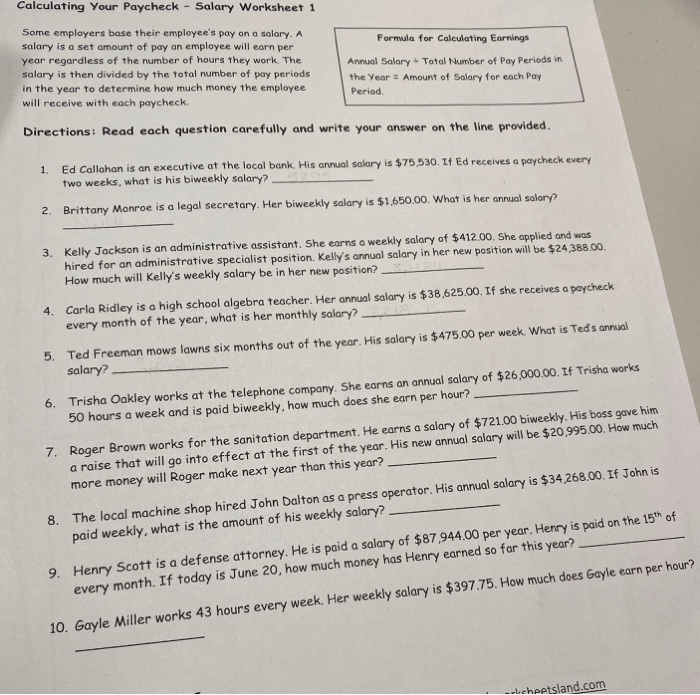

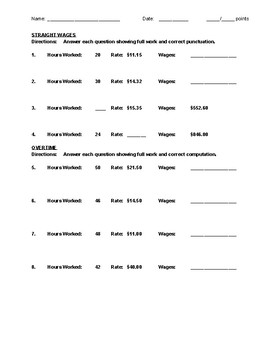

39 calculating your paycheck worksheet

› resources › understanding-andUnderstanding and Calculating Year to Date (YTD) in Payroll Feb 15, 2022 · Apart from balancing the accounting books, these numbers play a significant role in calculating and filing quarterly and yearly tax liabilities. Typically, the quarterly filing includes IRS form 941, and other state withholding and unemployment insurance filings. For example, YTD values are used to calculate the Lines 2, 3, and 5a to 5d on Form ... › retirement › net-worthNet Worth Calculator: What is My Net Worth? | RamseySolutions.com Start with what you own: cash, retirement accounts, investment accounts, cars, real estate and anything else that you could sell for cash.Then subtract what you owe: credit card debt, student loans, mortgages, auto loans and anything else you owe money on.

Payroll Calculator - Free Employee Payroll Template for Excel This payroll template contains several worksheets each of which are intended for performing the specific function. The first worksheet is the employee register intended for storing detailed information about each of your employees. The payroll calculator worksheet helps you with calculating the employee payroll based upon regular hours, sick leave hours, and vacation hours along with the ...

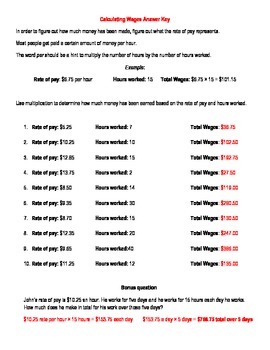

Calculating your paycheck worksheet

How to Calculate Withholding Tax: A Simple Payroll Guide ... - FreshBooks Payroll period details, including the frequency of your pay periods (weekly, biweekly or monthly) and the amount of time for that particular period, The gross pay amount for the pay period, i.e. the total amount paid for the pay period, either in salary or taxable wages, 4. Choose Your Calculation Method, Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Individual Rental Income from Investment ... Free Budget Planner Worksheet - NerdWallet NerdWallet recommends the 50/30/20 budget, which suggests that 50% of your income goes toward needs, 30% toward wants and 20% toward savings and debt repayment. Before you build a budget,...

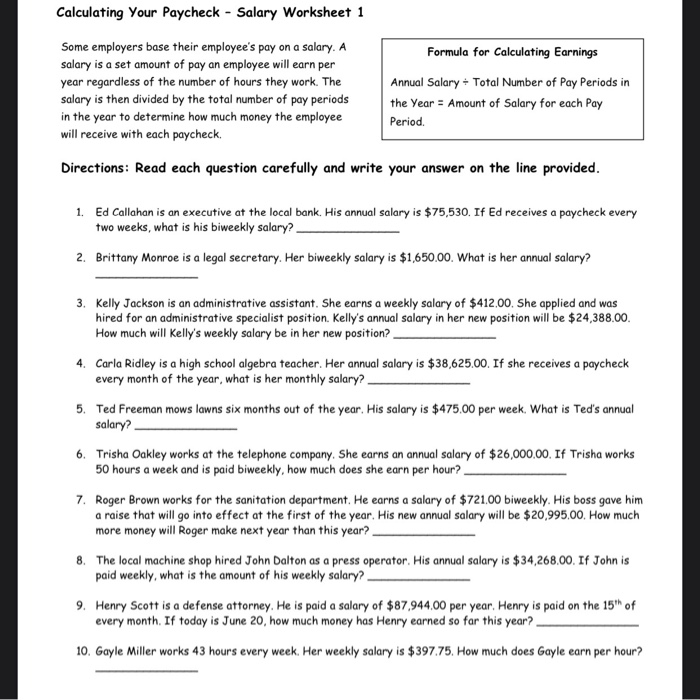

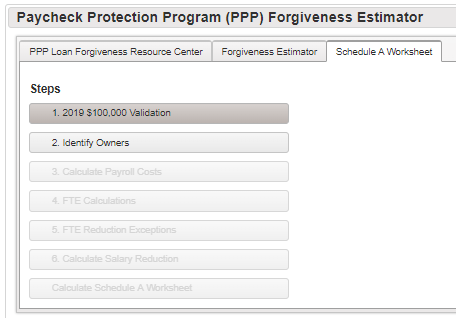

Calculating your paycheck worksheet. How to Calculate Federal Income Tax - Rates Table & Tax Brackets For simplicity's sake, the tax tables list all income over $3,000 in $50 chunks. The tables only go up to $99,999, so if your income is $100,000 or higher, you must use a separate worksheet (found in the Form 1040 Instructions) to calculate your tax. To illustrate, let's say your taxable income (Line 15 on Form 1040) is $41,049. Annual Income Calculator This is how to calculate your annual income with our calculator: Enter the hourly wage - how much money you earn per hour. In the second field, input how many hours you work in a week. By default, we set the value to 40 hours (full time). If you work half-time, change it to 20. KRA PAYE Calculator for 2022 Kenya PAYE Calculator with Income Tax Rates Of January 2022 | Calculate KRA PAYE, Net Pay, NHIF and NSSF Contribution Ani Globe. Ani Globe. My account. Get into your account. Login Register. Tax. PAYE Calculator. Vehicle Duty Calculator. VAT Calculator. Customs Duty. DHL Customs Duty Calculator. Property Stamp Duty Calculator ... How to Calculate Payroll Costs for Your PPP Loan - Finimpact Step 1 - Compute Yearly Total Payroll, The first step can be broken into a series of steps you need to take to compute your payroll costs. Find the total net earnings per partner (Schedule K-1 i.e. IRS Form 1065) and multiply this by 0.9235. Calculate the gross earnings of your employees.

Paycheck Calculator - Take Home Pay Calculator - Vertex42.com Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net take-home pay. Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it. W-4 Form: How to Fill It Out in 2022 - Investopedia You'll need to enter the number of pay periods in a year at the highest-paying job on line 3 of the Multiple Jobs Worksheet—for example, 12 for monthly, 26 for biweekly, or 52 for weekly. Divide... Basic Monthly Budget Worksheets Everyone Should Have - The Balance A good first step is to calculate your monthly income. On the first tab of the worksheet, enter the income you expect to receive from all sources in the "Gross Income" category in the "Projected" column. Enter any deductions from your paycheck in the "Taxes Withheld and Payment Deductions" section and the "Projected" column. Budget Spreadsheet: Financial Tool to Manage Your Money Even if this will be your first plan, using this simple spreadsheet is not that difficult. First, enter your income. Be careful to enter only real numbers. Then, put in your month's bills and receipts. There you'll find different appropriate categories to place the numbers. Now, it's easy to see how healthy is your financial situation.

Where can I find worksheet to calculate taxable amount of ... - Intuit the best way to estimate 2022 tax is to use the desktop software on your computer. start a new tax file and call it "TRIAL 2022 Tax return", It will be approximate, but close enough and you can adjust as needed if you are tax-savvy. Also you will have a head start on your next year's taxes. @Linda883, 0, Reply, NCperson, Level 15, How to Calculate Payroll | Taxes, Methods, Examples, & More Divide $9,928 by the 26 pay periods in the year to determine how much tax to withhold per paycheck for FIT. Withhold $381.85 per biweekly paycheck ($9,928 / 26). Then, account for the tax credits listed on Bob's Form W-4. Bob does not have any dependents, so enter a 0 on each line of Step 3 of Worksheet 1A. How to calculate cash flow: 3 cash flow formulas, calculations, and ... In theory, cash flow isn't too complicated—it's a reflection of how money moves into and out of your business. Unfortunately, for small business owners, understanding and using cash flow formulas doesn't always come naturally. So much so that 60% of small business owners say they don't feel knowledgeable about accounting or finance.But by taking the time to read about these three key ... How to Calculate Tip Credit in 2022 - The Motley Fool Follow these directions to calculate tipped wages with overtime: Multiply the applicable minimum wage -- not the minimum cash wage -- by 1.5. Subtract the state maximum tip credit from the result...

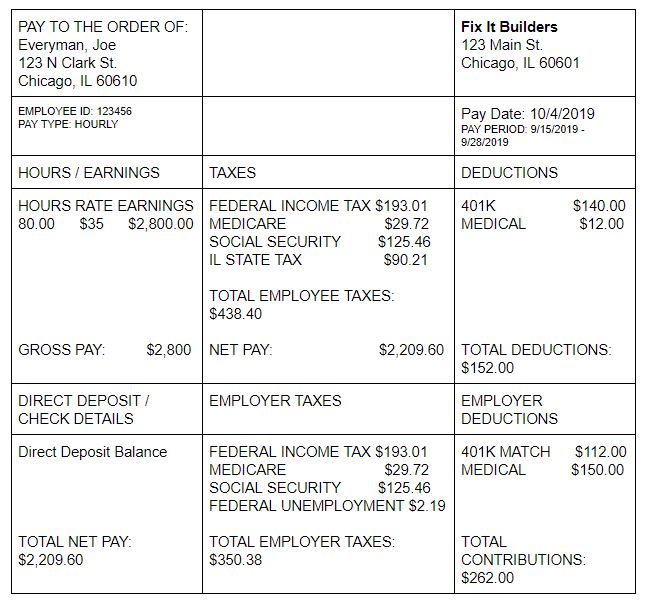

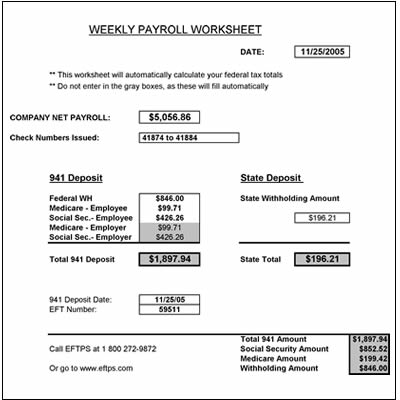

Payroll Tax: What It Is, How to Calculate It | Bench Accounting To calculate Medicare withholding, multiply your employee's gross pay by the current Medicare tax rate (1.45%). Example Medicare withholding calculation: $5,000 (employee's gross pay for the current pay period) x .0145 (current Medicare tax rate) = $72.50 (Medicare tax to be deducted from employee's paycheck, Employer matching,

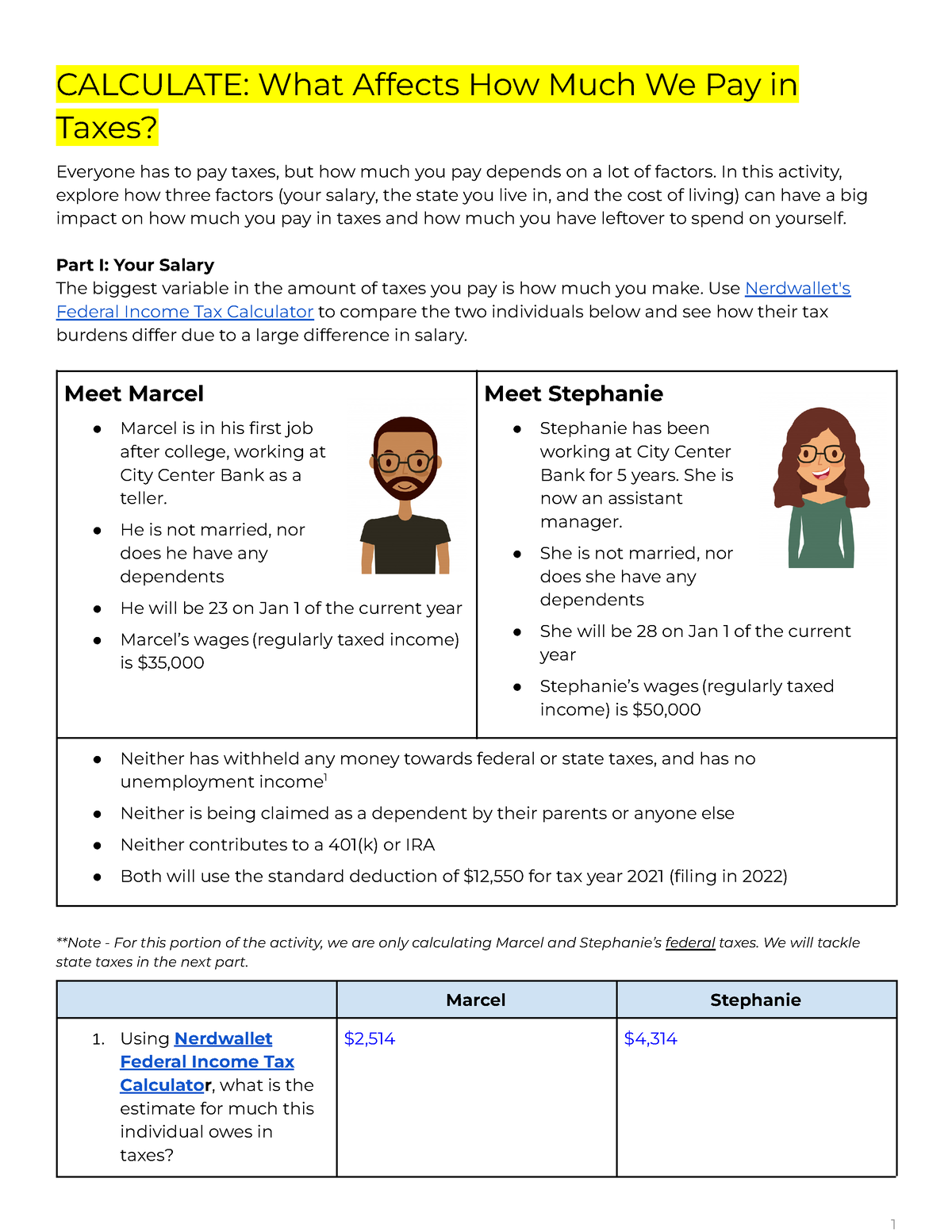

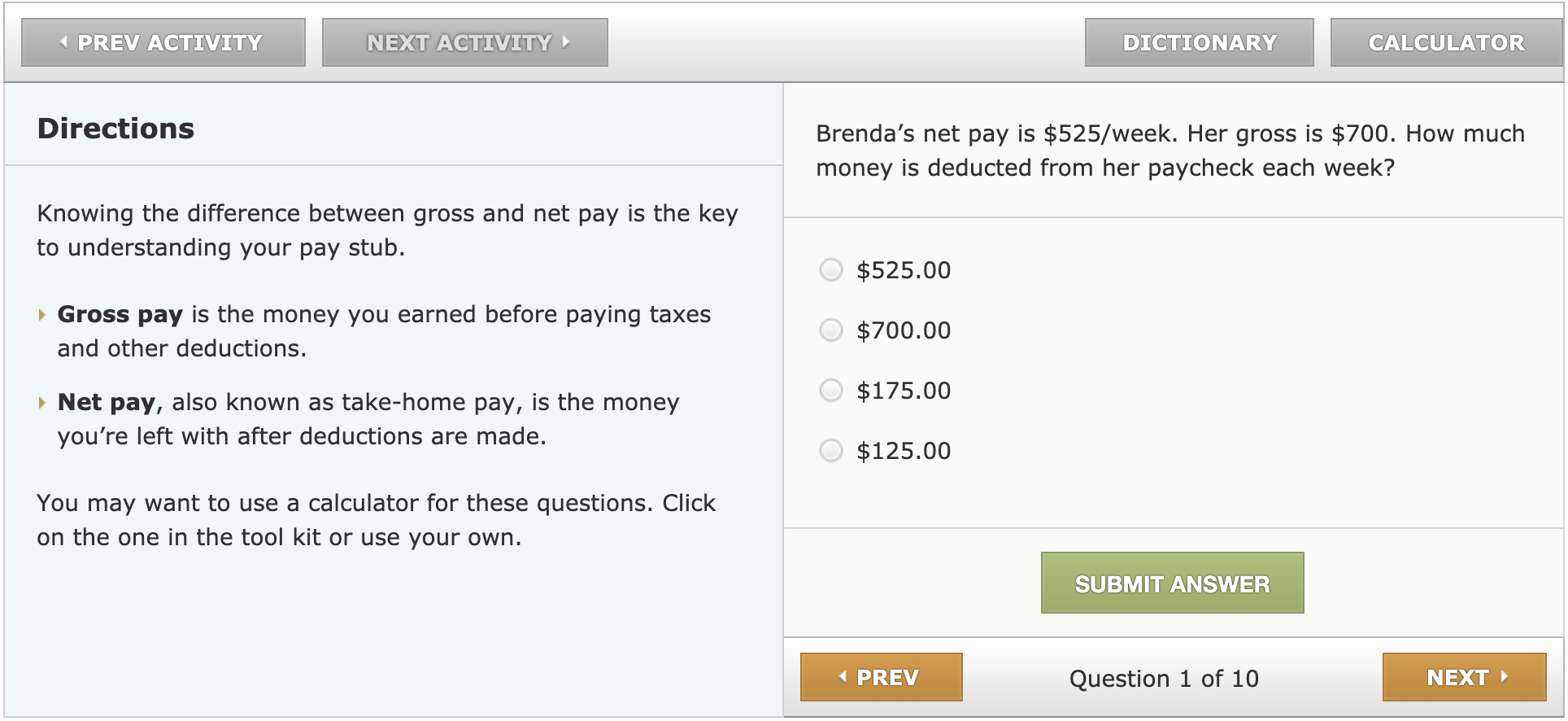

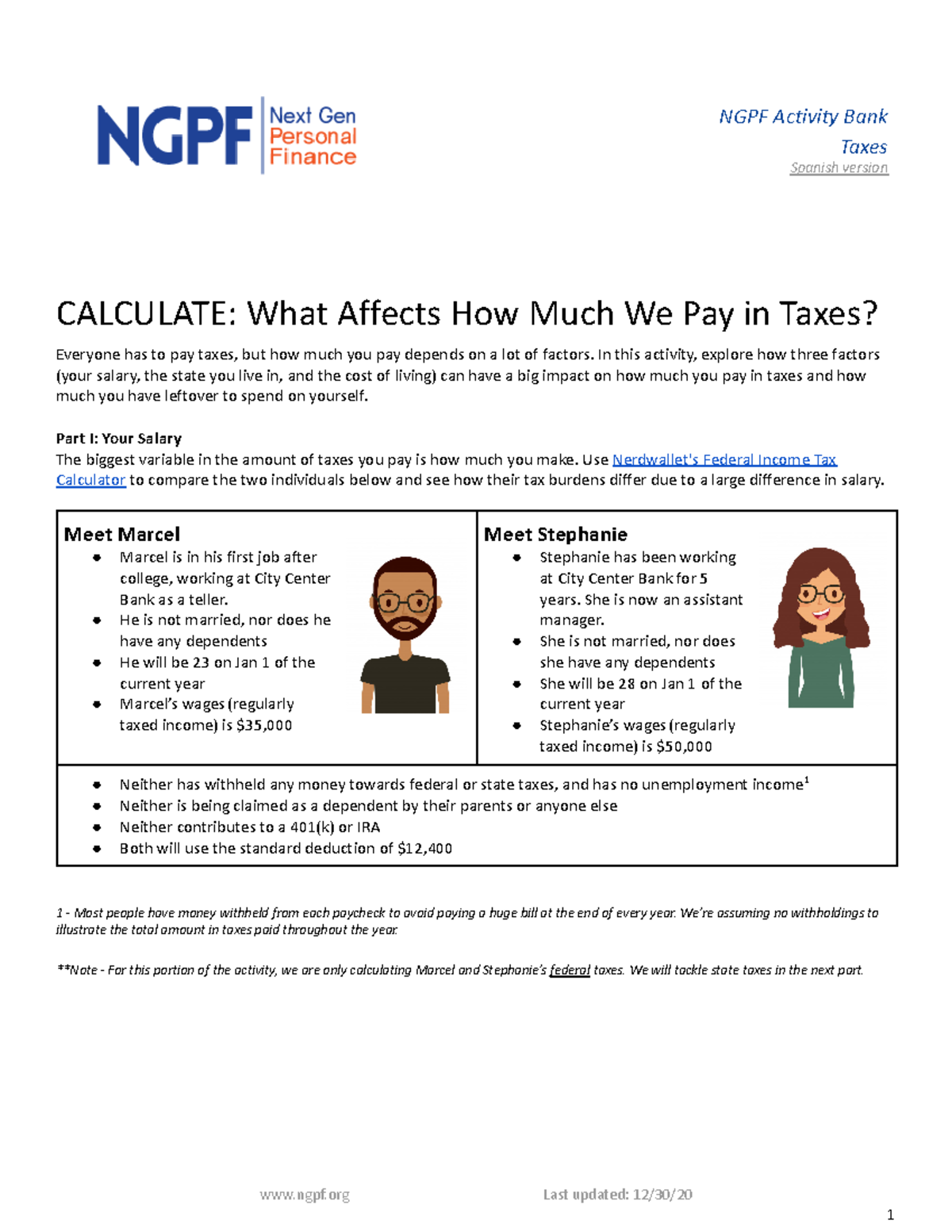

Calculating the numbers in your paycheck | Consumer Financial ... Calculating the numbers in your paycheck, Updated Aug 25, 2022, Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they receive. Big idea, The amount of money you earn from your job is different from the amount of money you receive in your paycheck.

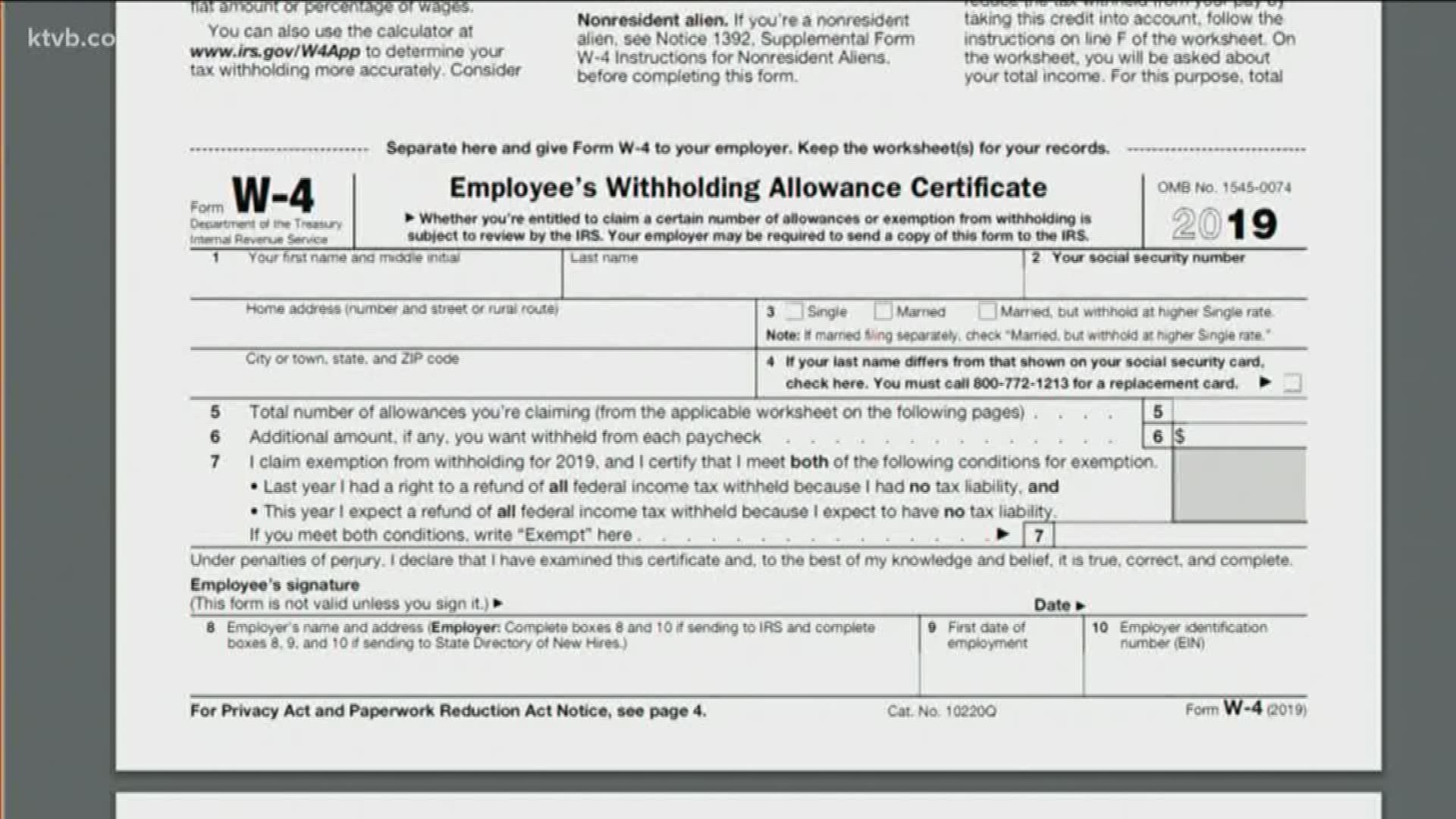

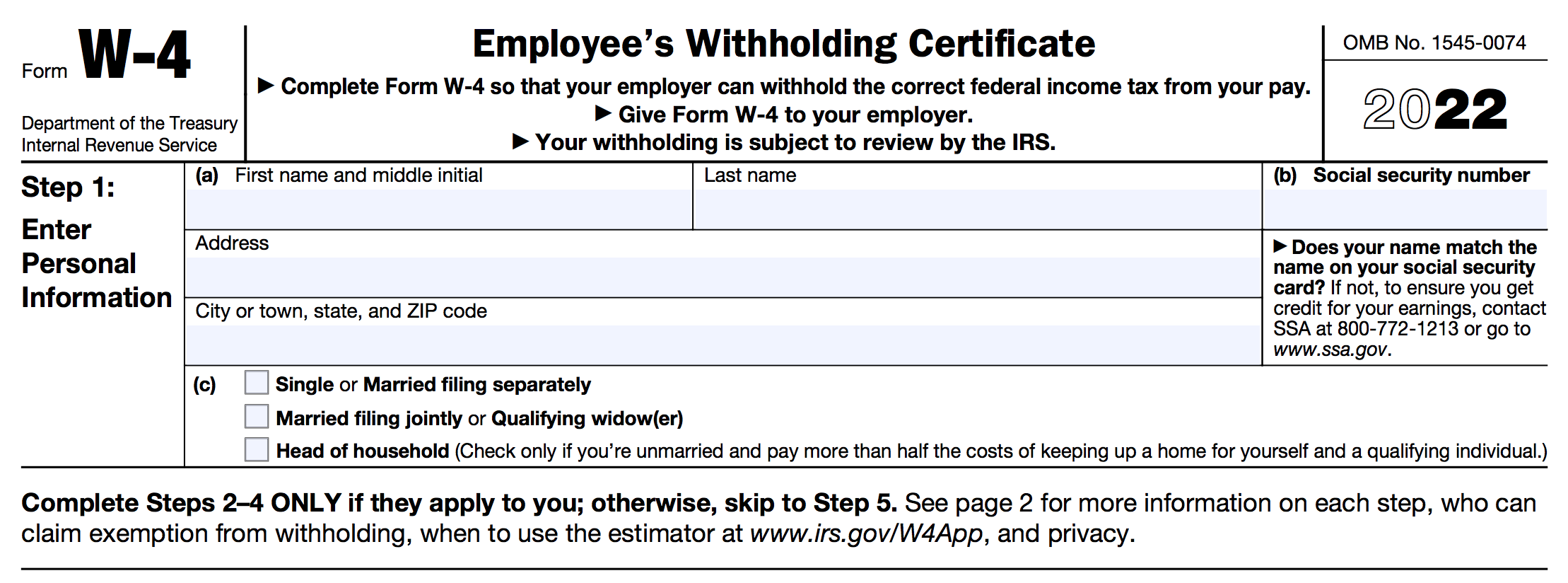

How Many Tax Allowances Should You Claim? - SmartAsset Here you'll be able to state other income and list your deductions, which can help reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

Payroll Template - Free Employee Payroll Template for Excel - Vertex42.com The Payroll Register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, FICA taxes, and other deductions. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it.

isc.uw.edu › calculating-your-withholdingCalculating Your Withholding | Integrated Service Center Jan 01, 2021 · How to Calculate Your Social Security/Medicare Withholding. The following guidance pertains to wages paid on and after January 1, 2022. To calculate the amount of Social Security and/or Medicare withheld from your paycheck, calculate your Taxable Gross: Gross Pay minus any Pre-Tax Reductions for Social Security/Medicare.* Then, determine your ...

› ma-child-supportNewest 2021 MA Child Support Calculator | Amherst Divorce After you have calculated your results and downloaded a court-ready .pdf, you should check your final calculations against the state court’s calculating .pdf at: MA fillable .pdf 2021 child support calculator. You may find the state court form very difficult to fill out unless you you use my website first.

How to Calculate Your Tax Withholding | RamseySolutions.com How to Calculate and Adjust Your Tax Withholding. Ready to get your tax withholding back on track? Here's how. Step 1: Total Up Your Tax Withholding. Let's start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Ugh, we know.

Military Retirement Calculator, Pay & Pension Info • Military OneSource How to use the High-3 military retirement calculator. If you joined between Sept. 8, 1980, and July 31, 1986, you can use the High-3 Calculator to figure out your estimated base pay. This retirement plan offers a pension after 20 years of service that equals 2.5% of your average basic pay for your three highest-paid years or 36 months, for each year you serve.

Free Budget Spreadsheets and Templates - NerdWallet NerdWallet's budget worksheet. How it works: Use this online form to input your monthly income and expenses. With that information, the worksheet shows how your finances compare with the 50/30 ...

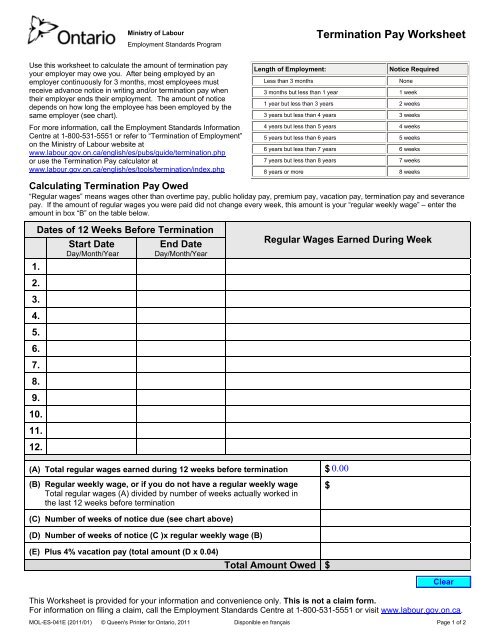

› insights › how-to-calculateHow to Calculate Severance Pay · PaycheckCity If you have been at the company for 10 years, your severance pay would be $40,000 ($4,000 X 10 years). Remember severance pay is not always given; it is dependent on the scenario with your employer. If you are looking for an easy way to estimate severance paycheck out this worksheet: Severance Pay Estimation Worksheet.

budgeting.thenest.com › arent-taking-out-enoughWhy Aren't They Taking Out Enough Federal Taxes from My Paycheck? Insufficient federal income tax withholding can happen if you’re married and you and your spouse both work but you didn’t complete the Two Earners/Multiple Jobs Worksheet on page 2 of Form W-4. By completing that section of the form and stating the additional amount you want withheld from each of your paychecks on line 6, you avoid having ...

Calculators | The Thrift Savings Plan (TSP) Calculator, This calculator helps you determine the specific dollar amount to be deducted each pay period. Simply know the number of salary payments you have left for the year and grab your most recent pay statement to see how much you can contribute.

› calculator › salarySalary Paycheck Calculator · Payroll Calculator · PaycheckCity To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay. Don't want to calculate this by hand? The PaycheckCity salary calculator will do the calculating for you.

How to Calculate Federal Unemployment Tax (FUTA) in 2022 - The Motley Fool 3. $40,000. $500. $400. $2,000. $37,100. The FUTA tax liability is based on $17,600 of employee earnings ($4,900 + $5,700 + $7,000). Employee 3 has $37,100 in eligible FUTA wages, but FUTA applies ...

How to Calculate Deductions & Adjustments on a W-4 Worksheet The fourth step of this process involves finalizing your W-4 worksheet results, which means that the totals listed on your worksheet should be added to the appropriate W-4 section. The final deduction amount that you wrote down on line five of the deductions worksheet should be added to Step 4(b) on IRS Form W-4.

How to Calculate Payroll Taxes: Step-by-Step Instructions Federal Income Tax (FIT) is calculated using the information from an employee's completed W-4, their taxable wages, and their pay frequency. Based on Publication 15-T (2022), Federal Income Tax Withholding Methods, you can use either the Wage Bracket Method or the Percentage Method to calculate FIT.

How to Calculate Your Modified Adjusted Gross Income - The Balance The Internal Revenue Service uses your adjusted gross income as a starting point to calculate your total income tax and to determine whether you can claim many credits and exemptions on your taxes, such as: Deductions for what you give to charity 8, Deductions for adoption expenses 9, Dependent tax credits 10,

Free Budget Calculator & Planner [Excel Download] - Mint Fill in the required information in each field and we'll do the math for you. Our free budget calculator is divided into three main areas: monthly income, monthly expenses, and monthly savings. Note: If you're entering variable costs that change month to month, enter your best estimate. Step 1. Enter All Sources of Monthly Income.

Free Budget Planner Worksheet - NerdWallet NerdWallet recommends the 50/30/20 budget, which suggests that 50% of your income goes toward needs, 30% toward wants and 20% toward savings and debt repayment. Before you build a budget,...

Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Individual Rental Income from Investment ...

How to Calculate Withholding Tax: A Simple Payroll Guide ... - FreshBooks Payroll period details, including the frequency of your pay periods (weekly, biweekly or monthly) and the amount of time for that particular period, The gross pay amount for the pay period, i.e. the total amount paid for the pay period, either in salary or taxable wages, 4. Choose Your Calculation Method,

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "39 calculating your paycheck worksheet"

Post a Comment