42 self employed expense worksheet

Simplified Option for Home Office Deduction | Internal ... Aug 01, 2022 · Beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business use of their home SELF-EMPLOYMENT WORKSHEET Deductible Expense: Advertising. Car/Truck Expenses. Commissions/Fees. Contract Labor. Depletion. Depreciation. Employee Benefit Programs. Insurance.

Publication 463 (2021), Travel, Gift, and Car Expenses ... Self-employed. Both self-employed and an employee. Employees. Gifts. Statutory employees. Reimbursement for personal expenses. Income-producing property. Vehicle Provided by Your Employer. Value reported on Form W-2. Full value included in your income. Less than full value included in your income. Reimbursements. No reimbursement.

Self employed expense worksheet

Tips on Rental Real Estate Income, Deductions and ... Oct 27, 2022 · When you include the fair market value of the property or services in your rental income, you can deduct that same amount as a rental expense. You may not deduct the cost of improvements. A rental property is improved only if the amounts paid are for a betterment or restoration or adaptation to a new or different use. Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... Free expenses spreadsheet for self-employed - Hello Bonsai Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. Simplify your accounting and billing and get on with your work.

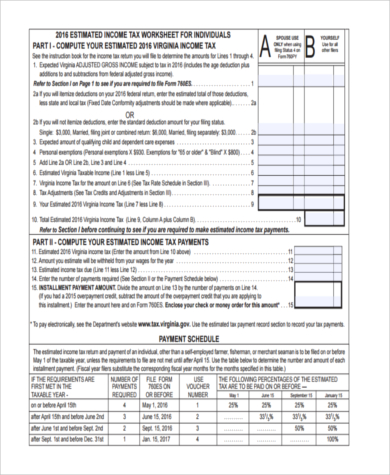

Self employed expense worksheet. Publication 334 (2021), Tax Guide for Small Business Small Business and Self-Employed (SB/SE) Tax Center. Do you need help with a tax issue or preparing your return, or do you need a free publication or form? SB/SE serves taxpayers who file Form 1040; Form 1040-SR; Schedules C, E, or F; or Form 2106, as well as small business taxpayers with assets under $10 million. Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC. LLCs & 1099-MISC with box 7 income listed. SELF-EMPLOYED WORKSHEET | NI Direct SELF-EMPLOYED WORKSHEET FOR RATES HOUSING BENEFIT/RATE RELIEF APPLICATION (4.0). Page 1 of 4 ... details of your income and expenses? From. DD/MM/YYYY. Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · Health Insurance Costs for Self-Employed Persons. If you were self-employed and had a net profit for the year, you may be able to deduct, as an adjustment to income, amounts paid for medical and qualified long-term care insurance on behalf of yourself, your spouse, your dependents, and your children who were under age 27 at the end of 2021.

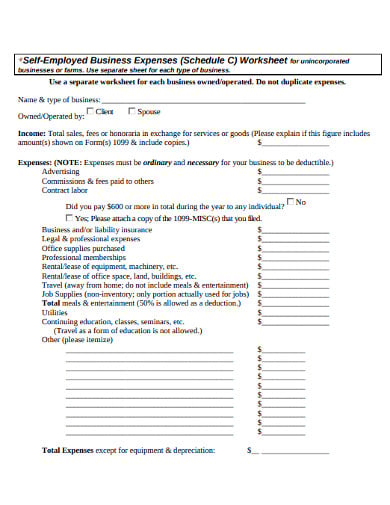

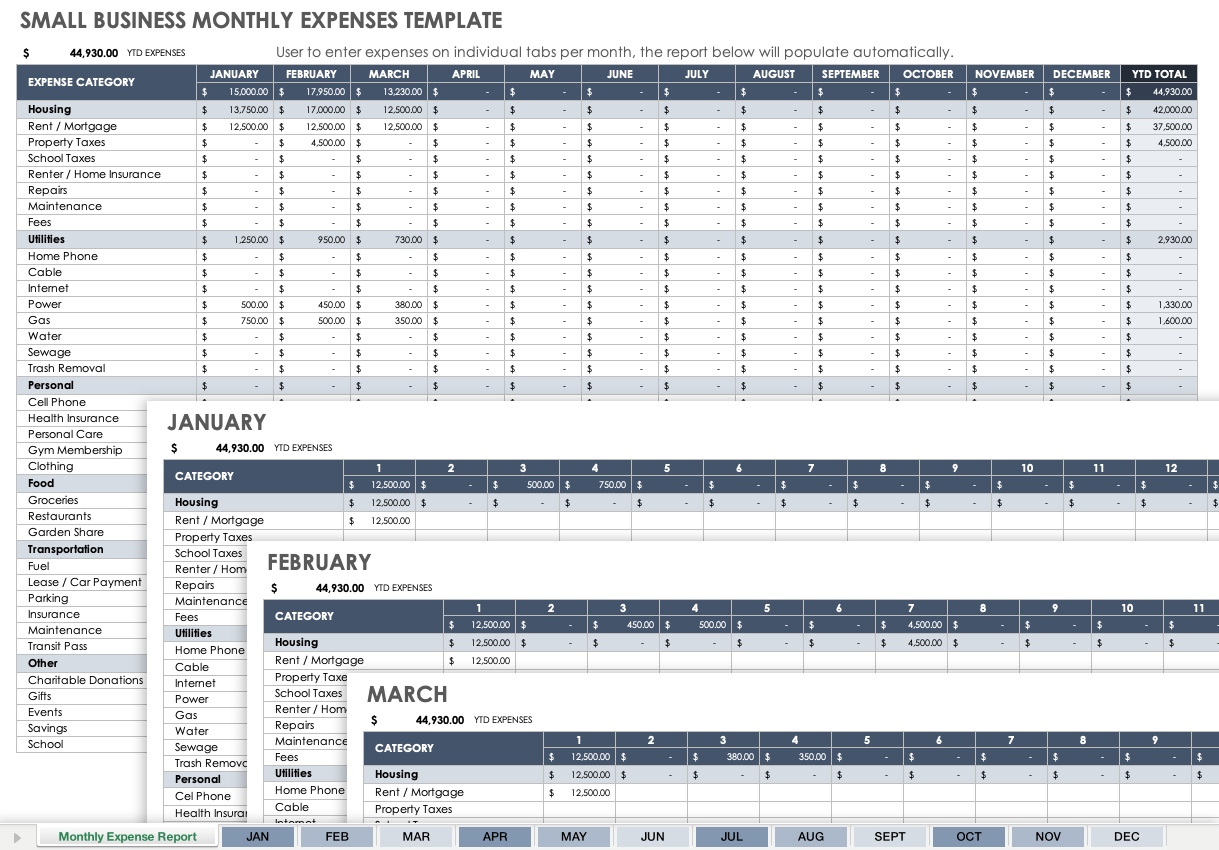

SELF-EMPLOYMENT INCOME AND EXPENSE WORKSHEET SELF-EMPLOYMENT INCOME AND EXPENSE WORKSHEET. Your name: ... Km for business/employment or %. Purchases for the year. Total Km driven. Subcontracts. The Ultimate Medical Expense Deductions Checklist Oct 18, 2022 · Self-Employed defined as a return with a Schedule C/C-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA ... (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use this worksheet to record your monthly income and expenses ... Track gas and vehicle expenses for your budget, but business mileage will be needed for your taxes. Use our SETO (Self-Employed Tax. Organizer) to calculate the ...

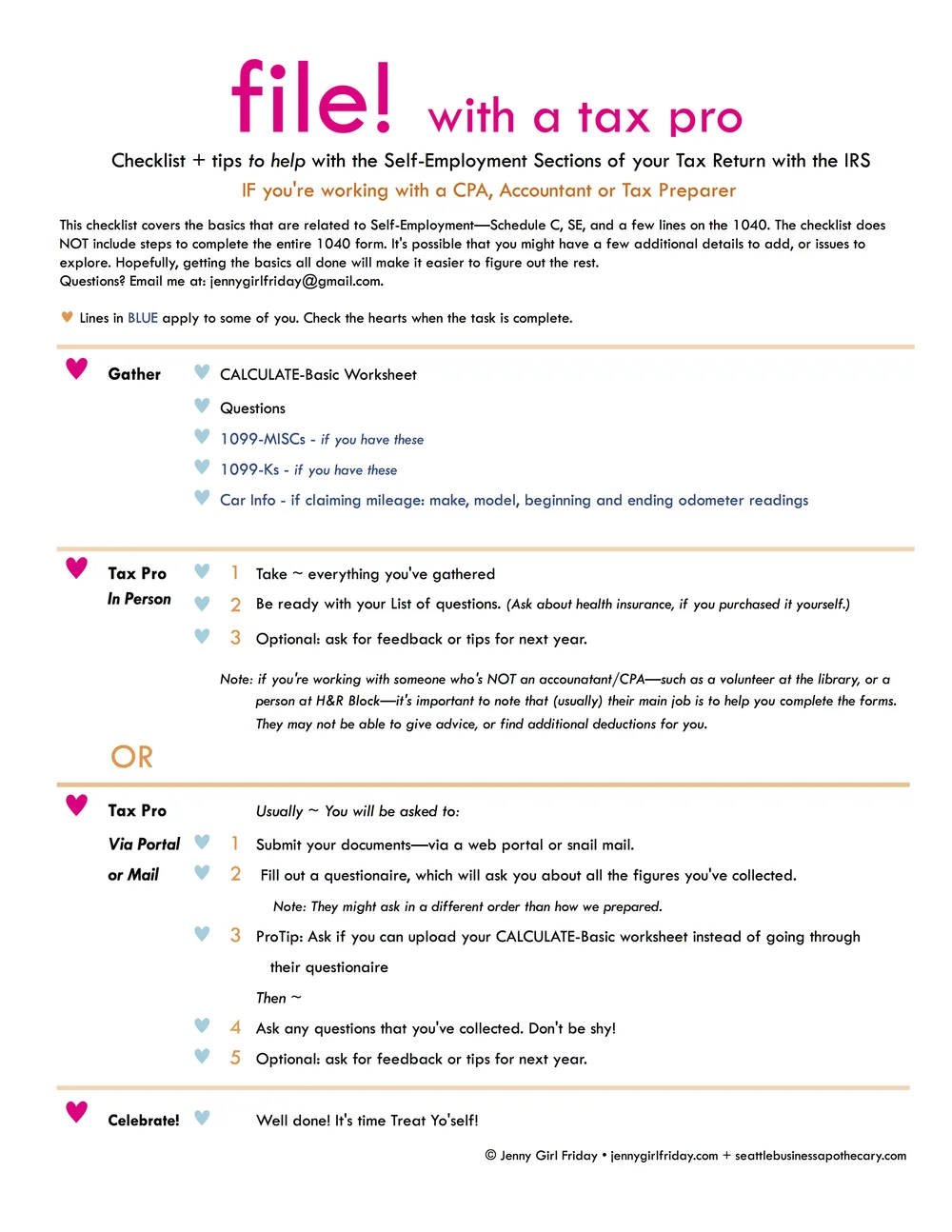

Self Employment Monthly Sales and Expense Worksheet - WA.gov Monthly Sales and Expense Worksheet, NAME. MONTH, CLIENT ID NUMBER. Self Employment Income. You must tell us about your monthly self employment income. SELF EMPLOYMENT INCOME WORKSHEET Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). - Income Taxes (federal, state, and local ). EXPENSES:. Self-Employed Tax Deductions Worksheet (Download FREE) Looking to lower your tax liability for the year? Well, you are in the right place. User our free self-employed tax deductions worksheet to record/track all ... Free expenses spreadsheet for self-employed - Hello Bonsai Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. Simplify your accounting and billing and get on with your work.

Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Tips on Rental Real Estate Income, Deductions and ... Oct 27, 2022 · When you include the fair market value of the property or services in your rental income, you can deduct that same amount as a rental expense. You may not deduct the cost of improvements. A rental property is improved only if the amounts paid are for a betterment or restoration or adaptation to a new or different use.

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/maxresdefault.jpg)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

0 Response to "42 self employed expense worksheet"

Post a Comment