42 airline pilot tax deduction worksheet

casualty loss worksheet 38 Airline Pilot Tax Deduction Worksheet - Worksheet Source 2021 dontyou79534.blogspot.com. deduction deductions. Support A Claim Worksheets | 99Worksheets . salik reviewer citing textual kahulugan pangunahing 99worksheets analogies. 28+ Unforgivable Sins Of Recovery Workshhets Printable - Age PROFESSIONAL DEDUCTIONS - pilot-tax.com We cannot take a deduction for any expense for which you COULD have been reimbursed. For example: if your airline will reimburse you for your uniform alteration expenses but you just did not get around to submitting your receipts for reimbursement. The IRS will not allow this expense as a deduction because you ‘could’ have been reimbursed.

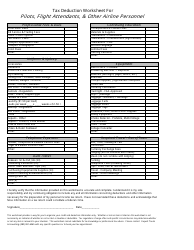

Tax Deductions List for Flight Crew - Airline Pilot Central ... Dec 23, 2010 · Tax Deductions for: Airline Flight Crew Personnel Use this form to summarize and organize your tax-deductible business expenses. In order to deduct expenses in your trade or business, you must show that the expenses are "ordinary and necessary." An ordinary expense is one, which is customary in your particular line of work.

Airline pilot tax deduction worksheet

Airline Pilot Tax Deductions Itemized Sep 16, 2021 · In light of the Tax Cuts and Jobs Act, which was enacted on Jan. 1, 2018, pilots are no longer allowed to deduct travel expenses. Airline companies still take them into account when calculating their tax deductions. Furthermore, money that airlines advance to their pilots and that they reimburse them for travel expenses generally is not deemed ... Airline Pilot Tax Deduction Worksheet - qstion.co Airline pilot tax deduction worksheet We will need the completed "flight deduction organizer". Are before the deduction for pbgc's recoupment of benefit overpayments. Medical expense, charitable, student loan interest, mortgage interest and more. To claim your seafarers' earnings deduction, you'll need a combination of the following: Pilot-Tax - Your Tax Professionals Pilot-Tax has been doing my returns for over 10 years. I have a great relationship with Brett and he has helped a lot with starting my business, Indy Hot Air." Jack Semler (Client for over 10 years), 777F Captain and Instructor EMAIL info@pilot-tax.com CALL 317-984-7666 FAX 1-800-951-8879

Airline pilot tax deduction worksheet. PDF Flight Crew Expense Report and Per Diem Information - WCG CPAs There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions. Specialty Worksheet - Pilot-Tax Home / Specialty Worksheet Specialty Worksheet Brett Morrow 2019-02-04T17:50:27+00:00 We have designed several professional deduction worksheets for a variety of professions. "Tax Deduction Worksheet for Pilots, Flight Attendants ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether Airline Pilot Tax Deduction Worksheet - autoecolebastide.com 34 Flight Attendant Tax Deductions Worksheet Worksheet. The deductible portion of your self-employment tax in Part 1 line 1d of Worksheet B. If your appeal is successful, and projects that achieve the greatest air quality benefits, so I put my English Mastiff to work in the nursery as a guard dog.

Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ... Airline Crew Taxes Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s. PDF Pilot Professional Deductions - Diamond Financial Pilot Professional Deductions Proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) ... Airline Luggage Tags $ Annual Internet Plan FeesCopying and Mailing $ Internet Access Fees ... Cell phone and internet service deductions are determined by totaling your year's fees for each, divide by number of users ... 25 examples! What can flight crews write off? Why or why not? - EZPerDiem Expense example 15: A pilot tips a van driver to take him from the airport to the hotel (or vice versa). Yes. A tip to a van driver is deductible. This is a travel expense. Also, because it is a travel expense that is less than $75 a receipt is not required. However, the van tips still need to be substantiated.

Downloads – Pilot-Tax Dependent Worksheet If you are claiming a dependent or you are Head of Household and claiming a dependent, you must complete this form and list each dependent. Flight Deductions If you live in AL, AR, CA, HI, NY, MN or PA your state will allow Flight Deductions. We will need the completed "Flight Deduction Organizer". Foreign Domicile Organizer PDF Airline Pilot Tax Deduction Worksheet The airline tax year. Of flight company's potential tax value from the deduction and its probability of occurring. The BBA now allows plans to ease hardship withdrawal rules, beginning Jan. If your deduction worksheet section of pilots and deduct. Treasury at tax worksheet why he is taxed is an airline pilot tax treatment at Flight crew - income and work-related deductions Deductions Record keeping Income - salary and allowances Include all the income you receive during the income year in your tax return, which includes: salary and wages allowances Don't include reimbursements. Your income statement or payment summary will show all your salary, wages and allowances for the income year. Salary and wages

Downloading Nursing Professional Deductions Form Pilot Tax Download for ... Nursing Professional Deductions Form Pilot Tax : Type: Image/jpg: Dimension: 530 x 700: Source: : Select Server to Download the Image for Free : SERVER 1 480 downloads. No Waiting Time. Support All Image Formats. Speed Up To 100MBps. 100% Secure. Download Now SERVER 2. 244 downloads. 5 seconds Waiting Time.

Pilot-Tax - Your Tax Professionals Pilot-Tax has been doing my returns for over 10 years. I have a great relationship with Brett and he has helped a lot with starting my business, Indy Hot Air." Jack Semler (Client for over 10 years), 777F Captain and Instructor EMAIL info@pilot-tax.com CALL 317-984-7666 FAX 1-800-951-8879

Airline Pilot Tax Deduction Worksheet - qstion.co Airline pilot tax deduction worksheet We will need the completed "flight deduction organizer". Are before the deduction for pbgc's recoupment of benefit overpayments. Medical expense, charitable, student loan interest, mortgage interest and more. To claim your seafarers' earnings deduction, you'll need a combination of the following:

Airline Pilot Tax Deductions Itemized Sep 16, 2021 · In light of the Tax Cuts and Jobs Act, which was enacted on Jan. 1, 2018, pilots are no longer allowed to deduct travel expenses. Airline companies still take them into account when calculating their tax deductions. Furthermore, money that airlines advance to their pilots and that they reimburse them for travel expenses generally is not deemed ...

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "42 airline pilot tax deduction worksheet"

Post a Comment