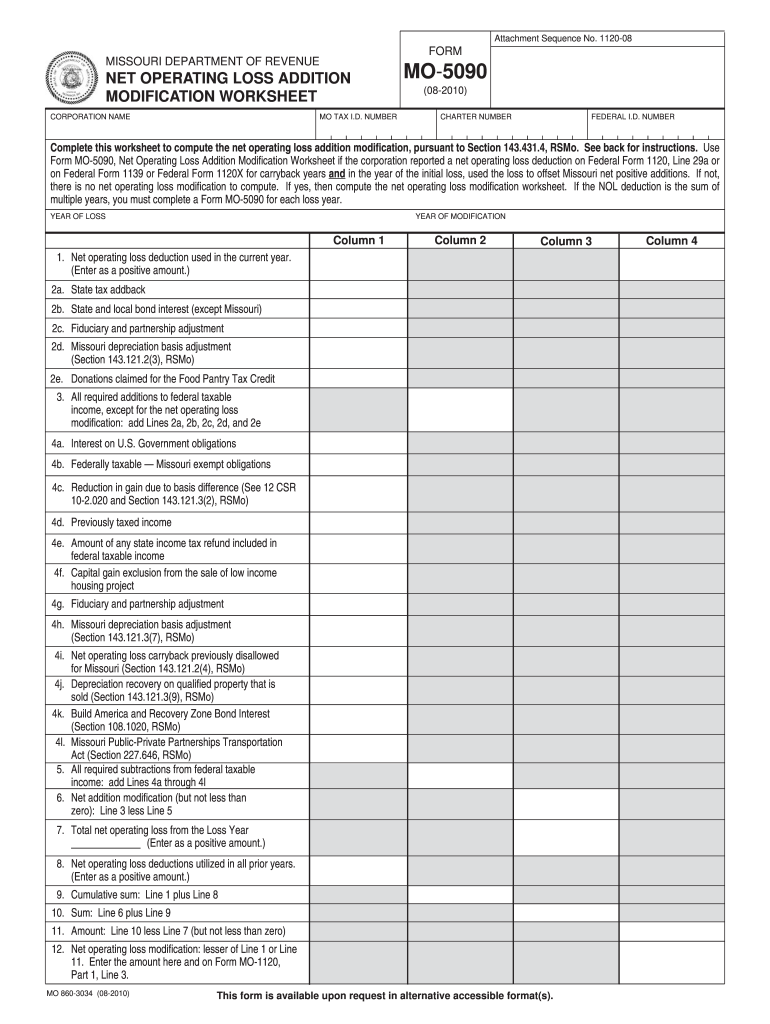

45 income tax deduction worksheet

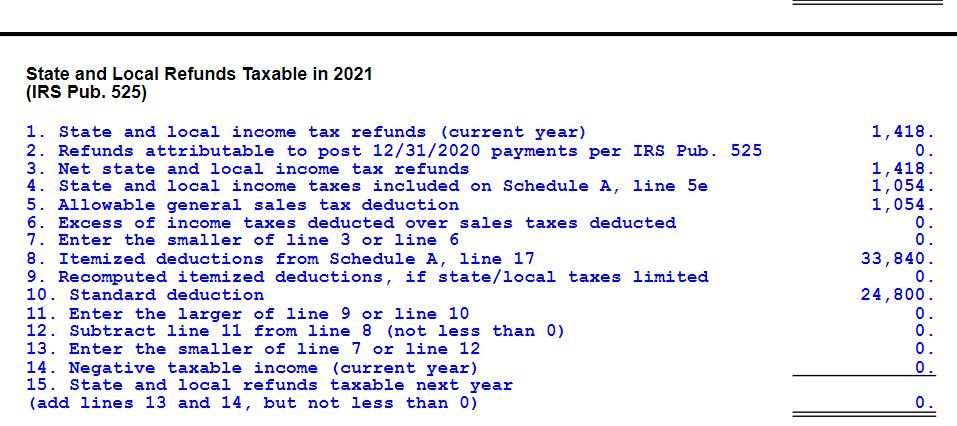

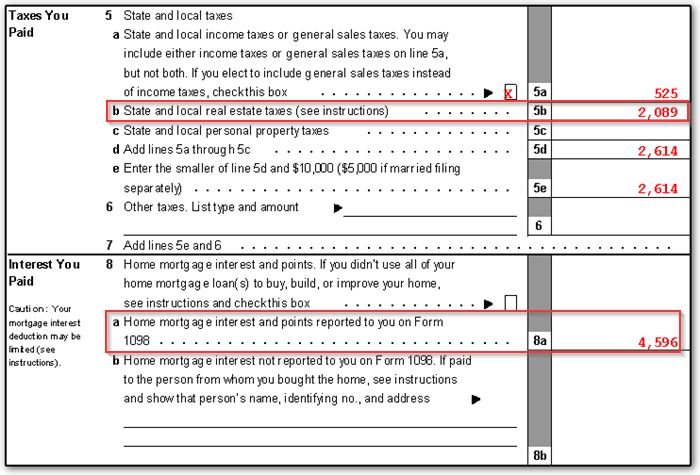

About Schedule A (Form 1040), Itemized Deductions Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Current Revision Schedule A (Form 1040) PDF Instructions for Schedule A (Form 1040) | Print Version PDF | eBook (epub) EPUB Recent Developments PDF Schedule A - Itemized Deductions - IRS tax forms were on a pre-tax basis) • Funeral, burial, or cremation expenses • Health savings account payments for medical expenses • Operation, treatment, or medicine that is illegal under federal or state law • Life insurance or income protection policies, or policies providing payment for loss of life, limb, sight, etc. • Maternity clothes

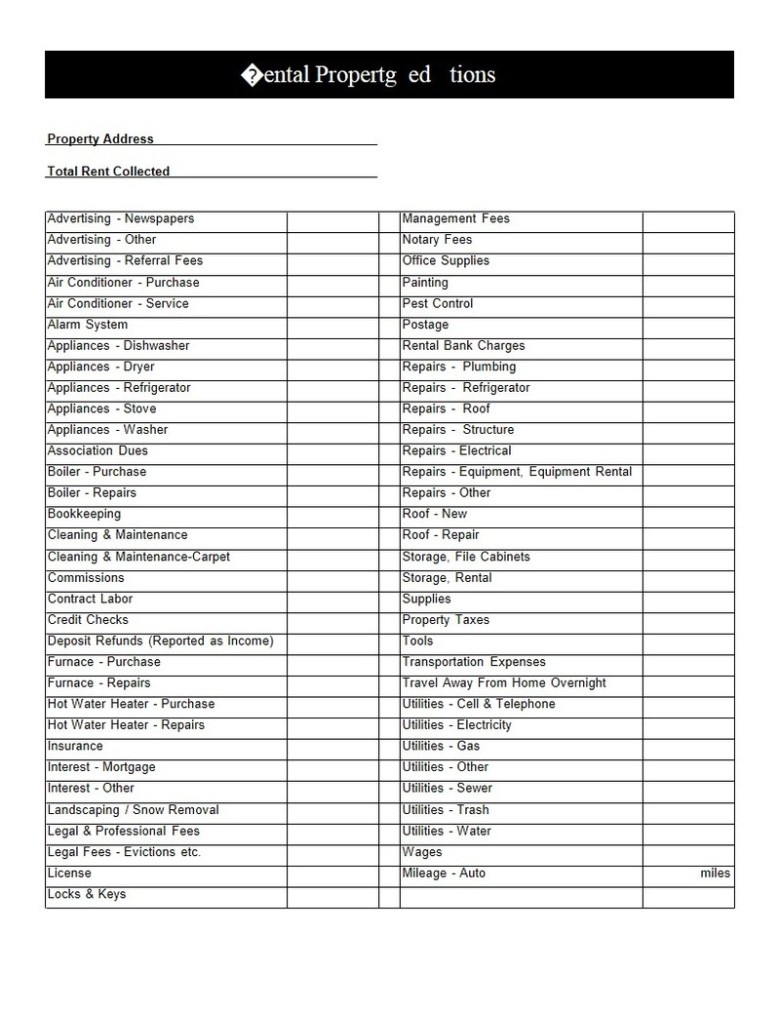

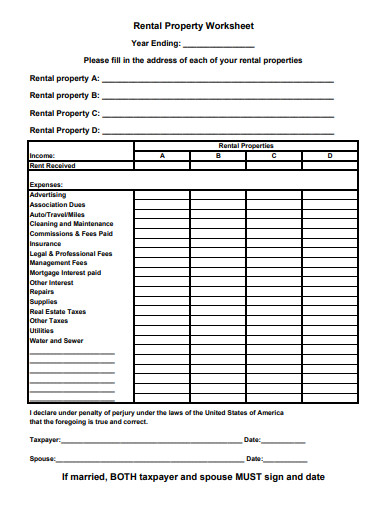

Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Income tax deduction worksheet

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Internet and phone bills - The cost of wifi and a portion of your phone bill may qualify as a deductible expense Deduct the cost of meals - meals with clients or any meetings where you discuss work may count as a deduction. Travel costs - If you have to travel for your work/services, you can deduct the fees related to traveling Alabama Federal Income Tax Deduction Worksheet - TaxFormFinder Page 2, Part IV Federal Income Tax Deduction The federal income tax allowed as a deduction to a nonresident of Alabama is the amount calculated using the federal income tax deduction worksheet on this page. The balance is then prorated by the percentage of income earned in Alabama to the total income from all sources. How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... Claim Dependents. If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000. Multiply the number of other dependents by $500 . Add the amounts above and enter the total.

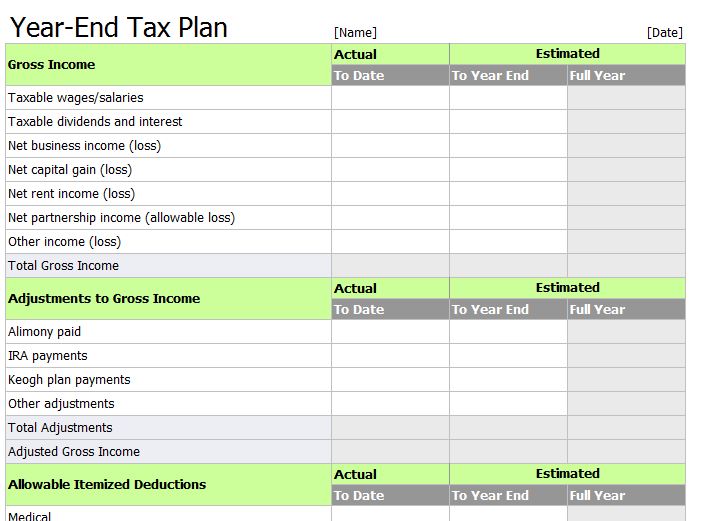

Income tax deduction worksheet. Tax Deduction | Excel Templates Included in this excel tax deduction template you will receive an itemized deductions calculator that comes with two sections known as the header section and the calculation section. These areas are where you will fill out your personal financial details that correspond to each category. Optional Tips 1. Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator if the older of you or your spouse (if married filing jointly) was born during the period january 1, 1953 through january 1, 1954, and reached the age of 67 on or before december 31, 2020, you may deduct the personal exemption amount and taxable social security benefits, military compensation (including retirement benefits), michigan national … Topic No. 456 Student Loan Interest Deduction - IRS tax forms Web05.10.2022 · If you file a Form 2555, Foreign Earned Income, Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, or if you exclude income from sources inside Puerto Rico, refer to Worksheet 4-1, Student Loan Interest Deduction Worksheet in Publication 970 instead of the worksheet in the Instructions for Form 1040 … Tax Worksheets - Assured Tax Tax Worksheets. Our Tax Organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your tax return. The organizer is revised annually to be compatible with the ever-changing tax laws. These organizers are primarily for the current tax year, although it can be used for past years.

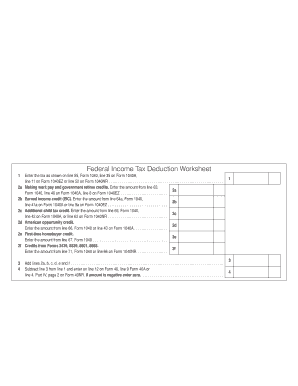

Downloadable tax organizer worksheets Data Organizers Available for Download Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax return is unique. Therefore we also have specialized worksheets to meet your specific needs. All the documents on this page are in PDF format. 3.11.3 Individual Income Tax Returns | Internal Revenue Service 3.11.3 Individual Income Tax Returns Manual Transmittal. November 15, 2022. Purpose (1) This transmits revised IRM 3.11.3, Returns and Documents Analysis - Individual Income Tax Returns. Material Changes (1) IRM 3.11.3.3(2) Rewritten to remove references to prior year schedules. IPU 22U0023 issued 01-03-2022. Estimated Tax Worksheet Qualified Business Income deduction OUT OF SCOPE : 0: Total Deductions: Taxable income: Taxable income: 0: Tax: Tax from tax tables: 0: Enter any additional taxes (Forms 4972, 6251, 8814 or 8889) Total tax amounts: 0: Nonrefundable Credits: actual amount: max available: will use: Foreign tax credit Form 1116 is required (Check to allow) PDF Federal Income Tax Deduction Worksheet - Alabama Part II - Pursuant to Act 2022-37 (HB 231) which provides that any federal income tax reductions attributable to the federal child tax credit, the earned income tax credit, and the federal child and dependent care tax credits, the federal income tax deduction shall be calculated as if the in dividual paid the federal income tax that would

PDF 2022 Form W-4 - IRS tax forms payments for that income. If you prefer to pay estimated tax rather than having tax on other income withheld from your paycheck, see Form 1040-ES, Estimated Tax for Individuals. Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2022 ... Income Tax Worksheet Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES. ARPA Tax Relief - Alabama Department of Revenue 2021 Federal Income Tax Deduction worksheet Update: ALDOR has created an Excel spreadsheet to assist in the calculation of the federal income tax deduction for paper or MAT filers. To use this spreadsheet you must have your completed 2021 Federal 1040/1040-SR/1040NR and all schedules, forms and worksheets used to calculate your federal income tax. Earned Income Tax Credit (EITC) | Internal Revenue Service Web31.10.2022 · The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about the EITC? Find out what to do. Who Qualifies. You may claim the EITC if your …

Topic No. 554 Self-Employment Tax | Internal Revenue Service Web13.10.2022 · Reporting Self-Employment Tax. Compute self-employment tax on Schedule SE (Form 1040). When figuring your adjusted gross income on Form 1040 or Form 1040-SR, you can deduct one-half of the self-employment tax. You calculate this deduction on Schedule SE (attach Schedule 1 (Form 1040), Additional Income and Adjustments to …

2020/2021 Tax Estimate Spreadsheet - Michael Kummer 2020/2021 Tax Estimate Spreadsheet. If you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. The formulas and spreadsheets shown and linked below take the new tax reform and tax cuts ...

Qualified Business Income Deduction | Internal Revenue Service WebEligible taxpayers can claim it for the first time on the 2018 federal income tax return they file in 2019. The deduction has two components. QBI Component. This component of the deduction equals 20 percent of QBI from a domestic business operated as a sole proprietorship or through a partnership, S corporation, trust or estate.

Federal Income Tax Deduction Worksheet Form - signNow Create this form in 5 minutes or less How to create an eSignature for the federal income tax deduction worksheet Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

PDF IRS tax forms IRS tax forms

The Complete 2022 Charitable Tax Deductions Guide - Daffy Your deductions, on the other hand, are not impacted by your tax bracket. The 2022 standard deduction applies to all taxpayers: Single taxpayers and married individuals filing separately: $12,950. Married individuals filing jointly: $25,900. In order to deduct charitable contributions and other eligible expenses, you'll need to itemize ...

A Free Home Office Deduction Worksheet to Automate Your Tax Savings The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage.

Quiz & Worksheet - Income Tax Liability & Deductions | Study.com Worksheet Print Worksheet 1. Tax liability is calculated based on _____. taxable income standard deduction adjusted gross income gross income 2. What is TRUE about the tax code? The...

Earned Income and Earned Income Tax Credit (EITC) Tables Web30.08.2022 · Earned income includes all the taxable income and wages you get from working for someone else, yourself or from a business or farm you own. Election to use prior-year earned income. You can elect to use your 2019 earned income to figure your 2021 earned income credit (EIC) if your 2019 earned income is more than your 2021 …

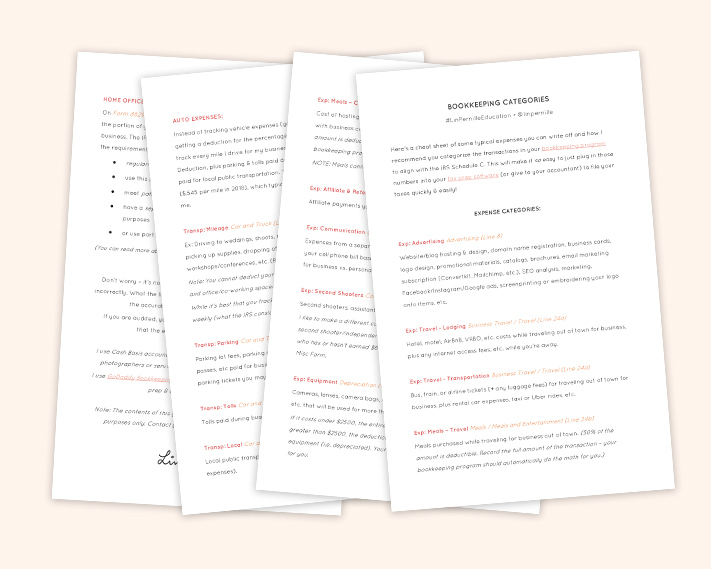

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

Tax Cuts and Jobs Act, Provision 11011 Section 199A - Qualified ... WebA3. S corporations and partnerships are generally not taxable and cannot take the deduction themselves. However, all S corporations and partnerships report each shareholder's or partner's share of QBI items, W-2 wages, UBIA of qualified property, qualified REIT dividends and qualified PTP income, and whether or not a trade or …

Topic No. 409 Capital Gains and Losses - IRS tax forms Web04.10.2022 · Capital Gain Tax Rates. The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er).

The Ultimate Small Business Tax Deductions Worksheet for 2022 Assuming your effective tax rate is 20%, that $5,000 tax deduction will save you $1,000. Without deductions: $50,000 x .2 = $10,000 With deductions: $45,000 x .2 = $9,000 Savings: $10,000 - $9,000 = $1,000 Over the course of the tax year, record business-related expenses so you can easily tell which costs are deductible when it's tax time.

Tax Preparation Checklist. Collect Your Forms Before you e-File. Step 3: Use Tax Software and eFileIT. Once you have gathered your forms and have a fair understanding of what your taxes may be, sign up for a free eFile.com account. The eFile Tax App will do the complicated math and gather all the tax forms for you as you enter information and answer questions.

PDF Form WT- 4A Worksheet For Employee Withholding Agreement Completing the worksheet for the Employee Withholding Agreement. Line 2. Refer to the Wisconsin income reported on line 7 of Form 1 or . line 30 of Form 1NPR of your Wisconsin income tax return. Your 2023 . Wisconsin estimated income should be computed in the same manner as you computed your 2022 Wisconsin income, taking into account any

Income Tax Folio S1-F3-C2, Principal Residence - Canada.ca Mar 19, 2019 · When he filed his 2011 income tax return, Mr. A designated the house as his principal residence for the 2004 to 2007 tax years inclusive (that is, the maximum four years) by virtue of a subsection 45(2) election (which he had already filed with his 2003 income tax return) having been in force for those years. (He was able to make this ...

Report amounts on your tax return - T4A COVID-19 amounts ... If you already filed your 2020 tax return, you can change your return to claim your repayment as a deduction on your 2020 tax return. Split the deduction between your tax returns. You can only claim a deduction on your 2020 tax return if you paid back a benefit amount you received in 2020. Make sure you do not deduct more than what you repaid.

Alabama — Federal Income Tax Deduction Worksheet We last updated Alabama Federal Income Tax Deduction Worksheet in January 2022 from the Alabama Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Alabama government.

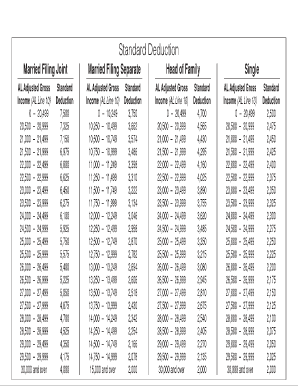

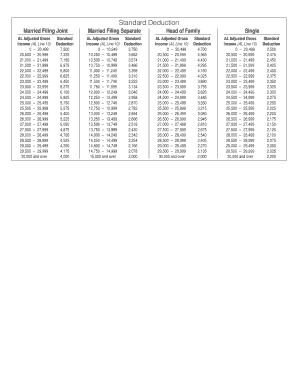

How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

Publication 17 (2021), Your Federal Income Tax - IRS tax forms WebQualified business income deduction. The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. If you don't meet the requirements to file Form 8995, use Form 8995-A, Qualified Business Income Deduction. For more information, see each form's ...

Deductions | FTB.ca.gov - California 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction 2. $1,100 3. Enter the larger of line 1 or line 2 here 3. 4. Enter amount shown for your filing status: Single or married/RDP filing separately, enter $4,803

2022-2023 Federal Income Tax Brackets & Tax Rates - NerdWallet WebGenerally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates Web14.11.2019 · See New Tax Brackets. On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. This is done to prevent what is called “bracket creep,” when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation, instead of any increase in real income. The IRS used to use …

Tax Deductions Worksheets - K12 Workbook Worksheets are Tax deduction work, Truckers work on what you can deduct, Realtors tax deductions work, Realtor, Schedule a tax deduction work, Rental property tax deduction work, Day care income and expense work year, Work to estimate federal tax withholding year 2019. *Click on Open button to open and print to worksheet. 1. Tax Deduction Worksheet

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... Claim Dependents. If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000. Multiply the number of other dependents by $500 . Add the amounts above and enter the total.

Alabama Federal Income Tax Deduction Worksheet - TaxFormFinder Page 2, Part IV Federal Income Tax Deduction The federal income tax allowed as a deduction to a nonresident of Alabama is the amount calculated using the federal income tax deduction worksheet on this page. The balance is then prorated by the percentage of income earned in Alabama to the total income from all sources.

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Internet and phone bills - The cost of wifi and a portion of your phone bill may qualify as a deductible expense Deduct the cost of meals - meals with clients or any meetings where you discuss work may count as a deduction. Travel costs - If you have to travel for your work/services, you can deduct the fees related to traveling

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

0 Response to "45 income tax deduction worksheet"

Post a Comment