38 sales tax and discount worksheet answers

Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Cost of Goods Sold Formula | Calculator (Excel template) - EDUCBA The costs that cannot be included in the Cost of Goods Sold are the costs of sending the car to a particular dealership or the sales workforce cost in selling a car. Also, another important point to be noted is that the Ferrari cars that the company was unable to sell, the costs associated with it will not be a part of COGS.

Publication 537 (2021), Installment Sales | Internal Revenue ... 2017 453A additional tax $121,800 2018 Deferred Tax Liability calculation: 2017 Deferred Obligation: 14,000,000 – 2018 Payment received (5,000,000) 2018 Deferred Obligation: 9,000,000 x Gross Profit Percentage: 96.6670% The amount of gain that has not been recognized: 8,700,030 x Maximum capital gains tax rate: 21% 2018 Deferred Tax Liability ...

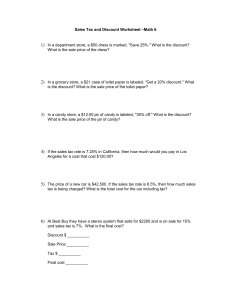

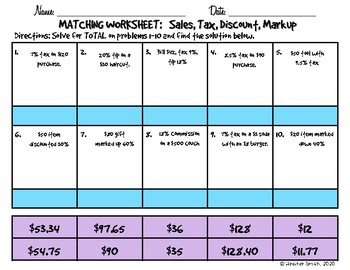

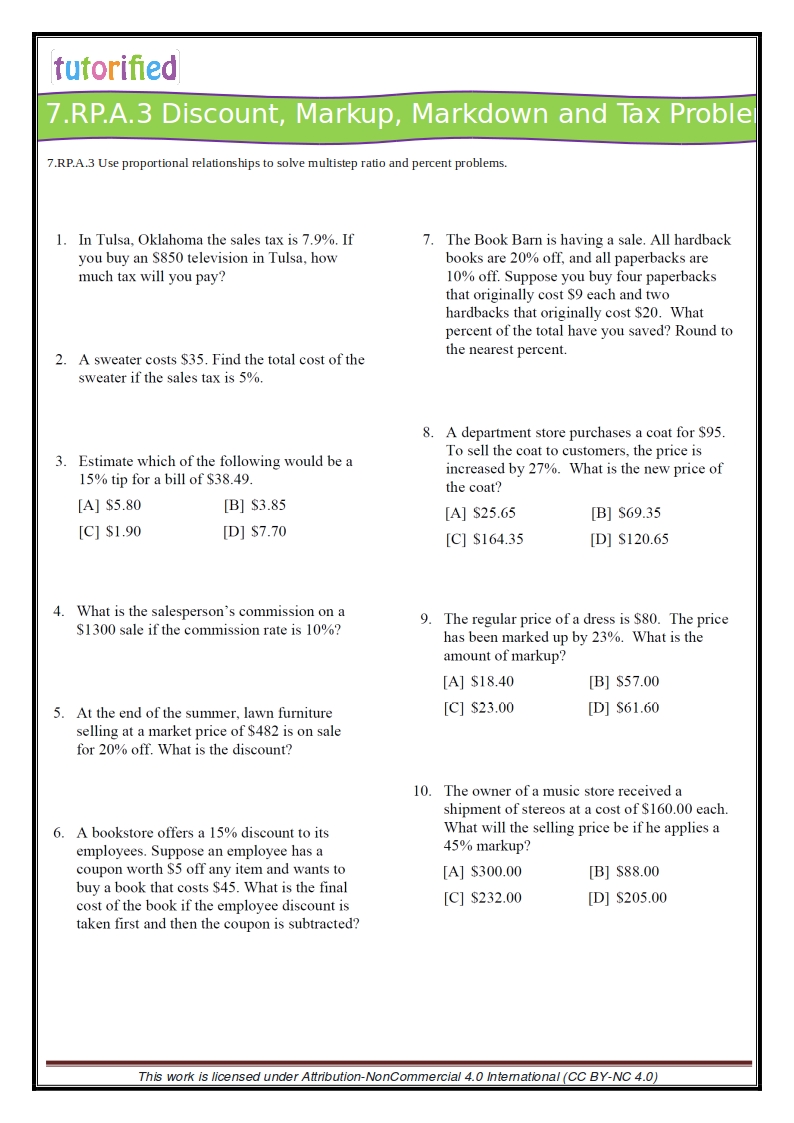

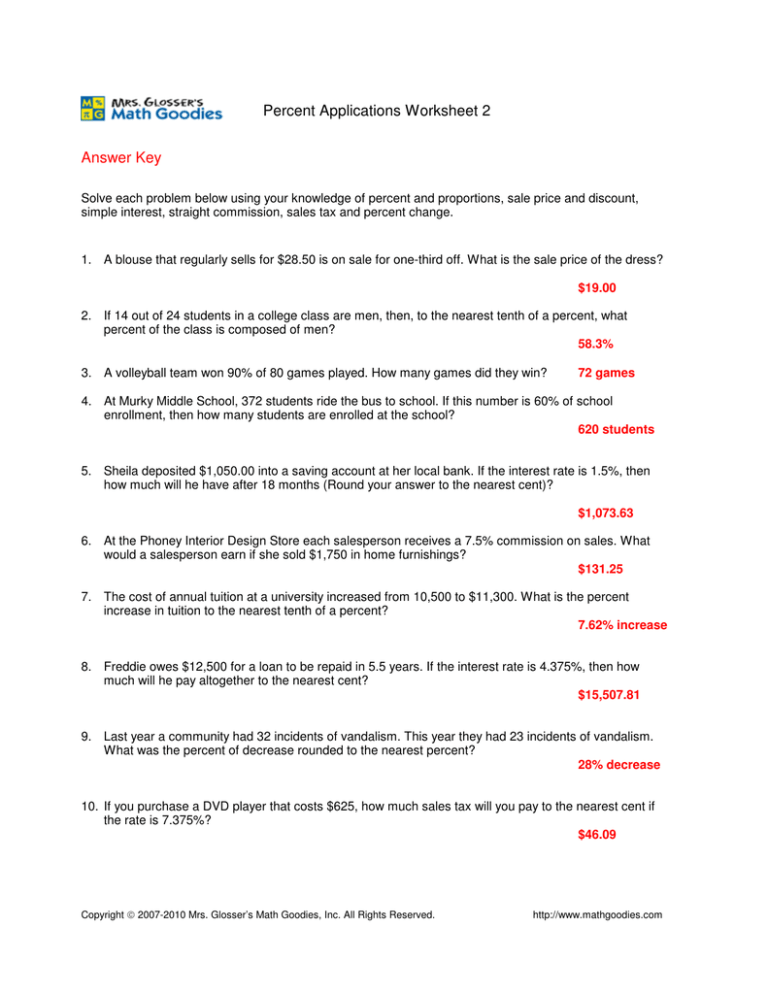

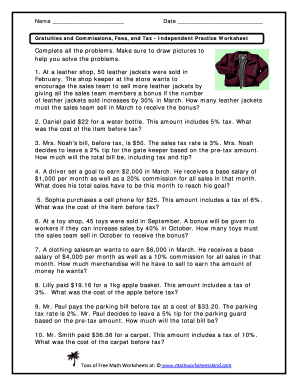

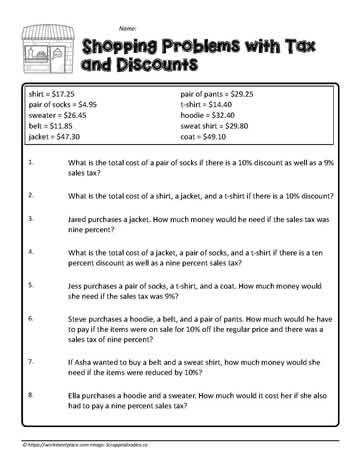

Sales tax and discount worksheet answers

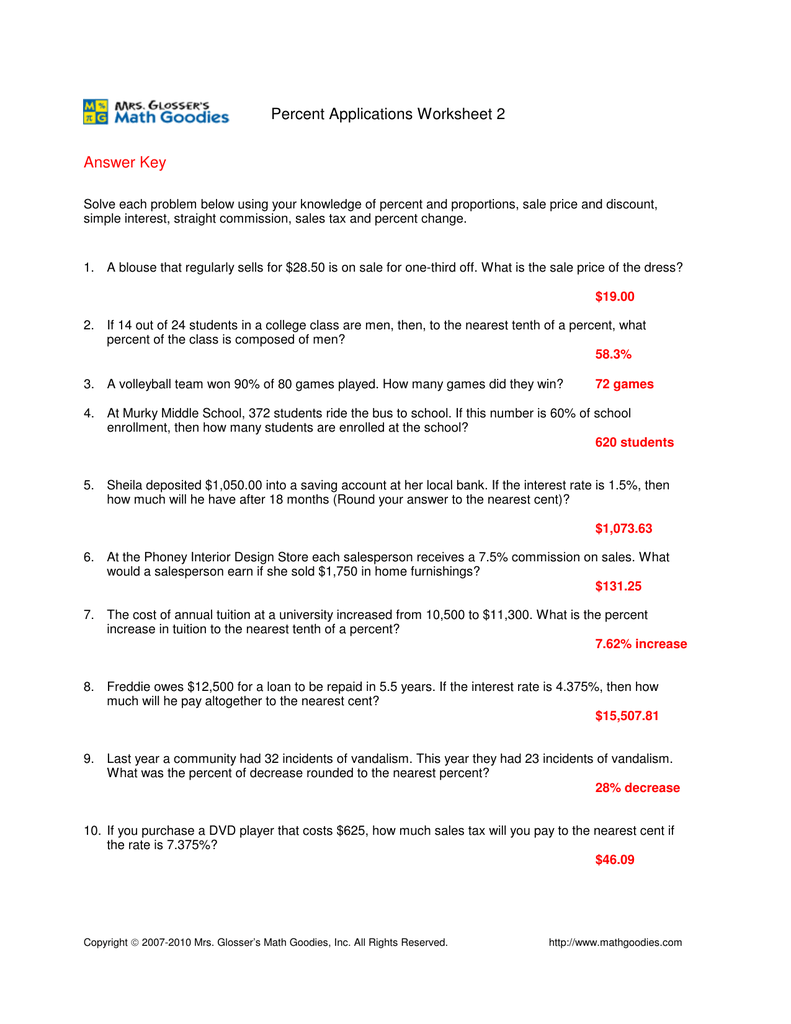

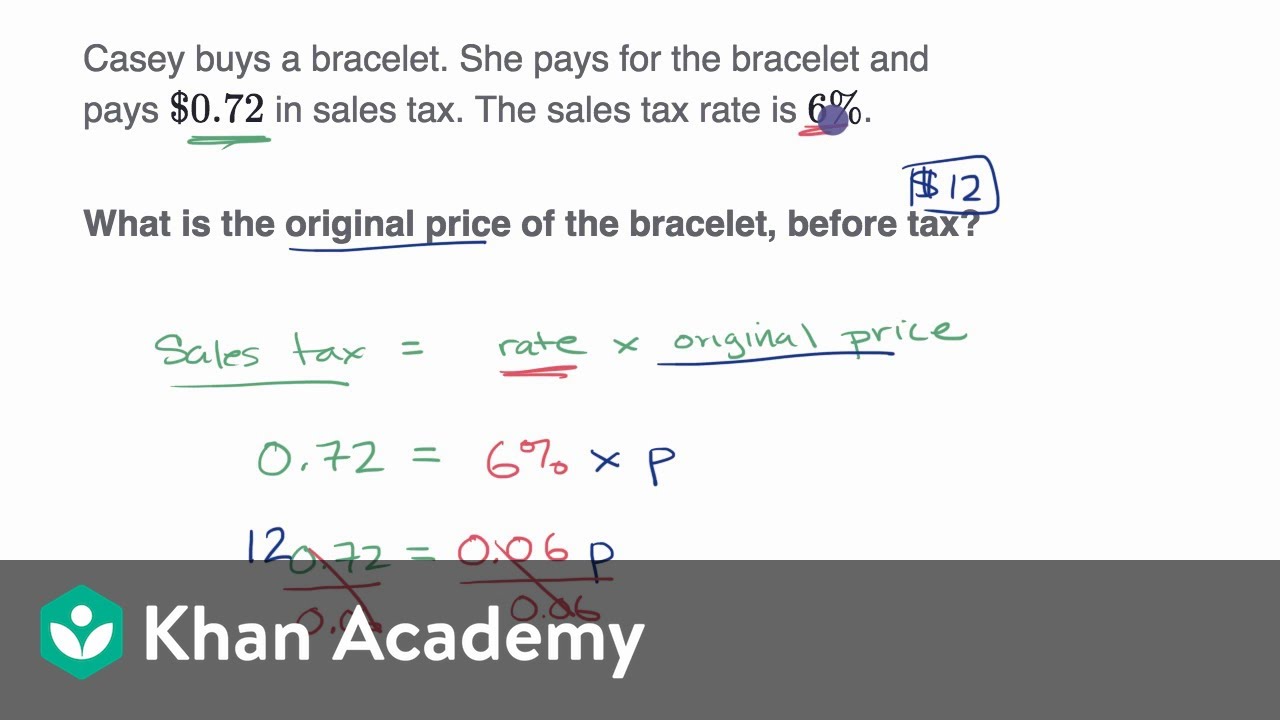

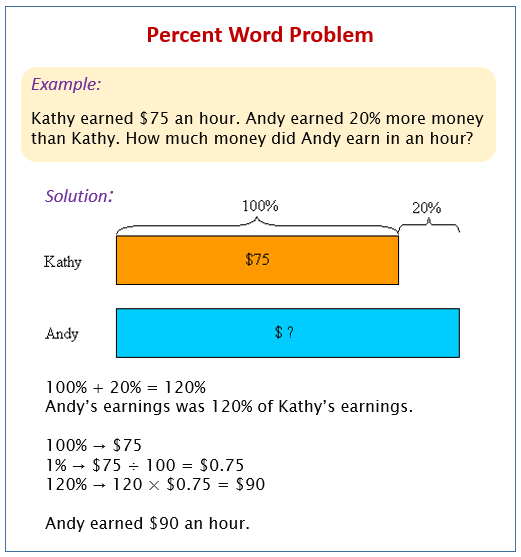

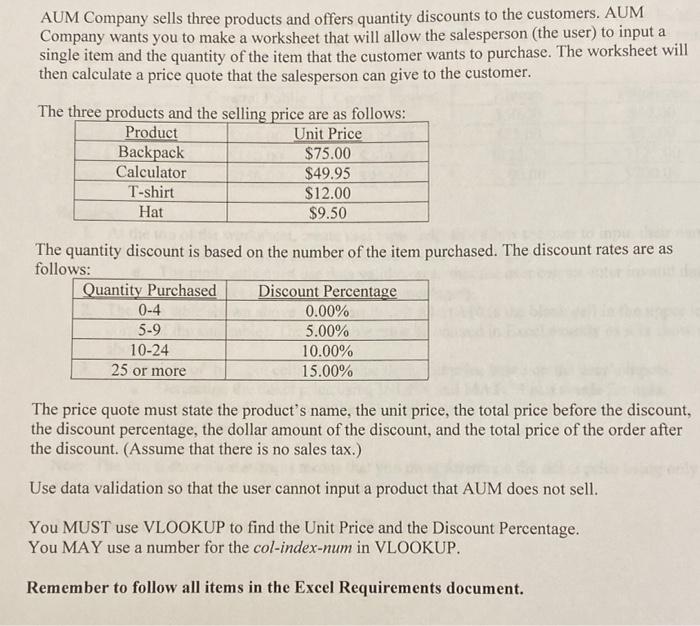

How To Calculate Discount and Sale Price - Math Goodies In this problem, an item that originally costs $15 is being discounted by 10%. So "10% off" refers to the rate of discount. To solve this problem, we need a procedure. Procedure: The rate is usually given as a percent. To find the discount, multiply the rate by the original price. To find the sale price, subtract the discount from original price. Virginia Sales & Use Tax Guide - Avalara - Taxrates As of April 2019, Virginia Tax offers a discount for businesses with a sales tax liability of less than $20,000. The discount applies only to state taxes, not on local or regional taxes. For more information, see section eight of worksheet ST-9 of the Virginia retail sales and use tax return . Forms — Finance and Administration Interactive forms may be completed on-line and printed for signature. A Account Change/Request Forms (Controller’s Office) Funds Center Request Form Funds Center Change Request Form Accounts Receivable Write-Off Request T-35 B B1-WB Honorarium Form Budget Revision – T-15 Interactive Version Excel Version Business Classification Form C Capital Outlay T-49 (Request for Approval of Current ...

Sales tax and discount worksheet answers. Checkpoint Quickfinder - Thomson Reuters Tax & Accounting So we’ve made it easy to find quick answers to your clients’ tax questions at an affordable price. With our new quantity discount pricing, you can bundle and save on Quickfinder – learn more. Choose the Quickfinder products you want in the quantities and formats you need to build your perfect tax quick reference library. Forms — Finance and Administration Interactive forms may be completed on-line and printed for signature. A Account Change/Request Forms (Controller’s Office) Funds Center Request Form Funds Center Change Request Form Accounts Receivable Write-Off Request T-35 B B1-WB Honorarium Form Budget Revision – T-15 Interactive Version Excel Version Business Classification Form C Capital Outlay T-49 (Request for Approval of Current ... Virginia Sales & Use Tax Guide - Avalara - Taxrates As of April 2019, Virginia Tax offers a discount for businesses with a sales tax liability of less than $20,000. The discount applies only to state taxes, not on local or regional taxes. For more information, see section eight of worksheet ST-9 of the Virginia retail sales and use tax return . How To Calculate Discount and Sale Price - Math Goodies In this problem, an item that originally costs $15 is being discounted by 10%. So "10% off" refers to the rate of discount. To solve this problem, we need a procedure. Procedure: The rate is usually given as a percent. To find the discount, multiply the rate by the original price. To find the sale price, subtract the discount from original price.

0 Response to "38 sales tax and discount worksheet answers"

Post a Comment