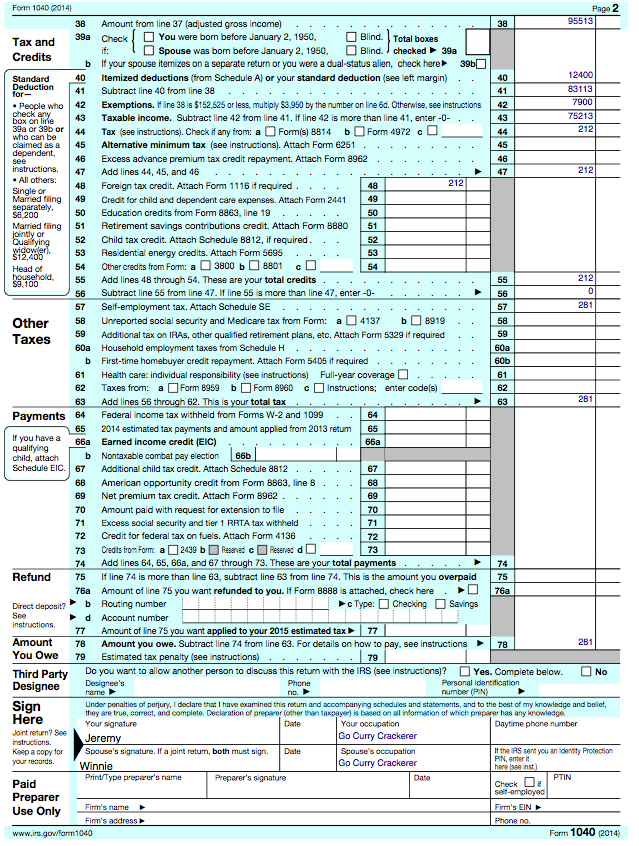

How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax... 40 capital gain worksheet 2015 - Worksheet Live Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Qualified Dividends and Capital Gain Tax - TaxAct The Tax Summary screen will then indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet. To review the Tax Summary in the TaxAct program: Click the vertical three-dots between the federal/state items and the shopping cart in the gray bar at the top of the screen, then click ...

2015 qualified dividends and capital gain tax worksheet

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments 42 qualified dividends and capital gain tax worksheet ... Qualified Dividends and Capital Gain Tax Worksheet for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106. 6%) were subject to the maximum long-term capital gains and qualified dividends rate (20%). Capital Gain Tax Calculation Worksheet and Similar ... Qualified Dividends And Capital Gains Tax Worksheet new worksheets.fonticello.com. Qualified Dividends And Capital Gains Tax Worksheet Posted on July 11, 2019 February 11, 2022 by admin Indirect costs are costs for which you'll need to finances, but is not going to be charged by SAIC.

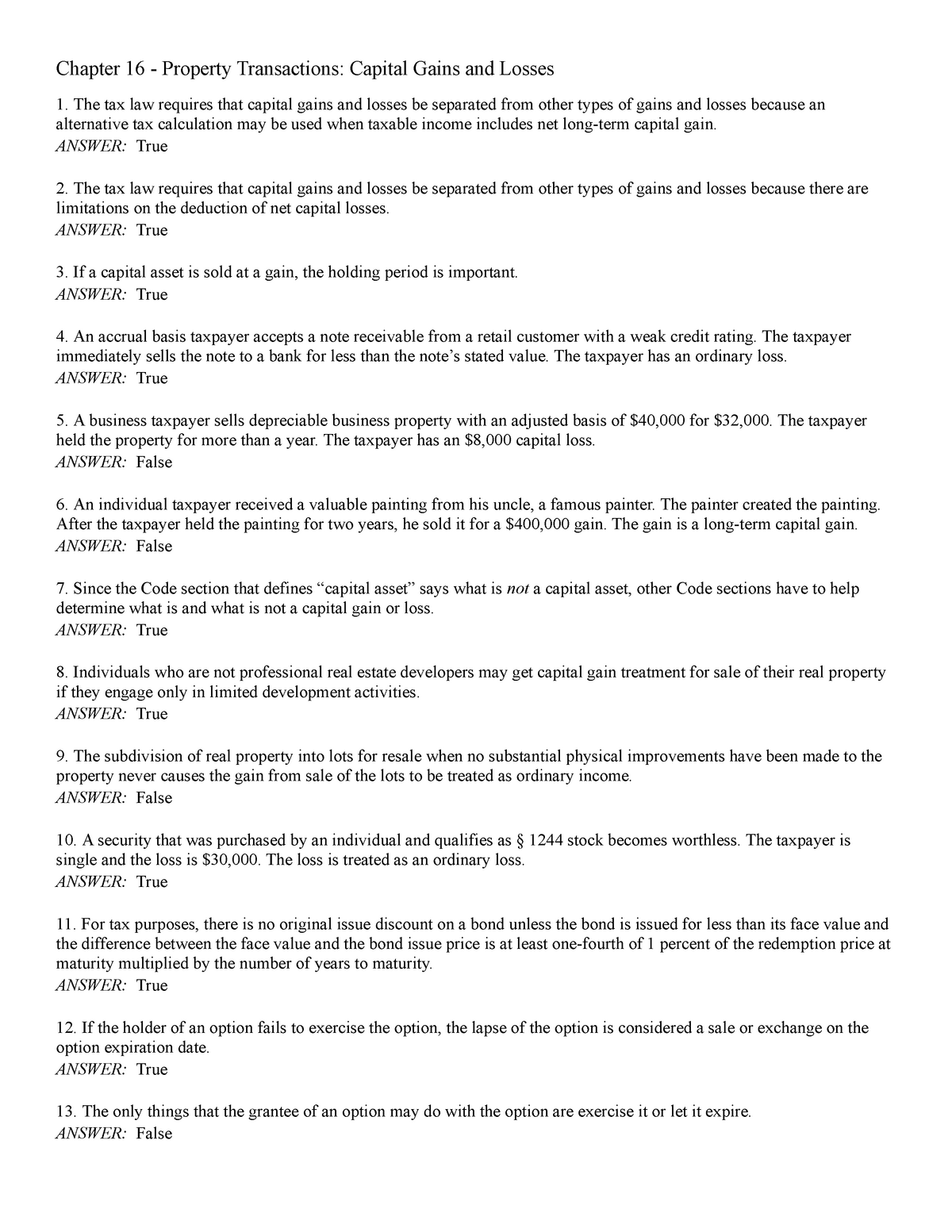

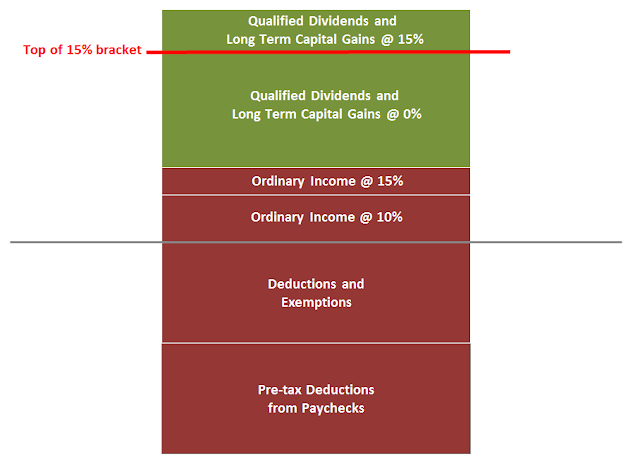

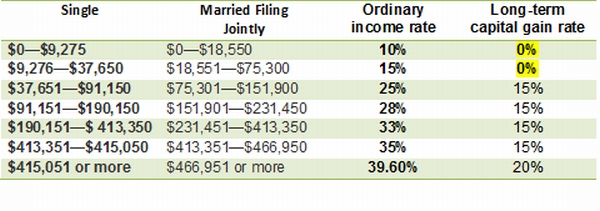

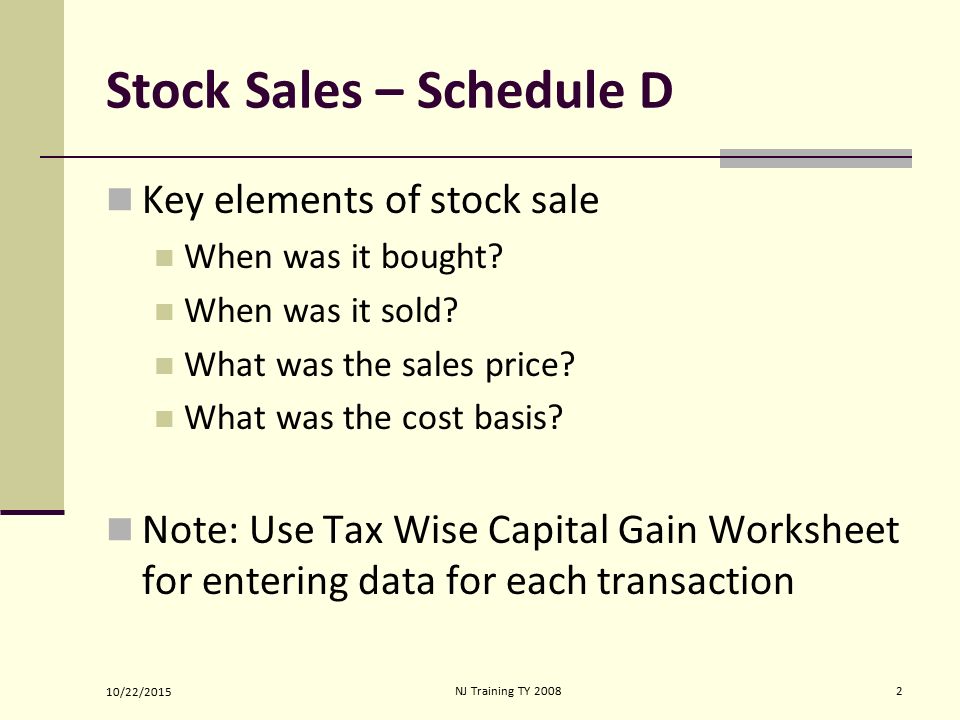

2015 qualified dividends and capital gain tax worksheet. PDF and Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information. How Capital Gains and Dividends Are Taxed Differently In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt from any tax. Investors who ... 40 qualified dividends and capital gain tax worksheet ... Qualified dividends are taxed at the same tax rate that applies to net long-term capital gains, while non-qualified If you have qualified dividends, you should use the qualified dividends and capital gain tax worksheet in the Form 1040 instructions to calculate your tax and take advantage of the... Qualified dividends and capital gain tax worksheet Qualified Dividends and Capital Gains Worksheet - ACC330 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

PDF 2015 Form 6251 - IRS tax forms Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 19 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. 39 capital gain worksheet 2015 - Worksheet Master capital gains tax worksheet to get professional and. 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. 2015 schedule d tax worksheet form 1040 schedule d instructions page d 15. 41 capital gain … 35+ Ideas For Qualified Capital Gains Worksheet 2015 30 Qualified Dividends And Capital Gain Tax Worksheet Calculator Worksheet Resource Plans. Dean Lance And Wanda 2015 Acc 321 Tax Accounting I Msu Studocu. Form 1040 Schedule J Income Averaging Form For Farmers And Fishermen 2015 Free Download.

Qualified Dividends and Capital Gain Tax - TaxAct Qualified Dividends and Capital Gain Tax With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate. And Gain Capital Tax Qualified Form Worksheet Dividends ... Search: Form Qualified Dividends And Capital Gain Tax Worksheet Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. Free Microsoft Excel-based 1040 form available ... Line 44 - Qualified Dividends and Capital Gain Tax Worksheet; Line 52 - Child Tax Credit Worksheet; Lines 64a and 64b - Earned Income Credit (EIC) Six additional worksheets round out the tool: W-2 input forms that support up to 4 employers for each spouse; 1099-R Retirement input forms for up to 4 payers for each spouse; SSA-1099 input ...

2021 Instructions for Schedule D (2021) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

Schedule D Tax Worksheet 2015 - worksheet Before completing this worksheet complete form 1040 through line 43. 2015 tax computation worksheet. Tax computation worksheet form 1040 instructions html. This form may be easier to complete if you round off cents to whole dollars. Otherwise complete the qualified dividends and capital gain tax worksheet in the instructions for forms 1040 and ...

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. Don't : complete lines 21 and 22 below. No. Complete the : Schedule D Tax Worksheet: in the instructions. Don't: complete lines 21 and 22 below. 21 : If line 16 is a loss, enter here and on Form 1040, 1040-SR, or 1040-NR, line 7, the :

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Qualified Dividends and Capital Gain Tax Worksheet Form ... Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Get form Checked the box on line 13 of Form 1040.

How to Dismantle an Ugly IRS Worksheet | Tax Foundation How to Dismantle an Ugly IRS Worksheet. February 27, 2015. Alan Cole. Alan Cole. In filing my own taxes, the most difficult part to calculate has always been the Qualified Dividends and Capital Gain Tax worksheet. I often have to do it several times in order to make sure I did not mess it up. And I work for Tax Foundation!

Qualified Dividends And Capital Gain Worksheet Qualified Dividends And Capital Gain Tax Worksheet. 2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. 2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. Review Alexander Smith S Information And The W2 Chegg Com.

2014 Qualified Dividends and Capital Gain Tax Worksheet ... 2014 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ...

Capital Gain Tax Worksheet - Diy Color Burst Qualified Dividends and Capital Gain Tax Worksheet. The positive gain here is equal to the selling price minus the buy price minus the buy commission minus the sale commission. Fill out securely sign print or email your qualified dividends tax worksheetpdffillercom 2015-2020 form instantly with SignNow.

41 1040 qualified dividends worksheet - Worksheet Live The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States.

Solved: How can I view and print a copy of the "Qualified ... Solved: How can I view and print a copy of the "Qualified Dividends and Capital Gains Tax Worksheet" form for my 2017 return?

Capital Gain Tax Calculation Worksheet and Similar ... Qualified Dividends And Capital Gains Tax Worksheet new worksheets.fonticello.com. Qualified Dividends And Capital Gains Tax Worksheet Posted on July 11, 2019 February 11, 2022 by admin Indirect costs are costs for which you'll need to finances, but is not going to be charged by SAIC.

42 qualified dividends and capital gain tax worksheet ... Qualified Dividends and Capital Gain Tax Worksheet for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106. 6%) were subject to the maximum long-term capital gains and qualified dividends rate (20%).

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

0 Response to "43 2015 qualified dividends and capital gain tax worksheet"

Post a Comment