44 1031 like kind exchange worksheet

About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales. Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? Sec 1031 of the IRC exempts such transactions in the name of Like-Kind Exchange to cover such transactions. Example Let us consider an example of Mr. A, who wants to sell his commercial property for $500,000, which was originally acquired for $300,000. This transaction would lead to a profit of $200,000, which would be subject to tax. But, if Mr.

Replacement Property Basis Worksheet - 1031 Corporation Exchange ... Replacement Property Basis Worksheet. ... Like-Kind Exchange Replacement Property Analysis of Tax Basis for Depreciation (pdf). Contact Us. Mail: Phone: Fax: Email: 1031 Corporation 1707 N Main St Longmont, CO 80501. 888-367-1031. 303-684-6899. 1031 Team. Resources. 1031 Exchange Manual; 1031 Exchange Manual; Escrow Services; What is a 1031 ...

1031 like kind exchange worksheet

1031 Exchange: Like-Kind Rules & Basics to Know - NerdWallet What is a 1031 exchange? A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by ... PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 7400 Heritage Village Plaza, Suite 102 Gainesville, VA 20155 800-795-0769 703-754-9411 Fax 703-754-0754 Compliments of Realty Exchange Corporation Your Nationwide Qualified Intermediary for the Tax Deferred Exchange of Real Estate PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 Note that multi-asset exchanges are covered in detail in Section 1.1031(j)-1 of the regulations. An exchange is only reported as a multi-asset exchange if the exchanger transferred AND received more than one group of like-kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges.

1031 like kind exchange worksheet. Like Kind Exchange Calculator - cchwebsites.com Description of Like Kind Property Brief description of the property involved in this exchange. Sales Price or Fair Market Value The sales price or Fair Market Value (FMV) of the property sold. Purchase Price or Fair Market Value The purchase price or Fair Market Value (FMV) of the property received. Less Liabilities/Mortgages Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Form 8824: Do it correctly | Michael Lantrip Wrote The Book Form 8824 is the 1031 Exchange tax form. We explain the Instruction for completing it, using real numbers from a real deal, and your HUD-1. ... The name of the form is Form 8824, it's called Like-Kind Exchanges, and you attach it to your Form 1040 if you are an individual. ... FORM 8824 WORKSHEET. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

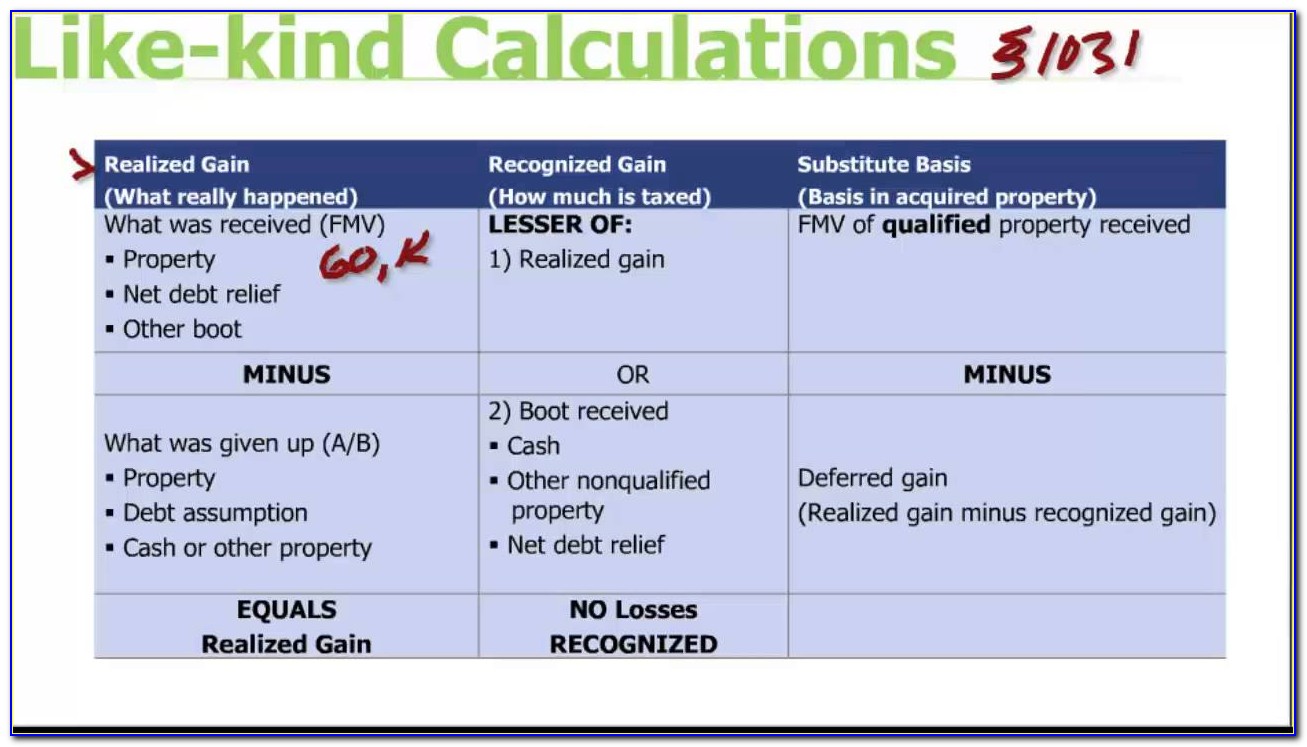

Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms the basis of property acquired in a section 1031 exchange is the basis of the property given up with some adjustments. this transfer of basis from the relinquished to the replacement property preserves the deferred gain for later recognition. a collateral affect is that the resulting depreciable basis is generally lower than what would … Accounting for 1031 Like-Kind Exchange - BKPR A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character. Even if the quality or grade of these properties differs, they may still qualify for like-kind exchange treatment. Personal Property Not Qualified for Like-Kind Exchange Like-Kind Exchanges - Real Estate Tax Tips Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section 1031. If, as part of the exchange, you also receive other (not like-kind) property or money, you must recognize a gain to the extent of the other property and money received. You can't recognize a loss. Under the ... Like-Kind Exchange Worksheet - Thomson Reuters Both properties must be similar enough to qualify as "like-kind." Like-kind property is property of the same nature, character or class. Quality or grade does not matter. Most real estate will be like-kind to other real estate. Specific types of property are excluded from like-kind treatment: Inventory or stock in trade; Stocks, bonds, or notes

1031 Like Kind Exchange Calculator - Excel Worksheet - Pinterest Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. P Pam Park 18 followers More information Download the Realized 1031 Calculator Find this Pin and more on Investment and future money by Pam Park. Tax Advisor Calculator Worksheets Investing Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1. 1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and IRS ...

IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for people who seek a picture according specific topic, you can find it in this website. Finally all pictures we have been displayed in this website will inspire you all. Thank you. Download by size: Handphone Tablet Desktop (Original Size)

1031 Exchange Worksheet - Pruneyardinn Worksheet April 19, 2018 18:23. The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

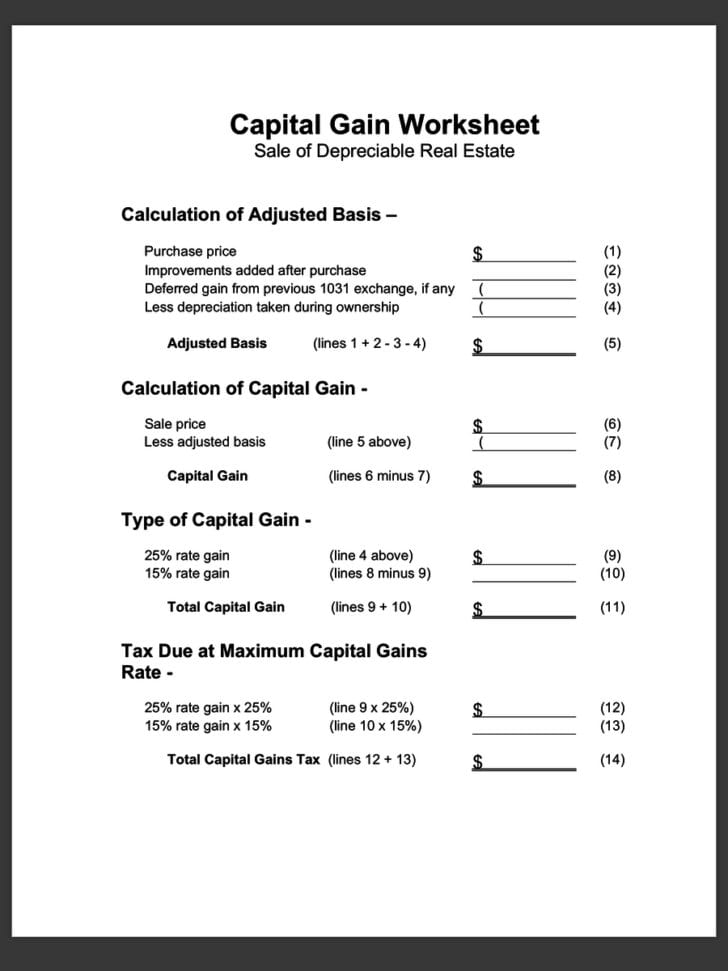

1031 Exchange Examples | 2022 Like Kind Exchange Example (1) Federal Capital Gains equal to Realized Gain less depreciation taken multiplied by the applicable rate. (2) Based on amount of depreciation taken during ownership of the property. In this example,the amount is based on $400,000 of depreciation taken. (3) Rate varies by state. Example assumes California.

1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template We constantly effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek an image according specific topic, you can find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 FORM 8824 WORKSHEET Tax Deferred Exchanges Under IRC § 1031Worksheet 1 TaxpayerExchange PropertyReplacement PropertyDateClosed Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3.

Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded ...

1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements

WorkSheets & Forms - 1031 Exchange Experts WorkSheet #1 - Calculation of Basis WorkSheet #2 & 3 Calculation of Exchange Expenses Information About Your Old Property WorkSheet #4, 5 & 6 Information About Your New Property Debt Associated with Your Old and New Property Calculation of Net Cash Received or Paid WorkSheet #7 & 8 Calculation of Form 8824, Line 15

IRC 1031 Like-Kind Exchange Calculator Exchange vs. Sale A 1031 arrangement allows you to defer all of your capital gains taxes. And this amounts to getting a long-term and interest-free loan from the Internal Revenue Service. The real advantage is not just in tax savings - investors who take advantage of 1031 provisions can acquire much more investment real estate than those who don't.

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 Note that multi-asset exchanges are covered in detail in Section 1.1031(j)-1 of the regulations. An exchange is only reported as a multi-asset exchange if the exchanger transferred AND received more than one group of like-kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 7400 Heritage Village Plaza, Suite 102 Gainesville, VA 20155 800-795-0769 703-754-9411 Fax 703-754-0754 Compliments of Realty Exchange Corporation Your Nationwide Qualified Intermediary for the Tax Deferred Exchange of Real Estate

1031 Exchange: Like-Kind Rules & Basics to Know - NerdWallet What is a 1031 exchange? A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by ...

0 Response to "44 1031 like kind exchange worksheet"

Post a Comment