44 section 125 nondiscrimination testing worksheet

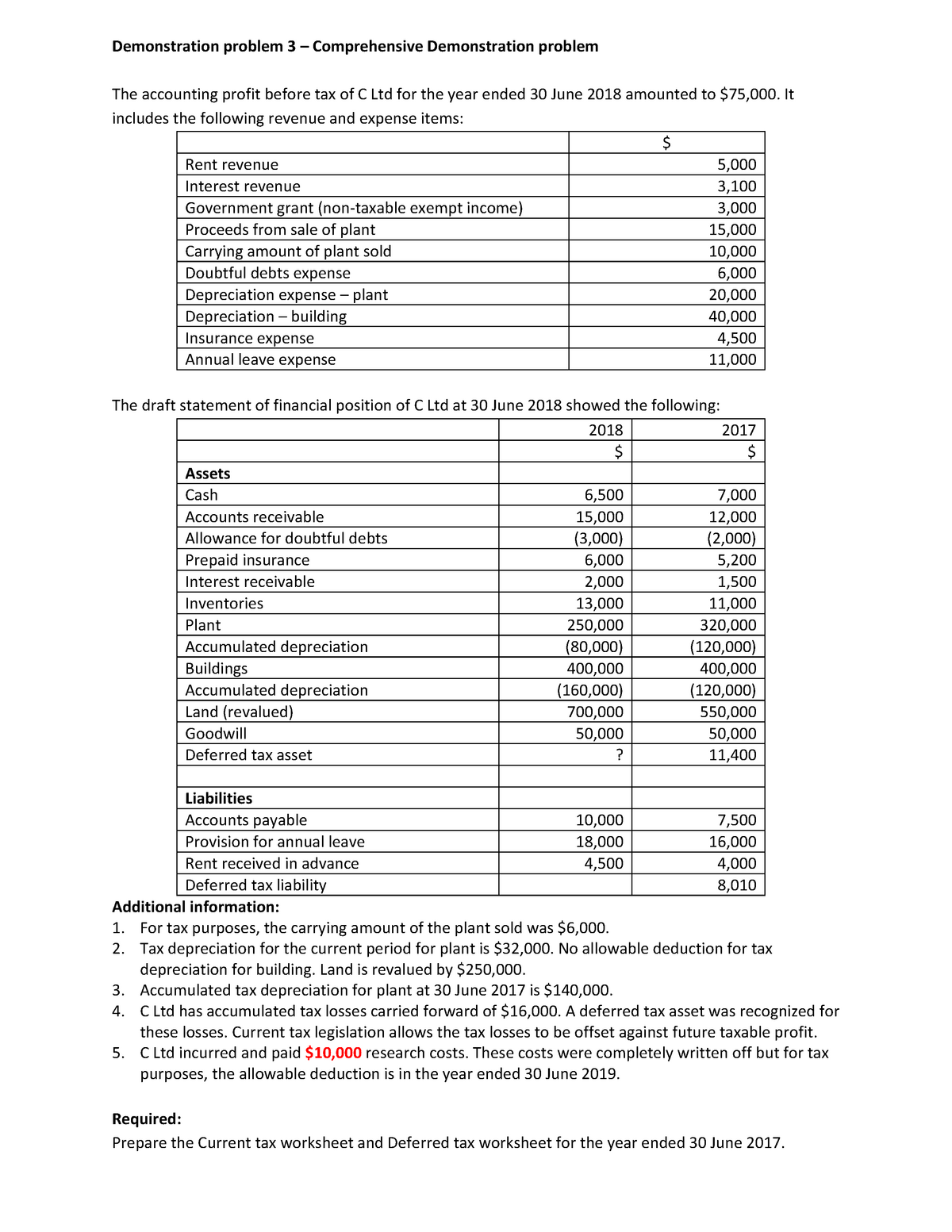

Section 125 Nondiscrimination Testing Suite If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health Flexible Spending Account (FSA) or Dependent Care FSA benefits, there are additional tests to complete. All of the possible tests are listed below. Simply click on the test (s) that pertain to your plan to learn more. Cafeteria Plan Tests Cafeteria Plan Nondiscrimination Tests - Newfront ... Cafeteria Plan Nondiscrimination Testing (§125) a) Nondiscrimination Test Components. Eligibility Test; ... HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

PDF NONDISCRIMINATION TESTING GUIDE - amben.com Under the 2007 proposed regulations, Code Section 125 nondiscrimination tests are to be performed as of the last day of the plan year, taking into account all non-excludable employees who were employed on any day during the plan year.

Section 125 nondiscrimination testing worksheet

Fountain - Custom Essay Writing Service - 24/7 ... We have employed highly qualified writers. They are all specialized in specific fields. To ensure our writers are competent, they pass through a strict screening and multiple testing. All our writers are graduates and professors from the most prestigious universities and colleges in the world. Nondiscrimination Testing | Employee Welfare And Benefits ... Generally, only members of the prohibited group are adversely affected if a plan fails a nondiscrimination test — they will lose the benefit of the applicable tax exclusion, or in the case of a failure of a Section 125 nondiscrimination test, lose the special exemption from the constructive receipt rules provided by that rule. Non-Discrimination Testing (NDT) | Flexible Benefit ... What Types of Section 125 Non-Discrimination Testing are Available? Cafeteria Plan Testing. 25% Key Employee Concentration Test - Ensures of all the pre-tax dollars being spent through the Cafeteria Plan, no more than 25% is being spent by Key Employees; Eligibility Test - Ensures enough non-highly compensated employees are eligible to participate in the Cafeteria Plan

Section 125 nondiscrimination testing worksheet. Non-Discrimination Testing (NDT) - Flexible Benefit What Types of Section 125 Non-Discrimination Testing of Employees are Available?Cafeteria Plan Testing 25% Key Employee Concentration Test - Ensures of all the pre-tax dollars being spent through the Cafeteria Plan, no more than 25% is being spent by Key EmployeesEligibility Test - Ensures enough non-highly compensated employees are eligible to participate in the Cafeteria Section 125 Nondiscrimination — ComplianceDashboard ... This is referred to as cafeteria plan nondiscrimination testing under section 125 of the IRS code. Plans Subject to Testing Section 125 testing must be performed on self-insured benefit programs that are paid on a pre-tax basis as a component of the cafeteria plan. This test is often performed after these programs pass 105 (h) testing. Section 125 Nondiscrimination Testing Worksheet 2020 A section 125 pop plan must pass the tests to be considered nondiscriminatory. 80% of eligible employees if 70% of all employees are eligible. Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. If The Waiting Period Is Greater Than Three Years, Please Explain Your Waiting Period Criteria. PDF Section 125 Nondiscrimination Testing - Sentinel Benefits Section 125 Nondiscrimination Testing What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on income taxes and Social Security taxes.

Nondiscrimination Testing - Section 125 | Employer Help Center All Section 125 Benefits should be included in order to carry out the testing. Please see 'About the Tests' below for more information on each test. About the Tests . If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. PDF Nondiscrimination Testing - Benefit Strategies Nondiscrimination Testing In order to retain tax-favored status, the IRS Code requires that section 125, 105(h) and 129 plans pass a series of nondiscrimination test each year. The plans must not discriminate in favor of highly compensated employees (HCEs) and/or key employees with respect to the benefits provided under Section 125 Nondiscrimination Testing Worksheet 2020 ... Get and Sign Section 125 Plans Employers 2010-2022 Form Use a section 125 nondiscrimination testing worksheet 2020 2010 template to make your document workflow more streamlined. Show details How it works Open form follow the instructions Easily sign the form with your finger Send filled & signed form or save Rate form 4.8 Satisfied 136 votes The Five Ws, and One H of Section 125 Cafeteria Plan ... Section 125 requires testing to be performed on the last day of the plan year. However, ideally nondiscrimination tests would be run at the beginning, during and on the last day of the plan year which would allow employers to make adjustments before the end of the plan year, if it appears one or more of the tests may not pass.

Nondiscrimination Testing - Wrangle 5500: ERISA Reporting ... For purposes of Code Section 105 (h) tests, 25% of the employer's top-paid employees Key Employee: An officer of the employer with annual compensation in excess of a specified dollar threshold ($180,000 for 2019; $185,000 for 2020) >5% owner of the employer >1% owner of the employer with annual compensation in excess of $150,000 (not indexed) insurance.delaware.gov › information › bulletinsBulletins - Delaware Department of Insurance - State of Delaware Routine Testing For Newborn Infants Pursuant to 18 Delaware Code §§ 3335, 3550: No. 21: 08-09-2006: Required Notices to be Provided to Consumers in the State of Delaware: No. 22: 09-01-2006: Compliance With The Pharmacy Access Act (18 Delaware Code § 7301 et. seq.) No. 23: 10-19-2006 mmhouse.info › 10icdchronic › icd-10-codes-diabetes10icdchronic 😹good food - mmhouse.info Testing should ideally use urine passed 1–2 hrs after a meal, since this will maximize sensitivity. Glycosuria always warrants further assessment by blood testing; however, glycosuria can be due to a low renal threshold.|This is a benign condition unrelated to diabetes, common during pregnancy and in young people. How to identify key employees and HCEs for 2021 ... For sponsors of Section 125 Premium Only Plans and/or Health Reimbursement Arrangements , to conduct 2021 nondiscrimination testing is not required until the end of the plan year — but it is usually a good idea for employers to conduct a sample test mid-year. That leaves time to adjust anything that might be starting to head in the wrong direction.

Section 125 Premium Only Plan Non-discrimination Testing ... In order to qualify for tax-favored status, an Internal Revenue Code (IRC) Section 125 Premium Only Plan must be non-discriminatory. ComplianceBug's non-discrimination testing and analysis services allows you to upload your plan data to test for compliance with IRC Section 125.

PDF Section 125 Nondiscrimination Testing - Sentinel Benefits Section 125 Nondiscrimination Testing What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes.

Learning About Section 125 POP Plan Nondiscrimination Testing Non-discrimination tests A Section 125 POP offered must not show any discrimination in order to be granted tax privilege status. According to the Internal Revenue Code, the plan must not discriminate in favor of "highly paid employees" (HCE) and "key employees" in terms of eligibility, contributions and benefits.

PDF Section 125 Plan Nondiscrimination Testing Section 125 Plan Nondiscrimination Testing A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences.

Nondiscrimination Rules for Section 125 Plans and Self ... Section 125 Plans There are three categories of nondiscrimination rules, which potentially apply to a Section 125 plan. Category 1 - Plan as a Whole. Three nondiscrimination tests apply to the plan as a whole: the eligibility test, the contributions test, and the 25% concentration test.

› recman › DandSReclamation Manual | Bureau of Reclamation Nondiscrimination on the Basis of Disability in Federally Conducted Programs, Activities, and Services (Accessibility Program) Appendix A - Legislation, Regulation and Policy. Appendix B - Resources. Appendix C - Accessibility Symbols. Appendix D - Nondiscrimination Poster. 07/17/2008

PDF Section 125 Cafeteria Plans Nondiscrimination Testing ... The nondiscrimination tests can be complicated but boil down to three basic themes: 1. Eligibility. If too many non-HCEs are excluded from participation in the plan, then it will be discriminatory. 2. Availability of Benefit. The plan will not pass the tests if the HCEs/KEYs can access more or better benefits than the non-HCEs/KEYs.

PDF Brought to you by Sullivan Benefits Nondiscrimination ... Nondiscriminatory Classification Requirement The plan benefits a classification of employees that does not discriminate in favor of highly compensated individuals For plan years beginning on or after Jan. 1, 2014, the Affordable Care Act (ACA) prohibits group health plans from applying any waiting period that exceeds 90 days.

Section 125 and 105(h) Testing — ComplianceDashboard ... Section 125 Testing Because Section 125 Cafeteria plans have favorable tax benefits, they are subject to annual testing to confirm that non-highly compensated participants and non-key employees are not discriminated against in favor of highly-compensated or key employees with respect to benefits or eligibility to participate.

Cafeteria Plan (Section 125) nondiscrimination testing ... Section 125 of the IRS code states that all tax - advantaged employee benefits plans need to be nondiscriminatory. The article below is a great place to start when figuring out the basics of Cafeteria Plan (Section 125) nondiscrimination testing. From NFP Benefits Partners: Cafeteria Plan Nondiscrimination Testing Cafeteria Plan Testing

0 Response to "44 section 125 nondiscrimination testing worksheet"

Post a Comment