43 qualified dividends and capital gain tax worksheet fillable

Qualified Dividends and Capital Gain Tax - TaxAct To review the Tax Summary in the TaxAct program, go to our Summary of Return - Tax Summary FAQ. If the tax was calculated on either of these worksheets, you should see "Tax computed on Qualified Dividend Capital Gain WS" as one of the items listed. Go to the IRS Topic No. 409 Capital Gains and Losses webpage for more information. Qualified Dividends And Capital Gain Tax Worksheet: Fillable, Printable ... Qualified Dividends And Capital Gain Tax Worksheet: Fill & Download for Free GET FORM Download the form How to Edit Your Qualified Dividends And Capital Gain Tax Worksheet Online Free of Hassle Click the Get Form button on this page. You will be forwarded to our PDF editor.

2021 Qualified Dividends And Capital Gains - tpdevpro.com 2021 Qualified Dividends And Capital Gains Worksheet 1 week ago Qualified Dividends and Capital Gain Tax Worksheet 1 week ago Jul 16, 2022 · Blank Qualified Dividends and Capital Gain Tax Worksheet (ignore 2019 year and treat as 2020. …. Show more View Detail

Qualified dividends and capital gain tax worksheet fillable

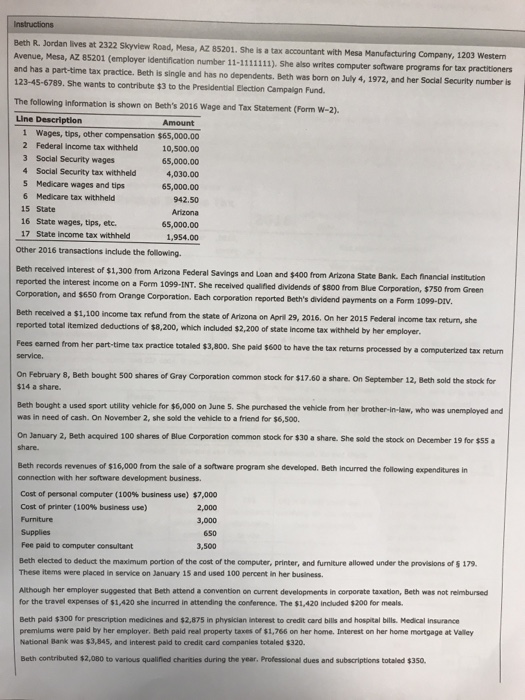

This is a flexible tool for owners/CFOs of beauty business to forecast ... Click on the fillable fields and put the required information.. [Filename: csme2545.pdf] - Read File Online - Report Abuse. ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

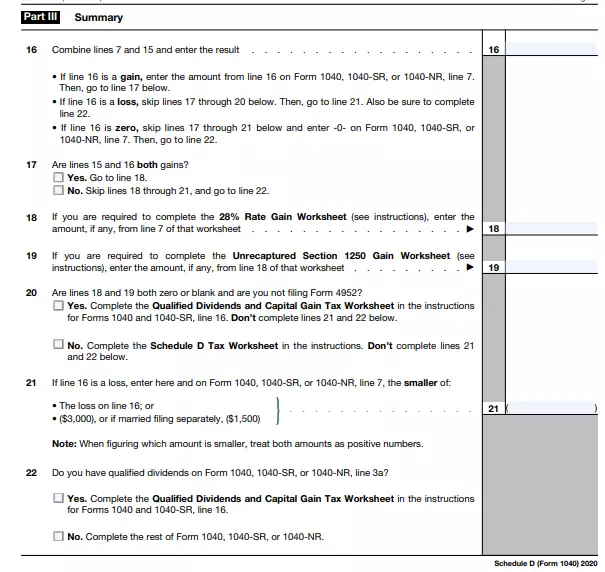

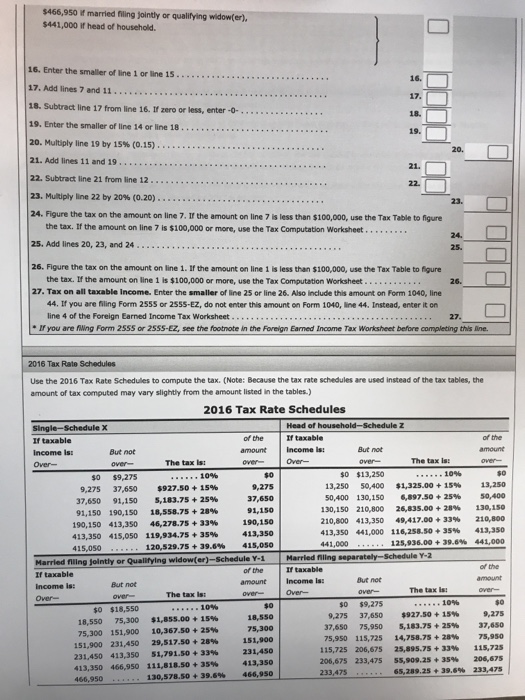

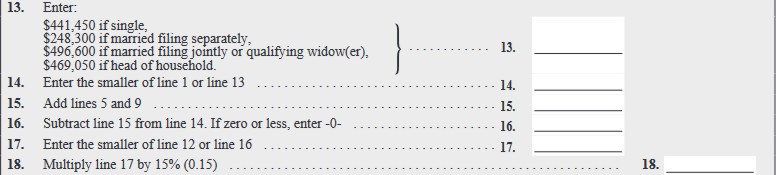

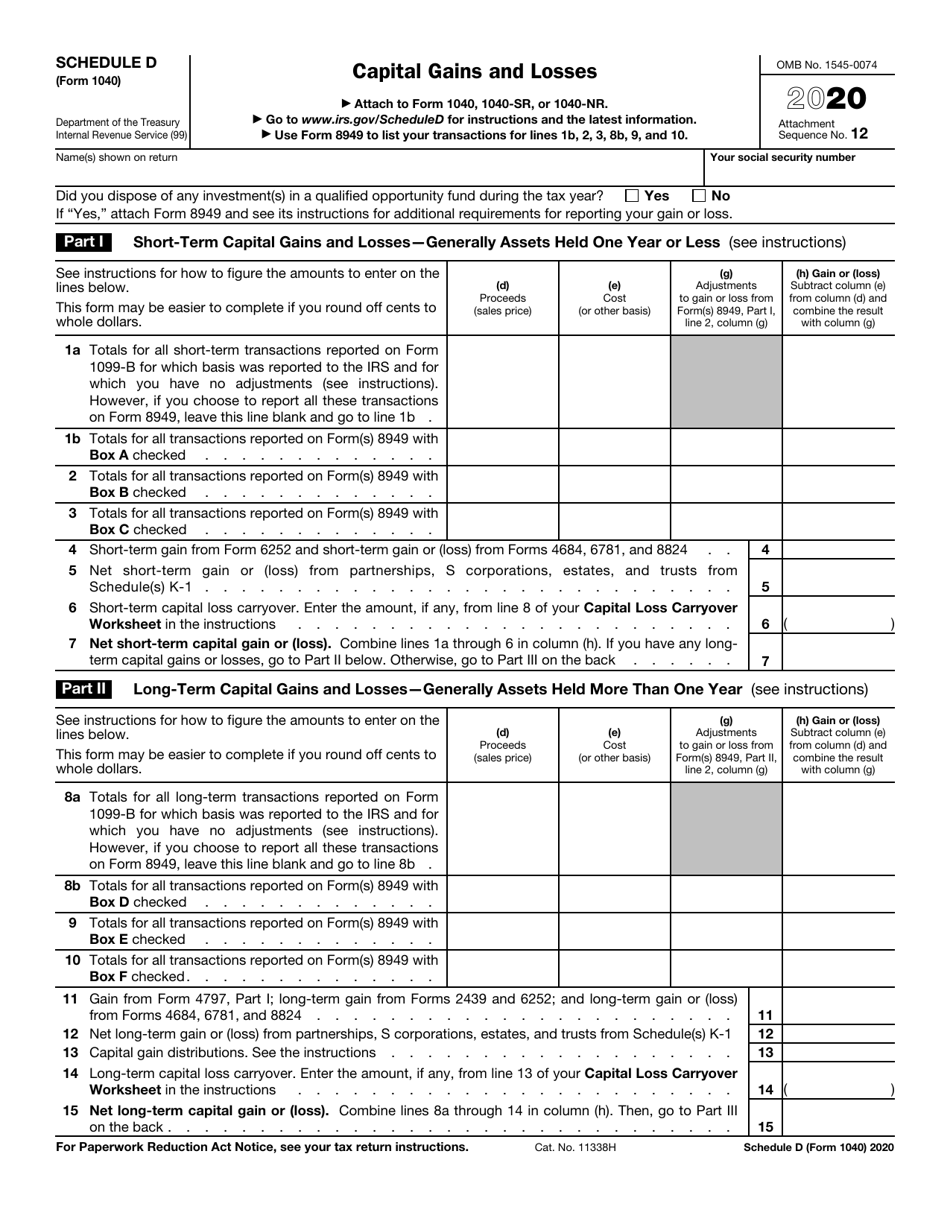

Qualified dividends and capital gain tax worksheet fillable. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. PDF Qualified Dividends and Capital Gain Tax Worksheet - Drake ETC to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet Add lines 18, 21, and 22 Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet Tax on all taxable ... Estimated Tax Worksheet - cotaxaide.org Tax-exempt interest expected: Ordinary dividends: Qualified dividends: Section 199A dividends: IRAs distributions (Amount of QCD included: ) Pensions and annuities: Amount of social security expected: Business income: Capital gains/loss Short term gain/loss: Long term gain/loss: Alimony (if taxable) Unemployment: Other income (rentals ... PDF Page 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Qualified Dividends and Capital Gain Tax - TaxAct The summary will include the text Tax computed on Qualified Dividend Capital Gain WS if the tax was calculated on either of these worksheets. Taxpayers will also see a Green Alert which explains " You have benefited from the lower capital gain tax rates... " Once updated, TaxTopic 409 Capital Gains and Losses should include additional information. Get Qualified Dividends And Capital Gain Tax Worksheet 2019 Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue. Type all necessary information in the necessary fillable fields. The easy-to-use drag&drop graphical user interface... Make sure everything is filled ... Qualified Dividends Tax Worksheet - Fill Out and Use - FormsPal The Qualified Dividends Tax Worksheet is a tax form used to calculate the 15% excise tax on qualified dividends paid by regular C corporations. If you wish to acquire this form PDF, our editor is what you need! By pressing the orange button below, you'll access the page where it's possible to edit, save, and print your document. Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete

Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields ... What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

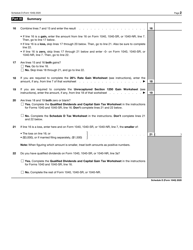

How do I display the Tax Computation Worksheet? - Intuit I would have had to go to that worksheet to find the tax calculations. In your case, if all you had were qualified dividends and/or capital gain, then box A.4 would be checked (as it is above), and then you would go to the Qualified Dividends and Capital Gains Worksheet to see the calculation - this worksheet is abbreviated on the left as "Qual ...

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

" Qualified Dividends and Capital Gain Tax Worksheet." not showing - Intuit In the search box type "qualified dividend" - singular, without the quotes. The Qualified Dividend and Capital Gain Tax Worksheet will then appear in the selection list. You can select it and open it. But if it's not in the list of forms in your return, that means it's not being used to calculate your tax.

IRS corrects error in Schedule D tax calculation worksheet The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Most taxpayers who file Schedule D do not have amounts on line 18, which contains capital gain taxed at the 28% rate, or line 19, where unrecaptured Sec. 1250 gain is reported.

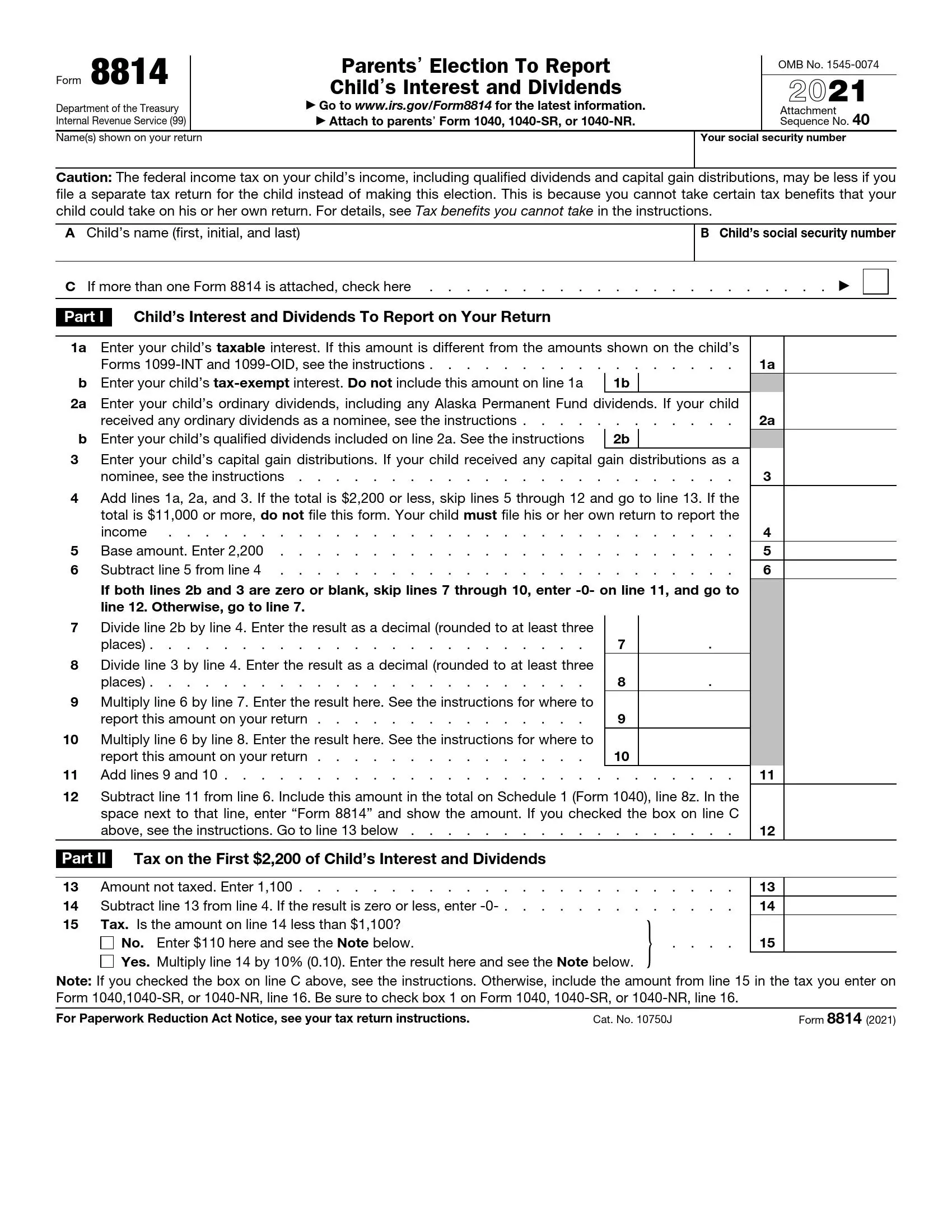

Free Microsoft Excel-based 1040 form available Line 44 - Qualified Dividends and Capital Gain Tax Worksheet Line 52 - Child Tax Credit Worksheet Lines 64a and 64b - Earned Income Credit (EIC) Six additional worksheets round out the tool: W-2 input forms that support up to 4 employers for each spouse 1099-R Retirement input forms for up to 4 payers for each spouse

How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gains Worksheet-Completed University Southern New Hampshire University Course Federal Taxation I (ACC330) Uploaded by Nickia Marie Academic year 2021/2022 Helpful? Please or to post comments. Students also viewed 6-2 Final Project Two-1040 Document

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

PDF 2019 Tax Computation Worksheet - cchcpelink.com 2019 Tax Computation Worksheet—Line 12a k! ... If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter ...

PDF 2020 Tax Computation Worksheet—Line 16 - H&R Block 2020 Tax Computation Worksheet—Line 16. ... If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter ...

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to Schedule D FS-2004-11, February 2004 Although many investors use Schedule D to get the benefit of lower capital gains tax rates, others can still use a worksheet in the tax instructions to skip Schedule D entirely. Lower Tax Rates

How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

This is a flexible tool for owners/CFOs of beauty business to forecast ... Click on the fillable fields and put the required information.. [Filename: csme2545.pdf] - Read File Online - Report Abuse. ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax.

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "43 qualified dividends and capital gain tax worksheet fillable"

Post a Comment