40 itemized deductions worksheet 2015

recoveries of itemized deductions worksheet 29 Itemized Deduction Worksheet 2015 - Worksheet Resource Plans starless-suite.blogspot.com. itemized worksheet deductions 2002 deduction 1040 tax irs archives main. 5 Best Images Of Itemized Tax Deduction Worksheet - 1040 Forms Itemized Deductions Worksheet . deduction worksheet preschool Itemized Deduction Worksheet 2015 - Worksheet List nofisunthi.blogspot.com. itemized deduction deductions limitation. Other Worksheet Category Page 846 - Worksheeto.com . itemized deductions worksheeto. Pin On Childcare Providers .

PDF 2021 Instructions for Schedule A - IRS tax forms expenses deduction. m. Don't forget to include insur-ance premiums you paid for medical and dental care. How-ever, if you claimed the self-employed health insurance deduction on Schedule 1 (Form 1040), line 17, reduce the pre-miums by the amount on line 17. If, during 2021, you were an el-igible trade adjustment assis-

Itemized deductions worksheet 2015

PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance PDF Form IT-203-B:2015:Nonresident and Part-Year Resident Income Allocation ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a: PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

Itemized deductions worksheet 2015. itemized deduction worksheet 8 Best Images of Monthly Bill Worksheet - 2015 Itemized Tax Deduction Worksheet Printable, Free. 8 Pictures about 8 Best Images of Monthly Bill Worksheet - 2015 Itemized Tax Deduction Worksheet Printable, Free : Itemized Tax Deduction Worksheet Oaklandeffect Deductions — db-excel.com, Goodwill Donation Spreadsheet Template Google Spreadshee goodwill donation spreadsheet template and also ... About Schedule A (Form 1040), Itemized Deductions Information about Schedule A (Form 1040), Itemized Deductions, including recent updates, related forms, and instructions on how to file. This schedule is used by filers to report itemized deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the ... Prior Year Products - IRS tax forms Prior Year Products. Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list. PDF 19 2021 Itemized Deduction (Sch A) Worksheet - cotaxaide.org 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 If you checked any of the above, please stop here and speak with one of our Counselors.

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A PDF Attach to Form 1040. - IRS tax forms Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ... 39 Itemized Deduction Worksheet 2015 - combining like terms worksheet Title: 39 Itemized Deduction Worksheet 2015 - combining like terms worksheet Resolution: 791px x 1024px File Size: 791 x 1024 · jpeg . Download Image. Crafts,actvities and worksheets for preschool,toddler and kindergarten Easter worksheets slideshare PDF 2015 ITEMIZED DEDUCTIONS WORKSHEET - saralandtax.com 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might ... 2015 ITEMIZED DEDUCTIONS - FINAL as of 9-18-2015.pub Author: Joe Created Date: 12/22 ...

w4 deductions and adjustments worksheet Itemized Deduction Wor 2015 Itemized Deductions Worksheet — db-excel.com. 12 Pictures about Itemized Deduction Wor 2015 Itemized Deductions Worksheet — db-excel.com : 5 Deductions and Adjustments Worksheet for Federal form W 4 | FabTemplatez, Deductions and Adjustments Worksheet | Mychaume.com and also Form Il-W-4 - Illinois Withholding Allowance Worksheet printable pdf download. PDF 2021 Schedule A (Form 1040) - IRS tax forms Itemized Deductions . 16. Other—from list in instructions. List type and amount . 2015 personal income tax forms - Government of New York 2015 personal income tax forms; Form number Instructions Form title; DTF-620: ... Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet: IT-203-C (Fill-in) Instructions on form: Nonresident or Part-Year Resident Spouse's Certification: IT-203-D (Fill-in) goodwill itemized deductions worksheet Itemized Deductions Worksheet 2016 — Db-excel.com db-excel.com. tax worksheet deductions deduction business itemized self employed spreadsheet excel template expense expenses db documents schedule briefencounters 1040 archives sheet. 37 Itemized Deductions Worksheet 2015 - Worksheet Source 2021 dontyou79534.blogspot.com. itemized deductions

standard deduction worksheet 2021 Irs 1040 Form Line 8B : How To Leave Form 8 For 8 Without Being Noticed. 17 Pictures about Irs 1040 Form Line 8B : How To Leave Form 8 For 8 Without Being Noticed : 31 Itemized Deduction Worksheet 2015 - Worksheet Information, Form W-4: Employee's Withholding Certificate Definition and also Irs 1040 Form Line 8B : How To Leave Form 8 For 8 Without Being Noticed.

Deductions | FTB.ca.gov - California Itemized deductions Itemized deductions are expenses that you can claim on your tax return. They can decrease your taxable income. We do not conform to all federal itemized deductions. You should itemize your deductions if: Your total itemized deductions are more than your standard deduction You do not qualify to claim the standard deduction

How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

2021 Instructions for Schedule CA (540) | FTB.ca.gov - California In general, for taxable years beginning on or after January 1, 2015, California law conforms to the IRC as of January 1, 2015. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level.

An Overview of Itemized Deductions - Investopedia This final category of itemized deductions includes items such as gambling losses to the extent of gambling winnings, losses from partnerships or subchapter S corporations, estate taxes on income...

2014 itemized deductions worksheet 30 Itemized Deductions Worksheet 2015 - Worksheet Information. 8 Pictures about 30 Itemized Deductions Worksheet 2015 - Worksheet Information : 10 Best Images of 2014 Itemized Deductions Worksheet - 1040 Forms, 8 Best Images of Tax Itemized Deduction Worksheet - IRS Form 1040 and also 8 Best Images of Tax Itemized Deduction Worksheet - IRS Form 1040.

Itemized Deductions: 2022 Complete List (+ getting the max return) Since the TCJA Act passed in 2017, standard deductions have practically doubled. For example, for married couples filing jointly, it went from $12,700 to $25,100 in 2021. Single taxpayers and those that are married but file separately saw a rise from $6,350 in 2017 to $12,550 in 2021. However, in the 2022 tax year, there is even more to ...

List of Itemized Deductions Checklist Form - signNow Follow the step-by-step instructions below to eSign your list of itemized deductions checklist: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to:

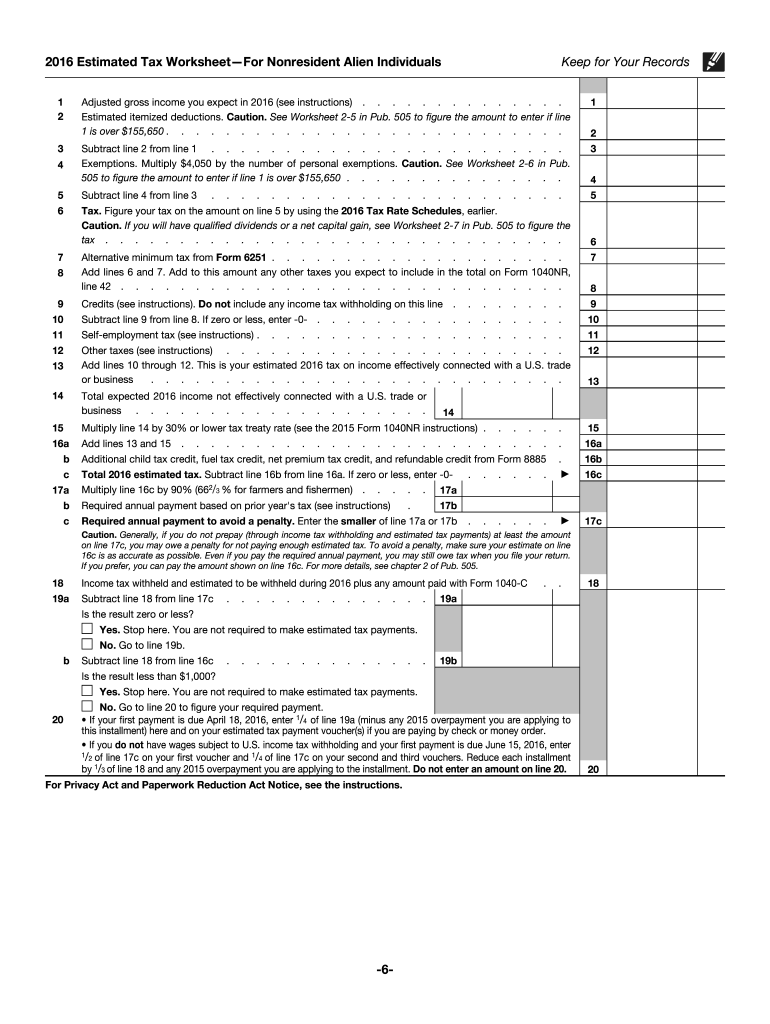

estimated work deductions worksheet b Itemized Deductions Worksheet 2015 - Worksheet List nofisunthi.blogspot.com deductions itemized fillable Deductions Worksheet ahuskyworld.blogspot.com deductions offs deduction expense spreadsheet irs scentsy ahuskyworld Insurance Premium Estimated Tax Instructions: Worksheet To Determine Estimated Tax Payments For

itemized deductions worksheet Itemized Deduction Wor 2015 Itemized Deductions Worksheet — Db-excel.com db-excel.com. itemized deduction deductions wor. 12 Best Images Of Self -Employed Tax Worksheet - Free Self-Esteem Building Worksheets, Personal .

PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

PDF Form IT-203-B:2015:Nonresident and Part-Year Resident Income Allocation ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a:

PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance

0 Response to "40 itemized deductions worksheet 2015"

Post a Comment