39 self employment expenses worksheet

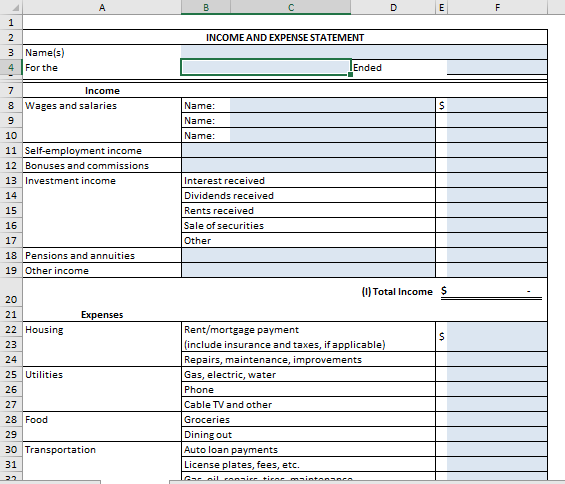

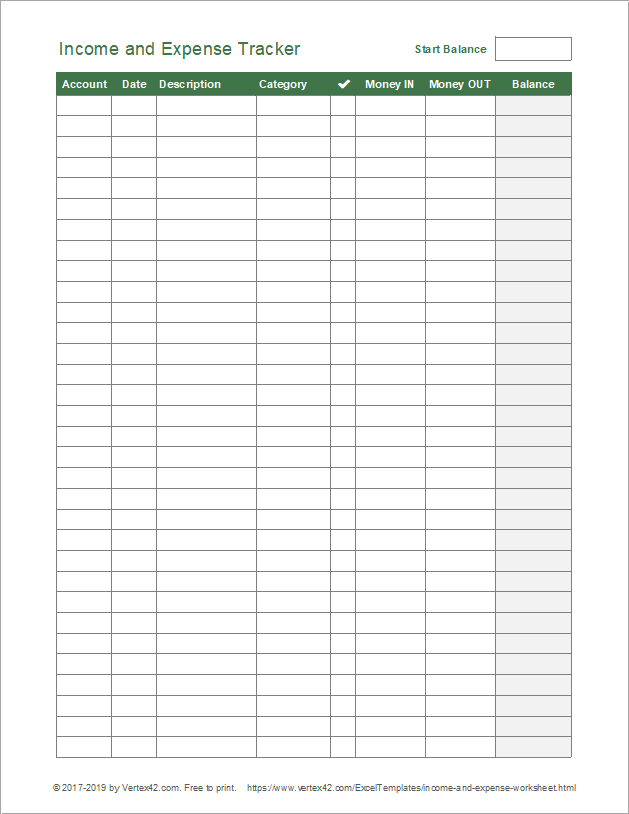

Publication 587 (2021), Business Use of Your Home WebDo not enter the deductible part of your self-employment tax. Add the amounts on lines 10 and 11, and enter the total on line 12. Subtract line 12 from line 4, and enter the result on line 13. This is your deduction limit. You use it to determine whether you can deduct any of your other expenses for business use of the home this year. If you cannot, you will carry them … Self Employment - Government of Nova Scotia WebIf you are not in receipt of Employment Insurance benefits, you may be eligible to receive financial assistance for living expenses. Temporary financial assistance may be provided in exceptional circumstances to cover all or part of the following costs related to participation (e.g., dependent care, disability needs, tuition costs, transportation and accommodation).

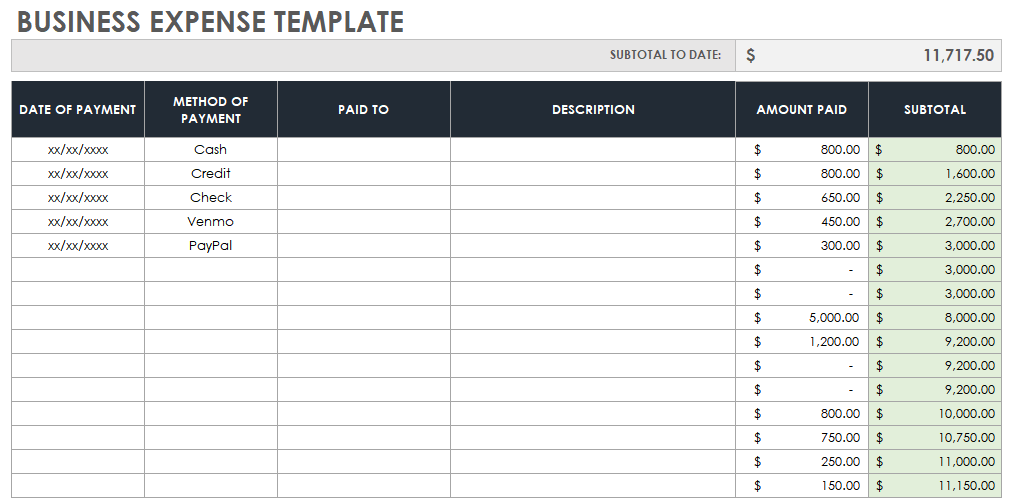

Gig Economy Tax Center | Internal Revenue Service - IRS tax forms Web04.10.2022 · Small Business and Self-Employed; Gig Economy Tax Center Gig Economy Tax Center. English ... Find forms, keep records, deduct expenses, file and pay taxes for your gig work. Manage Taxes for Your Gig Work. Digital Platforms and Businesses. Classify workers, report payments, pay and file taxes for a digital marketplace or business. …

Self employment expenses worksheet

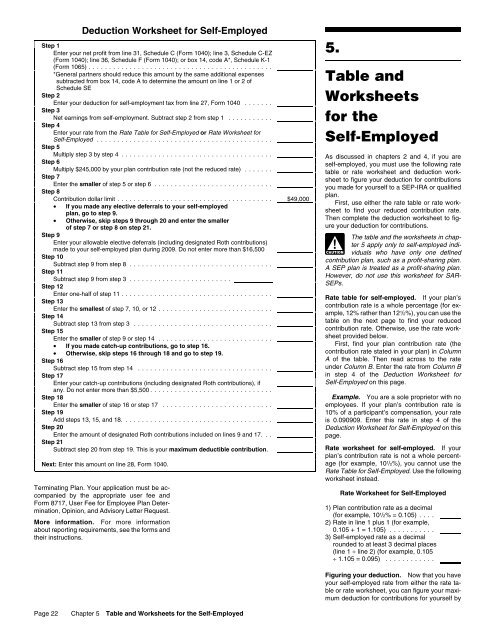

Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). May 2021 National Occupational Employment and Wage Estimates Web31.03.2022 · May 2021 National Occupational Employment and Wage Estimates United States. These estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in every state and the District of Columbia. Additional information, including the hourly and annual 10th, 25th, 75th, and … Publication 502 (2021), Medical and Dental Expenses Web13.01.2022 · You had more than one source of income subject to self-employment tax. You file Form 2555, Foreign Earned Income. You are using amounts paid for qualified long-term care insurance to figure the deduction. If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure …

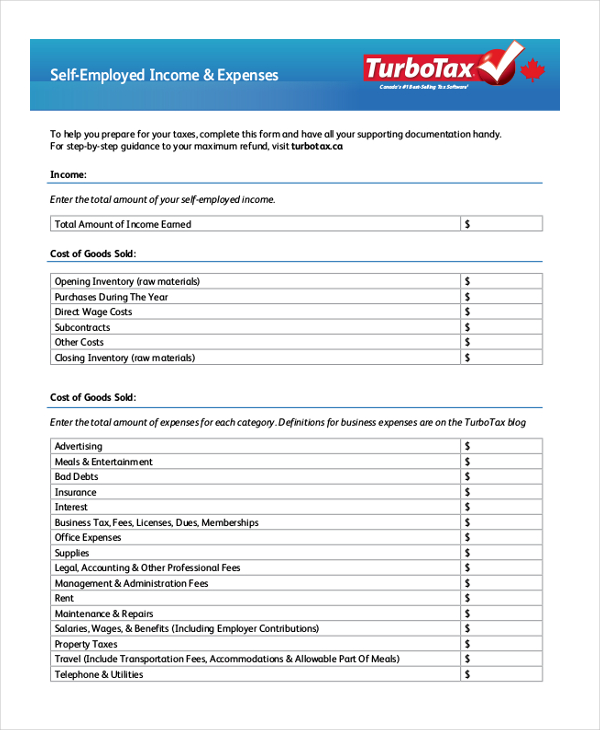

Self employment expenses worksheet. Topic No. 554 Self-Employment Tax | Internal Revenue Service Web13.10.2022 · You usually must pay self-employment tax if you had net earnings from self-employment of $400 or more. Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment. You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income … 16 Tax Deductions and Benefits for the Self-Employed Web15.11.2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ... Publication 535 (2021), Business Expenses - IRS tax forms WebWorksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. Effect on itemized deductions. Effect on self-employment tax. How to figure the deduction. Health coverage tax credit. More than one health plan and business. Nondeductible Premiums; Capitalized Premiums. Uniform ... 2022 Form 1040-ES - IRS tax forms self-employment) subject to the social security tax is $147,000. Adoption credit or exclusion. For 2022, the maximum adoption credit or exclusion for employer-provided . CAUTION! adoption benefits has increased to $14,890. In order to claim either the credit or exclusion, your modified adjusted gross income must be less than $263,410. Reminders

2022 Instructions for Schedule C (2022) | Internal Revenue Service WebAlso, use Schedule C to report (a) wages and expenses you had as a statutory employee; (b) income and deductions of certain qualified joint ventures; and (c) certain amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and Form 1099-K. See the instructions on your Form 1099 for more information about what to report on Schedule C. … Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Publication 502 (2021), Medical and Dental Expenses Web13.01.2022 · You had more than one source of income subject to self-employment tax. You file Form 2555, Foreign Earned Income. You are using amounts paid for qualified long-term care insurance to figure the deduction. If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure … May 2021 National Occupational Employment and Wage Estimates Web31.03.2022 · May 2021 National Occupational Employment and Wage Estimates United States. These estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in every state and the District of Columbia. Additional information, including the hourly and annual 10th, 25th, 75th, and …

Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

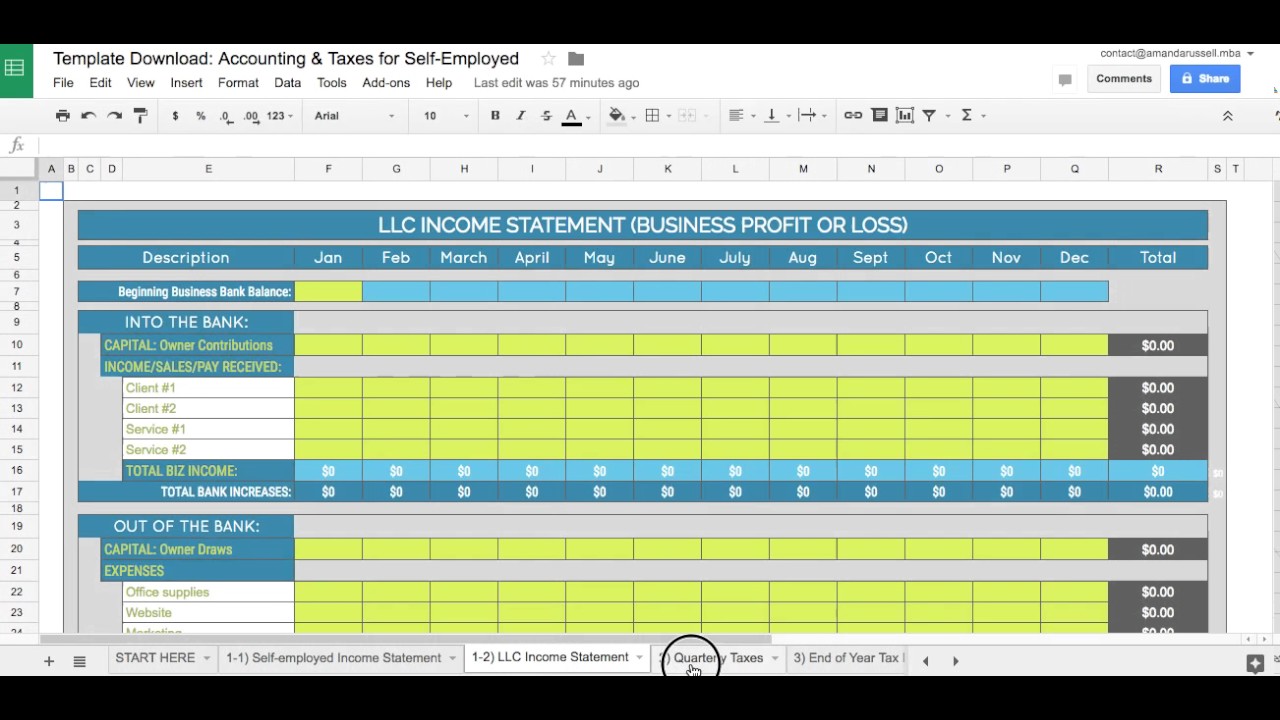

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/maxresdefault.jpg)

0 Response to "39 self employment expenses worksheet"

Post a Comment