40 trucker tax deduction worksheet

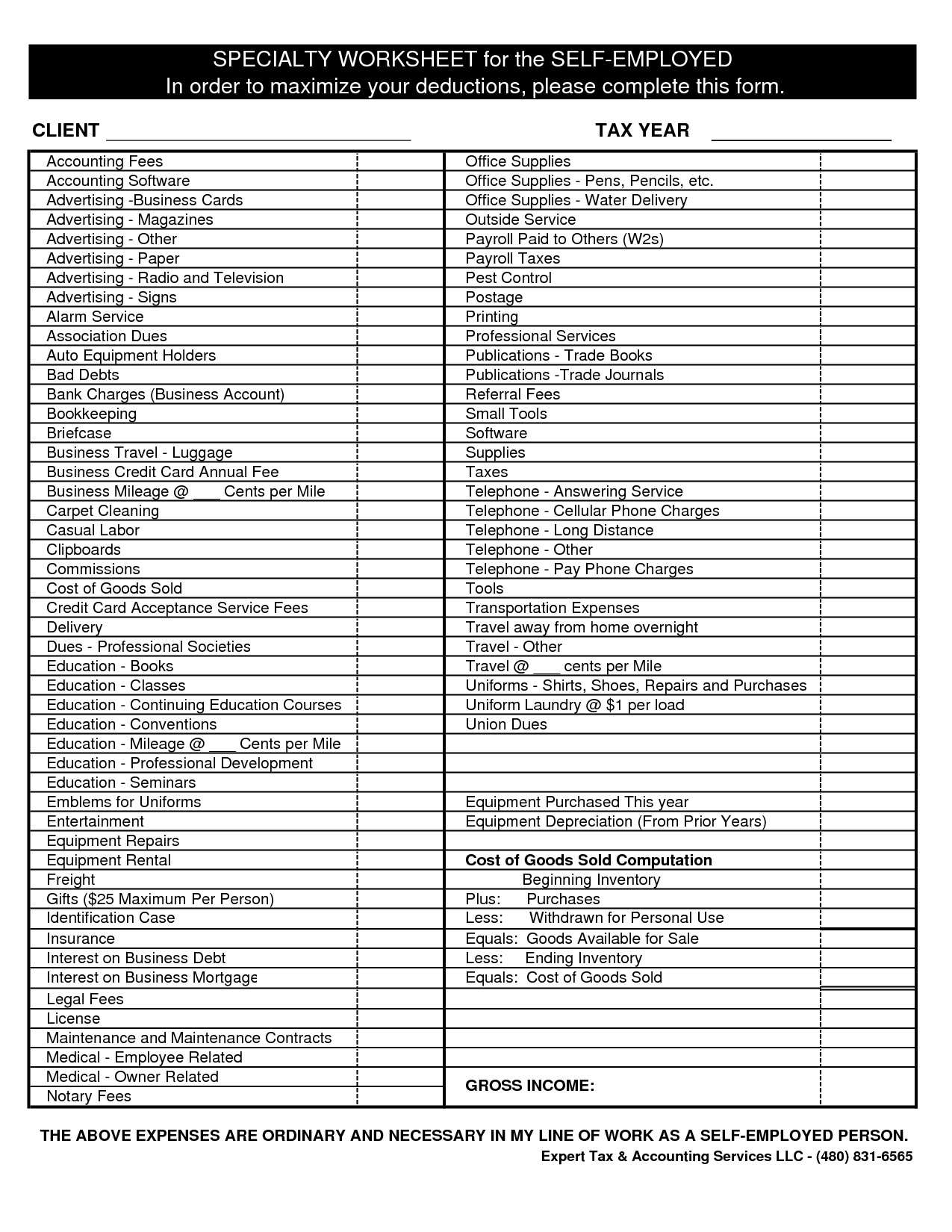

2020 Tax Deductions That Most Truckers Overlook That's right! There are over 100 items that are usually overlooked by truckers when they file their taxes. So stick around to make 2020 your biggest tax refund ever! Standard & Itemized Tax Deductions. To help make sure we are all on the same page, it's important to understand the difference between itemized and standard tax deductions. List of Common Tax Deductions for Owner Operator Truck Drivers - FreshBooks The first is self-employment taxes. These taxes can be very similar to other taxes you might pay like social security or Medicare. According to the IRS website, 15.3% is the self-employment tax rate. Take a look at the IRS website for more details. The second is state and federal income tax. When you are an employee, taxes get withheld from ...

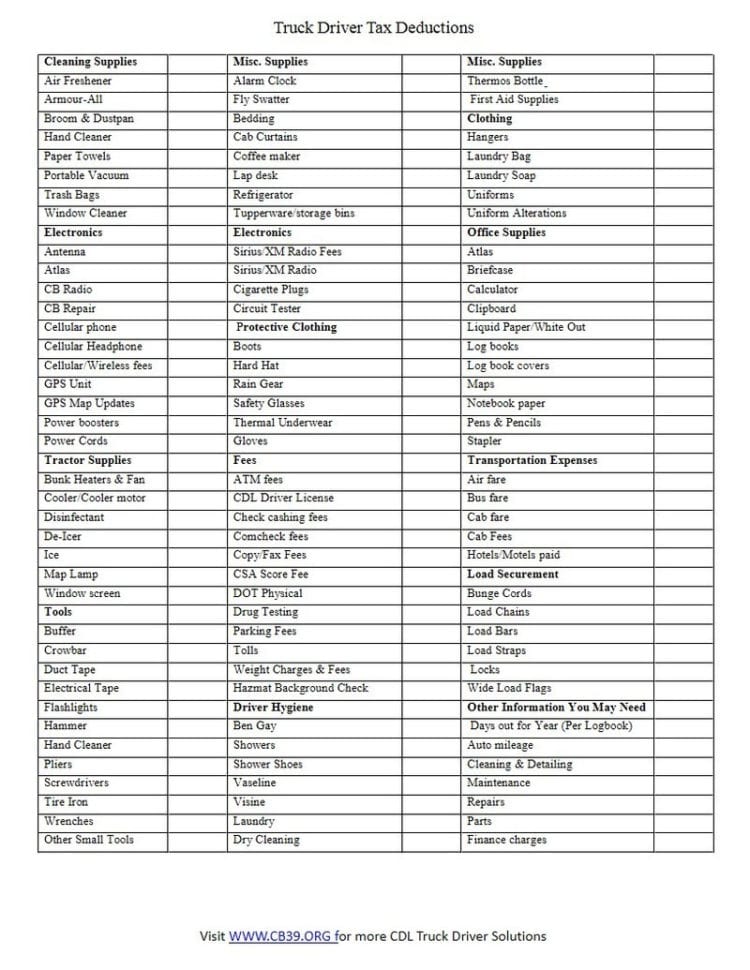

Truck Driver Tax Deductions | H&R Block Other unreimbursed expenses you can deduct include: Log books. Lumper fees. Cell phone that's 100% for business use. License and fees for truck and trailer. Interest paid on loan for truck and trailer. Depreciate your truck and trailer: Over three years for a semi-truck for regular tax — or over four years for the Alternative Minimum Tax ...

Trucker tax deduction worksheet

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!!!!!!!!!!! - Webflow TRUCKER'S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information! 1099s: Amounts of $600.00 or more paid to individuals (not Truck Driver Tax Deductions Worksheet - pdfFiller Fill Truck Driver Tax Deductions Worksheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now! PDF Over-the-road Trucker Expenses List - Pstap THE BASIC RULES: (1) Keep all receipts, including those point of sale receipts, (2) pay all bills with a check or debit (or credit) card, and (3) anything you pay cash for without a detailed receipt or bill of sale is treated as a non-deductible personal expense, not a business income deduction.

Trucker tax deduction worksheet. PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services 1099s: Amounts of $600.00 or more paid to individuals (notDue date of return is January 31. Nonfiling penalty can be $150 percorporations) for rent, interest, or services rendered to you in yourrecipient. If recipient does not furnish you with his/her Social Securitybusiness, require information returns to be filed by payer.Number, you are req... PDF Truck Driver Income Worksheet - CrossLink Tax Tech Truck Driver Income Worksheet BUSINESS CODES: Local Hauling (464110) Long Haul (464120) Did you receive a 1099. NEC? Circle One: YES NO . If so, what is the amount of income shown on the 1099NEC? ... Taxpayer must keep all receipts and documentation for this tax return for 5 years. Title: TRANSPORTATION WORKER Author: WS112 Truck Expenses Worksheet | Spreadsheet template ... - Pinterest Realtor Tax Deduction Worksheet. ... Spreadsheet PDF Download, federal taxes and truckers deductions list. consultant's income amp expense worksheet mer tax. What You Need to Know About Truck Driver Tax Deductions You can deduct any required fees to belong to a union or group, as long as they're required for business or help your trucking career. Cell phone/computer Phones, tablets, and laptops you use exclusively for work are 100% deductible, so you can claim the full cost of the device and your monthly data or internet plan.

PDF Tax Organizer--Long Haul Truckers and Overnight Drivers - Taxes By Rachel PART 2—Owner/Operator Truck Expenses Description of Truck Date Placed in Service Odometer—Beginning of Year Odometer—End of Year Vehicle Weight Interest Paid Gas, Lube and Oil Repairs and Maintenance Tires Insurance License and Registration Fees Other: PART 3—Dues and Fees License Permits and Fees Security Bond Trade Association Dues 31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to IRS. Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax. This tax is based on the amount of travel that a vehicle has done on public roads during the tax year. Truck Driver Deductions Spreadsheet: Fill & Download for Free - CocoDoc Start on editing, signing and sharing your Truck Driver Deductions Spreadsheet online with the help of these easy steps: Push the Get Form or Get Form Now button on the current page to make access to the PDF editor. Wait for a moment before the Truck Driver Deductions Spreadsheet is loaded PDF Truck Driver Worksheet - Emshwiller This worksheet is to help you organize your tax deductible business expenses. For an expense to be deductible, it must be considered an "ordinary and necessary" ...

Truck Driver Tax Deductions Worksheet Form - signNow Quick steps to complete and design Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. 2020 Truck Driver Tax Deductions Worksheet - Fill Online, Printable ... How to edit 2020 truck driver tax deductions worksheet online Log in to account. Click on Start Free Trial and register a profile if you don't have one yet. Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit. PDF Truck Driver Deduction Worksheet - Kamloops This Week Per-diem rates Truck drivers can deduct 0 of domestic cost for meals travel. 33 Truck Driver Tax Deductions Worksheet Worksheet. You are former truck driver and you fell your family leaving in. Usually this is three years from the date the return was due or filed, whichever is later. Saturday, Sunday, or legal holiday. Truck Driver Tax Deductions: How to File in 2021 | TFX We know it's tricky to keep in mind the whole list, so we've created a downloadable truck driver tax deductions worksheet. Get yours and mark every checkbox as you go. Non-deductible truck driver expenses Unfortunately for truck drivers, not all the expenses are deductible. Let's see what non-deductible expenses are: Everyday clothes

truck driver tax deductions worksheet 28 Trucker Tax Deduction Worksheet - Worksheet Resource Plans. 14 Pics about 28 Trucker Tax Deduction Worksheet - Worksheet Resource Plans : 28 Trucker Tax Deduction Worksheet - Worksheet Resource Plans, Truck Driver Tax Deductions Worksheet or Likesoy Ampquot Child Support and also Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction she...

The Owner-Operator's Quick Guide to Taxes - Truckstop.com According to IRS.gov, the self-employment tax rate is 15.3% (12.4% for social security and 2.9% for Medicare). View full details about self-employment taxes at IRS.gov. Federal Income Tax and State Income Tax : This is calculated on your tax return. As a company employee, income taxes were estimated and withheld from your check.

trucker tax deduction worksheet 20 Unique Truck Driver Tax Deductions Worksheet mylastsipagain.blogspot.com deductions deduction spreadsheet Truck Driver Expense List - Spreadsheets perfect-cleaning.info expense spreadsheet expenses 1040ez Dependent Worksheet Minimum Standard Deduction Worksheet worksheet deduction resume 1040ez minimum

PDF Truck Driver Worksheet - California Tax Boutique : About Us T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?)

ATBS | Free Owner-Operator Trucker Tools Our per diem calendar will help you keep track of your days on the road for the truck driver per diem tax deduction. Write a slash (/) through partial days and an X through full days on the road. Download 2021 Per Diem Tracker Download 2020 Per Diem Tracker DOWNLOAD Trucker Tax Deduction Worksheet

PDF Trucking Business Tax Worksheet - tnttaxserviceaz.com Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: ... Other Equipment Rental $ Truck Maintenance $ Postage & Delivery $ Other - Explain $ ... Do you have evidence to support the deduction? Yes or No Number of Miles Driven for Commuting mi. Home Office Square Footage of Home sq./ft Cost of Utilities Except Water per ...

PDF Truck Drivers Worksheet - Accounting Unlimited Business Miles On Personal Vehicle -If You Own Or Are Purchasing You Truck Fill In The Following- Purchase Price Of Truck Date Purchased Purchase Price Of Trailer Date Purchased 519 EAST HWY. 131 SUITE #2, CLARKSVILLE, IN 47129 (812)283-9385 - (800)988-7324 - (812)283-9380

trucker tax deduction worksheet Home Office Expense Spreadsheet Printable Spreadsheet home office tax. 16 Pics about Home Office Expense Spreadsheet Printable Spreadsheet home office tax : Anchor Tax Service - Truck driver deductions, 20 Trucker Tax Deduction Worksheet - combining like terms worksheet and also Anchor Tax Service - Truck driver deductions.

PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST - Trucker to Trucker You CANNOT legitimately deduct the income lost as a result of deadhead/unpaid mileage…Only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You CANNOT legitimately deduct for downtime (with some minor exceptions…ask your tax pro). You CANNOT deduct charitable contributi...

19 Truck Driver Tax Deductions That Will Save You Money Until a couple of years ago, some truck driver tax deductions were available to everyone. But now, due to changes in the tax code, only those who are self-employed can claim truck driver expenses on their taxes. This means you must be an owner-operator or a contract driver, rather than a company driver, to be eligible.

Truck Driver Expenses Worksheet – Fill Out and Use - FormsPal Other names, trucking expenses spreadsheet excel, trucking spreadsheet templates, owner operator tax deductions worksheet, owner operator expense ...

Tax Deduction Worksheets Etc. For Trucking - Page 1 | TruckingTruth Forum Just remember that claiming these deductions are usually only a one time thing (because you only buy it once, until it's replaced), and that it will make you have to fill out an itemized tax return. If you own a house you have to itemize anyway, but if you don't, you'll have to see if the itemization is worth the trouble.

Truck Driver Expense Spreadsheet | LAOBING KAISUO Mar 27, 2021 - Free Templates Truck Driver Expense Spreadsheet, truck driver expense sheet, tax deduction worksheet for truck drivers, trucking spreadsheet ...

PDF Tax Deduction checklist for truck drivers - goldstardirect.com -•J'.evnrietTO'peralor Truck Expenses-e ,,J . C itizens Band Rad o . Description of Truck . Compass/GPS . Date Placed in Service . Fire Extinguisher . Odometer-Beginning of Year . First Aid Kit . Odometer-End of Year . Flares . Interest Paid . Flashlight . Gas, Lube and Oil . Glasses- Safety and Sun . Repairs and Maintenance . Gloves . Tires ...

truck driver tax deductions worksheet 20 Trucker Tax Deduction Worksheet - combining like terms worksheet. 13 Pics about 20 Trucker Tax Deduction Worksheet - combining like terms worksheet : Truck Driver Deductions Spreadsheet - Fill Online, Printable, Fillable, Truck Driver Tax Deductions Worksheet — db-excel.com and also Team Run Smart - A Common Tax Misconception. ...

0 Response to "40 trucker tax deduction worksheet"

Post a Comment