42 form 1023 ez eligibility worksheet

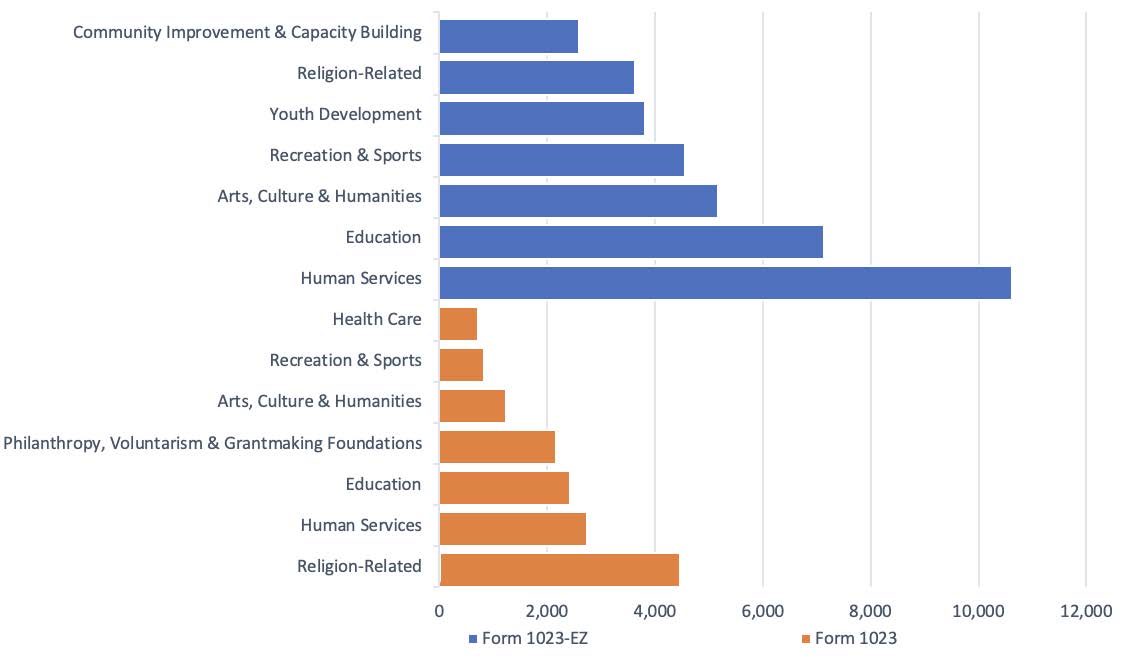

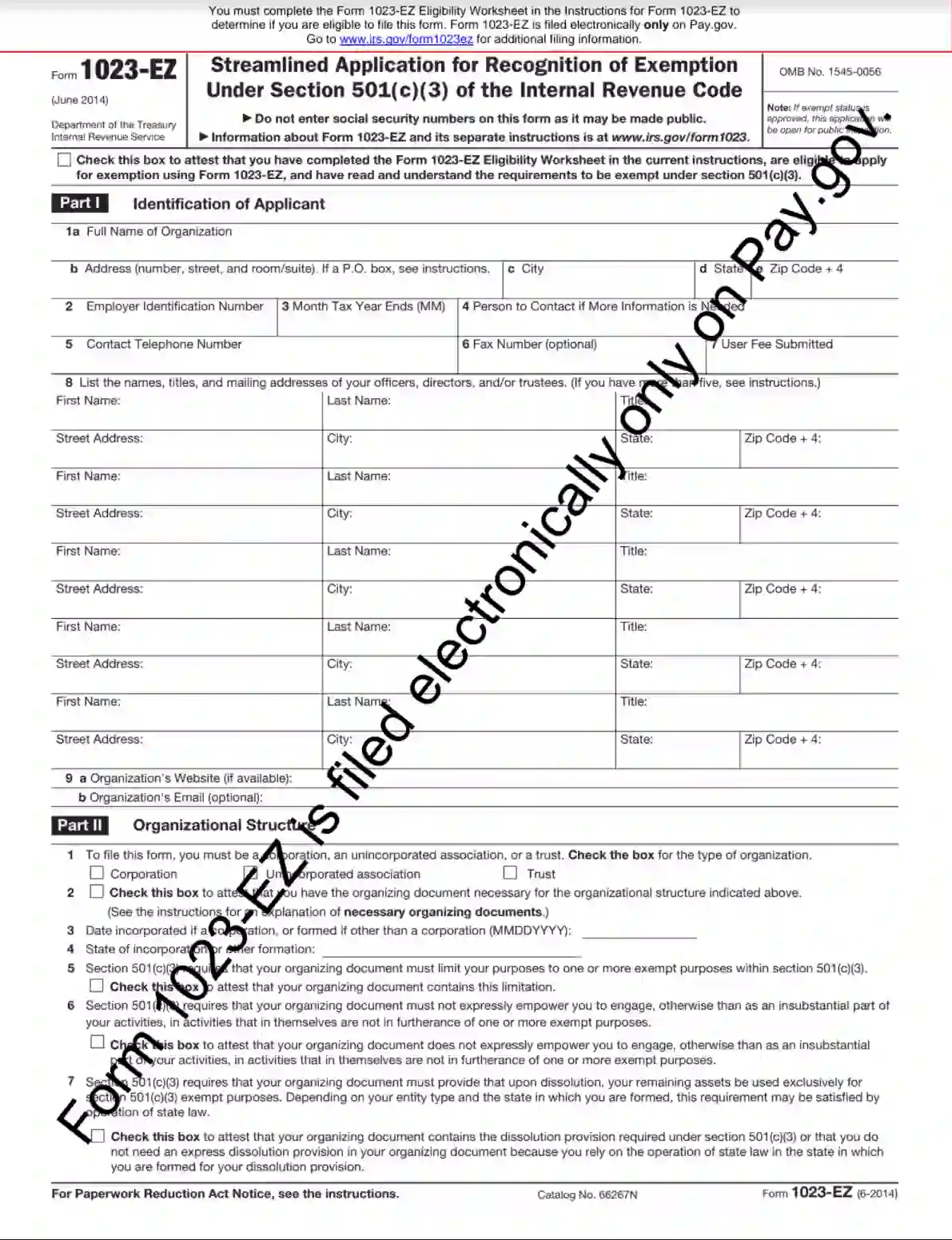

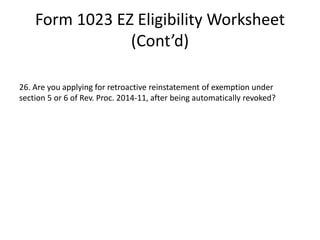

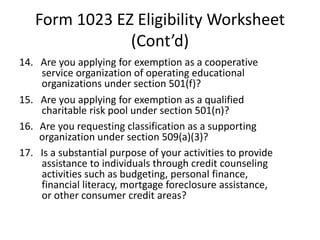

Instructions for Form 1023-EZ (01/2018) - IRS tax forms To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501 (c) (3) using Form 1023-EZ. You must apply on Form 1023. PDF Form 1023-EZ Streamlined Application for Reinstatement of Tax-Exempt ... Before completing the Form 1023-EZ, be sure to complete the "Form 1023-EZ Eligibility Worksheet," to ensure you are eligible to complete the Form 1023-EZ. If you answer yes to any of the 26 questions included in the worksheet, you are unable to complete the Form 1023-EZ, and must complete the full Form 1023.

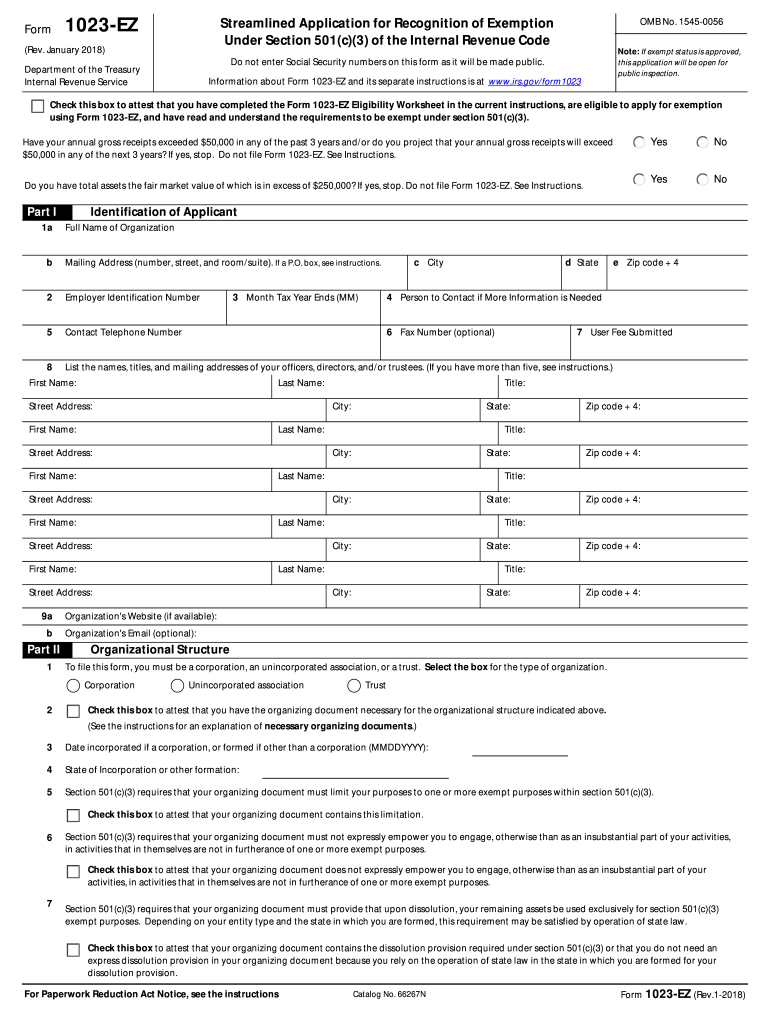

All About IRS Form 1023-EZ - SmartAsset If you haven't done it already, don't forget to complete the Form 1023-EZ Eligibility Worksheet (although you don't need to submit it with your application). Form 1023-EZ has six sections. In the first section, you'll enter the name of the organization and other personal information about it (including its phone number and employer ...

Form 1023 ez eligibility worksheet

1023 ez eligibility worksheet - Fill Online, Printable, Fillable Blank How to complete any Form 1023-EZ Reinstatement Instructions online: On the site with all the document, click on Begin immediately along with complete for the editor. Use your indications to submit established track record areas. Add your own info and speak to data. Make sure that you enter correct details and numbers throughout suitable areas. IRS Form 1023-EZ ≡ Fill Out Printable PDF Forms Online Before a business entity embarks on filing Form 1023-EZ, they have to submit the eligibility worksheet, a questionnaire including 30 questions. The worksheet is aimed to indicate the form you need to submit, depending on the answers you give on the questionnaire. An entity is required to fill the sheet with accuracy and honesty. IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Corporations ... IRS Form 1023-EZ Eligibility Test, Take the 30 question test below to see if your non-profit corporation is eligible to file IRS Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code.

Form 1023 ez eligibility worksheet. 1023 Ez Eligibility Worksheet Form - signNow Follow the step-by-step instructions below to design your form 1023 EZ eligibility worksheet national pta: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. PDF Form 1023-EZ Infosheet - IRS tax forms COLUMN D - ELIGIBILITY WORKSHEET , Organization must complete the Eligibility Worksheet to determine if they are eligible to file the Form 1023-EZ. 1=Eligible 0=Ineligible , COLUMN E - ORGANIZATION PRIMARY NAME , Organization's name exactly as it appears on their organizing documents, including amendments. , COLUMN F - ORGANIZATION SECONDARY NAME , PDF ----------------------------------------------------------------------- Form 1023-EZ must be filled and submitted online on , this PDF copy is for reference only! ... Please go to and read the Pros & Cons and eligibility requirements before using the Form 1023-EZ.----- ¾ È» ÏÅË ÅȽ·Ä¿Ð»º ·É ·Ä »ÄÊ¿ÊÏ Åʾ»È ʾ·Ä · ¹ÅÈÆÅÈ·Ê¿ÅÄ ËÄ ... About Form 1023-EZ, Streamlined Application for Recognition of ... Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023 .) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the form.

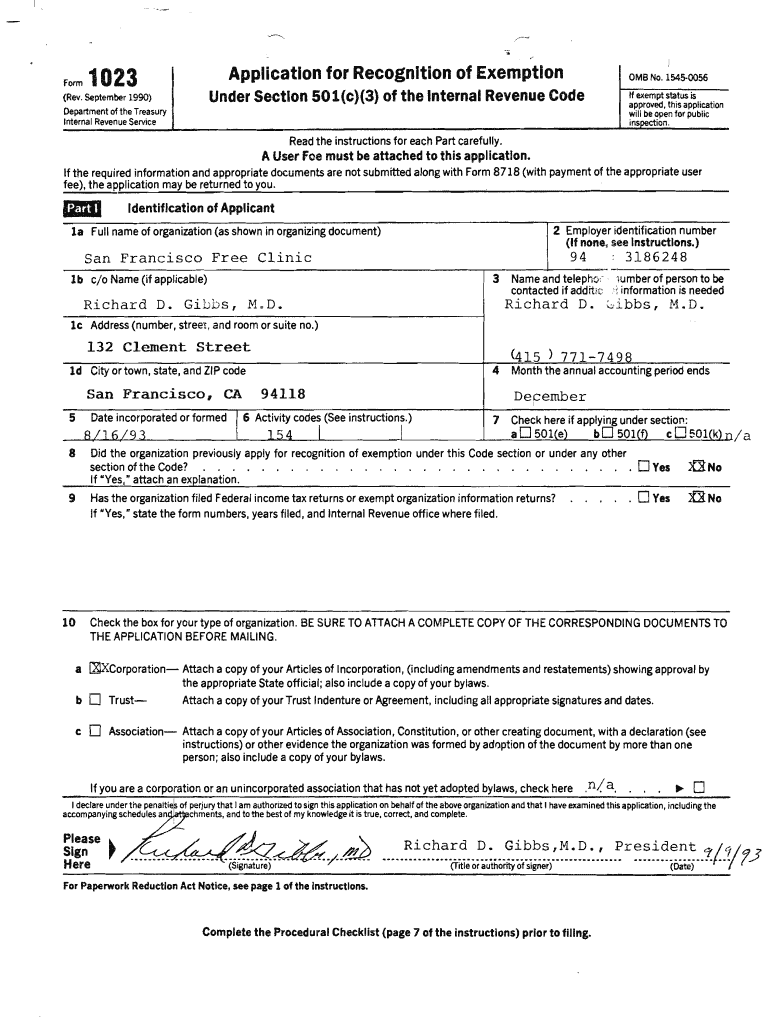

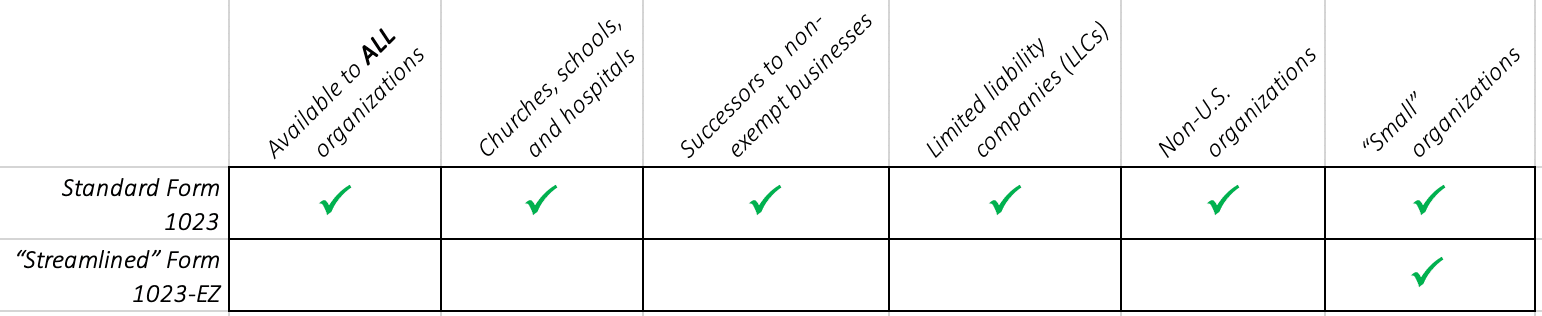

How to Fill Out Form 1023 and Form 1023-EZ for Nonprofits Requirements for the form. 1. Eligibility worksheet. Before looking at the form instructions, you must complete the eligibility worksheet to see if your organization qualifies to use Form 1023-EZ. Also, there are thirty questions on the worksheet; if you answer yes to even one of them, you are not eligible to use that form. But worry not! Application for Recognition of Exemption Under Section 501(c)(3) You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501 (c) (3). You'll have to create a single PDF file (not exceeding 15MB) that ... PDF Page 11 of 20 - microscopy.org Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1. A Beginner's Guide to Tax Exempt Forms: 1023 vs. 1023 EZ - Springly For determination of whether your nonprofit meets eligibility criteria for completing the EZ version of Form 1023, fill out this Eligibility Worksheet. If even a single time you must answer "yes" to one of the 30 questions, your organization is not eligible for the shortcut and must fill out the standard Form 1023.

PDF Page 13 of 23 - Community Law Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply PDF …ˇ¯¸•˜É˝»¨ ˝»É ˚¯•˜ˇ¯…˚¾»˝¯¨`ɾ»»˚˙¸»É˚¿¯˜É ˇ¯¸•¨»˜¯˚»´¿‰¿‚´»˚¯•˘˘´ˇ ... ¯¨ˆ ‚•„"Œ˛´¿‰¿‚¿´¿˚ˇˆ¯¨`ɾ»»˚ " ¸É˚‚»„¯ˆ˘´»˚»"˘¨¿¯¨˚¯„¯ˆ˘´»˚¿˜‰ ¯¨ˆ ‚•„"Œ˛ » About Form 1023, Application for Recognition of Exemption Under Section ... You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. Current Revision, To submit Form 1023, you must: Register for an account on Pay.gov. PDF Form 1023-EZ Streamlined Application for Recognition of Exemption Under ... Information about Form 1023-EZ and its separate instructions is at Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3).

PDF Page 13 of 23 - WSPTA Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1.

Who Is Eligible to Use IRS Form 1023-EZ? | Nolo To determine whether your organization is eligible to use the streamlined application, you can use the 1023-EZ eligibility worksheet. The basic requirements are as follows: gross income under $50,000 in the past 3 years. estimated gross income less than $50,00 for the next 3 years. fair market assets under $250,000.

Form 1023 Ez Eligibility Worksheet: Fill & Download for Free If you take an interest in Modify and create a Form 1023 Ez Eligibility Worksheet, heare are the steps you need to follow: Hit the "Get Form" Button on this page. Wait in a petient way for the upload of your Form 1023 Ez Eligibility Worksheet. You can erase, text, sign or highlight as what you want. Click "Download" to conserve the changes.

PDF Form 1023-EZ Streamlined Application for Recognition of Exemption Under ... Form 1023-EZ Eligibility Worksheet, (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ.

Form 1023-EZ Eligibility Worksheet - Cognito Forms Form 1023-EZ Eligibility Worksheet - Cognito Forms

Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons One of the qualification clauses on the Form 1023EZ is that your organization CANNOT have more than $50,000 gross income in ANY given year for the next consecutive three years after filing your application. Pay close attention to the 3 years requirement because it does not include the current tax year that you're applying.

PDF Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ.

What is IRS Form 1023-EZ? Filing Fees & Eligibility - Hurwit & Associates What is the Form 1023-EZ? Form 1023-EZ is a new, streamlined, online form created by the IRS for smaller organizations that wish to apply for federal tax-exempt status under Internal Revenue Code Section 501(c)(3), and anticipate receiving $50,000 or less in annual gross receipts.; Can I file the Form 1023-EZ? Perhaps. The IRS has created an eligibility worksheet (located on page 11 of the ...

form 1023-ez eligibility worksheet - CocoDoc form 1023-ez eligibility worksheet . Amended Rule 40-10-1-20 MARKED - Georgia Department of bb - agr georgia. 40-10-1-.20 entry into official establishments: reinspection and preparation of products. (1) products and other articles entering official establishment: (a) except as otherwise provided in paragraphs (g) and (h) of this section, no ...

Get the free 1023 ez eligibility worksheet form - pdfFiller One-Stop Forms & Templates Download. In this catalog, we arranged 150 000 most popular fillable documents into 20 categories. For convenient searching and filing of the issue-related forms, select the category and have all relevant documents in one place. Edit professional templates, download them in any text format or send via pdfFiller ...

Get Form 1023 Ez Eligibility Worksheet 2020-2022 - US Legal Forms Keep to these simple instructions to get Form 1023 Ez Eligibility Worksheet completely ready for submitting: Get the sample you will need in the collection of legal forms. Open the template in our online editing tool. Go through the guidelines to discover which information you need to give. Click the fillable fields and put the required data.

IRS Form 1023-EZ Eligibility Worksheet - Nonprofit Corporations ... IRS Form 1023-EZ Eligibility Test, Take the 30 question test below to see if your non-profit corporation is eligible to file IRS Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code.

IRS Form 1023-EZ ≡ Fill Out Printable PDF Forms Online Before a business entity embarks on filing Form 1023-EZ, they have to submit the eligibility worksheet, a questionnaire including 30 questions. The worksheet is aimed to indicate the form you need to submit, depending on the answers you give on the questionnaire. An entity is required to fill the sheet with accuracy and honesty.

1023 ez eligibility worksheet - Fill Online, Printable, Fillable Blank How to complete any Form 1023-EZ Reinstatement Instructions online: On the site with all the document, click on Begin immediately along with complete for the editor. Use your indications to submit established track record areas. Add your own info and speak to data. Make sure that you enter correct details and numbers throughout suitable areas.

0 Response to "42 form 1023 ez eligibility worksheet"

Post a Comment