39 1040 qualified dividends worksheet

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Fill Online, Printable, Fillable, Blank Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Form Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Clarification of Worksheet Line References in the 2020 Instructions for ... Clarification of Worksheet Line References in the 2020 Instructions for Form 8615 On page 6 of the 2020 Instructions for Form 8615, Tax for Certain Children Who Have Unearned Income, there are two incorrect line references to the Qualified Dividends and Capital Gain Tax Worksheet, which is located in the 2020 Instructions for Form 1040.

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Find and fill out the correct qualified dividends worksheet 2021 signNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out. Versions Form popularity Fillable & printable IRS Instruction 1040 Line 44 2015 4.7 Satisfied (957 Votes)

1040 qualified dividends worksheet

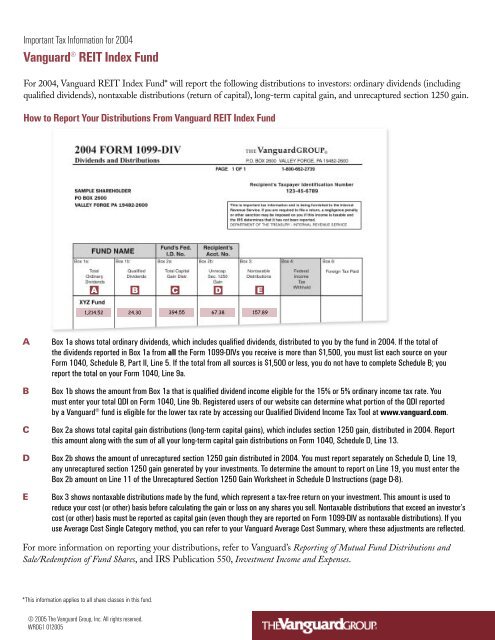

About Schedule B (Form 1040), Interest and Ordinary Dividends About Schedule B (Form 1040), Interest and Ordinary Dividends Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond. How Dividends Are Taxed and Reported on Tax Returns - The … Verkko15.11.2022 · You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. Non-dividend distributions can reduce your cost basis in the stock by the amount of the distribution. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. Before completing this worksheet, complete Form 1040 through line 15.

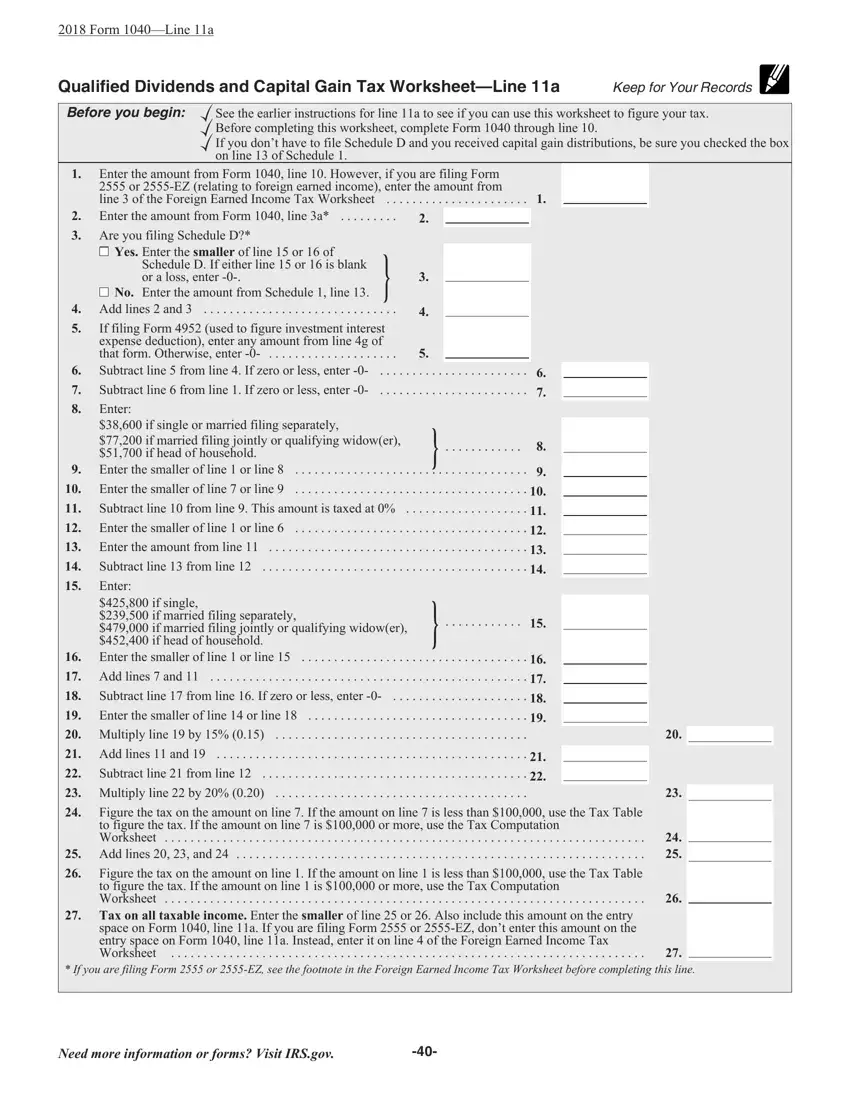

1040 qualified dividends worksheet. Qualified Dividend and Capital Gains Tax Worksheet? - YouTube The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub... Qualified Business Income Deduction | Internal Revenue Service VerkkoREIT/PTP Component. This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. This component is not limited by W-2 wages or the UBIA of qualified property. Depending on the taxpayer’s taxable income, the amount of PTP income that qualifies may be limited depending on the PTP’s trade or … Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 11b. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 ... How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

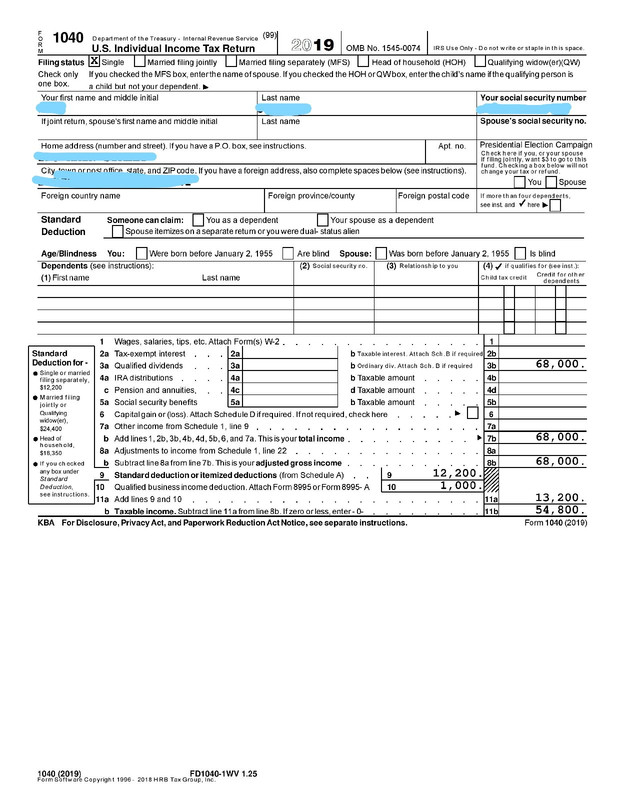

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). Solved: When you have ordinary dividends and qualified dividends (line ... The amount of qualified dividends on line 3a on the 2020 1040 is used to calculate the tax on line 16 using the "Qualified Dividend and Capital Gains Worksheet". "Taxable Income" and "Tax" are not the same thing. Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form. Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... For each qualifying child, you must check the “child tax credit” box in column (4) of the Dependents section on page 1 of Form 1040, 1040-SR, or 1040-NR and complete Schedule 8812 (Form 1040). If you meet the residency requirements to claim the RCTC, you will claim the RCTC on Form 1040, 1040-SR, or 1040-NR, line 28.

1040 qualified dividends and capital gains worksheet 34 Qualified Dividends And Capital Gain Tax Worksheet Line 44. 17 Pictures about 34 Qualified Dividends And Capital Gain Tax Worksheet Line 44 : 1040 Qualified Dividends Worksheet - Worksheet List, irs qualified dividends and capital gain tax worksheet - rap.iworksheet.co and also Download Instructions for IRS Form 1040 Schedule D Capital Gains and. Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. › dividends-on-tax-returnsHow Dividends Are Taxed and Reported on Tax Returns - The Balance Nov 15, 2022 · Dividends can be taxed at either ordinary income tax rates or at the lower long-term capital gains tax rates. Dividends that qualify for long-term capital gains tax rates are referred to as "qualified dividends." In 2022, ordinary income tax rates range from 10% and 37% while long-term capital gains tax rate is capped at 20%. › publications › p575Publication 575 (2021), Pension and Annuity Income Qualified plan annuity starting before November 19, 1996. If your annuity is paid under a qualified plan and your annuity starting date (defined earlier under Cost (Investment in the Contract)) is after July 1, 1986, and before November 19, 1996, you could have chosen to use either the Simplified Method or the General Rule. If your annuity ...

Publication 3 (2021), Armed Forces' Tax Guide VerkkoPublication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia.

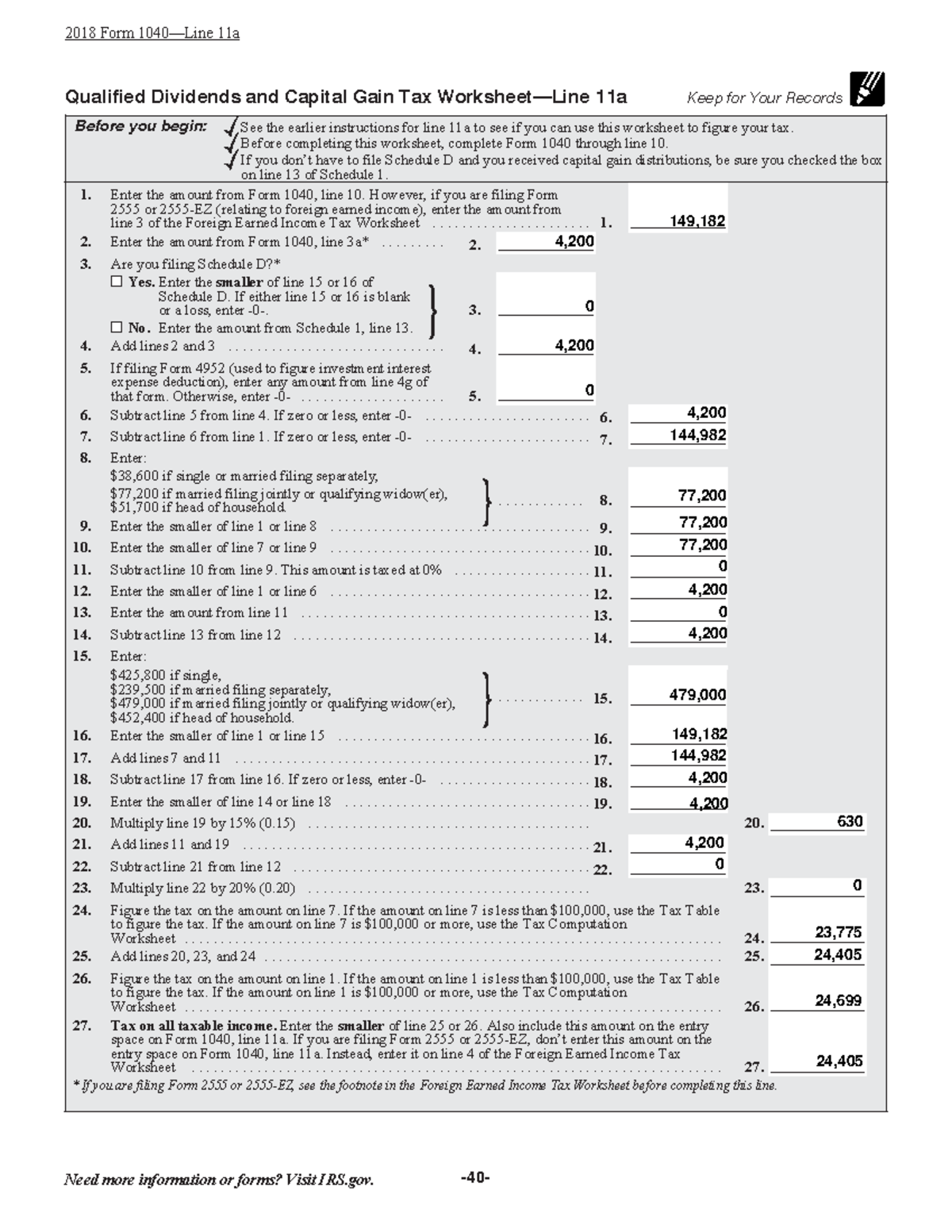

Page 40 of 117 - IRS tax forms Verkko2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing …

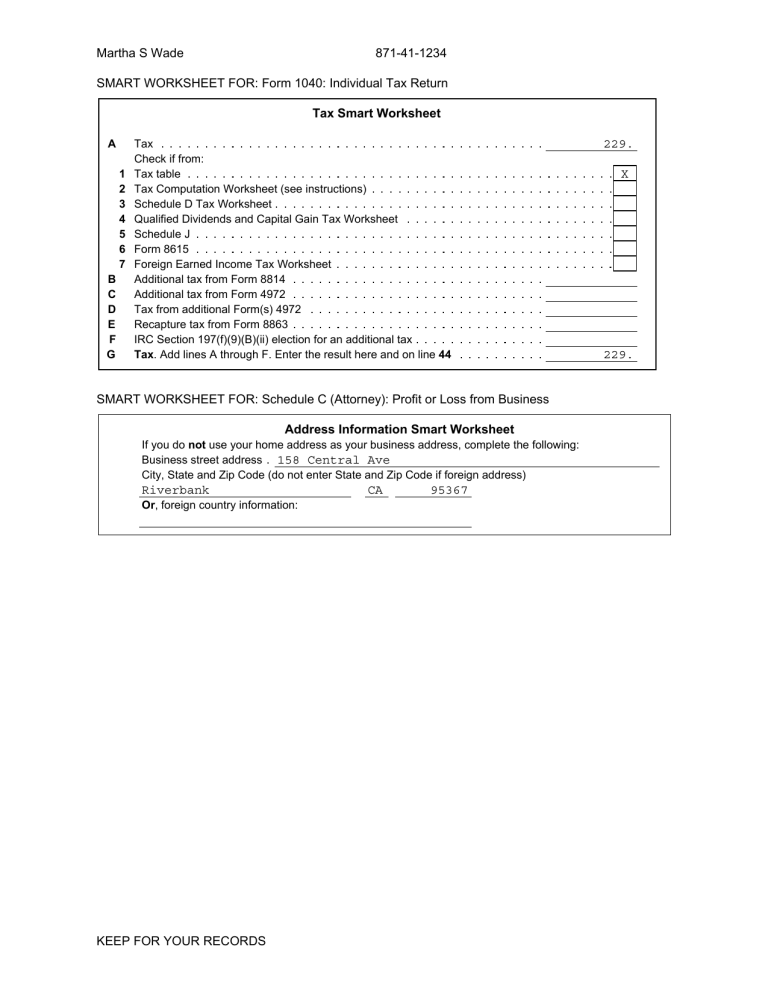

What is a Qualified Dividend Worksheet? - Money Inc If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a." In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10.

› newsroom › qualified-business-incomeQualified Business Income Deduction | Internal Revenue Service REIT/PTP Component. This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. This component is not limited by W-2 wages or the UBIA of qualified property. Depending on the taxpayer’s taxable income, the amount of PTP income that qualifies may be limited depending on the PTP’s trade or business.

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

Solved: On my 1040, ordinary dividends include qualified dividends in ... The IRS Instructions for line 3a on the 1040 state "Enter your total qualified dividends on line 3a. Qualified dividends also are included in the ordinary dividend total required to be shown on line 3b." So qualified dividends end up being in Adjusted Gross Income, even though they are taxed differently (you should be able to find a Qualified Dividend/Capital Gains Worksheet showing the ...

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts. Taxpayers must still use Schedule D if any amount is reported in box 2c, ...

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

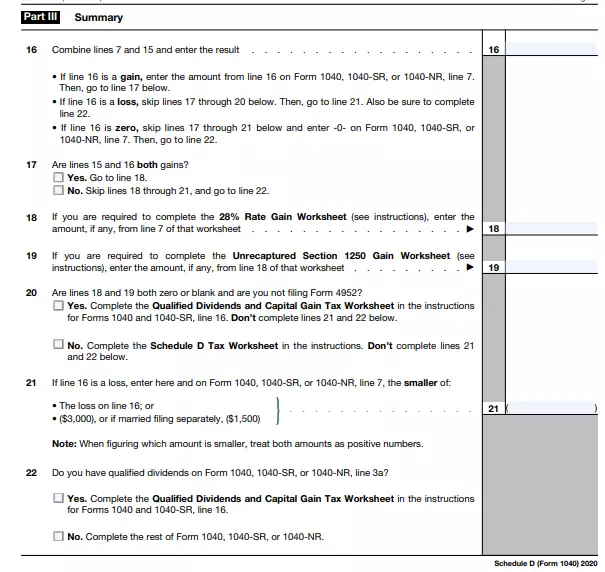

2022 Instructions for Schedule D (2022) | Internal Revenue Service If there is an amount in box 2d, include that amount on line 4 of the 28% Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D. If you received capital gain distributions as a nominee (that is, they were paid to you but actually belong to someone else), report on Schedule D, line 13, only the amount that belongs to you.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Verkko24.9.2021 · Instead, 1040 Line 16 “Tax” asks you to “see instructions.” In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet Mr. and Mrs. Butler 2019 I got an A on this assignment qualified dividends and capital gain tax 12a keep for. 📚 ... Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you ...

› en-us › documentQualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year2021/2022 Helpful? 85 Comments Please sign inor registerto post comments. Tim5 months ago 2019 - Correct Year Related Studylists ACC 330 Preview text

Qualified Dividends and Capital Gain Tax Worksheet - Course Hero Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. ☒No.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet On Form 1040, you add all of your taxable income and subtract all your deductions to calculate your Taxable Income on Line 15. This 1040 Line 15 Taxable Income number is misleading. Hidden within the calculation are actually two separate tax rates. First, your ordinary income which is taxed at income rates.

How to Figure the Qualified Dividends on a Tax Return Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the...

qualified dividend on qualified dividend & capital gain tax worksheet last year line one = $ 1586.00 line two = $2945.00. married filing jointly. line 24 was $159.00 line 25 was ... or tell us the amounts if any on lines16 through 24 on the 1040. or contact. The Audit Defense service is provided by TaxResources, Inc., also called TaxAudit.com, in partnership with ...

Qualified Dividends And Capital Gain Tax Worksheet 2021 VerkkoFAQs 2021 form 1040 qualified dividends and capital gain tax worksheet Here is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

PDF 2021 IL-1040 Instructions Enter the Illinois Use Tax from the UT Worksheet or UT Table on Form IL-1040, Line 21. If we find that you owe additional tax, we may assess the ... 3 Ordinary dividends (federal Form 1040 or 1040-SR, Line 3b) 3 4Taxable refunds, ... SIMPLE, and qualified plans (federal Form 1040 or 1040-SR, Schedule 1, Line 16) 21 22 Self-employed health ...

About Form 1040, U.S. Individual Income Tax Return VerkkoForm 1040 is used by citizens or residents of the United States to file an annual income tax return. Form 1040 is used by U.S. taxpayers to file an annual income tax return. Current Revision Form 1040PDF Skip to main ... Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified dividends-- 06-APR-2021. Filing Extension and Other Relief for Form …

Qualified Dividends Tax Worksheet PDF Form - FormsPal The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it. What are qualified dividends?

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... Qualified Dividends and Capital Gain Tax Worksheet - Line 44 (Form 1040) Line 28 (Form 1040A) WK_CGTAX.LD

Publication 575 (2021), Pension and Annuity Income VerkkoForm 8915-F replaces Form 8915-E. Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022, as applicable.In previous years, distributions and repayments would be reported on the …

How to Figure the Qualified Dividends on a Tax Return VerkkoReport your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

1040 (2021) | Internal Revenue Service - IRS tax forms Verkko1040 - Introductory Material What's New Introduction Due date of Skip to main ... Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV. ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax …

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. Before completing this worksheet, complete Form 1040 through line 15.

How Dividends Are Taxed and Reported on Tax Returns - The … Verkko15.11.2022 · You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. Non-dividend distributions can reduce your cost basis in the stock by the amount of the distribution.

About Schedule B (Form 1040), Interest and Ordinary Dividends About Schedule B (Form 1040), Interest and Ordinary Dividends Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

![Solved] Skylar and Walter Black have been married | SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/07/60ea435668138_ScreenShot20210710at8.53.37PM.png)

0 Response to "39 1040 qualified dividends worksheet"

Post a Comment