43 self employed expenses worksheet

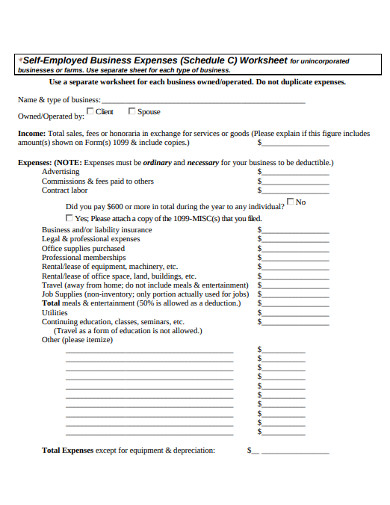

Solved: Self employed health insurance deduction and exces... Apr 13, 2021 · However, turbo tax is taking the full amount of the health insurance premium as a deduction for self employed health insurance on Schedule 1 line 16. In other words, the amount on my Form1095-A in part III column A is the same as the amount on Form 1040 Schedule 1 line 16 despite the fact that the excess advance premium tax credit on Form 1095 ... Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C’s Business Name (if any)_____ Address (if any) _____ Is this your first year in business? Yes

Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate.

Self employed expenses worksheet

Publication 560 (2021), Retirement Plans for Small Business For this reason, you determine the deduction for your own contributions indirectly by reducing the contribution rate called for in your plan. To do this, use either the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed in chapter 5. Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in ... Self-Employed and Taxes, Deductions for Health, Retirement Mar 17, 2022 · There are many self-employed or small business tax deductions you can claim on your taxes as a self-employed person. This includes business expenses, such as office supplies, deductible business miles, and tools or equipment for your business. Below, find other deductible expenses to claim on your taxes. Self Employed Health Insurance Premium FAQs - Simplified Method for Home Office Deduction Overview Q1. What is the simplified method for determining the home office deduction? A. The simplified method, as announced in Revenue Procedure 2013-13 PDF, is an easier way than the method provided in the Internal Revenue Code (the "standard method") to determine the amount of expenses you can deduct for a qualified business use of a home.

Self employed expenses worksheet. How Much Can I Contribute To My Self-Employed 401k Plan? Mar 22, 2022 · A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. A self-employed 401k plan is also know as a Solo 401k plan. This article will discuss how much you can contribute to your self-employed 401k plan. For 2021, the IRS says you can contribute up to $61,000 in your self-employed 401k plan. The amount should go up by $500 - $1,000 every one or ... FAQs - Simplified Method for Home Office Deduction Overview Q1. What is the simplified method for determining the home office deduction? A. The simplified method, as announced in Revenue Procedure 2013-13 PDF, is an easier way than the method provided in the Internal Revenue Code (the "standard method") to determine the amount of expenses you can deduct for a qualified business use of a home. Self-Employed and Taxes, Deductions for Health, Retirement Mar 17, 2022 · There are many self-employed or small business tax deductions you can claim on your taxes as a self-employed person. This includes business expenses, such as office supplies, deductible business miles, and tools or equipment for your business. Below, find other deductible expenses to claim on your taxes. Self Employed Health Insurance Premium Publication 560 (2021), Retirement Plans for Small Business For this reason, you determine the deduction for your own contributions indirectly by reducing the contribution rate called for in your plan. To do this, use either the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed in chapter 5. Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in ...

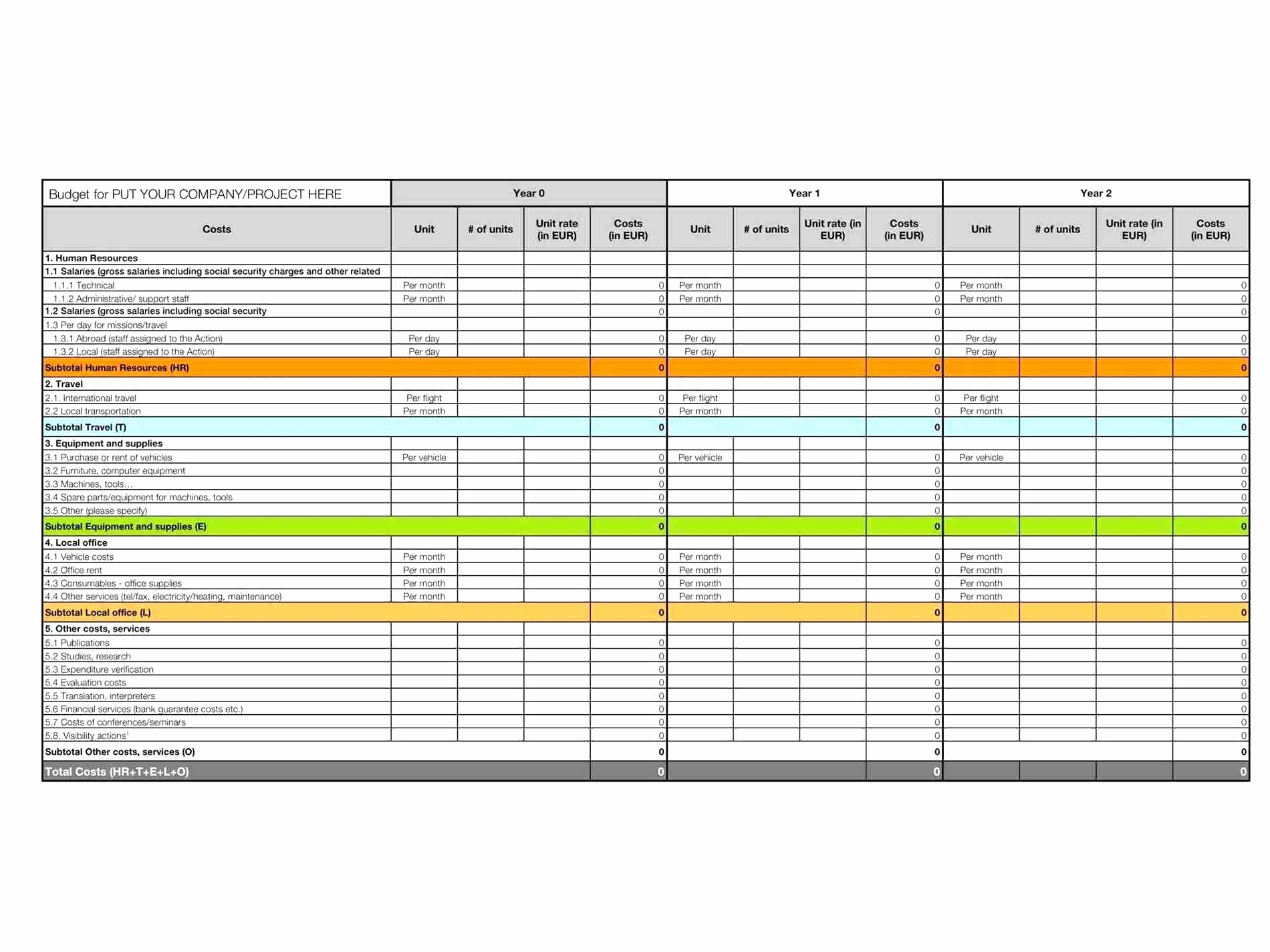

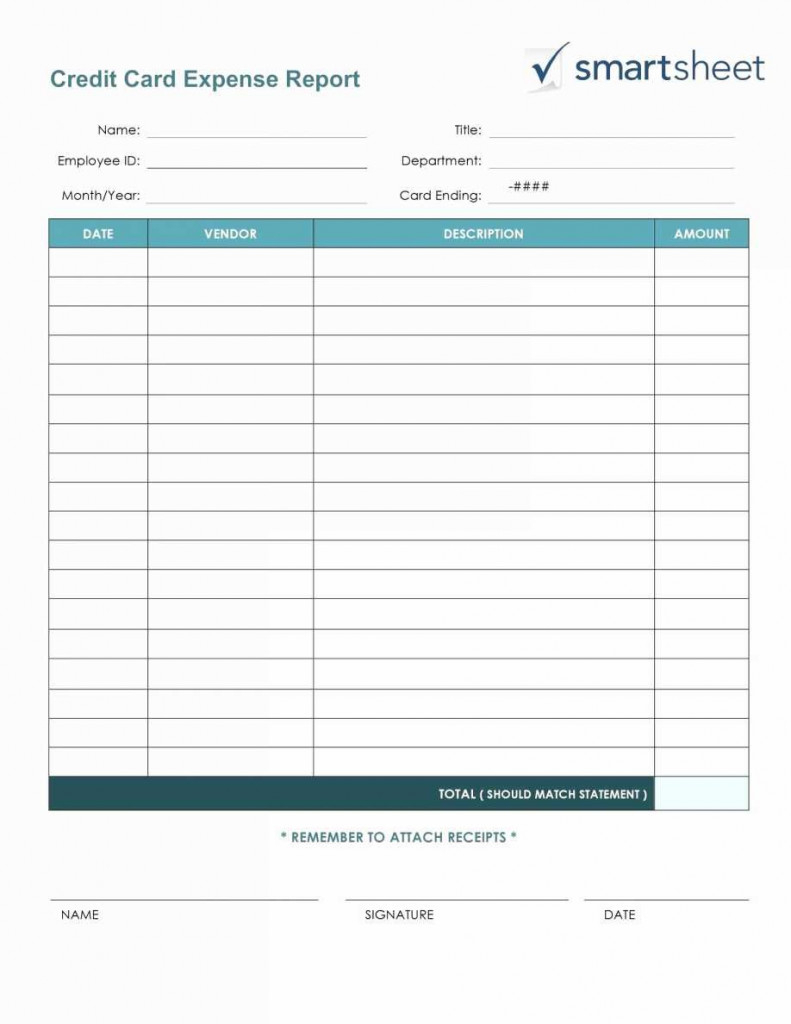

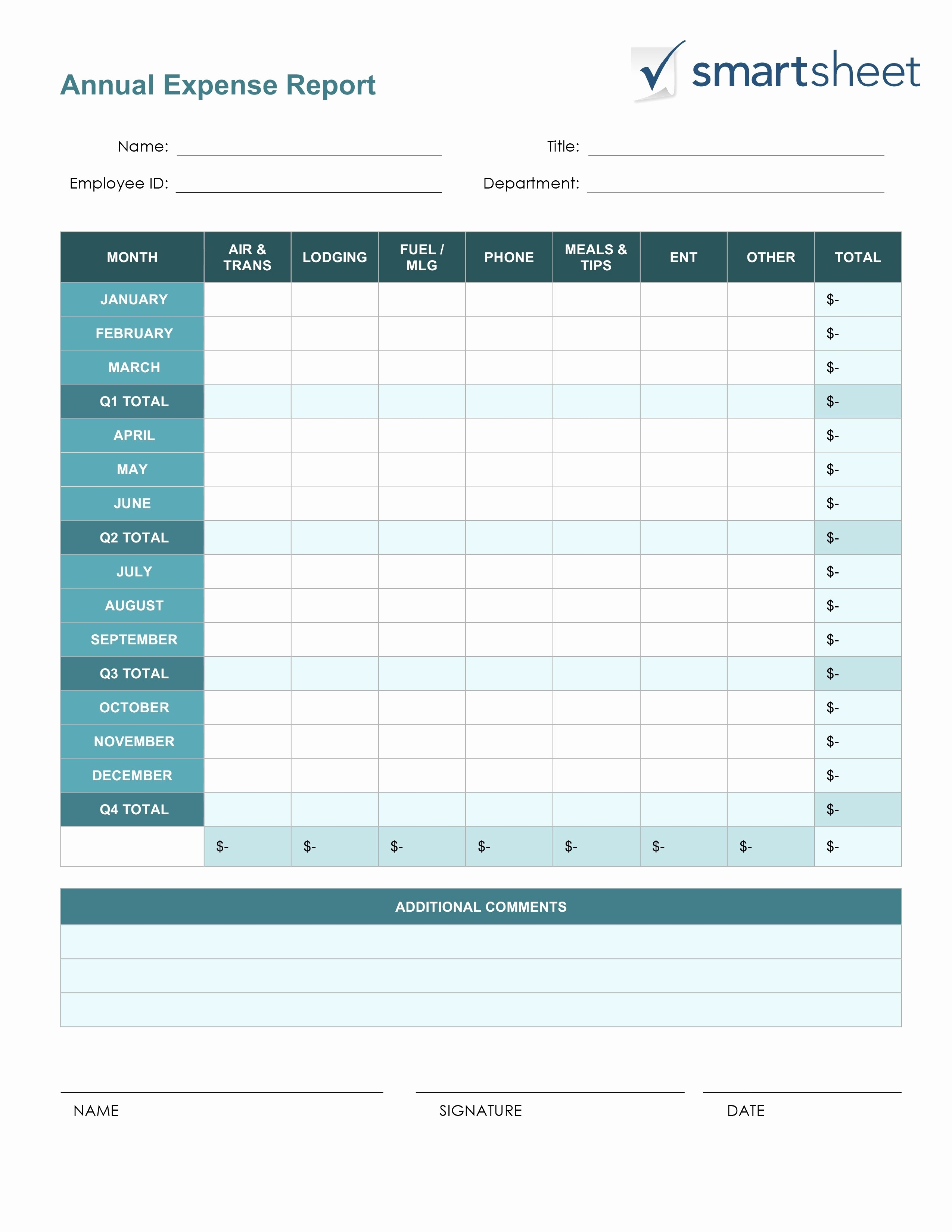

Self Employed Expenses Spreadsheet Free Spreadsheet Downloa Self Employed Expenses Spreadsheet Free.

16 Best Images of Budget Worksheet Self-Employed - Make a Budget Worksheet, Hair Salon Business ...

Self Employed Excel Spreadsheet pertaining to Self Employed Expense Sheet Sample Worksheets Tax ...

Self Employed Expense Spreadsheet Spreadsheet Download self employed tax calculator spreadsheet ...

Self Employed Expense Spreadsheet Spreadsheet Download self employed tax calculator spreadsheet ...

Self Employed Spreadsheet pertaining to Bookkeeping For Self Employed Spreadsheet Home Business ...

0 Response to "43 self employed expenses worksheet"

Post a Comment