45 student loan interest deduction worksheet 1040a

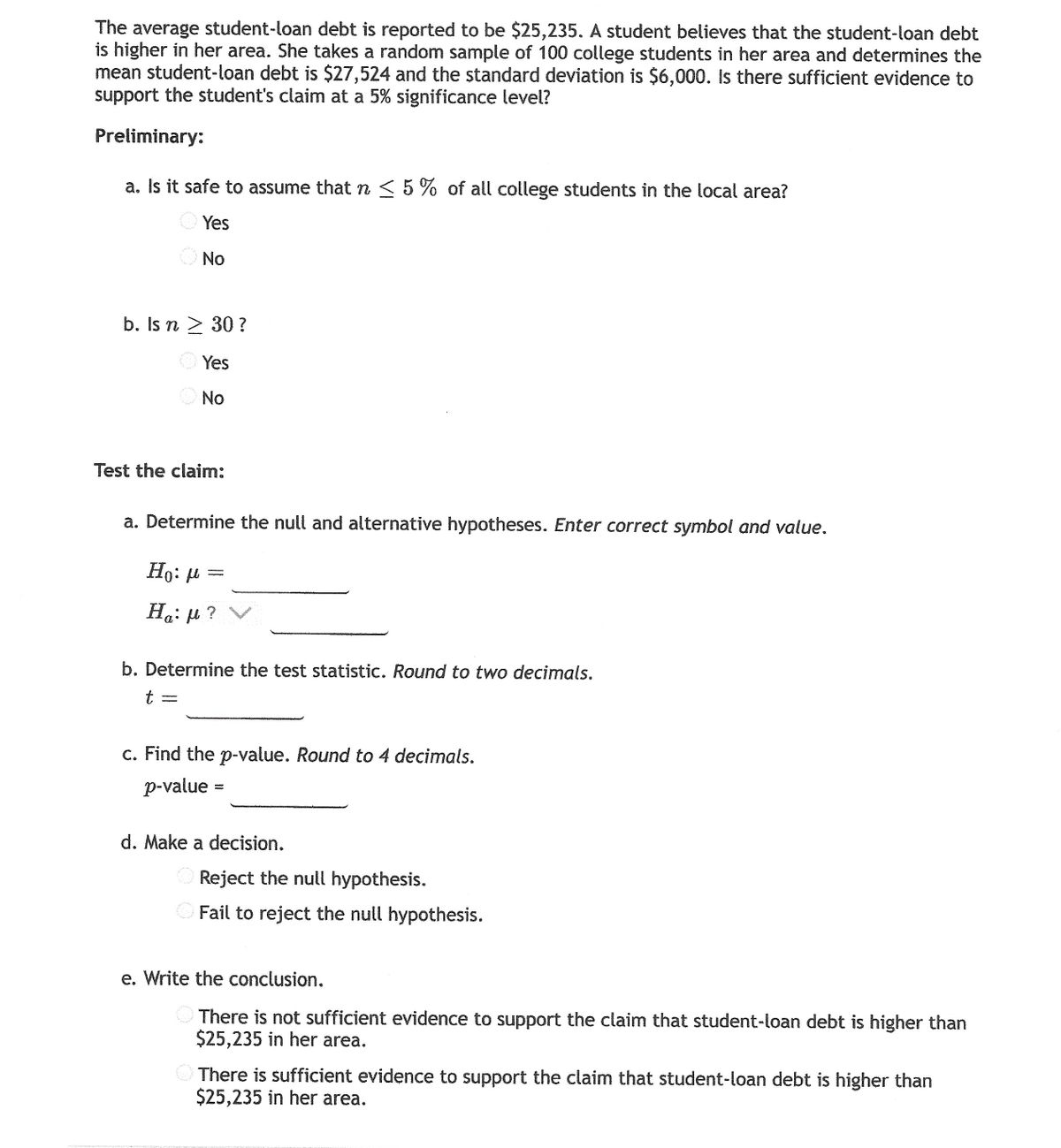

2021 1040A Form and Instructions (1040-A, Short Form) Free printable 2021 1040A form and 2021 1040A instructions booklet sourced from the IRS. Download and print the PDF file. Then, complete your US Individual Income Tax Return and supporting schedules. ... IRA deduction, student loan interest, and tuition and fees gross income adjustments are allowed. Credits for child and dependent care expenses ... Publication 970 (2021), Tax Benefits for Education | Internal Revenue ... Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. Reporting ...

Tax Form 1040 Student Loan Interest - Frank Financial Aid Although the student loan deduction is only open to people who fall between a certain MAGI, you need to keep in mind that if your MAGI is between $65,000 and $80,000 single or $130,000 and $160,000 joint, your maximum deduction gets reduced. For example, if you're a couple filing jointly with $145,000 in MAGI, your deduction is $1,250.

Student loan interest deduction worksheet 1040a

Solved: Student Loan Deduction - Intuit I used the "Student Loan Interest Deduction Worksheet" from IRS.gov and confirmed the 1040 was correct. View solution in original post. 0 2,689 Reply. 4 Replies Lisa995. ... (Line 21 of the 1040 or Line 15 of the 1040A) ♪♫•*¨*•.¸¸♥Lisa♥ ¸¸.•*¨*•♫♪ 0 1 2,693 Reply. zmclell. Returning Member March 27, 2018 11:16 AM. Irs Form 1040A ≡ Fill Out Printable PDF Forms Online The Irs Form 1040A is a shorter and simpler version of the Irs Form 1040. This form is for taxpayers who have income from wages, salaries, tips, taxable interest, ordinary dividends, and capital gain distributions. The Irs Form 1040A can be used by singles or married couples filing jointly with total income of less than $100,000. Can I Deduct Student Loan Interest? - College Ave With the student loan interest tax deduction, you can deduct the interest you paid during the year on a qualified student loan. As of 2019, you can deduct $2,500 or the actual amount of interest you paid during the year, whichever is less. However, not everyone will qualify for the deduction.

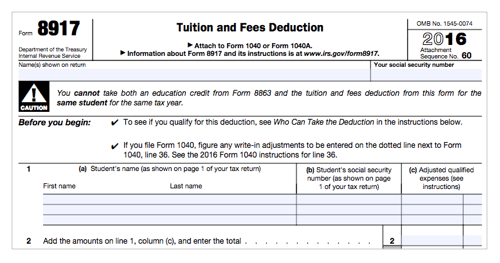

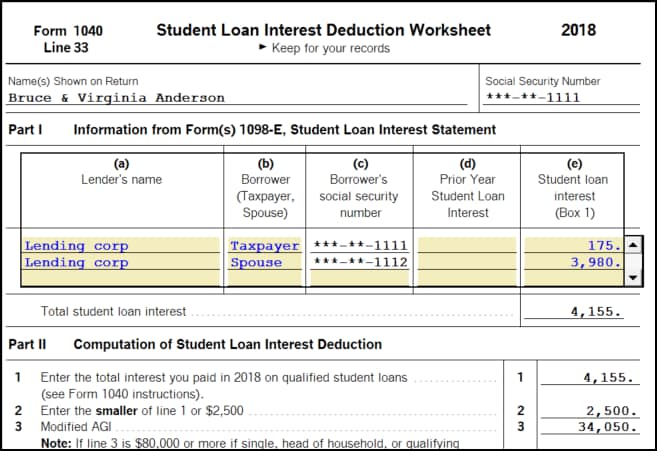

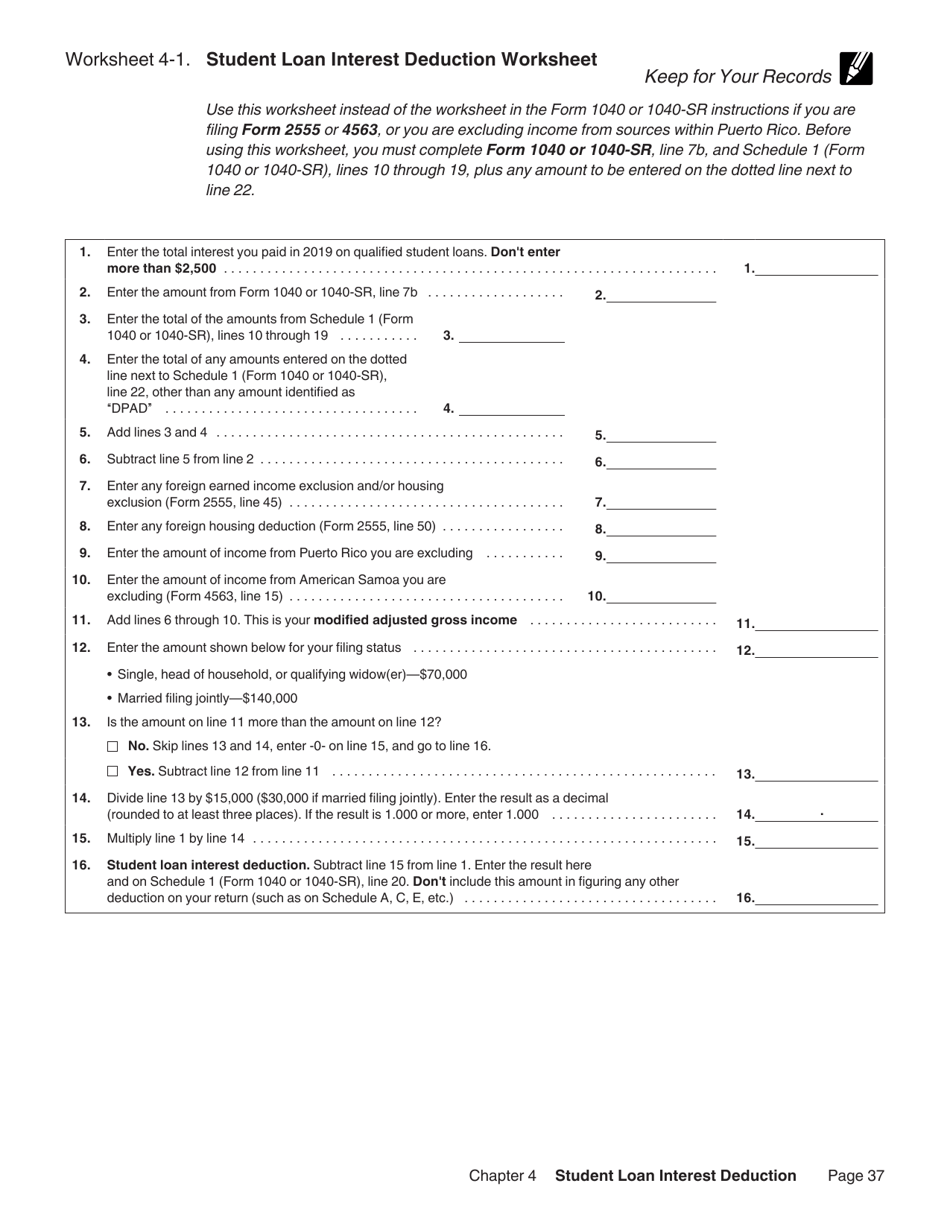

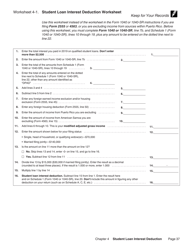

Student loan interest deduction worksheet 1040a. PDF Qualified student loan interest deductions are reported on Form 1040 ... Qualified student loan interest deductions are reported on Form 1040, Schedule 1. DO NOT FILE July 11, 2019 DRAFT AS OF SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040 or 1040-SR. Chapter 4 - Student Loan Interest Deduction - Uncle Fed This deduction can reduce the amount of your income subject to tax by up to $2,500 in 2004. The student loan interest deduction is taken as an adjustment to income. This means you can claim this deduction even if you do not itemize deductions on Schedule A (Form 1040). This chapter explains: What type of loan interest you can deduct, Student Loan Interest Deduction Worksheet - TaxAct Scroll down and click Form 1040 Student Loan Interest - Student Loan Interest Deduction Worksheet to open a form you already created in Forms View, then click ... Student Loan Interest Deduction Worksheet (Publication 970) 2. 3. Enter the total of the amounts from Schedule 1 (Form. 1040 or 1040-SR), lines 10 through 19 ...

Topic No. 456 Student Loan Interest Deduction - IRS tax forms It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status. PDF Student Loan Interest Deduction Worksheet Form 1040, Line 33, or Form ... Enter the total interest you paid in 2016 on qualified student loans (see instructions). Do not enter more than $2,500 Enter the amount from Form 1040, line 22 or Form 1040A, line 15 Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to line 36 or from Form 1040A ... What is a 1098-E: Student Loan Interest - TurboTax The student loan interest deduction is taken as an adjustment when calculating your adjusted gross income, or AGI. This means you don't have to itemize your deductions to take it. To qualify, the interest payments you make during the year must be on a student loan that you took out to put yourself, your dependents or spouse through school. PDF Page 96 of 117 14:16 - 24-Jan-2019 - IRS tax forms Enter the amount from Form 1040, line 6 2. 3. Enter the total of the amounts from Schedule 1, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to Schedule 1, line 36 other than any amounts identified as "DPAD" 3. 4. Subtract line 3 from line 2 4. 5. Enter the amount shown below for your filing status.

Frequently Asked Questions | UIC Law | University of Illinois Chicago Figure the deduction using the "Student Loan Interest Deduction Worksheet" in the Form 1040 or Form 1040A instructions. There are many other provisions to the Taxpayer Relief Act.Please consult with your tax advisor to be sure you are eligible for any of these taxpayer benefits. Stratus Financial Blog - Managing Your Student Loan Tax Benefits and ... Form 1098-E: Student Loan Interest Statement. ... Review the Student Loan Interest Deduction Worksheet in the 1040 or 1040A instructions. Related Blogs. Protecting yourself from online fraud. Benefits Increase as The Demand for Pilots Grow. Thinking of Cosigning A Private Student Loan? Here are five things you should know! How to Deduct Student Loan Interest - Tax Guide - 1040.com The max deduction is $2,500 for your 2021 tax return. This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. Note: Since federal student loan interest was waived in 2021, the interest deduction will only apply to non-federal loans that continued to charge interest. Where To Put Student Loan Interest On 1040 - UnderstandLoans.net The student loan interest deduction is reportable on Form 1040 in the AGI category. Loan servicers make reporting this amount on your taxes easy: theyre required to send you a Form 1098-E stating how much you paid in interest. The student loan tax deduction for paid interest is limited to $2,500, and its also limited by your income.

2017 Instructions for Schedule CA (540NR) | FTB.ca.gov Student Loan Interest Deduction Worksheet. Enter the total amount from Schedule CA (540NR), line 33, column A. If the amount on line 1 is zero, STOP. You are not allowed a deduction for California; Enter the total interest you paid in 2017 on qualified student loans but not more than $2,500 here

Student Loan Tax Forms - Information & Tax Deductions | Sallie Mae Visit IRS.gov or call 800-829-1040. Refer to IRS Pub 970, Tax Benefits for Education, or review the Student Loan Interest Deduction Worksheet in your 1040 or 1040A instructions. Contact your tax advisor. This information is not meant to provide tax advice. Consult with a tax advisor for education tax credit and deduction eligibility.

The Federal Student Loan Interest Deduction The maximum student loan interest deduction you can claim is $2,500 as of the 2021 tax year, and it might be less. It can be limited by your income. The deduction is reduced for taxpayers with modified adjusted gross incomes (MAGIs) in a certain phaseout range and is eventually eliminated entirely if your MAGI is too high. 4

Your 1098-E and Your Student Loan Tax Information Your 1098-E Student Loan Interest Statement has one of the most important numbers we'll give you this year—the amount of interest paid on your student loans in 2021. ... You can also complete the Student Loan Interest Deduction worksheet in the Form 1040 or 1040A instructions. Get in Touch. Have a social account and have a question? Send us a ...

What Is Form 1040-A? - The Balance Form 1040-A was much faster and easier to prepare by hand than the longer Form 1040, but it covered more deductions and tax credits than Form 1040EZ, the other simplified return option that was available until 2018. For example, it was possible to deduct IRA contributions and student loan interest on the 1040-A, but not on the 1040EZ.

PDF Stimulus Payment - AARP IRA deduction (see page 27). Student loan interest deducti( Tuition and fees deduction. A Add lines 16 through 19. Subtract line 20 from line 15. ... 1 1 7,300, see the worksheet on page 32. 26 26 is more than line 25, enter -0-. um tax see a e 30 . 28 Form 1040A (2007) Tax,

How Student Loan Interest Deduction Works | VSAC Please log into your MyVSAC account to view the amount of interest paid. Fill out your 1040 or 1040A. To determine your student loan interest tax deduction, use the information from your 1098-E and follow the directions within the IRS Form 1040 or 1040A instruction booklet. Ask for help.

2021 1040 Form and Instructions (Long Form) - Income Tax Pro For the 2021 tax year, federal tax form 1040, US Individual Income Tax Return, must be postmarked by April 18, 2022 . Federal income taxes due are based on the calendar year January 1, 2021 through December 31, 2021. Prior year federal tax forms, instructions, and schedules are also available, and should be mailed as soon as possible if late.

How to Use Form 1098-E for My Taxes - The Nest Step 4. Complete the "Student Loan Interest Deduction Worksheet" in the form's instructions to calculate the amount of your deduction. The amount listed in Box 1 of Form 1098-E is the total interest you paid on your student loan. If you paid interest to more than one lender and received more than one Form 1098-E, enter the total amount ...

PDF Illinois Department of Revenue Nonresident and Part-Year Resident 2016 ... Attach to your Form IL-1040 Your name as shown on your Form IL-1040 Your Social Security number Step 1: Provide the following information 1Were you, or your spouse if "married filing jointly," a full-year resident of Illinois during the tax year?

Form 1098-E | Cornell University Division of Financial Affairs Each student receiving a 1098-E form is responsible for determining whether he or she is eligible to deduct the interest in accordance with IRS regulations. See IRS Forms and Publications for more details. For other questions about the 1098-E form, contact the Student Loan office, (607) 255-7234. What is a 1098-E form?

Student Loan Interest Deduction - Uncle Fed This deduction can reduce the amount of your income subject to tax by up to $2,500 in 2003. The student loan interest deduction is taken as an adjustment to income. This means you can claim this deduction even if you do not itemize deductions on Schedule A (Form 1040). This chapter explains: What type of loan interest you can deduct,

Can I Deduct Student Loan Interest? - College Ave With the student loan interest tax deduction, you can deduct the interest you paid during the year on a qualified student loan. As of 2019, you can deduct $2,500 or the actual amount of interest you paid during the year, whichever is less. However, not everyone will qualify for the deduction.

0 Response to "45 student loan interest deduction worksheet 1040a"

Post a Comment