42 nebraska inheritance tax worksheet

› terms › tTaxes Definition Oct 14, 2021 · There is no federal inheritance tax, and, as of 2021, only six states have an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. ... “Worksheet Solutions: ... › wills › what-you-should-neverWhat You Should Never Put in Your Will - Policygenius Jan 19, 2022 · If you have specific details about how someone should use their inheritance, whether they are a spendthrift or someone with special needs, you may be better off opening a trust that can give you more control over your beneficiaries, even from beyond the grave. → Learn what to include in a will. Other things you may not want to put in a will

revenue.nebraska.gov › sites › revenueFile with the county Personal Property Return Tax ... - Nebraska that is tax-free for income tax purposes, the Nebraska adjusted basis is the same as it was for the previous owner. Example 2. A son inherits a business from his father. The tangible personal property of the business will have the same Nebraska adjusted basis as it had when the business was owned by the father. The year the property was

Nebraska inheritance tax worksheet

Nebraska Medicaid Eligibility: 2022 Income & Asset Limits In 2022, the MNIL in Nebraska is $392 / month for an individual, as well as a couple. As an example, a Medicaid applicant with $1,500 / month in income would have a "share of cost" of $1,109 / month ($1,500 - $392 = $1,109). Once an individual or couple has met their "share of cost", they are eligible for Medicaid for the remainder of ... Calculating Your Potential Estate Tax Liability Your estate would owe a tax of $804,000 if you didn't make any taxable gifts during your lifetime that exceeded the annual exemption amounts: $7,500,000 net estate less $5,490,000 estate tax exemption equals $2,010,000 taxable estate. Your taxable estate is then multiplied by the 40% tax rate to arrive at your federal estate tax liability ... Nebraska Homestead Exemption | Property Assessment Contact. Property Assessment Division. 301 Centennial Mall South. PO Box 98919. Lincoln, NE 68509-8919. 402-471-5984. Contact Us

Nebraska inheritance tax worksheet. Divorce Laws in Nebraska: A Beginner's Guide - Survive Divorce Inheritance and gifts are treated as separate property when dividing assets in Nebraska divorce. However, if the assets were commingled, meaning they were put into a joint account, or both spouses had access and determined how the assets were used, then they can become marital assets and subject to equitable distribution. revenue.nebraska.gov › about › legal-informationChapter 22 - Individual Income Tax | Nebraska Department of ... REG-22-004 Income of Partial-Year Resident Individuals Subject to Nebraska Income Tax. 004.01 Nebraska adjusted gross income for a partial-year resident individual is all income not taxed by another state which is earned while a resident and all income derived from Nebraska sources according to Reg-22-003, while a nonresident, after the adjustments provided in Reg-22-004.03. SVOBODA v. LARSON | 311 Neb. 352 | By FUNKE - leagle.com The county court for Colfax County, Nebraska, approved the schedule of distribution for the estate of Blain Larson, filed by Blain's personal representative. The court overruled the objections of a devisee, and the devisee appeals. We conclude that the court erred in charging inheritance tax to the estate. The appeal is otherwise without merit. Nebraska Department of Revenue Under Nebraska law, the Nebraska income tax return is due the same day as the federal income tax return. Because Emancipation Day is observed in the District of Columbia on April 15, 2022, the due date for the federal and Nebraska income tax return is April 18, 2022 for most taxpayers.

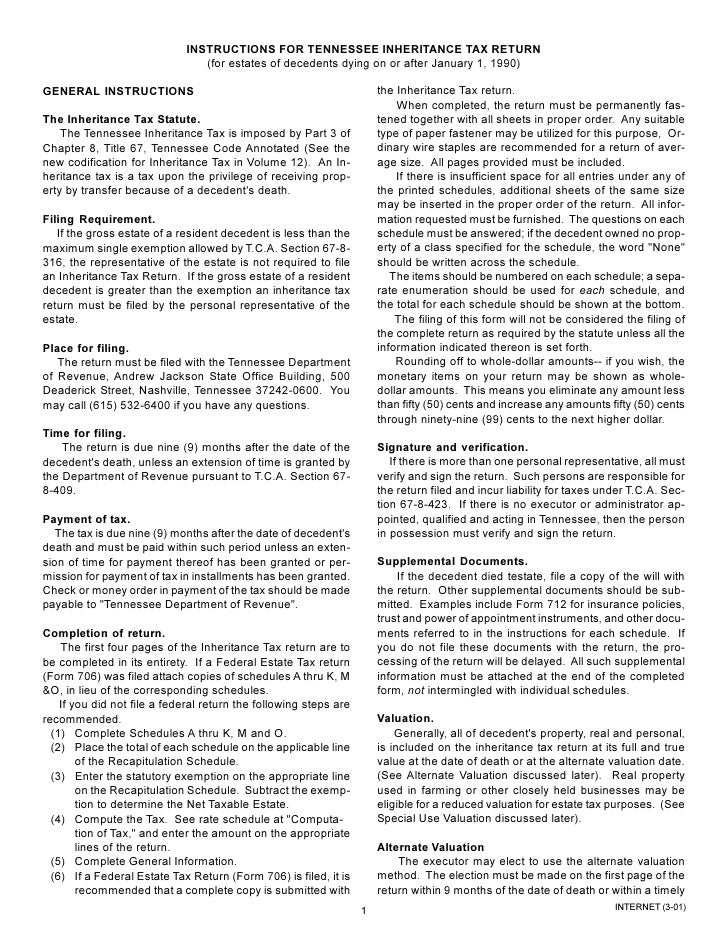

Inheritance Tax: The Complete Guide Since tax rates do vary widely, I can't tell you specifically how much your inheritance tax will be, however, the range will be from 0% to 18%. Below is a chart that provides a little more detail on state inheritance tax rate ranges: turbotax.intuit.com › tax-tips › estates4 Ways to Protect Your Inheritance from Taxes - TurboTax Tax ... Oct 16, 2019 · America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form. Will You Have To Pay a State Tax on Your Inheritance? Inheritances that fall below these exemption amounts aren't subject to the tax. You might inherit $100,000, but you would pay an inheritance tax on only $50,000 if the state only imposes the tax on inheritances over $50,000. Iowa, for instance, doesn't impose an inheritance tax on beneficiaries of estates valued at $25,000 or less. 8. Nebraska State Bar Association What the County Attorney Wants to See in Inheritance Tax and An Update on Inheritance Tax Jon S. Schroeder, Schroeder & Schroeder, P.C. This presentation will address information necessary for a County Attorney to review and approve a Nebraska Inheritance Tax Worksheet (Form 500) without unnecessary delay and additional correspondence.

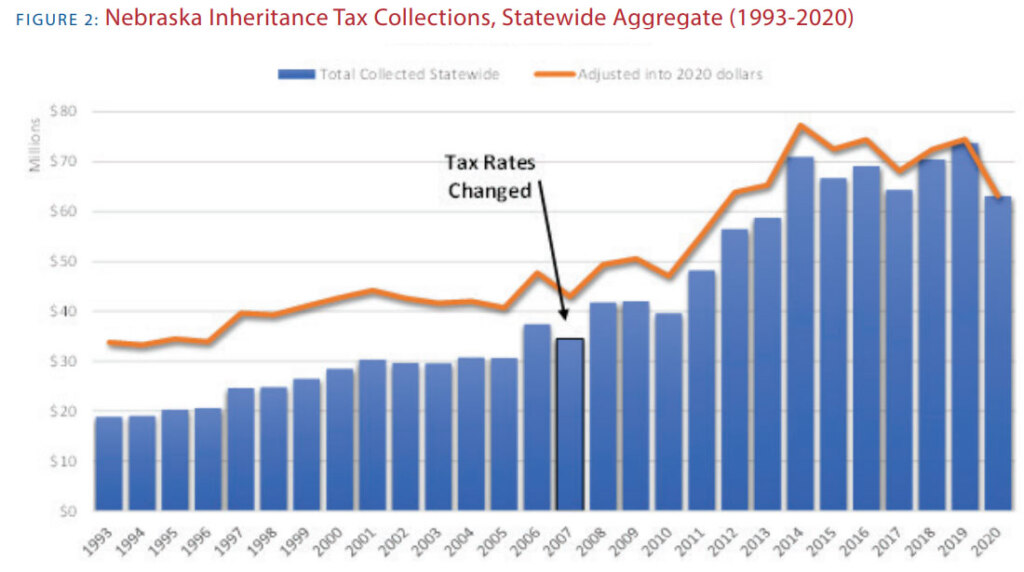

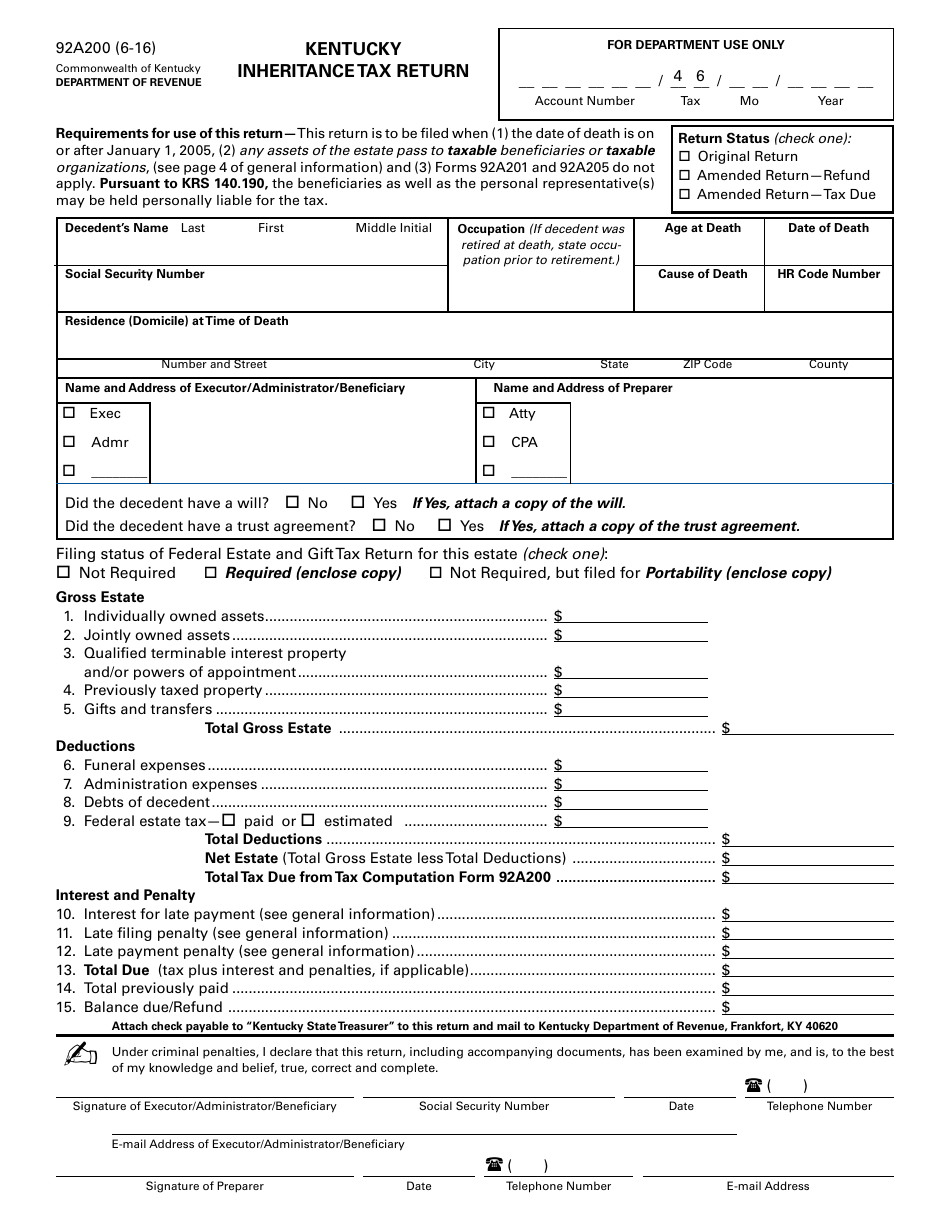

What Is the 2022 Connecticut Estate Tax Exclusion ... This type of tax is imposed on each inheritor when a single estate is being administered. That's the bad news, but the good news is that close relatives are typically exempt. There is no federal inheritance tax, but there are six states with inheritance taxes. They are Maryland, New Jersey, Pennsylvania, Iowa, Nebraska, and Kentucky. nebraska inheritance tax rates - Very Much So Blogsphere ... Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs. In re Estate of Craven 281 Neb. Currently the first 15000 of the inheritance is not taxed. 13 15000. N The inheritance tax is inequitable. First you take out the exemption of 1206 million leaving a taxable estate of 782 million. Capital Gains on Inherited Property - SmartAsset Sale price ($500,000) - Stepped-up original cost basis ($500,000) = $0.00 taxable capital gains On the other hand say that you hold the house for a year, during which time the price of this house goes up by $100,000. If you sell it, you would owe capital gains taxes only on $100,000: Does an Estate Beneficiary Pay Capital Gains Taxes ... There are state-level inheritance taxes in New Jersey, Pennsylvania, Maryland, Kentucky, and Nebraska. This is a tax on distributions to individual inheritors rather than the entire taxable portion. The Iowa tax has been repealed, but it will be phased out over a few years.

› articles › how-do-i-create-a-willHow Do I Create a Will? | legalzoom.com Jan 25, 2022 · Debt includes: Mortgages, credit cards, car loans, student loans, tax debts, personal debts, and medical bills; Make sure your beneficiaries are aware of your debt standing so they can make plans to mitigate these debts. 3. Choose Your Beneficiaries. Beneficiaries are the people who will inherit your real and personal property according to your ...

18 States With Scary Death Taxes - Kiplinger Nieces, nephews, daughters-in-law, sons-in-law, aunts, uncles and great-grandchildren are taxed at rates ranging from 4% to 16%, depending on the value of the property inherited (the first $1,000...

› pennsylvaniaPrintable Pennsylvania Income Tax Forms for Tax Year 2021 Tax Worksheet for PA-20S/PA-65 Schedule M, Part B, Section e, Line a (REV-1190) Download / Print: Form REV-414 -P-S. 2020 † Estimated: PA Nonresident Withholding Tax Worksheet For Partnerships and PA S Corporations: Download / Print: Form PA-20S-PA-65 H. 2021 † PA Schedule H - Apportioned Business Income (Loss)/Calculation of PA Net ...

Homeschool Math Worksheets K-6 Math Worksheets Licensed for 12 months unlimited access on every device in a classroom. Ad Download over 30000 K-8 worksheets covering math reading social s...

What You Need to Know About Nebraska's Inheritance Tax ... The burden of paying Nebraska's inheritance tax ultimately falls upon those who inherit the property, not the estate. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount, which ranges between $10,000 and $40,000.

Can an Out of State Inheritance Tax Affect You? | Oklahoma ... There is no federal inheritance tax, but there are a total of six states in the union that have state-level inheritance taxes. These six states are Nebraska, Iowa, Kentucky, New Jersey, Pennsylvania, and Maryland. That's the bad news, but the good news is that close relatives like children, spouses, parents, and grandchildren are typically exempt.

Nebraska Tax Forms and Instructions for 2021 (Form 1040N) The Nebraska income tax rate for tax year 2021 is progressive from a low of 2.46% to a high of 6.84%. The state income tax table can be found inside the Nebraska Form 1040N instructions booklet. The Nebraska Form 1040N instructions and the most commonly filed individual income tax forms are listed below on this page.

Nebraska Transfer Tax Calculator - Ark Advisor Computing real estate transfer tax is done in increments of $500. Nebraska transfer tax calculator. The nebraska state sales and use tax rate is 5.5% (. The state charges $3.75 for each increment and the county charges $.55 (which an be up to $.75 as authorized by the county board of commissioners with a population more than 2,000,000 or more).

State-by-State Guide to Inheritance Taxes in 2022 ... If you are the descendant's brother, sister, half-brother, half-sister, son-in-law, or daughter-in-law, you will pay tax rates ranging from 4% on the first $12,500 of inheritance up to 8% on the value of inheritances worth more than $150,000. All other individuals (related or unrelated) will pay between 8% and 12% of their inheritance.

Estate & Inheritance Tax - Threshold, Rates & Calculating ... Nebraska; New Jersey; Pennsylvania; Like most estate taxes, inheritance taxes are progressive in all states that use them. The highest inheritance tax is in Nebraska, where non-relatives pay up to 18% on the wealth they inherit. The best way to find more information about inheritance taxes in your state is to contact the state tax agency.

Staff Lancaster County Board of Commissioners January 13 ... Lancaster County, Nebraska, website and emailed to the media on January 12, 2022. Notice was also ... Kohout discussed LB310 (Change inheritance tax rates and exemption amounts ), the inheritance tax ... "worksheet order of bills" that will be taken up in the coming weeks. LB?.r{ (Geist] Direct a portion of the proceeds from the Nebraska ...

Does Nebraska Have an Inheritance Tax? - Hightower Reff Law Determination of inheritance tax is a court proceeding in Nebraska. On a base level, a petition, inventory and inheritance tax worksheet must be filed in court in the county where the decedent lived at the time of death. The county attorney reviews these documents at the time of submission.

What Is Seventh Grade Math? - Homeschool Math Worksheets This simple KWL chart can be used in all curriculum areas and all grade levels. Topics covered in our 7th grade lessons include. 005aa can be written instead as 105a which means increase by 5 or multiply by 105. 5 perimeter of the ground Ground is in the shape of rectangle.

Omaha Legal Blog - Reisinger Booth & Associates, P.C., L.L.O. On Behalf of Reisinger Booth & Associates, P.C., L.L.O. | Oct 22, 2021 | Estate Planning. A will is intended to convey a person's final wishes for how they want their property to be distributed after their death. If a will is valid, it is legally binding on the probate court. The deceased is no longer around to answer any questions, and so ...

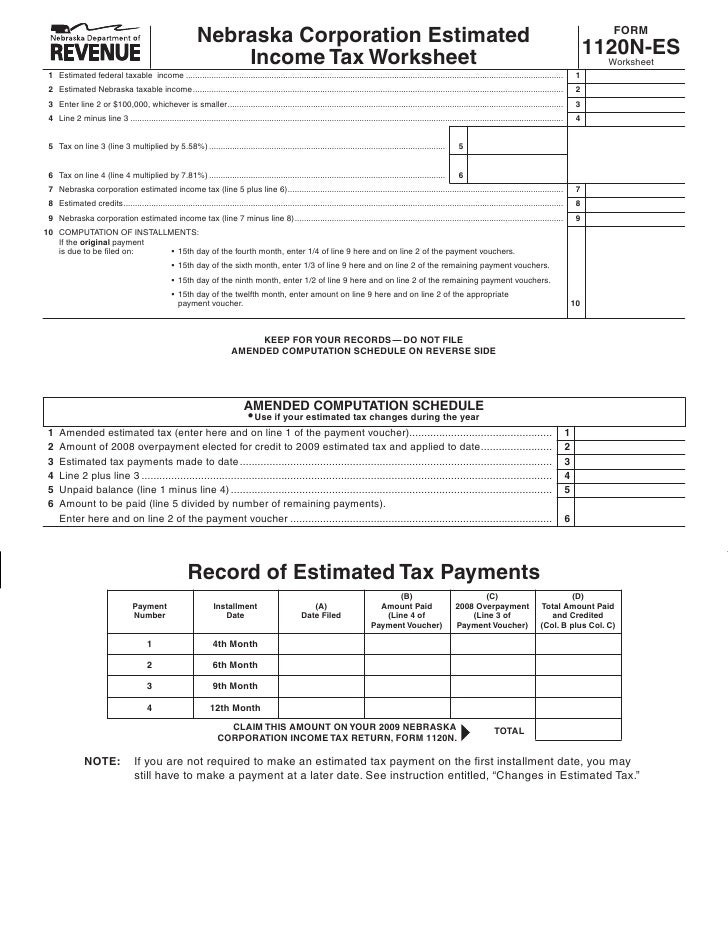

Nebraska Inheritance Tax Worksheet - alreda.net Get, create, make and sign fillable nebraska tax worksheet form. Nebraska inheritance tax worksheet form 500. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. Determination of inheritance tax is a court proceeding in nebraska.

Is an Inheritance Subject to Capital Gains Taxes ... At the present time, the long-term rate is 15 percent for people that claim between $40,401 and $445,850. For those that report income that exceeds the top figure, the rate is 20 percent, and people that claim less than $40,401 are exempt from long-term capital gains taxes.

0 Response to "42 nebraska inheritance tax worksheet"

Post a Comment