43 capital gains tax worksheet

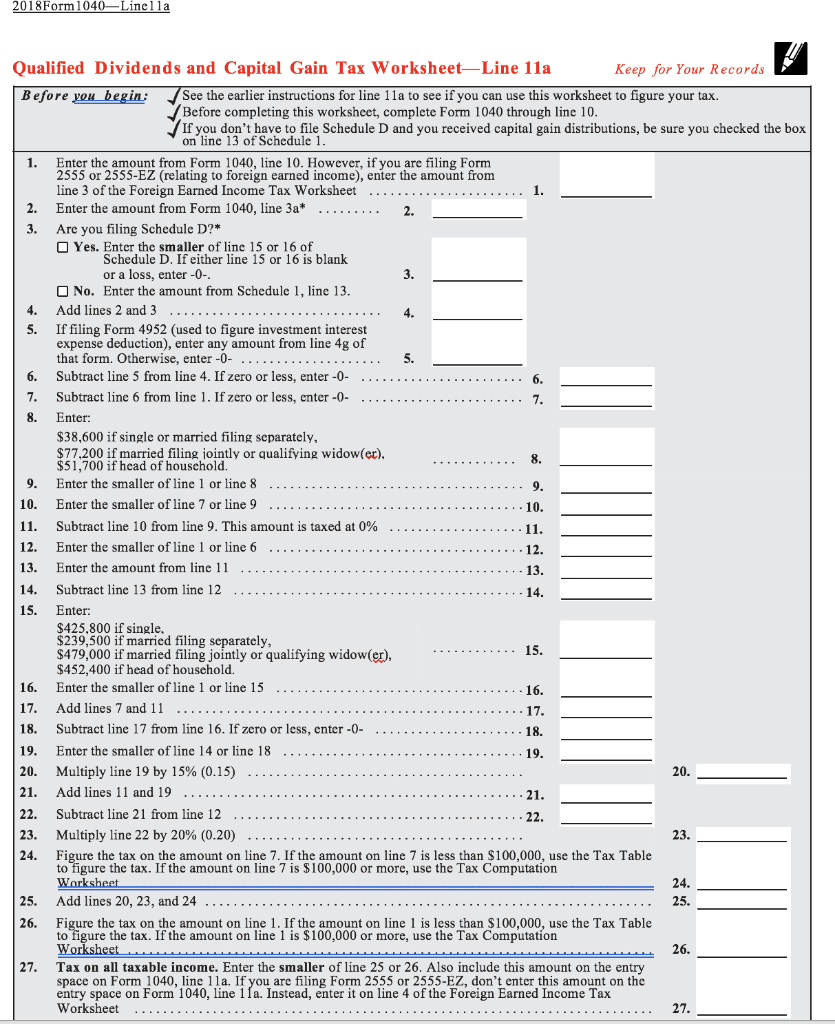

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet ACC 330 Federal Taxation I Final Project - Qualified Dividends and Capital Gains Worksheet University Southern New Hampshire University Course ACC 300 (t6988) Uploaded by Trinity Williams Academic year How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Schedule D contains different worksheets that you may need to complete, including the Capital Loss Carryover Worksheet, 28% Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. Each of...

› pub › irs-newsQualified Dividends and Capital Gain Tax Worksheet: An ... Although many investors use Schedule D to get the benefit of lower capital gains tax rates, others can still use a worksheet in the tax instructions to skip Schedule D entirely. Lower Tax Rates The Jobs and Growth Tax Relief Reconciliation Act of 2003 lowered the maximum capital gains tax rates from eight or 10 percent to five percent and from ...

Capital gains tax worksheet

Forms and Publications (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439: Notice to Shareholder of Undistributed Long-Term Capital Gains 1121 11/29/2021 › how-to-figure-capital-gains-taxHow to Calculate Capital Gains Tax | H&R Block Short-term capital gain tax rates . Short-term capital gains are gains apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they’re taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Long-term capital gains tax rate . Long-term capital gains apply to assets that you held ... › forms-pubs › about-schedule-d-form-1040About Schedule D (Form 1040), Capital Gains and Losses Information about Schedule D (Form 1040 or 1040-SR), Capital Gains and Losses, including recent updates, related forms, and instructions on how to file. Use Schedule D to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts.

Capital gains tax worksheet. Using the capital gain or loss worksheet | Australian Taxation Office The Capital gain or capital loss worksheet (PDF 143KB) calculates a capital gain or capital loss for each separate capital gains tax (CGT) event. Remember that: you show the type of CGT asset or CGT event that resulted in the capital gain or capital loss, and if a capital gain was made, you calculate it using the indexation method What is tax-loss harvesting? - Stash Learn Tax-loss harvesting is selling investments at a loss to lower your tax liability. The losses you "harvest" could offset up to $3,000 of capital gains or ordinary income, as of the 2021-22 tax year. The basic idea is to make a profit selling some investments while selling others at a loss. Then you subtract the loss from the gain, and only ... turbotax.intuit.com › tax-tips › investments-andCapital Gains and Losses - TurboTax Tax Tips & Videos Feb 28, 2022 · A capital loss is a loss on the sale of a capital asset such as a stock, bond, mutual fund or real estate. As with capital gains, capital losses are divided by the calendar into short- and long-term losses. Can I deduct my capital losses? Yes, but there are limits. Losses on your investments are first used to offset capital gains of the same ... Capital Gains Tax on Real Estate: How It Works In 2022 - NerdWallet The IRS typically allows you to exclude up to: $250,000 of capital gains on real estate if you're single. $500,000 of capital gains on real estate if you're married and filing jointly. For ...

Capital Gains Tax Calculation Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock. Capital Gains Tax forms - GOV.UK Self Assessment: Capital gains summary (SA108) 6 April 2022. Form. Post transaction valuation checks for Capital Gains (CG34) 29 April 2022. Form. Capital Gains Tax: investment club certificate ... Worksheet: Calculate Capital Gains | Realtor Magazine Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. Capital Gain Tax Calculator For 2021 & 2022 The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 (filing in 2023)and 2021. As you know, everything you own as personal or investments- like your home, land or household furnishings, shares, stocks or bonds- will fall under the term " capital asset".

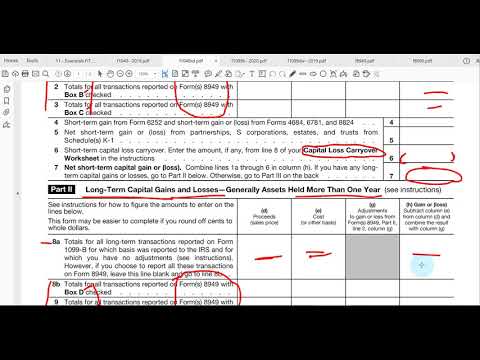

Where do you calculate your long-term Schedule D c... - Intuit The worksheet used to calculate your taxes when taking capital gains into account is found in the IRS Instructions for Form 1040. It is called the Qualified Dividends and Captial Gains Tax Worksheet . You can find it on page 33 of the PDF document at this link: 2019 Form 1040 Instructions **Say "Thanks" by clicking the thumb icon in a post › ask › answersHow Capital Gains and Dividends Are Taxed Differently Dec 25, 2021 · For 2022, the 0% long-term capital gains tax rate applies if your income is $41,675 or less, 15% if you have income of $459,750 or less, and 20% if your income is greater than $459,750. Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Self Assessment forms and helpsheets for Capital Gains Tax

PDF Capital Gain Worksheet Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3) ... Tax Due at Maximum Capital Gains Rate - 25% rate gain x 25% (line 9 x 25%) $ (12) 15% rate gain x 15% (line 10 x 15%) (13) ...

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet In 2021 and 2022, the capital gains tax rates are either 0%, 15% or 20% on most assets held for longer than a year. Capital gains tax rates on most assets held for a year or less correspond to...

1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. Ordinary Dividends. Each payer should send you a Form 1099-DIV. Enter your total ordinary dividends on line 3b. This amount should be shown in box 1a of Form(s ...

en.wikipedia.org › wiki › Capital_gains_tax_in_theCapital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table.

PDF Schedule D, Form N-35, Rev 2016, Capital Gains and Losses and ... - Hawaii as appropriate. Total capital gains are then reduced by the qualifying capital gains on line 4 or line 13. Capital losses on the sale of this stock do not need to be added back to income. Lines 5 and 14 - Section 235-7(a)(14), HRS, Short-Term and Long-Term Capital Gain Exemp - tion—For tax years beginning after 2007 and end-

PDF and Losses Capital Gains - IRS tax forms from its net realized long-term capital gains. Distributions of net realized short-term capital gains aren't treated as capital gains. Instead, they are included on Form 1099-DIV as ordinary divi-dends. Enter on Schedule D, line 13, the to-tal capital gain distributions paid to you during the year, regardless of how long you held your investment.

2022 Capital Gains Tax Calculator - See What You'll Owe - SmartAsset That means you pay the same tax rates you pay on federal income tax. Long-term capital gains are gains on assets you hold for more than one year. They're taxed at lower rates than short-term capital gains. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top ...

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form

Calculating the capital gains 28% rate in Lacerte - Intuit Lacerte calculates the 28% rate on capital gains according to the IRS form instructions. Per the instructions, the 28% rate will generate if an amount is present on Schedule D, Lines 18 or 19. Line 18: If you checked Yes on Line 17, complete the 28% Rate Gain worksheet in these instructions (page 10) if either of the following applies for 20xx:

Capital Improvements Worksheet Do not file this worksheet with your tax return -- keep it in your permanent records until you sell the home. capital improvements worksheet The file is in rich text format (RTF) that is suitable for use with most word processing programs used in the Windows environment. For more information, see our discussion of adjustments to your home's basis.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Long Term Capital Gains Tax - TurboTax Online - Intuit From the schedule D worksheet, line 15 (net Long Term Capital Gains) is $37,477. Line 20 is checked Yes to complete the Qual Div/ Cap Gain Tax Worksheet, but it's not included in my downloaded paperwork from TurboTax Online Return. This should be taxed at 15% with my income bracket. Why is the full amount $37,477 listed on line 7 (Cap Gains) of ...

› forms-pubs › about-schedule-d-form-1040About Schedule D (Form 1040), Capital Gains and Losses Information about Schedule D (Form 1040 or 1040-SR), Capital Gains and Losses, including recent updates, related forms, and instructions on how to file. Use Schedule D to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts.

› how-to-figure-capital-gains-taxHow to Calculate Capital Gains Tax | H&R Block Short-term capital gain tax rates . Short-term capital gains are gains apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they’re taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Long-term capital gains tax rate . Long-term capital gains apply to assets that you held ...

Forms and Publications (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439: Notice to Shareholder of Undistributed Long-Term Capital Gains 1121 11/29/2021

0 Response to "43 capital gains tax worksheet"

Post a Comment