38 nc-4 allowance worksheet

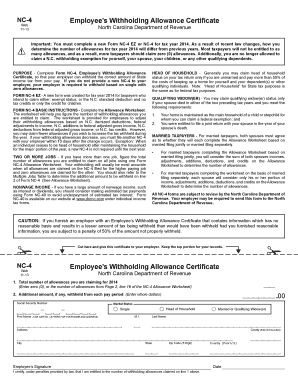

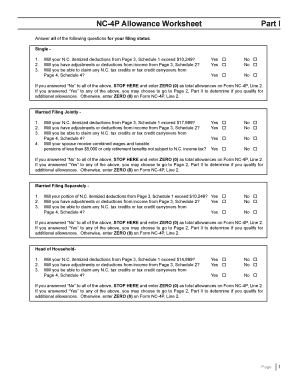

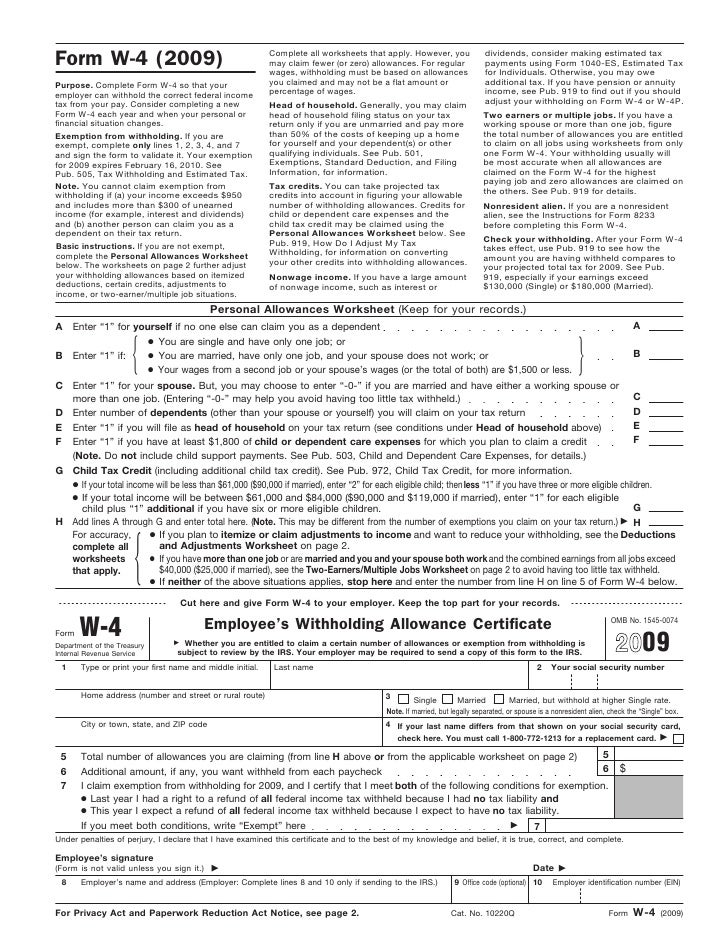

Nc 4 Employee S Withholding 9 16 Allowance Certificate Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. BASIC INSTRUCTIONS. Complete the Personal Allowances Worksheet on Page 2. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits. › media › 11624c; sides of paper. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Child and Adult Care Food Program: Center-Based Component Child and Adult Care Food Program: Center-Based Component. The following are forms, fact sheets, and links to federal regulations and policy memorandums from the Ohio Department of Education (ODE) that pertain to administration of the Child and Adult Care Food Program (CACFP) Center-Based component.

Nc-4 allowance worksheet

HUD Income Guidelines - Westchestergov HUD Income, Sales and Rent Limits. To qualify for housing programs households or individuals must meet the U.S. Department of Housing and Urban Development's (HUD) Income Limits. The income limits, expressed as a percentage of the County's area median income (AMI), are used in calculating the rents and sales prices of affordable housing. How Many Tax Allowances Should You Claim? - SmartAsset Finally, Section 4 of the W-4 is a bit more indefinite. Here you'll be able to state other income and list your deductions, which can help reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible. Small Business Tax Deductions for 2022 [LLC & S Corp Write ... 4. Health insurance tax deductions. It's possible to claim the health insurance you pay as a tax write-off. The amounts that you pay on behalf of your employees can be claimed on the employer's income tax return. You need to attach Form 8941- Credit for Small Employer Health Insurance Premiums.

Nc-4 allowance worksheet. Personal Income Tax for Nonresidents | Mass.gov This guide has general information about Personal Income tax for nonresidents. It is not designed to address all questions which may arise nor to address complex issues in detail. Nothing contained herein supersedes, alters or otherwise changes any provision of the Massachusetts General Laws, Massachusetts Department of Revenue Regulations, Department rulings or any other sources of the law. › w-4-tax-withholding-forms-by-statesTax Withholding Forms by States for Employees to Submit Colorado Income Tax Withholding Worksheet for Employers Form DR 1098. Connecticut. ... Employee’s Withholding Allowance Certificate Form NC-4. North Dakota. FNS Documents & Resources (Compact View) | Food and ... Assistance for Babies, Young Children & Women (1) Assistance for Babies, Young Children & Women (1) Center for Nutrition Policy and Promotion (CNPP) (90) Center for Nutrition Policy and Promotion (CNPP) (90) Child and Adult Care Food Program (792) Child and Adult Care Food Program (792) Child Nutrition Programs (1205) Child Nutrition Programs ... 2018-2021 Child Support Calculator The court has the final authority to determine the amount of child support awarded. The amount yielded by this calculator is only an estimate and is not a guarantee of the amount of child support that will be awarded. Please see an attorney for more detailed information. Enter the required data for the selected forms.

Moving Expense Deduction | Mass.gov Overview. Employees or self-employed individuals may deduct the expense of moving themselves and their families provided the move relates to employment or business income that is subject to Massachusetts tax. Moving Expense Reimbursements may not be claimed as a deduction. Out of pocket expenses, however, may be deducted. Payroll tax withholding: Everything employers need to know If your employee was hired in 2019 or prior, you can continue to use the information they provided on the old W-4. It includes a worksheet that allows your employees to calculate withholding allowances for dependents and children. Some employees may want to fill out a new W-4 if they work a second job, get married, have a child, or get divorced. Fuel Surcharge Chart - Cheeseman Transport Fuel Surcharge Chart. When the DOE (Department of Energy) National fuel index national average falls into one of the following categories, a fuel surcharge will be added to the net charges on a single shipment. D.O.E. Diesel Fuel Index is updated every Monday at 4:00pm and will be effective the following Tuesday. DOR Withholding Tax Forms | Mass.gov Form M-3: Reconciliation of Massachusetts Income Taxes Withheld for Employers (PDF 39.92 KB) Open PDF file, 34.7 KB, for. Form M-4-MS: Annual Withholding Tax Exemption Certificate for Nonresident Military Spouse (PDF 34.7 KB) Open PDF file, 87.17 KB, for. Form M-4: Massachusetts Employee's Withholding Exemption Certificate (PDF 87.17 KB)

Learn about the income tax paid to another jurisdiction credit If you qualify, enter the amount from Line 9 of the worksheet on Form 1, Line 30. Complete and include Schedule OJC, Income Tax Due to Other Jurisdictions. Part-year residents - Calculate the credit on the Form 1-NR/PY Worksheet for Taxes Due Any Other State (part-year residents only). If you qualify, enter the amount from Line 9 of the ... Instructions & Tips to Help You Fill Out & Submit a W-4 Form Start the Taxometer for Your W-4 Tool Complete, Submit a W-4 To complete a W-4, you need to enter some personal information (name, address, Social Security number, and filing status), your amount of simultaneously held jobs, your dependents, and any other adjustments or deductions all finalized by your signature at the bottom. Tax Withholding Forms by States for Employees to Submit Colorado Income Tax Withholding Worksheet for Employers Form DR 1098. Connecticut. Connecticut Employee's Withholding Certificate Form CT-W4. Delaware. Employee Withholding Allowance Certificate Form W-4. Washington, D.C. DC Withholding Allowance Worksheet Form D-4. Florida. Florida does not have Income Taxes. You might have to submit a tax withholding … Learn about filing status on Massachusetts personal income tax For federal purposes, there are 5 filing statuses: Single. Married filing a joint return. Married filing a separate return. Head of household. Qualifying widow (er) with dependent child. Massachusetts offers all but the qualifying widow (er) with dependent child. Generally, if you claim this status federally, you qualify for head of household ...

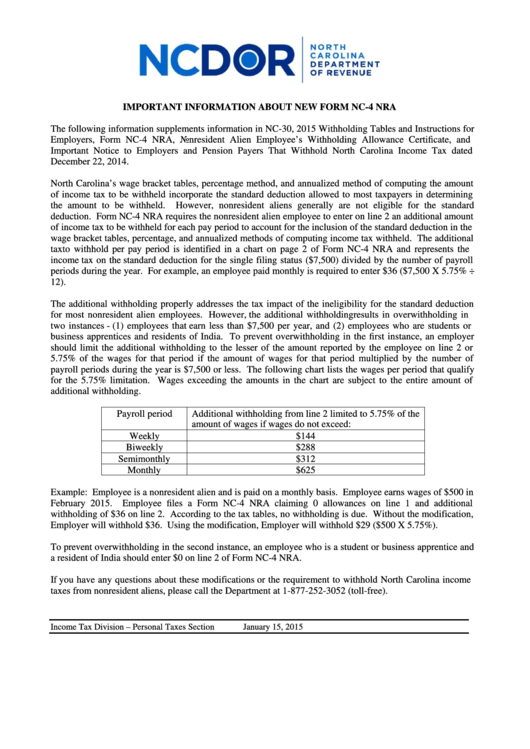

› taxes-forms › individual-income-taxFrequently Asked Questions Regarding Military Spouses - NCDOR If a new Form NC-4 EZ is not provided by February 15, the employer is required to withhold based on single status with zero allowances. If, during the year, the spouse no longer meets the requirements for exemption on line 4, the spouse must complete a new Form NC-4 EZ. 12.

mmhouse.info › sugarsymptoms400 › blood-sugar-levelsugarsymptoms400 😔natural home remedies for Apr 26, 2022 · 1. The estimated number of people in the US that have diabetes (diagnosed or undiagnosed) is: 22 million 650,000 16 million 8.5 million: 2. Diabetes mellitus is characterized by hypoglycemia.

PDF Nc 4 Employee S Withholding 9 16 Allowance Certificate NC-4 Web Employee's Withholding 12-18 Allowance Certificate PURPOSE - Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. If you do not provide an NC-4 to your employer, your employer is required to withhold based on the filing status, "Single" with zero allowances.

B3-4.2-02, Depository Accounts (05/04/2022) - Fannie Mae Depository Accounts. Funds held in a checking, savings, money market, certificate of deposit, or other depository accounts may be used for the down payment, closing costs, and financial reserves. The funds must be verified as described in B3-4.2-01, Verification of Deposits and Assets. Unverified funds are not acceptable for the down payment ...

Cost Reports | CMS HCRIS Data Disclaimer The Centers for Medicare & Medicaid Services (CMS) has made a reasonable effort to ensure that the provided data/records/reports are up-to-date, accurate, complete, and comprehensive at the time of disclosure. This information reflects data as reported to the Healthcare Cost Report Information System (HCRIS). These reports are a true and accurate representation of the ...

21st Century Accounting - Payroll Tax Updates If the employee did NOT complete the optional DR 0004 Form, enter an amount in the Allowances box based on the filing status checked on the IRS W-4. Each Allowance is worth $4000 and should either be entered as a "1" for Single or Married filing Separately or "2" for Married filing jointly or a qualifying Widow/er.

Provider Relief Fund Reporting Requirements and Auditing All recipients of PRF payments must comply with the reporting requirements described in the Terms and Conditions and specified in directions issued by the U.S. Department of Health and Human Services (HHS) Secretary.. Step 1: Register in the Provider Relief Fund Reporting Portal

Small Business Tax Deductions for 2022 [LLC & S Corp Write ... 4. Health insurance tax deductions. It's possible to claim the health insurance you pay as a tax write-off. The amounts that you pay on behalf of your employees can be claimed on the employer's income tax return. You need to attach Form 8941- Credit for Small Employer Health Insurance Premiums.

How Many Tax Allowances Should You Claim? - SmartAsset Finally, Section 4 of the W-4 is a bit more indefinite. Here you'll be able to state other income and list your deductions, which can help reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

0 Response to "38 nc-4 allowance worksheet"

Post a Comment