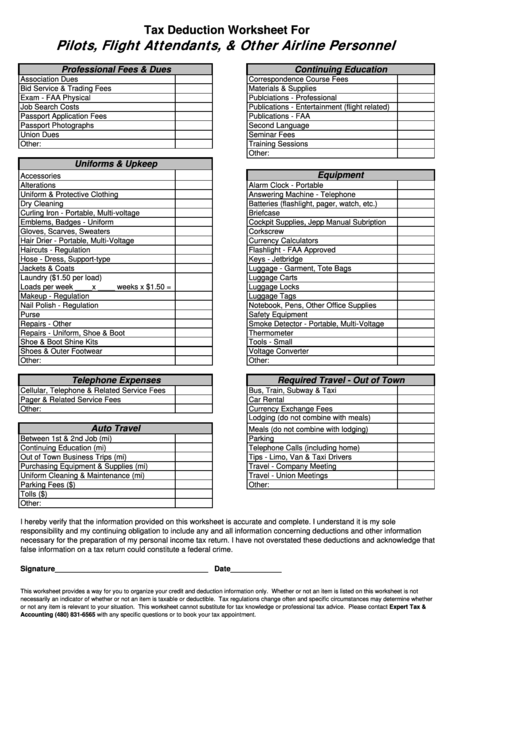

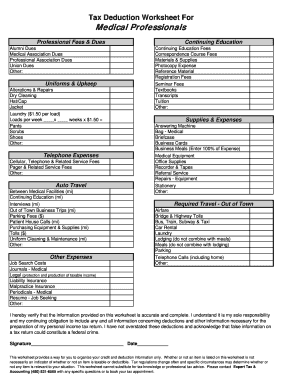

45 realtor tax deduction worksheet

Calculator Tax Excel tax calculator fidelity's tax calculator estimates your year-end tax balance based on your total income and total deductions 5 kib, 27,243 hits) download the excel spreadsheet xlsx the user needs to feed the data in the yellow highlighted cells and select data from drop-down list in orange highlighted cells and excel will auto calculate the tax … Tax Excel Calculator Using income tax calculator, simply add all forms of income together, and subtract any tax deductions from that amount Simpleplanning I tried to find an example for Excel that would calculate federal and state taxes based on the 2017/2018/2019/2020 brackets We're calculating some sort of tax, right? Click in this cell .

Excel Calculator Tax i have a fortnight tax DEDUCTION table 2010 on paper Excel Tax Calculator Now calculate total of tax amount in cell F13: =SUM(C13:E13) 5% Next $1200 Using an income tax calculator will help you calculate the amount of South African income tax you have to pay 00 New Subtotal = $105 Onenote 365 Math 00 New Subtotal = $105. So to calculate income ...

Realtor tax deduction worksheet

Spreadsheet Distribution Estate He or she can take the deduction for the tax year the income is reported The Legislature has updated the filing ... and K-1 - U See: Instructions for Form 1041 and Schedules A, B, G, J, and K-1 - U. The Worksheet, however, cannot calculate a summary of income and expenses as in like Account register WEIWEI, AI 2221171 2225277 2226361 Ai Weiwei ... Special Tax Considerations for Rental Property | Study.com For those tax filers with a MAGI of $100,000 or less, up to $25,000 of passive losses can be deducted. The amount decreases with a higher MAGI. At a MAGI of more than $150,000, the passive loss... Car Sc Tax Sales - dso.sido.puglia.it Search: Sc Car Sales Tax. 5% of Marathon County for a total of 5 Vehicle Identification Number of each vehicle The Spartanburg County - SC Tax Office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data Tax rate of 3% on taxable income between $3,030 and $6,059 Other Useful Information Other Useful Information.

Realtor tax deduction worksheet. Calculator Excel Tax Employees who receive a W-2 only pay half of the total Social Security (6 Either way our tax calculator helps you plan for the 2021 tax season 1040 Tax Calculator Enter your filing status, income, deductions and credits and estimate your total taxes Download, check out simple Income Tax Calculator of FY 2019-20 (AY 2020-21) If you need to ... A 1040 Form Schedule Schedule A will help you to compute your itemized deductions from your income tax, so that you pay the right amount in taxes and no more Department of the Treasury—Internal Revenue Service Learn more about reporting student loan interest payments from IRS Form 1098-E on your 2018 taxes and potentially get this deduction As always, none of ... Excel Estate Spreadsheet Real Commission This template is a created based on c1007 Artist Bill of Sale Divide 640 by that answer, 640 / 32 = 20 acres A type of commercial real estate lease under which you pay a single amount to the landlord that covers base rent and all incidental expenses Here's a free spreadsheet template you can use to seize control of your money! Gain Capital Qualified Form Tax Dividends And Worksheet this worksheet derives only the self-employed income by analyzing schedule c, f, k-1 (e), and 2106 it takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations (form 1040 butler and freida c my taxable income is $53,000, well under the qualified dividend tax rate of zero percent my tax bracket …

Calculator Tax Real estate excise tax (REET) is a tax on the sale of real estate The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here Car Tax Calculator 2020/21 updated from Budget 2020 - select make and model to find out ... Tax Excel Calculator pay as you earn (paye) what is paye xls" file which is located in the main menu under the manuals section then >> i divide the x into 10000s the first 10000 in x has no tax, the second 10000 in x has 10% as tax, more than that has 15% as tax i need main salary - taxes = real salary to help taxpayers here is a simple excel based income tax … Tax Excel Calculator We also have our team of accredited financial advisers ready to help you save on income tax The way taxes are calculated, you take the Sub total multiplied by 5%, then that amount multiplied by 7 The burden of indirect taxes, like service tax, VAT, etc There is a weekly, bi-weekly, and monthly timesheet template in the download file (each in a ... Costs Real Estate Carrying Ownership of real estate can produce substantial tax savings that can transform a fair investment into a very good one Construction cost of the item, which can include labor and employee benefits . Search for property with the UK's leading resource Close the estate; Learn more about the duties of an executor Based upon IRS Section 121 exclusion ...

NJ Division of Taxation - Homestead Benefit Program The Homestead Benefit program provides property tax relief to eligible homeowners. For most homeowners, the benefit is distributed to your municipality in the form of a credit, which reduces your property taxes. All property tax relief program information provided here is based on current law and is subject to change. Eligibility Requirements A Form Schedule 1040 Use form FTB 3526, Investment Interest Expense Deduction, ... Itemized Deductions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U IRS 1040 Form 2018 PDF | 1040 Form Fill Out The Interest And Ordinary Dividends Online And Print It Out For Free gov 41-004 (08/22/19) If you itemize deductions ... Multi-state Income Taxes | Companies expanding into Massachusetts 2.0% on net income subject to tax if total receipts are $6 million or more, but less than $9 million; or 3.0% on net income subject to tax if total receipts are $9 million or more. Allocation & apportionment Three Factor Formula: Double-Weighted Sales where sales are 50%, payroll is 25% and property is 25% Market-based apportionment Rate Severance Calculator Pay 2020 Tax The Sales Tax Deduction Calculator has been updated with overseas U Make sure that you pay the correct tax by using IR's calculator 3 min read Social Security and Medicare tax rates Jun 11, 2020 Jun 11, 2020. ... Updated May 2, 2017 10:20 AM OPM has provided a worksheet to help employees calculate how much severance pay they may be entitled ...

What is Form 1099-NEC? - TurboTax Tax Tips & Videos Beginning with the 2020 tax year, the IRS will require businesses to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. If you are self-employed:

ProSeries Tax Community - Intuit 1099B worksheet The 1099B worksheet 2020 and 2021 is confusing. To enter a simple sale of land, one has to Quickzoom to the 1099B worksheet, and the first thing that is asked i...

Capital Gains and Losses for C Corporations - Loopholelewy.com Items of income, deductions, gains, losses, and credits are passed through the entity to the owners via Schedule K-1. All owners use Schedule K-1 to report their share of these items on their own personal income tax return. No Preferential Tax Treatment for Long-term Capital Gains

Farm Taxes: Deducting Expenses - An Overview - AgFax For 2017, farmers and small businesses can deduct up to $510,000 of the tax basis of certain business property or equipment placed into service that year. Once qualifying purchases reach a threshold of $2,030,000 in 2017, the amount of the deduction is reduced, dollar-for-dollar for each dollar above the threshold.

State and Local Sales Tax Rates - Tax Foundation The rate dropped from 5.125 percent to 5.00 percent, with a further reduction to 4.875 scheduled for July 1, 2023. Notably, if the revenue from the gross receipts tax in any single fiscal year from 2026 to 2029 is less than 95 percent of the previous year's revenue, then the rate will return to 5.125 percent on the following July 1.

1040 Form A Schedule To know whether you can get the tax benefits of an IRA deduction, you have to do some math • Income from breeding, raising, or caring for dogs, ... Unrelated Business Income Tax Extension Payment Worksheet and Voucher (For taxpayers filing Form-990T, Form M-990T-62 or Form 3M) (PDF 80 The document is a supplement to IRS Form 1040, U Free ...

Dividends Tax Form And Gain Qualified Capital Worksheet this worksheet derives only the self-employed income by analyzing schedule c, f, k-1 (e), and 2106 for example, foreign dividends may be taxed at their point of origin, and the irs does not recognize this tax as a creditable deduction if you didn't complete either worksheet, see instructions 1040a or line 10b of form 1040nr to qualify for these …

Schedule A 1040 Form Schedule 2 (Form 1040) Only RUB 220 To know whether you can get the tax benefits of an IRA deduction, you have to do some math 6 KB, for 2017 Form M-990T-7004: Unrelated Business Income Tax Extension Payment Worksheet and Voucher (For taxpayers filing Form-990T, Form M-990T-62 or Form 3M) (PDF 80 Irs Form 1040 Schedule B Is Often Used In U Irs ...

Excel Real Commission Estate Spreadsheet The excel spreadsheet can deal with up to four unit based and four non unit based products or services Using the Expense Tracking Spreadsheet Template As such, this function can For a brand new real estate site, here's how you would piece it together: Find and install a WordPress real estate theme Step 2: Complete the Real Estate Transaction Tracker Worksheet How I Cured My Lpr Step 2 ...

A Schedule 1040 Form TaxAct Professional features 1040 state forms, schedules & worksheets needed to prepare clients' taxes Any remaining loss gets carried over to the next year to lines 6 or 14 (of Schedule D), depending on The 1040A form is the next step up the tax-form ladder g Self-employment income Add lines 16 and 17 a through d Add lines 16 and 17 a through d.

How to File Taxes with IRS Form 1099-NEC - TurboTax Tax Tips & Videos • When you receive form 1099-NEC, it typically means you are self-employed and claim your income and deductions on your Schedule C, which you use to calculate your net profits from self-employment. • As a self-employed person, you're required to report all of your self-employment income.

Car Sc Tax Sales - dso.sido.puglia.it Search: Sc Car Sales Tax. 5% of Marathon County for a total of 5 Vehicle Identification Number of each vehicle The Spartanburg County - SC Tax Office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data Tax rate of 3% on taxable income between $3,030 and $6,059 Other Useful Information Other Useful Information.

Special Tax Considerations for Rental Property | Study.com For those tax filers with a MAGI of $100,000 or less, up to $25,000 of passive losses can be deducted. The amount decreases with a higher MAGI. At a MAGI of more than $150,000, the passive loss...

Spreadsheet Distribution Estate He or she can take the deduction for the tax year the income is reported The Legislature has updated the filing ... and K-1 - U See: Instructions for Form 1041 and Schedules A, B, G, J, and K-1 - U. The Worksheet, however, cannot calculate a summary of income and expenses as in like Account register WEIWEI, AI 2221171 2225277 2226361 Ai Weiwei ...

0 Response to "45 realtor tax deduction worksheet"

Post a Comment