38 1120s other deductions worksheet

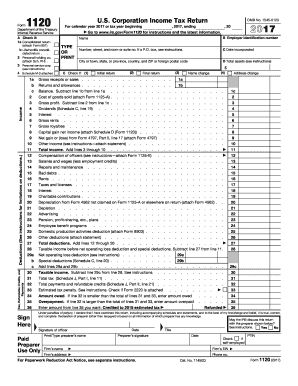

1120s Income Deductions Worksheets - K12 Workbook Worksheets are 2018 form 1120s, 6717 form 1120s 2018 part i shareholders share of, Instructions and work to schedule k 1, Instructions for form 1120s, 2016 100s schedule k 1 shareholders instructions for, Us 1120s line 19, Wisconsin department of health services division of, Llc s corp small business work. Why does Form 1120 show a statement for deductions on Line 26? - Intuit Per IRS instructions, Lacerte generates a statement for Form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. To generate a statement for line 26: Enter deduction type and amounts in the Other(Ctrl+E)field in Screen 20.1, Deductions.

singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae Line 3b - Nonrecurring Other (Income) Loss/ Expense: Other income reported on Schedule C represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is

1120s other deductions worksheet

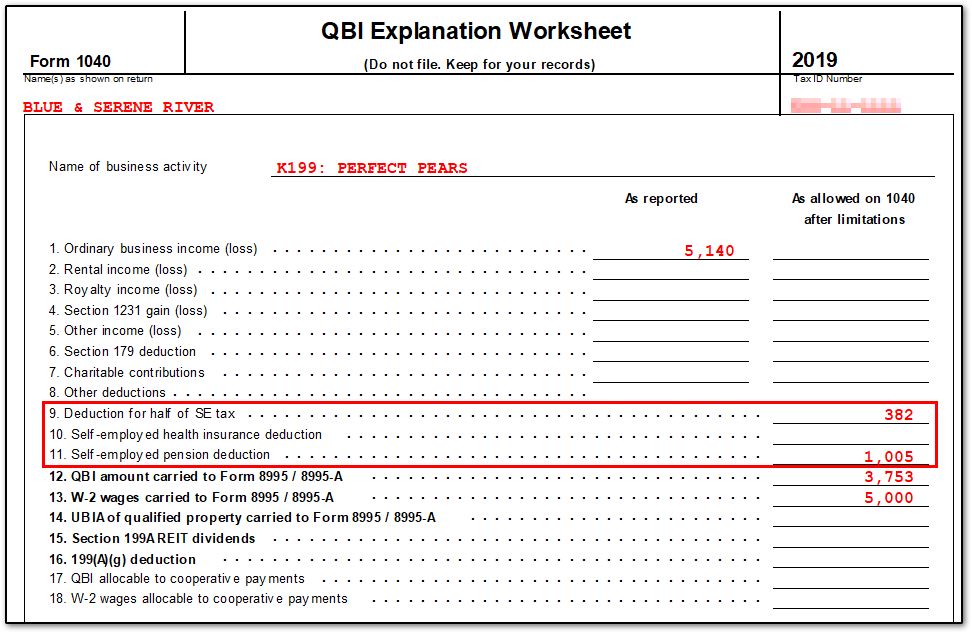

Shareholder's Instructions for Schedule K-1 (Form 1120-S) (2021 ... Other Deductions Contributions. Codes A through G. Form 8283. Code A. Cash contributions (60%). Code B. Cash contributions (30%). Code C. Noncash contributions (50%). Food inventory contributions. Code D. Noncash contributions (30%). Code E. Capital gain property to a 50% limit organization (30%). Code F. Capital gain property (20%). 1120 Line 26 Other Deductions Worksheets - Learny Kids Some of the worksheets for this concept are 2019 form 1120, 2020 form 1120 w work, Schedule o 720 17030300 other additions and, Fannie mae cash flow analysis calculator, 2018 ia 1120f general instructions who must file federal, 2018 nonconformity adjustments work, Schedule analysis method sam calculator, Qualified business income deduction. 2018 1120s Other Deductions Worksheets - K12 Workbook Displaying all worksheets related to - 2018 1120s Other Deductions. Worksheets are 2018 form 1120s, 6717 form 1120s 2018 part i shareholders share of, Instructions and work to schedule k 1, 1120s income tax return for an s corporation omb no, 2018 il 1120 instructions, Basis reporting required for 2018 draft form schedule e, 2018 net profit booklet 11 18, Qualified business income deduction.

1120s other deductions worksheet. 2018 Other Deductions Form 1120s Line 19 - K12 Workbook *Click on Open button to open and print to worksheet. 1. 2018 Form 1120S - 2. 1120S U.S. Income Tax Return for an S Corporation OMB No ... 3. 671117 (Form 1120S) 2018 Part III Shareholders Share of ... 4. BASIS REPORTING REQUIRED FOR 2018 Draft Form Schedule E 5. Instructions for Form 1120S 6. 1120S U.S. Income Tax Return for an S Corporation Form revenue.ky.gov › Forms › Schedule K-1 (Form PTE) (10SCHEDULE K-1 OWNER’S SHARE OF INCOME, CREDITS, DEDUCTIONS ... any (loss) reported in Section A, Lines 1, 2, or 3 and any other related items of income, (loss), and deductions reported on Kentucky Schedule K-1. Refer to the federal Instructions for federal Schedule K-1 (Form 1120S or Form 1065) to determine if the passive activity limitations apply to your share of › pub › irs-pdf2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) Box 10. Other Income \(Loss\) Box 11. Section 179 Deduction. Box 12. Other Deductions. Box 13. Credits. Box 14. International Transactions. Box 15. AMT Items. Box 16. Items Affecting Shareholder Basis. Box 17. Other Information. Box 18. More Than One Activity for At-Risk Purposes. Box 19. More Than One Activity for Passive Activity ... form 1120 line 26 other deductions worksheet - Fill Online, Printable ... PDF editor permits you to help make changes to your Form 1120-A from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently. Video instructions and help with filling out and completing Form 1120 line 26 other deductions worksheet

How to File S Corp Taxes & Maximize Deductions | White Coat Investor If you are filing as a C Corporation, file form 1120. The 1120S is only for S Corps. This tax form is due to be postmarked by March 15th, but you can file an extension on Form 7004. It's literally one page, 8 lines, and will take about 30 seconds. You see, with an S Corp being a pass-through entity, you pretty much put $0 on every line. Schedule K-1 (Form 1120S) - Deductions - Support By making a separate entry on Line 1 of the K-1 1120-S Edit Screen, it will allow the item to carry to Worksheet 3 of Form 8582 and if the deduction is allowed under the passive loss requirements, it will be reported as a separate line item on Schedule E (Form 1040), line 28, column (f). › irm › part33.8.45 Manual Deposit Process | Internal Revenue Service The teller/cash clerk or remittance perfection technician will lock the safe, vault, money chest, or other receptacle or facility provided therein to store funds or other valuables including the door of the teller's/cash clerk's working area whenever the working area is left unattended, refer to IRM 10.2.14, Methods of Providing Protection. Other Deductions Supporting Details For Form 1120 Worksheets are Us 1120s line 19, Corporate 1120, 1120s income tax return for an s corporation omb no, 2019 form 1120 w work, Instructions for filing 2010 federal form 1065 sample return, Instructions for form 1120s, 6717 form 1120s 2018 part i shareholders share of, California tax forms guide. *Click on Open button to open and print to worksheet.

Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More. 1219. 12/26/2019. Form 1120 (Schedule N) Foreign Operations of U.S. Corporations. 2021. 11/16/2021. Form 1120 (Schedule O) Consent Plan and Apportionment Schedule for a Controlled Group. PDF 2018 Form 1120S - IRS tax forms Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. Go to for instructions and the latest information. OMB No. 1545-0123 2018 1120 Line 26 Supporting Details Worksheets - K12 Workbook Displaying all worksheets related to - 1120 Line 26 Supporting Details. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, Instructions for form 1120s, Us 1120s line 19, Product knowledge guide plastics, Paycheck protection program p information borrowers, Instructions for form n 11 rev 2018, Reporting and paying the 965 transition tax for 2017. Instructions for Form 1120-S (2021) | Internal Revenue Service If the income, deductions, credits, or other information provided to any shareholder on Schedule K-1 or K-3 is incorrect, file an amended Schedule K-1 or K-3 (Form 1120-S) for that shareholder with the amended Form 1120-S. Also give a copy of the amended Schedule K-1 or K-3 to that shareholder.

1120S U.S. Income Tax Return for an S Corporation Form - REGINFO.GOV Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. ... Other deductions (see instructions) . . .

PDF 2020 Instructions for Form 1120-S - IRS tax forms Temporary allowance of 100% for business meals. A corporation is allowed a 100% deduction for certain business meals paid or incurred in 2021 and 2022. See Travel, meals, and entertainment. Reminders Election by a small business corpora- tion.

Creating a Basic Form 1120-S - U.S. Income Tax Return for an S ... A 1120-S return has four basic areas that need to be completed, each of which will be covered below. Specifically, the preparer needs to address each of the following areas: (1) Enter basic information about the corporation and the return (Steps 1- 7); (2) Enter the various income, deductions and items being distributed to the shareholder ...

1120-US: Calculating the Other deductions lines on the S Corporation ... Other deductions, line 19 The Other deductions line on Page 2 of the Tax Return History Report is the sum of the following amounts on the Form 1120S, Schedule K. Investment interest expense, line 12b Section 59 (e) (2) expenditures, line 12c Other deductions, line 12d 1120-US: Tax Return History Report FAQs

Forms and Instructions (PDF) - IRS tax forms Instructions for Form 1120-S, U.S. Income Tax Return for an S Corporation. Instructions for Schedule K-2 (Form 1120-S) and Schedule K-3 (Form 1120-S) Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains. Instructions for Schedule K-1 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc.

1120s Line 19 Other Deductions 2019 - Printable Worksheets Showing top 8 worksheets in the category - 1120s Line 19 Other Deductions 2019. Some of the worksheets displayed are 1120 s income tax return for an s corporation, 2019 instructions for form 1120 s, Income tax return for an s corporation omb 1545, 2019 ia 1120s income tax return for s corporations, Self employment income work s corporation schedule, 1120s income tax return for an s corporation ...

1120s Other Deductions Worksheets - Printable Worksheets Some of the worksheets displayed are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 net profit booklet 11 18.

kb.drakesoftware.com › Site › Browse1120 - Dividends - Drake Software The Dividends Received Deduction Worksheet (Wks DRD) is generated from data entered in fields 3-1, 3-2, 3-3, and 3-4. The result of the Wks DRD is carried to Schedule C, line 3. Beginning with Drake18, the total from Schedule C, Line 23, column A, is carried to Form 1120, line 4 ("Dividends"), and the total from Schedule C, line 24, column C ...

Other Deductions Supporting Details For Form 1120 Some of the worksheets for this concept are Us 1120s line 19, Corporate 1120, 1120s income tax return for an s corporation omb no, 2019 form 1120 w work, Instructions for filing 2010 federal form 1065 sample return, Instructions for form 1120s, 6717 form 1120s 2018 part i shareholders share of, California tax forms guide.

› pub › irs-pdfFuture Developments 21 - IRS tax forms gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. How To Make the Election. For details about the election, see Form 2553, Election by a Small Business Corporation, and the Instructions for Form 2553. Who Must File

Instructions for Form 1120 (2021) | Internal Revenue Service Schedule M-3 (Form 1120) Item B. Employer Identification Number (EIN) EIN applied for, but not received. Item D. Total Assets Item E. Initial Return, Final Return, Name Change, or Address Change Income Exception for income from qualifying shipping activities. Line 1. Gross Receipts or Sales Line 1a. Gross receipts or sales. Advance payments.

2018 1120s Other Deductions Worksheets - K12 Workbook Displaying all worksheets related to - 2018 1120s Other Deductions. Worksheets are 2018 form 1120s, 6717 form 1120s 2018 part i shareholders share of, Instructions and work to schedule k 1, 1120s income tax return for an s corporation omb no, 2018 il 1120 instructions, Basis reporting required for 2018 draft form schedule e, 2018 net profit booklet 11 18, Qualified business income deduction.

1120 Line 26 Other Deductions Worksheets - Learny Kids Some of the worksheets for this concept are 2019 form 1120, 2020 form 1120 w work, Schedule o 720 17030300 other additions and, Fannie mae cash flow analysis calculator, 2018 ia 1120f general instructions who must file federal, 2018 nonconformity adjustments work, Schedule analysis method sam calculator, Qualified business income deduction.

Shareholder's Instructions for Schedule K-1 (Form 1120-S) (2021 ... Other Deductions Contributions. Codes A through G. Form 8283. Code A. Cash contributions (60%). Code B. Cash contributions (30%). Code C. Noncash contributions (50%). Food inventory contributions. Code D. Noncash contributions (30%). Code E. Capital gain property to a 50% limit organization (30%). Code F. Capital gain property (20%).

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

0 Response to "38 1120s other deductions worksheet"

Post a Comment