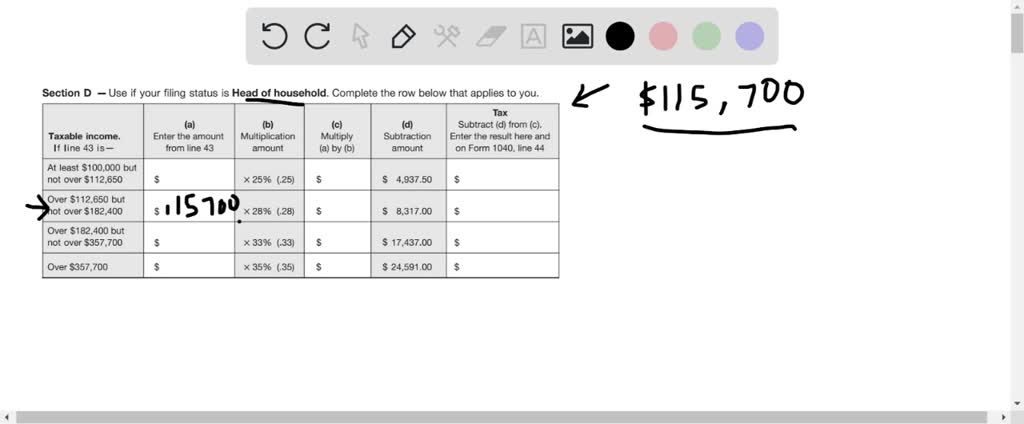

43 2015 tax computation worksheet

Capital Gain Tax Calculator - Download - MoneyExcel Long Term Capital Gain Tax rate is 20%. You can get calculate Gross Long Term Capital Gain by subtracting index cost of purchase, expense on transfer/sell and index cost of improvement from sale price. Gross Long Term Capital Gain =. "Fair Market Value or Sale Price - Expense on Transfer - Index Cost of Purchase - Index Cost of ... Basic Math Concepts Worksheets: Timed Mixed Math Facts Worksheets This math worksheet was created on 2015-03-18 and has been viewed 128 times this week and 353 times this month. Addition subtraction multiplication and division because that might be. Each day you want generate a unique daily worksheet simply visit your bookmark. Discover learning games guided lessons and other interactive activities for children.

2015 Tax Guide Pershing Llc - verticalmarketing.net Acces PDF 2015 Tax Guide Pershing Llc verticalmarketing.net ... spouse on split gifts included on Schedule G. Enter amount from Worksheet TG, line 2, col. f. 5: Add lines 3 and 4. Enter here and on Part 2̶Tax Computation, line 7. 6: Cumulative lifetime gifts on which tax was paid or payable. Enter this amount on line 3, Section C, Part 6 of ...

2015 tax computation worksheet

Claiming the Foreign Tax Credit with Form 1116 - TurboTax Deduct their foreign taxes on Schedule A, like other common deductions. Use Form 1116 to claim the Foreign Tax Credit (FTC) and subtract the taxes they paid to another country from whatever they owe the IRS. Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign ... Line Worksheet - Page 342 of 350 - Learning Line Worksheet Here 2-1 Solving Linear Equations And Inequalities Worksheet Answers May 1, 2022. Line. 3.3 Proving Lines Parallel Worksheet Answer Key April 30, 2022 April 30, 2022. Line ... IRS Form 1116: Foreign Tax Credit With An Example - 1040 Abroad Step 2. Complete Part I. Here you need to report the income and name of the foreign country. Columns A, B, and C stand for multiple countries in which a taxpayer could earn income (in our first Foreign Tax Credit Form 1116, we will have only Canadian sourced wages under column A, as general type of income.

2015 tax computation worksheet. qualified dividends and capital gain tax worksheet 2017 pdf qualified dividends and capital gain tax worksheet 2017 pdf. April 25, 2022 / Posted by / 1 / 0 ... Tax Worksheet 2014 - Balancing Equations Worksheet For most US individual tax payers your 2014 federal income tax forms were due on April 15 2015 for income earned from January 1 2014. ... Posts Related to Capital Gains Tax Worksheet 2014. 18 TOTAL INCOME TAX AND CONSUMER USE TAX - Add Lines 16 and 17. ... WORKSHEET NR-3 2014 NET PROFITS TAX RETURN Computation of apportionment factors to be ... 2021 tax tables NYS tax table: AND NYS taxable income is $65,000 or MORE: NYS tax rate schedule: NYS adjusted gross income is MORE than $107,650: Use the NYS tax computation: New York City or Yonkers Tax; Part-year NYC resident tax: Use Form IT-360.1: Yonkers nonresident earnings tax: Use Form Y-203: Part-year Yonkers resident tax: Use Form IT-360.1 New Jersey Tax Forms 2021 - Income Tax Pro For tax year 2021, Single residents must file if their gross income is more than $10,000. Married residents must file if their gross income is more than $20,000. ... The computation worksheet for Form NJ-1040-ES can be found inside the instructions PDF file. Pages one and two of the New Jersey 1040-ES file are the fillable vouchers for the 2022 ...

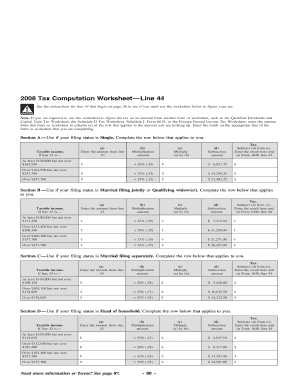

Forms and Instructions (PDF) 08/20/2015 Form 8981: Waiver of the Period Under IRC Section 6231(b)(2)(A) and Expiration of the Period for Modification Submissions Under IRC Section 6225(c)(7) ... Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 Form 14157-A: Tax Return Preparer Fraud or Misconduct Affidavit 1118 12/12/2018 Form 1040-NR (Sch NEC) (sp) Tax ... Form 1040 State And Local Income Tax Refund Worksheet Form 1040 Schedule A Sch B Sch C Sch SE Form 4684 Tax Computation Worksheet. Add lines 3 and 4 5. State and local income tax refunds prior year Income tax refunds credits or offsets 2 2. ... The U S Federal Income Tax Process . Use Excel To File 2015 Form 1040 And Related Schedules Accountingwebhow To Use Excel To File 2015 Form 1040s . Capital Gains Tax Calculation Worksheet - The Balance Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ... 5000-D1 Federal Worksheet (for all except non-residents) 5000-D1 Federal Worksheet (for all except non-residents) For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in: PDF 5000-d1-21e.pdf. PDF fillable/saveable 5000-d1-fill-21e.pdf. For people with visual impairments, the following alternate formats are also available:

PDF Federal Tax Study Manual 2015 - homes.starnewsonline.com File Type PDF Federal Tax Study Manual 2015 to split pension income for 2015. See lines 115, 116, 129, and 210. You received working income tax benefit (WITB) advance payments in 2015. General Income Tax and Benefit Guide 2015 The CCH Federal Tax Study Manual provides students with an approach that combines self-study with programmed learning ... Payroll Tax: What It Is, How to Calculate It | Bench Accounting To calculate Medicare withholding, multiply your employee's gross pay by the current Medicare tax rate (1.45%). Example Medicare withholding calculation: $5,000 (employee's gross pay for the current pay period) x .0145 (current Medicare tax rate) = $72.50 (Medicare tax to be deducted from employee's paycheck. Tax Calculator | UK Tax Calculators For percentage, add a % symbol at the end of the amount. So, if contributing 5 percent, enter '5%'. If contribution £50, enter '50'. The calculator will automatically adjust and calculate any pension tax reliefs applicable. How to Calculate Federal Income Tax - Rates Table & Tax Brackets Using the brackets above, you can calculate the tax for a single person with a taxable income of $41,049: The first $9,950 is taxed at 10% = $995. The next $30,575 is taxed at 12% = $3,669. The last $5,244 is taxed at 22% = $1,154. In this example, the total tax comes to $5,818.

for How to Fill in IRS Form 6251 - Wondershare PDFelement Subtract line 34 from line 33 and write the amount on line 35. Step 5: Complete Part III. Tax Computation Using Maximum Capital gains Rate. On line 36, enter the amount on Form 6251, line 30. But if you bare filling form 2555, write the amount from line 3 of the worksheet in the instructions for line 31. For lines 37,38 and 39, see instructions ...

Mississippi Tax Forms and Instructions for 2021 (Form 80-105) Mississippi state income tax Form 80-105 must be postmarked by April 18, 2022 in order to avoid penalties and late fees. Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1, 2021 through December 31, 2021. The Mississippi income tax rate for tax year 2021 is progressive from a low of 0% ...

Basic Math Concepts Worksheets Then use this months. Whether youre trying to pay off debt increase your savings rate or eat out less this budget will hold you accountable....

2015-2016 Personal Income Tax Forms - State of Delaware 2015 Income Tax Table. Download Fill-In Form (71K) 200 V - Payment Voucher Download Fill-In Form (123K) Schedule W Apportionment Worksheet Download Fill-In Form (154K) 200-01X Resident Amended Income Tax Return Download Fill-In Form (352K) 200-01 Xi Resident Amended Income Instructions ... Form 329 Special Tax Computation for Distribution ...

IRS Form 14453 Download Fillable PDF or Fill Online Penalty Computation Worksheet | Templateroller

D-76 Estate Tax Instructions Booklet and Computation Worksheets for ... D-76 Estate Tax Instructions Booklet and Computation Worksheets for 2022 and Prior. Friday, February 25, 2022. Please use the DC D-76 Estate Tax Instructions booklet regardless of the year prior to January 1, 2022. The DC D-76 Estate Tax Computation Worksheets contain the information pertinent to the computation of tax for years after January 1 ...

How to perform a complex recomputation of return recovery exclusion Follow these steps to recompute the prior-year return for ProSeries 2015 and later: Go to the State Tax Refund Worksheet. Scroll down to Part II - Recovery Amount. Make a note of the Recovery Amount on Line 6 for the current-year program. Open the prior-year tax return. Open the Computation of Recovery Exclusion For State Income Tax Deduction.

PDF Federal Tax Study Manual 2015 - jobs.cjonline.com 2015 Tax Table.....249 2015 Tax Computation Worksheet ... 2015 Publication 17 - Internal Revenue Service Exam Study Guide Federal Income Tax Study Aids Search this Guide Search. ... Study Aids for Federal Income Tax Review and Exam Preparation ... Call Number: Available Online via Lexis OverDrive. ISBN: 9781632809506. Publication Date: 2015-07 ...

Tax Calculators and Forms: Current and Previous Tax Years - eFile For example, before you make decisions on how to finance important purchases (e.g., car or home purchases, home mortgage refinancing, student loan applications), use one of the free tax calculator and estimating tools. The eFile.com tax calculator is based on the IRS 1040 federal income tax forms, making it applicable to users of all these forms.The Form 1040 is the first page of a federal tax ...

Where To Find and How To Read 1040 Tax Tables How To Read the 1040 Tax Tables. First, you'll need to know what your "taxable income" is. You can find that on Line 15 of your Form 1040 for 2021. Next, scroll down through the tax tables found in the IRS publication mentioned above to find your taxable income in the two far left columns.

Australian Tax Calculator Excel Spreadsheet 2022 - atotaxrates.info Free Australian Income Tax Excel Spreadsheet Calculator. This free to download Excel tax calculator has been updated for the 2021-22 and later years 2022-23, 2022-24 and 2024-25 and includes the March 2022 Budget increase of $420 to the Lower and Middle Income Tax Offset for the 2021-22 year. The current version of the Excel spreadsheet (xlsx ...

4.25.6 Report Writing Guide for Estate and Gift Tax Examinations ... The Worksheet functions as an alternative to Form 4808 (gift tax credit manual worksheet). To open the Worksheet, on the Miscellaneous tab of the Adjustments screen, select Gift Tax Credit from the Adjustment Type drop-down list and click Worksheet. To include the gift tax credit as a variable in the interrelated computation the examiner must ...

IRS Form 1116: Foreign Tax Credit With An Example - 1040 Abroad Step 2. Complete Part I. Here you need to report the income and name of the foreign country. Columns A, B, and C stand for multiple countries in which a taxpayer could earn income (in our first Foreign Tax Credit Form 1116, we will have only Canadian sourced wages under column A, as general type of income.

Line Worksheet - Page 342 of 350 - Learning Line Worksheet Here 2-1 Solving Linear Equations And Inequalities Worksheet Answers May 1, 2022. Line. 3.3 Proving Lines Parallel Worksheet Answer Key April 30, 2022 April 30, 2022. Line ...

Claiming the Foreign Tax Credit with Form 1116 - TurboTax Deduct their foreign taxes on Schedule A, like other common deductions. Use Form 1116 to claim the Foreign Tax Credit (FTC) and subtract the taxes they paid to another country from whatever they owe the IRS. Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign ...

0 Response to "43 2015 tax computation worksheet"

Post a Comment