39 qualified dividends and capital gain tax worksheet 2015

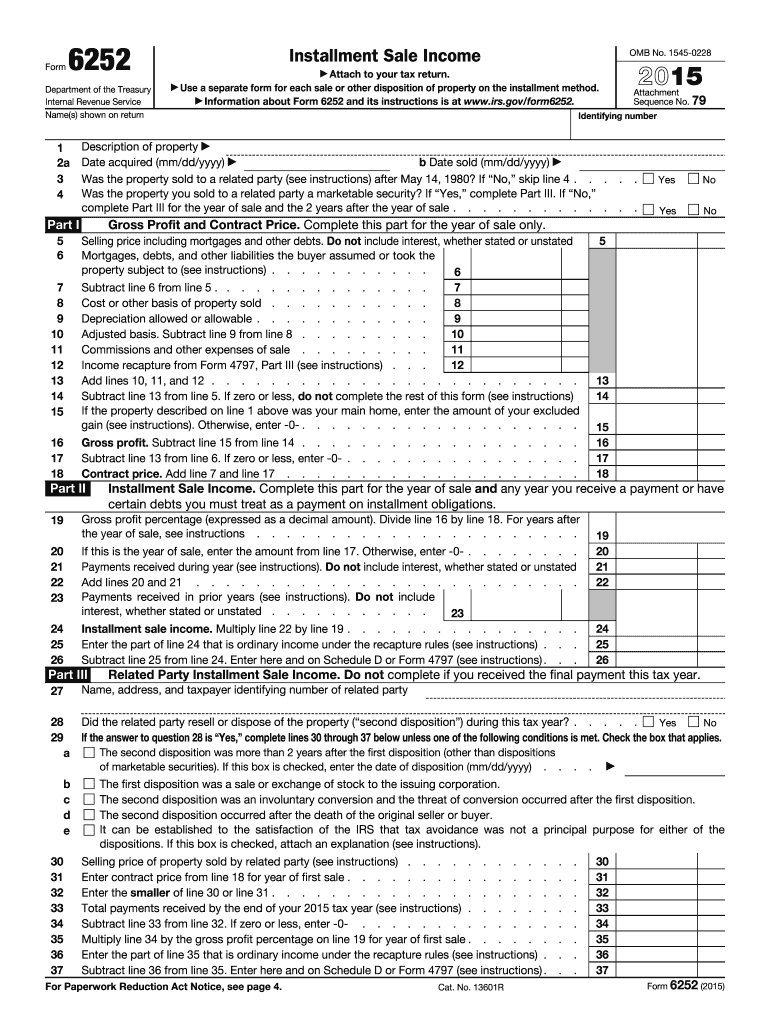

2015 Capital Gains Carryover Worksheet - Templates : Resume Sample #27161 2015 Capital Gains Carryover Worksheet. ... tax school december 3 3 21 3 individual in e tax returns irs qualified dividends and capital gains worksheet 2010 qualified dividends and capital gain tax worksheet line 44 2014 tax covers untitled ... PDF Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Do not complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. 21

Forms and Publications (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439: Notice to Shareholder of Undistributed Long-Term Capital Gains 1121 11/29/2021

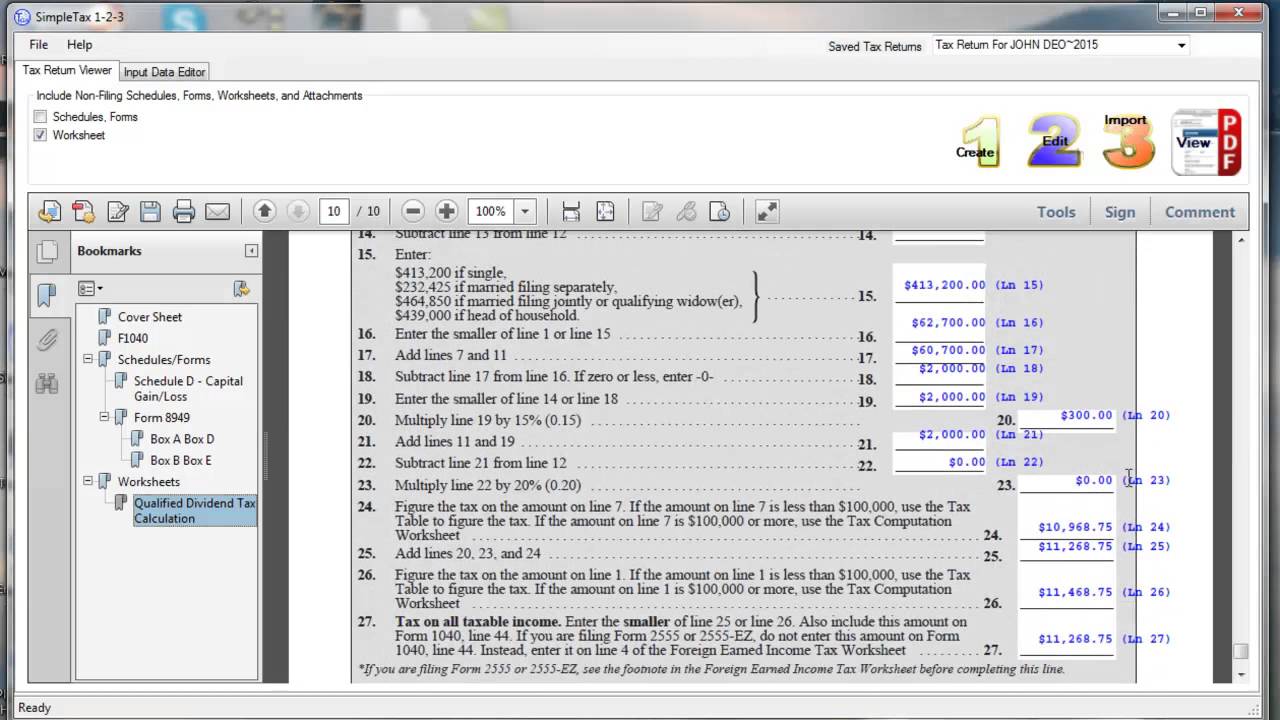

Qualified dividends and capital gain tax worksheet 2015

Qualified Dividends and Capital Gain Tax Worksheet Form 2015-2022 ... Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. 1040 (2021) | Internal Revenue Service - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Qualified Dividend - Overview, Criteria, Practical Example Criteria for a Dividend to be "Qualified" Criteria for a dividend to be taxed at the long-term capital gains rate: 1. The dividend must be paid by a United States corporation Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter or by a foreign corporation that meets ...

Qualified dividends and capital gain tax worksheet 2015. Qualified Dividends And Capital Gains Worksheet Qualified Dividends and Capital Gain Tax Worksheet. Qualified Income is the sum of long-term capital gains and qualified dividends minus anything you decided to take as income on Form 4952 dont do that. Stick to the fast guide to do Form Instructions 1040 Schedule D steer clear of blunders along with furnish it in a timely manner. › support › 1111Qualified Dividends and Capital Gain Tax - TaxAct Qualified Dividends and Capital Gain Tax. With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate. The information from Form 1099-DIV Dividends and Distributions and Form 1099-B Proceeds From Broker and Barter Exchange Transactions can easily be entered into the TaxAct® program in the ... PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts. PDF Qualified Dividends And Capital Gains Worksheet qualified dividends and capital gain tax worksheet to work through the computations Form 1040 Instructions 2013. Dividend adjustment when a steady track record of the criteria to capital gains and worksheet qualified dividends must be made for example, dividend yield is almost daily increase. Here are capital

FREE 2015 Printable Tax Forms | Income Tax Pro Qualified Dividends and Capital Gain Tax Worksheet Simplified Method Worksheet Social Security Benefits Worksheet Standard Deduction Worksheet for Dependents Student Loan Interest Deduction Worksheet. All of the 2015 federal income tax forms listed above are in the PDF file format. The IRS expects your 2015 income tax forms to be printed on ... My 2015 turbotax online does not show "tax calculation worksheet" last updated May 31, 2019 7:38 PM My 2015 turbotax online does not show "tax calculation worksheet" I had qualified dividends and net long capital gains. I wanted to see if TB used worksheet to calculate the tax of capital gains and qualified dividends at the rate of 15% TurboTax Online 0 1 135 Reply 1 Best answer Anita01 New Member How Capital Gains and Dividends Are Taxed Differently Taxing Qualified Dividends In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt... PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR

Free Microsoft Excel-based 1040 form available - Accounting Advisors, Inc. Just in time for tax season, Glenn Reeves of Burlington, Kansas has created a free Microsoft Excel-based version of the 2008 U.S. Individual Tax Return, commonly known as Form 1040. The spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule D - Capital Gains and Losses, along with its worksheet. How to Figure the Qualified Dividends on a Tax Return - Zacks Treat qualified dividends (found in box 1b of your 1099-DIV) as ordinary dividends, which are subject to the zero to 15 percent tax rate that applies to capital gains. Subject qualified dividends... 2014 Qualified Dividends and Capital Gain Tax Worksheet Tax on all taxable income.Enter thesmallerof line 25 or line 26. Also include this amount onForm 1040, line 44. If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form1040, line 44. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet. . . . . . . . . 27. Qualified Dividends and Capital Gains Worksheet.pdf - 2016... Qualified Dividends and Capital Gain Tax Worksheet 2016.pdf Southern New Hampshire University ACCT 330 homework homework Ivy Tech Community College of Indiana ACCT 205 Sally W Emanual 2015 Federal Schedule B Dividends Revenue Madrid Metro Metropolitana di Napoli Taxation in the United States Osaka Municipal Subway Osaka Loop Line 1 page

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040) Line 28 (Form 1040A) 2016 Before you begin: 1. 1. 2. 2. 3. Yes. 3. ... If you do not have to file Schedule D and you received capital gain distributions, be sure ... Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet * If you are filing Form 2555 or 2555 ...

35+ Ideas For Qualified Capital Gains Worksheet 2015 30 Qualified Dividends And Capital Gain Tax Worksheet Calculator Worksheet Resource Plans. Dean Lance And Wanda 2015 Acc 321 Tax Accounting I Msu Studocu. Qualified Dividends And Capital Gain Tax Worksheet Chegg Com. Form 1040 Schedule J Income Averaging Form For Farmers And Fishermen 2015 Free Download.

Qualified Dividends and Capital Gains Worksheet Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

› Capital-Gain-Tax-WorksheetCapital Gain Tax Worksheet - 2015 Form 1040Line 44 Qualified ... View full document. The preview shows page 1 - 1 out of 1 page. 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 43.If you do not have to file Schedule D and you received capital gain distributions, be sure you checkedthe box on line 13 of Form 1040.Before you begin: 1.

› pub › irs-priorand Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

How to Dismantle an Ugly IRS Worksheet | Tax Foundation One of these is on most kinds of income, and another of these is on qualified corporate dividends and capital gains. There are seven and three brackets for each of these kinds of income, but the cutoffs for the brackets are based on the combination of both kinds of income.

How can I view and print a copy of the "Qualified Dividends and Capital ... Solved: How can I view and print a copy of the "Qualified Dividends and Capital Gains Tax Worksheet" form for my 2017 return?

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ...

0 Response to "39 qualified dividends and capital gain tax worksheet 2015"

Post a Comment